Analyst Viewpoint

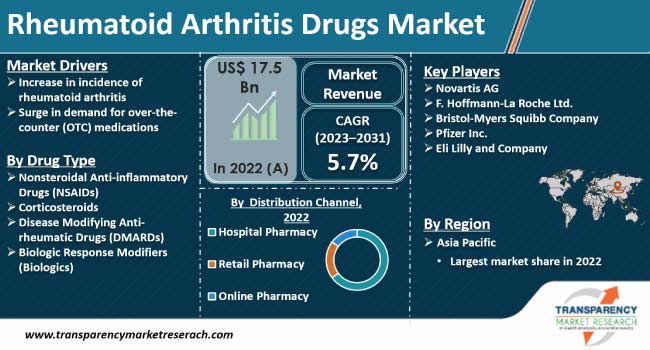

Increase in incidence of rheumatoid arthritis and surge in demand for over-the-counter (OTC) medications are expected to propel the rheumatoid arthritis drugs market size during the forecast period. Rise in initiatives of various health organizations to create awareness regarding rheumatoid arthritis and growth in need for early treatment are also boosting demand for rheumatoid arthritis medications.

Rise in geriatric population is likely to offer lucrative opportunities to vendors in the global rheumatoid arthritis drugs industry. Healthcare professionals are recommending the intake of over-the-counter (OTC) medications for the treatment of rheumatoid arthritis. Vendors are investing in precision medicine in rheumatoid arthritis treatment to expand their customer base. They are also tapping into new regions to increase their rheumatoid arthritis drugs market share.

Rheumatoid arthritis adversely affects the joints of the hands, wrists, knees, and ankles. It is a systemic disease as it ends up affecting the cardiac and respiratory systems. The symptoms constitute redness, warmth, and swelling of affected areas. Rheumatoid arthritis drugs are capable of enhancing mobility and prognosis. According to a study published by Rheumatology International entitled ‘The Global Prevalence of Rheumatoid Arthritis; a meta-analysis based on a systematic review’ in November 2020, the global prevalence of rheumatoid arthritis was close to 0.9%. Thus, rise in prevalence of rheumatoid arthritis is expected to spur the rheumatoid arthritis drugs market growth during the forecast period.

According to a study published in Frontiers in Immunology entitled ‘Promising Therapeutic Targets for Treatment of Rheumatoid Arthritis’ in July 2021, nonsteroidal anti-inflammatory drugs (NSAIDs) inclusive of acetylsalicylate, ibuprofen, naproxen, and etodolac are used for alleviating pain, inflammation, and swelling. They are used as the very first line of treatment. R&D in anti-rheumatic drugs (DMARDs), corticosteroids, and biologic drugs is estimated to propel the rheumatoid arthritis drugs market value in the near future.

According to the World Health Organization (WHO), in 2019, 18 million people worldwide suffered from rheumatoid arthritis; out of which 13 million experienced it in severe form. Various health organizations, including the WHO, are taking measures to extend access to rheumatoid arthritis treatment. The WHO has made rehabilitation one of its top priorities through the Rehabilitation 2030 initiative. Such initiatives are projected to contribute to the rheumatoid arthritis drugs market progress during the forecast period.

According to the American College of Rheumatology and the Arthritis Foundation (ACR/AF), NSAIDs are amongst the effective OTC remedies to manage pain related to osteoarthritis (OA). Some of them include ibuprofen (Motrin) tablets for every type of OA, creams, and ointments that contain NSAIDs for OA of the hand and knee. The other NSAIDs approved by the American Academy of Orthopedic Surgeons (AAOS) are naproxen (Aleve), aspirin, and nabumetone (Refalen).

NSAIDs help in limiting the production of prostaglandins (responsible for causing inflammation and pain in the body). Elderly patients prefer OTC medications over surgeries to avert probable complications post-surgeries. The WHO recommends the reorientation of healthcare systems to promote healthy aging. The Integrated Care for Older People (ICOPE) approach helps in the promotion of person-centered assessment of older persons for designing long-term care interventions. Thus, increase in demand for OTC medications is fueling the rheumatoid arthritis drugs market development.

According to the latest rheumatoid arthritis drugs market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Rise in geriatric population is fueling the market dynamics of the region. According to the Asian Development Bank, by 2050, one in four people in Asia Pacific is expected to be over 60 years old. The population of older persons (aged over 60) in the region is projected to triple between 2010 and 2050, reaching close to 1.3 billion people.

Surge in adoption of monoclonal antibodies and high prevalence of rheumatoid arthritis are propelling the rheumatoid arthritis drugs market statistics in North America. According to the CDC, more than 58 million people in the U.S. suffer from arthritis. As per the Government of Canada, as of September 2020, close to 374,000 people in Canada aged 16 and above suffered from rheumatoid arthritis. The industry in Europe is driven by increase in adoption of biosimilars. According to a survey in 2020, 92% of the EU clinicians prescribed biosimilars to close to 25% of patients suffering from rheumatoid arthritis.

Most rheumatoid arthritis drug manufacturers are investing in the R&D of new drugs to expand their product portfolio. AbbVie Inc., Johnson & Johnson Innovative Medicine, Amgen Inc., Pfizer Inc., Novartis AG, Sanofi S.A., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Bristol-Myers Squibb Company, and Eli Lilly and Company are key players operating in this market.

These companies have been profiled in the global market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 17.5 Bn |

| Market Forecast Value in 2031 | US$ 29.3 Bn |

| Growth Rate (CAGR) | 5.7% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 17.5 Bn in 2022

It is projected to grow at a CAGR of 5.7% from 2023 to 2031

Increase in incidence of rheumatoid arthritis and surge in demand for over-the-counter (OTC) medications

The hospital pharmacy segment held the largest share in 2022

Asia Pacific is estimated to dominate during the forecast period

AbbVie Inc., Johnson & Johnson Innovative Medicine, Amgen Inc., Pfizer Inc., Novartis AG, Sanofi S.A., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Bristol-Myers Squibb Company, and Eli Lilly and Company

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Rheumatoid Arthritis Drugs Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Rheumatoid Arthritis Drugs Market Analysis and Forecast, 2022-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Progression in Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Rheumatoid Arthritis Drugs Market Analysis and Forecast, by Drug Type

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Type, 2023–2031

6.3.1. Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

6.3.2. Corticosteroids

6.3.3. Disease Modifying Anti-rheumatic Drugs (DMARDs)

6.3.4. Biologic Response Modifiers (Biologics)

6.4. Market Attractiveness, by Drug Type

7. Global Rheumatoid Arthritis Drugs Market Analysis and Forecast, by Distribution Channel

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2023–2031

7.3.1. Hospital Pharmacy

7.3.2. Retail Pharmacy

7.3.3. Online Pharmacy

7.4. Market Attractiveness, by Distribution Channel

8. Global Rheumatoid Arthritis Drugs Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Rheumatoid Arthritis Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Drug Type, 2022–2031

9.2.1. Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

9.2.2. Corticosteroids

9.2.3. Disease Modifying Anti-rheumatic Drugs (DMARDs)

9.2.4. Biologic Response Modifiers (Biologics)

9.3. Market Value Forecast, by Distribution Channel, 2022–2031

9.3.1. Hospital Pharmacy

9.3.2. Retail Pharmacy

9.3.3. Online Pharmacy

9.4. Market Value Forecast, by Country, 2022–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Drug Type

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Rheumatoid Arthritis Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Type, 2022–2031

10.2.1. Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

10.2.2. Corticosteroids

10.2.3. Disease Modifying Anti-rheumatic Drugs (DMARDs)

10.2.4. Biologic Response Modifiers (Biologics)

10.3. Market Value Forecast, by Distribution Channel, 2022–2031

10.3.1. Hospital Pharmacy

10.3.2. Retail Pharmacy

10.3.3. Online Pharmacy

10.4. Market Value Forecast, by Country/Sub-region, 2022–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Drug Type

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Rheumatoid Arthritis Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Type, 2022–2031

11.2.1. Polycarbonate (PC) Compound

11.2.2. Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

11.2.3. Corticosteroids

11.2.4. Disease Modifying Anti-rheumatic Drugs (DMARDs)

11.2.5. Biologic Response Modifiers (Biologics)

11.3. Market Value Forecast, by Distribution Channel, 2022–2031

11.3.1. Hospital Pharmacy

11.3.2. Retail Pharmacy

11.3.3. Online Pharmacy

11.4. Market Value Forecast, by Country/Sub-region, 2022–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Drug Type

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Rheumatoid Arthritis Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Type, 2022–2031

12.2.1. Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

12.2.2. Corticosteroids

12.2.3. Disease Modifying Anti-rheumatic Drugs (DMARDs)

12.2.4. Biologic Response Modifiers (Biologics)

12.3. Market Value Forecast, by Distribution Channel, 2022–2031

12.3.1. Hospital Pharmacy

12.3.2. Retail Pharmacy

12.3.3. Online Pharmacy

12.4. Market Value Forecast, by Country/Sub-region, 2022–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Drug Type

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Rheumatoid Arthritis Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Type, 2022–2031

13.2.1. Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

13.2.2. Corticosteroids

13.2.3. Disease Modifying Anti-rheumatic Drugs (DMARDs)

13.2.4. Biologic Response Modifiers (Biologics)

13.3. Market Value Forecast, by Distribution Channel, 2022–2031

13.3.1. Hospital Pharmacy

13.3.2. Retail Pharmacy

13.3.3. Online Pharmacy

13.4. Market Value Forecast, by Country/Sub-region, 2022–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Drug Type

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. AbbVie Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Johnson & Johnson Innovative Medicine

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Amgen Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Pfizer Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Novartis AG

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Sanofi S.A.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. F. Hoffmann-La Roche Ltd.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Merck & Co., Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Bristol-Myers Squibb Company

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Eli Lilly and Company

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 1: Global Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2023–2031

Table 2: Global Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2023–2031

Table 3: Global Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 4: North America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 5: North America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2023–2031

Table 6: North America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2023–2031

Table 7: Europe Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 8: Europe Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2023–2031

Table 9: Europe Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Distribution Channel 2023–2031

Table 10: Asia Pacific Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 11: Asia Pacific Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2023–2031

Table 12: Asia Pacific Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2023–2031

Table 13: Latin America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Latin America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2023–2031

Table 15: Latin America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Distribution Channel 2023–2031

Table 16: Middle East & Africa Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Middle East & Africa Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2023–2031

Table 18: Middle East & Africa Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, by Distribution Channel 2023–2031

List of Figures

Figure 1: Global Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 2: Global Rheumatoid Arthritis Drugs Market Value Share, by Drug Type, 2022

Figure 3: Global Rheumatoid Arthritis Drugs Market Value Share, by Distribution Channel, 2022

Figure 4: Global Rheumatoid Arthritis Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 5: Global Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 6: Global Rheumatoid Arthritis Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 7: Global Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 8: Global Rheumatoid Arthritis Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 9: Global Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 11: North America Rheumatoid Arthritis Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 13: North America Rheumatoid Arthritis Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 14: North America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 15: North America Rheumatoid Arthritis Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 16: North America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 17: Europe Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 18: Europe Rheumatoid Arthritis Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 20: Europe Rheumatoid Arthritis Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 21: Europe America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 22: Europe Rheumatoid Arthritis Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 23: Europe Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 24: Asia Pacific Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 25: Asia Pacific Rheumatoid Arthritis Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific Rheumatoid Arthritis Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 28: Asia Pacific America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 29: Asia Pacific Rheumatoid Arthritis Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 30: Asia Pacific Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 31: Latin America Rheumatoid Arthritis Drugs Market Value (US$ Bn) Forecast, 2023–2031

Figure 32: Latin America Rheumatoid Arthritis Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Latin America Rheumatoid Arthritis Drugs Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 35: Latin America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 36: Middle East & Africa Rheumatoid Arthritis Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Middle East & Africa Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Middle East & Africa America Rheumatoid Arthritis Drugs Market Value Share Analysis, by Drug Type, 2023–2031

Figure 39: Middle East & Africa America Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Drug Type, 2023–2031

Figure 40: Middle East & Africa Rheumatoid Arthritis Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 41: Middle East & Africa Rheumatoid Arthritis Drugs Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 42: Global Rheumatoid Arthritis Drugs Market Share Analysis, by Company (2022)