Analysts’ Viewpoint

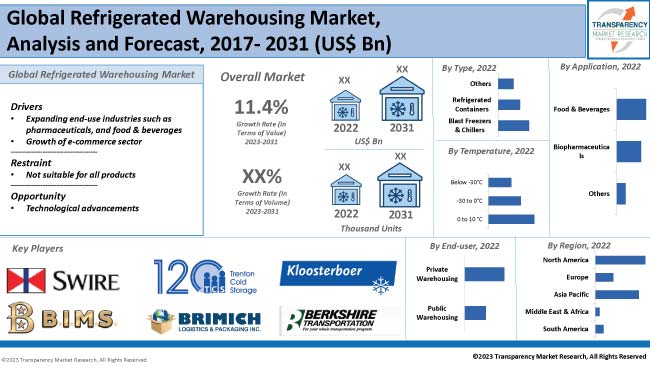

Expansion in the food & beverage, pharmaceuticals, and botanical sectors is expected to boost the demand for cold storage warehouses, or refrigerated warehousing, to keep products in an optimal state. Higher consumer spending in e-commerce grocery channels, population growth, changing demographics, and shift in consumption patterns are expected to propel the demand for freezer storage warehouses.

Manufacturers perceive the increase in cold storage spaces as a way to accommodate the need for faster grocery delivery in an increasingly competitive market.

The market is expected to observe an increase in product diversity as numerous international refrigerated warehouse companies with R&D capabilities and internet platform resources are set to enter the arena to gain maximum refrigerated warehousing market share.

Refrigerated warehousing is a building or facility designed to maintain certain environmental conditions to keep temperature sensitive products safe. A refrigerated warehouse is used to store goods at selected temperatures to keep them fresh. It eliminates sprouting, rotting, and insect damage. Large companies need to pay for a dedicated custom space when they provide products and services to a large client base.

A refrigerated container is a basic, mobile, and cost-effective option for small quantities of products. Restaurants and food service companies use blast freezers and chillers to store products. Facilities that need a lot of cold, dry storage can rely on cold rooms, which are large alternatives to smaller refrigerated spaces and offer considerable control and flexibility. Pharmaceuticals products have their special grade of storage to maintain blood, vaccines, and biopharmaceuticals.

Food safety is the highest priority in a food supply chain business. Factors fueling market progress include rise in demand from the food and beverage industry to keep products (usually food items) at an optimum temperature. A refrigerated storage warehouse, typically for food, aims to maintain the produce at an optimum temperature that halts spoilage and extends product life.

Refrigerated warehousing market trends indicate a rise in demand for frozen and refrigerated prepared foods. Today's eating habits are rather diverse, resulting in a higher consumption of international and frozen foodstuffs. Consumers are also looking for healthier food options. In response, the food industry is eliminating artificial flavors and preservatives in various product. Thus, many of these items must be stored and distributed from cold storage facilities. These factors are likely to spur market development during the forecast period.

Expansion of the e-commerce sector is expected to support refrigerated warehousing market growth globally during the forecast period.

According to refrigerated warehousing market statistics, by 2023, online retail sales are projected to be valued at US$ 6.17 Trn, with e-commerce websites accounting for 22.3% of all retail sales. China is likely to dominate the global e-commerce market during the forecast period.

Businesses are collaborating with online stores and developing their e-portals to reach a bigger audience. More customers are taking advantage of the convenience of online shopping and buying a variety of goods. This is expected to spur market expansion. Development of online e-commerce is projected to offer lucrative opportunities for refrigerated warehousing and fueling the global refrigerated warehousing market size.

According to the latest refrigerated warehousing market forecast, North America is estimated to constitute the largest share from 2023 to 2031. The American population is becoming more health conscious, demanding more natural and organic products, which is further increasing the demand for refrigerated warehousing in the region.

Asia Pacific is anticipated to be the fastest growing market for refrigerated warehousing as future market demand for refrigerated warehousing is expected to rise from the pharmaceutical industry in the region. Moreover, presence of numerous manufacturers, design innovation, technological advancement, and rise in disposable income are additional factors providing substantial growth opportunities in refrigerated warehousing in the region.

Key refrigerated warehousing manufacturers are investing significantly in comprehensive R&D activities, primarily to introduce innovative products. Expansion of product portfolios and mergers and acquisitions are the main strategies adopted by key players.

B.I.M.S., Inc., Berkshire Transportation, Brimich Logistics, Conestoga Cold Storage, John Swire & Sons, Kloosterboer, Lineage Logistics, RWI, The Dexion Company, and Trenton Cold Storage, are the prominent entities operating in this market.

Key players have been profiled in the refrigerated warehousing market research report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 36.5 Bn |

|

Market Forecast Value in 2031 |

US$ 96.3 Bn |

|

Growth Rate (CAGR) |

11.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 36.5 Bn in 2022.

It is projected to advance at a CAGR of 11.4% from 2023 to 2031.

Expanding food and beverage industry and growth of the e-commerce sector.

The refrigerated containers type segment accounted for significant share of the global market in 2022.

Asia Pacific is likely to be one of the lucrative markets in the next few years.

B.I.M.S., Inc., Berkshire Transportation, Brimich Logistics, Conestoga Cold Storage, John Swire & Sons, Kloosterboer, Lineage Logistics, RWI, The Dexion Company, and Trenton Cold Storage.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Regional Snapshot

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Technological Overview Analysis

5.8. Regulatory Framework

5.9. Global Refrigerated Warehousing Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projections (US$ Bn)

5.9.2. Market Revenue Projections (Thousand Units)

6. Global Refrigerated Warehousing Market Analysis and Forecast, By Type

6.1. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Blast Freezers & Chillers

6.1.2. Refrigerated Containers

6.1.3. Others

6.2. Incremental Opportunity, By Type

7. Global Refrigerated Warehousing Market Analysis and Forecast, By Temperature

7.1. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

7.1.1. 0 to 10 °C

7.1.2. -30 to 0°C

7.1.3. Below -30°C

7.2. Incremental Opportunity, By Temperature

8. Global Refrigerated Warehousing Market Analysis and Forecast, By Application

8.1. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Food & Beverages

8.1.2. Biopharmaceuticals

8.1.3. Others

8.2. Incremental Opportunity, By Application

9. Global Refrigerated Warehousing Market Analysis and Forecast, By End-user

9.1. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

9.1.1. Public Warehousing

9.1.2. Private Warehousing

9.2. Incremental Opportunity, By End-user

10. Global Refrigerated Warehousing Market Analysis and Forecast, by Region

10.1. Refrigerated Warehousing Market (US$ Bn and Thousand Units), Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Refrigerated Warehousing Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side

11.3.2. Supply Side

11.4. Key Supplier Analysis

11.5. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

11.5.1. Blast Freezers & Chillers

11.5.2. Refrigerated Containers

11.5.3. Others

11.6. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

11.6.1. 0 to 10 °C

11.6.2. -30 to 0°C

11.6.3. Below -30°C

11.7. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

11.7.1. Food & Beverages

11.7.2. Biopharmaceuticals

11.7.3. Others

11.8. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

11.8.1. Public Warehousing

11.8.2. Private Warehousing

11.9. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Refrigerated Warehousing Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Key Supplier Analysis

12.5. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

12.5.1. Blast Freezers & Chillers

12.5.2. Refrigerated Containers

12.5.3. Others

12.6. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

12.6.1. 0 to 10 °C

12.6.2. -30 to 0°C

12.6.3. Below -30°C

12.7. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.7.1. Food & Beverages

12.7.2. Biopharmaceuticals

12.7.3. Others

12.8. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

12.8.1. Public Warehousing

12.8.2. Private Warehousing

12.9. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

12.9.1. Germany

12.9.2. U.K

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Refrigerated Warehousing Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Key Supplier Analysis

13.5. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.5.1. Blast Freezers & Chillers

13.5.2. Refrigerated Containers

13.5.3. Others

13.6. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

13.6.1. 0 to 10 °C

13.6.2. -30 to 0°C

13.6.3. Below -30°C

13.7. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.7.1. Food & Beverages

13.7.2. Biopharmaceuticals

13.7.3. Others

13.8. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

13.8.1. Public Warehousing

13.8.2. Private Warehousing

13.9. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Refrigerated Warehousing Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Key Supplier Analysis

14.5. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.5.1. Blast Freezers & Chillers

14.5.2. Refrigerated Containers

14.5.3. Others

14.6. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

14.6.1. 0 to 10 °C

14.6.2. -30 to 0°C

14.6.3. Below -30°C

14.7. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.7.1. Food & Beverages

14.7.2. Biopharmaceuticals

14.7.3. Others

14.8. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

14.8.1. Public Warehousing

14.8.2. Private Warehousing

14.9. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Refrigerated Warehousing Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trends Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Key Supplier Analysis

15.5. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

15.5.1. Blast Freezers & Chillers

15.5.2. Refrigerated Containers

15.5.3. Others

15.6. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Temperature, 2017 - 2031

15.6.1. 0 to 10 °C

15.6.2. -30 to 0°C

15.6.3. Below -30°C

15.7. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.7.1. Food & Beverages

15.7.2. Biopharmaceuticals

15.7.3. Others

15.8. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By End-user, 2017 - 2031

15.8.1. Public Warehousing

15.8.2. Private Warehousing

15.9. Refrigerated Warehousing Market (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), By Company, (2022)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. B.I.M.S., Inc.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Berkshire Transportation

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Brimich Logistics

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Conestoga Cold Storage

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. John Swire & Sons

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Kloosterboer

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Lineage Logistics

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. RWI

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. The Dexion Company

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Trenton Cold Storage

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Temperature

17.1.3. Application

17.1.4. End-user

17.1.5. Region

17.2. Prevailing Market Risks

List of Tables

Table 1: Global Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Table 3: Global Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Table 4: Global Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Table 5: Global Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Table 6: Global Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Table 7: Global Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Table 8: Global Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Table 9: Global Refrigerated Warehousing Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Refrigerated Warehousing Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Table 13: North America Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Table 14: North America Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Table 15: North America Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Table 16: North America Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Table 17: North America Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Table 18: North America Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Table 19: North America Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Table 20: North America Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Table 21: Europe Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Table 23: Europe Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Table 24: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Table 25: Europe Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Table 26: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Table 27: Europe Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Table 28: Europe Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Table 29: Europe Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Table 30: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Table 31: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Table 33: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Table 34: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Table 35: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Table 36: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Table 37: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Table 38: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Table 39: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Table 40: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Table 41: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Table 43: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Table 44: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Table 45: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Table 46: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Table 47: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Table 48: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Table 49: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Table 50: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Table 51: South America Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Table 53: South America Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Table 54: South America Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Table 55: South America Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Table 56: South America Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Table 57: South America Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Table 58: South America Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Table 59: South America Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Table 60: South America Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

List of Figures

Figure 1: Global Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Figure 5: Global Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Figure 6: Global Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 7: Global Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Figure 8: Global Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Figure 9: Global Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 10: Global Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Figure 11: Global Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Figure 12: Global Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 13: Global Refrigerated Warehousing Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Refrigerated Warehousing Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Figure 18: North America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Figure 20: North America Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Figure 21: North America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 22: North America Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Figure 23: North America Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Figure 24: North America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 25: North America Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Figure 26: North America Refrigerated Warehousing Market Volume (Thousand Units), by End-user 2017-2031

Figure 27: North America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 28: North America Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Figure 29: North America Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Figure 30: North America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 31: Europe Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Europe Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Figure 35: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Figure 36: Europe Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 37: Europe Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Figure 38: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Figure 39: Europe Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 40: Europe Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Figure 41: Europe Refrigerated Warehousing Market Volume (Thousand Units), by End-user, 2017-2031

Figure 42: Europe Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 43: Europe Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Figure 44: Europe Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Figure 45: Europe Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 46: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Figure 48: Asia Pacific Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Figure 50: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Figure 51: Asia Pacific Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 52: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Figure 53: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Figure 54: Asia Pacific Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 55: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Figure 56: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by End-user, 2017-2031

Figure 57: Asia Pacific Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 58: Asia Pacific Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Figure 59: Asia Pacific Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Figure 60: Asia Pacific Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 61: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Figure 63: Middle East & Africa Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Figure 65: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Figure 66: Middle East & Africa Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 67: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Figure 68: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Figure 69: Middle East & Africa Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 70: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Figure 71: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by End-user, 2017-2031

Figure 72: Middle East & Africa Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 73: Middle East & Africa Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Figure 74: Middle East & Africa Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Figure 75: Middle East & Africa Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 76: South America Refrigerated Warehousing Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Refrigerated Warehousing Market Volume (Thousand Units), by Type 2017-2031

Figure 78: South America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Refrigerated Warehousing Market Value (US$ Bn), by Temperature, 2017-2031

Figure 80: South America Refrigerated Warehousing Market Volume (Thousand Units), by Temperature 2017-2031

Figure 81: South America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Temperature, 2023-2031

Figure 82: South America Refrigerated Warehousing Market Value (US$ Bn), by Application, 2017-2031

Figure 83: South America Refrigerated Warehousing Market Volume (Thousand Units), by Application 2017-2031

Figure 84: South America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 85: South America Refrigerated Warehousing Market Value (US$ Bn), by End-user, 2017-2031

Figure 86: South America Refrigerated Warehousing Market Volume (Thousand Units), by End-user, 2017-2031

Figure 87: South America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 88: South America Refrigerated Warehousing Market Value (US$ Bn), by Country, 2017-2031

Figure 89: South America Refrigerated Warehousing Market Volume (Thousand Units), by Country 2017-2031

Figure 90: South America Refrigerated Warehousing Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031