Analysts’ Viewpoint

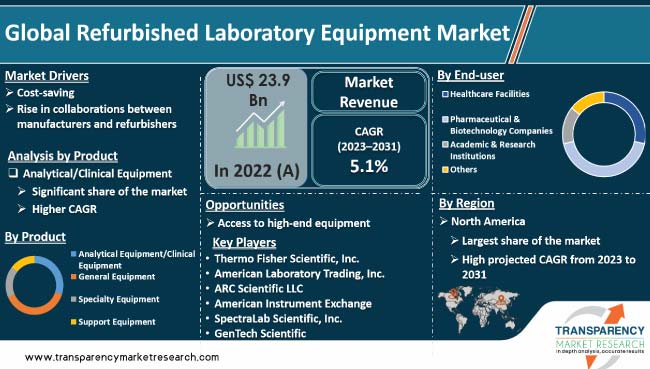

Cost-effectiveness, sustainability, and technological advancements are the key factors driving The global refurbished laboratory equipment market. Refurbished laboratory equipment provide organizations with the opportunity to acquire high-quality laboratory equipment at a lower cost. Large number of organizations are committed to reducing waste and promoting environmental sustainability. Refurbishing and reusing laboratory equipment helps to reduce waste and supports these organizations' sustainability goals.

Technological advancements also play a significant role in driving demand for refurbished laboratory equipment, as new technologies are developed at a fast pace, leading to rapid obsolescence of laboratory equipment. Demand for refurbished laboratory equipment is expected to rise, as organizations seek access to essential laboratory equipment while prioritizing sustainability and keeping pace with the latest technological advancements.

Refurbished laboratory equipment is equipment that has been previously used, but has undergone a process of refurbishment, which includes inspection, cleaning, repair, and replacement of any worn or damaged parts.

The refurbished equipment is then tested to ensure that it is functioning properly before being resold. The market includes a wide range of equipment, including analytical instruments, clinical instruments, microscopes, centrifuges, and lab consumables.

The market offers services to various industries, including biotechnology, pharmaceuticals, healthcare, and academic research. Players in the refurbished laboratory equipment market are focusing on improving the quality and reliability of the refurbished equipment, developing new technologies, and enhancing customer service. Manufacturers and refurbishers are also focusing on environmental sustainability by promoting the reuse of laboratory equipment and reducing waste.

Refurbished laboratory equipment is often sold at a lower price than new equipment, making it an attractive option for laboratories with limited budgets or those seeking to reduce costs. Rise in cost of new laboratory equipment is expected to propel the demand for refurbished laboratory equipment.

Refurbished laboratory equipment has been restored to working condition and is often covered by a warranty, providing laboratories with a reliable and cost-effective alternative to purchasing new equipment.

In addition to the initial cost savings, refurbished laboratory equipment can provide long-term cost savings. For instance, refurbished laboratory equipment could require less maintenance or repairs than older equipment, reducing ongoing costs. Furthermore, purchasing refurbished lab equipment could allow laboratories to extend the lifespan of their existing equipment, avoiding the need for costly equipment replacements.

Demand for refurbished laboratory equipment is high in developing countries, where budgets for laboratory equipment are more limited. Refurbished equipment provides an affordable way for these countries to build and equip their labs, allowing them to conduct research and provide diagnostic services that may not have been possible otherwise.

Manufacturers are increasingly partnering with refurbishers to extend the life of their equipment and provide customers with affordable options for purchasing high-quality laboratory equipment.

One of the key benefits of these collaborations is that they allow refurbishers to access manufacturer expertise, technical support, and replacement parts. This helps ensure that refurbished equipment is restored to working condition and meets the same quality standards as new equipment. Manufacturers who partner with refurbishers can also expand their customer base and generate additional revenue from the sale of refurbished equipment.

Collaborations between manufacturers and refurbishers can also benefit customers by providing access to a wider range of equipment options. Refurbishers can offer equipment from multiple manufacturers and often provide customized solutions to meet specific customer needs. This allows customers to find the right equipment for their needs at a lower cost than purchasing new equipment.

Increase in collaborations between manufacturers and refurbishers is also helping to improve the reputation of the refurbished laboratory equipment market. Manufacturers can ensure that their equipment is properly refurbished and meets the same quality standards as new equipment. This helps to build trust with customers and increase the adoption of refurbished laboratory equipment.

For instance, Thermo Fisher Scientific, a renowned manufacturer of laboratory equipment, partnered with RefurbX, a specialized refurbishing company focusing on analytical instruments. Through this collaboration, RefurbX refurbishes Thermo Fisher Scientific's instruments, such as mass spectrometers and chromatography systems, to restore them to OEM-like conditions. Adhering to Thermo Fisher Scientific's quality standards enables RefurbX to retain the reliability and performance of the refurbished equipment, while offering cost-effective options to customers. This collaboration enhances the availability of refurbished Thermo Fisher Scientific equipment, meeting the needs of budget-conscious customers without compromising on quality.

In terms of product, the analytical/clinical equipment segment accounted for the largest global refurbished laboratory equipment market share in 2022. Analytical/clinical equipment is essential in a number of laboratory settings, including research, healthcare, and diagnostics.

These equipment are generally expensive and require regular maintenance, which makes them an attractive target for refurbishment and resale. The analytical/clinical equipment segment includes a range of equipment, including spectrophotometers, chromatography instruments, mass spectrometers, and microscopes.

These equipment are essential in several laboratory settings and are used in various applications, including drug discovery, disease diagnosis, and research. Furthermore, high demand for analytical/clinical equipment in different industries such as biotechnology, pharmaceuticals, and healthcare is driving demand for refurbished equipment.

Based on end-user, the healthcare facilities segment dominated the global refurbished laboratory equipment market demand in 2022. Healthcare facilities, including hospitals, clinics, and diagnostic centers, require various laboratory equipment to provide quality care to patients.

These equipment are often expensive, and purchasing new equipment can be cost-prohibitive for many healthcare facilities. Refurbished laboratory equipment can provide these facilities with access to high-quality equipment at a lower cost than purchasing new equipment.

Cost savings is a primary factor for high demand for refurbished laboratory equipment in healthcare facilities. These facilities have tight budgets and are always looking for ways to reduce costs without compromising patient care. Refurbished laboratory equipment can provide these facilities with access to essential equipment at a lower cost than purchasing new equipment.

Refurbished laboratory equipment can also provide healthcare facilities with access to advanced technology at a lower cost than purchasing new equipment. This is particularly important for healthcare facilities that require access to the latest technology to provide the best care to their patients. Refurbished laboratory equipment can provide these facilities with access to advanced technology at a lower cost than purchasing new equipment.

Increase in demand for point-of-care testing is also driving demand for refurbished laboratory equipment in healthcare facilities. Point-of-care testing allows healthcare providers to diagnose and treat patients more quickly, reducing the need for costly hospital stays and improving patient outcomes. Refurbished point-of-care testing equipment can provide healthcare facilities with affordable access to this technology, allowing them to provide better care to their patients.

As per refurbished laboratory equipment market trends, North America accounted for major share of the global market in 2022. The region is home to a large number of research institutions, universities, and healthcare facilities, which require various laboratory equipment to conduct research and provide quality care to their patients. High demand for laboratory equipment in these sectors is driving the refurbished laboratory equipment market growth in North America.

Growth of the refurbished laboratory equipment industry in Asia Pacific can also be attributed to recent developments in the market. For instance, the COVID-19 pandemic created a surge in demand for laboratory equipment, including refurbished equipment, as healthcare facilities and research institutions have had to rapidly expand their capabilities to respond to the pandemic. The pandemic has also led to increased focus on cost savings, which is driving demand for refurbished laboratory equipment in the region.

Surge of the refurbished laboratory equipment market value in Asia Pacific is also driven by the region's rapidly expanding healthcare and life sciences industries. As these industries continue to grow, demand for laboratory equipment is expected to increase, providing opportunities in the region.

The global refurbished laboratory equipment market is fragmented, with the presence of a number of players. Companies focus on strategies such as mergers and partnerships & collaborations to compete in the marketplace.

Thermo Fisher Scientific, Inc., American Laboratory Trading, Inc., ARC Scientific LLC, American Instrument Exchange, SpectraLab Scientific, Inc., GenTech Scientific., International Equipment Trading Ltd., Copia Scientific, Inc., and Cambridge Scientific are the prominent players in the market.

Prominent players have been profiled in the refurbished laboratory equipment market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 23.9 Bn |

|

Forecast Value in 2031 |

More than US$ 37.6 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The global industry was valued at US$ 23.9 Bn in 2022

It is projected to reach more than US$ 37.6 Bn by 2031

The industry is anticipated to expand at a CAGR of 5.1% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

Thermo Fisher Scientific, Inc., American Laboratory Trading, Inc., ARC Scientific LLC, American Instrument Exchange, SpectraLab Scientific, Inc., GenTech Scientific., International Equipment Trading Ltd., Copia Scientific, Inc., and Cambridge Scientific are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Refurbished Laboratory Equipment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Refurbished Laboratory Equipment Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

5. Key Insights

5.1. Technological Advancements

5.2. Supply Value Chain Analysis

5.3. Key Industry Events

5.4. Covid-19 Pandemic Analysis

6. Global Refurbished Laboratory Equipment Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Analytical Equipment/Clinical Equipment

6.3.1.1. Chromatography Systems

6.3.1.2. Spectroscopy Instruments

6.3.1.3. Mass Spectrometers

6.3.1.4. Thermal Analyzers

6.3.1.5. Immunoassay Analyzers

6.3.1.6. Blood Gas Analyzers

6.3.1.7. Coagulation Analyzers

6.3.1.8. Others

6.3.2. General Equipment

6.3.2.1. Centrifuges

6.3.2.2. Incubators

6.3.2.3. Ovens

6.3.2.4. Autoclaves

6.3.2.5. Safety cabinets

6.3.2.6. Others

6.3.3. Specialty Equipment

6.3.3.1. DNA Sequencers

6.3.3.2. PCR Instruments

6.3.3.3. Flow Cytometers

6.3.3.4. Microscopes

6.3.3.5. Bioreactors

6.3.3.6. Others

6.3.4. Support Equipment

6.4. Market Attractiveness Analysis, by Product

7. Global Refurbished Laboratory Equipment Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Healthcare Facilities

7.3.2. Pharmaceutical & Biotechnology Companies

7.3.3. Academic & Research Institutions

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Refurbished Laboratory Equipment Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Refurbished Laboratory Equipment Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017-2031

9.2.1. Analytical Equipment/Clinical Equipment

9.2.1.1. Chromatography Systems

9.2.1.2. Spectroscopy Instruments

9.2.1.3. Mass Spectrometers

9.2.1.4. Thermal Analyzers

9.2.1.5. Immunoassay Analyzers

9.2.1.6. Blood Gas Analyzers

9.2.1.7. Coagulation Analyzers

9.2.1.8. Others

9.2.2. General Equipment

9.2.2.1. Centrifuges

9.2.2.2. Incubators

9.2.2.3. Ovens

9.2.2.4. Autoclaves

9.2.2.5. Safety cabinets

9.2.2.6. Others

9.2.3. Specialty Equipment

9.2.3.1. DNA Sequencers

9.2.3.2. PCR Instruments

9.2.3.3. Flow Cytometers

9.2.3.4. Microscopes

9.2.3.5. Bioreactors

9.2.3.6. Others

9.2.4. Support Equipment

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Healthcare Facilities

9.3.2. Pharmaceutical & Biotechnology Companies

9.3.3. Academic & Research Institutions

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Refurbished Laboratory Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Analytical Equipment/Clinical Equipment

10.2.1.1. Chromatography Systems

10.2.1.2. Spectroscopy Instruments

10.2.1.3. Mass Spectrometers

10.2.1.4. Thermal Analyzers

10.2.1.5. Immunoassay Analyzers

10.2.1.6. Blood Gas Analyzers

10.2.1.7. Coagulation Analyzers

10.2.1.8. Others

10.2.2. General Equipment

10.2.2.1. Centrifuges

10.2.2.2. Incubators

10.2.2.3. Ovens

10.2.2.4. Autoclaves

10.2.2.5. Safety cabinets

10.2.3. Specialty Equipment

10.2.3.1. DNA Sequencers

10.2.3.2. PCR Instruments

10.2.3.3. Flow Cytometers

10.2.3.4. Microscopes

10.2.3.5. Bioreactors

10.2.3.6. Others

10.2.4. Support Equipment

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Healthcare Facilities

10.3.2. Pharmaceutical & Biotechnology Companies

10.3.3. Academic & Research Institutions

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Refurbished Laboratory Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Analytical Equipment/Clinical Equipment

11.2.1.1. Chromatography Systems

11.2.1.2. Spectroscopy Instruments

11.2.1.3. Mass Spectrometers

11.2.1.4. Thermal Analyzers

11.2.1.5. Immunoassay Analyzers

11.2.1.6. Blood Gas Analyzers

11.2.1.7. Coagulation Analyzers

11.2.1.8. Others

11.2.2. General Equipment

11.2.2.1. Centrifuges

11.2.2.2. Incubators

11.2.2.3. Ovens

11.2.2.4. Autoclaves

11.2.2.5. Safety cabinets

11.2.2.6. Others

11.2.3. Specialty Equipment

11.2.3.1. DNA Sequencers

11.2.3.2. PCR Instruments

11.2.3.3. Flow Cytometers

11.2.3.4. Microscopes

11.2.3.5. Bioreactors

11.2.3.6. Bioreactors

11.2.4. Support Equipment

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Healthcare Facilities

11.3.2. Pharmaceutical & Biotechnology Companies

11.3.3. Academic & Research Institutions

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Refurbished Laboratory Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Analytical Equipment/Clinical Equipment

12.2.1.1. Chromatography Systems

12.2.1.2. Spectroscopy Instruments

12.2.1.3. Mass Spectrometers

12.2.1.4. Thermal Analyzers

12.2.1.5. Immunoassay Analyzers

12.2.1.6. Blood Gas Analyzers

12.2.1.7. Coagulation Analyzers

12.2.1.8. Others

12.2.2. General Equipment

12.2.2.1. Centrifuges

12.2.2.2. Incubators

12.2.2.3. Ovens

12.2.2.4. Autoclaves

12.2.2.5. Safety cabinets

12.2.2.6. Others

12.2.3. Specialty Equipment

12.2.3.1. DNA Sequencers

12.2.3.2. PCR Instruments

12.2.3.3. Flow Cytometers

12.2.3.4. Microscopes

12.2.3.5. Bioreactors

12.2.3.6. Others

12.2.4. Support Equipment

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Healthcare Facilities

12.3.2. Pharmaceutical & Biotechnology Companies

12.3.3. Academic & Research Institutions

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Refurbished Laboratory Equipment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Analytical Equipment/Clinical Equipment

13.2.1.1. Chromatography Systems

13.2.1.2. Spectroscopy Instruments

13.2.1.3. Mass Spectrometers

13.2.1.4. Thermal Analyzers

13.2.1.5. Immunoassay Analyzers

13.2.1.6. Blood Gas Analyzers

13.2.1.7. Coagulation Analyzers

13.2.1.8. Others

13.2.2. General Equipment

13.2.2.1. Centrifuges

13.2.2.2. Incubators

13.2.2.3. Ovens

13.2.2.4. Autoclaves

13.2.2.5. Safety cabinets

13.2.2.6. Others

13.2.3. Specialty Equipment

13.2.3.1. DNA Sequencers

13.2.3.2. PCR Instruments

13.2.3.3. Flow Cytometers

13.2.3.4. Microscopes

13.2.3.5. Bioreactors

13.2.3.6. Others

13.2.4. Support Equipment

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Healthcare Facilities

13.3.2. Pharmaceutical & Biotechnology Companies

13.3.3. Academic & Research Institutions

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Company Profiles

14.2.1. Thermo Fisher Scientific, Inc.

14.2.1.1. Company Overview

14.2.1.2. Financial Overview

14.2.1.3. Product Portfolio

14.2.1.4. Business Strategies

14.2.1.5. Recent Developments

14.2.2. American Laboratory Trading, Inc.

14.2.2.1. Company Overview

14.2.2.2. Financial Overview

14.2.2.3. Product Portfolio

14.2.2.4. Business Strategies

14.2.2.5. Recent Developments

14.2.3. ARC Scientific LLC

14.2.3.1. Company Overview

14.2.3.2. Financial Overview

14.2.3.3. Product Portfolio

14.2.3.4. Business Strategies

14.2.3.5. Recent Developments

14.2.4. American Instrument Exchange

14.2.4.1. Company Overview

14.2.4.2. Financial Overview

14.2.4.3. Product Portfolio

14.2.4.4. Business Strategies

14.2.4.5. Recent Developments

14.2.5. SpectraLab Scientific Inc.

14.2.5.1. Company Overview

14.2.5.2. Financial Overview

14.2.5.3. Product Portfolio

14.2.5.4. Business Strategies

14.2.5.5. Recent Developments

14.2.6. GenTech Scientific

14.2.6.1. Company Overview

14.2.6.2. Financial Overview

14.2.6.3. Product Portfolio

14.2.6.4. Business Strategies

14.2.6.5. Recent Developments

14.2.7. International Equipment Trading Ltd.

14.2.7.1. Company Overview

14.2.7.2. Financial Overview

14.2.7.3. Product Portfolio

14.2.7.4. Business Strategies

14.2.7.5. Recent Developments

14.2.8. Copia Scientific, Inc.

14.2.8.1. Company Overview

14.2.8.2. Financial Overview

14.2.8.3. Product Portfolio

14.2.8.4. Business Strategies

14.2.8.5. Recent Developments

14.2.9. Cambridge Scientific

14.2.9.1. Company Overview

14.2.9.2. Financial Overview

14.2.9.3. Product Portfolio

14.2.9.4. Business Strategies

14.2.9.5. Recent Developments

List of Tables

Table 01: Global Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Refurbished Laboratory Equipment Market Volume (Unit) Forecast, by Product, 2017-2031

Table 03: Global Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Analytical Equipment/Clinical Equipment, 2017-2031

Table 04: Global Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by General Equipment, 2017-2031

Table 05: Global Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Specialty Equipment, 2017-2031

Table 06: Global Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Global Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 08: North America Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 09: North America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 10: North America Refurbished Laboratory Equipment Market Volume (Unit) Forecast, by Product, 2017-2031

Table 11: North America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Analytical Equipment/Clinical Equipment, 2017-2031

Table 12: North America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by General Equipment, 2017-2031

Table 13: North America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Specialty Equipment, 2017-2031

Table 14: North America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Europe Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Europe Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 17: Europe Refurbished Laboratory Equipment Market Volume (Unit) Forecast, by Product, 2017-2031

Table 18: Europe Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Analytical Equipment/Clinical Equipment, 2017-2031

Table 19: Europe Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by General Equipment, 2017-2031

Table 20: Europe Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Specialty Equipment, 2017-2031

Table 21: Europe Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 22: Asia Pacific Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 23: Asia Pacific Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 24: Asia Pacific Refurbished Laboratory Equipment Market Volume (Unit) Forecast, by Product, 2017-2031

Table 25: Asia Pacific Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Analytical Equipment/Clinical Equipment, 2017-2031

Table 26: Asia Pacific Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by General Equipment, 2017-2031

Table 27: Asia Pacific Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Specialty Equipment, 2017-2031

Table 28: Asia Pacific Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 29: Latin America Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 30: Latin America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 31: Latin America Refurbished Laboratory Equipment Market Volume (Unit) Forecast, by Product, 2017-2031

Table 32: Latin America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Analytical Equipment/Clinical Equipment, 2017-2031

Table 33: Latin America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by General Equipment, 2017-2031

Table 34: Latin America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Specialty Equipment, 2017-2031

Table 35: Latin America Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 36: Middle East and Africa Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 37: Middle East and Africa Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 38: Middle East and Africa Refurbished Laboratory Equipment Market Volume (Unit) Forecast, by Product, 2017-2031

Table 39: Middle East and Africa Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Analytical Equipment/Clinical Equipment, 2017-2031

Table 40: Middle East and Africa Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by General Equipment, 2017-2031

Table 41: Middle East and Africa Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by Specialty Equipment, 2017-2031

Table 42: Middle East and Africa Refurbished Laboratory Equipment Market Size (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Refurbished Laboratory Equipment Market Value Share, by Product, 2022

Figure 03: Global Refurbished Laboratory Equipment Market Value Share, by End-user, 2022

Figure 04: Global Refurbished Laboratory Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 05: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Analytical Equipment/Clinical Equipment, 2017-2031

Figure 06: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by General Equipment, 2017-2031

Figure 07: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Specialty Equipment, 2017-2031

Figure 08: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Support Equipment, 2017-2031

Figure 09: Global Refurbished Laboratory Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 10: Global Refurbished Laboratory Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Healthcare Facilities, 2017-2031

Figure 12: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017-2031

Figure 13: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Academic & Research Institutions, 2017-2031

Figure 14: Global Refurbished Laboratory Equipment Market Revenue (US$ Mn), by Others, 2017-2031

Figure 15: Global Refurbished Laboratory Equipment Market Attractiveness Analysis, by End-user 2023-2031

Figure 16: Global Refurbished Laboratory Equipment Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Refurbished Laboratory Equipment Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, 2017-2031

Figure 19: North America Refurbished Laboratory Equipment Market Value Share Analysis, by Country, 2022 and 2031

Figure 20: North America Refurbished Laboratory Equipment Market Attractiveness Analysis, by Country, 2023-2031

Figure 21: North America Refurbished Laboratory Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 22: North America Refurbished Laboratory Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 23: North America Refurbished Laboratory Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Refurbished Laboratory Equipment Market Attractiveness Analysis, by End-user, 2023-2031

Figure 25: Europe Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, 2017-2031

Figure 26: Europe Refurbished Laboratory Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 27: Europe Refurbished Laboratory Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 28: Europe Refurbished Laboratory Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 29: Europe Refurbished Laboratory Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 30: Europe Refurbished Laboratory Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 31: Europe Refurbished Laboratory Equipment Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Asia Pacific Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, 2017-2031

Figure 33: Asia Pacific Refurbished Laboratory Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 34: Asia Pacific Refurbished Laboratory Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 35: Asia Pacific Refurbished Laboratory Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 36: Asia Pacific Refurbished Laboratory Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 37: Asia Pacific Refurbished Laboratory Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 38: Asia Pacific Refurbished Laboratory Equipment Market Attractiveness Analysis, by End-user, 2023-2031

Figure 39: Latin America Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, 2017-2031

Figure 40: Latin America Refurbished Laboratory Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 41: Latin America Refurbished Laboratory Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 42: Latin America Refurbished Laboratory Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 43: Latin America Refurbished Laboratory Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 44: Latin America Refurbished Laboratory Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 45: Latin America Refurbished Laboratory Equipment Market Attractiveness Analysis, by End-user, 2023-2031

Figure 46: Middle East and Africa Refurbished Laboratory Equipment Market Value (US$ Mn) Forecast, 2017-2031

Figure 47: Middle East and Africa Refurbished Laboratory Equipment Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Middle East and Africa Refurbished Laboratory Equipment Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 49: Middle East and Africa Refurbished Laboratory Equipment Market Value Share Analysis, by Product, 2022 and 2031

Figure 50: Middle East and Africa Refurbished Laboratory Equipment Market Attractiveness Analysis, by Product, 2023-2031

Figure 51: Middle East and Africa Refurbished Laboratory Equipment Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Middle East and Africa Refurbished Laboratory Equipment Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Company Share Analysis