Coronavirus (COVID-19) has exposed the vulnerability of healthcare systems worldwide. With the ongoing shortage of PPE (Personal Protective Equipment), there is an unprecedented demand for used and refurbished medical equipment such as ventilators and other critical care equipment. Hence, companies in the refurbished medical equipment market are capitalizing on this trend, since the Government of India has lifted the import ban on used and refurbished medical equipment. The Union Environment Ministry of India announced that it has relaxed the country’s import ban up to September 2020 to support hospitals in need of ventilators.

The healthcare system in India refurbished medical equipment market is increasing efforts to increase the inventory of ventilators in order to enhance preparedness against the COVID-19 pandemic. Though stringent regulations prohibit the use of waste materials in India, health ministry are making an exception by lifting the import ban to tackle uncertainties associated with the pandemic.

Individuals have a common misconception that used and refurbished medical equipment is the same. However, refurbished medical equipment are restored according to factory specifications. On the other hand, purchasing used medical equipment is less expensive. Companies in the refurbished medical equipment market are reaping incremental benefits, as healthcare systems plan on cost savings by purchasing refurbished medical products.

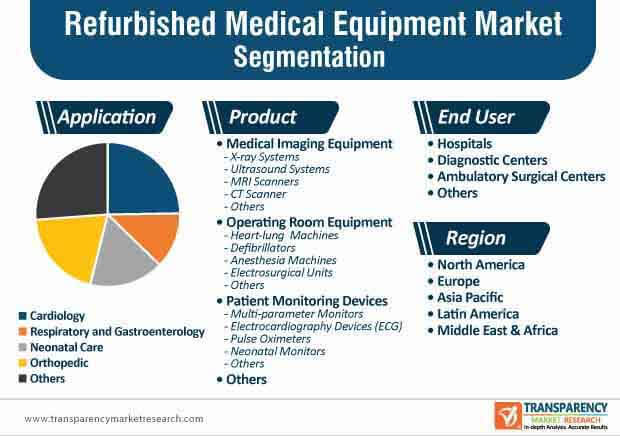

Companies in the refurbished medical equipment market make sure that the equipment are tested, repaired, and pass the inspection test before handing it over to healthcare practitioners. For instance, Soma Technology— a medical equipment supplier in Connecticut, has an extensive product profile in medical imaging equipment and operating room equipment. As such, the revenue of medical imaging equipment and patient monitoring devices is projected for exponential growth in the market landscape.

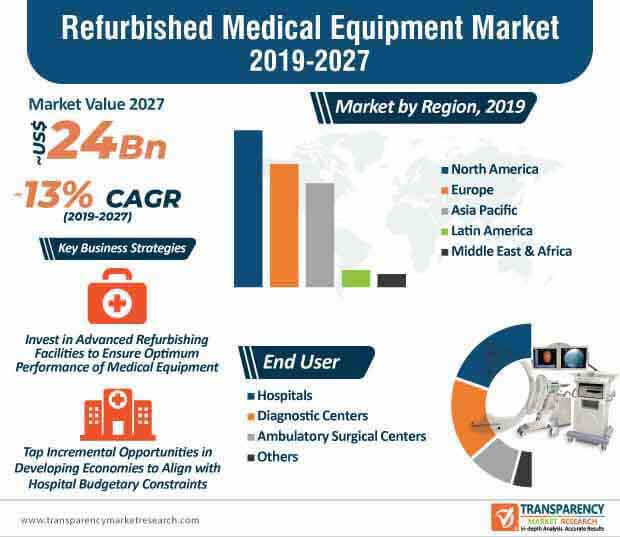

Companies in the refurbished medical equipment market are exploring untapped opportunities in developing economies. India being one of the rapidly growing economies of Asia Pacific is creating a demand for affordable medical equipment. This is evident since the refurbished medical equipment market revenue in Asia Pacific is expected to grow at an aggressive pace, where the global market is projected to reach a value of ~US$ 24 Bn by the end of 2027.

The healthcare sector is witnessing better growth in tier 2 and tier 3 cities of India, which involves semi-urban and rural population looking for affordable treatment and care. This trend has sparked the demand for refurbished medical equipment in order to keep the cost of setting up hospitals at a reasonable budget. Already pre-owned, second-hand and refurbished medical equipment hold a significant share of the India medical equipment sector. Imaging and critical care equipment are among the popular choices for owning refurbished medical products.

The refurbished medical equipment market is estimated to register a striking CAGR of ~13% during the forecast period. However, costs involved in maintaining the uptime of refurbished medical equipment is prohibitively expensive for budget-constrained healthcare systems. Moreover, many sellers are ignorant to invest in fulfilling the requirements of sustained performance mandatory in refurbished products. This has tarnished the reputation of other reliable companies in the refurbished medical equipment market, which is likely to hamper market growth. Hence, companies are increasing awareness to only buy refurbished products from trusted and reliable sellers.

Key market players invest in people skills and training to maintain optimum performance of refurbished medical equipment. They are increasing spending in state-of-the-art refurbishing facilities and stock of spares to bolster their credibility credentials in the global healthcare landscape. OEMs such as GE, Siemens, Toshiba, and Philips are gaining increased visibility, owing to their investments in refurbishing facilities. Market players are complying with regulatory standards of every country they operate in to boost their credibility in the global market landscape.

Analysts’ Viewpoint

Hospitals in the India refurbished medical equipment market are stocking refurbished medical inventories such as ventilators to be better prepared for undetermined times of the COVID-19 era. Similarly, healthcare systems in small cities of India are investing in refurbished medical products to align with low budget set up costs of hospitals.

Imaging and critical care equipment such as heart-lung machines are growing increasingly popular in hospital environments. However, high costs associated with uptime and optimum maintenance of products have led to a reluctance in the adoption of refurbished products. Hence, companies should increase awareness about the warranty of products and encourage practitioners to purchase refurbished goods only from trusted and reliable sellers who invest in state-of-the-art refurbishing facilities.

Refurbished medical equipment market to reach the valuation of ~US$ 24 Bn by 2027

Refurbished medical equipment market is predicted to expand at a CAGR of ~13% from 2019 to 2027

Refurbished medical equipment market is driven by rise in prevalence of various chronic conditions

North America accounted for a major share of the global refurbished medical equipment market

Key players in the refurbished medical equipment market include Siemens Healthineers AG, Hitachi, Ltd., GE Healthcare, Shimadzu Corporation, Koninklijke Philips N.V

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Refurbished Medical Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Refurbished Medical Equipment Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Global Installed base of CT scanners, MRI Machines, PET Scanners, by key region

5.2. Good Refurbishment Practices for Medical Imaging Equipment

5.3. Import Scenario of Refurbished Medical Devices

5.4. Strategic development and Key Mergers & Acquisitions

5.5. Regulatory Scenario, by Region/globally

5.6. Pricing Analysis

5.7. Key Vendors & Distributors

6. Global Refurbished Medical Equipment Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2027

6.3.1. Medical Imaging Equipment

6.3.1.1. X-ray Systems

6.3.1.2. Ultrasound Systems

6.3.1.3. MRI Scanners

6.3.1.4. CT Scanner

6.3.1.5. Others

6.3.2. Operating Room Equipment

6.3.2.1. Heart-lung Machines

6.3.2.2. Defibrillators

6.3.2.3. Anesthesia Machines

6.3.2.4. Electrosurgical Units

6.3.2.5. Others

6.3.3. Patient Monitoring Devices

6.3.3.1. Multi-parameter Monitors

6.3.3.2. Electrocardiography Devices (ECG)

6.3.3.3. Pulse Oximeters

6.3.3.4. Neonatal Monitors

6.3.3.5. Others

6.3.4. Others

6.4. Market Attractiveness, by Product

7. Global Refurbished Medical Equipment Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2027

7.3.1. Cardiology

7.3.2. Respiratory and Gastroenterology

7.3.3. Neonatal Care

7.3.4. Orthopedic

7.3.5. Others

7.4. Market Attractiveness, by Application

8. Global Refurbished Medical Equipment Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2027

8.3.1. Hospitals

8.3.2. Diagnostic Centers

8.3.3. Ambulatory Surgical Centers

8.3.4. Others

8.4. Market Attractiveness, by End-user

9. Global Refurbished Medical Equipment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America Refurbished Medical Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2027

10.2.1. Medical Imaging Equipment

10.2.1.1. X-ray Systems

10.2.1.2. Ultrasound Systems

10.2.1.3. MRI Scanners

10.2.1.4. CT Scanner

10.2.1.5. Others

10.2.2. Operating Room Equipment

10.2.2.1. Heart-lung Machines

10.2.2.2. Defibrillators

10.2.2.3. Anesthesia Machines

10.2.2.4. Electrosurgical Units

10.2.2.5. Others

10.2.3. Patient Monitoring Devices

10.2.3.1. Multi-parameter Monitors

10.2.3.2. Electrocardiography Devices (ECG)

10.2.3.3. Pulse Oximeters

10.2.3.4. Neonatal Monitors

10.2.3.5. Others

10.2.4. Others

10.3. Market Value Forecast, by Application, 2017–2027

10.3.1. Cardiology

10.3.2. Respiratory and Gastroenterology

10.3.3. Neonatal Care

10.3.4. Orthopedic

10.3.5. Others

10.4. Market Value Forecast, by End-user, 2017–2027

10.4.1. Hospitals

10.4.2. Diagnostic Centers

10.4.3. Ambulatory Surgical Centers

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2027

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Refurbished Medical Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2027

11.2.1. Medical Imaging Equipment

11.2.1.1. X-ray Systems

11.2.1.2. Ultrasound Systems

11.2.1.3. MRI Scanners

11.2.1.4. CT Scanner

11.2.1.5. Others

11.2.2. Operating Room Equipment

11.2.2.1. Heart-lung Machines

11.2.2.2. Defibrillators

11.2.2.3. Anesthesia Machines

11.2.2.4. Electrosurgical Units

11.2.2.5. Others

11.2.3. Patient Monitoring Devices

11.2.3.1. Multi-parameter Monitors

11.2.3.2. Electrocardiography Devices (ECG)

11.2.3.3. Pulse Oximeters

11.2.3.4. Neonatal Monitors

11.2.3.5. Others

11.2.4. Others

11.3. Market Value Forecast, by Application, 2017–2027

11.3.1. Cardiology

11.3.2. Respiratory and Gastroenterology

11.3.3. Neonatal Care

11.3.4. Orthopedic

11.3.5. Others

11.4. Market Value Forecast, by End-user, 2017–2027

11.4.1. Hospitals

11.4.2. Diagnostic Centers

11.4.3. Ambulatory Surgical Centers

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2027

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Refurbished Medical Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2027

12.2.1. Medical Imaging Equipment

12.2.1.1. X-ray Systems

12.2.1.2. Ultrasound Systems

12.2.1.3. MRI Scanners

12.2.1.4. CT Scanner

12.2.1.5. Others

12.2.2. Operating Room Equipment

12.2.2.1. Heart-lung Machines

12.2.2.2. Defibrillators

12.2.2.3. Anesthesia Machines

12.2.2.4. Electrosurgical Units

12.2.2.5. Others

12.2.3. Patient Monitoring Devices

12.2.3.1. Multi-parameter Monitors

12.2.3.2. Electrocardiography Devices (ECG)

12.2.3.3. Pulse Oximeters

12.2.3.4. Neonatal Monitors

12.2.3.5. Others

12.2.4. Others

12.3. Market Value Forecast, by Application, 2017–2027

12.3.1. Cardiology

12.3.2. Respiratory and Gastroenterology

12.3.3. Neonatal Care

12.3.4. Orthopedic

12.3.5. Others

12.4. Market Value Forecast, by End-user, 2017–2027

12.4.1. Hospitals

12.4.2. Diagnostic Centers

12.4.3. Ambulatory Surgical Centers

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2027

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Refurbished Medical Equipment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2027

13.2.1. Medical Imaging Equipment

13.2.1.1. X-ray Systems

13.2.1.2. Ultrasound Systems

13.2.1.3. MRI Scanners

13.2.1.4. CT Scanner

13.2.1.5. Others

13.2.2. Operating Room Equipment

13.2.2.1. Heart-lung Machines

13.2.2.2. Defibrillators

13.2.2.3. Anesthesia Machines

13.2.2.4. Electrosurgical Units

13.2.2.5. Others

13.2.3. Patient Monitoring Devices

13.2.3.1. Multi-parameter Monitors

13.2.3.2. Electrocardiography Devices (ECG)

13.2.3.3. Pulse Oximeters

13.2.3.4. Neonatal Monitors

13.2.3.5. Others

13.2.4. Others

13.3. Market Value Forecast, by Application, 2017–2027

13.3.1. Cardiology

13.3.2. Respiratory and Gastroenterology

13.3.3. Neonatal Care

13.3.4. Orthopedic

13.3.5. Others

13.4. Market Value Forecast, by End-user, 2017–2027

13.4.1. Hospitals

13.4.2. Diagnostic Centers

13.4.3. Ambulatory Surgical Centers

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Refurbished Medical Equipment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2027

14.2.1. Medical Imaging Equipment

14.2.1.1. X-ray Systems

14.2.1.2. Ultrasound Systems

14.2.1.3. MRI Scanners

14.2.1.4. CT Scanner

14.2.1.5. Others

14.2.2. Operating Room Equipment

14.2.2.1. Heart-lung Machines

14.2.2.2. Defibrillators

14.2.2.3. Anesthesia Machines

14.2.2.4. Electrosurgical Units

14.2.2.5. Others

14.2.3. Patient Monitoring Devices

14.2.3.1. Multi-parameter Monitors

14.2.3.2. Electrocardiography Devices (ECG)

14.2.3.3. Pulse Oximeters

14.2.3.4. Neonatal Monitors

14.2.3.5. Others

14.2.4. Others

14.3. Market Value Forecast, by Application, 2017–2027

14.3.1. Cardiology

14.3.2. Respiratory and Gastroenterology

14.3.3. Neonatal Care

14.3.4. Orthopedic

14.3.5. Others

14.4. Market Value Forecast, by End-user, 2017–2027

14.4.1. Hospitals

14.4.2. Diagnostic Centers

14.4.3. Ambulatory Surgical Centers

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2027

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles

15.2.1. Siemens Healthineers AG

15.2.2. GE Healthcare

15.2.3. Canon Medical Systems Corporation

15.2.4. Koninklijke Philips N.V

15.2.5. Atlantis Worldwide, LLC

15.2.6. Block Imaging International, Inc.

15.2.7. Shimadzu Corporation

15.2.8. Hitachi, Ltd.

15.2.9. Other Prominent Players

List of Tables

Table 01: Import Scenario Refurbished Medical Devices

Table 02: Import Scenario Refurbished Medical Devices

Table 03: Regulatory Scenario

Table 04: Regulatory Scenario

Table 05: Mergers & Acquisitions

Table 06: Mergers & Acquisitions

Table 07: Mergers & Acquisitions

Table 08: Key Vendors and Distributors

Table 09: Global Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 10: Global Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Medical Imaging Equipment, 2017–2027

Table 11: Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Operating Room Equipment, 2017–2027

Table 12: Global Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring Devices Room Equipment, 2017–2027

Table 13: Global Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 14: Global Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 15: Global Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Region, 2016–2026

Table 16: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 17: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 18: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Medical Imaging Equipment, 2017–2027

Table 19: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Operating Room Equipment, 2017–2027

Table 20: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring Devices Room Equipment, 2017–2027

Table 21: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 22: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 23: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 25: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Medical Imaging Equipment, 2017–2027

Table 26: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Operating Room Equipment, 2017–2027

Table 27: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring Devices Room Equipment, 2017–2027

Table 28: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 29: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 30: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 31: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 32: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Medical Imaging Equipment, 2017–2027

Table 33: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Operating Room Equipment, 2017–2027

Table 34: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring Devices Room Equipment, 2017–2027

Table 35: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 36: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 37: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 38: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 39: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Medical Imaging Equipment, 2017–2027

Table 40: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Operating Room Equipment, 2017–2027

Table 41: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring Devices Room Equipment, 2017–2027

Table 42: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 43: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 44: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 45: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 46: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Medical Imaging Equipment, 2017–2027

Table 47: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Operating Room Equipment, 2017–2027

Table 48: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Patient Monitoring Devices Room Equipment, 2017–2027

Table 49: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 50: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Market Snapshot of Global Refurbished Medical Equipment Market

Figure 02: Regional Share: 2018

Figure 03: Global Installed Base of CT Scanners – By Key Regions (2017)

Figure 04: Global Installed Base of MRI Machines – By Key Regions (2017)

Figure 05: Global Installed Base of PET Scanners – By Key Regions (2017)

Figure 06: Global Refurbished Medical Equipment Market Value Share Analysis, Product, 2018 and 2027

Figure 07: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Medical Imaging Equipment, 2017–2027

Figure 08: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Operating Room Equipment, 2017–2027

Figure 09: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Patient Monitoring Devices, 2017–2027

Figure 10: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 11: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by CT Scanners, 2017–2027

Figure 12: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by MRI Scanners, 2017–2027

Figure 13: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by X-ray Systems, 2017–2027

Figure 14: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Ultrasound Systems, 2017–2027

Figure 15: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 16: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Heart-lung Machines, 2017–2027

Figure 17: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Defibrillators, 2017–2027

Figure 18: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Anesthesia Machines, 2017–2027

Figure 19: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Electrosurgical Units, 2017–2027

Figure 20: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 21: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Multi-parameter Monitors, 2017–2027

Figure 22: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Electrocardiography Devices (ECG), 2017–2027

Figure 23: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Pulse Oximeters, 2017–2027

Figure 24: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Neonatal Monitors, 2017–2027

Figure 25: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 26: Global Refurbished Medical Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 27: Global Refurbished Medical Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 28: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Cardiology, 2017–2027

Figure 29: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Respiratory and Gastroenterology, 2017–2027

Figure 30: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Neonatal Care, 2017–2027

Figure 31: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Orthopedic, 2017–2027

Figure 32: Global Refurbished Medical Equipment Market Size (US$ Mn) and Y-o-Y Growth, by Others, 2017–2027

Figure 33: Global Refurbished Medical Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 34: Global Refurbished Medical Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 35: Global Refurbished Medical Equipment Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Hospitals, 2017–2027

Figure 36: Global Refurbished Medical Equipment Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Diagnostic Centers, 2017–2027

Figure 37: Global Refurbished Medical Equipment Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Ambulatory Surgical Centers, 2017–2027

Figure 38: Global Refurbished Medical Equipment Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, by Others, 2017–2027

Figure 39: Global Refurbished Medical Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 40: Global Refurbished Medical Equipment Market Value Share Analysis, by Region, 2018 and 2027

Figure 41: Global Refurbished Medical Equipment Market Attractiveness Analysis, by Region, 2018–2026

Figure 42: North America Refurbished Medical Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 43: North America Refurbished Medical Equipment Market Value Share (%) Analysis, by Country, 2018 and 2027

Figure 44: North America Refurbished Medical Equipment Market Attractiveness Analysis, by Country, 2019?2027

Figure 45: North America Refurbished Medical Equipment Market Value Share (%) Analysis, by Product, 2018 and 2027

Figure 46: North America Refurbished Medical Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 47: North America Refurbished Medical Equipment Market Value Share (%) Analysis, by Application, 2018 and 2027

Figure 48: North America Refurbished Medical Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 49: North America Refurbished Medical Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 50: North America Refurbished Medical Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 51: Europe Refurbished Medical Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 52: Europe Refurbished Medical Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 53: Europe Refurbished Medical Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019?2027

Figure 54: Europe Refurbished Medical Equipment Market Value Share (%) Analysis, by Product, 2018 and 2027

Figure 55: Europe Refurbished Medical Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 56: Europe Refurbished Medical Equipment Market Value Share (%) Analysis, by Application, 2018 and 2027

Figure 57: Europe Refurbished Medical Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 58: Europe Refurbished Medical Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 59: Europe Refurbished Medical Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 60: Asia Pacific Refurbished Medical Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 61: Asia Pacific Refurbished Medical Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 62: Asia Pacific Refurbished Medical Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 63: Asia Pacific Refurbished Medical Equipment Market Value Share (%) Analysis, by Product, 2018 and 2027

Figure 64: Asia Pacific Refurbished Medical Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 65: Asia Pacific Refurbished Medical Equipment Market Value Share (%) Analysis, by Application, 2018 and 2027

Figure 66: Asia Pacific Refurbished Medical Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 67: Asia Pacific Refurbished Medical Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 68: Asia Pacific Refurbished Medical Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 69: Latin America Refurbished Medical Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 70: Latin America Refurbished Medical Equipment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 71: Latin America Refurbished Medical Equipment Market Attractiveness, by Country/Sub-region, 2019?2027

Figure 72: Latin America Refurbished Medical Equipment Market Value Share (%) Analysis, by Product, 2018 and 2027

Figure 73: Latin America Refurbished Medical Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 74: Latin America Refurbished Medical Equipment Market Value Share (%) Analysis, by Application, 2018 and 2027

Figure 75: Latin America Refurbished Medical Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 76: Latin America Refurbished Medical Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 77: Latin America Refurbished Medical Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 78: Middle East & Africa Refurbished Medical Equipment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 79: Middle East & Africa Refurbished Medical Equipment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 80: Middle East & Africa Refurbished Medical Equipment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 81: Middle East & Africa Refurbished Medical Equipment Market Value Share (%) Analysis, by Product, 2018 and 2027

Figure 82: Middle East & Africa Refurbished Medical Equipment Market Attractiveness Analysis, by Product, 2019–2027

Figure 83: Middle East & Africa Refurbished Medical Equipment Market Value Share (%) Analysis, by Application, 2018 and 2027

Figure 84: Middle East & Africa Refurbished Medical Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 85: Middle East & Africa Refurbished Medical Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 86: Middle East & Africa Refurbished Medical Equipment Market Attractiveness Analysis, by End-user, 2019–2027