An alarming rate of deaths caused due to drink and drive scenarios are increasingly becoming a matter of concern for government authorities worldwide. Thus, innovations in the healthcare industry are generating incremental opportunities for companies in the roadside drug testing devices market. For instance, in December 2019, Abbott-a global leader in medical devices announced the launch of the SoToxa™ Mobile Test System, which is acquiring global recognition. Novel roadside drug testing devices are gaining importance to combat drug-impaired driving and ensure road safety.

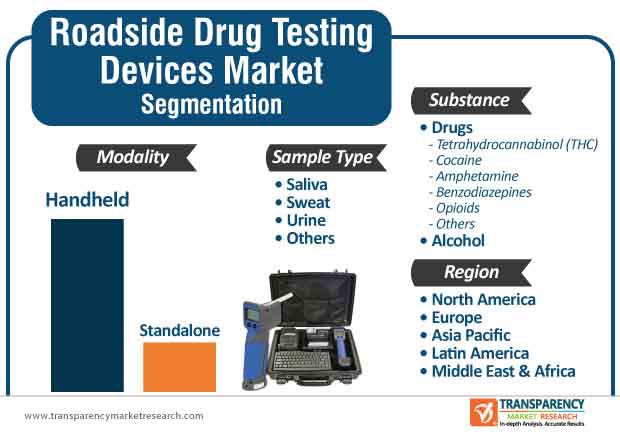

Companies in the roadside drug testing devices market are increasing their production capabilities to develop handheld devices. This is evident since handheld modality segment is estimated for exponential growth during the forecast period and the global roadside drug testing devices market is expected to reach a value of ~US$ 924 Mn by the end of 2027. Stakeholders in law enforcement are using oral fluid swabs that are inserted in handheld analyzers to detect marijuana and other drugs within minutes.

As suggested by the Swinburne University of Technology, drug users are apparently surpassing the number of alcohol consumers in Australia, resulting in high rates of fatal crashes. Hence, companies in the roadside drug testing devices market should tap opportunities in Australia to increase the uptake of detection devices. Likewise, companies in the market for roadside drug testing devices are collaborating with researchers to increase R&D in psychology and neurosciences to ascertain if drivers under the influence of cannabis are more likely to meet with an accident, as compared to alcohol consumers.

With the introduction of driving simulators, companies in the roadside drug testing devices market are able to conduct better analysis of cognitive behavior and psychomotor functioning of individuals through the help of clinical trials. Companies in the market for roadside drug testing devices are gaining important insights through research findings carried out as a result of collaborations between universities and medical institutes.

Breathalyzers are becoming increasingly mainstream in the detection of alcohol in the roadside drug testing devices market. However, there is a growing need for breathalyzers that are also capable of detecting marijuana. Hence, researchers in the market for roadside drug testing devices are increasing R&D to develop novel breathalyzers that detect THC. For instance, an interdisciplinary team at the University of Pittsburgh, developed a breathalyzer using nanotechnology sensors that detect THC. Thus, innovative breathalyzers are increasingly becoming the gold standard for THC detection and manufacturers should collaborate with researchers to innovate in devices. This trend has supported the exponential growth of THC among other substance types in the roadside drug testing devices market.

Companies in the roadside drug testing devices market are increasing research in developing breathalyzers using carbon nanotubes and nanotechnology sensors to meet requirements of mass spectrometry. This trend is prominent in the U.S. since legalization of recreational marijuana has raised concerns about the enforcement of DUI (Driving Under the Influence) laws in the region.

Since THC drugs segment is anticipated for exponential growth in the market for roadside drug testing devices, manufacturers are introducing breakthrough innovations that are a novel addition to the cannabis detection sector. For instance, Cannabix Technologies- a supplier of drug detection tools has announced that its scientific team has come up with a proprietary method-Field asymmetric waveform ion mobility spectrometry (FAIMS) to detect THC. Such innovations have contributed toward the modest of the roadside drug testing devices market, which is expected to expand at a CAGR of ~4% during the forecast period. Hence, manufacturers are focusing on innovating breathalyzers using high-field ion mobility and mass spectrometry.

Companies in the roadside drug testing devices market are developing lightweight devices that are user-friendly and store numerous samples. They are increasing efforts to develop devices that are capable of detecting extremely low quantities of THC analytes. Thus, innovative breathalyzers are increasingly replacing conventional breath analyzing techniques.

Analysts’ Viewpoint

The roadside drug testing devices market is projected for exponential growth in North America. Lack of efficient DUI laws in the U.S. are fueling the demand for drug testing devices. Manufacturers are increasing efforts to meet the demand for breath analyzers that can detect extremely low quantities of THC analytes.

Increased research spending has become the key focus point of companies in the market landscape. However, incidences of false positives from poppy seeds and tea in drug testing devices act as barriers for market growth. Hence, manufacturers should develop devices that can differentiate between drugs or alcohol and food items that are merely in the system of an individual.

Roadside drug testing devices market is expected to reach a value of ~US$ 924 Mn by the end of 2027

Roadside drug testing devices market is projected to expand at a CAGR of ~4% from 2019 to 2027

Roadside drug testing devices market is driven by increase in the number of drug and alcohol abusers

North America accounted for a major share of the global roadside drug testing devices market

Key players in the global roadside drug testing devices market are Drägerwerk AG & Co. KgaA, Abbott Laboratories, Oranoxis, Inc., CareHealth America

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Roadside Drug Testing Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Pricing Analysis

4.1.2. Industry Evolution/ Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.4. Global Roadside Drug Testing Devices Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. Technological Advancements

5.2. Roadside Drugs Testing Programs, by Country/Region

5.3. Regulatory Scenario Assessment

5.4. Key Industry Events (mergers, acquisitions, collaborations, launch & approvals, etc.)

6. Global Roadside Drug Testing Devices Market Analysis and Forecast, by Modality

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Modality, 2017–2027

6.3.1. Handheld

6.3.2. Standalone

6.4. Market Attractiveness Analysis, by Modality

7. Global Roadside Drug Testing Devices Market Analysis and Forecast, by Substance

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Substance, 2017–2027

7.3.1. Drugs

7.3.1.1. Tetrahydrocannabinol (THC)

7.3.1.2. Cocaine

7.3.1.3. Amphetamine

7.3.1.4. Benzodiazepines

7.3.1.5. Opioids

7.3.1.6. Others

7.3.2. Alcohol

7.4. Market Attractiveness Analysis, by Substance

8. Global Roadside Drug Testing Devices Market Analysis and Forecast, by Sample Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Sample Type, 2017–2027

8.3.1. Saliva

8.3.2. Sweat

8.3.3. Urine

8.3.4. Others

8.4. Market Attractiveness Analysis, by Substance

9. Global Roadside Drug Testing Devices Market Analysis and Forecast, by Region

9.1. Key Findings / Developments

9.2. Market Value Forecast, by Region, 2017–2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Roadside Drug Testing Devices Market Analysis and Forecast

10.1. Key Findings

10.2. Market Value Forecast, by Modality, 2017–2027

10.2.1. Handheld

10.2.2. Standalone

10.3. Market Value Forecast, by Substance, 2017–2027

10.3.1. Drugs

10.3.1.1. Tetrahydrocannabinol (THC)

10.3.1.2. Cocaine

10.3.1.3. Amphetamine

10.3.1.4. Benzodiazepines

10.3.1.5. Opioids

10.3.1.6. Others

10.3.2. Alcohol

10.4. Market Value Forecast, by Sample Type, 2017–2027

10.4.1. Saliva

10.4.2. Sweat

10.4.3. Urine

10.4.4. Others

10.5. Market Attractiveness Analysis, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Modality

10.6.2. By Substance

10.6.3. By Sample Type

10.6.4. By Country

11. Europe Roadside Drug Testing Devices Market Analysis and Forecast

11.1. Key Findings

11.2. Market Value Forecast, by Modality, 2017–2027

11.2.1. Handheld

11.2.2. Standalone

11.3. Market Value Forecast, by Substance, 2017–2027

11.3.1. Drugs

11.3.1.1. Tetrahydrocannabinol (THC)

11.3.1.2. Cocaine

11.3.1.3. Amphetamine

11.3.1.4. Benzodiazepines

11.3.1.5. Opioids

11.3.1.6. Others

11.3.2. Alcohol

11.4. Market Value Forecast, by Sample Type, 2017–2027

11.4.1. Saliva

11.4.2. Sweat

11.4.3. Urine

11.4.4. Others

11.5. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Modality

11.6.2. By Substance

11.6.3. By Sample Type

11.6.4. By Country/Sub-region

12. Asia Pacific Roadside Drug Testing Devices Market Analysis and Forecast

12.1. Key Findings

12.2. Market Value Forecast, by Modality, 2017–2027

12.2.1. Handheld

12.2.2. Standalone

12.3. Market Value Forecast, by Substance, 2017–2027

12.3.1. Drugs

12.3.1.1. Tetrahydrocannabinol (THC)

12.3.1.2. Cocaine

12.3.1.3. Amphetamine

12.3.1.4. Benzodiazepines

12.3.1.5. Opioids

12.3.1.6. Others

12.3.2. Alcohol

12.4. Market Value Forecast, by Sample Type, 2017–2027

12.4.1. Saliva

12.4.2. Sweat

12.4.3. Urine

12.4.4. Others

12.5. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Modality

12.6.2. By Substance

12.6.3. By Sample Type

12.6.4. By Country/Sub-region

13. Latin America Roadside Drug Testing Devices Market Analysis and Forecast

13.1. Key Findings

13.2. Market Value Forecast, by Modality, 2017–2027

13.2.1. Handheld

13.2.2. Standalone

13.3. Market Value Forecast, by Substance, 2017–2027

13.3.1. Drugs

13.3.1.1. Tetrahydrocannabinol (THC)

13.3.1.2. Cocaine

13.3.1.3. Amphetamine

13.3.1.4. Benzodiazepines

13.3.1.5. Opioids

13.3.1.6. Others

13.3.2. Alcohol

13.4. Market Value Forecast, by Sample Type, 2017–2027

13.4.1. Saliva

13.4.2. Sweat

13.4.3. Urine

13.4.4. Others

13.5. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Substance

13.6.2. By Substance

13.6.3. By Sample Type

13.6.4. By Country/Sub-region

14. Middle East & Africa Roadside Drug Testing Devices Market Analysis and Forecast

14.1. Key Findings

14.2. Market Value Forecast, by Modality, 2017–2027

14.2.1. Handheld

14.2.2. Standalone

14.3. Market Value Forecast, by Substance, 2017–2027

14.3.1. Drugs

14.3.1.1. Tetrahydrocannabinol (THC)

14.3.1.2. Cocaine

14.3.1.3. Amphetamine

14.3.1.4. Benzodiazepines

14.3.1.5. Opioids

14.3.1.6. Others

14.3.2. Alcohol

14.4. Market Value Forecast, by Sample Type, 2017–2027

14.4.1. Saliva

14.4.2. Sweat

14.4.3. Urine

14.4.4. Others

14.5. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Modality

14.6.2. By Substance

14.6.3. By Sample Type

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company, 2018

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Drägerwerk AG & Co. KGaA.

15.3.2.1. Company Overview

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. UriTox, LLC

15.3.3.1. Company Overview

15.3.3.2. Growth Strategies

15.3.3.3. SWOT Analysis

15.3.4. Oranoxis, Inc.

15.3.4.1. Company Overview

15.3.4.2. Growth Strategies

15.3.4.3. SWOT Analysis

15.3.5. Securetec

15.3.5.1. Company Overview

15.3.5.2. Growth Strategies

15.3.5.3. SWOT Analysis

15.3.6. CareHealth America

15.3.6.1. Company Overview

15.3.6.2. Growth Strategies

15.3.6.3. SWOT Analysis

15.3.7. MAVAND Solutions GmbH

15.3.7.1. Company Overview

15.3.7.2. Growth Strategies

15.3.7.3. SWOT Analysis

15.3.8. Pacific Data Systems Pty Ltd.

15.3.8.1. Company Overview

15.3.8.2. Growth Strategies

15.3.8.3. SWOT Analysis

List of Tables

Table 01: Global Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance, 2017–2027

Table 02: Global Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 03: Global Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample Type, 2017–2027

Table 04: Global Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 05: Global Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 06: North America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance, 2017–2027

Table 07: North America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 08: North America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample Type, 2017–2027

Table 09: North America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 10: North America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 11: Europe Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance, 2017–2027

Table 12: Europe Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 13: Europe Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample Type, 2017–2027

Table 14: Europe Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 15: Europe Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance, 2017–2027

Table 17: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 18: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample Type, 2017–2027

Table 19: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 20: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: Latin America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance, 2017–2027

Table 22: Latin America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 23: Latin America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample Type, 2017–2027

Table 24: Latin America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 25: Latin America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 26: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Substance, 2017–2027

Table 27: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Drugs, 2017–2027

Table 28: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Sample Type, 2017–2027

Table 29: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Modality, 2017–2027

Table 30: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Roadside Drug Testing Devices Market Value (US$ Mn) Forecast, 2017–2027

Figure 02: Global Roadside Drug Testing Devices Market Value Share, by Substance, 2018

Figure 03: Global Roadside Drug Testing Devices Market Value Share, by Sample Type, 2018

Figure 04: Global Roadside Drug Testing Devices Market Value Share, by Modality, 2018

Figure 05: Global Roadside Drug Testing Devices Market Value Share, by Region, 2018

Figure 06: Global Roadside Drug Testing Devices Market Value Share Analysis, by Substance, 2018 and 2027

Figure 07: Global Roadside Drug Testing Devices Market Value Share Analysis, by Drugs, 2018 and 2027

Figure 08: Global Roadside Drug Testing Devices Market Attractiveness Analysis, by Drugs, 2019–2027

Figure 09: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Drugs,

Figure 10: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Alcohol, 2017–2027

Figure 11: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Tetrahydrocannabinol (THC), 2017–2027

Figure 12: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cocaine, 2017–2027

Figure 13: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Amphetamine, 2017–2027

Figure 14: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Benzodiazepines, 2017–2027

Figure 15: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Opioids, 2017–2027

Figure 16: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 17: Global Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2019–2027

Figure 18: Global Roadside Drug Testing Devices Market Value Share Analysis, by Sample Type, 2018 and 2027

Figure 19: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Saliva, 2017–2027

Figure 20: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 21: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Urine, 2017–2027

Figure 22: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Sweat, 2017–2027

Figure 23: Global Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample Type, 2019–2027

Figure 24: Global Roadside Drug Testing Devices Market Value Share Analysis, by Modality, 2018 and 2027

Figure 25: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Handheld, 2017–2027

Figure 26: Global Roadside Drug Testing Devices Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Standalone, 2017–2027

Figure 27: Global Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2019–2027

Figure 28: Global Roadside Drug Testing Devices Market Value Share Analysis, by Region, 2018 and 2027

Figure 29: Global Roadside Drug Testing Devices Market Attractiveness Analysis, by Region, 2019–2027

Figure 30: North America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 31: North America Roadside Drug Testing Devices Market Value Share Analysis, by Substance, 2018 and 2027

Figure 32: North America Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2019–2027

Figure 33: North America Roadside Drug Testing Devices Market Value Share Analysis, by Sample Type, 2018 and 2027

Figure 34: North America Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample Type, 2019–2027

Figure 35: North America Roadside Drug Testing Devices Market Value Share Analysis, by Modality, 2018 and 2027

Figure 36: North America Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2019–2027

Figure 37: North America Roadside Drug Testing Devices Market Value Share Analysis, by Country, 2018 and 2027

Figure 38: North America Roadside Drug Testing Devices Market Attractiveness Analysis, by Country, 2019–2027

Figure 39: Europe Roadside Drug Testing Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 40: Europe Roadside Drug Testing Devices Market Value Share Analysis, by Substance, 2018 and 2027

Figure 41: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2019–2027

Figure 42: Europe Roadside Drug Testing Devices Market Value Share Analysis, by Sample Type, 2018 and 2027

Figure 43: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample Type, 2019–2027

Figure 44: Europe Roadside Drug Testing Devices Market Value Share Analysis, by Modality, 2018 and 2027

Figure 45: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2019–2027

Figure 46: Europe Roadside Drug Testing Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 47: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 48: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 49: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, by Substance, 2018 and 2027

Figure 50: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2019–2027

Figure 51: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, by Sample Type, 2018 and 2027

Figure 52: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample Type, 2019–2027

Figure 53: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, by Modality, 2018 and 2027

Figure 54: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2019–2027

Figure 55: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 56: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 57: Latin America Roadside Drug Testing Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 58: Latin America Roadside Drug Testing Devices Market Value Share Analysis, by Substance, 2018 and 2027

Figure 59: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2019–2027

Figure 60: Latin America Roadside Drug Testing Devices Market Value Share Analysis, by Sample Type, 2018 and 2027

Figure 61: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample Type, 2019–2027

Figure 62: Latin America Roadside Drug Testing Devices Market Value Share Analysis, by Modality, 2018 and 2027

Figure 63: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2019–2027

Figure 64: Latin America Roadside Drug Testing Devices Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 65: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 66: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 67: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, by Substance, 2018 and 2027

Figure 68: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, by Substance, 2019–2027

Figure 69: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, by Sample Type, 2018 and 2027

Figure 70: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, by Sample Type, 2019–2027

Figure 71: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, by Modality, 2018 and 2027

Figure 72: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, by Modality, 2019–2027

Figure 73: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, by Country/Sub-region,

Figure 74: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 75: Global Roadside Drugs Testing Devices Analysis, by Top Company Ranking, 2018