Sensors in Mobile Phone Market: Snapshot

Technological inventions in electronic equipment has increased at a fast pace. Sensors are one such innovation that plays a vital role in the mobile industry. Sensors are the components which measure a physical or environmental quantity and convert it into a signal. Various types of sensors are embedded in mobile phones. The combination of sensors and mobile phones leads to the development of sensor technology which is likely to revolutionize a large number of business sectors. The introduction of smart sensors in smartphones results in an advance computing platform as well as richer functionalities for the smartphones.

Sensors in mobile phones offer numerous opportunities for countries that are expected to invest in developing new technological features in the mobile industry. It is anticipated that various vendors are popularizing the use of sensors in order to develop interactive applications and games across operating systems such as Android OS, iOS, and Windows. Several mobile phone manufacturers are focusing on integrating various types of sensors in phones to extend the functional capabilities and features of phones. The embedding of sensors in mobile phones transforms the ordinary mobile phone into a smartphone.

Key drivers of the sensors in mobile phone market are increasing penetration of smartphones, increase in investments for research and development for technological inventions, and adoption of sensing applications. Demand for mobile phones or smartphones is increasing exponentially due to the advance features offered by the smartphones. Vendors across regions are investing more to develop advance technology for mobile devices. Sensors are widely adopted due to their multiple functions. For instance, smartphones are developed with various sets of cheap, powerful embedded sensors, such as accelerometer, digital compass, gyroscope, GPS, microphone, and camera which enable the creation of personal, group, and community scale sensing applications. Sensors in mobile phones will revolutionize many sectors of economies, including business, healthcare, social networks, environmental monitoring, and transportation. The major restraint faced by the market is the various challenges faced by vendors during the import and export of mobile phones due to the imposition of taxes. The market brings an opportunity for vendors across Brazil, Canada, Indonesia, and South Africa to develop new mobile sensing applications.

The sensors in mobile phone market is segmented on the basis of sensor type and region. By sensor type, the market is segmented as interface sensors, security sensors, environmental sensors, motion sensors, and others. Interface sensors are classified into proximity sensors, near to field communication (NFC), and ambient light sensor. Security sensors comprise fingerprint sensors and face recognition sensors. It is anticipated that fingerprint sensors have a strong opportunity for the sensors in mobile phone market. Environmental sensors are classified into humidity sensor, temperature sensor, and barometer. Motion sensor segment is segregated as gyroscope, accelerometer, compass, and pedometer.

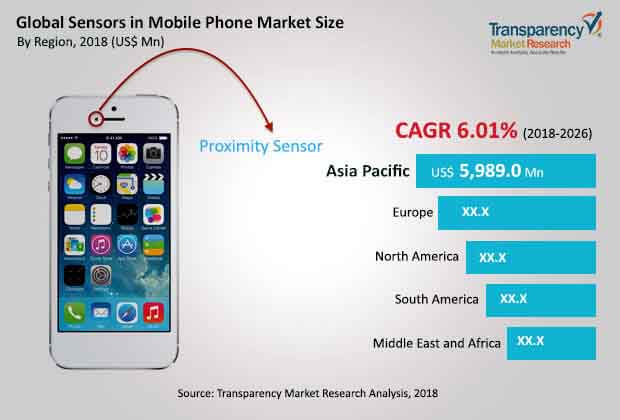

Regional segmentation of the sensors in mobile phone market includes North America, Europe, Asia Pacific, South America, and Middle East & Africa (MEA). Asia Pacific is projected to dominate the sensors in mobile phone market due to the presence of strong players in countries such as China, Taiwan, South Korea, and Japan. Europe and North America are likely to observe strong growth opportunities during the forecast period due to rising investments in the mobile phones manufacturing industry.

Key players of the sensors in mobile phone market are Alps Electric., Bosch Sensortec, Fujitsu Limited, Hillcrest Labs, Inc., InvenSense Inc., MEMSVision., Murata Manufacturing Co., Ltd.., Goertek Inc., Panasonic Corporation, Pyreos Limited, Qualcomm Incorporated, Senodia Technologies, Sensirion, Silicon Laboratories, Inc. , and STMicroelectronics.

Sensors in Mobile Phone Market -Outline

The worldwide electronics industry is experiencing promising growth avenues from the period of past few years. Major companies manufacturing electronic equipment are growing investments in technological advancements. The invention of sensors has resulted into boosting the growth of present mobile industry. Sensors are gaining immense demand from the worldwide mobile industry. Sensors refer to the components that hold ability to measure environmental or physical quantities and convert them into a signal. Increased penetration of smartphones in all worldwide locations is likely to generate promising sales avenues in the sensors in mobile phone market in the years to come.

Many companies in the mobile phones industry across the globe are growing interest in the sensors use. One of the key purposes behind this strategy is the development of games and interactive applications across various operating systems including iOS, Windows, and Android OS. Moving forward, several enterprises in the mobile phone manufacturing industry are concentrated toward the integration of diverse sensors types into phones. This strategy is helping vendors in extending the features and functional abilities of mobile phones. Thus, the incorporation of sensors in mobile phones can transform a regular mobile phone into smartphones.

A mobile phone consists of different types of sensors. While the sensor technology is the output of a blend of mobile phones and sensors, this technology is expected to transform numerous business sectors across the globe. Thus, the launch of smart sensors in smartphones is expected to advance computing platform together with superior functionalities of smartphones. At present, there is extensive growth in the use of fingerprint sensors integrated in smartphones. Apart from this, there is notable increase in the research and development activities in the mobile phones manufacturing industry. These are some of the key factors driving demand avenues in the sensors in mobile phone market.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modeling

3. Executive Summary : Global Sensors in Mobile Phones Market

4. Market Overview

4.1. Introduction

4.2. Porter’s Five Forces Analysis - Global Sensors in Mobile Phones Market

4.3. PESTEL Analysis - Global Sensors in Mobile Phones Market

4.4. Technology/Product Roadmap

4.5. Key Trends for Sensors in Mobile Phone Market

4.6. Value Chain Analysis

4.6.1. Product cost analysis

4.6.2. Key raw material suppliers

4.6.3. Key raw materials price trends

4.6.4. Key end user/customers analysis

4.6.5. Market Channel Development Trends

4.6.5.1. Key distributors/ VARs/ intermediaries

4.7. Market Dynamics

4.7.1. Drivers

4.7.1.1. Supply Side

4.7.1.2. Demand Side

4.7.2. Restraints

4.7.3. Opportunities

4.7.4. Impact Analysis of Drivers & Restraints

4.8. Regulations and Policies

4.9. Adoption of Mobile Phones by Price

4.10. Sensors in Mobile Phone Analysis

4.11. Global Sensors in Mobile Phones Market Analysis and Forecast, 2016 - 2026

4.11.1. Market Revenue Analysis (US$ Mn)

4.11.1.1. Historic growth trends, 2015-2017

4.11.1.2. Forecast trends, 2017-2026

4.11.2. Market Volume Projections (Mn Units)

4.11.2.1. Historic growth trends, 2015-2017

4.11.2.2. Forecast trends, 2018-2026

4.12. Market Outlook

4.13. Competitive Scenario and Trends

4.13.1. Sensors in Mobile Phones Market Concentration Rate

4.13.1.1. List of New Entrants

4.13.2. Mergers & Acquisitions, Expansions

5. Global Sensors in Mobile Phones Market Analysis and Forecast, by Sensor Type

5.1. Overview& Definition

5.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Sensor Type, 2016 - 2026

5.2.1. Interface

5.2.1.1. Proximity

5.2.1.2. Near Field Communication(NFC)

5.2.1.3. Ambient Light Sensor

5.2.2. Security

5.2.2.1. Face/Eye/Iris Recognition

5.2.2.2. Fingerprint Sensor

5.2.2.3. Environmental

5.2.2.4. Barometer

5.2.2.5. Thermometer

5.2.2.6. Humidity Sensor

5.2.3. Motion

5.2.3.1. Accelerometer

5.2.3.2. Gyroscope

5.2.3.3. Compass

5.2.3.4. Pedometer

5.2.4. Others(Touch Sensors, Optical Sensor)

5.3. Market Attractiveness by Sensor Type

6. Global Sensors in Mobile Phones Market Analysis and Forecast, by Region

6.1. Key Findings

6.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Region, 2016 - 2026

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Attractiveness by Region

7. North America Sensors in Mobile Phones Market Analysis and Forecast

7.1. Key Findings

7.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Sensor Type, 2016 - 2026

7.2.1. Interface

7.2.1.1. Proximity

7.2.1.2. Near Field Communication(NFC)

7.2.1.3. Ambient Light Sensor

7.2.2. Security

7.2.2.1. Face/Eye/Iris Recognition

7.2.2.2. Fingerprint Sensor

7.2.2.3. Environmental

7.2.2.4. Barometer

7.2.2.5. Thermometer

7.2.2.6. Humidity Sensor

7.2.3. Motion

7.2.3.1. Accelerometer

7.2.3.2. Gyroscope

7.2.3.3. Compass

7.2.3.4. Pedometer

7.2.4. Others(Touch Sensors, Optical Sensor)

7.3. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Country, 2016 - 2026

7.3.1. The U.S.

7.3.2. Canada

7.3.3. Rest of North America

7.4. Market Attractiveness Analysis

7.4.1. By Sensor Type

7.4.2. By Country

8. Europe Sensors in Mobile Phones Market Analysis and Forecast

8.1. Key Findings

8.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Sensor Type, 2016 - 2026

8.2.1. Interface

8.2.1.1. Proximity

8.2.1.2. Near Field Communication(NFC)

8.2.1.3. Ambient Light Sensor

8.2.2. Security

8.2.2.1. Face/Eye/Iris Recognition

8.2.2.2. Fingerprint Sensor

8.2.2.3. Environmental

8.2.2.4. Barometer

8.2.2.5. Thermometer

8.2.2.6. Humidity Sensor

8.2.3. Motion

8.2.3.1. Accelerometer

8.2.3.2. Gyroscope

8.2.3.3. Compass

8.2.3.4. Pedometer

8.2.4. Others(Touch Sensors, Optical Sensor)

8.3. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Country, 2016 - 2026

8.3.1. Germany

8.3.2. France

8.3.3. UK

8.3.4. Rest of Europe

8.4. Market Attractiveness Analysis

8.4.1. By Sensor Type

8.4.2. By Country

9. Asia Pacific Sensors in Mobile Phones Market Analysis and Forecast

9.1. Key Findings

9.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Sensor Type, 2016 - 2026

9.2.1. Interface

9.2.1.1. Proximity

9.2.1.2. Near Field Communication(NFC)

9.2.1.3. Ambient Light Sensor

9.2.2. Security

9.2.2.1. Face/Eye/Iris Recognition

9.2.2.2. Fingerprint Sensor

9.2.3. Environmental

9.2.3.1. Barometer

9.2.3.2. Thermometer

9.2.3.3. Humidity Sensor

9.2.4. Motion

9.2.4.1. Accelerometer

9.2.4.2. Gyroscope

9.2.4.3. Compass

9.2.4.4. Pedometer

9.2.5. Others(Touch Sensors, Optical Sensor)

9.3. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Country, 2016 - 2026

9.3.1. China

9.3.2. Japan

9.3.3. India

9.3.4. Rest of Asia Pacific

9.4. Market Attractiveness Analysis

9.4.1. By Sensor Type

9.4.2. By Country

10. Middle East and Africa (MEA) Sensors in Mobile Phones Market Analysis and Forecast

10.1. Key Findings

10.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Sensor Type, 2016 - 2026

10.2.1. Interface

10.2.1.1. Proximity

10.2.1.2. Near Field Communication(NFC)

10.2.1.3. Ambient Light Sensor

10.2.2. Security

10.2.2.1. Face/Eye/Iris Recognition

10.2.2.2. Fingerprint Sensor

10.2.3. Environmental

10.2.3.1. Barometer

10.2.3.2. Thermometer

10.2.3.3. Humidity Sensor

10.2.4. Motion

10.2.4.1. Accelerometer

10.2.4.2. Gyroscope

10.2.4.3. Compass

10.2.4.4. Pedometer

10.2.5. Others(Touch Sensors, Optical Sensor)

10.3. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Country, 2016 - 2026

10.3.1. GCC

10.3.2. South Africa

10.3.3. Rest of MEA

10.4. Market Attractiveness Analysis

10.4.1. By Sensor Type

10.4.2. By Country

11. South America Sensors in Mobile Phones Market Analysis and Forecast

11.1. Key Findings

11.2. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Sensor Type, 2016 - 2026

11.2.1. Interface

11.2.1.1. Proximity

11.2.1.2. Near Field Communication(NFC)

11.2.1.3. Ambient Light Sensor

11.2.2. Security

11.2.2.1. Face/Eye/Iris Recognition

11.2.2.2. Fingerprint Sensor

11.2.3. Environmental

11.2.3.1. Barometer

11.2.3.2. Thermometer

11.2.3.3. Humidity Sensor

11.2.4. Motion

11.2.4.1. Accelerometer

11.2.4.2. Gyroscope

11.2.4.3. Compass

11.2.4.4. Pedometer

11.2.5. Others(Touch Sensors, Optical Sensor)

11.3. Sensors in Mobile Phones Market Size (US$ Mn and Mn Units) Forecast, by Country, 2016 - 2026

11.3.1. Brazil

11.3.2. Rest of South America

11.4. Market Attractiveness Analysis

11.4.1. By Sensor Type

11.4.2. By Country

12. Competition Landscape

12.1. Market Player – Competition Matrix

12.2. Market Revenue Share Analysis (%), by Company (2018)

13. Company Profiles(Details – Basic Overview, Manufacturing Base, Sales Area/Geographical Presence, Key Competitors, Production and Revenue, Gross Margin, SWOT Analysis, Strategy)

13.1.1. Alps Electric

13.1.1.1. Basic Overview

13.1.1.2. Sales Area/Geographical Presence

13.1.1.3. Revenue

13.1.1.4. SWOT Analysis

13.1.1.5. Strategy

13.1.2. Bosch Sensortec

13.1.2.1. Basic Overview

13.1.2.2. Sales Area/Geographical Presence

13.1.2.3. Revenue

13.1.2.4. SWOT Analysis

13.1.2.5. Strategy

13.1.3. Fujitsu Limited

13.1.3.1. Basic Overview

13.1.3.2. Sales Area/Geographical Presence

13.1.3.3. Revenue

13.1.3.4. SWOT Analysis

13.1.3.5. Strategy

13.1.4. Hillcrest Labs

13.1.4.1. Basic Overview

13.1.4.2. Sales Area/Geographical Presence

13.1.4.3. Revenue

13.1.4.4. SWOT Analysis

13.1.4.5. Strategy

13.1.5. InvenSenseInc.

13.1.5.1. Basic Overview

13.1.5.2. Sales Area/Geographical Presence

13.1.5.3. Revenue

13.1.5.4. SWOT Analysis

13.1.5.5. Strategy

13.1.6. MEMSVision

13.1.6.1. Basic Overview

13.1.6.2. Sales Area/Geographical Presence

13.1.6.3. Revenue

13.1.6.4. SWOT Analysis

13.1.6.5. Strategy

13.1.7. Murata Manufacturing Co., Ltd.

13.1.7.1. Basic Overview

13.1.7.2. Sales Area/Geographical Presence

13.1.7.3. Revenue

13.1.7.4. SWOT Analysis

13.1.7.5. Strategy

13.1.8. Goertek Inc.

13.1.8.1. Basic Overview

13.1.8.2. Sales Area/Geographical Presence

13.1.8.3. Revenue

13.1.8.4. SWOT Analysis

13.1.8.5. Strategy

13.1.9. Panasonic Corporation,

13.1.9.1. Basic Overview

13.1.9.2. Sales Area/Geographical Presence

13.1.9.3. Revenue

13.1.9.4. SWOT Analysis

13.1.9.5. Strategy

13.1.10. Pyreos Limited

13.1.10.1. Basic Overview

13.1.10.2. Sales Area/Geographical Presence

13.1.10.3. Revenue

13.1.10.4. SWOT Analysis

13.1.10.5. Strategy

13.1.11. Qualcomm Incorporated

13.1.11.1. Basic Overview

13.1.11.2. Sales Area/Geographical Presence

13.1.11.3. Revenue

13.1.11.4. SWOT Analysis

13.1.11.5. Strategy

13.1.12. Senodia Technologies

13.1.12.1. Basic Overview

13.1.12.2. Sales Area/Geographical Presence

13.1.12.3. Revenue

13.1.12.4. SWOT Analysis

13.1.12.5. Strategy

13.1.13. Sensirion

13.1.13.1. Basic Overview

13.1.13.2. Sales Area/Geographical Presence

13.1.13.3. Revenue

13.1.13.4. SWOT Analysis

13.1.13.5. Strategy

13.1.14. Silicon Laboratories, Inc.

13.1.14.1. Basic Overview

13.1.14.2. Sales Area/Geographical Presence

13.1.14.3. Revenue

13.1.14.4. SWOT Analysis

13.1.14.5. Strategy

13.1.15. STMicroelectronics

13.1.15.1. Basic Overview

13.1.15.2. Sales Area/Geographical Presence

13.1.15.3. Revenue

13.1.15.4. SWOT Analysis

13.1.15.5. Strategy

14. Key Takeaways

List of Figures

Figure 1: Global Sensors in Mobile Phone Market Revenue, 2016 – 2026(US$ Mn) and Year-on-Year Growth (%)

Figure 2: Global Sensors in Mobile Phone Market Revenue, 2016 – 2026(Million Units) and Year-on-Year Growth (%)

Figure 3: Global Sensors in Mobile Phone Value Share (Value %), by Sensor Type, 2018

Figure 4: Global Sensors in Mobile Phone Market Size ( Million Units) Forecast, 2016 – 2026

Figure 5 : Global Sensors in Mobile Phone Market Y-o-Y Growth (US$ Mn) Forecast, 2016 – 2026

Figure 6: Global Sensors in Mobile Phone Market, by Sensor Type

Figure 7: Global Sensors in Mobile Phone Market, Size (US$ Mn) Forecast, by Sensor Type, Interface, 2016 – 2026

Figure 8: Global Sensors in Mobile Phone Market, Size (US$ Mn) Forecast, by Sensor Type, Security, 2016 – 2026

Figure 9: Global Sensors in Mobile Phone Market, Size (US$ Mn) Forecast, by Sensor Type, Environmental, 2016 – 2026

Figure 10: Global Sensors in Mobile Phone Market, Size (US$ Mn) Forecast, by Sensor Type, Motion, 2016 – 2026

Figure 11: Global Sensors in Mobile Phone Market, Size (US$ Mn) Forecast, by Sensor Type, Others, 2016 – 2026

Figure 12: Global Sensors in Mobile Phone Market Attractiveness Analysis, by Sensor Type (2018)

Figure 13: Global Sensors in Mobile Phone Market, by Region

Figure 14: Global Sensors in Mobile Phone Market Attractiveness Analysis, by Region (2017)

Figure 16: North America Sensors in Mobile Phone Market Size ( Million Units) Forecast, 2016 – 2026

Figure 17: North America Sensors in Mobile Phone Market Y-o-Y Growth (US$ Mn) Forecast, 2016 – 2026

Figure 18: North America Sensors in Mobile Phone Market, by Sensor Type (US$ Mn)

Figure 19: North America Sensors in Mobile Phone Market Value Share Analysis, by Country, 2018 and 2026 (US$ Mn)

Figure 20: North America Sensors in Mobile Phone Market Attractiveness Analysis, by Sensor Type (2018)

Figure 21: North America Sensors in Mobile Phone Market Attractiveness Analysis, by Country (2018)

Figure 24: Europe Sensors in Mobile Phone Market Size ( Million Units) Forecast, 2016 – 2026

Figure 25: Europe Sensors in Mobile Phone Market Y-o-Y Growth (US$ Mn) Forecast, 2016 – 2026

Figure 26: Europe Sensors in Mobile Phone Market, by Sensor Type (US$ Mn)

Figure 27: Europe Sensors in Mobile Phone Market Value Share Analysis, by Country, 2018 and 2026 (US$ Mn)

Figure 28: Europe Sensors in Mobile Phone Market Attractiveness Analysis, by Sensor Type (2018)

Figure 29: Europe Sensors in Mobile Phone Market Attractiveness Analysis, by Country (2018)

Figure 30: Asia Pacific Sensors in Mobile Phone Market Size ( Million Units) Forecast, 2016 – 2026

Figure 31: Asia Pacific Sensors in Mobile Phone Market Y-o-Y Growth (US$ Mn) Forecast, 2016 – 2026

Figure 32:Asia Pacific Sensors in Mobile Phone Market, by Sensor Type (US$ Mn)

Figure 33: Asia Pacific Sensors in Mobile Phone Market Value Share Analysis, by Country, 2018 and 2026 (US$ Mn)

Figure 34: Asia Pacific Sensors in Mobile Phone Market Attractiveness Analysis, by Sensor Type (2018)

Figure 35: Asia Pacific Sensors in Mobile Phone Market Attractiveness Analysis, by Country (2018)

Figure 36: MEA Sensors in Mobile Phone Market Size ( Million Units) Forecast, 2016 – 2026

Figure 37: MEA Sensors in Mobile Phone Market Y-o-Y Growth (US$ Mn) Forecast, 2016 – 2026

Figure 38: MEA Sensors in Mobile Phone Market, by Sensor Type

Figure 39: MEA Sensors in Mobile Phone Market Value Share Analysis, by Country, 2018 and 2026

Figure 40: MEA Sensors in Mobile Phone Market Attractiveness Analysis, by Sensor Type (2018)

Figure 41: MEA Sensors in Mobile Phone Market Attractiveness Analysis, by Country (2018)

Figure 42: South America Sensors in Mobile Phone Market Size ( Million Units) Forecast, 2016 – 2026

Figure 43: South America Sensors in Mobile Phone Market Y-o-Y Growth (US$ Mn) Forecast, 2016 – 2026

Figure 44: South America Sensors in Mobile Phone Market, by Sensor Type

Figure 45: South America Sensors in Mobile Phone Market Value Share Analysis, by Country, 2018 and 2026

Figure 46: South America Sensors in Mobile Phone Market Attractiveness Analysis, by Sensor Type(2018)

Figure 47: South America Sensors in Mobile Phone Market Attractiveness Analysis, by Country (2018)

Figure 48: Global Sensors in Mobile Phone Market Analysis, by Company (2017)

Figure 49: Global Sensors in Mobile Phone Market Analysis, by Company (2017)