Global Safety Service Market: Snapshot

The presence of numerous players of varying sizes characterize fragmentation yet intense competition in the global safety service market. Investments in cutting-edge technologies and acquisitions to develop innovative safety solutions is the focus of players in this market. This will not only help these companies garner a greater market share, but shape up the market to become an organized one.

The global safety service market is primarily driven by increasing trend of workplace safety. The spectrum of workplace safety covers process safety to employee safety to safe data management to asset management.

However, with rising complexities of business operations, integration of safety solutions with routine business functionalities is need of the times. This is addressed by customer-centric safety service solutions that integrate everyday business operations with safety solutions to bring about operational efficiency.

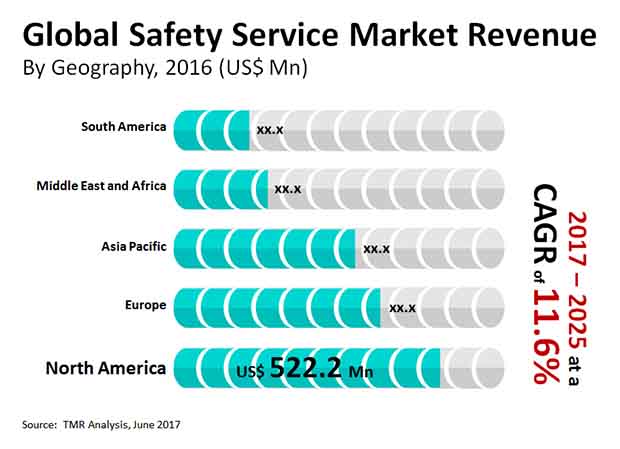

A report by Transparency Market Research says the global safety service market will be worth US$4,278.2 mn by 2025 expanding at a CAGR of 11.6% between 2017 and 2025.

Technology-driven Solutions Overcome Loopholes of Predecessor Solutions

The safety service market based upon component is divided into software and services. The segments under software are incident and action management, safety risk assessment, data analytics, hazard analysis management, process safety management, mobile apps, and others. The segments under services are consulting, project management, analytics, training, implementation, auditing, and certification.

The sub-segment of mobile apps under software is predicted to display a significant growth over the forecast period. This is because businesses are susceptible to unpredictable incidents and the timely reporting of safety issues enable responsible personnel to take appropriate action in a timely manner.

Apart from this, the sub-segment of auditing under services is expected to rise significantly over the forecast period. The growth of auditing is attributed due to the need to evaluate the status of regulations and policies followed by a company. Software and tools prescribed by safety service providers are used by internal auditors to measure the level of compliance followed at every stage of business operations. These tools also help to identify non-compliance to business protocols.

The end-use segments into which the safety service market is divided are oil and gas, petrochemical, chemical, wastewater, utilities, pharmaceutical, transportation of hazardous materials, food and beverage, and others. Among these, the oil and gas end-use industry is anticipated to rise at a significant growth rate over the forecast period. High risk of accidents in oil and gas demands safety solutions that adhere to regulatory compliances. As these industries are generally located in remote areas, reporting of incidents in a timely manner is challenging. Nevertheless, with technology-based solutions, safety service providers furnish a fluid approach that enables reporting of incidents in real time for quick decisions. With increasing shift of companies towards technology-driven solutions, the safety service market is expected to be benefitted especially in emerging economies.

North America Commands Market due to Stringent Workplace Safety Norms

Geographically, the global safety service market has been segmented into North America, Asia Pacific, Europe, the Middle East and Africa, and South America. North America currently holds command in the global market. However, Asia Pacific followed by Europe is expected to account for significant market shares over the forecast period.

Key names in the safety service market that are profiled in this report are UL LLC, HSE Integrated Ltd., Trinity Consultants Inc., Gensuite LLC, 3E Company, Velocity EHS, Intelex Technologies, Enablon Corporation, Enviance Inc., EtQ Inc., ProcessMAP Corporation, Enhesa Inc., Hygiene Technologies International Inc., Haztek Inc., CSA Group Company, Jaama Ltd, Crown Safety LLC, Workcare Inc., PureSafety Inc., FDR Safety LLC, PrSM Corporation, and Dade Moeller & Associates Inc.

The Global Safety Service Market is segmented as below:

|

By Component |

|

|

By End-Use Industry |

|

|

By Region |

|

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Safety Service Market

4. Market Overviews

4.1. Introduction

4.1.1. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Global Safety Service Market Analysis and Forecasts, 2015 – 2025

4.3.1. Market Revenue Projections, 2015 – 2025 (US$ Mn)

4.4. Key Market Indicators

4.4.1. Trend analysis of Outsourcing of safety services

4.5. Porter’s Five Force Analysis

4.6. Ecosystem Analysis

4.7. Market Outlook

5. Global Safety Service Market Analysis and Forecasts By Component

5.1. Market Analysis (US$ Mn) Forecast By Component, 2015 - 2025

5.1.1. Software

5.1.1.1. Incident & Action Management

5.1.1.2. Safety Risk Assessment

5.1.1.3. Data Analytics

5.1.1.4. Hazard Analysis Management

5.1.1.5. Process Safety Management

5.1.1.6. Mobile Apps

5.1.1.7. Others

5.1.2. Service

5.1.2.1. Consulting

5.1.2.2. Project Management

5.1.2.3. Analytics

5.1.2.4. Training

5.1.2.5. Implementation

5.1.2.6. Auditing

5.1.2.7. Certification

6. Global Safety Service Market Analysis and Forecasts By End-Use Industry

6.1. Market Analysis (US$ Mn) Forecast By End-Use Industry, 2015 - 2025

6.1.1. Oil and Gas (NAICS 211)

6.1.2. Chemical (NAICS 325)

6.1.3. Petrochemical (NAICS 32511)

6.1.4. Wastewater (NAICS 2213)

6.1.5. Utilities (NAICS 22 – Excluding Wastewater)

6.1.6. Pharmaceutical (NAICS 3254)

6.1.7. Food and Beverage (NAICS 311, 3119, 3121)

6.1.8. Transportation of hazardous materials (NAICS 48)

6.1.9. Others

7. Global Safety Service Market Analysis and Forecasts By Region

7.1. Key Findings

7.2. Key Trends

7.3. Market Analysis (US$ Mn) Forecast By Region, 2015 – 2025

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

7.4. Market Attractiveness

7.4.1. By Component

7.4.2. By End-Use Industry

7.4.3. By Region

8. North America Safety Service Market Analysis and Forecasts

8.1. Key trends

8.2. Regulations & Policies

8.3. Market Analysis (US$ Mn) Forecast By Component, 2015 - 2025

8.3.1. Software

8.3.1.1. Incident & Action Management

8.3.1.2. Safety Risk Assessment

8.3.1.3. Data Analytics

8.3.1.4. Hazard Analysis Management

8.3.1.5. Process Safety Management

8.3.1.6. Mobile Apps

8.3.1.7. Others

8.3.2. Service

8.3.2.1. Consulting

8.3.2.2. Project Management

8.3.2.3. Analytics

8.3.2.4. Training

8.3.2.5. Implementation

8.3.2.6. Auditing

8.3.2.7. Certification

8.4. Market Analysis (US$ Mn) Forecast By End-use Industry, 2015 – 2025

8.4.1. Oil and Gas (NAICS 211)

8.4.2. Chemical (NAICS 325)

8.4.3. Petrochemical (NAICS 32511)

8.4.4. Wastewater (NAICS 2213)

8.4.5. Utilities (NAICS 22 – Excluding Wastewater)

8.4.6. Pharmaceutical (NAICS 3254)

8.4.7. Food and Beverage (NAICS 311, 3119, 3121)

8.4.8. Transportation of hazardous materials (NAICS 48)

8.4.9. Others

8.5. Market Analysis (US$ Mn) Forecast By Country, 2015-2025

8.5.1. The U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Country

8.6.2. By Component

8.6.3. By End-use Industry

9. Europe Safety Service Market Analysis and Forecasts

9.1. Key Trends

9.2. Regulations & Policies

9.3. Market Analysis (US$ Mn) Forecast By Component, 2015 - 2025

9.3.1. Software

9.3.1.1. Incident & Action Management

9.3.1.2. Safety Risk Assessment

9.3.1.3. Data Analytics

9.3.1.4. Hazard Analysis Management

9.3.1.5. Process Safety Management

9.3.1.6. Mobile Apps

9.3.1.7. Others

9.3.2. Service

9.3.2.1. Consulting

9.3.2.2. Project Management

9.3.2.3. Analytics

9.3.2.4. Training

9.3.2.5. Implementation

9.3.2.6. Auditing

9.3.2.7. Certification

9.4. Market Analysis (US$ Mn) Forecast By End-use Industry, 2015 – 2025

9.4.1. Oil and Gas (NAICS 211)

9.4.2. Chemical (NAICS 325)

9.4.3. Petrochemical (NAICS 32511)

9.4.4. Wastewater (NAICS 2213)

9.4.5. Utilities (NAICS 22 – Excluding Wastewater)

9.4.6. Pharmaceutical (NAICS 3254)

9.4.7. Food and Beverage (NAICS 311, 3119, 3121)

9.4.8. Transportation of hazardous materials (NAICS 48)

9.4.9. Others

9.5. Market Analysis (US$ Mn) Forecast By Country, 2015-2025

9.5.1. The U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Italy

9.5.5. Russia

9.5.6. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Country

9.6.2. By Component

9.6.3. By End-use Industry

10. Asia Pacific Safety Service Market Analysis and Forecasts

10.1. Key Trends

10.2. Regulations & Policies

10.3. Market Analysis (US$ Mn) Forecast By Component, 2015 - 2025

10.3.1. Software

10.3.1.1. Incident & Action Management

10.3.1.2. Safety Risk Assessment

10.3.1.3. Data Analytics

10.3.1.4. Hazard Analysis Management

10.3.1.5. Process Safety Management

10.3.1.6. Mobile Apps

10.3.1.7. Others

10.3.2. Service

10.3.2.1. Consulting

10.3.2.2. Project Management

10.3.2.3. Analytics

10.3.2.4. Training

10.3.2.5. Implementation

10.3.2.6. Auditing

10.3.2.7. Certification

10.4. Market Analysis (US$ Mn) Forecast By End-use Industry, 2015 – 2025

10.4.1. Oil and Gas (NAICS 211)

10.4.2. Chemical (NAICS 325)

10.4.3. Petrochemical (NAICS 32511)

10.4.4. Wastewater (NAICS 2213)

10.4.5. Utilities (NAICS 22 – Excluding Wastewater)

10.4.6. Pharmaceutical (NAICS 3254)

10.4.7. Food and Beverage (NAICS 311, 3119, 3121)

10.4.8. Transportation of hazardous materials (NAICS 48)

10.4.9. Others

10.5. Market Analysis (US$ Mn) Forecast By Country, 2015-2025

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. South Korea

10.5.5. Australia

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Country

10.6.2. By Component

10.6.3. By End-use Industry

11. Middle East and Africa Safety Service Market Analysis and Forecasts

11.1. Key Trends

11.2. Regulations & Policies

11.3. Market Analysis (US$ Mn) Forecast By Component, 2015 - 2025

11.3.1. Software

11.3.1.1. Incident & Action Management

11.3.1.2. Safety Risk Assessment

11.3.1.3. Data Analytics

11.3.1.4. Hazard Analysis Management

11.3.1.5. Process Safety Management

11.3.1.6. Mobile Apps

11.3.1.7. Others

11.3.2. Service

11.3.2.1. Consulting

11.3.2.2. Project Management

11.3.2.3. Analytics

11.3.2.4. Training

11.3.2.5. Implementation

11.3.2.6. Auditing

11.3.2.7. Certification

11.4. Market Analysis (US$ Mn) Forecast By End-use Industry, 2015 – 2025

11.4.1. Oil and Gas (NAICS 211)

11.4.2. Chemical (NAICS 325)

11.4.3. Petrochemical (NAICS 32511)

11.4.4. Wastewater (NAICS 2213)

11.4.5. Utilities (NAICS 22 – Excluding Wastewater)

11.4.6. Pharmaceutical (NAICS 3254)

11.4.7. Food and Beverage (NAICS 311, 3119, 3121)

11.4.8. Transportation of hazardous materials (NAICS 48)

11.4.9. Others

11.5. Market Analysis (US$ Mn) Forecast By Country, 2015-2025

11.5.1. UAE

11.5.2. Saudi Arabia

11.5.3. South Africa

11.5.4. Rest of Middle East and Africa

11.6. Market Attractiveness Analysis

11.6.1. By Country

11.6.2. By Component

11.6.3. By End-use Industry

12. South America Safety Service Market Analysis and Forecasts

12.1. Key Trends

12.2. Regulations & Policies

12.3. Market Analysis (US$ Mn) Forecast By Component, 2015 - 2025

12.3.1. Software

12.3.1.1. Incident & Action Management

12.3.1.2. Safety Risk Assessment

12.3.1.3. Data Analytics

12.3.1.4. Hazard Analysis Management

12.3.1.5. Process Safety Management

12.3.1.6. Mobile Apps

12.3.1.7. Others

12.3.2. Service

12.3.2.1. Consulting

12.3.2.2. Project Management

12.3.2.3. Analytics

12.3.2.4. Training

12.3.2.5. Implementation

12.3.2.6. Auditing

12.3.2.7. Certification

12.4. Market Analysis (US$ Mn) Forecast By End-use Industry, 2015 – 2025

12.4.1. Oil and Gas (NAICS 211)

12.4.2. Chemical (NAICS 325)

12.4.3. Petrochemical (NAICS 32511)

12.4.4. Wastewater (NAICS 2213)

12.4.5. Utilities (NAICS 22 – Excluding Wastewater)

12.4.6. Pharmaceutical (NAICS 3254)

12.4.7. Food and Beverage (NAICS 311, 3119, 3121)

12.4.8. Transportation of hazardous materials (NAICS 48)

12.4.9. Others

12.5. Market Analysis (US$ Mn) Forecast By Country, 2015-2025

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Country

12.6.2. By Component

12.6.3. By End-use Industry

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.2. Market Share Analysis By Company (2016)

13.3. Company Profiles

13.3.1. 3E Company

13.3.1.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.1.2. Market Presence, By Segment.

13.3.1.3. Strategy

13.3.1.4. Revenue and Operating Profits

13.3.1.5. SWOT Analysis

13.3.2. Enablon North America Corporation

13.3.2.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.2.2. Market Presence, By Segment.

13.3.2.3. Strategy

13.3.2.4. Revenue and Operating Profits

13.3.2.5. SWOT Analysis

13.3.3. Enhesa technologies

13.3.3.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.3.2. Market Presence, By Segment.

13.3.3.3. Strategy

13.3.3.4. Revenue and Operating Profits

13.3.3.5. SWOT Analysis

13.3.4. Enviance, Inc.

13.3.4.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.4.2. Market Presence, By Segment.

13.3.4.3. Strategy

13.3.4.4. Revenue and Operating Profits

13.3.4.5. SWOT Analysis

13.3.5. EtQ, Inc.

13.3.5.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.5.2. Market Presence, By Segment.

13.3.5.3. Strategy

13.3.5.4. Revenue and Operating Profits

13.3.5.5. SWOT Analysis

13.3.6. Gensuite LLC.

13.3.6.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.6.2. Market Presence, By Segment.

13.3.6.3. Strategy

13.3.6.4. Revenue and Operating Profits

13.3.6.5. SWOT Analysis

13.3.7. HSE Integrated Ltd.

13.3.7.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.7.2. Market Presence, By Segment.

13.3.7.3. Strategy

13.3.7.4. Revenue and Operating Profits

13.3.7.5. SWOT Analysis

13.3.8. Intelex Technologies

13.3.8.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.8.2. Market Presence, By Segment.

13.3.8.3. Strategy

13.3.8.4. Revenue and Operating Profits

13.3.8.5. SWOT Analysis

13.3.9. Medgate, Inc.

13.3.9.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.9.2. Market Presence, By Segment.

13.3.9.3. Strategy

13.3.9.4. Revenue and Operating Profits

13.3.9.5. SWOT Analysis

13.3.10. ProcessMAP Corporation

13.3.10.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.10.2. Market Presence, By Segment.

13.3.10.3. Strategy

13.3.10.4. Revenue and Operating Profits

13.3.10.5. SWOT Analysis

13.3.11. Trinity Consultants, LLC

13.3.11.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.11.2. Market Presence, By Segment.

13.3.11.3. Strategy

13.3.11.4. Revenue and Operating Profits

13.3.11.5. SWOT Analysis

13.3.12. UL LLC

13.3.12.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.12.2. Market Presence, By Segment.

13.3.12.3. Strategy

13.3.12.4. Revenue and Operating Profits

13.3.12.5. SWOT Analysis

13.3.13. VelocityEHS

13.3.13.1. Company Details (HQ, Foundation Year, Employee Strength)

13.3.13.2. Market Presence, By Segment.

13.3.13.3. Strategy

13.3.13.4. Revenue and Operating Profits

13.3.13.5. SWOT Analysis

14. Key Takeaways

List of Tables

Table 1: Global Safety Service Revenue (US$ Mn) Forecast and CAGR, by Software component, 2015–2025

Table 2: Global Safety Service Revenue (US$ Mn) Forecast and CAGR, by Services component, 2015–2025

Table 3: Global Safety Service Revenue (US$ Mn) Forecast and CAGR, by End-Use Industry, 2015–2025

Table 4: Global Safety Service Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

Table 5: North America Safety Service Revenue (US$ Mn) Forecast and CAGR, by Software component, 2015–2025

Table 6: North America Safety Service Revenue (US$ Mn) Forecast and CAGR, by Services component, 2015–2025

Table 7: North America Safety Service Revenue (US$ Mn) Forecast and CAGR, by End-Use Industry, 2015–2025

Table 8: North America Safety Service Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

Table 9: Europe Safety Service Revenue (US$ Mn) Forecast and CAGR, by Software component, 2015–2025

Table 10: Europe Safety Service Revenue (US$ Mn) Forecast and CAGR, by Services component, 2015–2025

Table 11: Europe Safety Service Revenue (US$ Mn) Forecast and CAGR, by End-Use Industry, 2015–2025

Table 12: Europe Safety Service Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

Table 13: Asia Pacific Safety Service Revenue (US$ Mn) Forecast and CAGR, by Software component, 2015–2025

Table 14: Asia Pacific Safety Service Revenue (US$ Mn) Forecast and CAGR, by Services component, 2015–2025

Table 15: Asia Pacific Safety Service Revenue (US$ Mn) Forecast and CAGR, by End-Use Industry, 2015–2025

Table 16: Asia Pacific Safety Service Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

Table 17: Middle East & Africa Safety Service Revenue (US$ Mn) Forecast and CAGR, by Software component, 2015–2025

Table 18: Middle East & Africa Safety Service Revenue (US$ Mn) Forecast and CAGR, by Services component, 2015–2025

Table 19: Middle East & Africa Safety Service Revenue (US$ Mn) Forecast and CAGR, by End-Use Industry, 2015–2025

Table 20: Middle East & Africa Safety Service Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

Table 21: South America Safety Service Revenue (US$ Mn) Forecast and CAGR, by Software component, 2015–2025

Table 22: South America Safety Service Revenue (US$ Mn) Forecast and CAGR, by Services component, 2015–2025

Table 23: South America Safety Service Revenue (US$ Mn) Forecast and CAGR, by End-Use Industry, 2015–2025

Table 24: South America Safety Service Revenue (US$ Mn) Forecast and CAGR, by Region, 2015–2025

List of Figures

Figure 1: Global Safety Service Market Size, Indicative (US$ Mn)

Figure 2: Global Safety Services Market, Top Segments (2017) - A

Figure 3: Global Safety Services Market, Top Segments (2017) - B

Figure 4: Global Safety Services Market, by Region, 2025

Figure 5: Global Safety Service Market Key industry developments

Figure 6: Global Safety Services Market – Insights

Figure 7: Global Safety Services Market Revenue Projection (US$ Mn), 2015 – 2025

Figure 8: Global Safety Services Market Y-o-Y Growth (Value %) Forecast, 2015 - 2025

Figure 9: Global Safety Services Market Revenue Share (%),by Region, 2015 – 2025

Figure 10: Global Safety Service Market Porter’s Analysis

Figure 11: Global Safety Service Market Ecosystem Analysis

Figure 12: Global Safety Services Market CAGR (%) by End-Use Industry (2017 – 2025)

Figure 13: Global Safety Services Market CAGR (%) by Services (2017 – 2025)

Figure 14: Global Safety Services Market CAGR (%) by Software (2017 – 2025)

Figure 15: Global Safety Services Market Value Share Analysis, by Software (2016 & 2025)

Figure 16: Global Safety Services Market Value Share Analysis, by Service (2016 & 2025)

Figure 17: Global Safety Services Market Share Value Analysis, by End-Use Industry (2016 & 2025)

Figure 18: Global Safety Services Market Value Share Analysis, by Region (2016 & 2025)

Figure 19: Global Safety Services Market Value Share Analysis, by top segments (2016 & 2025)

Figure 20: Global Safety Services Market Size and Y-o-Y Growth, by Region –North America, 2015 – 2025, (US$ Mn & %)

Figure 21: Global Safety Services Market Size and Y-o-Y Growth, by Region –Europe, 2015 – 2025, (US$ Mn & %)

Figure 22: Global Safety Services Market Size and Y-o-Y Growth, by Region –APAC, 2015 – 2025, (US$ Mn & %)

Figure 23: Global Safety Services Market Size and Y-o-Y Growth, by Region –MEA, 2015 – 2025, (US$ Mn & %)

Figure 24: Global Safety Services Market Size and Y-o-Y Growth, by Region –South America, 2015 – 2025, (US$ Mn & %)

Figure 25: Global Safety Services Market Attractiveness Analysis, By Software (2016)

Figure 26: Global Safety Services Market Attractiveness Analysis, By Service (2016)

Figure 27: Global Safety Services Market Attractiveness Analysis By End-Use Industry (2016)

Figure 28: Global Safety Services Market Attractiveness Analysis By Region (2016)

Figure 29: North America Safety Services Market Size and Y-o-Y Growth, by Country – The U.S., 2015 – 2025, (US$ Mn & %)

Figure 30: North America Safety Services Market Size and Y-o-Y Growth, by Country – Canada, 2015 – 2025, (US$ Mn & %)

Figure 31: North America Safety Services Market Size and Y-o-Y Growth, by Country – Rest of NA, 2015 – 2025, (US$ Mn & %)

Figure 32: North America Safety Services Market Attractiveness Analysis, By Software (2016)

Figure 33: North America Safety Services Market Attractiveness Analysis, By Service (2016)

Figure 34: North America Safety Services Market Attractiveness Analysis By End-Use Industry (2016)

Figure 35: North America Safety Services Market Attractiveness Analysis By Country (2016)

Figure 36: Europe Safety Services Market Size and Y-o-Y Growth, by Country – The U.K., 2015 – 2025, (US$ Mn & %)

Figure 37: Europe Safety Services Market Size and Y-o-Y Growth, by Country – Germany, 2015 – 2025, (US$ Mn & %)

Figure 38: Europe Safety Services Market Size and Y-o-Y Growth, by Country – France, 2015 – 2025, (US$ Mn & %)

Figure 39: Europe Safety Services Market Size and Y-o-Y Growth, by Country – Italy, 2015 – 2025, (US$ Mn & %)

Figure 40: Europe Safety Services Market Size and Y-o-Y Growth, by Country – Russia, 2015 – 2025, (US$ Mn & %)

Figure 41: Europe Safety Services Market Size and Y-o-Y Growth, by Country – Rest ofEurope, 2015 – 2025, (US$ Mn & %)

Figure 42: Europe Safety Services Market Attractiveness Analysis, By Software (2016)

Figure 43: Europe Safety Services Market Attractiveness Analysis, By Service (2016)

Figure 44: Europe Safety Services Market Attractiveness Analysis By End-Use Industry (2016)

Figure 45: Europe Safety Services Market Attractiveness Analysis By Country (2016)

Figure 46: APAC Safety Services Market Size and Y-o-Y Growth, by Country – China, 2015 – 2025, (US$ Mn & %)

Figure 47: APAC Safety Services Market Size and Y-o-Y Growth, by Country – Japan, 2015 – 2025, (US$ Mn & %)

Figure 48: APAC Safety Services Market Size and Y-o-Y Growth, by Country – India, 2015 – 2025, (US$ Mn & %)

Figure 49: APAC Safety Services Market Size and Y-o-Y Growth, by Country – South Korea, 2015 – 2025, (US$ Mn & %)

Figure 50: APAC Safety Services Market Size and Y-o-Y Growth, by Country – Australia, 2015 – 2025, (US$ Mn & %)

Figure 51: APAC Safety Services Market Size and Y-o-Y Growth, by Country – Rest ofAPAC, 2015 – 2025, (US$ Mn & %)

Figure 52: APAC Safety Services Market Attractiveness Analysis, By Software (2016)

Figure 53: APAC Safety Services Market Attractiveness Analysis, By Service (2016)

Figure 54: APAC Safety Services Market Attractiveness Analysis By End-Use Industry (2016)

Figure 55: APAC Safety Services Market Attractiveness Analysis By Country (2016)

Figure 56: MEA Safety Services Market Size and Y-o-Y Growth, by Country – UAE, 2015 – 2025, (US$ Mn & %)

Figure 57: MEA Safety Services Market Size and Y-o-Y Growth, by Country – Saudi Arabia, 2015 – 2025, (US$ Mn & %)

Figure 58: MEA Safety Services Market Size and Y-o-Y Growth, by Country – South Africa, 2015 – 2025, (US$ Mn & %)

Figure 59: MEA Safety Services Market Size and Y-o-Y Growth, by Country – Rest ofMEA, 2015 – 2025, (US$ Mn & %)

Figure 60: MEA Safety Services Market Attractiveness Analysis, By Software (2016)

Figure 61: MEA Safety Services Market Attractiveness Analysis, By Service (2016)

Figure 62: MEA Safety Services Market Attractiveness Analysis By End-Use Industry (2016)

Figure 63: MEA Safety Services Market Attractiveness Analysis By Country (2016)

Figure 64: South America Safety Services Market Size and Y-o-Y Growth, by Country – Brazil, 2015 – 2025, (US$ Mn & %)

Figure 65: South America Safety Services Market Size and Y-o-Y Growth, by Country – Argentina, 2015 – 2025, (US$ Mn & %)

Figure 66: South America Safety Services Market Size and Y-o-Y Growth, by Country – Rest ofSouth America, 2015 – 2025, (US$ Mn & %)

Figure 67: South America Safety Services Market Attractiveness Analysis, By Software (2016)

Figure 68: South America Safety Services Market Attractiveness Analysis, By Service (2016)

Figure 69: South America Safety Services Market Attractiveness Analysis By End-Use Industry (2016)

Figure 70: South America Safety Services Market Attractiveness Analysis By Country (2016)

Figure 71: Global Safety Service Market (Enhesa Inc. Competition matrix)

Figure 72: Global Safety Service Market (UL, LLC. Competition Matrix)

Figure 73: Global Safety Service Market (Medgate, Inc. Competition Matrix)

Figure 74: Global Safety Service Market (Intelex Technologies Competition Matrix)

Figure 75: Global Safety Service Market Share Analysis, by Company (2016)

Figure 76: Global Safety Service Market Share Pie Chart