Global Rigid Polyurethane Foam Market: Snapshot

The global rigid polyurethane foam market is gaining from the excellent thermal insulation property of rigid polyurethane foam. Due to this, rigid polyurethane foam finds varied applications across several areas such as in domestic appliances, building and construction, automotive, and industrial insulation.

The insulating properties of rigid polyurethane foam make it ideal for walls and roofs of new homes and also for remodeling existing homes. Rigid polyurethane foam helps to maintain a uniform temperature inside homes and buildings that directly translates into energy savings. This holds significance in cold countries that have a huge temperature difference between the inside and outside temperatures. Rigid polyurethane foam also helps reduce noise level inside homes and buildings.

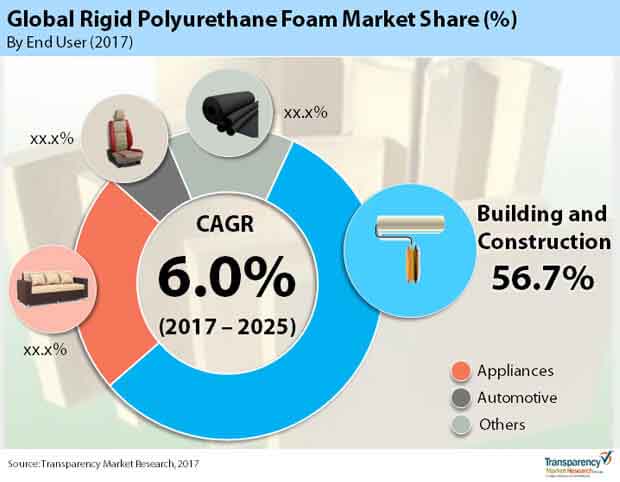

A report by Transparency Market Research (TMR) forecasts the global rigid polyurethane foam market to clock a CAGR of 6.0% between 2017 and 2025. Progressing at this rate, the market’s valuation of US$15.2 bn in 2016 will become US$25.5 bn by the end of 2025.

Building and Construction to Continue to Register Strong Growth

The various end users of rigid polyurethane foam are automotive, building and construction, industrial, and others. Vis-à-vis value and volume, building and construction stood as the leading end-use segment amongst all in 2016. The rigid polyurethane foam for building and construction is used for residential housing, commercial spaces, retail stores, factories, power stations, food processing plants, warehouses, cold stores, telecom shelters and public institutions such as schools and hospitals.

Some of the forms in which rigid polyurethane foam is used in the building and construction segment are sandwich panels with firm facings as roof and wall panels, insulating boards with flexible facings for ceilings, roofs, walls, and floors, spray-in-place foam for sealing and insulation, and insulating and construction material as cut to-size pieces from slabstock. Of these, insulation board and block is widely used in the construction sector owing to its range of qualities that make it simple and highly effective to work with.

In 2016, appliances stood as the second-leading end user in the rigid polyurethane foam market. Freezers, refrigerators, and hot water tanks are some of the appliances that use rigid polyurethane foam to maintain the inside temperature in the appliances.

Powered by China, Asia Pacific to Remain Dominant

Geography-wise, the report takes stock of the potential of rigid polyurethane market in North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Of them, Asia Pacific led the overall market in 2016 holding more than 38% share in terms of revenue. Going forward too, the region is anticipated to hold on to its dominant position. China alone contributes more than 55% revenue of Asia Pacific rigid polyurethane foam market mainly because of large volume production of rigid polyurethane foam.

Rapid urbanization as well as increasing awareness about environmental sustainability will further boost Asia Pacific rigid polyurethane foam market over the forecast period. The construction sector accounts for substantial demand for rigid polyurethane foam, along with demand from appliances segment. Tax rebates on the purchase of energy efficient properties in some countries in Asia Pacific is further bolstering the market’s growth. Developing countries such as China, India, and countries in South East Asia are anticipated to present ample opportunities to serve the thermal insulation needs of new construction undertakings in the upcoming years.

Europe is also a key market for rigid polyurethane foam; the region consumes more than 20% of the total volume of rigid polyurethane foam produced globally.

Some of the leading companies in the global rigid polyurethane foam market are Covestro AG, BASF SE, DUNA CORRADINI S.p.A., DuPont, Huntsman Corporation, ISOTHANE Ltd., Kingspan Group plc, Owens Corning, and Rockwoll International A/S.

Players Lean on Adopting Environmentally Friendly Ways of Synthesis in Rigid Polyurethane Foam Market

Rigid polyurethane foams are one of the most popular insulation materials used in wide range of insulation applications, the key reasons having to do with the combination of low-density, and attractive mechanical properties. The past few decades have seen rapidly expanding commercially available products for insulation for range of residential architectures and constructions. The need for energy-efficient walls and roofs in households has been a crucial approach for reducing the heating and cooling costs. This in essence reduces the use of air conditioning for the inmates. Developing high-performance foams that act as external weather and moisture barriers is one of the key focus areas for manufacturers in the rigid polyurethane foams market. Users of such high-performance foam materials also presume these foams to be dimensionally stable. Growing utilization of polyurethane foams is one of the key trends in commercial building construction, notably in the food and beverages industry. In recent years, the need for replacing fossil fuels in raw materials with renewable sources has caught on momentum with innovators and disruptors in the rigid polyurethane foams market. Bio-based polyols are a case in point. Focus is on using bioresources that are not only abundant in nature but have low carbon footprints. In this regard, lignin-derived polycarboxylic acids (LPCAs) have attracted research interest.

The health pandemic caused by the novel Coronavirus, popularly known as COVID-19, has made wide-ranging repercussions on the demand and consumption volumes. Business executives in consumer markets have had to suffer from vast unprecedented decline in demand in the second quarter of 2020. Rigid polyurethane foams market are witnessing new demand frameworks from construction industry. The stay-at-home restrictions for the most part of 2020 led to demand for cost-effective insulation materials. The market witnessed a new avenue from the trend of building and construction activities picking up some pace in a few developing countries in the last few months. Further, the growing focus of sustainability quotient will shape the strategies of key players in the rigid polyurethane foams market.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Indicative (US$ Bn)

3.2. Top Trends

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

4.3. Drivers and Restraints Snapshot Analysis

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.5. Global Rigid Polyurethane Foam Market Analysis and Forecasts

4.6. Porter’s Analysis

4.6.1. Threat of Substitutes

4.6.2. Bargaining Power of Buyers

4.6.3. Bargaining Power of Suppliers

4.6.4. Threat of New Entrants

4.6.5. Degree of Competition

4.6.6. Value Chain Analysis

5. SWOT Analysis

6. Global Rigid PU (Polyurethane) Foams Market, by End-user6

6.1. Global Rigid PU (Polyurethane) Foams Market, by End-user

6.2. Global Rigid PU (Polyurethane) Foams Market Forecast, by End-user

6.3. Global Rigid PU (Polyurethane) Foams Market Forecast, by End-user

6.4. Global Rigid PU (Polyurethane) Foams Market Forecast, by End-user

6.5. Global Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by End-user

7. Global Rigid PU (Polyurethane) Foams Market, by Region

7.1. Global Rigid PU (Polyurethane) Foams Market, by Region

7.2. Global Rigid PU (Polyurethane) Foams Market Forecast, by Region

8. North America Global Rigid PU (Polyurethane) Foams Market Analysis

8.1. Key Findings

8.2. North America Rigid PU (Polyurethane) Foams Market Overview

8.3. North America Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-user

8.4. North America Rigid PU (Polyurethane) Foams Market Forecast, by End-user

8.5. North America Rigid PU (Polyurethane) Foams Market Forecast, by End-user

8.6. North America Rigid PU (Polyurethane) Foams Market Forecast, by Country

8.7. U.S. Rigid PU (Polyurethane) Foams Market Forecast, by End-user

8.8. U.S. Rigid PU (Polyurethane) Foams Market Forecast, by End-user

8.9. Canada Rigid PU (Polyurethane) Foams Market Forecast, by End-user

8.10. Canada Rigid PU (Polyurethane) Foams Market Forecast, by End-user

8.11. North America Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by End-user

8.12. North America PEST Analysis: Rigid Polyurethane Foam

9. Europe Rigid PU (Polyurethane) Foams Market Analysis

9.1. Key Findings

9.2. Europe Rigid PU (Polyurethane) Foams Market Overview

9.3. Europe Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User

9.4. Europe Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.5. Europe Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.6. Europe Rigid PU (Polyurethane) foams market Forecast, by Country/Sub-Region

9.7. Europe Rigid PU (Polyurethane) foams market Forecast, by Country/Sub-Region

9.8. Germany Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.9. Germany Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.10. France Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.11. France Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.12. U.K. Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.13. U.K. Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.14. Russia Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.15. Russia Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.16. Turkey Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.17. Turkey Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.18. Rest of Europe Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.19. Rest of Europe Rigid PU (Polyurethane) Foams Market Forecast, by End-user

9.20. Europe Market Attractiveness Analysis, by End-User

9.21. Europe PEST Analysis: Rigid Polyurethane Foam

10. Asia Pacific Rigid PU (Polyurethane) Foams Market Analysis

10.1. Key Findings

10.2. Asia Pacific Rigid PU (Polyurethane) Foams Market Overview

10.3. Asia Pacific Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User

10.4. Asia Pacific Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.5. Asia Pacific Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.6. Asia Pacific Rigid PU (Polyurethane) foams market Forecast, by Country/Sub-Region

10.7. Asia Pacific Rigid PU (Polyurethane) foams market Forecast, by Country/Sub-Region

10.8. China Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.9. China Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.10. Japan Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.11. Japan Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.12. India Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.13. India Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.14. South Korea Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.15. South Korea Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.16. ASEAN Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.17. ASEAN Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.18. Rest of Asia Pacific Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.19. Rest of Asia Pacific Rigid PU (Polyurethane) Foams Market Forecast, by End-user

10.20. Asia Pacific Market Attractiveness Analysis, by End-User

10.21. Asia Pacific PEST Analysis: Rigid Polyurethane Foam

11. Latin America Rigid PU (Polyurethane) Foams Market Analysis

11.1. Key Findings

11.2. Latin America Rigid PU (Polyurethane) Foams Market Overview

11.3. Latin America Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User

11.4. Latin America Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.5. Latin America Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.6. Latin America Rigid PU (Polyurethane) Foams Market Forecast, by Country/Sub-Region

11.7. Latin America Rigid PU (Polyurethane) Foams Market Forecast, by Country/Sub-Region

11.8. Brazil Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.9. Brazil Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.10. Mexico Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.11. Mexico Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.12. Rest of Latin America Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.13. Rest of Latin America Rigid PU (Polyurethane) Foams Market Forecast, by End-user

11.14. Latin America Market Attractiveness Analysis, by End-User

11.15. Latin America PEST Analysis: Rigid Polyurethane Foam

12. Middle East & Africa Rigid PU (Polyurethane) Foams Market Analysis

12.1. Key Findings

12.2. Middle East & Africa Rigid PU (Polyurethane) Foams Market Overview

12.3. Middle East & Africa Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User

12.4. Middle East & Africa Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.5. Middle East & Africa Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.6. Middle East & Africa Rigid PU (Polyurethane) Foams Market Forecast, by Country/Sub-Region

12.7. Middle East & Africa Rigid PU (Polyurethane) Foams Market Forecast, by Country/Sub-Region

12.8. GCC Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.9. GCC Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.10. South Africa Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.11. South Africa Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.12. Rest of Middle East & Africa Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.13. Rest of Middle East & Africa Rigid PU (Polyurethane) Foams Market Forecast, by End-user

12.14. The Middle East & Africa Market Attractiveness Analysis, by End-user

12.15. Middle East & Africa PEST Analysis: Rigid Polyurethane Foam

13. Competition Landscape

13.1. Rigid Polyurethane Foam Market Share Analysis, by Company (2016)

13.2. Competition Matrix

13.2.1. Covestro AG

13.2.2. BASF SE

13.2.3. Huntsman International LLC

13.2.4. Others

13.3. Company Profiles

13.3.1 BASF SE

13.3.1.1 Company Description

13.3.1.2 Business Overview

13.3.1.3 Strategic Overview

13.3.1.4 Product/Technology Features

13.3.1.5 Recent Developments

13.3.2 Covestro AG

13.3.2.1 Company Description

13.3.2.2 Business Overview

13.3.2.3 Strategic Overview

13.3.3 DUNA- Corradini S.p.A

13.3.3.1 Company Description

13.3.3.2 Business Overview

13.3.3.3 Strategic Overview

13.3.3.4 Product/Technology Features

13.3.3.5 Recent Developments

13.3.4 DuPont

13.3.4.1 Company Description

13.3.4.2 Business Overview

13.3.4.3 Strategic Overview

13.3.5 Huntsman International LLC

13.3.5.1 Company Description

13.3.5.2 Business Overview

13.3.5.3 Strategic Overview

13.3.6 Isothane Ltd

13.3.6.1 Company Description

13.3.6.2 Business Overview

13.3.6.3 Strategic Overview

13.3.6.4 Product/Technology Features

13.3.6.5 Recent Developments

13.3.7 Kingspan Group PLC

13.3.7.1 Company Description

13.3.7.2 Business Overview

13.3.7.3 Strategic Overview

13.3.8 Owens Corning

13.3.8.1 Company Description

13.3.8.2 Business Overview

13.3.8.3 Strategic Overview

13.3.9 ROCKWOOL International A/S

13.3.9.1 Company Description

13.3.9.2 Business Overview

13.3.9.3 Strategic Overview

13.3.10 Saint-Gobain S.A.

13.3.10.1 Company Description

13.3.10.2 Business Overview

13.3.10.3 Strategic Overview

13.3.11 Trident Foams

13.3.11.1 Business Overview

13.3.11.2 Strategic Overview

13.3.11.3 Product/Technology Features

13.3.11.4 Recent Developments

13.3.12 ILPO srl

13.3.12.1 Business Overview

13.3.12.2 Strategic Overview

13.3.12.3 Product/Technology Features

13.3.12.4 Strategic Overview

14. Primary Research - Key Insights

List of Tables

Table 01: Global Rigid PU (Polyurethane) Foams Market Size (US$ Mn) Forecast, by End-user, 2016–2025

Table 02: Global Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 03: Global Rigid PU (Polyurethane) Foams Market Size (US$ Mn) Forecast, by Region, 2016–2025

Table 04: Global Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by Region, 2016–2025

Table 05: North America Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 06: North America Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 07: North America Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country, 2016–2025

Table 08: U.S. Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 09: U.S. Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 10: Canada Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 11: Canada Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 12: Europe Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 13: Europe Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 14: Europe Rigid PU (Polyurethane) foams market (US$ Mn) Forecast, by Country/Sub-Region, 2016–2025

Table 15: Europe Rigid PU (Polyurethane) foams market Volume (Kilo Tons) Forecast, by Country/Sub-Region, 2016–2025

Table 16: Germany Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 17: Germany Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 18: France Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 19: France Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 20: U.K. Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 21: U.K. Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 22: Russia Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 23: Russia Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 24: Turkey Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 25: Turkey Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 26: Rest of Europe Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 27: Rest of Europe Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 28: Asia Pacific Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 29: Asia Pacific Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 30: Asia Pacific Rigid PU (Polyurethane) foams market (US$ Mn) Forecast, by Country/Sub-Region, 2016–2025

Table 31: Asia Pacific Rigid PU (Polyurethane) foams market Volume (Kilo Tons) Forecast, by Country/Sub-Region, 2016–2025

Table 32: China Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 33: China Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 34: Japan Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 35: Japan Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 36: India Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 37: India Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 38: South Korea Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 39: South Korea Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 40: ASEAN Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 41: ASEAN Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 42: Rest of Asia Pacific Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 43: Rest of Asia Pacific Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 44: Latin America Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 45: Latin America Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 46: Latin America Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by Country/Sub-Region, 2016–2025

Table 47: Latin America Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by Country/Sub-Region, 2016–2025

Table 48: Brazil Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 49: Brazil Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 50: Mexico Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 51: Mexico Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 52: Rest of Latin America Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 53: Rest of Latin America Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 54: Middle East & Africa Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 55: Middle East & Africa Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 56: Middle East & Africa Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by Country/Sub-Region, 2016–2025

Table 57: Middle East & Africa Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by Country/Sub-Region, 2016–2025

Table 58: GCC Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 59: GCC Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 60: South Africa Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 61: South Africa Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

Table 62: Rest of Middle East & Africa Rigid PU (Polyurethane) Foams Market (US$ Mn) Forecast, by End-user, 2016–2025

Table 63: Rest of Middle East & Africa Rigid PU (Polyurethane) Foams Market Volume (Kilo Tons) Forecast, by End-user, 2016–2025

List of Figures

Figure 01: Global Rigid Polyurethane Foam Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 02: Global Rigid Polyurethane Foam Price (US$/ Ton) 2016–2025

Figure 03: Global Rigid PU (Polyurethane) Foams Market, by End-user, 2016–2025

Figure 04: Global Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by End-user, 2016

Figure 05: Global Rigid PU (Polyurethane) Foams Market, by Region, 2016–2025

Figure 06: Global Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by Region, 2016

Figure 07: North America Global Rigid PU (Polyurethane) Foams Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 08: North America Rigid PU (Polyurethane) Foams Market Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 09: North America Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by Country

Figure 10: North America Global Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-user, 2016–2025

Figure 11: North America Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by End-use Industry, 2016

Figure 12: Europe Rigid PU (Polyurethane) Foams Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 13: Europe Rigid PU (Polyurethane) Foams Market Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 14: Europe Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by Country / Sub-Region

Figure 15: Europe Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User, 2016 and 2025

Figure 16: Europe Market Attractiveness Analysis, by End-User

Figure 17: Asia Pacific Rigid PU (Polyurethane) Foams Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 18: Asia Pacific Rigid PU (Polyurethane) Foams Market Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 19: Asia Pacific Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by Country / Sub-Region

Figure 20: Asia Pacific Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User, 2016 and 2025

Figure 21: Asia Pacific America Market Attractiveness Analysis, by End-User

Figure 22: Latin America Rigid PU (Polyurethane) Foams Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 23: Latin America Rigid PU (Polyurethane) Foams Market Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 24: Latin America Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by Country

Figure 25: Latin America Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User, 2016 and 2025

Figure 26: Latin America Market Attractiveness Analysis, by End-User

Figure 27: Middle East & Africa Rigid PU (Polyurethane) Foams Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 28: Middle East & Africa Rigid PU (Polyurethane) Foams Market Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 29: Middle East & Africa Rigid PU (Polyurethane) Foams Market Attractiveness Analysis, by Country

Figure 30: Middle East & Africa Rigid PU (Polyurethane) Foams Market Value Share Analysis, by End-User, 2016 and 2025

Figure 31: The Middle East & Africa Market Attractiveness Analysis, by End-user

Figure 32: Rigid Polyurethane Foam Market Share Analysis, by Company

Figure 33: Competition Matrix 1 (Covestro AG and BASF SE)

Figure 34: Competition Matrix 2 (Huntsman International and Rockwool International A/S)

Figure 35: BASF SE: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 36: Covestro AG: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 37: DuPont: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 38: Huntsman International LLC: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 39: Kingspan Group PLC: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 40: Owens Corning: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 41: ROCKWOOL International A/S: Breakdown of Net Sales, by Business Segment and by Region, 2016

Figure 40: Saint-Gobain S.A.: Breakdown of Net Sales, by Business Segment and by Region, 2016