Analysts’ Viewpoint on Market Scenario

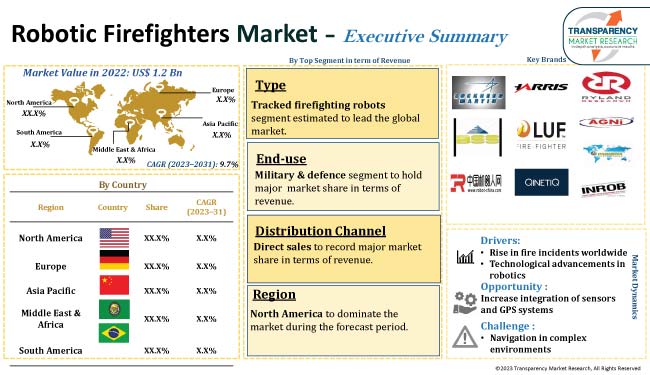

Increase in fire accidents and rise in focus on safety and risk mitigation are major factors that are anticipated to propel the robotic firefighters market size in the near future. Moreover, technological advancements, such as autonomous capabilities, communication and coordination, and sensor technologies, are expected to drive market expansion during the forecast period.

Vendors operating in the global robotic firefighters industry are focusing on research and development activities to accelerate the rolling out of advanced products with new features. They are also collaborating with other companies and organizations to increase their robotic firefighters market share.

Robotic firefighters are specialized robots designed and deployed to assist in firefighting operations. These robots are equipped with advanced technology and capabilities to support human firefighters and enhance their effectiveness in responding to fires and emergency situations.

Robotic firefighters are equipped with firefighting tools such as water cannons, fire extinguishers, or foam dispensers. They can be remotely operated or programmed to autonomously navigate through fire-affected areas, targeting flames and applying suppressants to control or extinguish the fire.

Robotic firefighters are designed to navigate through challenging environments, such as burning buildings or hazardous terrains. They can maneuver over debris, climb stairs, and access confined spaces that may be inaccessible or unsafe for human firefighters. Robotic firefighters are being developed and deployed to enhance the capabilities of human firefighters, particularly in situations that are too dangerous or inaccessible for humans.

Robotic firefighters offer the potential to enhance firefighting capabilities and reduce human risks in dangerous situations. They are equipped with a range of sensors to gather information about the fire and the surrounding environment. These may include thermal cameras to detect heat sources, gas sensors to identify hazardous substances, and LIDAR or ultrasonic sensors for obstacle detection and mapping.

In addition to fire suppression, robotic firefighters may have tools and mechanisms to assist in rescue operations. They can be equipped with robotic arms, grippers, or cutting tools to remove debris, open doors, or extract trapped individuals. Thus, surge in fire incidents worldwide is propelling the robotic firefighters market development.

Robotic firefighters are capable of communicating with each other and with human firefighters to enhance coordination during firefighting operations. They can perform tasks such as reconnaissance, search and rescue operations, and carrying heavy equipment, freeing up human firefighters to focus on critical tasks and improving overall operational efficiency. This allows them to share information, and optimize their actions for better efficiency and safety.

Advancements in robotics, such as Artificial Intelligence (AI) and sensor technologies, are significantly improving the capabilities of robotic firefighters. These technologies enable robots to navigate through challenging environments, detect fires, and suppress them with greater precision and effectiveness.

Advanced robotic firefighters may possess autonomous capabilities, allowing them to operate independently in certain situations. They can navigate through a burning building, search for survivors, and make decisions based on their programming and sensor inputs. Hence, technological advancements in robotics are expected to spur the robotic firefighters market growth in the near future.

Robotic firefighters can be remotely controlled by human operators who monitor their actions and make strategic decisions. However, advancements in artificial intelligence and robotics have also led to the development of more autonomous robotic firefighters capable of independent decisions based on the data collected from the sensors and pre-programmed algorithms.

According to the latest robotic firefighters market trends, the tracked firefighting robots type segment is expected to hold largest share from 2023 to 2031. Tracked robots are designed to navigate rough terrain and overcome obstacles. They typically have excellent stability and can traverse challenging environments such as rubble, debris, or uneven surfaces. Tracked firefighting robots offer several advantages over other firefighting robots such as enhanced safety, remote operation, increased efficiency, and remote sensing and monitoring.

According to the latest robotic firefighters market analysis, the military & defense end-use segment is projected to dominate the industry during the forecast period. Robotic firefighters can be used by military forces to combat fires in military installations, vehicles, or during combat operations. They can offer valuable support in military and defense applications. Robotic firefighters can assist in extinguishing fires in challenging environments, such as on naval vessels, military aircraft, or in war zones.

According to the latest robotic firefighters market forecast, North America is estimated to hold largest share from 2023 to 2031. Rise in fire incidents and rapid urbanization are fueling market dynamics in the region. Aging infrastructure and climate change-related events like wildfires are also likely to boost market statistics in North America during the forecast period.

The global industry is fragmented due to the presence of many local and global players. Competition in the industry is expected to intensify in the next few years due to the entry of local players. Thus, robotic firefighter companies are adopting various marketing strategies to stay competitive in the industry.

Manufacturers are also focusing on product development to cater to rise in demand for advanced products and services at reasonable prices. Lockheed Martin Corporation, Harris Corporation, Ryland Research Limited, BSS Holland B.V., LUF GmbH, Agni Industries Fire Service, Ltd, Changzhou Changtan Robot Co., Ltd., QinetiQ Group plc, Parosha Group, and InRob Tech Ltd. are prominent players operating in this industry.

Key players have been profiled in the robotic firefighters market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 1.2 Bn |

|

Market Value in 2031 |

US$ 2.9 Bn |

|

Growth Rate (CAGR) |

9.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 1.2 Bn in 2022

It is projected to reach US$ 2.9 Bn by the end of 2031

It is estimated to grow at a CAGR of 9.7% from 2031 to 2031

Rise in fire incidents worldwide and technological advancements in robotics

The tracked firefighting robots type segment is expected to hold major share during the forecast period

North America is projected to record the highest demand during the forecast period

Lockheed Martin Corporation, Harris Corporation, Ryland Research Limited, BSS Holland B.V., LUF GmbH, Agni Industries Fire Service, Ltd, Changzhou Changtan Robot Co., Ltd., QinetiQ Group plc, Parosha Group, and InRob Tech Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Raw Pressure Analysis

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Robotic Firefighters Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Bn)

5.9.2. Market Volume Projection (Thousand Units)

6. Global Robotic Firefighters Market Analysis and Forecast, by Type

6.1. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Tracked Firefighting Robots

6.1.2. Wheeled Firefighting Robots

6.1.3. Humanoid Firefighting Robots

6.2. Incremental Opportunity, by Type

7. Global Robotic Firefighters Market Analysis and Forecast, by End-use

7.1. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

7.1.1. Corporates

7.1.2. Education

7.1.3. Hospitality

7.1.4. Government

7.1.5. Military & Defense

7.1.6. Energy & Utilities

7.2. Incremental Opportunity, by End-use

8. Global Robotic Firefighters Market Analysis and Forecast, by Distribution Channel

8.1. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

8.1.1. Direct Sales

8.1.2. Indirect Sales

8.2. Incremental Opportunity, by Distribution Channel

9. Global Robotic Firefighters Market Analysis and Forecast, by Region

9.1. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Robotic Firefighters Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Pressure Trend Analysis

10.2.1. Weighted Average Pressure

10.3. Key Trends Analysis

10.3.1. Demand Side Analysis

10.3.2. Supply Side Analysis

10.4. Key Supplier Analysis

10.5. Consumer Buying Behavior Analysis

10.6. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

10.6.1. Tracked Firefighting Robots

10.6.2. Wheeled Firefighting Robots

10.6.3. Humanoid Firefighting Robots

10.7. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

10.7.1. Corporates

10.7.2. Education

10.7.3. Hospitality

10.7.4. Government

10.7.5. Military & Defense

10.7.6. Energy & Utilities

10.8. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

10.8.1. Direct Sales

10.8.2. Indirect Sales

10.9. Robotic Firefighters Market (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2027

10.9.1. U.S.

10.9.2. Canada

10.9.3. Rest of North America

10.10. Incremental Opportunity Analysis

11. Europe Robotic Firefighters Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Pressure Trend Analysis

11.2.1. Weighted Average Pressure

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Key Supplier Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

11.6.1. Tracked Firefighting Robots

11.6.2. Wheeled Firefighting Robots

11.6.3. Humanoid Firefighting Robots

11.7. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

11.7.1. Corporates

11.7.2. Education

11.7.3. Hospitality

11.7.4. Government

11.7.5. Military & Defense

11.7.6. Energy & Utilities

11.8. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. Robotic Firefighters Market (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

11.9.1. U.K.

11.9.2. Germany

11.9.3. France

11.9.4. Rest of Europe

11.10. Incremental Opportunity Analysis

12. Asia Pacific Robotic Firefighters Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Pressure Trend Analysis

12.2.1. Weighted Average Pressure

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Key Supplier Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

12.6.1. Tracked Firefighting Robots

12.6.2. Wheeled Firefighting Robots

12.6.3. Humanoid Firefighting Robots

12.7. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

12.7.1. Corporates

12.7.2. Education

12.7.3. Hospitality

12.7.4. Government

12.7.5. Military & Defense

12.7.6. Energy & Utilities

12.8. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Robotic Firefighters Market (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

12.9.1. China

12.9.2. India

12.9.3. Japan

12.9.4. Rest of Asia Pacific

12.10. Incremental Opportunity Analysis

13. Middle East & Africa Robotic Firefighters Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Pressure Trend Analysis

13.2.1. Weighted Average Pressure

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

13.6.1. Tracked Firefighting Robots

13.6.2. Wheeled Firefighting Robots

13.6.3. Humanoid Firefighting Robots

13.7. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

13.7.1. Corporates

13.7.2. Education

13.7.3. Hospitality

13.7.4. Government

13.7.5. Military & Defense

13.7.6. Energy & Utilities

13.8. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Robotic Firefighters Market (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

13.9.1. GCC

13.9.2. South Africa

13.9.3. Rest of Middle East & Africa

13.10. Incremental Opportunity Analysis

14. South America Robotic Firefighters Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Pressure Trend Analysis

14.2.1. Weighted Average Pressure

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Supplier Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Type, 2017 - 2031

14.6.1. Tracked Firefighting Robots

14.6.2. Wheeled Firefighting Robots

14.6.3. Humanoid Firefighting Robots

14.7. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by End-use, 2017 - 2031

14.7.1. Corporates

14.7.2. Education

14.7.3. Hospitality

14.7.4. Government

14.7.5. Military & Defense

14.7.6. Energy & Utilities

14.8. Robotic Firefighters Market (US$ Bn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Robotic Firefighters Market (US$ Bn) (Bn Units) Forecast, by Country/Sub-region, 2017 - 2031

14.9.1. Brazil

14.9.2. Rest of South America

14.10. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Share Analysis - 2022 (%)

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Lockheed Martin Corporation

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. Harris Corporation

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. Ryland Research Limited

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. BSS Holland B.V.

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. UF GmbH

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Agni Industries Fire Service, Ltd

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Changzhou Changtan Robot Co., Ltd.

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. QinetiQ Group plc

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Parosha Group

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. InRob Tech Ltd.

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. Type

16.1.2. End-use

16.1.3. Distribution channel

16.1.4. Region

16.2. Understanding Procurement Process of End-users

17. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Robotic Firefighters Market by Type, Thousand Units 2017-2031

Table 2: Global Robotic Firefighters Market by Type, US$ Bn 2017-2031

Table 3: Global Robotic Firefighters Market by End-use, Thousand Units, 2017-2031

Table 4: Global Robotic Firefighters Market by End-use, US$ Bn 2017-2031

Table 5: Global Robotic Firefighters Market by Distribution Channel, Thousand Units, 2017-2031

Table 6: Global Robotic Firefighters Market by Distribution Channel, US$ Bn 2017-2031

Table 7: Global Robotic Firefighters Market by Region, Thousand Units, 2017-2031

Table 8: Global Robotic Firefighters Market by Region, US$ Bn 2017-2031

Table 9: North America Robotic Firefighters Market by Type, Thousand Units 2017-2031

Table 10: North America Robotic Firefighters Market by Type, US$ Bn 2017-2031

Table 11: North America Robotic Firefighters Market by End-use, Thousand Units, 2017-2031

Table 12: North America Robotic Firefighters Market by End-use, US$ Bn 2017-2031

Table 13: North America Robotic Firefighters Market by Distribution Channel, Thousand Units, 2017-2031

Table 14: North America Robotic Firefighters Market by Distribution Channel, US$ Bn 2017-2031

Table 15: Europe Robotic Firefighters Market by Type, Thousand Units 2017-2031

Table 16: Europe Robotic Firefighters Market by Type, US$ Bn 2017-2031

Table 17: Europe Robotic Firefighters Market by End-use, Thousand Units, 2017-2031

Table 18: Europe Robotic Firefighters Market by End-use, US$ Bn 2017-2031

Table 19: Europe Robotic Firefighters Market by Distribution Channel, Thousand Units, 2017-2031

Table 20: Europe Robotic Firefighters Market by Distribution Channel, US$ Bn 2017-2031

Table 21: Asia Pacific Robotic Firefighters Market by Type, Thousand Units 2017-2031

Table 22: Asia Pacific Robotic Firefighters Market by Type, US$ Bn 2017-2031

Table 23: Asia Pacific Robotic Firefighters Market by End-use, Thousand Units, 2017-2031

Table 24: Asia Pacific Robotic Firefighters Market by End-use, US$ Bn 2017-2031

Table 25: Asia Pacific Robotic Firefighters Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: Asia Pacific Robotic Firefighters Market by Distribution Channel, US$ Bn 2017-2031

Table 27: Middle East & Africa Robotic Firefighters Market by Type, Thousand Units 2017-2031

Table 28: Middle East & Africa Robotic Firefighters Market by Type, US$ Bn 2017-2031

Table 29: Middle East & Africa Robotic Firefighters Market by End-use, Thousand Units, 2017-2031

Table 30: Middle East & Africa Robotic Firefighters Market by End-use, US$ Bn 2017-2031

Table 31: Middle East & Africa Robotic Firefighters Market by Distribution Channel, Thousand Units, 2017-2031

Table 32: Middle East & Africa Robotic Firefighters Market by Distribution Channel, US$ Bn 2017-2031

Table 33: South America Robotic Firefighters Market by Type, Thousand Units 2017-2031

Table 34: South America Robotic Firefighters Market by Type, US$ Bn 2017-2031

Table 35: South America Robotic Firefighters Market by End-use, Thousand Units, 2017-2031

Table 36: South America Robotic Firefighters Market by End-use, US$ Bn 2017-2031

Table 37: South America Robotic Firefighters Market by Distribution Channel, Thousand Units, 2017-2031

Table 38: South America Robotic Firefighters Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Robotic Firefighters Market Projections, by Type, Thousand Units 2017-2031

Figure 2: Global Robotic Firefighters Market Projections, by Type, US$ Bn 2017-2031

Figure 3: Global Robotic Firefighters Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 4: Global Robotic Firefighters Market Projections, by End-use, Thousand Units, 2017-2031

Figure 5: Global Robotic Firefighters Market Projections, by End-use, US$ Bn 2017-2031

Figure 6: Global Robotic Firefighters Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 7: Global Robotic Firefighters Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 8: Global Robotic Firefighters Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 9: Global Robotic Firefighters Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 10: Global Robotic Firefighters Market Projections, by Region, Thousand Units, 2017-2031

Figure 11: Global Robotic Firefighters Market Projections, by Region, US$ Bn 2017-2031

Figure 12: Global Robotic Firefighters Market, Incremental Opportunity, by Region, US$ Bn 2023 -2031

Figure 13: North America Robotic Firefighters Market Projections, by Type, Thousand Units 2017-2031

Figure 14: North America Robotic Firefighters Market Projections, by Type, US$ Bn 2017-2031

Figure 15: North America Robotic Firefighters Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 16: North America Robotic Firefighters Market Projections, by End-use, Thousand Units, 2017-2031

Figure 17: North America Robotic Firefighters Market Projections, by End-use, US$ Bn 2017-2031

Figure 18: North America Robotic Firefighters Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 19: North America Robotic Firefighters Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 20: North America Robotic Firefighters Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 21: North America Robotic Firefighters Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 22: Europe Robotic Firefighters Market Projections, by Type, Thousand Units 2017-2031

Figure 23: Europe Robotic Firefighters Market Projections, by Type, US$ Bn 2017-2031

Figure 24: Europe Robotic Firefighters Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 25: Europe Robotic Firefighters Market Projections, by End-use, Thousand Units, 2017-2031

Figure 26: Europe Robotic Firefighters Market Projections, by End-use, US$ Bn 2017-2031

Figure 27: Europe Robotic Firefighters Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 28: Europe Robotic Firefighters Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 29: Europe Robotic Firefighters Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 30: Europe Robotic Firefighters Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 31: Asia Pacific Robotic Firefighters Market Projections, by Type, Thousand Units 2017-2031

Figure 32: Asia Pacific Robotic Firefighters Market Projections, by Type, US$ Bn 2017-2031

Figure 33: Asia Pacific Robotic Firefighters Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 34: Asia Pacific Robotic Firefighters Market Projections, by End-use, Thousand Units, 2017-2031

Figure 35: Asia Pacific Robotic Firefighters Market Projections, by End-use, US$ Bn 2017-2031

Figure 36: Asia Pacific Robotic Firefighters Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 37: Asia Pacific Robotic Firefighters Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: Asia Pacific Robotic Firefighters Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 39: Asia Pacific Robotic Firefighters Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 40: Middle East & Africa Robotic Firefighters Market Projections, by Type, Thousand Units 2017-2031

Figure 41: Middle East & Africa Robotic Firefighters Market Projections, by Type, US$ Bn 2017-2031

Figure 42: Middle East & Africa Robotic Firefighters Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 43: Middle East & Africa Robotic Firefighters Market Projections, by End-use, Thousand Units, 2017-2031

Figure 44: Middle East & Africa Robotic Firefighters Market Projections, by End-use, US$ Bn 2017-2031

Figure 45: Middle East & Africa Robotic Firefighters Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 46: Middle East & Africa Robotic Firefighters Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 47: Middle East & Africa Robotic Firefighters Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 48: Middle East & Africa Robotic Firefighters Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 49: South America Robotic Firefighters Market Projections, by Type, Thousand Units 2017-2031

Figure 50: South America Robotic Firefighters Market Projections, by Type, US$ Bn 2017-2031

Figure 51: South America Robotic Firefighters Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 52: South America Robotic Firefighters Market Projections, by End-use, Thousand Units, 2017-2031

Figure 53: South America Robotic Firefighters Market Projections, by End-use, US$ Bn 2017-2031

Figure 54: South America Robotic Firefighters Market, Incremental Opportunity, by End-use, US$ Bn 2023 -2031

Figure 55: South America Robotic Firefighters Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: South America Robotic Firefighters Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 57: South America Robotic Firefighters Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031