Analysts’ Viewpoint on Rigid Paper Container Market Scenario

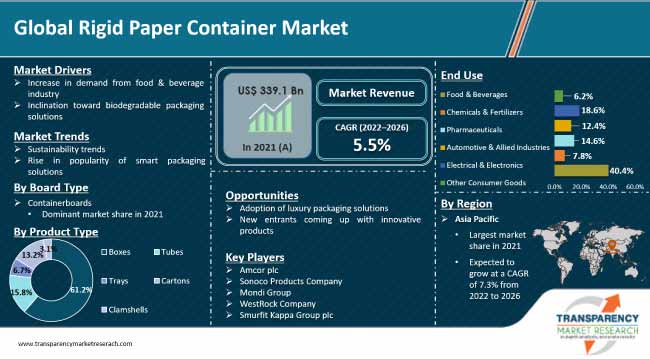

The global rigid paper container market is expected to grow at a steady pace during the forecast period owing to the rise in adoption of sustainable, biodegradable, and eco-friendly packaging solutions. Biodegradable packaging solutions do not harm the environment; therefore, demand for rigid paper containers is rising among several end-use industries across the globe. Various end-use industries such as food & beverages, pharmaceuticals, and electrical & electronics are likely to opt for paper-based packaging solutions, as paper is known to have lower carbon footprint vis-à-vis conventional packaging materials such as plastics, glass, and metals. Manufacturers operating in the global rigid paper container market are focusing on design and development of innovative packaging solutions to gain revenue benefits.

Rigid paper containers are paper-based packaging solutions that are biodegradable and sustainable. These containers are highly economical and offer greater mechanical strength. Demand for rigid paper containers is increasing due to the sustainability features offered by them. Rigid paper containers require fewer resources and entail lower production costs. They also help lower the carbon footprint. Demand for biodegradable packaging is rising in various end-use industries. Thus, the global rigid paper container market growth forecast appears positive during the forecast period.

The COVID-19 pandemic has had a significant impact on the rigid paper container market. Production and supply chain operations of end-use industries were hampered due to the limitations imposed during lockdowns. These lockdowns compelled manufacturers to change their production schedules. However, companies have been increasing their production to meet the rising demand for sustainable packaging solutions post the peak of the pandemic. Thus, the rigid paper container market is anticipated to grow at a steady pace during the forecast period.

The e-commerce market expanded at a faster pace during the peak of the COVID-19 pandemic. Global e-commerce sales stood at US$ 26.7 Trn in 2019, according to the United Nations Conference on Trade and Development (UNCTAD). The U.S. remains the leader in the e-commerce market. Total e-commerce sales in the U.S. stood at US$ 9.6 Trn in 2019. This indicates growth opportunities for recyclable, sustainable, and lightweight packaging solutions such as rigid paper containers. Increase in demand for rigid paper containers such as boxes and cartons among customers can be ascribed to the popularity of e-commerce platforms.

Rigid paper containers are light in weight and eco-friendly. Hence, they are increasingly used in the food & beverage industry. According to the American Beverage Association (ABA), the non-alcoholic beverage industry plays an important role in the U.S. economy. Beverage cartons made from paper or paperboard are preferred by beverage manufacturers, as these cartons protect the freshness and quality of beverages during their transportation and storage. This increases the shelf-life of products. These cartons are also easy to handle and convenient to use. Rapid growth in the food & beverage industry is estimated to augment the sale of rigid paper containers during the forecast period.

Bulk materials/goods can be stored or transported using rigid paper containers such as boxes. Bulk transportation or storage helps reduce packaging costs. A variety of goods can be adjusted in a container. This leads to proper utilization of space in a rigid paper container. The U.S. has the largest consumer goods market. This is driving the demand for rigid paper containers. Bulk packaging facilitates easy handling of various goods without any loss or damage. Hence, rigid containers are extensively used to store and transport consumer goods.

Luxury packaging is gaining popularity among various end-use industries such as cosmetics & personal care. According to the Personal Care Products Council (PCPC), cosmetics & personal care is considered the most dynamic and innovative industry. Rigid paper containers such as boxes and cartons are widely used in the packaging of several personal care products and cosmetics around the globe. Increase in need for specialized and esthetic packaging solutions is anticipated to offer lucrative opportunities to luxury packaging manufacturers, including rigid paper container producers.

Smart packaging solutions is used to protect goods against counterfeit products. Smart packaging also helps enhance the quality and shelf-life of products. Rigid paper container manufacturers are focusing on using smart packaging solutions such as RFID, barcodes, and QR codes to protect products from counterfeiting activities that result in brand losses. Increase in usage of smart packaging solutions helps trace and track product packages during transportation, thus providing the maximum safety to products. Increase in demand for smart and secure packaging solutions in various end-use industries such as food & beverages, pharmaceuticals, and personal care is estimated to fuel the global rigid paper container market during the forecast period.

Rise in environmental concerns has led to an increase in adoption of sustainable and eco-friendly products and packaging solutions across the globe. End-use industries are also focusing on developing sustainable packaging solutions such as rigid paper containers. Growth in concerns about environmental wastes and their ill-effects is expected to drive the global demand for recyclable rigid paper containers. Thus, consumers are more likely to avoid the use of non-recyclable materials such as plastic and opt for sustainable products in the near future.

Rigid paper trays and rigid paper clamshells are preferred for fruit and vegetable packaging. These rigid paper containers are eco-friendly and economical packaging solutions. According to the U.S. Department of Agriculture (USDA), fresh fruits and vegetables worth about US$ 6.9 Bn were exported from the U.S. in 2020. Rigid paper trays and clamshells protect the fruit quality during transportation and storage. Growth in import-export activities related to fruits is expected to create lucrative opportunities for manufacturers operating in the global rigid paper container market in the next few years.

Automotive parts require custom packaging for delivery to car manufacturers or parts suppliers in order to withstand the potential freight damages. Folding cartons, boxes, partition structures, and foams are the preferred packaging formats by the automotive industry. Folding cartons help avoid any damage to the product during transit. Expansion in the automotive industry is estimated to augment the sale of protective packaging products such as rigid paper containers. According to the American Automotive Policy Council (AAPC), the U.S. exported vehicles and parts worth US$ 142 Bn in 2018. Export of automotive parts or vehicles requires safe and efficient packaging solutions. Rigid paper containers such as cartons are available in different shapes and sizes. This makes it easy for automotive manufacturers to fit the part in the packaging solution without causing any damage. This has also reduced the cost of extra packaging required to protect the product. Thus, rise in need for protective packaging solutions in the automotive industry is anticipated to offer lucrative opportunities for players in the global rigid paper container market during the forecast period.

Asia Pacific is expected to account for the largest share of the global rigid paper container market during the forecast period. Easy availability of paper materials and cost-effective labor are projected to drive the market in the region during the forecast period. The market in Asia Pacific is anticipated to grow at a healthy CAGR of 7.3% from 2022 to 2026.

North America is anticipated to be a significant market for rigid paper containers during the forecast period. The U.S. is projected to hold around 72.0% share of the North America rigid paper container market by the end of 2026. Consumers in the U.S. are more likely to opt for recyclable and sustainable packaging solutions. According to the American Forest & Paper Association (AF&PA), paper is one of the widely recycled materials in the U.S. Recyclability of paper packaging is gaining traction among the U.S. consumers. This is driving the demand for various paper & paperboard packaging solutions, including rigid paper containers, in various end-use industries. Thus, the market in North America is anticipated to grow at a significant pace from 2022 to 2026.

The global rigid paper container market is fragmented, with the presence of large numbers of manufacturers that control majority of the share. Mergers and acquisitions and development of product portfolios are prominent strategies adopted by key players. The global rigid paper container market assessment report includes various sections such as rigid paper container market drivers, rigid paper container market restraints, rigid paper container market challenges, rigid paper container market pricing analysis, rigid paper container market supply analysis, rigid paper container market sales analysis, and rigid paper container market opportunities analysis. The report also focuses on rigid paper container market competition analysis, rigid paper container market trends, rigid paper container market recent developments, and rigid paper container market demand analysis.

Leading players operating in the market are Amcor plc, Sonoco Products Company, Mondi Group, WestRock Company, Smurfit Kappa Group plc, DS Smith Plc, Georgia-Pacific LLC, Huhtamäki Oyj, Oji Holdings Corporation, Packaging Corporation of America, and International Paper Company.

Each of these companies has been summarized in the rigid paper container market report based on factors such as financial overview, company overview, business strategies, business segments, application portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 339.1 Bn |

|

Market Forecast Value in 2026 |

US$ 443.4 Bn |

|

Growth Rate (CAGR) |

5.5% from 2022 to 2026 |

|

Forecast Period |

2022–2026 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global rigid paper container market was valued at US$ 339.1 Bn in 2021.

The global rigid paper container market is expected to grow at a CAGR of 5.5% during 2022-2026.

The global rigid paper container market is projected to reach US$ 443.4 Bn by the end of 2026.

Increase in demand from food & beverage industry and inclination toward biodegradable packaging solutions.

The containerboards segment is estimated to remain dominant during the forecast period.

Asia Pacific is estimated to showcase high demand for rigid paper containers during the forecast period.

Amcor plc, Sonoco Products Company, Mondi Group, WestRock Company, Smurfit Kappa Group plc, DS Smith Plc, and International Paper Company.

The rigid paper container market in the U.S is anticipated to grow at a CAGR of 3.6% during the forecast period.

The global rigid paper container market is projected to create a growth opportunity of US$ 104.3 Bn during 2022-2026.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Rigid Paper Container Market Overview

3.1. Introduction

3.2. Global Rigid Paper Container Market Overview

3.3. Rigid Paper Container Market (US$ Mn) and Forecast

3.4. Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Raw Product Suppliers

3.4.1.2. Rigid Paper Container Manufacturers/Distributors

3.4.1.3. End Users/Customers

3.4.2. Profitability Margins

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Rigid Paper Container Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Rigid Paper Container Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Rigid Paper Container Market Analysis and Forecast, By Board Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Board Type

7.1.2. Y-o-Y Growth Projections, By Board Type

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Board Type

7.2.1. Paperboards

7.2.2. Containerboards

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Board Type

7.3.1. Paperboards

7.3.2. Containerboards

7.4. Market Attractiveness Analysis, By Board Type

8. Global Rigid Paper Container Market Analysis and Forecast, By Product Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Product Type

8.1.2. Y-o-Y Growth Projections, By Product Type

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Product Type

8.2.1. Boxes

8.2.2. Tubes

8.2.3. Trays

8.2.4. Cartons

8.2.5. Clamshells

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Product Type

8.3.1. Boxes

8.3.2. Tubes

8.3.3. Trays

8.3.4. Cartons

8.3.5. Clamshells

8.4. Market Attractiveness Analysis, By Product Type

9. Global Rigid Paper Container Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By End Use

9.2.1. Food & Beverages

9.2.2. Chemicals & Fertilizers

9.2.3. Pharmaceuticals

9.2.4. Automotive & Allied Industries

9.2.5. Electrical & Electronics

9.2.6. Other Consumer Goods

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

9.3.1. Food & Beverages

9.3.2. Chemicals & Fertilizers

9.3.3. Pharmaceuticals

9.3.4. Automotive & Allied Industries

9.3.5. Electrical & Electronics

9.3.6. Other Consumer Goods

9.4. Market Attractiveness Analysis, By End Use

10. Global Rigid Paper Container Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East & Africa

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East & Africa

10.4. Market Attractiveness Analysis By Region

11. North America Rigid Paper Container Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Country

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Board Type

11.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Board Type

11.5.1. Paperboards

11.5.2. Containerboards

11.6. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Product Type

11.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Product Type

11.7.1. Box

11.7.2. Tubes

11.7.3. Trays

11.7.4. Cartons

11.7.5. Clamshells

11.8. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By End Use

11.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By End Use

11.9.1. Food & Beverages

11.9.2. Chemical & fertilizers

11.9.3. Pharmaceuticals

11.9.4. Automotive & Allied Industries

11.9.5. Electrical and Electronics

11.9.6. Other Consumer Goods

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Board Type

11.10.3. By Product Type

11.10.4. By End Use

12. Latin America Rigid Paper Container Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Board Type

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Board Type

12.5.1. Paperboards

12.5.2. Containerboards

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Product Type

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Product Type

12.7.1. Box

12.7.2. Tubes

12.7.3. Trays

12.7.4. Cartons

12.7.5. Clamshells

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By End Use

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By End Use

12.9.1. Food & Beverages

12.9.2. Chemical & fertilizers

12.9.3. Pharmaceuticals

12.9.4. Automotive & Allied Industries

12.9.5. Electrical and Electronics

12.9.6. Other Consumer Goods

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Board Type

12.10.3. By Product Type

12.10.4. By End Use

13. Europe Rigid Paper Container Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

13.3.1. Germany

13.3.2. Italy

13.3.3. France

13.3.4. Spain

13.3.5. Nordics

13.3.6. U.K.

13.3.7. Benelux

13.3.8. Russia

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Board Type

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Board Type

13.5.1. Paperboards

13.5.2. Containerboards

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Type

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Product Type

13.7.1. Box

13.7.2. Tubes

13.7.3. Trays

13.7.4. Cartons

13.7.5. Clamshells

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By End Use

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By End Use

13.9.1. Food & Beverages

13.9.2. Chemical & fertilizers

13.9.3. Pharmaceuticals

13.9.4. Automotive & Allied Industries

13.9.5. Electrical and Electronics

13.9.6. Other Consumer Goods

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Board Type

13.10.3. By Product Type

13.10.4. By End Use

14. Asia Pacific Rigid Paper Container Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

14.3.1. China

14.3.2. India

14.3.3. ASEAN

14.3.4. Australia & New Zealand

14.3.5. Japan

14.3.6. Rest of APAC

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Board Type

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Board Type

14.5.1. Paperboards

14.5.2. Containerboards

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Product Type

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Product Type

14.7.1. Box

14.7.2. Tubes

14.7.3. Trays

14.7.4. Cartons

14.7.5. Clamshells

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By End Use

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By End Use

14.9.1. Food & Beverages

14.9.2. Chemical & fertilizers

14.9.3. Pharmaceuticals

14.9.4. Automotive & Allied Industries

14.9.5. Electrical and Electronics

14.9.6. Other Consumer Goods

14.10. Market Attractiveness Analysis

14.10.1. By Country

14.10.2. By Board Type

14.10.3. By Product Type

14.10.4. By End Use

15. Middle East & Africa Rigid Paper Container Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Country

15.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

15.3.1. Northern Africa

15.3.2. GCC Countries

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Board Type

15.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Board Type

15.5.1. Paperboards

15.5.2. Containerboards

15.6. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By Product Type

15.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By Product Type

15.7.1. Box

15.7.2. Tubes

15.7.3. Trays

15.7.4. Cartons

15.7.5. Clamshells

15.8. Historical Market Value (US$ Mn) and Volume (Units), 2013-2021, By End Use

15.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 Analysis 2022-2026, By End Use

15.9.1. Food & Beverages

15.9.2. Chemical & fertilizers

15.9.3. Pharmaceuticals

15.9.4. Automotive & Allied Industries

15.9.5. Electrical and Electronics

15.9.6. Other Consumer Goods

15.10. Market Attractiveness Analysis

15.10.1. By Country

15.10.2. By Board Type

15.10.3. By Product Type

15.10.4. By End Use

16. Country wise Rigid Paper Container Market Analysis, 2022-2026

16.1. U.S. Rigid Paper Container Market Analysis

16.1.1. By Board Type

16.1.2. By Product Type

16.1.3. By End Use

16.2. Canada Rigid Paper Container Market Analysis

16.2.1. By Board Type

16.2.2. By Product Type

16.2.3. By End Use

16.3. Brazil Rigid Paper Container Market Analysis

16.3.1. By Board Type

16.3.2. By Product Type

16.3.3. By End Use

16.4. Mexico Rigid Paper Container Market Analysis

16.4.1. By Board Type

16.4.2. By Product Type

16.4.3. By End Use

16.5. Germany Rigid Paper Container Market Analysis

16.5.1. By Board Type

16.5.2. By Product Type

16.5.3. By End Use

16.6. Spain Rigid Paper Container Market Analysis

16.6.1. By Board Type

16.6.2. By Product Type

16.6.3. By End Use

16.7. France Rigid Paper Container Market Analysis

16.7.1. By Board Type

16.7.2. By Product Type

16.7.3. By End Use

16.8. U.K. Rigid Paper Container Market Analysis

16.8.1. By Board Type

16.8.2. By Product Type

16.8.3. By End Use

16.9. Italy Rigid Paper Container Market Analysis

16.9.1. By Board Type

16.9.2. By Product Type

16.9.3. By End Use

16.10. Russia Rigid Paper Container Market Analysis

16.10.1. By Board Type

16.10.2. By Product Type

16.10.3. By End Use

16.11. China Rigid Paper Container Market Analysis

16.11.1. By Board Type

16.11.2. By Product Type

16.11.3. By End Use

16.12. India Rigid Paper Container Market Analysis

16.12.1. By Board Type

16.12.2. By Product Type

16.12.3. By End Use

16.13. Japan Rigid Paper Container Market Analysis

16.13.1. By Board Type

16.13.2. By Product Type

16.13.3. By End Use

16.14. GCC Countries Rigid Paper Container Market Analysis

16.14.1. By Board Type

16.14.2. By Product Type

16.14.3. By End Use

16.15. South Africa Rigid Paper Container Market Analysis

16.15.1. By Board Type

16.15.2. By Product Type

16.15.3. By End Use

17. Competitive Landscape

17.1. Market Structure

17.2. Competition Dashboard

17.3. Company Market Share Analysis

17.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.5. Competition Deep Dive (Key Global Market Players)

17.5.1. Amcor plc

17.5.1.1. Overview

17.5.1.2. Financials

17.5.1.3. Strategy

17.5.1.4. Recent Developments

17.5.1.5. SWOT Analysis

17.5.2. Sonoco Products Company

17.5.2.1. Overview

17.5.2.2. Financials

17.5.2.3. Strategy

17.5.2.4. Recent Developments

17.5.2.5. SWOT Analysis

17.5.3. Mondi Group

17.5.3.1. Overview

17.5.3.2. Financials

17.5.3.3. Strategy

17.5.3.4. Recent Developments

17.5.3.5. SWOT Analysis

17.5.4. WestRock Company

17.5.4.1. Overview

17.5.4.2. Financials

17.5.4.3. Strategy

17.5.4.4. Recent Developments

17.5.4.5. SWOT Analysis

17.5.5. Smurfit Kappa Group plc

17.5.5.1. Overview

17.5.5.2. Financials

17.5.5.3. Strategy

17.5.5.4. Recent Developments

17.5.5.5. SWOT Analysis

17.5.6. DS Smith Plc

17.5.6.1. Overview

17.5.6.2. Financials

17.5.6.3. Strategy

17.5.6.4. Recent Developments

17.5.6.5. SWOT Analysis

17.5.7. Georgia-Pacific LLC

17.5.7.1. Overview

17.5.7.2. Financials

17.5.7.3. Strategy

17.5.7.4. Recent Developments

17.5.7.5. SWOT Analysis

17.5.8. Huhtamäki Oyj

17.5.8.1. Overview

17.5.8.2. Financials

17.5.8.3. Strategy

17.5.8.4. Recent Developments

17.5.8.5. SWOT Analysis

17.5.9. Oji Holdings Corporation

17.5.9.1. Overview

17.5.9.2. Financials

17.5.9.3. Strategy

17.5.9.4. Recent Developments

17.5.9.5. SWOT Analysis

17.5.10. Packaging Corporation of America

17.5.10.1. Overview

17.5.10.2. Financials

17.5.10.3. Strategy

17.5.10.4. Recent Developments

17.5.10.5. SWOT Analysis

17.5.11. International Paper Company

17.5.11.1. Overview

17.5.11.2. Financials

17.5.11.3. Strategy

17.5.11.4. Recent Developments

17.5.11.5. SWOT Analysis

17.5.12. Shetron Group

17.5.12.1. Overview

17.5.12.2. Financials

17.5.12.3. Strategy

17.5.12.4. Recent Developments

17.5.12.5. SWOT Analysis

17.5.13. Corex Group

17.5.13.1. Overview

17.5.13.2. Financials

17.5.13.3. Strategy

17.5.13.4. Recent Developments

17.5.13.5. SWOT Analysis

17.5.14. Papeles y Conversiones de México

17.5.14.1. Overview

17.5.14.2. Financials

17.5.14.3. Strategy

17.5.14.4. Recent Developments

17.5.14.5. SWOT Analysis

17.5.15. Danhill Containers

17.5.15.1. Overview

17.5.15.2. Financials

17.5.15.3. Strategy

17.5.15.4. Recent Developments

17.5.15.5. SWOT Analysis

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global Rigid Paper Container Market Historic Value (US$ Mn), By Board Type 2013(H)-2021(A)

Table 02: Global Rigid Paper Container Market Forecast Value (US$ Mn), By Board Type 2022(E)-2026(F)

Table 03: Global Rigid Paper Container Market Historic Volume (Units), By Board Type 2013(H)-2021(A)

Table 04: Global Rigid Paper Container Market Forecast Volume (Units), By Board Type 2022(E)-2026(F)

Table 05: Global Rigid Paper Container Market Historic Value (US$ Mn), By Product Type 2013(H)-2021(A)

Table 06: Global Rigid Paper Container Market Forecast Value (US$ Mn), By Product Type 2022(E)-2026(F)

Table 07: Global Rigid Paper Container Market Historic Volume (Units), By Product Type 2013(H)-2021(A)

Table 08: Global Rigid Paper Container Market Forecast Volume (Units), By Product Type 2022(E)-2026(F)

Table 09: Global Rigid Paper Container Market Historic Value (US$ Mn), By End Use 2013(H)-2021(A)

Table 10: Global Rigid Paper Container Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 11: Global Rigid Paper Container Market Historic Volume (Units), By End Use 2013(H)-2021(A)

Table 12: Global Rigid Paper Container Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 13: Global Rigid Paper Container Market Historic Value (US$ Mn), By Region 2013(H)-2021(A)

Table 14: Global Rigid Paper Container Market Forecast Value (US$ Mn), By Region 2022(E)-2026(F)

Table 15: Global Rigid Paper Container Market Historic Volume (Units), By Region 2013(H)-2021(A)

Table 16: Global Rigid Paper Container Market Forecast Volume (Units), By Region 2022(E)-2026(F)

Table 17: North America Rigid Paper Container Market Historic Value (US$ Mn), By Board Type 2013(H)-2021(A)

Table 18: North America Rigid Paper Container Market Forecast Value (US$ Mn), By Board Type 2022(E)-2026(F)

Table 19: North America Rigid Paper Container Market Historic Volume (Units), By Board Type 2013(H)-2021(A)

Table 20: North America Rigid Paper Container Market Forecast Volume (Units), By Board Type 2022(E)-2026(F)

Table 21: North America Rigid Paper Container Market Historic Value (US$ Mn), By Product Type 2013(H)-2021(A)

Table 22: North America Rigid Paper Container Market Forecast Value (US$ Mn), By Product Type 2022(E)-2026(F)

Table 23: North America Rigid Paper Container Market Historic Volume (Units), By Product Type 2013(H)-2021(A)

Table 24: North America Rigid Paper Container Market Forecast Volume (Units), By Product Type 2022(E)-2026(F)

Table 25: North America Rigid Paper Container Market Historic Value (US$ Mn), By End Use 2013(H)-2021(A)

Table 26: North America Rigid Paper Container Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 27: North America Rigid Paper Container Market Historic Volume (Units), By End Use 2013(H)-2021(A)

Table 28: North America Rigid Paper Container Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 29: North America Rigid Paper Container Market Historic Value (US$ Mn), By Country 2013(H)-2021(A)

Table 30: North America Rigid Paper Container Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 31: North America Rigid Paper Container Market Historic Volume (Units), By Country 2013(H)-2021(A)

Table 32: North America Rigid Paper Container Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 33: Latin America Rigid Paper Container Market Historic Value (US$ Mn), By Board Type 2013(H)-2021(A)

Table 34: Latin America Rigid Paper Container Market Forecast Value (US$ Mn), By Board Type 2022(E)-2026(F)

Table 35: Latin America Rigid Paper Container Market Historic Volume (Units), By Board Type 2013(H)-2021(A)

Table 36: Latin America Rigid Paper Container Market Forecast Volume (Units), By Board Type 2022(E)-2026(F)

Table 37: Latin America Rigid Paper Container Market Historic Value (US$ Mn), By Product Type 2013(H)-2021(A)

Table 38: Latin America Rigid Paper Container Market Forecast Value (US$ Mn), By Product Type 2022(E)-2026(F)

Table 39: Latin America Rigid Paper Container Market Historic Volume (Units), By Product Type 2013(H)-2021(A)

Table 40: Latin America Rigid Paper Container Market Forecast Volume (Units), By Product Type 2022(E)-2026(F)

Table 41: Latin America Rigid Paper Container Market Historic Value (US$ Mn), By End Use 2013(H)-2021(A)

Table 42: Latin America Rigid Paper Container Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 43: Latin America Rigid Paper Container Market Historic Volume (Units), By End Use 2013(H)-2021(A)

Table 44: Latin America Rigid Paper Container Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 45: Latin America Rigid Paper Container Market Historic Value (US$ Mn), By Country 2013(H)-2021(A)

Table 46: Latin America Rigid Paper Container Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 47: Latin America Rigid Paper Container Market Historic Volume (Units), By Country 2013(H)-2021(A)

Table 48: Latin America Rigid Paper Container Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 49: Europe Rigid Paper Container Market Historic Value (US$ Mn), By Board Type 2013(H)-2021(A)

Table 50: Europe Rigid Paper Container Market Forecast Value (US$ Mn), By Board Type 2022(E)-2026(F)

Table 51: Europe Rigid Paper Container Market Historic Volume (Units), By Board Type 2013(H)-2021(A)

Table 52: Europe Rigid Paper Container Market Forecast Volume (Units), By Board Type 2022(E)-2026(F)

Table 53: Europe Rigid Paper Container Market Historic Value (US$ Mn), By Product Type 2013(H)-2021(A)

Table 54: Europe Rigid Paper Container Market Forecast Value (US$ Mn), By Product Type 2022(E)-2026(F)

Table 55: Europe Rigid Paper Container Market Historic Volume (Units), By Product Type 2013(H)-2021(A)

Table 56: Europe Rigid Paper Container Market Forecast Volume (Units), By Product Type 2022(E)-2026(F)

Table 57: Europe Rigid Paper Container Market Historic Value (US$ Mn), By End Use 2013(H)-2021(A)

Table 58: Europe Rigid Paper Container Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 59: Europe Rigid Paper Container Market Historic Volume (Units), By End Use 2013(H)-2021(A)

Table 60: Europe Rigid Paper Container Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 61: Europe Rigid Paper Container Market Historic Value (US$ Mn), By Country 2013(H)-2021(A)

Table 62: Europe Rigid Paper Container Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 63: Europe Rigid Paper Container Market Historic Volume (Units), By Country 2013(H)-2021(A)

Table 64: Europe Rigid Paper Container Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 65: Asia Pacific Rigid Paper Container Market Historic Value (US$ Mn), By Board Type 2013(H)-2021(A)

Table 66: Asia Pacific Rigid Paper Container Market Forecast Value (US$ Mn), By Board Type 2022(E)-2026(F)

Table 67: Asia Pacific Rigid Paper Container Market Historic Volume (Units), By Board Type 2013(H)-2021(A)

Table 68: Asia Pacific Rigid Paper Container Market Forecast Volume (Units), By Board Type 2022(E)-2026(F)

Table 69: Asia Pacific Rigid Paper Container Market Historic Value (US$ Mn), By Product Type 2013(H)-2021(A)

Table 70: Asia Pacific Rigid Paper Container Market Forecast Value (US$ Mn), By Product Type 2022(E)-2026(F)

Table 71: Asia Pacific Rigid Paper Container Market Historic Volume (Units), By Product Type 2013(H)-2021(A)

Table 72: Asia Pacific Rigid Paper Container Market Forecast Volume (Units), By Product Type 2022(E)-2026(F)

Table 73: Asia Pacific Rigid Paper Container Market Historic Value (US$ Mn), By End Use 2013(H)-2021(A)

Table 74: Asia Pacific Rigid Paper Container Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 75: Asia Pacific Rigid Paper Container Market Historic Volume (Units), By End Use 2013(H)-2021(A)

Table 76: Asia Pacific Rigid Paper Container Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 77: Asia Pacific Rigid Paper Container Market Historic Value (US$ Mn), By Country 2013(H)-2021(A)

Table 78: Asia Pacific Rigid Paper Container Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 79: Asia Pacific Rigid Paper Container Market Historic Volume (Units), By Country 2013(H)-2021(A)

Table 80: Asia Pacific Rigid Paper Container Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 81: MEA Rigid Paper Container Market Historic Value (US$ Mn), By Board Type 2013(H)-2021(A)

Table 82: MEA Rigid Paper Container Market Forecast Value (US$ Mn), By Board Type 2022(E)-2026(F)

Table 83: MEA Rigid Paper Container Market Historic Volume (Units), By Board Type 2013(H)-2021(A)

Table 84: MEA Rigid Paper Container Market Forecast Volume (Units), By Board Type 2022(E)-2026(F)

Table 85: MEA Rigid Paper Container Market Historic Value (US$ Mn), By Product Type 2013(H)-2021(A)

Table 86: MEA Rigid Paper Container Market Forecast Value (US$ Mn), By Product Type 2022(E)-2026(F)

Table 87: MEA Rigid Paper Container Market Historic Volume (Units), By Product Type 2013(H)-2021(A)

Table 88: MEA Rigid Paper Container Market Forecast Volume (Units), By Product Type 2022(E)-2026(F)

Table 89: MEA Rigid Paper Container Market Historic Value (US$ Mn), By End Use 2013(H)-2021(A)

Table 90: MEA Rigid Paper Container Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 91: MEA Rigid Paper Container Market Historic Volume (Units), By End Use 2013(H)-2021(A)

Table 92: MEA Rigid Paper Container Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 93: MEA Rigid Paper Container Market Historic Value (US$ Mn), By Country 2013(H)-2021(A)

Table 94: MEA Rigid Paper Container Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 95: MEA Rigid Paper Container Market Historic Volume (Units), By Country 2013(H)-2021(A)

Table 96: MEA Rigid Paper Container Market Forecast Volume (Units), By Country 2022(E)-2026(F)

List of Figures

Figure 01: Global Rigid Paper Container Market Share Analysis by Board Type, 2022E & 2026F

Figure 02: Global Rigid Paper Container Market Attractiveness Analysis by Board Type, 2022E-2026F

Figure 03: Global Rigid Paper Container Market Y-o-Y Analysis by Board Type, 2019H-2026F

Figure 04: Global Rigid Paper Container Market Share Analysis by Product Type, 2022E & 2026F

Figure 05: Global Rigid Paper Container Market Attractiveness Analysis by Product Type, 2022E-2026F

Figure 06: Global Rigid Paper Container Market Y-o-Y Analysis by Product Type, 2019H-2026F

Figure 07: Global Rigid Paper Container Market Share Analysis by End Use, 2022E & 2026F

Figure 08: Global Rigid Paper Container Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 09: Global Rigid Paper Container Market Y-o-Y Analysis by End Use, 2019H-2026F

Figure 10: Global Rigid Paper Container Market Share Analysis by Region, 2022E & 2026F

Figure 11: Global Rigid Paper Container Market Attractiveness Analysis by Region, 2022E-2026F

Figure 12: Global Rigid Paper Container Market Y-o-Y Analysis by Region, 2019H-2026F

Figure 13: North America Rigid Paper Container Market Share Analysis by Board Type, 2022E & 2026F

Figure 14: North America Rigid Paper Container Market Value Share Analysis by Product Type 2022(E)

Figure 15: North America Rigid Paper Container Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 16: North America Rigid Paper Container Market Value Share Analysis by Country 2022(E)

Figure 17: Latin America Rigid Paper Container Market Share Analysis by Board Type, 2022E & 2026F

Figure 18: Latin America Rigid Paper Container Market Value Share Analysis by Product Type 2022(E)

Figure 19: Latin America Rigid Paper Container Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 20: Latin America Rigid Paper Container Market Value Share Analysis by Country 2022(E)

Figure 21: Europe Rigid Paper Container Market Share Analysis by Board Type, 2022E & 2026F

Figure 22: Europe Rigid Paper Container Market Value Share Analysis by Product Type 2022(E)

Figure 23: Europe Rigid Paper Container Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 24: Europe Rigid Paper Container Market Value Share Analysis by Country 2022(E)

Figure 25: Asia Pacific Rigid Paper Container Market Share Analysis by Board Type, 2022E & 2026F

Figure 26: Asia Pacific Rigid Paper Container Market Value Share Analysis by Product Type 2022(E)

Figure 27: Asia Pacific Rigid Paper Container Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 28: Asia Pacific Rigid Paper Container Market Value Share Analysis by Country 2022(E)

Figure 29: MEA Rigid Paper Container Market Share Analysis by Board Type, 2022E & 2026F

Figure 30: MEA Rigid Paper Container Market Value Share Analysis by Product Type 2022(E)

Figure 31: MEA Rigid Paper Container Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 32: MEA Rigid Paper Container Market Value Share Analysis by Country 2022(E)

Figure 33: U.S. Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 34: U.S. Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 35: U.S. Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 36: Canada Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 37: Canada Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 38: Canada Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 39: Brazil Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 40: Brazil Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 41: Brazil Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 42: Mexico Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 43: Mexico Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 44: Mexico Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 45: Germany Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 46: Germany Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 47: Germany Specialty Paper Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 48: Spain Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 49: Spain Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 50: Spain Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 51: France Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 52: France Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 53: France Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 54: U.K. Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 55: U.K. Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 56: U.K. Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 57: Italy Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 58: Italy Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 59: Italy Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 60: Russia Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 61: Russia Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 62: Russia Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 63: China Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 64: China Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 65: China Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 66: India Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 67: India Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 68: India Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 69: Japan Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 70: Japan Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 71: Japan Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 72: GCC Countries Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 73: GCC Countries Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 74: GCC Countries Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 75: South Africa Rigid Paper Container Market Value Share Analysis, by Board Type, 2022E & 2026F

Figure 76: South Africa Rigid Paper Container Market Value Share Analysis, by Product Type, 2022E

Figure 77: South Africa Rigid Paper Container Market Value Share Analysis, by End Use, 2022E & 2026F