The COVID-19 (coronavirus) crisis is continuously evolving in states of the U.S. Analysts at the Transparency Market Research opine that New York is expected to suffer power disruptions during the ongoing winter season. This situation is anticipated to exacerbate due to the high prevalence of COVID-19 cases. Such situations are creating incremental opportunities for companies in the U.S. residential generators market. However, issues in workforce management at production facilities and transportation hurdles are hampering market growth.

Companies in the U.S. residential generators market are adopting contingency plans to tide over uncertainties with volatile supply and demand. Since stakeholders in utilities and discoms are isolating important workers to ensure their safety, power disruptions are estimated to fuel demand for generators.

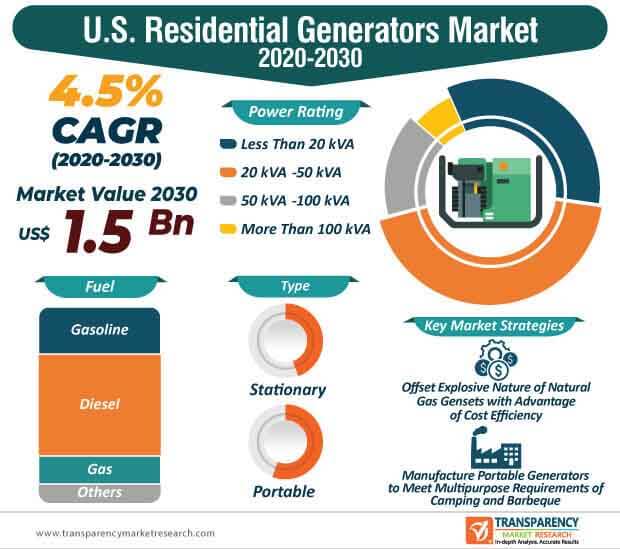

The growing consumer acceptance toward natural gas generators is bolstering the U.S. residential generators market, which is predicted to clock a modest CAGR of 4.5% during the forecast period. Cost efficiency and reduced emissions are driving sales for natural gas generators. However, people do not prefer natural gas, since it is extremely explosive in nature and can lead to a fire hazard. Moreover, in many cases, consumers face lack of fuel as natural gas requires direct pipeline connection.

On the other hand, diesel generators ensure a steady power supply. Companies in the U.S. residential generators market are incorporating improved versions of diesel engines in systems. However, the high cost of diesel generators is inhibiting market growth. As such, its low maintenance cost makes up for the initial investment. In conclusion, manufacturers are strategically targeting generators toward customers according to their unique requirements.

Portable generators are growing in popularity in the U.S. residential generators market. As such, the market is predicted to surpass the revenue of US$ 1.5 Bn by the end of 2030. Extreme weather events call for the demand for portable generators. Multipurpose use of portable generators such as for camping and barbeques is grabbing the attention of customers and companies alike.

Companies in the U.S. residential generators market are increasing the availability of cost efficient portable systems to gain a competitive edge. Online reviews on generators are building company credibility.

Standby and portable generators are some of the most preferred systems in urban areas of the U.S. Individuals willing to install generators outside of their homes are opting for standby systems, as they are capable of withstanding adverse weather conditions. Manufacturers are increasing their production capabilities to incorporate petrol, diesel, and CNG (Compressed Natural Gas)/LPG (Liquefied Petroleum Gas) fuel in standby systems.

Manufacturers in the U.S. residential generators market are increasing their R&D in exhaust management. This helps to ensure the safety of individuals living in the house as well as the environment. Thus, manufacturers are understanding different regulations governing exhaust management to avoid compliance issues.

Companies in the U.S. residential generators market are offering genset sizing calculation services to offer tailored solutions to customers. For instance, Generac Holdings— a Fortune 1000 American manufacturer of backup power generation products, is providing custom home backup gensets in order to increase product uptake. Automated features in gensets are fueling the growth of the U.S. residential generators market. Companies are increasing efforts to offer home energy monitoring systems, along with gensets to help individuals track their electrical wastage.

Deep insights about real-time usage help individuals to cut down on electric utility bills. Companies in the U.S. residential generators market are increasing their focus in mobile apps, which deliver deep insights about electricity usage and eliminate electricity wastage. Historical energy screens and live monitoring of gensets via mobile apps ensure cost savings for consumers.

Analysts’ Viewpoint

Governments are delaying and decreasing late payment surcharges for discoms during the coronavirus pandemic to reduce financial burden. Gensets are being leveraged with real-time mobile tracking of home energy monitoring systems. Liquid-cooled gensets are growing in popularity to prevent issues of overheating during heavy load and hot climate. However, natural gas generators are expensive to run and emit more carbon dioxide compared to diesel generators. Hence, companies in the U.S. residential generators market are promoting advantages of gas generators such as availability in urban cities and elimination of pungent odor. This helps to balance the sales of both diesel and natural gas generators.

U.S. Residential Generators Market: Overview

Rise in Incidence of Power Outages: Key Driver of U.S. Residential Generators Market

Increase in Adoption of Renewable Energy to Boost U.S. Residential Generators Market

U.S. Residential Generators Market: Competition Landscape

U.S. Residential Generators Market: Major Developments

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

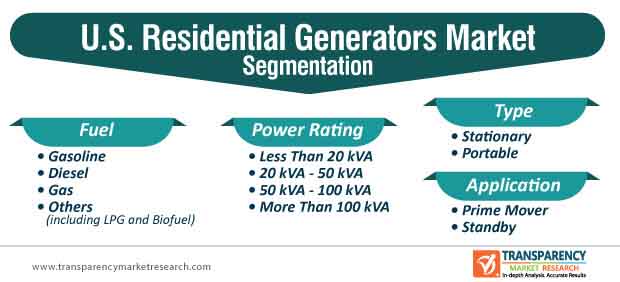

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1.1. Drivers

3.1.1.2. Restraints

3.1.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

4. COVID-19 Impact Analysis

5. Price Trend Analysis

6. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Analysis, by Fuel

6.1. Key Findings and Introduction

6.1.1. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Gasoline, 2019–2030

6.1.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Diesel, 2019–2030

6.1.3. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Natural Gas, 2019–2030

6.1.4. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Others, 2019–2030

6.2. U.S. Residential Generators Market Attractiveness Analysis, by Fuel

7. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Analysis, by Power Rating

7.1. Key Findings and Introduction

7.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Power Rating, 2019–2030

7.2.1. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Less Than 20 kVA, 2019–2030

7.2.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by 20 kVA - 50 kVA, 2019–2030

7.2.3. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by 50 kVA - 100 kVA, 2019–2030

7.2.4. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by More Than 100 kVA, 2019–2030

7.3. U.S. Residential Generators Market Attractiveness Analysis, by Power Rating

8. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Analysis, by Application

8.1. Key Findings and Introduction

8.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Application, 2019–2030

8.2.1. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Peak Shaving, 2019–2030

8.2.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Standby, 2019–2030

8.3. U.S. Residential Generators Market Attractiveness Analysis, by Application

9. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Analysis, by Type

9.1. Key Findings and Introduction

9.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Type, 2019–2030

9.2.1. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Stationary, 2019–2030

9.2.2. U.S. Residential Generators Market Volume (Units) and Value (US$ Mn) Forecast, by Portable, 2019–2030

10. U.S. Residential Generators Market Attractiveness Analysis, by Type

11. Competition Landscape

11.1. Competition Matrix

11.2. U.S. Residential Generators Market Share Analysis, by Company (2019)

11.3. Market Footprint Analysis

11.4. Company Profiles

11.4.1. Generac Holdings Inc.

11.4.1.1. Company Details

11.4.1.2. Company Description

11.4.1.3. Business Overview

11.4.1.4. Financial Details

11.4.1.5. Recent Developments

11.4.2. Cummins Inc.

11.4.2.1. Company Details

11.4.2.2. Company Description

11.4.2.3. Business Overview

11.4.2.4. Financial Details

11.4.2.5. Recent Developments

11.4.3. Caterpillar Inc.

11.4.3.1. Company Details

11.4.3.2. Company Description

11.4.3.3. Business Overview

11.4.3.4. Financial Details

11.4.3.5. Recent Developments

11.4.4. HIMOINSA

11.4.4.1. Company Details

11.4.4.2. Company Description

11.4.4.3. Business Overview

11.4.4.4. Recent Developments

11.4.5. Kirloskar Oil Engines Limited

11.4.5.1. Company Details

11.4.5.2. Company Description

11.4.5.3. Business Overview

11.4.5.4. Financial Details

11.4.5.5. Recent Developments

11.4.6. Kohler Co.

11.4.6.1. Company Details

11.4.6.2. Company Description

11.4.6.3. Business Overview

11.4.6.4. Recent Developments

11.4.7. Atlas Copco

11.4.7.1. Company Details

11.4.7.2. Company Description

11.4.7.3. Business Overview

11.4.7.4. Financial Details

11.4.7.5. Recent Developments

11.4.8. Siemens AG

11.4.8.1. Company Details

11.4.8.2. Company Description

11.4.8.3. Business Overview

11.4.8.4. Financial Details

11.4.8.5. Recent Developments

11.4.9. Honeywell International Inc.

11.4.9.1. Company Details

11.4.9.2. Company Description

11.4.9.3. Business Overview

11.4.9.4. Financial Details

11.4.9.5. Recent Developments

11.4.10. Yamaha Generators

11.4.10.1. Company Details

11.4.10.2. Company Description

11.4.10.3. Business Overview

11.4.11. Honda Motor Co., Ltd

11.4.11.1. Company Details

11.4.11.2. Company Description

11.4.11.3. Business Overview

11.4.11.4. Financial Details

11.4.11.5. Recent Developments

11.4.12. Briggs & Stratton, LLC.

11.4.12.1. Company Details

11.4.12.2. Company Description

11.4.12.3. Business Overview

11.4.12.4. Financial Details

11.4.12.5. Recent Developments

12. Primary Research – Key Insights

13. Appendix

13.1. Research Methodology and Assumptions

List of Tables

Table 01: U.S. Residential Generators Market Volume (Units) Forecast, by Fuel, 2019–2030

Table 02: U.S. Residential Generators Market Value (US$ Mn) Forecast, by Fuel, 2019–2030

Table 03: U.S. Residential Generators Market Volume (Units) Forecast, by Power Rating, 2019–2030

Table 04: U.S. Residential Generators Market Value (US$ Mn) Forecast, by Power Rating, 2019–2030

Table 05: U.S. Residential Generators Market Volume (Units) Forecast, by Type, 2019–2030

Table 06: U.S. Residential Generators Market Value (US$ Mn) Forecast, by Type, 2019–2030

Table 07: U.S. Residential Generators Market Volume (Units) Forecast, by Application, 2019–2030

Table 08: U.S. Residential Generators Market Value (US$ Mn) Forecast, by Application, 2019–2030

List of Figures

Figure 01: U.S. Residential Generators Market Value Analysis, by Fuel

Figure 02: U.S. Residential Generators Market Attractiveness Analysis, by Fuel

Figure 03: U.S. Residential Generators Market Value Analysis, by Power Rating

Figure 04: U.S. Residential Generators Market Attractiveness Analysis, by Power Rating

Figure 05: U.S. Residential Generators Market Value Analysis, by Type

Figure 06: U.S. Residential Generators Market Attractiveness Analysis, by Type

Figure 07: U.S. Residential Generators Market Value Analysis, by Application

Figure 08: U.S. Residential Generators Market Attractiveness Analysis, by Application

Figure 09: U.S. Residential Generators Market Share Analysis, by Company, 2019