Analysts’ Viewpoint on Two-wheeler Shock Absorber Market Scenario

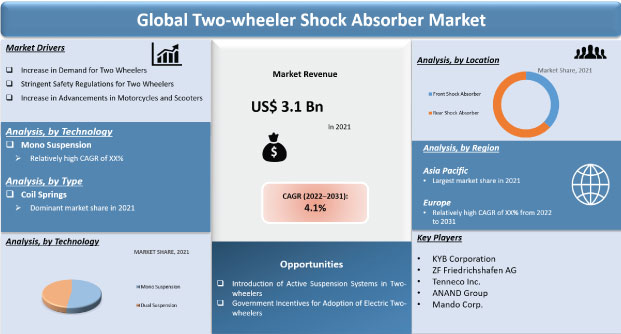

Rise in preference for sports and luxury motorcycles, stringent safety regulations for two-wheelers, increase in government funding to improve vehicle safety, and growth in awareness about electric two-wheelers are the factors driving the production and sale of two-wheelers across the globe. Increase in investment by component manufacturers in the development of active and semi-active suspension systems is boosting the global two-wheeler shock absorber market. Manufacturers & suppliers of motorcycle shock absorbers are focusing on the development of new and advanced solutions for two-wheeler components by adopting lightweight but tough materials, i.e. carbon composites, to enhance the durability of automotive shock absorbers and other parts.

Motorcycle shock absorbers are oil pumps or hydraulic-like devices that help two-wheelers control the rebound and impact movement of bike suspension and springs. Bike absorbers ensure that the bike’s tires are intact and remain in contact with the road surface at all times. They further smoothen vibrations and bumps. Decrease in contact of the tire with the road compromises the ability to brake, drive, and steer. The two-wheeler front fork is used to support the weight of the bike, which further enables the wheel to react to the damping system and bumps that reduce two-wheeler bobbing. Manufacturers of automotive components need to obtain the “Type Approval” legislative certification for the sale of automotive components. They also need to comply with quality standards of ISO TS/16949 & ISO 9001. The certification is granted to products that comply with a minimum set of technical, safety, and regulatory requirements. The certification also allows the sale of other two-wheelers parts including lights, horns, signaling devices, seats, mirrors, and tires. The global two-wheeler shock absorber market is also anticipated to be driven by the introduction of advanced active and semi-active two-wheeler suspension systems in order to enhance the safety and comfort of the rider. For instance, the Bose suspension system comprises a set of control algorithms, power amplifier, and linear electromagnetic motor at each wheel. Such a combination of control software and hardware provides superior safety and comfort while riding a two-wheeler.

Increase in preference for two-wheelers among the global population is anticipated to propel the demand for two-wheeler shock absorbers. Rise in disposable and per capita income of consumers is further contributing to the growth of sales of two-wheelers across the globe. Sales and production of two-wheelers are directly proportional to the demand for motorcycle suspension systems. This is expected to fuel the global two-wheeler shock absorber market. Implementation of stringent vehicle emission norms across the globe has increased the demand for electric two-wheelers, which further enhances sales and production of geared and gearless electric two-wheelers. This rise in sales prompts two-wheeler shock absorber manufacturers and other part providers to increase their production capacity to gain revenue benefits. However, increase in demand for electric two-wheelers is anticipated to provide significant opportunities for motorcycle shock absorbers manufacturers & suppliers. Several initiatives taken by private as well as government organizations, such as funding for numerous projects in order to enhance safety and comfort for the vehicle, are expected to drive the global automotive suspension parts market during the forecast period.

The global two-wheeler shock absorber market is significantly driven by surge in demand for technologically advanced and innovative motorcycles and scooters. The intelligent active suspension system offers the best shock absorber for bikes and other gearless two-wheelers. It is a new type of system, where innovative pneumatic suspension and sensors are used for adding an intellect system, which can sense the unevenness of the road and further transmit various signals to the electronic control unit (ECU). The ECU activates the solenoid valve and controls the suspension system accordingly. Thus, increase in advancements in suspension systems prompts several manufacturers and suppliers to form collaborative agreements to provide automotive vibration absorbers/dampers for motorcycles and scooters.

Demand for motorcycles for road trips and adventure activities is rising among consumers. This is expected to create considerable opportunities for manufacturers of two-wheeler shock absorbers. Moreover, demand for scooters is increasing significantly due to their low price, good stability, and easy handling as compared to other conventional motorcycles. Consumer preference is shifting from motorcycles to mopeds, as OEM manufacturers are focusing on offering similar featured mopeds as that of motorcycles, including ABS systems and disc brakes. Hence, rise in demand for advanced motorcycles and scooters is anticipated to fuel the global two-wheeler shock absorber market.

In terms of technology, the global two-wheeler shock absorber market has been classified into mono suspension and dual suspension. The mono suspension segment held dominant share of the two-wheeler shock absorber market in 2021. Mono suspension shock absorbers are extensively used as motorcycle rear shock absorbers. The mono suspension segment is anticipated to account for notable share of the two-wheeler shock absorber market during the forecast period, as the mono suspension technology provides better braking, handling, stability, friction, and centralization of mass. Currently, mono suspensions are widely being used in sports as well as commercial standard motorcycles. Furthermore, demand for motorcycle front shock absorbers is expected to rise significantly in developing countries due to the increase in sales and production of motorcycles in China and India.

In terms of type, the global two-wheeler shock absorber market has been split into metal spring, rubber buffer hydraulic dashpot, collapsing safety shock absorbers, pneumatic cylinders, coil springs, electromagnetic suspension, self-compensating hydraulic, and others. The coil spring segment held major share of the global market in 2021. Coil spring offers more range of movement, which further allows the driver during wider turning, as compared to other springs. Coil springs are lightweight, as they are made from steel and other inexpensive materials, which improves two-wheeler ride quality and offers better performance on rough terrains. However, coil springs are widely used in the two-wheeler suspension system.

Regional analysis of the two-wheeler shock absorber market is based on motorcycle and scooter production trends, demand, regulation changes, and political reforms. In terms of revenue, the two-wheeler shock absorber market in Asia Pacific grew significantly in 2021. Countries in Asia Pacific including China and India have witnessed the highest production and sale of two-wheelers. Rise in population and urbanization in these countries is a key factor driving the two-wheeler shock absorber market in the region. Asia Pacific has more number of two-wheelers and related component manufacturers. Furthermore, China’s emergence as a global two-wheeler manufacturing hub, easy availability of raw materials, and cheap labor have augmented the demand for two-wheeler manufacturing in the region. Furthermore, implementation of vehicle emission norms and incentives offered by governments for the adoption of electric vehicles (EVs) has increased the demand for EVs in Asia Pacific. This is boosting the production of electric two-wheelers in the region. Rise in demand for sports and premium two-wheelers in China, India, and South Korea is further propelling the two-wheeler shock absorber market in the region.

Europe holds substantial share of the two-wheeler shock absorber market owing to the increase in adoption of sports, luxury, and premium motorcycles; presence of large numbers of shock absorber manufacturers; and rise in disposable income among customers in the region.

The global two-wheeler shock absorber market is fragmented, with the presence of large number of manufacturers that control majority of the share. Key companies hold the potential to upsurge the pace of growth by adopting newer and advanced technologies and making consistent changes in their two-wheeler models. Mergers and acquisitions and development in product portfolios are major strategies adopted by key players.

Some of the manufacturers that operate in the global two-wheeler shock absorber market are KYB Corporation, ZF Friedrichshafen AG, Tenneco Inc., ANAND Group, Mando Corp., Marelli Holdings Co., Ltd., Meritor Inc., Thyssenkrupp AG, Yamaha Corporation, Showa Corporation, TFX Suspension Technology, Nitron Racing Systems Ltd., Hagon Shocks, and NJB SHOCKS.

Each of these players has been profiled in the two-wheeler shock absorber market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.1 Bn |

|

Market Forecast Value in 2031 |

US$ 4.6 Bn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The two-wheeler shock absorber market was valued at US$ 3.1 Bn in 2021

The two-wheeler shock absorber market is expected to grow at a CAGR of 4.1% by 2031

The two-wheeler shock absorber market is expected to reach US$ 4.6 Bn in 2031

Rise in preference for sports and luxury motorcycles, stringent safety regulations for two-wheelers, increase in government funding to improve vehicle safety and to create awareness regarding electric two-wheelers, and rise in production of two-wheelers in China and India

The mono suspension segment accounts for 53.8% share of the two-wheeler shock absorber market

Asia Pacific is a highly lucrative region of the global two-wheeler shock absorber market

KYB Corporation, ZF Friedrichshafen AG, Tenneco Inc., ANAND Group, Mando Corp., Marelli Holdings Co., Ltd., Meritor Inc., Thyssenkrupp AG, Yamaha Corporation, Showa Corporation, TFX Suspension Technology, Nitron Racing Systems Ltd., Hagon Shocks, and NJB SHOCKS

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Mn, 2017‒2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. COVID-19 Impact Analysis – Two-wheeler Shock Absorber Market

5. Global Two-wheeler Shock Absorber Market, by Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017‒2031, Type

5.2.1. Metal Spring

5.2.2. Rubber Buffer Hydraulic Dashpot

5.2.3. Collapsing safety Shock Absorbers

5.2.4. Pneumatic Cylinders

5.2.5. Coil Springs

5.2.6. Electromagnetic Suspension

5.2.7. Self-compensating Hydraulic

5.2.8. Others

6. Global Two-wheeler Shock Absorber Market, by Technology

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Technology, 2017‒2031

6.2.1. Mono Suspension

6.2.2. Dual Suspension

7. Global Two-wheeler Shock Absorber Market, by Location

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Electric Vehicle Type, 2017‒2031

7.2.1. Front Shock Absorber

7.2.1.1. Motorcycle

7.2.1.2. Scooter/Moped

7.2.1.3. Cargo Bike

7.2.1.4. Electric Bike

7.2.1.5. Electric Scooter/Moped

7.2.1.6. Electric Motorcycle

7.2.2. Rear Shock Absorber

7.2.2.1. Motorcycle

7.2.2.2. Scooter/Moped

7.2.2.3. Cargo Bike

7.2.2.4. Electric Bike

7.2.2.5. Electric Scooter/Moped

7.2.2.6. Electric Motorcycle

8. Global Two-wheeler Shock Absorber Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Region, 2017‒2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Two-wheeler Shock Absorber Market

9.1. Market Snapshot

9.2. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

9.2.1. Metal Spring

9.2.2. Rubber Buffer Hydraulic Dashpot

9.2.3. Collapsing safety Shock Absorbers

9.2.4. Pneumatic Cylinders

9.2.5. Coil Springs

9.2.6. Electromagnetic Suspension

9.2.7. Self-compensating Hydraulic

9.2.8. Others

9.3. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Technology, 2017‒2031

9.3.1. Mono Suspension

9.3.2. Dual Suspension

9.4. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Location, 2017‒2031

9.4.1. Front Shock Absorber

9.4.1.1. Motorcycle

9.4.1.2. Scooter/Moped

9.4.1.3. Cargo Bike

9.4.1.4. Electric Bike

9.4.1.5. Electric Scooter/Moped

9.4.1.6. Electric Motorcycle

9.4.2. Rear Shock Absorber

9.4.2.1. Motorcycle

9.4.2.2. Scooter/Moped

9.4.2.3. Cargo Bike

9.4.2.4. Electric Bike

9.4.2.5. Electric Scooter/Moped

9.4.2.6. Electric Motorcycle

9.5. Key Country Analysis – North America Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017‒2031

9.5.1. U. S.

9.5.2. Canada

9.5.3. Mexico

10. Europe Two-wheeler Shock Absorber Market

10.1. Market Snapshot

10.2. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

10.2.1. Metal Spring

10.2.2. Rubber Buffer Hydraulic Dashpot

10.2.3. Collapsing safety Shock Absorbers

10.2.4. Pneumatic Cylinders

10.2.5. Coil Springs

10.2.6. Electromagnetic Suspension

10.2.7. Self-compensating Hydraulic

10.2.8. Others

10.3. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Technology, 2017‒2031

10.3.1. Mono Suspension

10.3.2. Dual Suspension

10.4. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Location, 2017‒2031

10.4.1. Front Shock Absorber

10.4.1.1. Motorcycle

10.4.1.2. Scooter/Moped

10.4.1.3. Cargo Bike

10.4.1.4. Electric Bike

10.4.1.5. Electric Scooter/Moped

10.4.1.6. Electric Motorcycle

10.4.2. Rear Shock Absorber

10.4.2.1. Motorcycle

10.4.2.2. Scooter/Moped

10.4.2.3. Cargo Bike

10.4.2.4. Electric Bike

10.4.2.5. Electric Scooter/Moped

10.4.2.6. Electric Motorcycle

10.5. Key Country Analysis – Europe Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017‒2031

10.5.1. Germany

10.5.2. U. K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Nordic Countries

10.5.7. Russia & CIS

10.5.8. Rest of Europe

11. Asia Pacific Two-wheeler Shock Absorber Market

11.1. Market Snapshot

11.2. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

11.2.1. Metal Spring

11.2.2. Rubber Buffer Hydraulic Dashpot

11.2.3. Collapsing safety Shock Absorbers

11.2.4. Pneumatic Cylinders

11.2.5. Coil Springs

11.2.6. Electromagnetic Suspension

11.2.7. Self-compensating Hydraulic

11.2.8. Others

11.3. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Technology, 2017‒2031

11.3.1. Mono Suspension

11.3.2. Dual Suspension

11.4. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Location, 2017‒2031

11.4.1. Front Shock Absorber

11.4.1.1. Motorcycle

11.4.1.2. Scooter/Moped

11.4.1.3. Cargo Bike

11.4.1.4. Electric Bike

11.4.1.5. Electric Scooter/Moped

11.4.1.6. Electric Motorcycle

11.4.2. Rear Shock Absorber

11.4.2.1. Motorcycle

11.4.2.2. Scooter/Moped

11.4.2.3. Cargo Bike

11.4.2.4. Electric Bike

11.4.2.5. Electric Scooter/Moped

11.4.2.6. Electric Motorcycle

11.5. Key Country Analysis – Asia Pacific Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017‒2031

11.5.1. China

11.5.2. India

11.5.3. Japan

11.5.4. ASEAN Countries

11.5.5. South Korea

11.5.6. ANZ

11.5.7. Rest of Asia Pacific

12. Middle East & Africa Two-wheeler Shock Absorber Market

12.1. Market Snapshot

12.2. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

12.2.1. Metal Spring

12.2.2. Rubber Buffer Hydraulic Dashpot

12.2.3. Collapsing safety Shock Absorbers

12.2.4. Pneumatic Cylinders

12.2.5. Coil Springs

12.2.6. Electromagnetic Suspension

12.2.7. Self-compensating Hydraulic

12.2.8. Others

12.3. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Technology, 2017‒2031

12.3.1. Mono Suspension

12.3.2. Dual Suspension

12.4. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Location, 2017‒2031

12.4.1. Front Shock Absorber

12.4.1.1. Motorcycle

12.4.1.2. Scooter/Moped

12.4.1.3. Cargo Bike

12.4.1.4. Electric Bike

12.4.1.5. Electric Scooter/Moped

12.4.1.6. Electric Motorcycle

12.4.2. Rear Shock Absorber

12.4.2.1. Motorcycle

12.4.2.2. Scooter/Moped

12.4.2.3. Cargo Bike

12.4.2.4. Electric Bike

12.4.2.5. Electric Scooter/Moped

12.4.2.6. Electric Motorcycle

12.5. Key Country Analysis – Middle East & Africa Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017‒2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Turkey

12.5.4. Rest of Middle East & Africa

13. South America Two-wheeler Shock Absorber Market

13.1. Market Snapshot

13.2. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Type, 2017‒2031

13.2.1. Metal Spring

13.2.2. Rubber Buffer Hydraulic Dashpot

13.2.3. Collapsing safety Shock Absorbers

13.2.4. Pneumatic Cylinders

13.2.5. Coil Springs

13.2.6. Electromagnetic Suspension

13.2.7. Self-compensating Hydraulic

13.2.8. Others

13.3. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Technology, 2017‒2031

13.3.1. Mono Suspension

13.3.2. Dual Suspension

13.4. Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, by Location, 2017‒2031

13.4.1. Front Shock Absorber

13.4.1.1. Motorcycle

13.4.1.2. Scooter/Moped

13.4.1.3. Cargo Bike

13.4.1.4. Electric Bike

13.4.1.5. Electric Scooter/Moped

13.4.1.6. Electric Motorcycle

13.4.2. Rear Shock Absorber

13.4.2.1. Motorcycle

13.4.2.2. Scooter/Moped

13.4.2.3. Cargo Bike

13.4.2.4. Electric Bike

13.4.2.5. Electric Scooter/Moped

13.4.2.6. Electric Motorcycle

13.5. Key Country Analysis – South America Two-wheeler Shock Absorber Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017‒2031

13.5.1. Brazil

13.5.2. Argentina

13.5.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2020

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

14.3. Company Profile/ Key Players – Two-wheeler Shock Absorber Market

14.3.1. KYB Corporation

14.3.1.1. Company Overview

14.3.1.2. Company Footprints

14.3.1.3. Production Locations

14.3.1.4. Product Portfolio

14.3.1.5. Competitors & Customers

14.3.1.6. Subsidiaries & Parent Organization

14.3.1.7. Recent Developments

14.3.1.8. Financial Analysis

14.3.1.9. Profitability

14.3.1.10. Revenue Share

14.3.1.11. Executive Bios

14.3.2. ZF Friedrichshafen AG

14.3.2.1. Company Overview

14.3.2.2. Company Footprints

14.3.2.3. Production Locations

14.3.2.4. Product Portfolio

14.3.2.5. Competitors & Customers

14.3.2.6. Subsidiaries & Parent Organization

14.3.2.7. Recent Developments

14.3.2.8. Financial Analysis

14.3.2.9. Profitability

14.3.2.10. Revenue Share

14.3.2.11. Executive Bios

14.3.3. Tenneco Inc.

14.3.3.1. Company Overview

14.3.3.2. Company Footprints

14.3.3.3. Production Locations

14.3.3.4. Product Portfolio

14.3.3.5. Competitors & Customers

14.3.3.6. Subsidiaries & Parent Organization

14.3.3.7. Recent Developments

14.3.3.8. Financial Analysis

14.3.3.9. Profitability

14.3.3.10. Revenue Share

14.3.3.11. Executive Bios

14.3.4. ANAND Group

14.3.4.1. Company Overview

14.3.4.2. Company Footprints

14.3.4.3. Production Locations

14.3.4.4. Product Portfolio

14.3.4.5. Competitors & Customers

14.3.4.6. Subsidiaries & Parent Organization

14.3.4.7. Recent Developments

14.3.4.8. Financial Analysis

14.3.4.9. Profitability

14.3.4.10. Revenue Share

14.3.4.11. Executive Bios

14.3.5. Mando Corp.

14.3.5.1. Company Overview

14.3.5.2. Company Footprints

14.3.5.3. Production Locations

14.3.5.4. Product Portfolio

14.3.5.5. Competitors & Customers

14.3.5.6. Subsidiaries & Parent Organization

14.3.5.7. Recent Developments

14.3.5.8. Financial Analysis

14.3.5.9. Profitability

14.3.5.10. Revenue Share

14.3.5.11. Executive Bios

14.3.6. Marelli Holdings Co., Ltd

14.3.6.1. Company Overview

14.3.6.2. Company Footprints

14.3.6.3. Production Locations

14.3.6.4. Product Portfolio

14.3.6.5. Competitors & Customers

14.3.6.6. Subsidiaries & Parent Organization

14.3.6.7. Recent Developments

14.3.6.8. Financial Analysis

14.3.6.9. Profitability

14.3.6.10. Revenue Share

14.3.6.11. Executive Bios

14.3.7. Meritor Inc

14.3.7.1. Company Overview

14.3.7.2. Company Footprints

14.3.7.3. Production Locations

14.3.7.4. Product Portfolio

14.3.7.5. Competitors & Customers

14.3.7.6. Subsidiaries & Parent Organization

14.3.7.7. Recent Developments

14.3.7.8. Financial Analysis

14.3.7.9. Profitability

14.3.7.10. Revenue Share

14.3.7.11. Executive Bios

14.3.8. Thyssenkrupp AG

14.3.8.1. Company Overview

14.3.8.2. Company Footprints

14.3.8.3. Production Locations

14.3.8.4. Product Portfolio

14.3.8.5. Competitors & Customers

14.3.8.6. Subsidiaries & Parent Organization

14.3.8.7. Recent Developments

14.3.8.8. Financial Analysis

14.3.8.9. Profitability

14.3.8.10. Revenue Share

14.3.8.11. Executive Bios

14.3.9. Yamaha Corporation

14.3.9.1. Company Overview

14.3.9.2. Company Footprints

14.3.9.3. Production Locations

14.3.9.4. Product Portfolio

14.3.9.5. Competitors & Customers

14.3.9.6. Subsidiaries & Parent Organization

14.3.9.7. Recent Developments

14.3.9.8. Financial Analysis

14.3.9.9. Profitability

14.3.9.10. Revenue Share

14.3.9.11. Executive Bios

14.3.10. Showa Corporation

14.3.10.1. Company Overview

14.3.10.2. Company Footprints

14.3.10.3. Production Locations

14.3.10.4. Product Portfolio

14.3.10.5. Competitors & Customers

14.3.10.6. Subsidiaries & Parent Organization

14.3.10.7. Recent Developments

14.3.10.8. Financial Analysis

14.3.10.9. Profitability

14.3.10.10. Revenue Share

14.3.10.11. Executive Bios

14.3.11. TFX Suspension Technology

14.3.11.1. Company Overview

14.3.11.2. Company Footprints

14.3.11.3. Production Locations

14.3.11.4. Product Portfolio

14.3.11.5. Competitors & Customers

14.3.11.6. Subsidiaries & Parent Organization

14.3.11.7. Recent Developments

14.3.11.8. Financial Analysis

14.3.11.9. Profitability

14.3.11.10. Revenue Share

14.3.11.11. Executive Bios

14.3.12. Nitron Racing Systems Ltd.

14.3.12.1. Company Overview

14.3.12.2. Company Footprints

14.3.12.3. Production Locations

14.3.12.4. Product Portfolio

14.3.12.5. Competitors & Customers

14.3.12.6. Subsidiaries & Parent Organization

14.3.12.7. Recent Developments

14.3.12.8. Financial Analysis

14.3.12.9. Profitability

14.3.12.10. Revenue Share

14.3.12.11. Executive Bios

14.3.13. Hagon Shocks

14.3.13.1. Company Overview

14.3.13.2. Company Footprints

14.3.13.3. Production Locations

14.3.13.4. Product Portfolio

14.3.13.5. Competitors & Customers

14.3.13.6. Subsidiaries & Parent Organization

14.3.13.7. Recent Developments

14.3.13.8. Financial Analysis

14.3.13.9. Profitability

14.3.13.10. Revenue Share

14.3.13.11. Executive Bios

14.3.14. NJB SHOCKS

14.3.14.1. Company Overview

14.3.14.2. Company Footprints

14.3.14.3. Production Locations

14.3.14.4. Product Portfolio

14.3.14.5. Competitors & Customers

14.3.14.6. Subsidiaries & Parent Organization

14.3.14.7. Recent Developments

14.3.14.8. Financial Analysis

14.3.14.9. Profitability

14.3.14.10. Revenue Share

14.3.14.11. Executive Bios

14.3.15. Other Key Players

15. Key Takeaways

15.1. Market Attractiveness Opportunity

15.2. Manufacturer’s Perspective

List of Tables

Table 1: Global Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Type, 2017‒2031

Table 2: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Table 3: Global Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Technology, 2017‒2031

Table 4: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Table 5: Global Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Location, 2017‒2031

Table 6: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Table 7: Global Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Region, 2017‒2031

Table 8: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Region, 2017‒2031

Table 9: North America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Type, 2017‒2031

Table 10: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Table 11: North America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Technology, 2017‒2031

Table 12: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Table 13: North America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Location, 2017‒2031

Table 14: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Table 15: North America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Country, 2017‒2031

Table 16: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country, 2017‒2031

Table 17: Europe Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Type, 2017‒2031

Table 18: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Table 19: Europe Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Technology, 2017‒2031

Table 20: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Table 21: Europe Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Location, 2017‒2031

Table 22: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Table 23: Europe Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Country & Sub-region, 2017‒2031

Table 24: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Table 25: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Type, 2017‒2031

Table 26: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Table 27: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Technology, 2017‒2031

Table 28: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Table 29: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Location, 2017‒2031

Table 30: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Table 31: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Country & Sub-region, 2017‒2031

Table 32: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Table 33: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Type, 2017‒2031

Table 34: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Table 35: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Technology, 2017‒2031

Table 36: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Table 37: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Location, 2017‒2031

Table 38: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Table 39: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Country & Sub-region, 2017‒2031

Table 40: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Table 41: South America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Type, 2017‒2031

Table 42: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Table 43: South America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Technology, 2017‒2031

Table 44: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Table 45: South America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Location, 2017‒2031

Table 46: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Table 47: South America Two-wheeler Shock Absorber Market Size & Forecast, Volume (Thousand Units), by Country & Sub-region, 2017‒2031

Table 48: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

List of Figures

Figure 1: Global Two-wheeler Shock Absorber Market Volume (Thousand Units) Forecast, 2017–2031

Figure 2: Global Two-wheeler Shock Absorber Market Value (US$ Bn) Forecast, 2017–2031

Figure 3: Key Segment Analysis for Global

Figure 4: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 5: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Figure 6: Global Market Attractiveness, Value (US$ Bn), by Type, 2022‒2031

Figure 7: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Figure 8: Global Market Attractiveness, Value (US$ Bn), by Technology, 2022‒2031

Figure 9: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Figure 10: Global Market Attractiveness, Value (US$ Bn), by Location, 2022‒2031

Figure 11: Global Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Region, 2017‒2031

Figure 12: Global Market Attractiveness, Value (US$ Bn), by Region, 2022‒2031

Figure 13: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Figure 14: North America Market Attractiveness, Value (US$ Bn), by Type, 2022‒2031

Figure 15: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Figure 16: North America Market Attractiveness, Value (US$ Bn), by Technology, 2022‒2031

Figure 17: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Figure 18: North America Market Attractiveness, Value (US$ Bn), by Location, 2022‒2031

Figure 19: North America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country, 2017‒2031

Figure 20: North America Market Attractiveness, Value (US$ Bn), by Country, 2022‒2031

Figure 21: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Figure 22: Europe Market Attractiveness, Value (US$ Bn), by Type, 2022‒2031

Figure 23: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Figure 24: Europe Market Attractiveness, Value (US$ Bn), by Technology, 2022‒2031

Figure 25: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Figure 26: Europe Market Attractiveness, Value (US$ Bn), by Location, 2022‒2031

Figure 27: Europe Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Figure 28: Europe Market Attractiveness, Value (US$ Bn), by Country & Sub-region, 2022‒2031

Figure 29: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Figure 30: Asia Pacific Market Attractiveness, Value (US$ Bn), by Type, 2022‒2031

Figure 31: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Figure 32: Asia Pacific Market Attractiveness, Value (US$ Bn), by Technology, 2022‒2031

Figure 33: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Figure 34: Asia Pacific Market Attractiveness, Value (US$ Bn), by Location, 2022‒2031

Figure 35: Asia Pacific Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Figure 36: Asia Pacific Market Attractiveness, Value (US$ Bn), by Country & Sub-region, 2022‒2031

Figure 37: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Figure 38: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Type, 2022‒2031

Figure 39: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Figure 40: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Technology, 2022‒2031

Figure 41: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Figure 42: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Location, 2022‒2031

Figure 43: Middle East & Africa Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Figure 44: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Country & Sub-region, 2022‒2031

Figure 45: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Type, 2017‒2031

Figure 46: South America Market Attractiveness, Value (US$ Bn), by Type, 2022‒2031

Figure 47: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Technology, 2017‒2031

Figure 48: South America Market Attractiveness, Value (US$ Bn), by Technology, 2022‒2031

Figure 49: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Location, 2017‒2031

Figure 50: South America Market Attractiveness, Value (US$ Bn), by Location, 2022‒2031

Figure 51: South America Two-wheeler Shock Absorber Market Size & Forecast, Value (US$ Bn), by Country & Sub-region, 2017‒2031

Figure 52: South America Market Attractiveness, Value (US$ Bn), by Country & Sub-region, 2022‒2031