Analysts’ Viewpoint on Market Scenario

Increase in adoption of compact construction equipment is a key factor driving the global rubber track market size. Compact construction equipment requires rubber tracks for mobility and maneuverability in tight spaces. Rise in demand for heavy equipment in construction and mining industries is projected to boost the market value in the near future.

Surge in demand for multi-terrain vehicles is likely to offer lucrative opportunities for market players. Rubber track manufacturers are improving the quality of rubber tracks to stay competitive in the industry. They are also adopting strategies such as mergers and acquisitions, partnerships, and collaborations to strengthen their market position and expand their global reach.

Rubber track is a type of a track system that is used in various types of machinery and equipment, such as excavators, bulldozers, tractors, and skid steer loaders. These tracks consist of a continuous loop of rubber, with embedded metal components, that provides traction and stability. The rubber material used in these tracks is typically a high-quality compound that is durable and long-lasting. It offers excellent resistance to wear and tear, abrasion, and impact damage.

Rubber tracks are widely used in construction, agriculture, and mining industries. They offer several advantages over other track systems. Rubber tracks provide superior traction on rough terrain, making it easier to maneuver in challenging environments. They also reduce ground damage, as the rubber material is less likely to damage surfaces compared to metal tracks.

Increase in adoption of off-road vehicles and growth in production of automobiles are projected to boost the demand for rubber tracks in the near future. Off-road vehicles are gaining traction across the globe, led by the increase in the popularity of off-road sports.

All-terrain Vehicles (ATVs) and Utility Terrain Vehicles (UTVs) are not permitted on motorways and other major roads. This has prompted governments across the globe to invest in the construction of new off-road paths. In turn, this is projected to spur rubber track market growth in the next few years.

Governments of various countries across the globe are investing significantly in infrastructure development due to the rise in population. Infrastructure development projects, such as road construction, bridge building, and railway construction, require heavy equipment that can operate in challenging terrains. Rubber tracks are key components of such equipment, as they provide superior traction and stability on rough and uneven surfaces.

Demand for heavy equipment, including those that use rubber tracks, is expected to rise in the near future, as governments and private entities around the world invest more in infrastructure development. This is estimated to augment rubber track market expansion in the near future.

Rubber tracks are commonly employed in heavy equipment, such as excavators, bulldozers, tractors, and harvesters, that is used in mining and agriculture operations. Mining and agriculture industries require equipment that can operate in challenging and rough terrains. Rubber tracks provide superior traction, stability, and durability on such surfaces.

Demand for minerals and metals has been rising steadily in the mining industry, driven by factors such as urbanization, population growth, and increase in usage of renewable energy technologies. This has led to a surge in adoption of mining equipment that uses rubber tracks.

Similarly, the agriculture industry has been experiencing steady growth due to the increase in global population and rise in consumption of food. This growth has boosted the demand for agricultural equipment such as tractors and harvesters, which use rubber tracks to operate on rough and uneven farmland. Thus, surge in usage of heavy equipment in agriculture and mining industries is augmenting market progress.

According to the latest rubber track market trends, the snowmobile tracks equipment segment is anticipated to account for the largest share from 2023 to 2031. E-snowmobile is an efficient and eco-friendly means of transportation. It offers a long driving range and is easy to navigate.

Snowmobile gear wheels are fitted with rubber tracks. Multiply and textile-reinforced rubbers are employed to increase the snowmobile undercarriage's resilience to tearing and heat impact.

According to the latest rubber track market analysis, the construction application segment is projected to dominate the global landscape during the forecast period. Machines with rubber track undercarriage are regularly utilized on hard surfaces in the construction sector.

Rubber tracks are easy to build, use, and maintain during construction projects. Mini rubber excavator tracks provide superior mobility and work effectively on spongy, unstable surfaces or smaller sites due to their compact size.

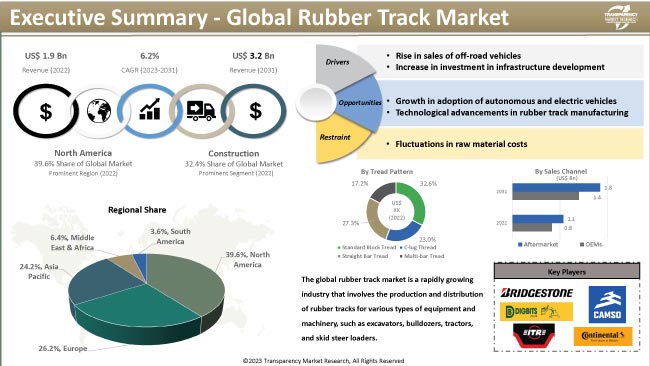

According to the latest rubber track market forecast, North America is expected to constitute the largest share with a CAGR of 5.5% from 2023 to 2031. The region held 39.6% share in 2022. High adoption of snow-handling vehicles and equipment is driving market statistics in the region.

The market in Europe is anticipated to grow at a significant pace in the near future. Presence of well-developed infrastructure, increase in investment in construction and infrastructure projects, and rise in focus on environmental sustainability are boosting market dynamics of the region.

The global industry is consolidated, with a few manufacturers controlling majority of the share. Key players are switching to automated rubber track production to boost their productivity and increase their rubber track market share.

Bridgestone Corporation, Camso Inc., CFS Machinery Co., Ltd., CGA Ricambi, Chermack Machine Inc., Continental AG, DIGBITS Ltd., Gruppo Minitop srl, ITR America, McLaren Industries, Inc., Poson Forging Co., Ltd., and X-Trac Rubber Tracks are prominent entities operating in this industry.

Each of these players has been profiled in the rubber track market report based on pointers such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 1.9 Bn |

|

Market Forecast Value in 2031 |

US$ 3.2 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, market size, share, and forecast. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.9 Bn in 2022

It is anticipated to grow at a CAGR of 6.2% from 2023 to 2031

It is projected to reach US$ 3.2 Bn by the end of 2031

Rise in sale of off-road vehicles and increase in investment in infrastructure development

The construction segment accounted for 32.4% share in 2022

North America is a highly lucrative region for vendors

Bridgestone Corporation, Camso Inc., CFS Machinery Co., Ltd., CGA Ricambi, Chermack Machine Inc., Continental AG, DIGBITS Ltd., Gruppo Minitop srl, ITR America, McLaren Industries, Inc., Poson Forging Co., Ltd., and X-Trac Rubber Tracks

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Thousand Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage/Taxonomy

2.2. Market Definition/Scope /Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Rubber Track Market

4. Global Rubber Track Market, By Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Component

4.2.1. Rubber

4.2.2. Metal Pieces

4.2.3. Steel Cord

4.2.4. Textile Wrapping

5. Global Rubber Track Market, By Tread Pattern

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Tread Pattern

5.2.1. Standard Block Tread

5.2.2. C-lug Thread

5.2.3. Straight Bar Tread

5.2.4. Multi-bar Tread

6. Global Rubber Track Market, By Product Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Product Type

6.2.1. Overlapping/Non-continuous Wire Strand

6.2.2. Continuous Wire Strand

7. Global Rubber Track Market, By Equipment

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Equipment

7.2.1. Snowmobile Tracks

7.2.2. Skid Steer Tracks

7.2.3. Snow Groomer Tracks

7.2.4. Earth-mover Tracks

7.2.5. Skid Loader Rubber Tracks

7.2.6. Dump Carrier Rubber Tracks

7.2.7. Excavator Rubber Tracks

7.2.8. Others

8. Global Rubber Track Market, By Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Application

8.2.1. Agriculture

8.2.2. Construction

8.2.3. Powersports

8.2.4. Government & Defense

8.2.5. Others

9. Global Rubber Track Market, By Sales Channel

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Sales Channel

9.2.1. OEMs

9.2.2. Aftermarket

10. Global Rubber Track Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Rubber Track Market Size & Forecast, 2017-2031, By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Rubber Track Market

11.1. Market Snapshot

11.2. North America Rubber Track Market Size & Forecast, 2017-2031, By Component

11.2.1. Rubber

11.2.2. Metal Pieces

11.2.3. Steel Cord

11.2.4. Textile Wrapping

11.3. North America Rubber Track Market Size & Forecast, 2017-2031, By Tread Pattern

11.3.1. Standard Block Tread

11.3.2. C-lug Thread

11.3.3. Straight Bar Tread

11.3.4. Multi-bar Tread

11.4. North America Rubber Track Market Size & Forecast, 2017-2031, By Product Type

11.4.1. Overlapping/Non-continuous Wire Strand

11.4.2. Continuous Wire Strand

11.5. North America Rubber Track Market Size & Forecast, 2017-2031, By Equipment

11.5.1. Snowmobile Tracks

11.5.2. Skid Steer Tracks

11.5.3. Snow Groomer Tracks

11.5.4. Earth-mover Tracks

11.5.5. Skid Loader Rubber Tracks

11.5.6. Dump Carrier Rubber Tracks

11.5.7. Excavator Rubber Tracks

11.5.8. Others

11.6. North America Rubber Track Market Size & Forecast, 2017-2031, By Application

11.6.1. Agriculture

11.6.2. Construction

11.6.3. Powersports

11.6.4. Government & Defense

11.6.5. Others

11.7. North America Rubber Track Market Size & Forecast, 2017-2031, By Sales Channel

11.7.1. OEMs

11.7.2. Aftermarket

11.8. North America Rubber Track Market Size & Forecast, 2017-2031, By Country

11.8.1. U.S.

11.8.2. Canada

11.8.3. Mexico

12. Europe Rubber Track Market

12.1. Market Snapshot

12.2. Europe Rubber Track Market Size & Forecast, 2017-2031, By Component

12.2.1. Rubber

12.2.2. Metal Pieces

12.2.3. Steel Cord

12.2.4. Textile Wrapping

12.3. Europe Rubber Track Market Size & Forecast, 2017-2031, By Tread Pattern

12.3.1. Standard Block Tread

12.3.2. C-lug Thread

12.3.3. Straight Bar Tread

12.3.4. Multi-bar Tread

12.4. Europe Rubber Track Market Size & Forecast, 2017-2031, By Product Type

12.4.1. Overlapping/Non-continuous Wire Strand

12.4.2. Continuous Wire Strand

12.5. Europe Rubber Track Market Size & Forecast, 2017-2031, By Equipment

12.5.1. Snowmobile Tracks

12.5.2. Skid Steer Tracks

12.5.3. Snow Groomer Tracks

12.5.4. Earth-mover Tracks

12.5.5. Skid Loader Rubber Tracks

12.5.6. Dump Carrier Rubber Tracks

12.5.7. Excavator Rubber Tracks

12.5.8. Others

12.6. Europe Rubber Track Market Size & Forecast, 2017-2031, By Application

12.6.1. Agriculture

12.6.2. Construction

12.6.3. Powersports

12.6.4. Government & Defense

12.6.5. Others

12.7. Europe Rubber Track Market Size & Forecast, 2017-2031, By Sales Channel

12.7.1. OEMs

12.7.2. Aftermarket

12.8. Europe Rubber Track Market Size & Forecast, 2017-2031, By Country

12.8.1. Germany

12.8.2. U.K.

12.8.3. France

12.8.4. Italy

12.8.5. Spain

12.8.6. Nordic Countries

12.8.7. Russia & CIS

12.8.8. Rest of Europe

13. Asia Pacific Rubber Track Market

13.1. Market Snapshot

13.2. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Component

13.2.1. Rubber

13.2.2. Metal Pieces

13.2.3. Steel Cord

13.2.4. Textile Wrapping

13.3. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Tread Pattern

13.3.1. Standard Block Tread

13.3.2. C-lug Thread

13.3.3. Straight Bar Tread

13.3.4. Multi-bar Tread

13.4. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Product Type

13.4.1. Overlapping/Non-continuous Wire Strand

13.4.2. Continuous Wire Strand

13.5. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Equipment

13.5.1. Snowmobile Tracks

13.5.2. Skid Steer Tracks

13.5.3. Snow Groomer Tracks

13.5.4. Earth-mover Tracks

13.5.5. Skid Loader Rubber Tracks

13.5.6. Dump Carrier Rubber Tracks

13.5.7. Excavator Rubber Tracks

13.5.8. Others

13.6. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Application

13.6.1. Agriculture

13.6.2. Construction

13.6.3. Powersports

13.6.4. Government & Defense

13.6.5. Others

13.7. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Sales Channel

13.7.1. OEMs

13.7.2. Aftermarket

13.8. Asia Pacific Rubber Track Market Size & Forecast, 2017-2031, By Country

13.8.1. China

13.8.2. India

13.8.3. Japan

13.8.4. ASEAN Countries

13.8.5. South Korea

13.8.6. ANZ

13.8.7. Rest of Asia Pacific

14. Middle East & Africa Rubber Track Market

14.1. Market Snapshot

14.2. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Component

14.2.1. Rubber

14.2.2. Metal Pieces

14.2.3. Steel Cord

14.2.4. Textile Wrapping

14.3. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Tread Pattern

14.3.1. Standard Block Tread

14.3.2. C-lug Thread

14.3.3. Straight Bar Tread

14.3.4. Multi-bar Tread

14.4. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Product Type

14.4.1. Overlapping/Non-continuous Wire Strand

14.4.2. Continuous Wire Strand

14.5. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Equipment

14.5.1. Snowmobile Tracks

14.5.2. Skid Steer Tracks

14.5.3. Snow Groomer Tracks

14.5.4. Earth-mover Tracks

14.5.5. Skid Loader Rubber Tracks

14.5.6. Dump Carrier Rubber Tracks

14.5.7. Excavator Rubber Tracks

14.5.8. Others

14.6. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Application

14.6.1. Agriculture

14.6.2. Construction

14.6.3. Powersports

14.6.4. Government & Defense

14.6.5. Others

14.7. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Sales Channel

14.7.1. OEMs

14.7.2. Aftermarket

14.8. Middle East & Africa Rubber Track Market Size & Forecast, 2017-2031, By Country

14.8.1. GCC

14.8.2. South Africa

14.8.3. Turkey

14.8.4. Rest of Middle East & Africa

15. South America Rubber Track Market

15.1. Market Snapshot

15.2. South America Rubber Track Market Size & Forecast, 2017-2031, By Component

15.2.1. Rubber

15.2.2. Metal Pieces

15.2.3. Steel Cord

15.2.4. Textile Wrapping

15.3. South America Rubber Track Market Size & Forecast, 2017-2031, By Tread Pattern

15.3.1. Standard Block Tread

15.3.2. C-lug Thread

15.3.3. Straight Bar Tread

15.3.4. Multi-bar Tread

15.4. South America Rubber Track Market Size & Forecast, 2017-2031, By Product Type

15.4.1. Overlapping/Non-continuous Wire Strand

15.4.2. Continuous Wire Strand

15.5. South America Rubber Track Market Size & Forecast, 2017-2031, By Equipment

15.5.1. Snowmobile Tracks

15.5.2. Skid Steer Tracks

15.5.3. Snow Groomer Tracks

15.5.4. Earth-mover Tracks

15.5.5. Skid Loader Rubber Tracks

15.5.6. Dump Carrier Rubber Tracks

15.5.7. Excavator Rubber Tracks

15.5.8. Others

15.6. South America Rubber Track Market Size & Forecast, 2017-2031, By Application

15.6.1. Agriculture

15.6.2. Construction

15.6.3. Powersports

15.6.4. Government & Defense

15.6.5. Others

15.7. South America Rubber Track Market Size & Forecast, 2017-2031, By Sales Channel

15.7.1. OEMs

15.7.2. Aftermarket

15.8. South America Rubber Track Market Size & Forecast, 2017-2031, By Country

15.8.1. Brazil

15.8.2. Argentina

15.8.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2021

16.2. Company Analysis for each player Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

17. Company Profile/ Key Players

17.1. Bridgestone Corporation

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. Camso Inc.

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. CFS Machinery Co., Ltd.

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. CGA Ricambi

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Chermack Machine Inc.

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. Continental AG

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. DIGBITS Ltd.

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Gruppo Minitop srl

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. ITR America

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. McLaren Industries, Inc.

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. Poson Forging Co., Ltd.

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. X-Trac Rubber Tracks

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Other Key Players

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

List of Tables

Table 1: Global Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 2: Global Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Table 3: Global Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017‒2031

Table 4: Global Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 5: Global Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 6: Global Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Table 7: Global Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017‒2031

Table 8: Global Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 9: Global Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 10: Global Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 11: Global Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 12: Global Rubber Track Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 13: Global Rubber Track Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 14: North America Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 15: North America Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Table 16: North America Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017‒2031

Table 17: North America Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 18: North America Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 19: North America Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Table 20: North America Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017‒2031

Table 21: North America Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: North America Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 23: North America Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 24: North America Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 25: North America Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 26: North America Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 27: Europe Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 28: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Table 29: Europe Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017‒2031

Table 30: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 31: Europe Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 32: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Table 33: Europe Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017‒2031

Table 34: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 35: Europe Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 36: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 37: Europe Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 38: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 39: Europe Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 40: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 41: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Table 42: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017‒2031

Table 43: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 44: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 45: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Table 46: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017‒2031

Table 47: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 48: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 49: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 50: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 51: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 52: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 53: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 54: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Table 55: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017‒2031

Table 56: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 57: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 58: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Table 59: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017‒2031

Table 60: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 61: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 62: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 63: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 64: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 65: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 66: South America Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 67: South America Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Table 68: South America Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017‒2031

Table 69: South America Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 70: South America Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 71: South America Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Table 72: South America Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017‒2031

Table 73: South America Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 74: South America Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 75: South America Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 76: South America Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 77: South America Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 78: South America Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 2: Global Rubber Track Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 3: Global Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Figure 4: Global Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017-2031

Figure 5: Global Rubber Track Market, Incremental Opportunity, by Tread Pattern, Value (US$ Bn), 2023-2031

Figure 6: Global Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 7: Global Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 8: Global Rubber Track Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 9: Global Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Figure 10: Global Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017-2031

Figure 11: Global Rubber Track Market, Incremental Opportunity, by Equipment, Value (US$ Bn), 2023-2031

Figure 12: Global Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 13: Global Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 14: Global Rubber Track Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 15: Global Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 16: Global Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 17: Global Rubber Track Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 18: Global Rubber Track Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 19: Global Rubber Track Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 20: Global Rubber Track Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 21: North America Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 22: North America Rubber Track Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 23: North America Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Figure 24: North America Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017-2031

Figure 25: North America Rubber Track Market, Incremental Opportunity, by Tread Pattern, Value (US$ Bn), 2023-2031

Figure 26: North America Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 27: North America Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 28: North America Rubber Track Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 29: North America Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Figure 30: North America Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017-2031

Figure 31: North America Rubber Track Market, Incremental Opportunity, by Equipment, Value (US$ Bn), 2023-2031

Figure 32: North America Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 33: North America Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 34: North America Rubber Track Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 35: North America Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 36: North America Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 37: North America Rubber Track Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 38: North America Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 39: North America Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: North America Rubber Track Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 41: Europe Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 42: Europe Rubber Track Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 43: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Figure 44: Europe Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017-2031

Figure 45: Europe Rubber Track Market, Incremental Opportunity, by Tread Pattern, Value (US$ Bn), 2023-2031

Figure 46: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 47: Europe Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 48: Europe Rubber Track Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 49: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Figure 50: Europe Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017-2031

Figure 51: Europe Rubber Track Market, Incremental Opportunity, by Equipment, Value (US$ Bn), 2023-2031

Figure 52: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 53: Europe Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: Europe Rubber Track Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Europe Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Europe Rubber Track Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Europe Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Europe Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Europe Rubber Track Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 62: Asia Pacific Rubber Track Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 63: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Figure 64: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017-2031

Figure 65: Asia Pacific Rubber Track Market, Incremental Opportunity, by Tread Pattern, Value (US$ Bn), 2023-2031

Figure 66: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 67: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 68: Asia Pacific Rubber Track Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 69: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Figure 70: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017-2031

Figure 71: Asia Pacific Rubber Track Market, Incremental Opportunity, by Equipment, Value (US$ Bn), 2023-2031

Figure 72: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 73: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 74: Asia Pacific Rubber Track Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 75: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 76: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 77: Asia Pacific Rubber Track Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 78: Asia Pacific Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 79: Asia Pacific Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 80: Asia Pacific Rubber Track Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 81: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 82: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 83: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Figure 84: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017-2031

Figure 85: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Tread Pattern, Value (US$ Bn), 2023-2031

Figure 86: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 87: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 88: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 89: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Figure 90: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017-2031

Figure 91: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Equipment, Value (US$ Bn), 2023-2031

Figure 92: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 93: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 94: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 95: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 96: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 97: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 98: Middle East & Africa Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 99: Middle East & Africa Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 100: Middle East & Africa Rubber Track Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 101: South America Rubber Track Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 102: South America Rubber Track Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 103: South America Rubber Track Market Volume (Thousand Units) Forecast, by Tread Pattern, 2017-2031

Figure 104: South America Rubber Track Market Value (US$ Bn) Forecast, by Tread Pattern, 2017-2031

Figure 105: South America Rubber Track Market, Incremental Opportunity, by Tread Pattern, Value (US$ Bn), 2023-2031

Figure 106: South America Rubber Track Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 107: South America Rubber Track Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 108: South America Rubber Track Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 109: South America Rubber Track Market Volume (Thousand Units) Forecast, by Equipment, 2017-2031

Figure 110: South America Rubber Track Market Value (US$ Bn) Forecast, by Equipment, 2017-2031

Figure 111: South America Rubber Track Market, Incremental Opportunity, by Equipment, Value (US$ Bn), 2023-2031

Figure 112: South America Rubber Track Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 113: South America Rubber Track Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 114: South America Rubber Track Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 115: South America Rubber Track Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 116: South America Rubber Track Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 117: South America Rubber Track Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 118: South America Rubber Track Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 119: South America Rubber Track Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 120: South America Rubber Track Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031