The race for a completely self-driving car is underway with increased ongoing testing and prototyping of self-driving cars taking place worldwide, and autonomous systems consistently becoming more advanced. The automotive industry is almost on the brink of entering into a new mobility ecosystem that could provide faster, cleaner, safer, cheaper, more efficient, and customized travel. However, this is just the tip of the iceberg, as below the surface, a massive restructuring of the automotive industry is underway, wherein, self-driving car companies are emerging as the key element in the strategies for future mobility.

While uncertainty abounds, specifically about the pace of transition, a fundamental shift is highly likely to drive a move away from driver-controlled vehicles toward a future mobility ecosystem that is centered around self-driving cars. As more and more automakers are experimenting and inventing in this direction, and have passionate voices that describe much-altered futures, Transparency Market Research (TMR), in its latest business intelligence, analyzed the opportunistic future prospects of this industry.

The first self-driving car was prototyped in the 1980s by the Carnegie Mellon University, and since then, automakers and research universities, as well as the IT industry, have become increasingly interested in self-driving car technologies. Google began its self-driving car project in 2009, and soon after, autonomous vehicle laws were passed in Nevada. In 2012, Google tested its driverless project with a self-driving car fleet, including 6 Toyota Prius, 3 Lexus RX, and an Audi TT; while Tesla begun the development of its fully-autonomous car in 2013. It was in 2016 that Tesla introduced fully-autonomous hardware in all its new cars, followed by autonomous vehicle guidelines by the U.S. Department of Transportation in the same year. The year 2018 marked the beginning of heavier investments in the self-driving car market, as Ford created a new AV division with plans to invest US$ 4 billion by 2023, and Uber ended its development of self-driving trucks to shift its focus on cars. The same year, the government of Japan announced plans to commence the testing of autonomous vehicles on public roads, with a vision to offer self-driving car services for the 2020 Tokyo Olympics. Since then, there has been no turning back for automakers in the self-driving car market. Though the self-driving car market is currently at a nascent stage, and gained US$ 20 Mn revenue in 2018, as per TMR, it holds high stakes of joining the mainstream in the years to come.

Embedded with various sensors, including ultrasonic, LiDAR, RADAR, cameras, vision detectors, and GPS receivers, self-driving cars can drive closer together, and hold the potential to eliminate the probability of traffic congestion. This will create a parallel space for less traffic and reduced congestion, even with more cars on the road. The time-saving aspect of self-driving cars, as they allow passengers to utilize the time of the journey without any interference or menace of driving, is likely to fuel their adoption in the coming years.

Self-driving cars are coming out of laboratories and are undergoing test runs on the roads, and drawing increasing attention for their potential role in reducing fatal collisions. Self-driving car technology is increasingly shaping the current discussions of road safety. The International Organization for Road Accident Prevention estimates that, human error leads to ~ 90% of the road accidents, worldwide. For that matter, the adoption of self-driving cars can considerably reduce the number of road accidents, while making the streets safer by automating safety features and reducing dependency. This is a key determinant projected to propel the self-driving car market in the years to come. However, automakers still need to delve deeper into innovation to make self-driving cars widely adopted on a global scale.

Self-Driving Cars - Boon for People with Disabilities

The growing traction for better commuting sources for people with disability is anticipated to shape the adoption prospects of self-driving cars, as they could revolutionize how disabled people get around and travel even far from home. Visually-impaired people often face hurdles while travelling, and self-driving cars are poised to emerge as viable assistants to help them get around.

Reluctant regulatory bodies around the world are increasingly turning in favor of autonomous vehicles, in view of the potential role of self-driving cars in reducing the escalating number of road accidents taking place around the world. For instance, the Government of France is backing the development of self-driving cars with a vision to deploy 'highly automated' vehicles on public roads between 2020 and 2022. In 2019, the U.K. established a government department - the Centre for Connected and Autonomous Vehicles (CAV) - and has a legislation to allow testing on the motorways in the country, in the pipeline.

With automakers increasingly realizing the fact that the emergence of self-driving car technology will take longer than expected, they have placed focus on ways to reduce development costs and speed up schedules. Collaborations with automakers that are operating at different levels, and technology companies, are garnering center stage in the market, given the long-term commitment required to put self-driving cars on public roads. This falls in line with the fact that, the development costs of self-driving cars are high and the near-term returns are likely to be lower than expected.

Several companies in the self-driving car market are foraying into new regions where they have no existing operations or facilities, to expand their growth prospects and drive higher gains. For instance, U.S. auto supplier and autonomous software company, Aptivis, is opening an autonomous mobility center in China to emphasize development and subsequent deployment of its technology on public roads. Whereas, BMW and Tencent Holdings are collaborating to launch a computing center in China to develop self-driving cars in the world’s biggest auto market.

Unorganized cities are making ideal candidature for trials for companies that are conducting self-driving cars’ performance evaluation tests. Several automakers are carrying out trials in such complex and unorganized cities with an aim to obtain better data about erratic human behavior and test the abilities of their cars. For instance, Lexus is planning to carry out its first European testing of an autonomous car in Brussels. Previously, its mother company, Toyota, carried out such tests in the U.S. and Japan. Automakers are choosing cities with a large number of cyclists and pedestrians who are prone to behave unexpectedly, with an aim to prepare their self-driving cars for the number of challenges that don’t exist on motorways.

The self-driving car market is witnessing a very high degree of competition, with market forerunners taking stock of the shifting automotive ecosystem to determine players to collaborate or partner with, or acquire outright, to pace up the path to success in the industry. Market forerunners such as Waymo, Ford Motor Company, and Daimler AG are adopting product differentiation strategies and mergers & acquisitions to unlock higher gains in the self-driving car market.

Automakers are expanding their traditional manufacturing capabilities, and are collaborating with autonomous vehicle technology suppliers, software developers, and others to offer a wider range of product choices. A safe, sellable, autonomous car has become the holy grail of a large number of companies operating in the automotive industry. With automakers such as Renault-Nissan, Toyota, and Honda planning to launch self-driving cars by 2020, the market is highly likely to witness unprecedented growth in the years to come.

Analysts’ Viewpoint

The adoption of self-driving cars is expected to grow at a stupendous ~ 89% CAGR through to 2030, owing to manifold advantages offered by these cars, such as elimination of driver efforts and increased passenger comfort and safety. Moreover, self-driving cars, being electric propelled and zero-emission vehicles, are likely to gain high adoption, as the world continues to witness stringent carbon-emission regulations. Though there is a long road ahead for automakers to gain a stronghold in this ‘as of now’ nascent self-driving car market, players who are adopting aggressive R&D are likely to witness huge growth in this rapidly altering automotive scenario.

Self-driving cars are expected to reduce the number of fatalities due to road accidents and improve vehicle safety, which is estimated to be a key factor that boosts the self-driving car market.

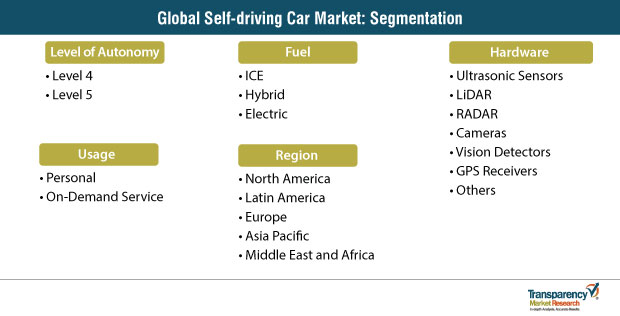

The global self-driving car market has been segmented based on level of autonomy, fuel, usage, hardware, and region.

Based on level of autonomy, the level 4 segment is expected to hold a major share of the self-driving car market. Automakers such as General Motors, Ford, and Honda have planned to launch level 4 autonomous car post 2020. Ride-hailing companies are testing level 4 self-driving cars. Companies such as WeRide, DiDi Chuxing, Waymo, and Uber are planning to launch mass autonomous taxi services in China and the U.S. by 2020.

Based on fuel, the hybrid segment is anticipated to expand significantly, owing to stringent emission norms to lower CO2 emissions. The hybrid and electric segments, cumulatively, are projected to hold a major share of the self-driving car market by 2030, due to a major shift in the automotive industry toward vehicle electrification.

In terms of usage, the on-demand service segment accounted for a notable share of the self-driving car market in 2018. Self-driving cars, being in the introductory phase, are currently used by ride-hailing companies, and hence, the on-demand service segment holds a major share.

Based on hardware, the global self-driving car market has been split into ultrasonic sensors, LiDAR, RADAR, cameras, vision detectors, GPS receivers, and others. The cameras segment accounted for a major share, in terms of volume, owing to the use of around 7 cameras in level 4 self-driving cars.

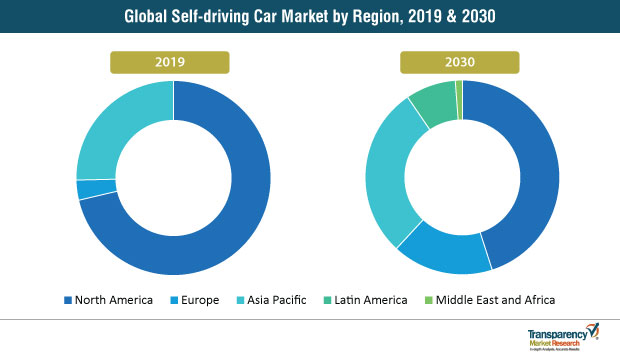

In terms of region, North America is expected to hold a major share of the global self-driving car market by 2030. Active participation from governments and positive consumer acceptance are anticipated to drive the self-driving car market in North America. North America is followed by Asia Pacific, in terms of market share, owing to the rising demand for self-driving cars in China.

Key players operating in the global self-driving car market include

Self-driving Car Market - Segmentation

TMR’s research study evaluates the self-driving car market on the basis of level of autonomy, fuel, hardware, usage, and region. The report provides exhaustive market dynamics and rapidly altering trends associated with various segments, and how they are influencing the growth prospects of the self-driving car market.

|

Level of Autonomy |

Level 4 Level 5 |

|

Fuel |

ICE Hybrid Electric |

|

Hardware |

Ultrasonic Sensors LiDAR RADAR Cameras Vision Detectors GPS Receivers Others |

|

Usage |

Personal On-Demand Service |

|

Region |

North America Latin America Europe Asia Pacific Middle East and Africa |

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Self-driving Car Market

3.1. Global Self-driving Car Market Value (US$ Bn) and Volume (Thousand Units) Forecast, 2018?2030

4. Market Overview

4.1. Introduction

4.1.1. Market Taxonomy

4.1.2. Self-driving Car Market Definition

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.6. SWOT Analysis

4.7. Government Initiatives & Regulatory Scenario

5. Global Self-driving Car Market: Demand Scenario

6. Global Self-driving Car Market: Country Wise Readiness Analysis

7. Global Self-driving Car Market: Number of cities with autonomous vehicle pilots

8. Global Self-driving Car Market: Business Case Study

9. Global Self-driving Car Market: Futuristic Trends Impact Analysis

10. Global Self-driving Car Market: Alliance and Partnership Among Manufacturers and Service Providers

11. Global Self-driving Car Market: Impact Factor

11.1. Road Infrastructure

11.2. Average Internet Speed

11.3. Urbanization

11.4. GDP Per Capita

12. Global Self-driving Car Market Analysis and Forecast

13. Global Self-driving Car Market Analysis and Forecast, by Level of Autonomy

13.1. Introduction & Definition

13.2. Market Growth & Y-O-Y projection

13.3. Global Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

13.3.1. Level 4

13.3.2. Level 5

13.4. Global Self-driving Car Market Attractiveness Analysis, by Level of Autonomy

14. Global Self-driving Car Market Analysis and Forecast, by Hardware

14.1. Introduction & Definition

14.2. Market Growth & Y-O-Y projection

14.3. Global Self-driving Car Market Value (US$ Bn) Forecast, by Hardware, 2018?2030

14.3.1. Ultrasonic Sensor

14.3.2. LiDAR

14.3.3. RADAR

14.3.4. Camera

14.3.5. Vision Detector

14.3.6. GPS Receiver

14.3.7. Others

14.4. Global Self-driving Car Market Attractiveness Analysis, by Hardware

15. Global Self-driving Car Market Analysis and Forecast, by Fuel Type

15.1. Introduction & Definition

15.2. Market Growth & Y-O-Y projection

15.3. Global Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

15.3.1. ICE

15.3.2. Hybrid

15.3.3. Electric

15.4. Global Self-driving Car Market Attractiveness Analysis, by Fuel Type

16. Global Self-driving Car Market Analysis and Forecast, by Usage

16.1. Introduction & Definition

16.2. Market Growth & Y-O-Y projection

16.3. Global Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

16.3.1. Personal

16.3.2. On- demand Service

16.4. Global Self-driving Car Market Attractiveness Analysis, by Usage

17. Global Self-driving Car Market Analysis and Forecast, by Region

17.1. Market Growth & Y-O-Y projection

17.2. Global Self-driving Car Market Value (US$ Bn) Forecast, by Region, 2018?2030

17.2.1. North America

17.2.2. Latin America

17.2.3. Europe

17.2.4. Asia Pacific

17.2.5. Middle East & Africa

17.3. Global Self-driving Car Market Attractiveness Analysis, by Region

18. North America Self-driving Car Market Value (US$ Bn), 2018?2030

18.1. Key Findings

18.2. Market Growth & Y-O-Y projection

18.3. North America Self-driving Car Market Forecast, by Level of Autonomy

18.3.1. Level 4

18.3.2. Level 5

18.4. North America Self-driving Car Market Forecast, by Hardware

18.4.1. Ultrasonic Sensor

18.4.2. LiDAR

18.4.3. RADAR

18.4.4. Camera

18.4.5. Vision Detector

18.4.6. GPS Receiver

18.4.7. Others

18.5. North America Self-driving Car Market Forecast, by Fuel Type

18.5.1. ICE

18.5.2. Hybrid

18.5.3. Electric

18.6. North America Self-driving Car Market Forecast, by Usage

18.6.1. Personal

18.6.2. On- demand Service

18.7. North America Self-driving Car Market Forecast, by Country

18.7.1. U.S.

18.7.2. Canada

18.8. U.S. Self-driving Car Market Forecast, by Level of Autonomy

18.8.1. Level 4

18.8.2. Level 5

18.9. U.S. Self-driving Car Market Forecast, by Hardware

18.9.1. Ultrasonic Sensor

18.9.2. LiDAR

18.9.3. RADAR

18.9.4. Camera

18.9.5. Vision Detector

18.9.6. GPS Receiver

18.9.7. Others

18.10. U.S. Self-driving Car Market Forecast, by Fuel Type

18.10.1. ICE

18.10.2. Hybrid

18.10.3. Electric

18.11. U.S. Self-driving Car Market Forecast, by Usage

18.11.1. Personal

18.11.2. On- demand Service

18.12. Canada Self-driving Car Market Forecast, by Level of Autonomy

18.12.1. Level 4

18.12.2. Level 5

18.13. Canada Self-driving Car Market Forecast, by Hardware

18.13.1. Ultrasonic Sensor

18.13.2. LiDAR

18.13.3. RADAR

18.13.4. Camera

18.13.5. Vision Detector

18.13.6. GPS Receiver

18.13.7. Others

18.14. Canada Self-driving Car Market Forecast, by Fuel Type

18.14.1. ICE

18.14.2. Hybrid

18.14.3. Electric

18.15. Canada Self-driving Car Market Forecast, by Usage

18.15.1. Personal

18.15.2. On- demand Service

18.16. North America Self-driving Car Market: PEST Analysis

19. Europe Self-driving Car Market Value (US$ Bn) Forecast, 2018?2030

19.1. Key Findings

19.2. Market Growth & Y-O-Y projection

19.3. Europe Self-driving Car Market Forecast, by Level of Autonomy

19.3.1. Level 4

19.3.2. Level 5

19.4. Europe Self-driving Car Market Forecast, by Hardware

19.4.1. Ultrasonic Sensor

19.4.2. LiDAR

19.4.3. RADAR

19.4.4. Camera

19.4.5. Vision Detector

19.4.6. GPS Receiver

19.4.7. Others

19.5. Europe Self-driving Car Market Forecast, by Fuel Type

19.5.1. ICE

19.5.2. Hybrid

19.5.3. Electric

19.6. Europe Self-driving Car Market Forecast, by Usage

19.6.1. Personal

19.6.2. On- demand Service

19.7. Europe Self-driving Car Market Forecast, by Country and Sub-region

19.7.1. Germany

19.7.2. U.K.

19.7.3. France

19.7.4. Italy

19.7.5. Spain

19.7.6. Rest of Europe

19.8. Germany Self-driving Car Market Forecast, by Level of Autonomy

19.8.1. Level 4

19.8.2. Level 5

19.9. Germany Self-driving Car Market Forecast, by Hardware

19.9.1. Ultrasonic Sensor

19.9.2. LiDAR

19.9.3. RADAR

19.9.4. Camera

19.9.5. Vision Detector

19.9.6. GPS Receiver

19.9.7. Others

19.10. Germany Self-driving Car Market Forecast, by Fuel Type

19.10.1. ICE

19.10.2. Hybrid

19.10.3. Electric

19.11. Germany Self-driving Car Market Forecast, by Usage

19.11.1. Personal

19.11.2. On- demand Service

19.12. U.K. Self-driving Car Market Forecast, by Level of Autonomy

19.12.1. Level 4

19.12.2. Level 5

19.13. U.K. Self-driving Car Market Forecast, by Hardware

19.13.1. Ultrasonic Sensor

19.13.2. LiDAR

19.13.3. RADAR

19.13.4. Camera

19.13.5. Vision Detector

19.13.6. GPS Receiver

19.13.7. Others

19.14. U.K. Self-driving Car Market Forecast, by Fuel Type

19.14.1. ICE

19.14.2. Hybrid

19.14.3. Electric

19.15. U.K Self-driving Car Market Forecast, by Usage

19.15.1. Personal

19.15.2. On- demand Service

19.16. France Self-driving Car Market Forecast, by Level of Autonomy

19.16.1. Level 4

19.16.2. Level 5

19.17. France Self-driving Car Market Forecast, by Hardware

19.17.1. Ultrasonic Sensor

19.17.2. LiDAR

19.17.3. RADAR

19.17.4. Camera

19.17.5. Vision Detector

19.17.6. GPS Receiver

19.17.7. Others

19.18. France Self-driving Car Market Forecast, by Fuel Type

19.18.1. ICE

19.18.2. Hybrid

19.18.3. Electric

19.19. France Self-driving Car Market Forecast, by Usage

19.19.1. Personal

19.19.2. On- demand Service

19.20. Italy Self-driving Car Market Forecast, by Level of Autonomy

19.20.1. Level 4

19.20.2. Level 5

19.21. Italy Self-driving Car Market Forecast, by Hardware

19.21.1. Ultrasonic Sensor

19.21.2. LiDAR

19.21.3. RADAR

19.21.4. Camera

19.21.5. Vision Detector

19.21.6. GPS Receiver

19.21.7. Others

19.22. Italy Self-driving Car Market Forecast, by Fuel Type

19.22.1. ICE

19.22.2. Hybrid

19.22.3. Electric

19.23. Italy Self-driving Car Market Forecast, by Usage

19.23.1. Personal

19.23.2. On- demand Service

19.24. Spain Self-driving Car Market Forecast, by Level of Autonomy

19.24.1. Level 4

19.24.2. Level 5

19.25. Spain Self-driving Car Market Forecast, by Hardware

19.25.1. Ultrasonic Sensor

19.25.2. LiDAR

19.25.3. RADAR

19.25.4. Camera

19.25.5. Vision Detector

19.25.6. GPS Receiver

19.25.7. Others

19.26. Spain Self-driving Car Market Forecast, by Fuel Type

19.26.1. ICE

19.26.2. Hybrid

19.26.3. Electric

19.27. Spain Self-driving Car Market Forecast, by Usage

19.27.1. Personal

19.27.2. On- demand Service

19.28. Rest of Europe Self-driving Car Market Forecast, by Level of Autonomy

19.28.1. Level 4

19.28.2. Level 5

19.29. Rest of Europe Self-driving Car Market Forecast, by Hardware

19.29.1. Ultrasonic Sensor

19.29.2. LiDAR

19.29.3. RADAR

19.29.4. Camera

19.29.5. Vision Detector

19.29.6. GPS Receiver

19.29.7. Others

19.30. Rest of Europe Self-driving Car Market Forecast, by Fuel Type

19.30.1. ICE

19.30.2. Hybrid

19.30.3. Electric

19.31. Rest of Europe Self-driving Car Market Forecast, by Usage

19.31.1. Personal

19.31.2. On- demand Service

19.32. Europe Self-driving Car Market: PEST Analysis

20. Asia Pacific Self-driving Car Market Value (US$ Bn), 2018?2030

20.1. Key Findings

20.2. Market Growth & Y-O-Y projection

20.3. Asia Pacific Self-driving Car Market Forecast, by Level of Autonomy

20.3.1. Level 4

20.3.2. Level 5

20.4. Asia Pacific Self-driving Car Market Forecast, by Hardware

20.4.1. Ultrasonic Sensor

20.4.2. LiDAR

20.4.3. RADAR

20.4.4. Camera

20.4.5. Vision Detector

20.4.6. GPS Receiver

20.4.7. Others

20.5. Asia Pacific Self-driving Car Market Forecast, by Fuel Type

20.5.1. ICE

20.5.2. Hybrid

20.5.3. Electric

20.6. Asia Pacific Self-driving Car Market Forecast, by Usage

20.6.1. Personal

20.6.2. On- demand Service

20.7. Asia Pacific Self-driving Car Market Forecast, by Country and Sub-region

20.7.1. China

20.7.2. India

20.7.3. Japan

20.7.4. ASEAN

20.7.5. Rest of Asia Pacific

20.8. China Self-driving Car Market Forecast, by Level of Autonomy

20.8.1. Level 4

20.8.2. Level 5

20.9. China Self-driving Car Market Forecast, by Hardware

20.9.1. Ultrasonic Sensor

20.9.2. LiDAR

20.9.3. RADAR

20.9.4. Camera

20.9.5. Vision Detector

20.9.6. GPS Receiver

20.9.7. Others

20.10. China Self-driving Car Market Forecast, by Fuel Type

20.10.1. ICE

20.10.2. Hybrid

20.10.3. Electric

20.11. China Self-driving Car Market Forecast, by Usage

20.11.1. Personal

20.11.2. On- demand Service

20.12. India Self-driving Car Market Forecast, by Level of Autonomy

20.12.1. Level 4

20.12.2. Level 5

20.13. India Self-driving Car Market Forecast, by Hardware

20.13.1. Ultrasonic Sensor

20.13.2. LiDAR

20.13.3. RADAR

20.13.4. Camera

20.13.5. Vision Detector

20.13.6. GPS Receiver

20.13.7. Others

20.14. India Self-driving Car Market Forecast, by Fuel Type

20.14.1. ICE

20.14.2. Hybrid

20.14.3. Electric

20.15. India Self-driving Car Market Forecast, by Usage

20.15.1. Personal

20.15.2. On- demand Service

20.16. Japan Self-driving Car Market Forecast, by Level of Autonomy

20.16.1. Level 4

20.16.2. Level 5

20.17. Japan Self-driving Car Market Forecast, by Hardware

20.17.1. Ultrasonic Sensor

20.17.2. LiDAR

20.17.3. RADAR

20.17.4. Camera

20.17.5. Vision Detector

20.17.6. GPS Receiver

20.17.7. Others

20.18. Japan Self-driving Car Market Forecast, by Fuel Type

20.18.1. ICE

20.18.2. Hybrid

20.18.3. Electric

20.19. Japan Self-driving Car Market Forecast, by Usage

20.19.1. Personal

20.19.2. On- demand Service

20.20. ASEAN Self-driving Car Market Forecast, by Level of Autonomy

20.20.1. Level 4

20.20.2. Level 5

20.21. ASEAN Self-driving Car Market Forecast, by Hardware

20.21.1. Ultrasonic Sensor

20.21.2. LiDAR

20.21.3. RADAR

20.21.4. Camera

20.21.5. Vision Detector

20.21.6. GPS Receiver

20.21.7. Others

20.22. ASEAN Self-driving Car Market Forecast, by Fuel Type

20.22.1. ICE

20.22.2. Hybrid

20.22.3. Electric

20.23. ASEAN Self-driving Car Market Forecast, by Usage

20.23.1. Personal

20.23.2. On- demand Service

20.24. Rest of Asia Pacific Self-driving Car Market Forecast, by Level of Autonomy

20.24.1. Level 4

20.24.2. Level 5

20.25. Rest of Asia Pacific Self-driving Car Market Forecast, by Hardware

20.25.1. Ultrasonic Sensor

20.25.2. LiDAR

20.25.3. RADAR

20.25.4. Camera

20.25.5. Vision Detector

20.25.6. GPS Receiver

20.25.7. Others

20.26. Rest of Asia Pacific Self-driving Car Market Forecast, by Usage

20.26.1. Personal

20.26.2. On- demand Service

20.27. Rest of Asia Pacific Self-driving Car Market Forecast, by Fuel Type

20.27.1. ICE

20.27.2. Hybrid

20.27.3. Electric

20.28. Asia Pacific Self-driving Car Market: PEST Analysis

21. Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, 2018?2030

21.1. Key Findings

21.2. Market Growth & Y-O-Y projection

21.3. Middle East & Africa Self-driving Car Market Forecast, by Level of Autonomy

21.3.1. Level 4

21.3.2. Level 5

21.4. Middle East & Africa Self-driving Car Market Forecast, by Hardware

21.4.1. Ultrasonic Sensor

21.4.2. LiDAR

21.4.3. RADAR

21.4.4. Camera

21.4.5. Vision Detector

21.4.6. GPS Receiver

21.4.7. Others

21.5. Middle East & Africa Self-driving Car Market Forecast, by Fuel Type

21.5.1. ICE

21.5.2. Hybrid

21.5.3. Electric

21.6. Middle East & Africa Self-driving Car Market Forecast, by Usage

21.6.1. Personal

21.6.2. On- demand Service

21.7. Middle East & Africa Self-driving Car Market Forecast, by Country and Sub-region

21.7.1. GCC

21.7.2. South Africa

21.7.3. Rest of Middle East & Africa

21.8. GCC Self-driving Car Market Forecast, by Level of Autonomy

21.8.1. Level 4

21.8.2. Level 5

21.9. GCC Self-driving Car Market Forecast, by Hardware

21.9.1. Ultrasonic Sensor

21.9.2. LiDAR

21.9.3. RADAR

21.9.4. Camera

21.9.5. Vision Detector

21.9.6. GPS Receiver

21.9.7. Others

21.10. GCC Self-driving Car Market Forecast, by Fuel Type

21.10.1. ICE

21.10.2. Hybrid

21.10.3. Electric

21.11. GCC Self-driving Car Market Forecast, by Usage

21.11.1. Personal

21.11.2. On- demand Service

21.12. South Africa Self-driving Car Market Forecast, by Level of Autonomy

21.12.1. Level 4

21.12.2. Level 5

21.13. South Africa Self-driving Car Market Forecast, by Hardware

21.13.1. Ultrasonic Sensor

21.13.2. LiDAR

21.13.3. RADAR

21.13.4. Camera

21.13.5. Vision Detector

21.13.6. GPS Receiver

21.13.7. Others

21.14. South Africa Self-driving Car Market Forecast, by Fuel Type

21.14.1. ICE

21.14.2. Hybrid

21.14.3. Electric

21.15. South Africa Self-driving Car Market Forecast, by Usage

21.15.1. Personal

21.15.2. On- demand Service

21.16. Rest of Middle East & Africa Self-driving Car Market Forecast, by Level of Autonomy

21.16.1. Level 4

21.16.2. Level 5

21.17. Rest of Middle East & Africa Self-driving Car Market Forecast, by Hardware

21.17.1. Ultrasonic Sensor

21.17.2. LiDAR

21.17.3. RADAR

21.17.4. Camera

21.17.5. Vision Detector

21.17.6. GPS Receiver

21.17.7. Others

21.18. Rest of Middle East & Africa Self-driving Car Market Forecast, by Fuel Type

21.18.1. ICE

21.18.2. Hybrid

21.18.3. Electric

21.19. Rest of Middle East & Africa Self-driving Car Market Forecast, by Usage

21.19.1. Personal

21.19.2. On- demand Service

21.20. Middle East & Africa Self-driving Car Market: PEST Analysis

22. Latin America Self-driving Car Market Value (US$ Bn) Forecast, 2018?2030

22.1. Key Findings

22.2. Market Growth & Y-O-Y projection

22.3. Latin America Self-driving Car Market Forecast, by Level of Autonomy

22.3.1. Level 4

22.3.2. Level 5

22.4. Latin America Self-driving Car Market Forecast, by Hardware

22.4.1. Ultrasonic Sensor

22.4.2. LiDAR

22.4.3. RADAR

22.4.4. Camera

22.4.5. Vision Detector

22.4.6. GPS Receiver

22.4.7. Others

22.5. Latin America Self-driving Car Market Forecast, by Fuel Type

22.5.1. ICE

22.5.2. Hybrid

22.5.3. Electric

22.6. Latin America Self-driving Car Market Forecast, by Usage

22.6.1. Personal

22.6.2. On- demand Service

22.7. Latin America Self-driving Car Market Forecast, by Country and Sub-region

22.7.1. Brazil

22.7.2. Mexico

22.7.3. Rest of Latin America

22.8. Brazil Self-driving Car Market Forecast, by Level of Autonomy

22.8.1. Level 4

22.8.2. Level 5

22.9. Brazil Self-driving Car Market Forecast, by Hardware

22.9.1. Ultrasonic Sensor

22.9.2. LiDAR

22.9.3. RADAR

22.9.4. Camera

22.9.5. Vision Detector

22.9.6. GPS Receiver

22.9.7. Others

22.10. Brazil Self-driving Car Market Forecast, by Fuel Type

22.10.1. ICE

22.10.2. Hybrid

22.10.3. Electric

22.11. Brazil Self-driving Car Market Forecast, by Usage

22.11.1. Personal

22.11.2. On- demand Service

22.12. Mexico Self-driving Car Market Forecast, by Level of Autonomy

22.12.1. Level 4

22.12.2. Level 5

22.13. Mexico Self-driving Car Market Forecast, by Hardware

22.13.1. Ultrasonic Sensor

22.13.2. LiDAR

22.13.3. RADAR

22.13.4. Camera

22.13.5. Vision Detector

22.13.6. GPS Receiver

22.13.7. Others

22.14. Mexico Self-driving Car Market Forecast, by Fuel Type

22.14.1. ICE

22.14.2. Hybrid

22.14.3. Electric

22.15. Mexico Self-driving Car Market Forecast, by Usage

22.15.1. Personal

22.15.2. On- demand Service

22.16. Rest of Latin America Self-driving Car Market Forecast, by Level of Autonomy

22.16.1. Level 4

22.16.2. Level 5

22.17. Rest of Latin America Self-driving Car Market Forecast, by Hardware

22.17.1. Ultrasonic Sensor

22.17.2. LiDAR

22.17.3. RADAR

22.17.4. Camera

22.17.5. Vision Detector

22.17.6. GPS Receiver

22.17.7. Others

22.18. Rest of Latin America Self-driving Car Market Forecast, by Fuel Type

22.18.1. ICE

22.18.2. Hybrid

22.18.3. Electric

22.19. Rest of Latin America Self-driving Car Market Forecast, by Usage

22.19.1. Personal

22.19.2. On- demand Service

22.20. Latin America Self-driving Car Market: PEST Analysis

23. Competition Landscape

23.1. Market Share Analysis, by Company (2018)

23.2. Market Player – Competition Matrix (By Tier and Size of companies)

23.3. Key Executives Bios

23.4. Company Financials

23.5. Key Market Players (Details – Overview, Overall Revenue, Recent Developments, Expansion Strategy, Trend Towards On- demand Service Vehicles)

23.5.1. AB Volvo

23.5.1.1. Overview

23.5.1.2. Overall Revenue

23.5.1.3. Recent Developments

23.5.1.4. Expansion Strategy

23.5.1.5. Trend Towards On- demand Service Vehicles

23.5.2. Audi AG

23.5.2.1. Overview

23.5.2.2. Overall Revenue

23.5.2.3. Recent Developments

23.5.2.4. Expansion Strategy

23.5.2.5. Trend Towards On- demand Service Vehicles

23.5.3. Apple Inc.

23.5.3.1. Overview

23.5.3.2. Overall Revenue

23.5.3.3. Recent Developments

23.5.3.4. Expansion Strategy

23.5.3.5. Trend Towards On- demand Service Vehicles

23.5.4. Aptiv

23.5.4.1. Overview

23.5.4.2. Overall Revenue

23.5.4.3. Recent Developments

23.5.4.4. Expansion Strategy

23.5.4.5. Trend Towards On- demand Service Vehicles

23.5.5. Baidu

23.5.5.1. Overview

23.5.5.2. Overall Revenue

23.5.5.3. Recent Developments

23.5.5.4. Expansion Strategy

23.5.5.5. Trend Towards On- demand Service Vehicles

23.5.6. BMW AG

23.5.6.1. Overview

23.5.6.2. Overall Revenue

23.5.6.3. Recent Developments

23.5.6.4. Expansion Strategy

23.5.6.5. Trend Towards On- demand Service Vehicles

23.5.7. Continental AG

23.5.7.1. Overview

23.5.7.2. Overall Revenue

23.5.7.3. Recent Developments

23.5.7.4. Expansion Strategy

23.5.7.5. Trend Towards On- demand Service Vehicles

23.5.8. Daimler AG

23.5.8.1. Overview

23.5.8.2. Overall Revenue

23.5.8.3. Recent Developments

23.5.8.4. Expansion Strategy

23.5.8.5. Trend Towards On- demand Service Vehicles

23.5.9. DiDi Chuxing

23.5.9.1. Overview

23.5.9.2. Overall Revenue

23.5.9.3. Recent Developments

23.5.9.4. Expansion Strategy

23.5.9.5. Trend Towards On- demand Service Vehicles

23.5.10. Ford Motor Company

23.5.10.1. Overview

23.5.10.2. Overall Revenue

23.5.10.3. Recent Developments

23.5.10.4. Expansion Strategy

23.5.10.5. Trend Towards On- demand Service Vehicles

23.5.11. General Motors

23.5.11.1. Overview

23.5.11.2. Overall Revenue

23.5.11.3. Recent Developments

23.5.11.4. Expansion Strategy

23.5.11.5. Trend Towards On- demand Service Vehicles

23.5.12. Waymo LLC

23.5.12.1. Overview

23.5.12.2. Overall Revenue

23.5.12.3. Recent Developments

23.5.12.4. Expansion Strategy

23.5.12.5. Trend Towards On- demand Service Vehicles

23.5.13. Honda Motor Co., Ltd

23.5.13.1. Overview

23.5.13.2. Overall Revenue

23.5.13.3. Recent Developments

23.5.13.4. Expansion Strategy

23.5.13.5. Trend Towards On- demand Service Vehicles

23.5.14. Microsoft

23.5.14.1. Overview

23.5.14.2. Overall Revenue

23.5.14.3. Recent Developments

23.5.14.4. Expansion Strategy

23.5.14.5. Trend Towards On- demand Service Vehicles

23.5.15. Nissan Motor Company

23.5.15.1. Overview

23.5.15.2. Overall Revenue

23.5.15.3. Recent Developments

23.5.15.4. Expansion Strategy

23.5.15.5. Trend Towards On- demand Service Vehicles

23.5.16. Groupe PSA

23.5.16.1. Overview

23.5.16.2. Overall Revenue

23.5.16.3. Recent Developments

23.5.16.4. Expansion Strategy

23.5.16.5. Trend Towards On- demand Service Vehicles

23.5.17. Robert Bosch GmbH

23.5.17.1. Overview

23.5.17.2. Overall Revenue

23.5.17.3. Recent Developments

23.5.17.4. Expansion Strategy

23.5.17.5. Trend Towards On- demand Service Vehicles

23.5.18. Tesla, Inc.

23.5.18.1. Overview

23.5.18.2. Overall Revenue

23.5.18.3. Recent Developments

23.5.18.4. Expansion Strategy

23.5.18.5. Trend Towards On- demand Service Vehicles

23.5.19. Toyota Motor Corporation

23.5.19.1. Overview

23.5.19.2. Overall Revenue

23.5.19.3. Recent Developments

23.5.19.4. Expansion Strategy

23.5.19.5. Trend Towards On- demand Service Vehicles

23.5.20. Uber Technologies, Inc.

23.5.20.1. Overview

23.5.20.2. Overall Revenue

23.5.20.3. Recent Developments

23.5.20.4. Expansion Strategy

23.5.20.5. Trend Towards On- demand Service Vehicles

23.5.21. Valeo SA

23.5.21.1. Overview

23.5.21.2. Overall Revenue

23.5.21.3. Recent Developments

23.5.21.4. Expansion Strategy

23.5.21.5. Trend Towards On- demand Service Vehicles

23.5.22. Volkswagen AG

23.5.22.1. Overview

23.5.22.2. Overall Revenue

23.5.22.3. Recent Developments

23.5.22.4. Expansion Strategy

23.5.22.5. Trend Towards On- demand Service Vehicles

List of Tables

Table 1: Global Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 2: Global Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 3: Global Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 4: Global Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 5: Global Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 6: Global Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 7: Global Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 8: Global Self-driving Car Market Volume (Thousand Units) Forecast, by Region, 2018?2030

Table 9: Global Self-driving Car Market Value (US$ Bn) Forecast, by Region, 2018?2030

Table 10: North America Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 11: North America Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 12: North America Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 13: North America Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 14: North America Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 15: North America Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 16: North America Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 17: North America Self-driving Car Market Volume (Mn Units) Forecast, by Country, 2018?2030

Table 18: North America Self-driving Car Market Value (US$ Bn) Forecast, by Country, 2018?2030

Table 19: U.S. Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 20: U.S. Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 21: U.S. Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 22: U.S. Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 23: U.S. Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 24: U.S. Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 25: U.S. Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 26: Canada Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 27: Canada Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 28: Canada Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 29: Canada Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 30: Canada Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 31: Canada Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 32: Canada Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 33: Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 34: Europe Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 35: Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 36: Europe Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 37: Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 38: Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 39: Europe Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 40: Europe Self-driving Car Market Volume (Mn Units) Forecast, by Country and Sub-region, 2018?2030

Table 41: Europe Self-driving Car Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 42: Germany Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 43: Germany Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 44: Germany Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 45: Germany Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 46: Germany Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 47: Germany Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 48: Germany Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 49: U.K. Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 50: U.K. Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 51: U.K. Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 52: U.K. Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 53: U.K. Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 54: U.K. Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 55: U.K. Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 56: France Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 57: France Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 58: France Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 59: France Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 60: France Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 61: France Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 62: France Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 63: Italy Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 64: Italy Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 65: Italy Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 66: Italy Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 67: Italy Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 68: Italy Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 69: Italy Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 70: Spain Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 71: Spain Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 72: Spain Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 73: Spain Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 74: Spain Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 75: Spain Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 76: Spain Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 77: Rest of Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 78: Rest of Europe Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 79: Rest of Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 80: Rest of Europe Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 81: Rest of Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 82: Rest of Europe Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 83: Rest of Europe Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 84: Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy,2018?2030

Table 85: Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 86: Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 87: Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 88: Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 89: Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 90: Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 91: Asia Pacific Self-driving Car Market Volume (Mn Units) Forecast, by Country and Sub-region, 2018?2030

Table 92: Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 93: China Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 94: China Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 95: China Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 96: China Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 97: China Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 98: China Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 99: China Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 100: India Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 101: India Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 102: India Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 103: India Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 104: India Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 105: India Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 106: India Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 107: Japan Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 108: Japan Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 109: Japan Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 110: Japan Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 111: Japan Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 112: Japan Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 113: Japan Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 114: ASEAN Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 115: ASEAN Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 116: ASEAN Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 117: ASEAN Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 118: ASEAN Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 119: ASEAN Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 120: ASEAN Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 121: Rest of Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 122: Rest of Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 123: Rest of Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 124: Rest of Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 125: Rest of Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 126: Rest of Asia Pacific Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 127: Rest of Asia Pacific Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 128: Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 129: Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 130: Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 131: Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 132: Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 133: Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 134: Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 135: Middle East & Africa Self-driving Car Market Volume (Mn Units) Forecast, by Country and Sub-region, 2018?2030

Table 136: Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 137: GCC Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 138: GCC Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 139: GCC Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 140: GCC Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 141: GCC Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 142: GCC Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 143: GCC Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 144: South Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 145: South Africa Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 146: South Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 147: South Africa Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 148: South Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 149: South Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 150: South Africa Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 151: Rest of Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 152: Rest of Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy,2018?2030

Table 153: Rest of Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 154: Rest of Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 155: Rest of Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 156: Rest of Middle East & Africa Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 157: Rest of Middle East & Africa Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 158: Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 159: Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 160: Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 161: Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 162: Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 163: Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 164: Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 165: Latin America Self-driving Car Market Volume (Mn Units) Forecast, by Country and Sub-region, 2018?2030

Table 166: Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Country and Sub-region, 2018?2030

Table 167: Brazil Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 168: Brazil Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 169: Brazil Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 170: Brazil Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 171: Brazil Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 172: Brazil Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 173: Brazil Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 174: Mexico Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 175: Mexico Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 176: Mexico Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 177: Mexico Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 178: Mexico Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 179: Mexico Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 180: Mexico Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

Table 181: Rest of Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Level of Autonomy, 2018?2030

Table 182: Rest of Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Level of Autonomy, 2018?2030

Table 183: Rest of Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Fuel Type, 2018?2030

Table 184: Rest of Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Fuel Type, 2018?2030

Table 185: Rest of Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Hardware, 2018?2030

Table 186: Rest of Latin America Self-driving Car Market Volume (Thousand Units) Forecast, by Usage, 2018?2030

Table 187: Rest of Latin America Self-driving Car Market Value (US$ Bn) Forecast, by Usage, 2018?2030

List of Figures

Figure 1: Global Self-driving Car Market Value Share Analysis

Figure 2: Global Self-driving Car Market Value Share Analysis, by Level of Autonomy

Figure 3: Global Self-driving Car Market Attractiveness Analysis, by Level of Autonomy

Figure 4: Global Self-driving Car Market Value Share Analysis, by Fuel Type

Figure 5: Global Self-driving Car Market Attractiveness Analysis, by Fuel Type

Figure 6: Global Self-driving Car Market Value Share Analysis, by Hardware

Figure 7: Global Self-driving Car Market Attractiveness Analysis, by Hardware

Figure 8: Global Self-driving Car Market Value Share Analysis, by Usage

Figure 9: Global Self-driving Car Market Attractiveness Analysis, by Usage

Figure 10: Global Self-driving Car Market Value Share Analysis, by Region

Figure 11: Global Self-driving Car Market Attractiveness Analysis, by Region

Figure 12: North America Self-driving Car Market Value Share Analysis

Figure 13: North America Self-driving Car Market Value Share Analysis, by Level of Autonomy

Figure 14: North America Self-driving Car Market Value Share Analysis, by Fuel Type

Figure 15: North America Self-driving Car Market Value Share Analysis, by Hardware

Figure 16: North America Self-driving Car Market Value Share Analysis, by Usage

Figure 17: North America Self-driving Car Market Value Share Analysis, by Country

Figure 18: Europe Self-driving Car Market Value Share Analysis

Figure 19: Europe Self-driving Car Market Value Share Analysis, by Level of Autonomy

Figure 20: Europe Self-driving Car Market Value Share Analysis, by Fuel Type

Figure 21: Europe Self-driving Car Market Value Share Analysis, by Hardware

Figure 22: Europe Self-driving Car Market Value Share Analysis, by Usage

Figure 23: Europe Self-driving Car Market Value Share Analysis, by Country and Sub-region

Figure 24: Asia Pacific Self-driving Car Market Value Share Analysis

Figure 25: Asia Pacific Self-driving Car Market Value Share Analysis, by Level of Autonomy

Figure 26: Asia Pacific Self-driving Car Market Value Share Analysis, by Fuel Type

Figure 27: Asia Pacific Self-driving Car Market Value Share Analysis, by Hardware

Figure 28: Asia Pacific Self-driving Car Market Value Share Analysis, by Usage

Figure 29: Asia Pacific Self-driving Car Market Value Share Analysis, by Country and Sub-region

Figure 30: Middle East & Africa Self-driving Car Market Value Share Analysis

Figure 31: Middle East & Africa Self-driving Car Market Value Share Analysis, by Level of Autonomy

Figure 32: Middle East & Africa Self-driving Car Market Value Share Analysis, by Fuel Type

Figure 33: Middle East & Africa Self-driving Car Market Value Share Analysis, by Hardware

Figure 34: Middle East & Africa Self-driving Car Market Value Share Analysis, by Usage

Figure 35: Middle East & Africa Self-driving Car Market Value Share Analysis, by Country and Sub-region

Figure 36: Latin America Self-driving Car Market Value Share Analysis

Figure 37: Latin America Self-driving Car Market Value Share Analysis, by Level of Autonomy

Figure 38: Latin America Self-driving Car Market Value Share Analysis, by Fuel Type

Figure 39: Latin America Self-driving Car Market Value Share Analysis, by Hardware

Figure 40: Latin America Self-driving Car Market Value Share Analysis, by Usage

Figure 41: Latin America Self-driving Car Market Value Share Analysis, by Country and Sub-region