Analysts’ Viewpoint on Market Scenario

Concerns about the environmental impact of conventional naphtha derived from crude oil are increasing. Consequently, demand for renewable naphtha, a more sustainable but functionally equivalent alternative to fossil-based naphtha, is projected to grow substantially during the forecast period. Several countries, such as Germany and the U.S., have enacted regulations and policies that promote the use of renewable fuels and reduce emissions. The Second Renewable Energy Directive (RED II), which mandates that renewable energy makes up 32% of the consumption mix by 2030, is the most significant piece of legislation for the transportation fuels industry in Europe.

Renewable naphtha can help industries comply with these regulations and improve their sustainability credentials. Bio naphtha, similar to legacy naphtha, is primarily utilized as a gasoline blending component or a feedstock for petrochemical crackers. Overall, the need for renewable naphtha is driven by the desire to create a more sustainable and environment-friendly economy, enhance energy security, and meet market demand for sustainable products and materials.

Renewable naphtha, which is made from renewable sources such as biomass or waste materials, has a lower carbon footprint and can help reduce greenhouse gas emissions. Bio naphtha is primarily produced through the gasification and pyrolysis of biomass such as wood, crop residues, and municipal solid waste. The process involves breaking down the complex organic molecules in the biomass into simpler hydrocarbons, which are then purified to produce bio naphtha.

Demand for bio naphtha is growing significantly as a petrochemical’s feedstock and gasoline blend stock to supplement its oil-derived predecessor. Bio naphtha can complement ethanol and ETBE in the gasoline blending pool and also substitute them.

The market for renewable naphtha has gained traction in two key application areas - sustainable aviation fuel and renewable diesel. The automotive industry is particularly interested in renewable naphtha as a bio-based fuel component, as it can be mixed with other fuels to create more environment-friendly options. Recent advancements in naphtha synthesis have made it an attractive option for promoting renewable naphtha.

Consumers are becoming increasingly conscious about their carbon footprint and are seeking products with lower environmental impact. This has fueled the demand for renewable and sustainable raw materials in the production of consumer goods.

The carbon footprint of consumer goods can be significantly reduced by using renewable naphtha in their manufacturing process. It is currently being utilized in various products, including packaging, electronics, and automotive parts. The global market for bioplastics is projected to expand at a robust CAGR from 2022 to 2031, reaching a market size of more than US$ 30 Bn by 2031. This growth is expected to drive renewable naphtha market demand as a feedstock for bioplastic production.

Governments worldwide are promoting the use of renewable naphtha as a sustainable alternative to traditional naphtha. Several countries have set targets to increase the usage of renewable energy, including bio naphtha, and are providing incentives to support its production and use.

In the European Union, the Renewable Energy Directive requires member states to increase their share of renewable energy in transport to 14% by 2030, and bio naphtha can be used to meet this target. Similarly, the U.S. has the Renewable Fuel Standard (RFS), which mandates the use of renewable fuels, including bio naphtha, in transportation. In addition to regulatory measures, governments are also providing financial incentives for the production and use of bio naphtha. For instance, in India, the government provides a subsidy for the production of advanced biofuels, which includes bio naphtha.

Overall, governments are playing a significant role in promoting the usage of renewable naphtha, globally, by setting targets, providing incentives, and investing in research and development.

Light-renewable naphtha is a versatile fuel that has a wide range of industrial applications, and it is commonly used as a feedstock for the production of various chemicals, including solvents, resins, and plastics. Additionally, it can serve as a blending component for gasoline, thereby reducing the carbon footprint of the transportation sector. In certain applications, light renewable naphtha can also be utilized as a fuel for specialized engines, as it is a cleaner-burning alternative to conventional fossil fuels.

The production of light olefins is a key driver of technological advancements in naphtha cracking. Industry demand for high-light olefin yields has led to increased research on the steam cracking of renewable naphtha. Advancements in steam cracking of renewable naphtha are also estimated to create new renewable naphtha business opportunities in the near future

Furthermore, the acceptance of alternative sources of energy has propelled the demand for renewable naphtha, as stringent pollution regulations have boosted its adoption. Overall, light renewable naphtha is a valuable resource that has diverse uses and is seen as an important component of the transition to a more sustainable and environment-friendly energy system.

In terms of value, Europe accounted for a major share of demand for renewable naphtha in 2022. The renewable naphtha industry trends in the region are expected to remain highly positive during the forecast period due to increase in industrial activities and the presence of large-scale operating plants and several projects undergoing construction, particularly in Germany, France, Italy and Sweden. The future of the renewable naphtha market in the EU is expected to be promising owing to government initiatives and an increase in awareness about greenhouse gas and carbon emissions in the region.

North America also held a significant share of the global renewable naphtha market value in 2022. The U.S. renewable naphtha market size is primarily due to growing investment in bio-oil projects, which in turn is driving the market in the region.

Meanwhile, in Asia Pacific, particularly India and China have emerged as prominent markets in the last few years, these countries are actively investing in renewable naphtha for biofuel and chemical production driven by increasing interest in renewable chemicals. The Middle East and Brazil also present promising opportunities for growth due to their expanding oil sector.

The global renewable naphtha industry is highly consolidated, with a small number of large-scale vendors controlling majority share. Key vendors in renewable naphtha market are investing significantly in comprehensive research and development activities, primarily to create environment-friendly products. Several companies are collaborating strategically to accelerate product innovation and expand their business lines in regional and international markets.

The commercialization of bio-oil has further boosted revenue generation in the naphtha market, prompting leading players to expand their production units in untapped markets, particularly in developing countries. UPM Biofuels, Neste, Renewable Energy Group, Borealis and TotalEnergies are a few key entities operating in the market.

Key players in the renewable naphtha market research report have been profiled on the basis of diverse parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 914.4 Mn |

|

Market Forecast Value in 2031 |

US$ 21.4 Bn |

|

Growth Rate (CAGR) |

41.9 % |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Mn/Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Renewable Naphtha market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

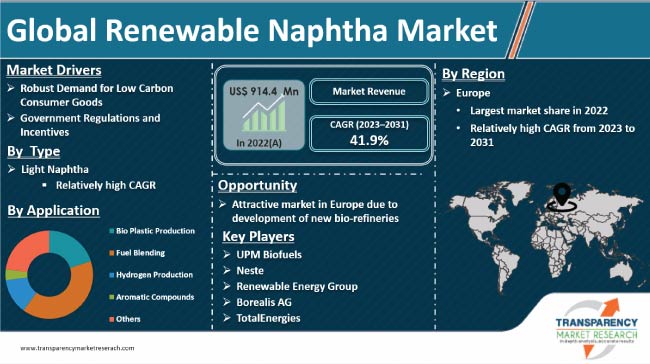

The global market was valued at US$ 914.4 Mn in 2022

It is expected to grow at a CAGR of 41.9% from 2022 to 2031

Robust demand for low carbon consumer goods and government regulations and incentives

Light naphtha was the largest type segment in 2022, and its value is anticipated to grow at a CAGR of 41.9% during the forecast period

Europe was the most lucrative region and held major share in 2022

UPM Biofuels, Neste, Renewable Energy Group, Borealis, and TotalEnergies

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. Product Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2020

5. Price Trend Analysis

6. Global Renewable Naphtha Market Analysis and Forecast, by Type, 2020–2031

6.1. Introduction and Definitions

6.2. Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

6.2.1. Light Naphtha

6.2.2. Heavy Naphtha

6.3. Global Renewable Naphtha Market Attractiveness, by Type

7. Global Renewable Naphtha Market Analysis and Forecast, by Feedstock, 2020–2031

7.1. Introduction and Definitions

7.2. Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

7.2.1. Wood Pulp Residue

7.2.2. Vegetable Oil Waste

7.2.3. Used Cooking Oil

7.2.4. Animal Fat

7.2.5. Others

7.3. Global Renewable Naphtha Market Attractiveness, by Feedstock

8. Global Renewable Naphtha Market Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.2.1. Bio Plastic Production

8.2.2. Hydrogen Production

8.2.3. Fuel Blending

8.2.4. Aromatic Compounds

8.2.5. Others

8.3. Global Renewable Naphtha Market Attractiveness, by Application

9. Global Renewable Naphtha Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Renewable Naphtha Market Attractiveness, by Region

10. North America Renewable Naphtha Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.3. North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.4. North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.5.1. U.S. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.2. U.S. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.3. U.S. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.4. Canada Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.5. Canada Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

10.5.6. Canada Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.6. North America Renewable Naphtha Market Attractiveness Analysis

11. Europe Renewable Naphtha Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.3. Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.4. Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. Germany Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.2. Germany Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.5.3. Germany Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.4. France Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.5. France Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.5.6. France Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.7. U.K. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.8. U.K. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.5.9. U.K. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.10. Italy Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.11. Italy Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.5.12. Italy Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.13. Russia & CIS Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.14. Russia & CIS Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.5.15. Russia & CIS Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.16. Rest of Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.17. Rest of Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

11.5.18. Rest of Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.6. Europe Renewable Naphtha Market Attractiveness Analysis

12. Asia Pacific Renewable Naphtha Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

12.4. Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. China Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.2. China Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

12.5.3. China Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.4. Japan Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.5. Japan Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

12.5.6. Japan Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.7. India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.8. India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

12.5.9. India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.10. ASEAN Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.11. ASEAN Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

12.5.12. ASEAN Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.13. Rest of Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.14. Rest of Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

12.5.15. Rest of Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.6. Asia Pacific Renewable Naphtha Market Attractiveness Analysis

13. Latin America Renewable Naphtha Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.3. Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.4. Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. Brazil Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.2. Brazil Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.5.3. Brazil Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.4. Mexico Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.5. Mexico Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.5.6. Mexico Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.7. Rest of Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.8. Rest of Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

13.5.9. Rest of Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.6. Latin America Renewable Naphtha Market Attractiveness Analysis

14. Middle East & Africa Renewable Naphtha Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.3. Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

14.4. Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5. Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

14.5.1. GCC Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.5.2. GCC Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

14.5.3. GCC Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.4. South Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.5.5. South Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

14.5.6. South Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.7. Rest of Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

14.5.8. Rest of Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

14.5.9. Rest of Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.6. Middle East & Africa Renewable Naphtha Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Renewable Naphtha Company Market Share Analysis, 2020

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. UPM Biofuels

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. Neste

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Renewable Energy Group

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. Borealis AG

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Eni

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. BASF

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Dow

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. St1

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. TotalEnergies

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. Rapsol

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.11. Sunshine Biofuels

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.12. Others

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.12.3. Financial Overview

15.2.12.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 2: Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 3: Global Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 4: Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 5: Global Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 6: Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: Global Renewable Naphtha Market Forecast, by Region, 2020–2031

Table 8: Global Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 9: North America Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 10: North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 11: North America Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 12: North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 13: North America Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 14: North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: North America Renewable Naphtha Market Forecast, by Country, 2020–2031

Table 16: North America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 17: U.S. Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 18: U.S. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: U.S. Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 20: U.S. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 21: U.S. Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 22: U.S. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Canada Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 24: Canada Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 25: Canada Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 26: Canada Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 27: Canada Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 28: Canada Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Europe Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 30: Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 31: Europe Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 32: Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 33: Europe Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 34: Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Europe Renewable Naphtha Market Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 38: Germany Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 39: Germany Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 40: Germany Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 41: Germany Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 42: Germany Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: France Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 44: France Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 45: France Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 46: France Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 47: France Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 48: France Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 49: U.K. Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 50: U.K. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 51: U.K. Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 52: U.K. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 53: U.K. Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 54: U.K. Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Italy Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 56: Italy Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 57: Italy Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 58: Italy Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 59: Italy Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 60: Italy Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 61: Spain Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 62: Spain Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 63: Spain Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 64: Spain Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 65: Spain Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 66: Spain Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Russia & CIS Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 68: Russia & CIS Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 69: Russia & CIS Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 70: Russia & CIS Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 71: Russia & CIS Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 72: Russia & CIS Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: Rest of Europe Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 74: Rest of Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 75: Rest of Europe Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 76: Rest of Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 77: Rest of Europe Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 78: Rest of Europe Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 79: Asia Pacific Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 80: Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 81: Asia Pacific Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 82: Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 83: Asia Pacific Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 84: Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Asia Pacific Renewable Naphtha Market Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 88: China Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type 2020–2031

Table 89: China Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 90: China Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 91: China Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 92: China Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 93: Japan Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 94: Japan Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 95: Japan Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 96: Japan Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 97: Japan Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 98: Japan Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: India Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 100: India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 101: India Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 102: India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 103: India Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 104: India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 105: India Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 106: India Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application 2020–2031

Table 107: ASEAN Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 108: ASEAN Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 109: ASEAN Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 110: ASEAN Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 111: ASEAN Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 112: ASEAN Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: Rest of Asia Pacific Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 114: Rest of Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 115: Rest of Asia Pacific Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 116: Rest of Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 117: Rest of Asia Pacific Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 118: Rest of Asia Pacific Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 119: Latin America Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 120: Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 121: Latin America Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 122: Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 123: Latin America Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 124: Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 125: Latin America Renewable Naphtha Market Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 128: Brazil Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 129: Brazil Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 130: Brazil Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 131: Brazil Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 132: Brazil Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 133: Mexico Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 134: Mexico Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 135: Mexico Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 136: Mexico Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 137: Mexico Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 138: Mexico Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 139: Rest of Latin America Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 140: Rest of Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 141: Rest of Latin America Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 142: Rest of Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 143: Rest of Latin America Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 144: Rest of Latin America Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 145: Middle East & Africa Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 146: Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 147: Middle East & Africa Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 148: Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 149: Middle East & Africa Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 150: Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 151: Middle East & Africa Renewable Naphtha Market Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 154: GCC Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 155: GCC Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 156: GCC Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 157: GCC Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 158: GCC Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 159: South Africa Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 160: South Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 161: South Africa Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 162: South Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 163: South Africa Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 164: South Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

Table 165: Rest of Middle East & Africa Renewable Naphtha Market Forecast, by Type, 2020–2031

Table 166: Rest of Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

Table 167: Rest of Middle East & Africa Renewable Naphtha Market Forecast, by Feedstock, 2020–2031

Table 168: Rest of Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Feedstock, 2020–2031

Table 169: Rest of Middle East & Africa Renewable Naphtha Market Forecast, by Application, 2020–2031

Table 170: Rest of Middle East & Africa Renewable Naphtha Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Renewable Naphtha Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 2: Global Renewable Naphtha Market Attractiveness, by Type

Figure 3: Global Renewable Naphtha Market Volume Share Analysis, by Feedstock, 2020, 2025, and 2031

Figure 4: Global Renewable Naphtha Market Attractiveness, by Feedstock

Figure 5: Global Renewable Naphtha Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 6: Global Renewable Naphtha Market Attractiveness, by Application

Figure 7: Global Renewable Naphtha Market Volume Share Analysis, by Region, 2020, 2025, and 2031

Figure 8: Global Renewable Naphtha Market Attractiveness, by Region

Figure 9: North America Renewable Naphtha Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 10: North America Renewable Naphtha Market Attractiveness, by Type

Figure 11: North America Renewable Naphtha Market Attractiveness, by Type

Figure 12: North America Renewable Naphtha Market Volume Share Analysis, by Feedstock, 2020, 2025, and 2031

Figure 13: North America Renewable Naphtha Market Attractiveness, by Feedstock

Figure 14: North America Renewable Naphtha Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 15: North America Renewable Naphtha Market Attractiveness, by Application

Figure 16: North America Renewable Naphtha Market Attractiveness, by Country

Figure 17: Europe Renewable Naphtha Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 18: Europe Renewable Naphtha Market Attractiveness, by Type

Figure 19: Europe Renewable Naphtha Market Volume Share Analysis, by Feedstock, 2020, 2025, and 2031

Figure 20: Europe Renewable Naphtha Market Attractiveness, by Feedstock

Figure 21: Europe Renewable Naphtha Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 22: Europe Renewable Naphtha Market Attractiveness, by Application

Figure 23: Europe Renewable Naphtha Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 24: Europe Renewable Naphtha Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Renewable Naphtha Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 26: Asia Pacific Renewable Naphtha Market Attractiveness, by Type

Figure 27: Asia Pacific Renewable Naphtha Market Volume Share Analysis, by Feedstock, 2020, 2025, and 2031

Figure 28: Asia Pacific Renewable Naphtha Market Attractiveness, by Feedstock

Figure 29: Asia Pacific Renewable Naphtha Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 30: Asia Pacific Renewable Naphtha Market Attractiveness, by Application

Figure 31: Asia Pacific Renewable Naphtha Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 32: Asia Pacific Renewable Naphtha Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Renewable Naphtha Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 34: Latin America Renewable Naphtha Market Attractiveness, by Type

Figure 35: Latin America Renewable Naphtha Market Volume Share Analysis, by Feedstock, 2020, 2025, and 2031

Figure 36: Latin America Renewable Naphtha Market Attractiveness, by Feedstock

Figure 37: Latin America Renewable Naphtha Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 38: Latin America Renewable Naphtha Market Attractiveness, by Application

Figure 39: Latin America Renewable Naphtha Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 40: Latin America Renewable Naphtha Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Renewable Naphtha Market Volume Share Analysis, by Type, 2020, 2025, and 2031

Figure 42: Middle East & Africa Renewable Naphtha Market Attractiveness, by Type

Figure 43: Middle East & Africa Renewable Naphtha Market Volume Share Analysis, by Feedstock, 2020, 2025, and 2031

Figure 44: Middle East & Africa Renewable Naphtha Market Attractiveness, by Feedstock

Figure 45: Middle East & Africa Renewable Naphtha Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 46: Middle East & Africa Renewable Naphtha Market Attractiveness, by Application

Figure 47: Middle East & Africa Renewable Naphtha Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 48: Middle East & Africa Renewable Naphtha Market Attractiveness, by Country and Sub-region