The severity of the septic process and the extent of organ dysfunction in patients require immediate admission to an ICU in hospital. To avoid extreme fatalities and admission to ICUs, healthcare companies in the sepsis therapeutics market are developing efficacious fourth- and fifth-generation drugs.

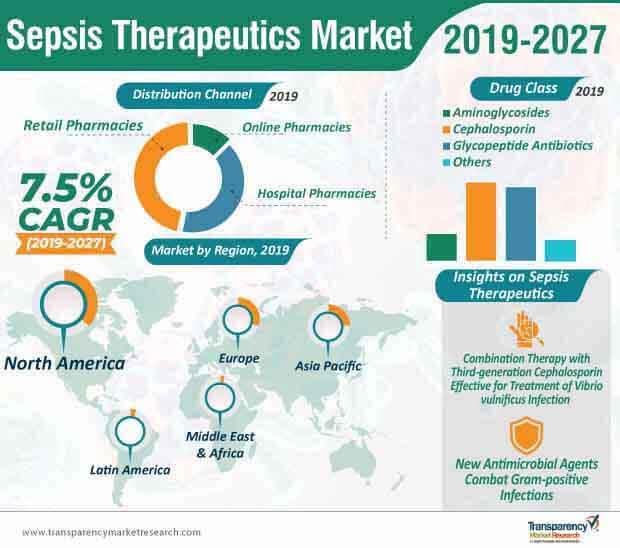

Revenue of cephalosporin drugs is projected to be the highest in 2027, in the sepsis therapeutics market, with an estimated value of ~US$ 2.2 billion. Thus, to gain positive outcome via clinical trials, manufacturers are collaborating with researchers & scientists to develop effective cephalosporin drugs. As such, healthcare institutions are approaching the combination therapy with third-generation cephalosporin and a tetracycline analogue to treat vibrio vulnificus infection in patients. This therapy has been gaining prominence in the sepsis therapeutics market, since the combination works as an 'in vitro' bactericidal activity against vibrio vulnificus.

Healthcare professionals are increasingly adopting antimicrobial therapy to minimize the damage caused by infections to the gut microbiome. As such, healthcare providers in the sepsis therapeutics market are delivering the right balance between the utilization of antimicrobials and the clinical need for treating specific signs and symptoms in patients.

Healthcare companies in the sepsis therapeutics market are increasing research on immunometabolism, as insights on immune regulation are helping manufacturers develop efficacious drugs. Since the early detection and treatment of sepsis is critical, researchers are studying the body’s natural and innate response to various classes of drugs by studying immunometabolism. To gain further insights, healthcare companies are running clinical trials involving antibiotics, fluids, and dialysis, to ensure blood flow to the affected organs. They are also devising methods of surgical therapies to remove damaged tissues.

As such, healthcare companies in the sepsis therapeutics market are trying to identify new therapeutic targets that could potentially reduce inflammatory response in patients. They are increasing research via animal testing by introducing lipopolysaccharide (LPS) in mice to see if the molecule can suppress the severity of inflammatory response.

Antimicrobials have a rapid and long-lasting effect on septic infections. However, antimicrobial resistance to gram-positive infections (GPIs) is emerging as a major public health threat to patients, worldwide. The growing prevalence of multidrug-resistant bacteria in patients has led to increased morbidity and mortality rates. This has created the issue of escalated treatment costs and prolonged hospitalization stay for patients. This is why, healthcare companies in the sepsis therapeutics market are developing new antimicrobial agents to reduce the resistance of drugs against gram-positive infections.

Healthcare companies are expected to develop a robust healthcare value and supply chain in the Asia Pacific region, as it is predicted for fast growth in the sepsis therapeutics market. For instance, stakeholders in the sepsis therapeutics market have observed the growing prevalence of methicillin resistant staphylococcus aureus bacteria in Indian patients that has led to the heavy consumption of antibiotics. Thus, stakeholders in the sepsis therapeutics market are recommending judicious prescription of antimicrobial agents, implementation of antibiotic stewardship programs, and conformation to suitable antibiotic policies developed by health commissions to reduce the problem of drug resistance in patients.

Analysts’ View of Sepsis Therapeutics Market

The sepsis therapeutics market is predicted to exponentially grow from a value of ~US$ 3.2 billion that was accounted in 2018, to a value of ~US$ 6 billion by 2027. Healthcare providers are practicing early therapeutic plasma exchange in cases of septic shock in patients. This method is considered medically safe, and effective for septic shock patients. They are also introducing high doses of vasopressors for rapid hemodynamic improvement and favorable changes in the cytokine profile for patients observed with septic shock. However, in the case of GPIs, adverse effects related to safety and tolerability towards drugs is an ongoing challenge for healthcare companies. To overcome this challenge, manufacturers should introduce new antimicrobial agents in efficacious fourth- and fifth-generation drugs.

Sepsis Therapeutics Market: Overview

Novel Pipeline Drugs and Rise in Incidence Rate of Sepsis: A Key Driver

Cephalosporin Drug Class Prominent

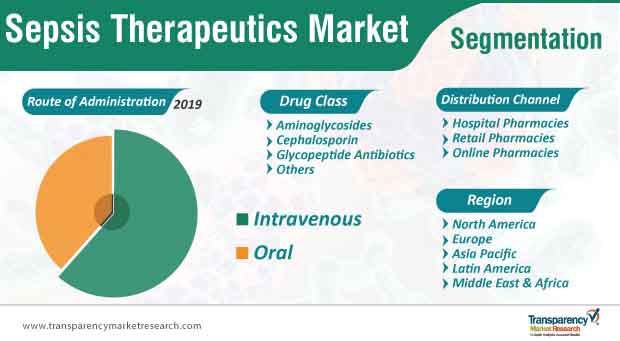

Intravenous Administration Popular

North America to Dominate Global Sepsis Therapeutics Market

Global Sepsis Therapeutics Market: Competitive Landscape

Global Sepsis Therapeutics Market: Key Developments

Major manufacturers in the global sepsis therapeutics market are adopting research collaboration, purchase and distribution agreement, and new product development strategies to strengthen their product portfolios and geographic presence in the international market. Key developments in the global sepsis therapeutics market are:

In the global sepsis therapeutics market report, we have discussed individual strategies, followed by company profiles of the manufacturers of sepsis drugs. The ‘competitive landscape’ section is included in the global sepsis therapeutics market report to provide readers with a dashboard view of the key players operating in the global sepsis therapeutics market.

Sepsis therapeutics market to reach a value of ~US$ 6 billion by 2027

Sepsis therapeutics market is expected to expand at a CAGR of 7.5% from 2019 to 2027

Sepsis therapeutics market is driven by increase in the number of products in the pipeline and rise in research & development expenditures

The cephalosporin segment dominated the global sepsis therapeutics market, and is expected to account for a major market share during the forecast period

Key players in the global sepsis therapeutics market include INOTREM S.A., Mylan N.V., Asahi Kasei Corporation Pfizer, Inc., GlaxoSmithKline plc

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Sepsis Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Sepsis Therapeutics Market Analysis and Forecasts, 2017–2027

5. Market Outlook

5.1. Regulatory Scenario

5.2. Pipeline Analysis

6. Global Sepsis Therapeutics Market Analysis and Forecasts, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017–2027

6.3.1. Aminoglycosides

6.3.2. Cephalosporin

6.3.3. Glycopeptide Antibiotics

6.3.4. Others

6.4. Market Attractiveness, by Drug Class

7. Global Sepsis Therapeutics Market Analysis and Forecasts, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2027

7.3.1. Intravenous

7.3.2. Oral

7.4. Market Attractiveness, by Route of Administration

8. Global Sepsis Therapeutics Market Analysis and Forecasts, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2027

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Distribution Channel

9. Global Sepsis Therapeutics Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Sepsis Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017–2027

10.2.1. Aminoglycosides

10.2.2. Cephalosporin

10.2.3. Glycopeptide Antibiotics

10.2.4. Others

10.3. Market Value Forecast, by Route of Administration, 2017–2027

10.3.1. Intravenous

10.3.2. Oral

10.4. Market Value Forecast, by Distribution Channel, 2017–2027

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Sepsis Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2027

11.2.1. Aminoglycosides

11.2.2. Cephalosporin

11.2.3. Glycopeptide Antibiotics

11.2.4. Others

11.3. Market Value Forecast, by Route of Administration, 2017–2027

11.3.1. Intravenous

11.3.2. Oral

11.4. Market Value Forecast, by Distribution Channel, 2017–2027

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Sepsis Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2027

12.2.1. Aminoglycosides

12.2.2. Cephalosporin

12.2.3. Glycopeptide Antibiotics

12.2.4. Others

12.3. Market Value Forecast, by Route of Administration, 2017–2027

12.3.1. Intravenous

12.3.2. Oral

12.4. Market Value Forecast, by Distribution Channel, 2017–2027

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Route of Administration

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Sepsis Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017–2027

13.2.1. Aminoglycosides

13.2.2. Cephalosporin

13.2.3. Glycopeptide Antibiotics

13.2.4. Others

13.3. Market Value Forecast, by Route of Administration, 2017–2027

13.3.1. Intravenous

13.3.2. Oral

13.4. Market Value Forecast, by Distribution Channel, 2017–2027

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Route of Administration

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Sepsis Therapeutics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017–2027

14.2.1. Aminoglycosides

14.2.2. Cephalosporin

14.2.3. Glycopeptide Antibiotics

14.2.4. Others

14.3. Market Value Forecast, by Route of Administration, 2017–2027

14.3.1. Intravenous

14.3.2. Oral

14.4. Market Value Forecast, by Distribution Channel, 2017–2027

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Route of Administration

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competitive Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. Mylan N.V.

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Product Portfolio

15.2.1.3. SWOT Analysis

15.2.1.4. Strategic Overview

15.2.1.5. Financial Overview

15.2.2. Asahi Kasei Corporation

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Product Portfolio

15.2.2.3. SWOT Analysis

15.2.2.4. Strategic Overview

15.2.2.5. Financial Overview

15.2.3. Pfizer, Inc.

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. SWOT Analysis

15.2.3.4. Strategic Overview

15.2.3.5. Financial Overview

15.2.4. GlaxoSmithKline plc

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Product Portfolio

15.2.4.3. SWOT Analysis

15.2.4.4. Strategic Overview

15.2.4.5. Financial Overview

15.2.5. RegeneRx

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Product Portfolio

15.2.5.3. SWOT Analysis

15.2.5.4. Strategic Overview

15.2.5.5. Financial Overview

15.2.6. Adrenomed AG

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Product Portfolio

15.2.6.3. Strategic Overview

15.2.7. AtoxBio

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8. ENDACEA, INC.

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. Strategic Overview

15.2.9. INOTREM S.A

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. Strategic Overview

List of Tables

Table 01: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 02: Global Sepsis Therapeutics Drugs Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 03: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 04: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 05: North America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 06: North America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 07: North America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 08: North America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 09: Europe Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 10: Europe Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 11: Europe Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 12: Europe Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 13: Asia Pacific Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 14: Asia Pacific Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 15: Asia Pacific Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 16: Asia Pacific Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 17: Latin America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 18: Latin America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 19: Latin America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 20: Latin America Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

Table 21: Middle East & Africa Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Middle East & Africa Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 23: Middle East & Africa Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 24: Middle East & Africa Sepsis Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2027

List of Figures

Figure 01: Global Sepsis Therapeutics Market Value (US$ Mn) and Distribution, by Region, 2018 and 2027

Figure 02: Global Sepsis Therapeutics Market Revenue (US$ Mn), by Route of Administration, 2018

Figure 04: Global Sepsis Therapeutics Market Revenue, by Drug Class (US$ Mn), 2018

Figure 03: Global Sepsis Therapeutics Market Revenue (US$ Mn), by Distribution Channel, 2018

Figure 05: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast, 2017–2027

Figure 07: Global Sepsis Therapeutics Market Value Share, by Route of Administration, 2018

Figure 09: Global Sepsis Therapeutics Market Value Share, by Region, 2018

Figure 06: Global Sepsis Therapeutics Market Value Share, by Drug Class, 2018

Figure 08: Global Sepsis Therapeutics Market Value Share, by Distribution Channel, 2018

Figure 10: Regulatory Approval Process - U.S.

Figure 11: Regulatory Approval Process - Canada

Figure 12: Regulatory Approval Process - Europe

Figure 13: Regulatory Approval Process - Japan

Figure 14: Regulatory Approval Process - India

Figure 15: Global Sepsis Therapeutics Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 16: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Aminoglycosides, 2017–2027

Figure 17: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Cephalosporin, 2017–2027

Figure 18: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Glycopeptide Antibiotics, 2017–2027

Figure 19: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Others, 2017–2027

Figure 20: Global Sepsis Therapeutics Market Attractiveness, by Drug Class, 2019–2027

Figure 21: Global Sepsis Therapeutics Market Value Share (%), by Route of Administration, 2018 and 2027

Figure 22: Global Sepsis Therapeutics Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Intravenous, 2017–2027

Figure 23: Global Sepsis Therapeutics Drugs Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Oral, 2017–2027

Figure 24: Global Sepsis Therapeutics Market Attractiveness, by Route of Administration, 2019–2027

Figure 25: Global Sepsis Therapeutics Market Value Share (%), by Distribution Channel, 2018 and 2027

Figure 26: Global Sepsis Therapeutics Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2027

Figure 27: Global Sepsis Therapeutics Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2027

Figure 28: Global Sepsis Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Online Pharmacies, 2017–2027

Figure 29: Global Sepsis Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 30: Global Sepsis Therapeutics Market Value Share Analysis, by Region 2018 and 2027

Figure 31: Global Sepsis Therapeutics Market Attractiveness, by Region, 2019–2027

Figure 32: North America Sepsis Therapeutics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 33: North America Sepsis Therapeutics Market Value Share (%) Analysis, by Country, 2018 and 2027

Figure 34: North America Sepsis Therapeutics Market Attractiveness Analysis, by Country, 2019?2027

Figure 35: North America Sepsis Therapeutics Market Value Share (%) Analysis, by Drug Class, 2018 and 2027

Figure 36: North America Sepsis Therapeutics Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 37: North America Sepsis Therapeutics Market Value Share (%) Analysis, by Route of Administration, 2018 and 2027

Figure 38: North America Sepsis Therapeutics Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 39: North America Sepsis Therapeutics Market Value Share (%) Analysis, by Distribution Channel, 2018 and 2027

Figure 40: North America Sepsis Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2019–2027

Figure 41: Europe Sepsis Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 42: Europe Sepsis Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 43: Europe Sepsis Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2019?2027

Figure 44: Europe Sepsis Therapeutics Market Value Share Analysis (%), by Drug Class, 2018 and 2027

Figure 45: Europe Sepsis Therapeutics Market Attractiveness, by Drug Class, 2019–2027

Figure 46: Europe Sepsis Therapeutics Market Value Share Analysis (%), by Route of Administration, 2018 and 2027

Figure 47: Europe Sepsis Therapeutics Market Attractiveness, by Route of Administration, 2019–2027

Figure 48: Europe Sepsis Therapeutics Market Value Share Analysis (%), by Distribution Channel, 2018 and 2027

Figure 49: Europe Sepsis Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 50: Asia Pacific Sepsis Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 51: Asia Pacific Sepsis Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 52: Asia Pacific Sepsis Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 53: Asia Pacific Sepsis Therapeutics Market Value Share Analysis (%), by Drug Class, 2018 and 2027

Figure 54: Asia Pacific Sepsis Therapeutics Market Attractiveness, by Drug Class, 2019–2027

Figure 55: Asia Pacific Sepsis Therapeutics Market Value Share Analysis (%), by Route of Administration, 2018 and 2027

Figure 56: Asia Pacific Sepsis Therapeutics Market Attractiveness, by Route of Administration, 2019–2027

Figure 57: Asia Pacific Sepsis Therapeutics Market Value Share Analysis (%), by Distribution Channel, 2018 and 2027

Figure 58: Asia Pacific Sepsis Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 59: Latin America Sepsis Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 60: Latin America Sepsis Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 61: Latin America Sepsis Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 62: Latin America Sepsis Therapeutics Market Value Share Analysis (%), by Drug Class, 2018 and 2027

Figure 63: Latin America Sepsis Therapeutics Market Attractiveness, by Drug Class, 2019–2027

Figure 64: Latin America Sepsis Therapeutics Market Value Share Analysis (%), by Route of Administration, 2018 and 2027

Figure 65: Latin America Sepsis Therapeutics Market Attractiveness, by Route of Administration, 2019–2027

Figure 66: Latin America Sepsis Therapeutics Market Value Share Analysis (%), by Distribution Channel, 2018 and 2027

Figure 67: Latin America Sepsis Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027

Figure 68: Middle East & Africa Sepsis Therapeutics Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 69: Middle East & Africa Sepsis Therapeutics Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 70: Middle East & Africa Sepsis Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2019-2027

Figure 71: Middle East & Africa Sepsis Therapeutics Market Value Share Analysis (%), by Drug Class, 2018 and 2027

Figure 72: Middle East & Africa Sepsis Therapeutics Market Attractiveness, by Drug Class, 2019–2027

Figure 73: Middle East & Africa Sepsis Therapeutics Market Value Share Analysis (%), by Route of Administration, 2018 and 2027

Figure 74: Middle East & Africa Sepsis Therapeutics Market Attractiveness, by Route of Administration, 2019–2027

Figure 75: Middle East & Africa Sepsis Therapeutics Market Value Share Analysis (%), by Distribution Channel, 2018 and 2027

Figure 76: Middle East & Africa Sepsis Therapeutics Market Attractiveness, by Distribution Channel, 2019–2027