Analysts’ Viewpoint on Set-top Boxes Market Scenario

The global set-top boxes market growth is fueled by numerous factors, such as rising flexibility in subscription models and growing demand for smart TVs with dynamic content. Smart TVs are expected to offer more choices to consumers with additional access to services such as Netflix, YouTube, and other streaming services, which are projected to boost the global set-top boxes market during the forecast period. Moreover, over-the-top (OTT) enables consumers to view the content of their choice without having to pay an additional fee. This is one of the key factors that is projected to boost the growth of the set-top boxes market in the near future. Introduction of smart TVs, HD, and Ultra HD channels, and technological innovations increase the adoption rate of high-end set-top boxes. Digital video recording is one of the key drivers of the market. The feature allows users to record the show and watch it later. The availability of TVs integrated with set-top boxes is one of the key trends that creates momentum in market growth. These TVs provide access to online video streaming platforms and social media platforms. In addition, they offer better storage option with up to 2TB capacity.

A set-top box (STB) is a device that is used to convert the video content transmitted from a pay TV operator to a format compatible with an end-user or subscriber TV. STBs may receive the video content from satellite, terrestrial, cable, or Internet-based transmission. STBs offer a greater number of channels compared to conventional broadcasting services and further improves the quality of the video content considerably. The introduction of High Definition (HD) channels, digitization of TV broadcasting, and demand for higher picture quality are resulting in the growth of the STB market. With advancements in technology, STB is increasingly being used to stream digital TV content through the Internet, further enabling a user to surf the Web, stream videos, access various applications, play games, and use allied features, such as OTT services. With advanced coding and compression techniques, it has become much easier to decode high-quality videos using comparatively less bandwidth.

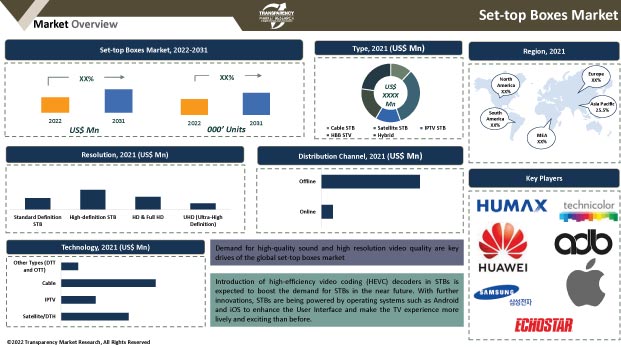

The introduction of high-efficiency video coding (HEVC) decoders in STBs is expected to boost the demand for the latter in the upcoming years. STBs are being powered by operating systems such as Android and iOS due to further innovations, to enhance the user interface and make the TV experience more lively and exciting than before.

The set-top boxes (STB) market is expected to register robust growth in the near future. Rising flexibility in subscription models and growing demand for smart TVs with dynamic content are likely to fuel the growth of the market. Smart TVs are expected to offer even more choices to users with additional access to services such as Netflix, YouTube, and other streaming services. Moreover, emerging subscription models in the market are expected to provide more choice with an increasing number of them moving toward pay-per-channel models. This is apparent in countries such as the U.S., where services such as HBO are highly demanded. Recent regulations in India empowered set-top-box providers to compete better with dynamic content from the Internet, making way for more competition and more choices for consumers. These trends are expected to be major drivers for the set-top boxes market.

Companies are always focused on quality to achieve market efficiency of set-top boxes. Companies are actively using integration and acquisition strategies to reap the benefits of partner innovation, distribution base, and promotional success. Increasing acceptance of high quality and new products for household appliances and rising global income are expected to further the demand for STB products for television sets.

On September 22, 2021, merger agreement of Zee-Sony was announced in India. The merger between two companies is expected to create a media behemoth that will generate US$ 2 Bn in revenue and a market share of more than 25% in the broadcast space. The combined business boasts 75 TV channels, two OTT platforms, and two film and distribution companies. Additionally, increasing demand for TV sets in retail outlets may increase the use of set-top box products.

Furthermore, cases of epidemics such as the current outbreak of COVID-19, which forced people to stay in their homes, have increased the use of online video and may further intensify the demand for STB products. In addition, the increasing consumer acceptance of digital STBs that are more efficient than analog STBs has created a need for new products based on digital technology.

Moreover, the growing e-commerce sector has made it easier to supply electronic products. Nevertheless, government regulations regarding the limited bandwidth usage of high-volume speakers is expected to hamper the growth of the set-top boxes market.

Digital growth in television networks and advancements in digital broadcasting technologies are key drivers of the set-top boxes market. Users are increasingly looking for seamless, high-quality video streaming, and profitable services such as channel package subscriptions, HD channels, and interactive videos. Additionally, the widespread adoption of set-top boxes has been witnessed in recent years.

The growing acquisition of smart TVs coupled with the rapid growth of Over the Top (OTT) media services has allowed viewers access to their chosen content at no additional cost. Moreover, various technological advancements such as the introduction of dynamic sensors, Bluetooth connectivity, IoT integration (Internet of Things), and support for interactive playgrounds, virtual reality, and artificial intelligence have further enhanced product demand. The implementation of government policies that authorize the installation of set-top boxes in several countries and the increase in revenues also have a positive impact on the growth of the set-top boxes market.

Satellite TV is one of the most important types in the market for set-top boxes. One of the innovations in satellite TV is the launch of the recording studio, which enables consumers to record their programs in real-time and watch them later at a convenient time. Besides, satellite STB units are becoming increasingly equipped with interactive features, such as video on demand, and electronic program guides.

STB units are highly developed, and provide a range of interactive and multimedia communication services directly through the user's television system, such as Internet browsing, email, and instant messaging, in addition to basic functionality. D2H offers a HD SMART set-top box that converts an existing LED TV into a smart TV. This set-top box allows users to browse content from Twitter, Facebook, and Daily Motion, videos on desired sites, OTT apps, and news. HD smart set-top boxes serve as tools to create a personal and new customer experience.

The two biggest advantages that set-top box manufacturers have against conventional cable services are the ability to provide a greater variety of channels, and to broadcast HD and ultra-HD channels. In the near future, increasingly digitized set-top box services coupled with highly interactive features is expected to be added, thus increasing the appeal of set-top boxes to consumers. This will serve as a primary driver for all set-top box manufacturers across the globe.

The effect of the proliferation of HD services in all developed regions are factors for set-top box providers to focus on them. Additionally, the near-sale of HEVC high-end boxes is expected to counteract problems service providers have with 4K video data transfer, which is data decoding. HEVC-enabled set-top boxes are projected to improve the speed at which 4K video can be recorded, thus enabling smooth 4K performance for users in a market where demand is high.

Another concept currently in high demand is the hybrid set-top box, which is a combination of Internet-based TV services and satellite-based HD services. Hybrid set-top boxes are expected to help TV channel providers assume a better competitive role against Internet-based OTT providers.

The rapid rate of industrial development in many Asia Pacific countries allows users to have a strong purchasing skills, providing a wide range of regional opportunities for set-top box companies to grow. Additionally, the growth of the IT industry is helping to create a better online service infrastructure that enables users to stream much-needed videos at affordable prices. In line with the developments, Asia Pacific could be a very lucrative market for set-top boxes soon.

Australia, China, and India already have a large network of Internet users. Improved use of advanced Internet services and the proliferation of smart TVs and IPTVs in the region will enable Asia Pacific to showcase a much faster growth rate in the upcoming years. The increase in HD services has been a key success for developed economies such as North America and Europe, with the release of a wide selection of HD TVs and HD channels. This makes it easier for many set-top box providers to access these regions. The demand for HD viewing services is growing rapidly in emerging economies of Asia Pacific, South America, and Middle East & Africa.

The global set-top boxes market is highly fragmented in nature and several key global players hold significant market share. Detailed profiles of providers of set-top boxes have been provided in the report to evaluate their financials, key product offerings, recent developments, and strategies.

Key players operating in the global set-top boxes market are Humax Co., Ltd., Huawei Technologies Co., Ltd., Technicolor SA, ADB (Advanced Digital Broadcast) SA, Apple, Inc., Samsung Electronics Co. Ltd., ARRIS Group, Inc., EchoStar Corporation, Kaonmedia Co. Ltd., and Sagemcom SAS, among others.

Some key developments and strategies adopted by manufacturers in the global set-top boxes market are highlighted below:

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 18.9 Bn |

|

Market Forecast Value in 2031 |

US$ 35.2 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, technology analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market size of set-top boxes stood at US$ 18.9 Bn in 2021

The set-top boxes market is estimated to grow at a CAGR of 6.4%

The set-top boxes market is estimated to reach US$ 35.2 Bn by 2031

Technological advancements and popularity of Android television are key drivers of the market

Satellite STBs contributed key share to the set-top boxes market

Asia Pacific is a more attractive region for vendors in the set-top boxes market

Humax Co., Ltd., Huawei Technologies Co., Ltd., Technicolor SA, ADB (Advanced Digital Broadcast) SA, Apple, Inc., Samsung Electronics Co. Ltd., ARRIS Group, Inc., EchoStar Corporation, Kaonmedia Co. Ltd., and Sagemcom SAS, etc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Television Overview

5.4. Porter’s Five Forces Analysis

5.5. Technological Overview

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. COVID-19 Impact Analysis

5.9. Standards and Regulations

5.10. Global Set-top Boxes Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Million Units)

6. Global Set-top Boxes Market Analysis and Forecast, By Type

6.1. Set-top Boxes Market Size (US$ Bn and Million Units), By Type, 2017 - 2031

6.1.1.1. Cable STB

6.1.1.2. Satellite STB

6.1.1.3. IPTV STB

6.1.1.4. HBB STV

6.1.1.5. Hybrid

6.2. Incremental Opportunity, By Type

7. Global Set-top Boxes Market Analysis and Forecast, By Resolution

7.1. Set-top Boxes Market Size (US$ Bn and Million Units), By Resolution, 2017 - 2031

7.1.1. Standard Definition STB

7.1.2. High-definition STB

7.1.3. HD & Full HD

7.1.4. UHD (Ultra-High Definition)

7.1.5. 4K & Above

7.2. Incremental Opportunity, By Resolution

8. Global Set-top Boxes Market Analysis and Forecast, By Technology

8.1. Set-top Boxes Market Size (US$ Bn and Million Units), By Technology, 2017 - 2031

8.1.1. Satellite/DTH

8.1.2. IPTV

8.1.3. Cable

8.1.4. Other Types (DTT, OTT, etc.)

8.2. Incremental Opportunity, By Technology

9. Global Set-top Boxes Market Analysis and Forecast, By Distribution Channel

9.1. Set-top Boxes Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.1.1. Company Website

9.1.1.2. E-commerce Website

9.1.2. Offline

9.1.2.1. Direct

9.1.2.2. Indirect

9.2. Incremental Opportunity, By Distribution Channel

10. Global Set-top Boxes Market Analysis and Forecast, by Region

10.1. Set-top Boxes Market Size (US$ Bn and Million Units), By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Set-top Boxes Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Supplier Analysis

11.4. Key Trends Analysis

11.4.1. Demand Side Analysis

11.4.2. Supply Side Analysis

11.5. COVID-19 Impact Analysis

11.6. Set-top Boxes Market Size (US$ Bn and Million Units), By Type, 2017 - 2031

11.6.1.1. Cable STB

11.6.1.2. Satellite STB

11.6.1.3. IPTV STB

11.6.1.4. HBB STV

11.6.1.5. Hybrid

11.7. Set-top Boxes Market Size (US$ Bn and Million Units), By Resolution, 2017 - 2031

11.7.1. Standard Definition STB

11.7.2. High-definition STB

11.7.3. HD & Full HD

11.7.4. UHD (Ultra-High Definition)

11.7.5. 4K & Above

11.8. Set-top Boxes Market Size (US$ Bn and Million Units), By Technology, 2017 - 2031

11.8.1. Satellite/DTH

11.8.2. IPTV

11.8.3. Cable

11.8.4. Other Types (DTT, OTT, etc.)

11.9. Set-top Boxes Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. Company Website

11.9.1.2. E-commerce Website

11.9.2. Offline

11.9.2.1. Direct

11.9.2.2. Indirect

11.10. Set-top Boxes Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Set-top Boxes Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Supplier Analysis

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. COVID-19 Impact Analysis

12.6. Set-top Boxes Market Size (US$ Bn and Million Units), By Type, 2017 - 2031

12.6.1.1. Cable STB

12.6.1.2. Satellite STB

12.6.1.3. IPTV STB

12.6.1.4. HBB STV

12.6.1.5. Hybrid

12.7. Set-top Boxes Market Size (US$ Bn and Million Units), By Resolution, 2017 - 2031

12.7.1. Standard Definition STB

12.7.2. High-definition STB

12.7.3. HD & Full HD

12.7.4. UHD (Ultra-High Definition)

12.7.5. 4K & Above

12.8. Set-top Boxes Market Size (US$ Bn and Million Units), By Technology, 2017 - 2031

12.8.1. Satellite/DTH

12.8.2. IPTV

12.8.3. Cable

12.8.4. Other Types (DTT, OTT, etc.)

12.9. Set-top Boxes Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. Company Website

12.9.1.2. E-commerce Website

12.9.2. Offline

12.9.2.1. Direct

12.9.2.2. Indirect

12.10. Set-top Boxes Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Set-top Boxes Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Supplier Analysis

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. COVID-19 Impact Analysis

13.6. Set-top Boxes Market Size (US$ Bn and Million Units), By Type, 2017 - 2031

13.6.1.1. Cable STB

13.6.1.2. Satellite STB

13.6.1.3. IPTV STB

13.6.1.4. HBB STV

13.6.1.5. Hybrid

13.7. Set-top Boxes Market Size (US$ Bn and Million Units), By Resolution, 2017 - 2031

13.7.1. Standard Definition STB

13.7.2. High-definition STB

13.7.3. HD & Full HD

13.7.4. UHD (Ultra-High Definition)

13.7.5. 4K & Above

13.8. Set-top Boxes Market Size (US$ Bn and Million Units), By Technology, 2017 - 2031

13.8.1. Satellite/DTH

13.8.2. IPTV

13.8.3. Cable

13.8.4. Other Types (DTT, OTT, etc.)

13.9. Set-top Boxes Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. Company Website

13.9.1.2. E-commerce Website

13.9.2. Offline

13.9.2.1. Direct

13.9.2.2. Indirect

13.10. Set-top Boxes Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

14. Middle East & Africa Set-top Boxes Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Supplier Analysis

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. COVID-19 Impact Analysis

14.6. Set-top Boxes Market Size (US$ Bn and Million Units), By Type, 2017 - 2031

14.6.1.1. Cable STB

14.6.1.2. Satellite STB

14.6.1.3. IPTV STB

14.6.1.4. HBB STV

14.6.1.5. Hybrid

14.7. Set-top Boxes Market Size (US$ Bn and Million Units), By Resolution, 2017 - 2031

14.7.1. Standard Definition STB

14.7.2. High-definition STB

14.7.3. HD & Full HD

14.7.4. UHD (Ultra-High Definition)

14.7.5. 4K & Above

14.8. Set-top Boxes Market Size (US$ Bn and Million Units), By Technology, 2017 - 2031

14.8.1. Satellite/DTH

14.8.2. IPTV

14.8.3. Cable

14.8.4. Other Types (DTT, OTT, etc.)

14.9. Set-top Boxes Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

14.9.1. Online

14.9.1.1. Company Website

14.9.1.2. E-commerce Website

14.9.2. Offline

14.9.2.1. Direct

14.9.2.2. Indirect

14.10. Set-top Boxes Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Set-top Boxes Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Supplier Analysis

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. COVID-19 Impact Analysis

15.6. Set-top Boxes Market Size (US$ Bn and Million Units), By Type, 2017 - 2031

15.6.1.1. Cable STB

15.6.1.2. Satellite STB

15.6.1.3. IPTV STB

15.6.1.4. HBB STV

15.6.1.5. Hybrid

15.7. Set-top Boxes Market Size (US$ Bn and Million Units), By Resolution, 2017 - 2031

15.7.1. Standard Definition STB

15.7.2. High-definition STB

15.7.3. HD & Full HD

15.7.4. UHD (Ultra-High Definition)

15.7.5. 4K & Above

15.8. Set-top Boxes Market Size (US$ Bn and Million Units), By Technology, 2017 - 2031

15.8.1. Satellite/DTH

15.8.2. IPTV

15.8.3. Cable

15.8.4. Other Types (DTT, OTT, etc.)

15.9. Set-top Boxes Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.1.1. Company Website

15.9.1.2. E-commerce Website

15.9.2. Offline

15.9.2.1. Direct

15.9.2.2. Indirect

15.10. Set-top Boxes Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2020

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Humax Co., Ltd.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. Huawei Technologies Co., Ltd.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Technicolor SA

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. ADB (Advanced Digital Broadcast) SA

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. Apple, Inc.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Samsung Electronics Co. Ltd.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. ARRIS Group, Inc.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. EchoStar Corporation

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. Kaonmedia Co. Ltd.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Sagemcom SAS

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Resolution

17.1.3. Technology

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 2: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 3: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 4: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 5: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 6: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 7: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 8: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 9: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 10: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 11: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 12: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 13: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 14: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 15: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 16: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 17: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 18: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 19: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 20: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 21: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 22: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 23: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 24: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 25: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 26: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 27: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 28: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 29: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 30: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 31: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 32: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 33: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 34: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 35: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 36: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 37: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 38: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 39: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 40: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 41: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 42: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 43: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 44: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 45: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 46: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 47: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 48: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 49: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 50: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 51: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 52: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 53: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 54: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 55: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 56: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 57: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 58: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031

Table 59: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031

Table 60: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031,

List of Figures

Figure 1: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, by Type

Figure 2: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 3: Global Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, by Type

Figure 4: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Resolution

Figure 5: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Resolution

Figure 6: Global Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Resolution

Figure 7: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Technology

Figure 8: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Technology

Figure 9: Global Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Technology

Figure 10: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Distribution Channel

Figure 11: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Distribution Channel

Figure 12: Global Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Distribution Channel

Figure 13: Global Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Region

Figure 14: Global Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Region

Figure 15: Global Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Region

Figure 16: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, by Type

Figure 17: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 18: North America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, by Type

Figure 19: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Resolution

Figure 20: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Resolution

Figure 21: North America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Resolution

Figure 22: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Technology

Figure 23: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Technology

Figure 24: North America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Technology

Figure 25: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Distribution Channel

Figure 26: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Distribution Channel

Figure 27: North America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Distribution Channel

Figure 28: North America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Country

Figure 29: North America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Country

Figure 30: North America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Country

Figure 31: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, by Type

Figure 32: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 33: Europe Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, by Type

Figure 34: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Resolution

Figure 35: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Resolution

Figure 36: Europe Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Resolution

Figure 37: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Technology

Figure 38: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Technology

Figure 39: Europe Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Technology

Figure 40: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Distribution Channel

Figure 41: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Distribution Channel

Figure 42: Europe Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Distribution Channel

Figure 43: Europe Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Country

Figure 44: Europe Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Country

Figure 45: Europe Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Country

Figure 46: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, by Type

Figure 47: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 48: Asia Pacific Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, by Type

Figure 49: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Resolution

Figure 50: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Resolution

Figure 51: Asia Pacific Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Resolution

Figure 52: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Technology

Figure 53: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Technology

Figure 54: Asia Pacific Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Technology

Figure 55: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Distribution Channel

Figure 56: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Distribution Channel

Figure 57: Asia Pacific Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Distribution Channel

Figure 58: Asia Pacific Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Country

Figure 59: Asia Pacific Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Country

Figure 60: Asia Pacific Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Country

Figure 61: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, by Type

Figure 62: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 63: Middle East & Africa Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, by Type

Figure 64: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Resolution

Figure 65: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Resolution

Figure 66: Middle East & Africa Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Resolution

Figure 67: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Technology

Figure 68: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Technology

Figure 69: Middle East & Africa Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Technology

Figure 70: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Distribution Channel

Figure 71: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Distribution Channel

Figure 72: Middle East & Africa Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Distribution Channel

Figure 73: Middle East & Africa Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Country

Figure 74: Middle East & Africa Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Country

Figure 75: Middle East & Africa Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Country

Figure 76: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, by Type

Figure 77: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, by Type

Figure 78: South America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, by Type

Figure 79: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Resolution

Figure 80: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Resolution

Figure 81: South America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Resolution

Figure 82: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Technology

Figure 83: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Technology

Figure 84: South America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Technology

Figure 85: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Distribution Channel

Figure 86: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Distribution Channel

Figure 87: South America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Distribution Channel

Figure 88: South America Set-top Boxes Market Value (US$ Bn) Forecast, 2017-2031, By Country

Figure 89: South America Set-top Boxes Market Volume (Million Units) Forecast, 2017-2031, By Country

Figure 90: South America Set-top Boxes Market, Incremental Opportunities, Forecast, 2017-2031, By Country