Analysts’ Viewpoint on Retractable Needles Market Scenario

The COVID-19 pandemic is compelling health care stakeholders to invest in high-quality products, such as retractable needles for injections, to improve patient outcomes. Retractable needles are cost-effective. The World Health Organization (WHO) is campaigning in many countries to promote the usage of auto-disable syringes, as they help reduce the spread of infection and diseases. Increase in needlestick injuries is boosting the demand for retractable needles. Significant opportunities exist for stakeholders in the retractable needles market due to the increase in concerns about needlestick injuries among health care professionals.

Retractable needles are available in a variety of sizes (0.5, 1, 3, 5, and 10mL), needle gauges, and needle lengths. The needle is automatically retracted directly from the patient into the barrel of the syringe when the plunger handle is fully depressed. Pre-removal and automated retraction virtually eliminate exposure to the contaminated needle, thus effectively reducing the risk of a needlestick injury.

Retractable needle syringes are easy to use and enable single-handed activation. After activation, these syringes require less disposal space than most other safety needles/syringes. Hence, they prevent disposal-related needlestick injuries. Retractable safety needle has a sheath of protection over it. The needle retracts into the barrel-shaped protection to protect the health care professional along with the patient from accidental needlestick injuries. Conventional needles tend to increase the risk of diseases. Thus, demand for retractable needles is expected to rise significantly in the near future. Retractable butterfly needles are uniquely designed to reduce the risk of bloodstream infections arising from catheter hub contamination. They protect the patient and clinician; and are available in various sizes.

Incidence of chronic diseases and conditions is increasing across the globe. Aging population is contributing to a steady rise in long-term health issues. These trends are anticipated to drive the adoption of retractable needles throughout the assessment tenure.

As per the American Diabetes Association, around 30.3 million people in the U.S., i.e. 9.4% of the total population, had diabetes in 2015. According to the World Health Organization (WHO), approximately 8.8 million people suffered from cancer worldwide in 2015. Approximately, 70% of total cancer deaths are recorded in low and middle-income economies.

Rise in number of patients suffering from cancer and circulatory diseases is a key factor boosting the global retractable needles market. As per the WHO, cancer, heart disease, and other chronic conditions account for around 24 million deaths in the world. The number of cancer cases is expected to double in most countries over the next 25 years. This is likely to propel the global retractable needles market.

Growth in cases of chronic diseases has also created awareness about the risks associated with retractable needles. Hence, med-tech companies are diversifying their production of prefilled syringes. Increase in adoption of prefilled syringes across the globe is fueling the global market.

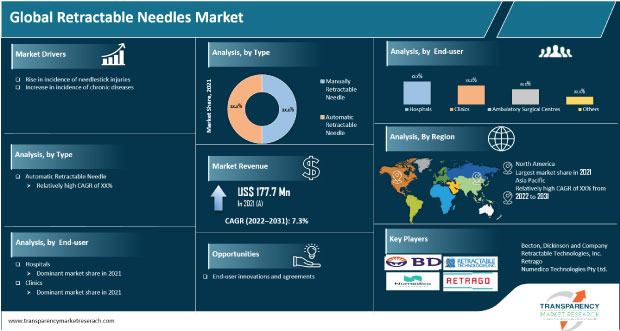

Based on type, the global retractable needles market has been bifurcated into manually retractable needles and automatic retractable needles.

In terms of revenue, the automatic retractable needles segment led the global retractable needles market in 2021. The automatic retractable needles segment includes a retractable needle assembly comprising needle seat, hypodermic needle, and barrel. A hollow plunger is slidably mounted within the barrel. A seal is provided between the plunger and barrel to prevent air from passing into or out of the barrel. A piston is slidably mounted within the plunger such that movement of the plunger into the fill position locks the piston in place. Automatic retractable needles are easy to use and enable single-handed activation. Thus, advantages offered by automatic retractable needles are driving the retractable needles market.

In terms of needle length, the global retractable needles market has been divided into 1 inch, 1.5 inch, and others.

The 1 inch needle has a 24G/0.55mm diameter, meaning it 'sits between' the thickness of orange and blue needles. This makes it suitable for intramuscular and deep intravenous injections. Stronger and slightly thicker than an orange needle, the purple or violet needle is also used for the injection of oil-based steroids.

The 1 inch needle is used in medical settings for intramuscular, intravenous, and subcutaneous injections. It is a fairly fine, long needle. It may be useful for injecting into the femoral vein, where the vein is relatively close to the surface. The needle eliminates the chances of scarring or damage.

Based on end-user, the global retractable needles market has been divided into hospitals, clinics, ambulatory surgical centers, and others. In terms of value, the hospitals segment led the global retractable needles market in 2021. The segment is anticipated to account for around 50% share of the global market by 2031. It is expected to grow at a CAGR of 8.1% from 2022 to 2031.

The hospitals segment accounted for a comparatively larger share of the revenue than clinics and ambulatory surgery centers segments in 2021. The segment is expected to account for a majority share during the forecast period. This can be attributed to higher volume of footfalls and patient admissions & treatments at hospitals than at other facilities. Hospital costs account for a large share of the total health costs and their number has been increasing exponentially since the last few years. Manufacturers are also increasing the availability of retractable needles at ambulatory surgical centers and small- & medium-scale clinics to broaden their revenue streams.

North America dominated the global retractable needles market in 2021. The market in the region is anticipated to grow at a CAGR of 9.0% from 2022 to 2031. In terms of revenue, North America accounted for prominent share of the global market in 2021, owing to the availability of robust standards for medical care and treatment, and enactment of various safety and operational regulations & policies in the region. Continuous advancements in technology, health care research initiatives, and development of more efficient & safe medical products & devices are boosting the market in North America.

In terms of revenue, Europe accounted for a large share of the global market in 2021, driven by increasing technological advancements, rising health care spending, and surging geriatric population in countries in the region. Increase in need for health care and treatment for various age-related diseases and conditions is propelling the demand for safe & retractable needle products.

In terms of revenue, China and India account for significant share of the market in Asia Pacific. This trend is expected to continue during the forecast period. Rapidly expanding economies, increasing spending capacity, changing lifestyles, rising focus on health & wellness, and surging awareness about early detection of diseases are key factors that are expected to propel the market in Asia Pacific in the near future.

The retractable needles market report concludes with the company profiles section, which includes important information about key players in the global retractable needles market. Leading players analyzed in the report include Becton, Dickinson and Company, Retractable Technologies, Inc., Retrago, RayMed, DMC Medical Limited & Numedico Technologies Pty Ltd.

Each of these players has been profiled in the retractable needles market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 177.7 Mn |

|

Market Forecast Value in 2031 |

More than US$ 355.7 Mn |

|

Growth Rate |

CAGR of 7.3% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global retractable needles market was valued at US$ 177.7 Mn in 2021

The global retractable needles market is expected to surpass US$ 355.7 Bn by 2031

The global retractable needles market is anticipated to record a CAGR of 7.3% from 2022 to 2031

The automatic retractable needle segment held over 68% share of the global retractable needles market in 2021

North America is expected to account for major share of the global retractable needles market during the forecast period

Prominent players in the global retractable needles market include Retractable Technologies, Inc., Becton, Dickinson and Company, Numedico Technologies Pty Ltd., and Retrago

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Retractable Needles Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Retractable Needles Market Analysis and Forecasts, 2017–2031

5. Key Insights

5.1. Needle Stick Injury Prevalence & Incidence Rate globally

5.2. Overview: Safety Needle and Syringe

5.3. Regulatory Scenario

5.4. Clinical Trials Pipeline Analysis

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short-/ Mid-/ Long -Term Impact)

6. Global Retractable Needles Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Manually Retractable Needle

6.3.2. Automatic Retractable Needle

6.4. Market Attractiveness, by Type

7. Global Retractable Needles Market Analysis and Forecast, by Needle Length

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Needle Length, 2017–2031

7.3.1. 1 inch

7.3.2. 1.5 inch

7.3.3. Others

7.4. Market Attractiveness, by Needle Length

8. Global Retractable Needles Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Ambulatory Surgical Centres

8.3.4. Others

8.4. Market Attractiveness, by End-user

9. Global Retractable Needles Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Retractable Needles Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Manually Retractable Needle

10.2.2. Automatic Retractable Needle

10.3. Market Value Forecast, by Needle Length, 2017–2031

10.3.1. 1 inch

10.3.2. 1.5 inch

10.3.3. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Ambulatory Surgical Centres

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Needle Length

10.6.3. By End-user

10.6.4. By Country

11. Europe Retractable Needles Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Manually Retractable Needle

11.2.2. Automatic Retractable Needle

11.3. Market Value Forecast, by Needle Length, 2017–2031

11.3.1. 1 inch

11.3.2. 1.5 inch

11.3.3. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Ambulatory Surgical Centres

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Needle Length

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Retractable Needles Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Manually Retractable Needle

12.2.2. Automatic Retractable Needle

12.3. Market Value Forecast, by Needle Length, 2017–2031

12.3.1. 1 inch

12.3.2. 1.5 inch

12.3.3. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Ambulatory Surgical Centres

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Needle Length

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Retractable Needles Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Manually Retractable Needle

13.2.2. Automatic Retractable Needle

13.3. Market Value Forecast, by Needle Length, 2017–2031

13.3.1. 1 inch

13.3.2. 1.5 inch

13.3.3. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Ambulatory Surgical Centres

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Needle Length

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Retractable Needles Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type,2017–2031

14.2.1. Manually Retractable Needle

14.2.2. Automatic Retractable Needle

14.3. Market Value Forecast, by Needle Length, 2017–2031

14.3.1. 1 inch

14.3.2. 1.5 inch

14.3.3. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Ambulatory Surgical Centres

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Needle Length

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2020)

15.3. Company Profiles

15.3.1. Retractable Technologies, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Becton, Dickinson and Company

15.3.2.1. Company Overview (HQ, Business Segments, Employee)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Numedico Technologies Pty Ltd.

15.3.3.1. Company Overview (HQ, Business Segments, Employee)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Retrago

15.3.4.1. Company Overview (HQ, Business Segments, Employee)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. DMC Medical Limited

15.3.5.1. Company Overview (HQ, Business Segments, Employee)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. RayMed

15.3.6.1. Company Overview (HQ, Business Segments, Employee)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Other Players

15.3.7.1. Company Overview (HQ, Business Segments, Employee)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

List of Tables

Table 01: Global Retractable Needles Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global Retractable Needles Market Value (US$ Mn) Forecast, by Needle Length, 2017‒2031

Table 03: Global Retractable Needles Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Retractable Needles Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Retractable Needles Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Retractable Needles Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 07: North America Retractable Needles Market Value (US$ Mn) Forecast, by Needle Length, 2017‒2031

Table 08: North America Retractable Needles Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Retractable Needles Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Retractable Needles Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 11: Europe Retractable Needles Market Value (US$ Mn) Forecast, by Needle Length, 2017‒2031

Table 12: Europe Retractable Needles Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Retractable Needles Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 14: Asia Pacific Retractable Needles Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 15: Asia Pacific Retractable Needles Market Value (US$ Mn) Forecast, by Needle Length, 2017‒2031

Table 16: Asia Pacific Retractable Needles Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Retractable Needles Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 18: Latin America Retractable Needles Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 19: Latin America Retractable Needles Market Value (US$ Mn) Forecast, by Needle Length, 2017‒2031

Table 20: Latin America Retractable Needles Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Retractable Needles Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 22: Middle East & Africa Retractable Needles Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 23: Middle East & Africa Retractable Needles Market Value (US$ Mn) Forecast, by Needle Length, 2017‒2031

Table 24: Middle East & Africa Retractable Needles Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Retractable Needles Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Retractable Needles Market Value Share, by Type, 2021

Figure 03: Global Retractable Needles Market Value Share, by Needle Length, 2021

Figure 04: Global Retractable Needles Market Value Share, by Needle Length, 2021

Figure 05: Global Retractable Needles Market Value Share Analysis, by Type, 2021 and 2031

Figure 06: Global Retractable Needles Market Attractiveness Analysis, by Type, 2022–2031

Figure 07: Global Retractable Needles Market Value (US$ Mn), by Manually Retractable Needle, 2017–2031

Figure 08: Global Retractable Needles Market Value (US$ Mn), by Automatic Retractable Needle, 2017–2031

Figure 09: Global Retractable Needles Market, by Needle Length, 2021 and 2031

Figure 10: Global Retractable Needles Market, by Needle Length, 2022–2031

Figure 11: Global Retractable Needles Market Value (US$ Mn), by 1 inch, 2017–2031

Figure 12: Global Retractable Needles Market Value (US$ Mn), by 1.5 inch, 2017–2031

Figure 13: Global Retractable Needles Market Value (US$ Mn), by Others, 2017–2031

Figure 14: Global Retractable Needles Market Value Share Analysis, by End-user, 2021 and 2031

Figure 15: Global Retractable Needles Market Attractiveness Analysis, by End-user, 2022–2031

Figure 16: Global Retractable Needles Market Value (US$ Mn), by Hospitals, 2017–2031

Figure 17: Global Retractable Needles Market Value (US$ Mn), by Clinics, 2017–2031

Figure 18: Global Retractable Needles Market Value (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 19: Global Retractable Needles Market Value (US$ Mn), by Others, 2017–2031

Figure 20: Global Retractable Needles Market Value Share Analysis, by Region, 2021 and 2031

Figure 21: Global Retractable Needles Market Attractiveness Analysis, by Region, 2022–2031

Figure 22: North America Retractable Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 23: North America Retractable Needles Market Value Share Analysis, by Country, 2021 and 2031

Figure 24: North America Retractable Needles Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America Retractable Needles Market Value Share Analysis, by Type, 2021 and 2031

Figure 26: North America Retractable Needles Market Attractiveness Analysis, by Type, 2022–2031

Figure 27: North America Retractable Needles Market, by Needle Length, 2021 and 2031

Figure 28: North America Retractable Needles Market, by Needle Length, 2022–2031

Figure 29: North America Retractable Needles Market Value Share Analysis, by End-user, 2021 and 2031

Figure 30: North America Retractable Needles Market Attractiveness Analysis, by End-user, 2022–2031

Figure 31: Europe Retractable Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: Europe Retractable Needles Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 33: Europe Retractable Needles Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Retractable Needles Market Value Share Analysis, by Type, 2021 and 2031

Figure 35: Europe Retractable Needles Market Attractiveness Analysis, by Type, 2022–2031

Figure 36: Europe Retractable Needles Market, by Needle Length, 2021 and 2031

Figure 37: Europe Retractable Needles Market, by Needle Length, 2022–2031

Figure 38: Europe Retractable Needles Market Value Share Analysis, by End-user, 2021 and 2031

Figure 39: Europe Retractable Needles Market Attractiveness Analysis, by End-user, 2022–2031

Figure 40: Asia Pacific Retractable Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 41: Asia Pacific Retractable Needles Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 42: Asia Pacific Retractable Needles Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific Retractable Needles Market Value Share Analysis, by Type, 2021 and 2031

Figure 44: Asia Pacific Retractable Needles Market Attractiveness Analysis, by Type, 2022–2031

Figure 45: Asia Pacific Retractable Needles Market, by Needle Length, 2021 and 2031

Figure 46: Asia Pacific Retractable Needles Market, by Needle Length, 2022–2031

Figure 47: Asia Pacific Retractable Needles Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Asia Pacific Retractable Needles Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Latin America Retractable Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 50: Latin America Retractable Needles Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 51: Latin America Retractable Needles Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Latin America Retractable Needles Market Value Share Analysis, by Type, 2021 and 2031

Figure 53: Latin America Retractable Needles Market Attractiveness Analysis, by Type, 2022–2031

Figure 54: Latin America Retractable Needles Market, by Needle Length, 2021 and 2031

Figure 55: Latin America Retractable Needles Market, by Needle Length, 2022–2031

Figure 56: Latin America Retractable Needles Market Value Share Analysis, by End-user, 2021 and 2031

Figure 57: Latin America Retractable Needles Market Attractiveness Analysis, by End-user, 2022–2031

Figure 58: Middle East & Africa Retractable Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 59: Middle East & Africa Retractable Needles Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 60: Middle East & Africa Retractable Needles Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East & Africa Retractable Needles Market Value Share Analysis, by Type, 2021 and 2031

Figure 62: Middle East & Africa Retractable Needles Market Attractiveness Analysis, by Type, 2022–2031

Figure 63: Middle East & Africa Retractable Needles Market, by Needle Length, 2021 and 2031

Figure 64: Middle East & Africa Retractable Needles Market, by Needle Length, 2022–2031

Figure 65: Middle East & Africa Retractable Needles Market Value Share Analysis, by End-user, 2021 and 2031

Figure 66: Middle East & Africa Retractable Needles Market Attractiveness Analysis, by End-user, 2022–2031

Figure 67: Global Retractable Needles Market Share, by Company, 2021