Analysts’ Viewpoint on Red Biotechnology Market Scenario

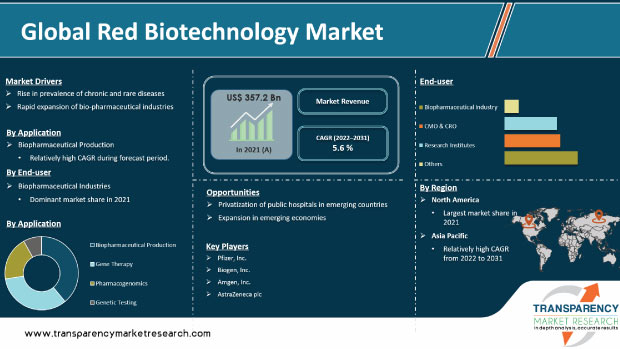

Introduction of recombinant DNA (rDNA) methods marked the beginning of the biotechnology era. Innumerable studies and tests on the potential of biotechnology to improve health have been undertaken since. Development of biotechnology has made it possible to design innovative therapeutic medications for effective disease treatment. Usage of red biotechnology products in individualized medical therapies is likely to create lucrative opportunities for market players. Rise in prevalence of chronic diseases, rapid growth of the biopharmaceutical sector, and increase in healthcare expenditure are expected to propel the global red biotechnology market in the next few years. Additionally, increase in technological advancements in the treatment of chronic diseases and rich pipeline of novel therapeutic compounds are likely to augment the global market.

Supporting sectors in the biotech industry, such as health services, are growing steadily. Investors are particularly interested in healthcare start-ups in the biotechnology field. Artificial intelligence (AI) is being used in various new ways. For instance, it has been used to progressively alter biotechnology research projects, as it helps reduce the cost and time taken to develop life-saving medications.

Stem cell research, which is one of the game-changing red biotechnology applications, is advancing at a heightened pace. It focuses on designing highly individualized therapies using a patient's own cells. Similarly, genetic engineering involves altering a patient's genetic makeup to find certain spots of interest. Steps are being taken to investigate and incorporate biotechnology into the development of individualized medical care. The implications of cloud-based technology, AI, and increasing focus on R&D have given businesses in the biotechnology sector a competitive edge.

The need for innovative drug molecules for effective disease treatment is expected to be driven by the increase in number of chronic and rare diseases globally. The WHO estimates that there are between 6,000 and 8,000 rare diseases, and over 80% of these are hereditary abnormalities. Hence, rise in incidence and prevalence of chronic and rare diseases and increase in need for diagnostics and treatments for quick and effective disease management are likely to drive the global red biotechnology market during the forecast period.

Increase in R&D efforts, rise in number of patients suffering from diseases such as cancer, and rapid expansion of health care and pharmaceutical sectors in developed and emerging markets are projected to augment the global red biotechnology market during the forecast period. According to India Brand Equity Foundation, the country’s biotechnology sector, which includes bio-pharmaceuticals, bio-services, bio-agriculture, bio-industrial, and bioinformatics, is expected to advance at a CAGR of 30% to reach US$ 100.0 Bn by 2025.

In terms of application, the global red biotechnology market has been classified into biopharmaceutical production, gene therapy, pharmacogenomics, and genetic testing. The biopharmaceutical production segment is likely to account for major share of the global market during the forecast period. Increase in demand for biologics and technological advancements are projected to drive the segment in the next few years. Furthermore, rise in disease prevalence in emerging and developed markets, and increase in healthcare spending are expected to boost the biopharmaceutical production segment.

Based on end-user, the global red biotechnology market has been divided into biopharmaceutical industry, CMO & CRO, research institutes, and others. The biopharmaceutical industry segment is expected to account for the major share of the global market during the forecast period. The segment is likely to be driven by the rise in demand for biologics in the treatment of chronic diseases and increase in clinical trial activities. Surge in adoption of expansion strategies by well-established players is also projected to augment the biopharmaceutical industry segment.

North America dominated the global red biotechnology market in 2021, led by the increase in adoption of red biotechnology, new product approvals, rise in mergers & acquisitions, and surge in healthcare expenditure.

Asia Pacific is expected to offer lucrative opportunities to leading players in the red biotechnology market during the forecast period. Growth in product approvals from regional governing authorities, rise in number of CMOs & CROs, and surge in investment by large biopharmaceutical manufacturers are the major drivers anticipated to propel the red biotechnology market in Asia Pacific in the near future.

Europe also held vital share of the global market in 2021. The market in the region is expected to be driven by research activities, increase in patient population, expansion of the healthcare infrastructure, and rise in number of clinical studies and product approvals.

The global red biotechnology market is fragmented, with significant presence of large-scale players. Leading players operating in the global red biotechnology market are Pfizer, Inc., Biogen, Inc., Amgen, Inc., AstraZeneca plc, Gilead Sciences, Inc., Celgene Corporation (Bristol-Myers Squibb Company), F. Hoffmann-La Roche, Ltd., Merck KGaA, Regeneron Pharmaceuticals, Inc., and Takeda Pharmaceutical Company Limited. These players are adopting growth strategies such as new product development, product launches, product approval, agreement, partnerships, and mergers to increase their market share.

Each of the players has been profiled in the red biotechnology market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 357.2 Bn |

|

Market Forecast Value in 2031 |

More than US$ 609.6 Bn |

|

Growth Rate (CAGR) 2022-2031 |

5.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global red biotechnology market was valued at US$ 357.2 Bn in 2021

The global red biotechnology market is projected to reach more than US$ 609.6 Bn by 2031

The global red biotechnology market grew at a CAGR of 3.6% from 2017 to 2021

The global red biotechnology market is anticipated to grow at a CAGR of 5.6% from 2022 to 2031

The biopharmaceutical industry segment held around 42% share of the global red biotechnology market in 2021

North America is expected to account for major share of the global red biotechnology market during the forecast period.

Prominent players in the global red biotechnology market are Pfizer, Inc., Biogen, Inc., Amgen, Inc., AstraZeneca plc, Gilead Sciences, Inc., Celgene Corporation (Bristol-Myers Squibb Company), F. Hoffmann-La Roche, Ltd., Merck KGaA, Regeneron Pharmaceuticals, Inc., and Takeda Pharmaceutical, Company Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Red Biotechnology Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Red Biotechnology Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. Reimbursement Scenario by Region/globally

5.3. Key Industry Events (merger & acquisitions)

5.4. Covid-19 Impact Analysis

6. Global Red Biotechnology Market Analysis and Forecast, by Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Application, 2017–2031

6.3.1. Biopharmaceutical Production

6.3.2. Pharmacogenomics

6.3.3. Gene Therapy

6.3.4. Genetic Testing

6.4. Market Attractiveness Analysis, by Application

7. Global Red Biotechnology Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Biopharmaceutical Industry

7.3.2. CMO & CRO

7.3.3. Research Institutes

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Red Biotechnology Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Red Biotechnology Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Application, 2017–2031

9.2.1. Biopharmaceutical Production

9.2.2. Pharmacogenomics

9.2.3. Gene Therapy

9.2.4. Genetic Testing

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Biopharmaceutical Industry

9.3.2. CMO & CRO

9.3.3. Research Institutes

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Application

9.5.2. By End-user

9.5.3. By Country

10. Europe Red Biotechnology Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Application, 2017–2031

10.2.1. Biopharmaceutical Production

10.2.2. Pharmacogenomics

10.2.3. Gene Therapy

10.2.4. Genetic Testing

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Biopharmaceutical Industry

10.3.2. CMO & CRO

10.3.3. Research Institutes

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Application

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Red Biotechnology Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Application, 2017–2031

11.2.1. Biopharmaceutical Production

11.2.2. Pharmacogenomics

11.2.3. Gene Therapy

11.2.4. Genetic Testing

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Biopharmaceutical Industry

11.3.2. CMO & CRO

11.3.3. Research Institutes

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Application

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Red Biotechnology Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Application, 2017–2031

12.2.1. Biopharmaceutical Production

12.2.2. Pharmacogenomics

12.2.3. Gene Therapy

12.2.4. Genetic Testing

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Biopharmaceutical Industry

12.3.2. CMO & CRO

12.3.3. Research Institutes

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Application

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Red Biotechnology Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Application, 2017–2031

13.2.1. Biopharmaceutical Production

13.2.2. Pharmacogenomics

13.2.3. Gene Therapy

13.2.4. Genetic Testing

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Biopharmaceutical Industry

13.3.2. CMO & CRO

13.3.3. Research Institutes

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Application

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Pfizer, Inc.

14.3.1.1. Company Overview

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. Business Strategies

14.3.1.5. Recent Developments

14.3.2. Biogen, Inc.

14.3.2.1. Company Overview

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. Business Strategies

14.3.2.5. Recent Developments

14.3.3. Amgen, Inc.

14.3.3.1. Company Overview

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. Business Strategies

14.3.3.5. Recent Developments

14.3.4. AstraZeneca plc

14.3.4.1. Company Overview

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. Business Strategies

14.3.4.5. Recent Developments

14.3.5. Gilead Sciences, Inc.

14.3.5.1. Company Overview

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. Business Strategies

14.3.5.5. Recent Developments

14.3.6. Celgene Corporation (Bristol-Myers Squibb Company)

14.3.6.1. Company Overview

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. Business Strategies

14.3.6.5. Recent Developments

14.3.7. F. Hoffmann-La Roche, Ltd.

14.3.7.1. Company Overview

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. Business Strategies

14.3.7.5. Recent Developments

14.3.8. Merck KGaA

14.3.8.1. Company Overview

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. Business Strategies

14.3.8.5. Recent Developments

14.3.9. Regeneron Pharmaceuticals, Inc.

14.3.9.1. Company Overview

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. Business Strategies

14.3.9.5. Recent Developments

14.3.10. Takeda Pharmaceutical Company Limited

14.3.10.1. Company Overview

14.3.10.2. Financial Overview

14.3.10.3. Product Portfolio

14.3.10.4. Business Strategies

14.3.10.5. Recent Developments

List of Tables

Table 01: Global Red Biotechnology Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 02: Global Red Biotechnology Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 03: Global Red Biotechnology Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 04: North America Red Biotechnology Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 05: North America Red Biotechnology Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 06: North America Red Biotechnology Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 07: Europe Red Biotechnology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 08: Europe Red Biotechnology Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 09: Europe Red Biotechnology Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 10: Asia Pacific Red Biotechnology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 11: Asia Pacific Red Biotechnology Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 12: Asia Pacific Red Biotechnology Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 13: Latin America Red Biotechnology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 14: Latin America Red Biotechnology Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 15: Latin America Red Biotechnology Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 16: Middle East & Africa Red Biotechnology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 17: Middle East & Africa Red Biotechnology Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 18: Middle East & Africa Red Biotechnology Market Value (US$ Bn) Forecast, by End-user, 2022–2031

List of Figures

Figure 01: Global Red Biotechnology Market Value (US$ Bn) Forecast, 2022–2031

Figure 02: Global Red Biotechnology Market Value Share (%), by Application, 2021

Figure 03: Global Red Biotechnology Market Value Share (%), by End-user, 2021

Figure 04: Global Red Biotechnology Market Value Share (%), by Region, 2021

Figure 05: Global Red Biotechnology Market Value Share (%), by Application, 2021 and 2031

Figure 06: Global Red Biotechnology Market Attractiveness Analysis, by Application, 2021–2031

Figure 07: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Biopharmaceutical Production, 2022–2031

Figure 08: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Gene Therapy, 2022–2031

Figure 09: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Pharmacogenomics, 2022–2031

Figure 10: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Genetic Testing, 2022–2031

Figure 11: Global Red Biotechnology Market Value Share Analysis, by End-user, 2021–2031

Figure 12: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Biopharmaceutical Industry, 2022–2031

Figure 13: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by CMO & CRO, 2022–2031

Figure 14: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Research Institutes, 2022–2031

Figure 15: Global Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%), by Others, 2022–2031

Figure 16: Global Red Biotechnology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 17: Global Red Biotechnology Market Value Share Analysis, by Region, 2021 and 2031

Figure 18: Global Red Biotechnology Market Attractiveness Analysis, by Region, 2021–2031

Figure 19: North America Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2022–2031

Figure 20: North America Red Biotechnology Market Value Share Analysis, by Country, 2021 and 2031

Figure 21: North America Red Biotechnology Market Attractiveness Analysis, by Country, 2021–2031

Figure 22: North America Red Biotechnology Market Value Share (%), by Application, 2021 and 2031

Figure 23: North America Red Biotechnology Market Attractiveness Analysis, by Application, 2021–2031

Figure 24: North America Red Biotechnology Market Value Share Analysis, by End-user, 2021–2031

Figure 25: North America Red Biotechnology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 26: Europe Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2022–2031

Figure 27: Europe Red Biotechnology Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 28: Europe Red Biotechnology Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 29: Europe Red Biotechnology Market Value Share (%), by Application, 2021 and 2031

Figure 30: Europe Red Biotechnology Market Attractiveness Analysis, by Application, 2021–2031

Figure 31: Europe Red Biotechnology Market Value Share Analysis, by End-user, 2022–2031

Figure 32: Europe Red Biotechnology Market Attractiveness Analysis, by End-user, 2022–2031

Figure 33: Asia Pacific Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2022–2031

Figure 34: Asia Pacific Red Biotechnology Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Asia Pacific Red Biotechnology Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 36: Asia Pacific Red Biotechnology Market Value Share (%), by Application, 2021 and 2031

Figure 37: Asia Pacific Red Biotechnology Market Attractiveness Analysis, by Application, 2021–2031

Figure 38: Asia Pacific Red Biotechnology Market Value Share Analysis, by End-user, 2022–2031

Figure 39: Asia Pacific Red Biotechnology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 40: Latin America Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2022–2031

Figure 41: Latin America Red Biotechnology Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Latin America Red Biotechnology Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 43: Latin America Red Biotechnology Market Value Share (%), by Application, 2021 and 2031

Figure 44: Latin America Red Biotechnology Market Attractiveness Analysis, by Application, 2021–2031

Figure 45: Latin America Red Biotechnology Market Value Share Analysis, by End-user, 2022–2031

Figure 46: Latin America Red Biotechnology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 47: Middle East & Africa Red Biotechnology Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2022–2031

Figure 48: Middle East & Africa Red Biotechnology Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 49: Middle East & Africa Red Biotechnology Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 50: Middle East & Africa Red Biotechnology Market Value Share (%), by Application, 2021 and 2031

Figure 51: Middle East & Africa Red Biotechnology Market Attractiveness Analysis, by Application, 2021–2031

Figure 52: Middle East & Africa Red Biotechnology Market Value Share Analysis, by End-user, 2022–2031

Figure 53: Middle East & Africa Red Biotechnology Market Attractiveness Analysis, by End-user, 2021–2031

Figure 54: Global Red Biotechnology Market Share, by Company, 2021