The packaging sector has witnessed a considerable evolution over the past decade. Due to growing demand for sustainable packaging solutions to innovative and user-friendly packaging alternatives, the packaging sector is undergoing significant developments. Within the packaging industry, competition is expected to be intense between flexible packaging solutions and rigid packaging solutions. Flexible and rigid packaging are both deployed across an array of industrial domains, including food & beverages, consumer goods, healthcare & pharmaceuticals, and chemicals. Rigid packaging solutions include glass containers, plastic boxes, cans, and cardboards, which are increasingly being used to package food, cosmetics, and personal care products.

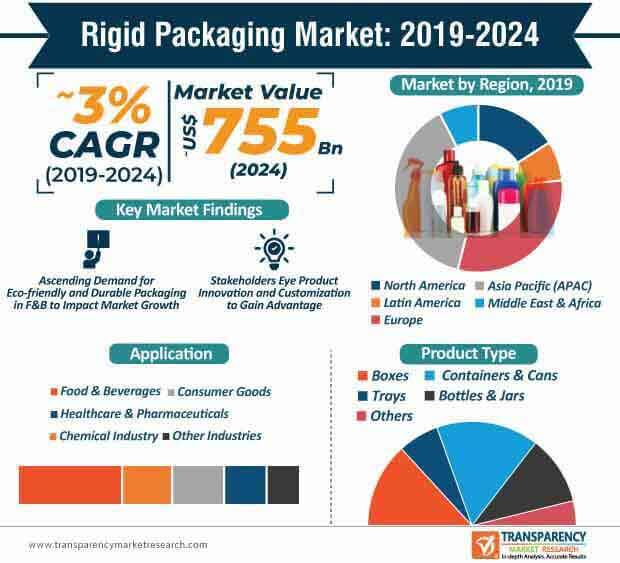

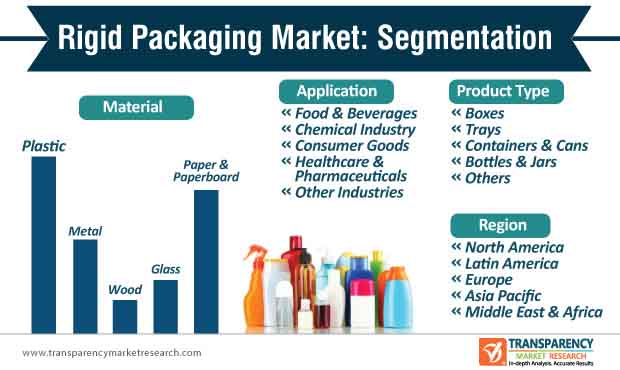

Although rigid packaging alternatives are marginally expensive and heavier than flexible packaging solutions, they offer improved protection from heat and other external factors, including moisture. Stakeholders in the rigid packaging market are increasingly focusing on the development of innovative rigid packaging solutions and product development. Due to the growing concerns over the use of single-use plastic, other grades of plastics are being utilized in the development of rigid plastic solutions. Due to the mounting demand for sustainable and eco-friendly rigid packaging solutions, glass, wood, and metal packaging alternatives are gaining popularity in the global rigid packaging market. The rigid packaging market is expected to reach a value of ~US$ 755 Bn by the end of 2024.

Due to growing consumer interest for flexible packaging solutions, players in the rigid packaging market are likely to focus on two major areas to stay relevant: innovations and customizations. At present, customization is a growing trend within the rigid packaging market and at the current rate, it is likely to remain a pivotal factor that is expected to drive the growth of the market for rigid packaging.

The use of plastic continues to garner significant attention and thus, production of rigid packaging solutions made from other materials has increased in the past few years. The growing popularity of flexible packaging solutions has played an imperative role in persuading players in the rigid packaging market to focus on the production of innovative packaging solutions that not only cater to regulations pertaining to re-usability and recyclability but also adhere to environmental regulations. Some of the other factors that are likely to impact the growth of the rigid packaging market during the forecast period include significant developments in technology, urbanization, and growing adoption of recyclable plastic in a range of end-use industries such as personal care & cosmetics, food & beverages, etc.

Another factor that is anticipated to boost the demand for rigid packaging is the rising awareness related to food safety. Stakeholders in the food & beverages industry are eyeing efficient rigid packaging solutions to address these consumer concerns. Moreover, experts in the packaging domain are of the opinion that rigid packaging solutions will also play an important role in improving food supply and enhancing long-term storage. In their bid to improve their footprint in the current rigid packaging market, stakeholders are expected to tap plethora of opportunities presented by the market in Asia Pacific and Europe.

On the regional front, Europe will remain the second most lucrative market for rigid packaging market after Asia Pacific. The introduction of the ‘Close the Glass Loop’ program by the European glass packaging industry is expected to provide an impetus to recycling rates of glass packaging across the region, and likely to reach around 90% during by 2030. The new EU rules to improve the overall recycling targets for glass packaging will play a key role in the adoption of sustainable and recyclable activities. The program, which is at a nascent stage, is projected to gain substantial traction during the forecast period. The objective of the program is to unite the various stakeholders in the rigid packaging market, particularly dealing with glass packaging solutions to boost the recycling collection rate. In addition, the growing demand for glass rigid packaging solutions is likely to play an imperative role in minimizing the dependency on natural resources for packaging.

Analysts’ Viewpoint

The global rigid packaging market is expected to grow at a CAGR of ~3% during the forecast period. The growth of the market can be attributed to reliance on the adoption of new packaging materials, including glass, metal, and wood. The meteoric demand for sustainable packaging solutions is expected to propel the demand for rigid packaging solutions across a host of end-use industries worldwide. Asia Pacific and Europe are likely to emerge as key regions for the rigid packaging market. Stakeholders in the current market landscape should focus on product development, innovation, and deployment of sustainable materials.

are some of the key players of global rigid packaging market. Among these players, Reynolds Group Holdings Ltd., and Georgia-Pacific LLC hold a maximum market share in the global rigid packaging market. The intensity of competition is estimated to be high in the global rigid packaging market, attributable to the presence of small- and medium-sized manufacturers.

1. Executive Summary

2. Market Introduction

3. Assumption & Acronyms

4. Market Introduction

4.1. Market Definition

4.2. Market Taxonomy

5. Rigid Packaging Market Overview

5.1. Introduction

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

5.3. Market Overview

5.3.1. Value Chain

5.3.2. Profitability Margins

5.3.3. List of Active Participants

5.3.3.1. Raw material Suppliers

5.3.3.2. Converters

5.3.3.3. Manufacturer

5.3.3.4. Distributors

5.4. Rigid Packaging Market and Y-o-Y Growth

5.5. Rigid Packaging Market (US$ Mn) and Forecast

6. Market Dynamics

6.1. Macro-economic Factors

6.2. Drivers

6.2.1. Supply Side

6.2.2. Demand Side

6.3. Restraints

6.4. Opportunity

6.5. Porters Five Force Analysis

7. Global Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024, by Material Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, by Material Type

7.1.2. Y-o-Y Growth Projections, by Material Type

7.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Material Type

7.2.1. Plastic

7.2.2. Glass

7.2.3. Metal

7.2.4. Wood

7.2.5. Paper & Paperboard

7.3. Market Attractiveness Analysis, by Material Type

7.4. Prominent Trends

8. Global Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024, by Product Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, by Product Type

8.1.2. Y-o-Y Growth Projections, by Product Type

8.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type

8.2.1. Boxes

8.2.2. Trays

8.2.3. Containers & Cans

8.2.4. Bottles & Jars

8.2.5. Others

8.3. Market Attractiveness Analysis, by Product Type

8.4. Prominent Trends

9. Global Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024, by Application Type

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, by Application Type

9.1.2. Y-o-Y Growth Projections, by Application Type

9.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type

9.2.1. Food & Beverages

9.2.2. Chemical & Petrochemical industries

9.2.3. Consumer Goods

9.2.4. Healthcare & Pharmaceuticals

9.2.5. Other Industries

9.3. Market Attractiveness Analysis, by Application Type

9.4. Prominent Trends

10. Global Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024, by Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, by Region

10.1.2. Y-o-Y Growth Projections, by Region

10.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East and Africa (MEA)

10.3. Market Attractiveness Analysis, by Region

11. North America Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, by Country

11.1.2. Y-o-Y Growth Projections, by Country

11.1.3. Key Regulations

11.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Country

11.2.1. U.S.

11.2.2. Canada

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast, by Material Type

11.3.1. Plastic

11.3.2. Metal

11.3.3. Glass

11.3.4. Wood

11.3.5. Paper & Paperboard

11.4. Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type

11.4.1. Boxes

11.4.2. Trays

11.4.3. Containers & Cans

11.4.4. Bottles & Jars

11.4.5. Others

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type

11.5.1. Food & Beverages

11.5.2. Chemical & Petrochemical Industry

11.5.3. Consumer Goods

11.5.4. Healthcare & Pharmaceuticals

11.5.5. Other Industries

11.6. Market Attractiveness Analysis

11.6.1. By Country

11.6.2. By Material Type

11.6.3. By Product Type

11.6.4. By Application Type

11.7. Prominent Trends

11.8. Drivers and Restraints: Impact Analysis

12. Latin America Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, by Country

12.1.2. Y-o-Y Growth Projections, by Country

12.1.3. Key Regulations

12.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Country

12.2.1. Brazil

12.2.2. Argentina

12.2.3. Rest of Latin America

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast, by Material Type

12.3.1. Plastic

12.3.2. Metal

12.3.3. Glass

12.3.4. Wood

12.3.5. Paper & Paperboard

12.4. Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type

12.4.1. Boxes

12.4.2. Trays

12.4.3. Containers & Cans

12.4.4. Bottles & Jars

12.4.5. Others

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type

12.5.1. Food & Beverages

12.5.2. Chemical & Petrochemical Industry

12.5.3. Consumer Goods

12.5.4. Healthcare & Pharmaceuticals

12.5.5. Other Industries

12.6. Market Attractiveness Analysis

12.6.1. By Country

12.6.2. By Material Type

12.6.3. By Product Type

12.6.4. By Application Type

12.7. Prominent Trends

12.8. Drivers and Restraints: Impact Analysis

13. Europe Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, by Country

13.1.2. Y-o-Y Growth Projections, by Country

13.1.3. Key Regulations

13.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Country

13.2.1. Germany

13.2.2. Spain

13.2.3. Italy

13.2.4. France

13.2.5. U.K.

13.2.6. Rest of Europe

13.3. Market Size (US$ Mn) and Volume (Tons) Forecast, by Material Type

13.3.1. Plastic

13.3.2. Metal

13.3.3. Glass

13.3.4. Wood

13.3.5. Paper & Paperboard

13.4. Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type

13.4.1. Boxes

13.4.2. Trays

13.4.3. Containers & Cans

13.4.4. Bottles & Jars

13.4.5. Others

13.5. Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type

13.5.1. Food & Beverages

13.5.2. Chemical & Petrochemical Industry

13.5.3. Consumer Goods

13.5.4. Healthcare & Pharmaceuticals

13.5.5. Other Industries

13.6. Market Attractiveness Analysis

13.6.1. By Country

13.6.2. By Material Type

13.6.3. By Product Type

13.6.4. By Application Type

13.7. Prominent Trends

13.8. Drivers and Restraints: Impact Analysis

14. Asia Pacific Rigid Packaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, by Country

14.1.2. Y-o-Y Growth Projections, by Country

14.1.3. Key Regulations

14.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Country

14.2.1. China

14.2.2. India

14.2.3. Korea

14.2.4. Japan

14.2.5. ASEAN

14.2.6. Rest of APAC

14.3. Market Size (US$ Mn) and Volume (Tons) Forecast, by Material Type

14.3.1. Plastic

14.3.2. Metal

14.3.3. Glass

14.3.4. Wood

14.3.5. Paper & Paperboard

14.4. Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type

14.4.1. Boxes

14.4.2. Trays

14.4.3. Containers & Cans

14.4.4. Bottles & Jars

14.4.5. Others

14.5. Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type

14.5.1. Food & Beverages

14.5.2. Chemical & Petrochemical Industry

14.5.3. Consumer Goods

14.5.4. Healthcare & Pharmaceuticals

14.5.5. Other Industries

14.6. Market Attractiveness Analysis

14.6.1. By Country

14.6.2. By Material Type

14.6.3. By Product Type

14.6.4. By Application Type

14.7. Prominent Trends

14.8. Drivers and Restraints: Impact Analysis

15. Middle East and Africa Rigid Packaging Market Analysis Historic 2014-2018 and Forecast 2019-2024

16. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis, by Country

16.1.2. Y-o-Y Growth Projections, by Country

16.1.3. Key Regulations

16.2. Market Size (US$ Mn) and Volume (Tons) Forecast, by Country

16.2.1. South Africa

16.2.2. GCC countries

16.2.3. Rest of MEA

16.3. Market Size (US$ Mn) and Volume (Tons) Forecast, by Material Type

16.3.1. Plastic

16.3.2. Metal

16.3.3. Glass

16.3.4. Wood

16.3.5. Paper & Paperboard

16.4. Market Size (US$ Mn) and Volume (Tons) Forecast, by Product Type

16.4.1. Boxes

16.4.2. Trays

16.4.3. Containers & Cans

16.4.4. Bottles & Jars

16.4.5. Others

16.5. Market Size (US$ Mn) and Volume (Tons) Forecast, by Application Type

16.5.1. Food & Beverages

16.5.2. Chemical & Petrochemical Industry

16.5.3. Consumer Goods

16.5.4. Healthcare & Pharmaceuticals

16.5.5. Other Industries

16.6. Market Attractiveness Analysis

16.6.1. By Country

16.6.2. By Material Type

16.6.3. By Product Type

16.6.4. By Application Type

16.7. Prominent Trends

16.8. Drivers and Restraints: Impact Analysis

17. Competitive Landscape

17.1. Competition Dashboard

17.2. Company Market Share Analysis

17.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.3.1. Amcor Limited

17.3.1.1. Overview

17.3.1.2. Financials

17.3.1.3. Recent Developments

17.3.1.4. SWOT Analysis

17.3.1.5. Strategy

17.3.2. Sealed Air Corp.

17.3.2.1. Overview

17.3.2.2. Financials

17.3.2.3. Recent Developments

17.3.2.4. SWOT Analysis

17.3.2.5. Strategy

17.3.3. Resilux NV

17.3.3.1. Overview

17.3.3.2. Financials

17.3.3.3. Recent Developments

17.3.3.4. SWOT Analysis

17.3.3.5. Strategy

17.3.4. Bemis Company, Inc.

17.3.4.1. Overview

17.3.4.2. Financials

17.3.4.3. Recent Developments

17.3.4.4. SWOT Analysis

17.3.4.5. Strategy

17.3.5. Berry Plastic Group, Inc.

17.3.5.1. Overview

17.3.5.2. Financials

17.3.5.3. Recent Developments

17.3.5.4. SWOT Analysis

17.3.5.5. Strategy

17.3.6. Reynolds Group Holdings Ltd.

17.3.6.1. Overview

17.3.6.2. Financials

17.3.6.3. Recent Developments

17.3.6.4. SWOT Analysis

17.3.6.5. Strategy

17.3.7. Georgia-Pacific LLC

17.3.7.1. Overview

17.3.7.2. Financials

17.3.7.3. Recent Developments

17.3.7.4. SWOT Analysis

17.3.7.5. Strategy

17.3.8. DS Smith Packaging Limited

17.3.8.1. Overview

17.3.8.2. Financials

17.3.8.3. Recent Developments

17.3.8.4. SWOT Analysis

17.3.8.5. Strategy

17.3.9. Holmen AB ADR

17.3.9.1. Overview

17.3.9.2. Financials

17.3.9.3. Recent Developments

17.3.9.4. SWOT Analysis

17.3.9.5. Strategy

17.3.10. Mondi Group

17.3.10.1. Overview

17.3.10.2. Financials

17.3.10.3. Recent Developments

17.3.10.4. SWOT Analysis

17.3.10.5. Strategy

List of Tables

Table 01: Global Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Material Type, 2014-2024

Table 02: Global Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Product Type, 2014-2024

Table 03: Global Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Application, 2014-2024

Table 04: Global Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Region, 2014-2024

Table 05: North America Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Material Type, 2014-2024

Table 06: North America Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Product Type, 2014-2024

Table 07: North America Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Application, 2014-2024

Table 08: Latin America Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Material Type, 2014-2024

Table 09: Latin America Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Product Type, 2014-2024

Table 10: Latin America Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Application, 2014-2024

Table 11: Europe Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Material Type, 2014-2024

Table 12: Europe Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Product Type, 2014-2024

Table 13: Europe Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Application, 2014-2024

Table 14: APAC Rigid Packaging Market Size (US$ Bn) and Volume (Mn MT) by Material Type, 2014-2024

List of Figures

Figure 01: Global Rigid Packaging Market Value (US$ Bn) and Volume (Mn MT), 2018-2024

Figure 02: Global Rigid Packaging Market Absolute $ Opportunity (US$ Bn), 2018-2024

Figure 03: Global Rigid Packaging Market Value Share by Material Type, 2018

Figure 05: Global Rigid Packaging Market Value Share by Product Type, 2018

Figure 04: Global Rigid Packaging Market Value Share by Application, 2018

Figure 06: Global Rigid Packaging Market Value Share by Region, 2018

Figure 07: Global Rigid Packaging Market Share & BPS Analysis by Material Type, 2019 & 2024

Figure 08: Global Rigid Packaging Market Revenue Y-o-Y Growth by Material Type, 2018-2024

Figure 09: Global Rigid Packaging Market Value (US$ Bn) by Material Type, 2018-2024

Figure 10: Global Rigid Packaging Market Volume (Mn MT) by Material Type, 2018-2024

Figure 11: Global Rigid Packaging Market Absolute $ Opportunity by Plastic, 2018–2024

Figure 12: Global Rigid Packaging Market Absolute $ Opportunity by Metal, 2018–2024

Figure 13: Global Rigid Packaging Market Absolute $ Opportunity by wood, 2018–2024

Figure 14: Global Rigid Packaging Market Absolute $ Opportunity by Glass, 2018–2024

Figure 15: Global Rigid Packaging Market Absolute $ Opportunity by Paper & Paperboard, 2018–2024

Figure 16: Global Rigid Packaging Market Attractiveness by Material Type, 2018–2024

Figure 17: Global Rigid Packaging Market Share & BPS Analysis by Product Type, 2019 & 2024

Figure 18: Global Rigid Packaging Market Revenue Y-o-Y Growth by Product Type, 2018-2024

Figure 19: Global Rigid Packaging Market Value (US$ Bn) by Product Type, 2018-2024

Figure 20: Global Rigid Packaging Market Volume (Mn MT) by Product Type, 2018-2024

Figure 21: Global Rigid Packaging Market Absolute $ Opportunity by Boxes Segment, 2018–2024

Figure 22: Global Rigid Packaging Market Absolute $ Opportunity by Trays Segment, 2018–2024

Figure 23: Global Rigid Packaging Market Absolute $ Opportunity by Containers & Cans Segment, 2018–2024

Figure 24: Global Rigid Packaging Market Absolute $ Opportunity by Bottles & Jars Segment, 2018–2024

Figure 25: Global Rigid Packaging Market Absolute $ Opportunity by Others Segment, 2018–2024

Figure 26: Global Rigid Packaging Market Attractiveness by Product Type, 2018–2024

Figure 27: Global Rigid Packaging Market, BPS Analysis by Application, 2019 & 2024

Figure 28: Global Rigid Packaging Market Revenue Y-o-Y Growth by Application, 2018-2024

Figure 29: Global Rigid Packaging Market Value (US$ Bn) by Application, 2018-2024

Figure 30: Global Rigid Packaging Market Volume (Mn MT) by Application, 2018-2024

Figure 31: Global Rigid Packaging Market Absolute $ Opportunity by Food & Beverages 2018–2024

Figure 32: Global Rigid Packaging Market Absolute $ Opportunity by Chemical & Petrochemical Industry Segment, 2018–2024

Figure 33: Global Rigid Packaging Market Absolute $ Opportunity by Consumer Goods Segment, 2018–2024

Figure 34: Global Rigid Packaging Market Absolute $ Opportunity by Healthcare & Pharmaceuticals Segment, 2018–2024

Figure 35: Other Industries Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 36: Global Rigid Packaging Market Attractiveness by Application, 2018–2024

Figure 37: Global Rigid Packaging Market Share & BPS Analysis by Region, 2019 & 2024

Figure 38: Global Rigid Packaging Market Revenue Y-o-Y Growth by Region, 2018-2024

Figure 39: Global Rigid Packaging Market Attractiveness by Region, 2018–2024

Figure 40: North America Rigid Packaging Market Value (US$ Bn) and Volume (Mn MT), 2018-2024

Figure 41: North America Rigid Packaging Market Absolute $ Opportunity (US$ Bn), 2018-2024

Figure 42: U.S. Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 43: Canada Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 44: North America Rigid Packaging Market Share & BPS Analysis, by Material Type, 2019 & 2024

Figure 45: North America Rigid Packaging Market Y-o-Y Growth Rate, by Material Type, 2018-2024

Figure 46: North America Rigid Packaging Market Attractiveness Analysis by Material Type, 2018–2024

Figure 47: North America Rigid Packaging Market Share & BPS Analysis, by Product Type, 2019 & 2024

Figure 48: North America Rigid Packaging Market Y-o-Y Growth Rate, by Product Type, 2018-2024

Figure 49: North America Rigid Packaging Market Attractiveness Analysis by Product Type, 2018–2024

Figure 50: North America Rigid Packaging Market Share & BPS Analysis, by Application Type, 2019 & 2024

Figure 51: North America Rigid Packaging Market Y-o-Y Growth Rate, by Application Type, 2018-2024

Figure 52: North America Rigid Packaging Market Attractiveness Analysis by Application Type, 2018–2024

Figure 53: Latin America Rigid Packaging Market Value (US$ Bn) and Volume (Mn MT), 2018-2024

Figure 54: Latin America Rigid Packaging Market Absolute $ Opportunity (US$ Bn), 2018-2024

Figure 55: Brazil Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 56: Argentina Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 57: Rest of the Latin America Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 58: Latin America Rigid Packaging Market Share & BPS Analysis, by Material Type, 2019 & 2024

Figure 59: Latin America Rigid Packaging Market Y-o-Y Growth Rate, by Material Type, 2018-2024

Figure 60: Latin America Rigid Packaging Market Attractiveness Analysis by Material Type, 2018–2024

Figure 61: Latin America Rigid Packaging Market Share & BPS Analysis, by Product Type, 2019 & 2024

Figure 62: Latin America Rigid Packaging Market Y-o-Y Growth Rate, by Product Type, 2018-2024

Figure 63: Latin America Rigid Packaging Market Attractiveness Analysis by Product Type, 2018–2024

Figure 64: Latin America Rigid Packaging Market Share & BPS Analysis, by Application Type, 2019 & 2024

Figure 65: Latin America Rigid Packaging Market Y-o-Y Growth Rate, by Application Type, 2018-2024

Figure 66: Latin America Rigid Packaging Market Attractiveness Analysis by Application Type, 2018–2024

Figure 67: Europe Rigid Packaging Market Value (US$ Bn) and Volume (Mn MT), 2018-2024

Figure 68: Europe Rigid Packaging Market Absolute $ Opportunity (US$ Bn), 2018-2024

Figure 69: Germany Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 70: France Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 71: U.K. Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 72: Spain Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 73: Italy Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 74: Rest of Europe Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 75: Europe Rigid Packaging Market Share & BPS Analysis, by Material Type, 2019 & 2024

Figure 76: Europe Rigid Packaging Market Y-o-Y Growth Rate, by Material Type, 2018-2024

Figure 77: Europe Rigid Packaging Market Attractiveness Analysis by Material Type, 2018–2024

Figure 78: Europe Rigid Packaging Market Share & BPS Analysis, by Product Type, 2019 & 2024

Figure 79: Europe Rigid Packaging Market Y-o-Y Growth Rate, by Product Type, 2018-2024

Figure 80: Europe Rigid Packaging Market Attractiveness Analysis by Product Type, 2018–2024

Figure 81: Europe Rigid Packaging Market Share & BPS Analysis, by Application Type, 2019 & 2024

Figure 82: Europe Rigid Packaging Market Y-o-Y Growth Rate, by Application Type, 2018-2024

Figure 83: Europe Rigid Packaging Market Attractiveness Analysis by Application Type, 2018–2024

Figure 84: APAC Rigid Packaging Market Value (US$ Bn) and Volume (Mn MT), 2018-2024

Figure 85: APAC Rigid Packaging Market Absolute $ Opportunity (US$ Bn), 2018-2024

Figure 86: China Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 87: India Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 88: South Korea Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 89: Japan Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 90: ASEAN Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 91: Rest of APAC Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 92: APAC Rigid Packaging Market Share & BPS Analysis, by Material Type, 2019 & 2024

Figure 93: APAC Rigid Packaging Market Y-o-Y Growth Rate, by Material Type, 2018-2024

Figure 94: APAC Rigid Packaging Market Attractiveness Analysis by Material Type, 2018–2024

Figure 95: APAC Rigid Packaging Market Share & BPS Analysis, by Product Type, 2019 & 2024

Figure 96: APAC Rigid Packaging Market Y-o-Y Growth Rate, by Product Type, 2018-2024

Figure 97: APAC Rigid Packaging Market Attractiveness Analysis by Product Type, 2018–2024

Figure 98: APAC Rigid Packaging Market Share & BPS Analysis, by Application Type, 2019 & 2024

Figure 99: APAC Rigid Packaging Market Y-o-Y Growth Rate, by Application Type, 2018-2024

Figure 100: APAC Rigid Packaging Market Attractiveness Analysis by Application Type, 2018–2024

Figure 101: MEA Rigid Packaging Market Value (US$ Bn) and Volume (Mn MT), 2018-2024

Figure 102: MEA Rigid Packaging Market Absolute $ Opportunity (US$ Bn), 2018-2024

Figure 103: GCC Countries Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 104: South Africa Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 105: Rest of MEA Rigid Packaging Market Absolute $ Opportunity, 2018-2024

Figure 106: MEA Rigid Packaging Market Share & BPS Analysis, by Material Type, 2019 & 2024

Figure 107: MEA Rigid Packaging Market Y-o-Y Growth Rate, by Material Type, 2018-2024

Figure 108: MEA Rigid Packaging Market Attractiveness Analysis by Product Type, 2018–2024

Figure 109: MEA Rigid Packaging Market Share & BPS Analysis, by Product Type, 2019 & 2024

Figure 110: MEA Rigid Packaging Market Y-o-Y Growth Rate, by Product Type, 2018-2024

Figure 111: MEA Rigid Packaging Market Attractiveness Analysis by Product Type, 2018–2024

Figure 112: MEA Rigid Packaging Market Share & BPS Analysis, by Application Type, 2019 & 2024

Figure 113: MEA Rigid Packaging Market Y-o-Y Growth Rate, by Application Type, 2018-2024

Figure 114: MEA Rigid Packaging Market Attractiveness Analysis by Application Type, 2018–2024