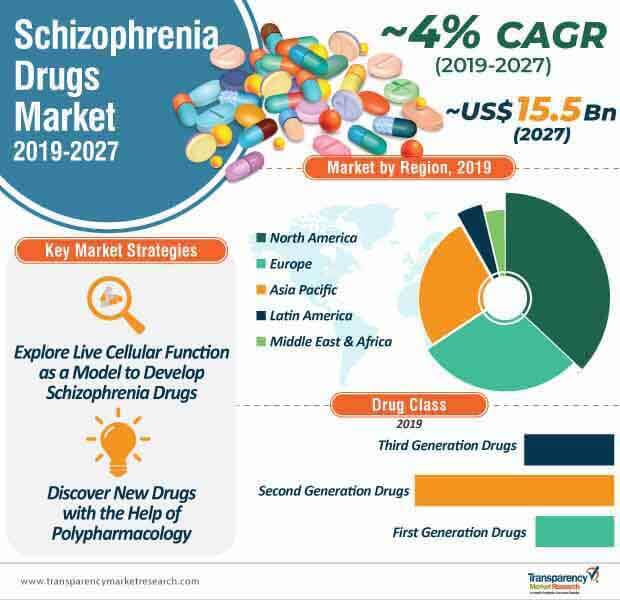

Several doctors and healthcare providers are adopting the methods of polypharmacology to develop new drugs for mental disorders. These methods are providing better outcomes in patients as compared to single-target drugs in the schizophrenia drugs market.

Likewise, multi-target drugs are emerging as an effective alternative to treat polygenic diseases, including schizophrenia. As such, the second-generation drugs market is estimated to reach ~US$ 11.1 billion by the year 2027; the highest amongst all drug classes in the schizophrenia drugs landscape. These second-generation drugs, i.e. atypical antipsychotics, target a number of aminergic G-protein coupled receptors (GPCRs) to treat complex pathomechanisms of schizophrenia.

Pharmaceutical companies are increasing research & development related to the schizophrenia drugs market to develop drugs that are beyond the dopaminergic hypothesis of schizophrenia and beyond monoamine G protein coupled receptors (GPCRs). They are increasing their production capacities of dopamine antagonists and drugs meant to effectively control the symptoms of schizophrenia and improve patient quality of life. Manufacturers in the schizophrenia drugs market are also turning towards other second-generation antipsychotics, such as serotonin and histamine, to prevent amphetamine-induced behavioral changes in patients.

There is the growing need for improved schizophrenia drugs, as psychiatric disorders lead to disorders of the whole body. That is why, healthcare companies are innovating on live cellular function as a model to treat schizophrenia. Manufacturers in the schizophrenia drugs market are using high-content single-cell screenings to develop efficacious compounds for new schizophrenia drugs. This drug 'repurposing' strategy serves as a cost-effective and time-saving alternative for the development of new schizophrenia drugs that can be supplied to small-scale clinics and other healthcare providers.

The live cellular function model helps manufacturers develop new potential drugs at competitive costs, and acts as an efficient alternative to develop the drugs in a significantly less amount of time. The high-content single-cell screening process helps companies test existing psychiatric treatments on patient blood cells and predict the effectiveness of the new schizophrenia drug, depending upon the health condition of each individual.

This first-of-its-kind process will help healthcare companies overcome the limitations of first-line treatments, as these treatments have been performing poorly in most patients.

One of the major challenges that restricts healthcare companies from developing novel drugs for the schizophrenia drugs market is the lack of sample-based tests. Since doctors cannot take brain tissue samples from patients like they do in a biopsy on a cancer tumor elsewhere in the body, it is challenging for researchers to study the root causes of schizophrenia. This becomes a hurdle for doctors and researchers as to what to target in order to design novel neuropsychiatric drugs. As such, healthcare companies are collaborating with doctors and researchers to study the live blood cells of patients with mental health disorders. These blood cells help researchers identify potential targets for drug discovery.

Companies are increasing focus on the study of human blood cells, as these cells are closely associated with the central nervous system. This makes blood cells an ideal environment to test potential new drugs.

Analysts’ Viewpoint

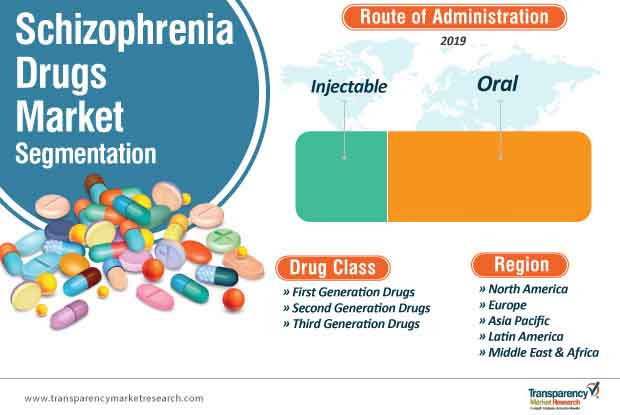

The schizophrenia drugs market is expected to grow the fastest in Asia Pacific on an account of the demand for less-invasive oral drugs that are anticipated to reach ~US$ 10.8 billion by 2027. Healthcare companies are increasing research on primary cells from patients to gain high success rates in the discovery of effective drugs. They are also innovating on antipsychotic drugs, as these drugs provide a range of tools to explore brain function in health and mental disorders. However, antipsychotic drugs have a high risk of disrupting the extrapyramidal function in patients. Also, these drugs do not have enough clinical evidence to prove their effectiveness in the development of new compounds in drugs.

As such, healthcare companies are increasing research & development to closely understand the effects of antipsychotic drugs on the central dopamine homeostasis of patients. Companies operating in the schizophrenia drugs market should focus on new models of preventive treatments of schizophrenia, such as the animal model and stem cell technology, for improved schizophrenia drug screenings.

Schizophrenia Drugs Market: Overview

Schizophrenia Drugs Market: Key Trends

Schizophrenia Drugs Market: Competition

FDA Approval and Product Expansion

Mergers & Acquisitions to Strengthen Market Position

Schizophrenia drugs market is projected to reach ~US$ 15.5 Bn by 2027

Schizophrenia drugs market expand at a CAGR of ~4% from 2019 to 2027

Schizophrenia drugs market is driven by rise in the prevalence of schizophrenia and launch of new schizophrenia drugs

The second generation drugs segment dominated the global schizophrenia drugs market, owing to their low risk of neurological side effects

Key players in the schizophrenia drugs market include Janssen Global Services, LLC (Johnson & Johnson), ALLERGAN, Pfizer Inc., and Otsuka Holdings Co., Ltd., Pfizer, Inc. and Hospira, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Schizophrenia Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Schizophrenia Drugs Introduction

4.1.2. Market Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Schizophrenia Drugs Market Analysis and Forecast, 2017–2027

4.4.1. Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast

5. Key Insights

5.1. Pipeline Analysis: Schizophrenia Drugs

5.2. Value Chain Analysis

5.3. Global Schizophrenia Drugs Sales Analysis, 2017–2027

6. Global Schizophrenia Drugs Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definitions

6.2. Key Findings / Developments

6.3. Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

6.3.1. First Generation Drugs

6.3.2. Second Generation Drugs

6.3.3. Third Generation Drugs

6.4. Global Schizophrenia Drugs Market Attractiveness, by Drug Class

7. Global Schizophrenia Drugs Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definitions

7.2. Key Findings / Developments

7.3. Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

7.3.1. Injectable

7.3.2. Oral

7.4. Global Schizophrenia Drugs Market Attractiveness, by Route of Administration

8. Global Schizophrenia Drugs Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Schizophrenia Drugs Market Attractiveness, by Region

9. North America Schizophrenia Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

9.2.1. First Generation Drugs

9.2.2. Second Generation Drugs

9.2.3. Third Generation Drugs

9.3. North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

9.3.1. Injectable

9.3.2. Oral

9.4. North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

9.4.1. U.S.

9.4.2. Canada

9.5. North America Schizophrenia Drugs Market Attractiveness Analysis

9.5.1. By Drug Class

9.5.2. By Route of Administration

9.5.3. By Country

10. Europe Schizophrenia Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

10.2.1. First Generation Drugs

10.2.2. Second Generation Drugs

10.2.3. Third Generation Drugs

10.3. Europe Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

10.3.1. Injectable

10.3.2. Oral

10.4. Europe Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Europe Schizophrenia Drugs Market Attractiveness Analysis

10.5.1. By Drug Class

10.5.2. By Route of Administration

10.5.3. By Country/Sub-region

11. Asia Pacific Schizophrenia Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

11.2.1. First Generation Drugs

11.2.2. Second Generation Drugs

11.2.3. Third Generation Drugs

11.3. Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

11.3.1. Injectable

11.3.2. Oral

11.4. Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Schizophrenia Drugs Market Attractiveness Analysis

11.5.1. By Drug Class

11.5.2. By Route of Administration

11.5.3. By Country/Sub-region

12. Latin America Schizophrenia Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

12.2.1. First Generation Drugs

12.2.2. Second Generation Drugs

12.2.3. Third Generation Drugs

12.3. Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

12.3.1. Injectable

12.3.2. Oral

12.4. Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Schizophrenia Drugs Market Attractiveness Analysis

12.5.1. By Drug Class

12.5.2. By Route of Administration

12.5.3. By Country/Sub-region

13. Middle East & Africa Schizophrenia Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

13.2.1. First Generation Drugs

13.2.2. Second Generation Drugs

13.2.3. Third Generation Drugs

13.3. Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

13.3.1. Injectable

13.3.2. Oral

13.4. Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

13.4.1. GCC

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Schizophrenia Drugs Market Attractiveness Analysis

13.5.1. By Drug Class

13.5.2. By Route of Administration

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Global Schizophrenia Drugs Market Share Analysis, by Company (2018)

14.2. Company Profiles

14.2.1. Allergan

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Financial Overview

14.2.1.3. Product Portfolio

14.2.1.4. SWOT Analysis

14.2.1.5. Strategic Overview

14.2.2. Otsuka Holdings Co., Ltd

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Financial Overview

14.2.2.3. Product Portfolio

14.2.2.4. SWOT Analysis

14.2.2.5. Strategic Overview

14.2.3. Janssen Pharmaceutica (Johnson & Johnson)

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Financial Overview

14.2.3.3. Product Portfolio

14.2.3.4. SWOT Analysis

14.2.3.5. Strategic Overview

14.2.4. Pfizer Inc.

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Financial Overview

14.2.4.3. Product Portfolio

14.2.4.4. SWOT Analysis

14.2.4.5. Strategic Overview

14.2.5. Maynepharma

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Financial Overview

14.2.5.3. Product Portfolio

14.2.5.4. SWOT Analysis

14.2.5.5. Strategic Overview

14.2.6. Vanda Pharmaceuticals Inc.

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Financial Overview

14.2.6.3. Product Portfolio

14.2.6.4. SWOT Analysis

14.2.6.5. Strategic Overview

14.2.7. Sumitomo Dainippon Pharma

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Financial Overview

14.2.7.3. Product Portfolio

14.2.7.4. SWOT Analysis

14.2.7.5. Strategic Overview

14.2.8. Eli Lilly & Co.

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Financial Overview

14.2.8.3. Product Portfolio

14.2.8.4. SWOT Analysis

14.2.8.5. Strategic Overview

14.2.9. AstraZeneca Plc

14.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.9.2. Financial Overview

14.2.9.3. Product Portfolio

14.2.9.4. SWOT Analysis

14.2.9.5. Strategic Overview

List of Tables

Table 01: Pipeline Analysis

Table 02: Depression Drugs Sales Analysis, 2015–2017

Table 03: Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 04: Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 05: Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

Table 07: North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 08: North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 09: Europe Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 10: Europe Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 11: Europe Schizophrenia drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 12: Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 14: Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 15: Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 17: Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

Table 18: Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 19: Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Drug Class, 2017–2027

Table 20: Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, by Route of Administration, 2017–2027

List of Figures

Figure 01: Global Schizophrenia Drugs Market Analysis, by Route of Administration

Figure 02: Global Schizophrenia Drugs Market Analysis, by Drug Class

Figure 03: Global Schizophrenia Drugs Market Analysis, by Region

Figure 04: Global Schizophrenia Drugs Market Revenue (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 05: Global Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018

Figure 06: Global Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018

Figure 07: Global Schizophrenia Drugs Market Value Share Analysis, by Region, 2018

Figure 08: Global Schizophrenia Drugs Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 09: Global Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 10: Global Schizophrenia Drugs Market Revenue (US$ Mn), by First Generation Drugs, 2017–2027

Figure 11: Global Schizophrenia Drugs Market Revenue (US$ Mn), by Second Generation Drugs, 2017–2027

Figure 12: Global Schizophrenia Drugs Market Revenue (US$ Mn), by Third Generation Drugs, 2017–2027

Figure 13: Global Schizophrenia Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 14: Global Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 15: Global Schizophrenia Drugs Market Revenue (US$ Mn), by Oral Route of Administration, 2017–2027

Figure 16: Global Schizophrenia Drugs Market Revenue (US$ Mn), by Injectable Route of Administration, 2017–2027

Figure 17: Global Schizophrenia Drugs Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 18: Global Schizophrenia Drugs Market Value Share Analysis, by Region, 2018 and 2027

Figure 19: Global Schizophrenia Drugs Market Attractiveness Analysis, by Region, 2019–2027

Figure 20: North America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 21: North America Schizophrenia Drugs Market Attractiveness Analysis, by Country, 2019–2027

Figure 22: North America Schizophrenia Drugs Market Value Share Analysis, by Country, 2018 and 2027

Figure 23: North America Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 24: North America Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 25: North America Schizophrenia Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 26: North America Schizophrenia drugs Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 27: Europe Schizophrenia Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 28: Europe Schizophrenia Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 29: Europe Schizophrenia Drugs Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 30: Europe Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 31: Europe Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 32: Europe Schizophrenia Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 33: Europe Schizophrenia Drugs Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 34: Asia Pacific Schizophrenia Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 35: Asia Pacific Schizophrenia Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 36: Asia Pacific Schizophrenia Drugs Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 37: Asia Pacific Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 38: Asia Pacific Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 39: Asia Pacific Schizophrenia Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 40: Asia Pacific Schizophrenia Drugs Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 41: Latin America Schizophrenia Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 42: Latin America Schizophrenia Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 43: Latin America Schizophrenia Drugs Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 44: Latin America Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 45: Latin America Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 46: Latin America Schizophrenia Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 47: Latin America Schizophrenia Drugs Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 48: Middle East & Africa Schizophrenia Drugs Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 49: Middle East & Africa Schizophrenia Drugs Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 50: Middle East & Africa Schizophrenia Drugs Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 51: Middle East & Africa Schizophrenia Drugs Market Value Share Analysis, by Drug Class, 2018 and 2027

Figure 52: Middle East & Africa Schizophrenia Drugs Market Value Share Analysis, by Route of Administration, 2018 and 2027

Figure 53: Middle East & Africa Schizophrenia Drugs Market Attractiveness Analysis, by Drug Class, 2019–2027

Figure 54: Middle East & Africa Schizophrenia Drugs Market Attractiveness Analysis, by Route of Administration, 2019–2027

Figure 55: Global Schizophrenia drugs Market Analysis, by Company Ranking, 2018

Figure 56: Johnson & Johnson Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2018

Figure 57: Johnson & Johnson R&D Expenses (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2018

Figure 58: Johnson & Johnson Breakdown of Net Sales, by Region, 2018

Figure 59: Johnson & Johnson Breakdown of Net Sales, by Business Segment, 2018

Figure 60: Allergan Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2018

Figure 61: Allergan R&D Expenses (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2018

Figure 62: Allergan Breakdown of Net Sales, by Business Segment (%), 2018

Figure 63: Pfizer Inc. Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2016–2018

Figure 64: Pfizer Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 65: Otsuka Holdings Co. Ltd. Revenue (US$ Bn) & Y-o-Y Growth (%) Projection, 2014–2017

Figure 66: Otsuka Holdings Co. Ltd. R&D Spending and Sales & Distribution Spending (US$ Bn) – Company Level, 2016–2017

Figure 67: Otsuka Holdings Co. Ltd. Breakdown of Net Sales, by Region (Company Level), 2017

Figure 68: Otsuka Holdings Co. Ltd. Breakdown of Net Sales (Overall Company Level), 2017

Figure 69: Eli Lily and Company Revenue (US$ Bn) & Y-o-Y Growth (%) Projection, 2016–2018

Figure 70: Eli Lily and Company Breakdown of Net Sales, by Neuroscience Level, 2018

Figure 71: Eli Lily and Company Breakdown of Net Sales, by Region, 2018

Figure 72: AstraZeneca Plc. Revenue (US$ Bn) & Y-o-Y Growth (%) Projection, 2014–2017

Figure 73: AstraZeneca Plc. Breakdown of Net Sales, by Region, 2018

Figure 74: AstraZeneca Plc. Breakdown of Net Sales, by Region, 2018 (%)

Figure 75: Mayne Pharma Group Limited Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2016-2018

Figure 76: Mayne Pharma Group Limited Breakdown of Net Sales (%), by Region, 2018

Figure 77: Sumitomo Dainippon Pharma Co., Ltd. Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2017

Figure 78: Sumitomo Dainippon Pharma Co., Ltd. Breakdown of Net Sales, by Business Segment, 2017

Figure 79: Sumitomo Dainippon Pharma Co., Ltd. Breakdown of Net Sales, by Region, 2017

Figure 80: Vanda Pharmaceuticals Inc. Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2017