The growing adoption of sustainable packaging with biodegradable and eco-friendly materials has triggered a huge demand for sack kraft paper in recent times. The demand for this type of paper is expected soar in the coming years as this material shows strength equal to synthetic or plastic materials. The global sack kraft paper is expected to be worth US$10.5 bn by the end of 2024 as compared to US$8.4 bn in 2015. The researchers estimate that the global market will expand at a CAGR of 2.6% during the forecast period of 2016 and 2024. Some of the factors that are expected to fuel the demand for sack kraft paper are features such as porosity, extensibility, printability, durability. Furthermore, this paper is also known to offer an exceptional high Tensile Energy Absorption (TEA) index of 3.8 J/g and is thus being used for industrial purposes.

The booming cement industry in the developing economies of East Asia, Africa, and the Middle East have augmented the demand for sack kraft paper. The continued growth of the construction industry across the globe as the overall economy recovers from the recent slowdown is expected to boost the uptake of sack kraft paper as well. Builders are expected to use sack kraft paper in lieu of cement to build multiwall paper sacks for packaging, which is also projected to have a positive impact on the revenue of the global market. This material is known to act as a filter, which allows quick de-aeration and a high filling speed. Thus it has earned the status of being an excellent substitute for plastics that are regularly used in industrial packaging.

The growing concerns amongst governments and environmentalists about the hazards of using plastic is forcing them to focus on greener alternatives. The demand for sack kraft paper is also being fueled by the steady ban on the distribution and production of plastics in several countries of the world. The ongoing technological advancements that have made sack kraft paper noticeably moisture resistant are also projected to fuel the demand for this material.

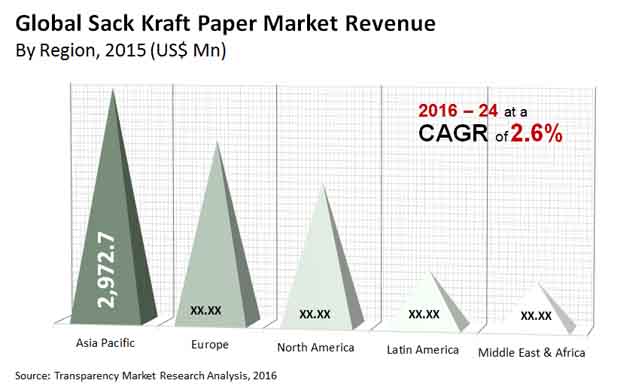

In terms of geography, the global sack kraft paper market is segmented into Asia Pacific, Latin America, North America, Europe, and the Middle East and Africa. The analysts state that the global market is being led by the Middle East and Africa and Asia Pacific. Collectively, the sack kraft paper market in these regions is expected to register a CAGR of 3.4% during the forecast period of 2016 and 2024 in terms of revenue. The rise in construction activities and the growing demand for cement and other materials for building purposes is expected to lend a serious impetus to the growth of the overall sack kraft paper market.

Additionally, the relentless demand for pet food and animal feed is also playing a crucial role in the growing demand for sack kraft paper in these regions. Currently, China holds a share of 55.9% in the Asia Pacific sack kraft paper market and is expected to offer lucrative opportunities to the overall market. On the other hand, North America and Europe will show sluggish demand during the forecast period as the markets are reaching a saturation point.

Some of the leading players operating in the global sack kraft paper market are Canfor Corporation, The Mondi Group plc, Nordic Paper Holding AB, Segezha Group, BillerudKorsnas AB, KapStone Paper and Packaging Corporation, Gascogne SA, Natron-Hayat d.o.o., Tolko Industries Ltd., and Horizon Pulp & Paper Ltd.

Sack Kraft Paper Market to Witness Remarkable Growth Owing to Growing Demand for Eco-friendly Products

The increasing adoption of sustainable packaging with eco-friendly and biodegradable materials is expected to aid in expansion of the global sack kraft paper market in the coming years. The interest for this sort of paper is normal take off in the coming a long time as this material shows strength equivalent to engineering or plastic materials. The developing worries among governments and earthy people about the risks of utilizing plastic are driving them to zero in on greener other options. The interest for sack kraft paper is likewise being filled by the consistent prohibition on the dispersion and creation of plastics in a few nations of the world. The progressing mechanical headways that have made sack kraft paper discernibly dampness safe are additionally projected to fuel the interest for this material.

Regarding geography, the worldwide sack kraft paper market is fragmented into Asia Pacific, Latin America, North America, Europe, and the Middle East and Africa. The investigators express that the worldwide market is being driven by the Middle East and Africa and Asia Pacific. The ascent in development exercises and the developing interest for concrete and different materials for building reasons for existing is required to loan a genuine driving force to the development of the general sack kraft paper market.

Moreover, the persistent interest for pet food and creature feed is likewise assuming a critical part in the developing interest for sack kraft paper in these areas. At present, China holds a portion of 55.9% in the Asia Pacific market and is required to offer worthwhile occasions to the general market. Then again, North America and Europe will show languid interest during the figure time frame as the business sectors are arriving at an immersion point.

1. Executive Summary

2. Research Methodology

3. Assumptions and Acronyms Used

4. Sack Kraft Paper Market Overview

4.1. Introduction

4.1.1. Sack Kraft Paper Market Taxonomy

4.1.2. Sack Kraft Paper Market Value Chain

4.2. Sack Kraft Paper Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Trends

4.2.4. Opportunities

5. Global Sack Kraft Paper Market Forecast, 2016-2024

5.1. Market Forecast

5.1.1. Market Value and Volume Forecast

5.1.2. Absolute $ Opportunity

5.2. Global Sack Kraft Paper Market Snapshot

5.2.1. Market Share & Market Growth, By Grade

5.2.2. Market Share & Market Growth, By Packaging Type

5.2.3. Market Share & Market Growth, By End-use Industry

5.2.4. Market Share & Market Growth, By Region

6. Global Sack Kraft Paper Market Analysis, By Grade

6.1. Introduction

6.1.1. Y-o-Y Growth Comparison, By Grade

6.1.2. Market Share & Basis Point (BPS) Analysis, By Grade

6.2. Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) Forecast, By Grade

6.2.1. White Grade

6.2.2. Brown Grade

6.3. Global Sack Kraft Paper Market Attractiveness Analysis, By Grade

7. Global Sack Kraft Paper Market Analysis, By Packaging Type

7.1. Introduction

7.1.1. Y-o-Y Growth Comparison, By Packaging Type

7.1.2. Market Share & Basis Point (BPS) Analysis, By Packaging Type

7.2. Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) Forecast, By Packaging Type

7.2.1. Valve Sack

7.2.2. Open Mouth Sack

7.3. Global Sack Kraft Paper Market Attractiveness Analysis, By Packaging Type

8. Global Sack Kraft Paper Market Analysis, By End-use Industry

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison, By End-use Industry

8.1.2. Market Share & Basis Point (BPS) Analysis, By End-use Industry

8.2. Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) Forecast, By End-use Industry

8.2.1. Cement and Building Materials

8.2.2. Chemicals

8.2.3. Animal Feed

8.2.4. Pet Food

8.2.5. Food

8.3. Global Sack Kraft Paper Market Attractiveness Analysis, By Packaging Type

9. Global Sack Kraft Paper Market Analysis, By Region

9.1. Introduction

9.1.1. Market Share & Basis Point (BPS) Analysis, By Region

9.1.2. Y-o-Y Growth Projections, By Region

9.2. Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) Forecast By Region

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. APAC

9.2.5. MEA

9.3. Global Sack Kraft Paper Market Attractiveness, By Region

10. North America Sack Kraft Paper Market Analysis

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison, By Country

10.1.2. Market Share & Basis Point (BPS) Analysis, By Country

10.2. North America Market Forecast

10.2.1. Market Forecast, By Country

10.2.1.1. U.S. Absolute $ Opportunity

10.2.1.2. Canada Absolute $ Opportunity

10.2.2. Market Forecast & Analysis, By Grade

10.2.2.1. White Grade

10.2.2.2. Brown Grade

10.2.2.3. Market Attractiveness Analysis, By Grade

10.2.3. Market Forecast & Analysis, By Packaging Type

10.2.3.1. Valve Sack

10.2.3.2. Open Mouth Sack

10.2.3.3. Market Attractiveness Analysis, By Packaging Type

10.2.4. Market Forecast & Analysis, By End-use Industry

10.2.4.1. Cement and Building Materials

10.2.4.2. Chemicals

10.2.4.3. Animal Feed

10.2.4.4. Pet Food

10.2.4.5. Food

10.2.4.6. Market Attractiveness Analysis, By End-use Industry

11. Latin America Sack Kraft Paper Market Analysis

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison, By Country

11.1.2. Market Share & Basis Point (BPS) Analysis, By Country

11.2. Latin America Market Forecast

11.2.1. Market Forecast, By Country

11.2.1.1. Argentina Absolute $ Opportunity

11.2.1.2. Brazil Absolute $ Opportunity

11.2.1.3. Mexico Absolute $ Opportunity

11.2.1.4. Rest of Latin America Absolute $ Opportunity

11.2.2. Market Forecast & Analysis, By Grade

11.2.2.1. White Grade

11.2.2.2. Brown Grade

11.2.2.3. Market Attractiveness Analysis, By Grade

11.2.3. Market Forecast & Analysis, By Packaging Type

11.2.3.1. Valve Sack

11.2.3.2. Open Mouth Sack

11.2.3.3. Market Attractiveness Analysis, By Packaging Type

11.2.4. Market Forecast & Analysis, By End-use Industry

11.2.4.1. Cement and Building Materials

11.2.4.2. Chemicals

11.2.4.3. Animal Feed

11.2.4.4. Pet Food

11.2.4.5. Food

11.2.4.6. Market Attractiveness Analysis, By End-use Industry

12. Europe Sack Kraft Paper Market Analysis

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison, By Country

12.1.2. Market Share & Basis Point (BPS) Analysis, By Country

12.2. Europe Market Forecast

12.2.1. Market Forecast, By Country

12.2.1.1. EU-5 Countries Absolute $ Opportunity

12.2.1.2. Nordic Absolute $ Opportunity

12.2.1.3. Benelux Absolute $ Opportunity

12.2.1.4. Russia Absolute $ Opportunity

12.2.1.5. Poland Absolute $ Opportunity

12.2.1.6. Rest of Europe Absolute $ Opportunity

12.2.2. Market Forecast & Analysis, By Grade

12.2.2.1. White Grade

12.2.2.2. Brown Grade

12.2.2.3. Market Attractiveness Analysis, By Grade

12.2.3. Market Forecast & Analysis, By Packaging Type

12.2.3.1. Valve Sack

12.2.3.2. Open Mouth Sack

12.2.3.3. Market Attractiveness Analysis, By Packaging Type

12.2.4. Market Forecast & Analysis, By End-use Industry

12.2.4.1. Cement and Building Materials

12.2.4.2. Chemicals

12.2.4.3. Animal Feed

12.2.4.4. Pet Food

12.2.4.5. Food

12.2.4.6. Market Attractiveness Analysis, By End-use Industry

13. APAC Sack Kraft Paper Market Analysis

13.1. Introduction

13.1.1. Y-o-Y Growth Comparison, By Country

13.1.2. Market Share & Basis Point (BPS) Analysis, By Country

13.2. APAC Market Forecast

13.2.1. Market Forecast, By Country

13.2.1.1. China Absolute $ Opportunity

13.2.1.2. India Absolute $ Opportunity

13.2.1.3. Japan Absolute $ Opportunity

13.2.1.4. ASEAN Absolute $ Opportunity

13.2.1.5. Australia & New Zealand Absolute $ Opportunity

13.2.1.6. Rest of APAC Absolute $ Opportunity

13.2.2. Market Forecast & Analysis, By Grade

13.2.2.1. White Grade

13.2.2.2. Brown Grade

13.2.2.3. Market Attractiveness Analysis, By Grade

13.2.3. Market Forecast & Analysis, By Packaging Type

13.2.3.1. Valve Sack

13.2.3.2. Open Mouth Sack

13.2.3.3. Market Attractiveness Analysis, By Packaging Type

13.2.4. Market Forecast & Analysis, By End-use Industry

13.2.4.1. Cement and Building Materials

13.2.4.2. Chemicals

13.2.4.3. Animal Feed

13.2.4.4. Pet Food

13.2.4.5. Food

13.2.4.6. Market Attractiveness Analysis, By End-use Industry

14. MEA Sack Kraft Paper Market Analysis

14.1. Introduction

14.1.1. Y-o-Y Growth Comparison, By Country

14.1.2. Market Share & Basis Point (BPS) Analysis, By Country

14.2. MEA Market Forecast

14.2.1. Market Forecast, By Country

14.2.1.1. GCC Countries Absolute $ Opportunity

14.2.1.2. South Africa Absolute $ Opportunity

14.2.1.3. North Africa Absolute $ Opportunity

14.2.1.4. Israel Absolute $ Opportunity

14.2.1.5. Turkey Absolute $ Opportunity

14.2.1.6. Rest of MEA Absolute $ Opportunity

14.2.2. Market Forecast & Analysis, By Grade

14.2.2.1. White Grade

14.2.2.2. Brown Grade

14.2.2.3. Market Attractiveness Analysis, By Grade

14.2.3. Market Forecast & Analysis, By Packaging Type

14.2.3.1. Valve Sack

14.2.3.2. Open Mouth Sack

14.2.3.3. Market Attractiveness Analysis, By Packaging Type

14.2.4. Market Forecast & Analysis, By End-use Industry

14.2.4.1. Cement and Building Materials

14.2.4.2. Chemicals

14.2.4.3. Animal Feed

14.2.4.4. Pet Food

14.2.4.5. Food

14.2.4.6. Market Attractiveness Analysis, By End-use Industry

15. Competition Landscape

15.1. Competitive Dashboard

15.2. Company Market Share Analysis

15.3. Company Profile

15.3.1. Revenue

15.3.2. Product Types/Brand Offerings

15.3.3. Key Developments

15.3.4. SWOT Analysis

15.4. Companies Profiled

15.4.1. The Mondi Group plc.

15.4.1.1. Overview & Company Description

15.4.1.2. Business Segments

15.4.1.3. Key Financials

15.4.1.4. Key Developments

15.4.1.5. SWOT Analysis

15.4.1.6. Strategy Overview

15.4.2. BillerudKorsnas AB

15.4.2.1. Overview & Company Description

15.4.2.2. Business Segments

15.4.2.3. Key Financials

15.4.2.4. Key Developments

15.4.2.5. SWOT Analysis

15.4.2.6. Strategy Overview

15.4.3. KapStone Paper and Packaging Corporation

15.4.3.1. Overview & Company Description

15.4.3.2. Business Segments

15.4.3.3. Key Financials

15.4.3.4. Key Developments

15.4.3.5. SWOT Analysis

15.4.3.6. Strategy Overview

15.4.4. Segezha Group

15.4.4.1. Overview & Company Description

15.4.4.2. Business Segments

15.4.4.3. Key Financials

15.4.4.4. Key Developments

15.4.4.5. SWOT Analysis

15.4.4.6. Strategy Overview

15.4.5. Gascogne SA

15.4.5.1. Overview & Company Description

15.4.5.2. Business Segments

15.4.5.3. Key Financials

15.4.5.4. Key Developments

15.4.5.5. SWOT Analysis

15.4.5.6. Strategy Overview

15.4.6. Nordic Paper Holding AB

15.4.6.1. Overview & Company Description

15.4.6.2. Business Segments

15.4.6.3. Key Developments

15.4.6.4. SWOT Analysis

15.4.6.5. Strategy Overview

15.4.7. Natron-Hayat d.o.o.

15.4.7.1. Overview & Company Description

15.4.7.2. Business Segments

15.4.7.3. Key Developments

15.4.7.4. SWOT Analysis

15.4.7.5. Strategy Overview

15.4.8. HORIZON PULP & PAPER LTD.

15.4.8.1. Overview & Company Description

15.4.8.2. Business Segments

15.4.8.3. Key Developments

15.4.8.4. SWOT Analysis

15.4.8.5. Strategy Overview

15.4.9. Tolko Industries Ltd.

15.4.9.1. Overview & Company Description

15.4.9.2. Business Segments

15.4.9.3. Key Developments

15.4.9.4. SWOT Analysis

15.4.9.5. Strategy Overview

15.4.10. Canfor Corporation

15.4.10.1. Overview & Company Description

15.4.10.2. Business Segments

15.4.10.3. Key Developments

15.4.10.4. SWOT Analysis

15.4.10.5. Strategy Overview

List of Table

Table 01: Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Grade, 2015–2024

Table 02: Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT), by Packaging Type, 2015–2024

Table 03: Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT), by End-use Industry, 2015–2024

Table 04: Global Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT), by Region, 2015–2024

Table 05: North America Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Grade, 2015–2024

Table 06: North America Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Packaging Type, 2015–2024

Table 07: North America Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by End-use Industry, 2015–2024

Table 08: Latin America Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Grade, 2015–2024

Table 09: Latin America Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Packaging Type, 2015–2024

Table 10: Latin America Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by End-use Industry, 2015–2024

Table 11: Europe Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Grade, 2015–2024

Table 12: Europe Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Packaging Type, 2015–2024

Table 13: Europe Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by End-use Industry, 2015–2024

Table 14: APAC Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Grade, 2015–2024

Table 15: APAC Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Packaging Type, 2015–2024

Table 16: APAC Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by End-use Industry, 2015–2024

Table 17: MEA Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Grade, 2015–2024

Table 18: MEA Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by Packaging Type, 2015–2024

Table 19: MEA Sack Kraft Paper Market Size (US$ Mn) and Volume (‘000 MT) by End-use Industry, 2015–2024

List of Figures

Figure 01: Global Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 02: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 03: Global Sack Kraft Paper Market Value Share by Grade, 2016

Figure 04: Global Sack Kraft Paper Market Value Share by Packaging Type, 2016

Figure 05: Global Sack Kraft Paper Market Value Share by End-use Industry, 2016

Figure 06: Global Sack Kraft Paper Market Value Share by Region, 2016

Figure 07: Global Sack Kraft Paper Market Share & BPS Analysis by Grades, 2016 & 2024

Figure 08: Global Sack Kraft Paper Market Revenue Y-o-Y Growth by Grades, 2015–2024

Figure 09: Global Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT) by White Grade Segment, 2015–2024

Figure 10: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn) by White Grade Segment, 2016–2024

Figure 11: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons) by Brown Grade Segment, 2015–2024

Figure 12: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn) by Brown Grade Segment, 2016–2024

Figure 13: Global Sack Kraft Paper Market Attractiveness by Grade, 2016–2024

Figure 14: Global Sack Kraft Paper Market Share & BPS Analysis by Packaging Type, 2016 & 2024

Figure 15: Global Sack Kraft Paper Market Revenue Y-o-Y Growth by Packaging Type, 2015–2024

Figure 16: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Valve Packaging Segment, 2015–2024

Figure 17: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Valve Packaging Segment, 2016–2024

Figure 18: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Open Mouth Sack Packaging Segment, 2015–2024

Figure 19: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Open Mouth Sack Packaging Segment, 2016–2024

Figure 20: Global Sack Kraft Paper Market Attractiveness, by Packaging Type, 2016–2024

Figure 21: Global Sack Kraft Paper Market Share & BPS Analysis, by End-use Industry, 2016 & 2024

Figure 22: Global Sack Kraft Paper Market Revenue Y-o-Y Growth, by End-use Industry, 2015–2024

Figure 23: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Cement and Building Materials Segment, 2015–2024

Figure 24: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Cement and Building Materials Segment, 2016–2024

Figure 25: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Chemicals Segment, 2015–2024

Figure 26: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Chemicals Segment, 2016–2024

Figure 27: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Animal Feed Segment, 2015–2024

Figure 28: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Animal Feed Segment, 2016–2024

Figure 29: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Pet Food Segment, 2015–2024

Figure 30: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Pet Food Segment, 2016–2024

Figure 31: Global Sack Kraft Paper Market Value (US$ Mn) and Volume ('000 Tons), by Food Segment, 2015–2024

Figure 32: Global Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), by Food Segment, 2016–2024

Figure 33: Global Sack Kraft Paper Market Attractiveness, by End-use Industry, 2016–2024

Figure 34: Global Sack Kraft Paper Market Share & BPS Analysis, by Region, 2016 & 2024

Figure 35: Global Sack Kraft Paper Market Revenue Y-o-Y Growth, by Region, 2015–2024

Figure 36: Global Sack Kraft Paper Market Attractiveness, by Region, 2016–2024

Figure 37: North America Sack Kraft Paper Market Value Share, by Country, 2016 & 2024

Figure 38: North America Sack Kraft Paper Market Value Share, by Grade, 2016 & 2024

Figure 39: North America Sack Kraft Paper Market Value Share, by Packaging Type, 2016 & 2024

Figure 40: North America Sack Kraft Paper Market Value Share, by End-use Industry, 2016 & 2024

Figure 41: North America Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 42: North America Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 43: North America Sack Kraft Paper Market Share & BPS Analysis, by Country, 2016 & 2024

Figure 44: North America Sack Kraft Paper Market Y-o-Y Growth Rate, by Country, 2015–2024

Figure 45: U.S. Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 46: Canada Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 47: North America Sack Kraft Paper Market Share & BPS Analysis, by Grade Segment, 2015 & 2024

Figure 48: North America Sack Kraft Paper Market Y-o-Y Growth Rate, by Grade Segment, 2015–2024

Figure 49: North America Sack Kraft Paper Market Attractiveness Analysis by Grade Segment, 2016–2024

Figure 50: North America Sack Kraft Paper Market Value (US$ Mn) by Grade, 2014–2024

Figure 51: North America Sack Kraft Paper Market Volume (‘000 MT) by Grade, 2015–2024

Figure 52: North America Sack Kraft Paper Market Share & BPS Analysis, by Packaging Type Segment, 2015 & 2024

Figure 53: North America Sack Kraft Paper Market Y-o-Y Growth Rate, by Packaging Type Segment, 2015–2024

Figure 54: North America Sack Kraft Paper Market Attractiveness Analysis by Packaging Type Segment, 2016–2024

Figure 55: North America Sack Kraft Paper Market Value (US$ Mn) by Packaging Type, 2014–2024

Figure 56: North America Sack Kraft Paper Market Volume (‘000 MT) by Packaging Type, 2015–2024

Figure 57: North America Sack Kraft Paper Market Share & BPS Analysis, by End-use Industry Segment, 2015 & 2024

Figure 58: North America Sack Kraft Paper Market Y-o-Y Growth Rate, by End-use Industry Segment, 2015–2024

Figure 59: North America Sack Kraft Paper Market Attractiveness Analysis by End-use Industry Segment, 2016–2024

Figure 60: North America Sack Kraft Paper Market Value (US$ Mn) by End-use Industry, 2014–2024

Figure 61: North America Sack Kraft Paper Market Volume (‘000 MT) by End-use Industry, 2015–2024

Figure 62: Latin America Sack Kraft Paper Market Value Share, by Country, 2016 & 2024

Figure 63: Latin America Sack Kraft Paper Market Value Share, by Grade, 2016 & 2024

Figure 64: Latin America Sack Kraft Paper Market Value Share, by Packaging Type, 2016 & 2024

Figure 65: Latin America Sack Kraft Paper Market Value Share, by End-use Industry, 2016 & 2024

Figure 66: Latin America Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 67: Latin America Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 68: Latin America Sack Kraft Paper Market Share & BPS Analysis, by Country, 2016 & 2024

Figure 69: Latin America Sack Kraft Paper Market Y-o-Y Growth Rate, by Country, 2015–2024

Figure 70: Argentina Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 71: Brazil Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 72: Mexico Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 73: Rest of Latin America Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 74: Latin America Sack Kraft Paper Market Share & BPS Analysis, by Grade Segment, 2015 & 2024

Figure 75: Latin America Sack Kraft Paper Market Y-o-Y Growth Rate, by Grade Segment, 2015–2024

Figure 76: Latin America Sack Kraft Paper Market Attractiveness Analysis by Grade Segment, 2016–2024

Figure 77: Latin America Sack Kraft Paper Market Value (US$ Mn) by Grade, 2014–2024

Figure 78: Latin America Sack Kraft Paper Market Volume (‘000 MT) by Grade, 2015–2024

Figure 79: Latin America Sack Kraft Paper Market Share & BPS Analysis, by Packaging Type Segment, 2015 & 2024

Figure 80: Latin America Sack Kraft Paper Market Y-o-Y Growth Rate, by Packaging Type Segment, 2015–2024

Figure 81: Latin America Sack Kraft Paper Market Attractiveness Analysis by Packaging Type Segment, 2016–2024

Figure 82: Latin America Sack Kraft Paper Market Value (US$ Mn) by Packaging Type, 2014–2024

Figure 83: Latin America Sack Kraft Paper Market Volume (‘000 MT) by Packaging Type, 2015–2024

Figure 84: Latin America Sack Kraft Paper Market Share & BPS Analysis, by End-use Industry Segment, 2015 & 2024

Figure 85: Latin America Sack Kraft Paper Market Y-o-Y Growth Rate, by End-use Industry Segment, 2015–2024

Figure 86: Latin America Sack Kraft Paper Market Attractiveness Analysis by End-use Industry Segment, 2016–2024

Figure 87: Latin America Sack Kraft Paper Market Value (US$ Mn) by End-use Industry, 2014–2024

Figure 88: Latin America Sack Kraft Paper Market Volume (‘000 MT) by End-use Industry, 2015–2024

Figure 89: Europe Sack Kraft Paper Market Value Share, by Country, 2016 & 2024

Figure 90: Europe Sack Kraft Paper Market Value Share, by Grade, 2016 & 2024

Figure 91: Europe Sack Kraft Paper Market Value Share, by Packaging Type, 2016 & 2024

Figure 92: Europe Sack Kraft Paper Market Value Share, by End-use Industry, 2016 & 2024

Figure 93: Europe Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 94: Europe Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 95: Europe Sack Kraft Paper Market Share & BPS Analysis, by Country, 2016 & 2024

Figure 96: Europe Sack Kraft Paper Market Y-o-Y Growth Rate, by Country, 2015–2024

Figure 97: EU-5 Countries Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 98: Nordic Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 99: Benelux Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 100: Russia Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 101: Poland Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 102: Rest of Europe Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 103: Europe Sack Kraft Paper Market Share & BPS Analysis, by Grade Segment, 2015 & 2024

Figure 104: Europe Sack Kraft Paper Market Y-o-Y Growth Rate, by Grade Segment, 2015–2024

Figure 105: Europe Sack Kraft Paper Market Attractiveness Analysis by Grade Segment, 2016–2024

Figure 106: Europe Sack Kraft Paper Market Value (US$ Mn) by Grade, 2014–2024

Figure 107: Europe Sack Kraft Paper Market Volume (‘000 MT) by Grade, 2015–2024

Figure 108: Europe Sack Kraft Paper Market Share & BPS Analysis, by Packaging Type Segment, 2015 & 2024

Figure 109: Europe Sack Kraft Paper Market Y-o-Y Growth Rate, by Packaging Type Segment, 2015–2024

Figure 110: Europe Sack Kraft Paper Market Attractiveness Analysis by Packaging Type Segment, 2016–2024

Figure 111: Europe Sack Kraft Paper Market Value (US$ Mn) by Packaging Type, 2014–2024

Figure 112: Europe Sack Kraft Paper Market Volume (‘000 MT) by Packaging Type, 2015–2024

Figure 113: Europe Sack Kraft Paper Market Share & BPS Analysis, by End-use Industry Segment, 2015 & 2024

Figure 114: Europe Sack Kraft Paper Market Y-o-Y Growth Rate, by End-use Industry Segment, 2015–2024

Figure 115: Europe Sack Kraft Paper Market Attractiveness Analysis by End-use Industry Segment, 2016–2024

Figure 116: Europe Sack Kraft Paper Market Value (US$ Mn) by End-use Industry, 2014–2024

Figure 117: Europe Sack Kraft Paper Market Volume (‘000 MT) by End-use Industry, 2015–2024

Figure 118: APAC Sack Kraft Paper Market Value Share, by Country, 2016 & 2024

Figure 119: APAC Sack Kraft Paper Market Value Share, by Grade, 2016 & 2024

Figure 120: APAC Sack Kraft Paper Market Value Share, by Packaging Type, 2016 & 2024

Figure 121: APAC Sack Kraft Paper Market Value Share, by End-use Industry, 2016 & 2024

Figure 122: APAC Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 123: APAC Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 124: APAC Sack Kraft Paper Market Share & BPS Analysis, by Country, 2016 & 2024

Figure 125: APAC Sack Kraft Paper Market Y-o-Y Growth Rate, by Country, 2015–2024

Figure 126: China Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 127: India Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 128: Japan Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 129: ASEAN Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 130: Australia & New Zealand Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 131: Rest of APAC Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 132: APAC Sack Kraft Paper Market Share & BPS Analysis, by Grade Segment, 2015 & 2024

Figure 133: APAC Sack Kraft Paper Market Y-o-Y Growth Rate, by Grade Segment, 2015–2024

Figure 134: APAC Sack Kraft Paper Market Attractiveness Analysis by Grade Segment, 2016–2024

Figure 135: APAC Sack Kraft Paper Market Value (US$ Mn) by Grade, 2014–2024

Figure 136: APAC Sack Kraft Paper Market Volume (‘000 MT) by Grade, 2015–2024

Figure 137: APAC Sack Kraft Paper Market Share & BPS Analysis, by Packaging Type Segment, 2015 & 2024

Figure 138: APAC Sack Kraft Paper Market Y-o-Y Growth Rate, by Packaging Type Segment, 2015–2024

Figure 139: APAC Sack Kraft Paper Market Attractiveness Analysis by Packaging Type Segment, 2016–2024

Figure 140: APAC Sack Kraft Paper Market Value (US$ Mn) by Packaging Type, 2014–2024

Figure 141: APAC Sack Kraft Paper Market Volume (‘000 MT) by Packaging Type, 2015–2024

Figure 142: APAC Sack Kraft Paper Market Share & BPS Analysis, by End-use Industry Segment, 2015 & 2024

Figure 143: APAC Sack Kraft Paper Market Y-o-Y Growth Rate, by End-use Industry Segment, 2015–2024

Figure 144: APAC Sack Kraft Paper Market Attractiveness Analysis by End-use Industry Segment, 2016–2024

Figure 145: APAC Sack Kraft Paper Market Value (US$ Mn) by End-use Industry, 2014–2024

Figure 146: APAC Sack Kraft Paper Market Volume (‘000 MT) by End-use Industry, 2015–2024

Figure 147: MEA Sack Kraft Paper Market Value Share, by Country, 2016 & 2024

Figure 148: MEA Sack Kraft Paper Market Value Share, by Grade, 2016 & 2024

Figure 149: MEA Sack Kraft Paper Market Value Share, by Packaging Type, 2016 & 2024

Figure 150: MEA Sack Kraft Paper Market Value Share, by End-use Industry, 2016 & 2024

Figure 151: MEA Sack Kraft Paper Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 152: MEA Sack Kraft Paper Market Absolute $ Opportunity (US$ Mn), 2015?2024

Figure 153: MEA Sack Kraft Paper Market Share & BPS Analysis, by Country, 2016 & 2024

Figure 154: MEA Sack Kraft Paper Market Y-o-Y Growth Rate, by Country, 2015–2024

Figure 155: GCC Countries Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 156: South Africa Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 157: North Africa Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 158: Israel Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 159: Turkey Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 160: Rest of MEA Sack Kraft Paper Market Absolute $ Opportunity, 2015–2024

Figure 161: MEA Sack Kraft Paper Market Share & BPS Analysis, by Grade Segment, 2015 & 2024

Figure 162: MEA Sack Kraft Paper Market Y-o-Y Growth Rate, by Grade Segment, 2015–2024

Figure 163: MEA Sack Kraft Paper Market Attractiveness Analysis by Grade Segment, 2016–2024

Figure 164: MEA Sack Kraft Paper Market Value (US$ Mn) by Grade, 2014–2024

Figure 165: MEA Sack Kraft Paper Market Volume (‘000 MT) by Grade, 2015–2024

Figure 166: MEA Sack Kraft Paper Market Share & BPS Analysis, by Packaging Type Segment, 2015 & 2024

Figure 167: MEA Sack Kraft Paper Market Y-o-Y Growth Rate, by Packaging Type Segment, 2015–2024

Figure 168: MEA Sack Kraft Paper Market Attractiveness Analysis by Packaging Type Segment, 2016–2024

Figure 169: MEA Sack Kraft Paper Market Value (US$ Mn) by Packaging Type, 2014–2024

Figure 170: MEA Sack Kraft Paper Market Volume (‘000 MT) by Packaging Type, 2015–2024

Figure 171: MEA Sack Kraft Paper Market Share & BPS Analysis, by End-use Industry Segment, 2015 & 2024

Figure 172: MEA Sack Kraft Paper Market Y-o-Y Growth Rate, by End-use Industry Segment, 2015–2024

Figure 173: MEA Sack Kraft Paper Market Attractiveness Analysis by End-use Industry Segment, 2016–2024

Figure 174: MEA Sack Kraft Paper Market Value (US$ Mn) by End-use Industry, 2014–2024

Figure 175: MEA Sack Kraft Paper Market Volume (‘000 MT) by End-use Industry, 2015–2024