Recombinant factor C (rFC) assay is a synthetic equivalent of Factor C and is the first component of the horseshoe crab clotting cascade, which is activated in response to endotoxins. Moreover, the horseshoe crab blood can be collected only during a short time frame, thus limiting its supply considerably. Hence, healthcare companies in the recombinant factor C assay market are increasing their focus on rFC methods to help alleviate this challenge and improve outcomes.

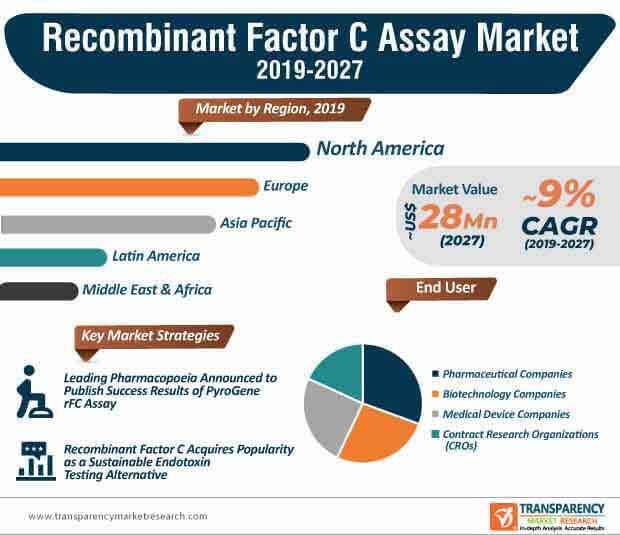

Novel rFC methods are benefitting healthcare companies, as these companies can limit their reliance on animals or any other source materials. Hence, recombinant factor C assay is acquiring popularity as a sustainable solution for endotoxin testing. Such advancements have led to the growth of the recombinant factor C assay market, where the market is estimated to reach a revenue of ~US$ 28 Mn by the end of 2027. Analysts of Transparency Market Research (TMR) opine that rFC will gain recognition in the endotoxin testing industry for its accuracy and specificity, which is as good as the LAL (Limulus Amebocyte Lysate) assay.

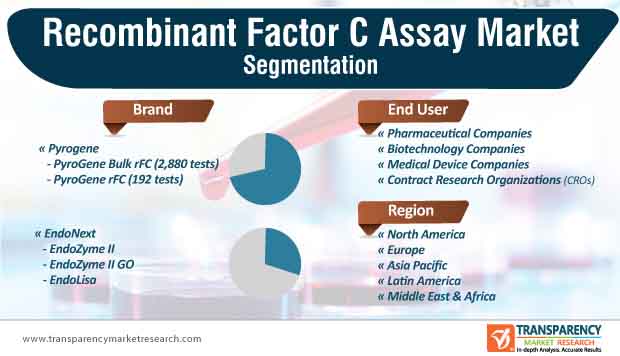

PyroGene™ recombinant factor C assay is gaining market prominence as a single-step enzymatic process as opposed to LAL assay that involves multiple procedural steps. As such, the PyroGene brand is anticipated to dictate the highest revenue as compared to EndoNext in the recombinant factor C assay market where the market is predicted to grow at a favorable CAGR of ~9% during the forecast period. Monitoring samples for contaminants play a pivotal role in pharmaceutical and medical device industries. This explains why the revenue of pharmaceutical companies is estimated to be the highest among all end users in the market landscape.

Traditional LAL testing is largely dependent on the blood of the horseshoe crab namely Limulus polyphemus. However, multiple enzymatic steps associated with LAL assay is majorly dependent on the availability of horseshoe crabs. Hence, companies in the recombinant factor C assay market are increasing their research spending in PyroGene recombinant factor C assay that can be associated with innovative software systems to gain a read-incubate-read sequence within the workflow.

LAL assays are considered as the gold standard for endotoxin testing. However, advantages of recombinant factor C assay are transforming the market landscape, which is dictated by only two major companies. Lonza Group— a leading Swiss multinational biotechnology company is increasing efforts to make its PyroGeneTM recombinant factor C assay a compendial method in Europe by collaborating with the European Pharmacopoeia. On the other hand, Hyglos GmbH— a bioMérieux company, which is a global player in in vitro diagnostics, is increasing efforts to reduce the incidence of false positives from ß-Glucan or interference due to colored or turbid samples. Thus, healthcare companies worldwide should tap opportunities in rFC, since the recombinant factor C assay market is consolidated.

Companies in the recombinant factor C assay market are reducing the pressure on LAL assays for innovations in monitoring samples for contaminants in pharmaceutical products. However, lack of long-term studies that validate rFC for combination testing of unknown samples, inter-laboratory, -operator, and -lot changes poses a barrier for market growth. Hence, pharmaceutical test users are increasing their efficacy in research studies to validate successful outcomes of rFC in specific products.

Effective FDA-approved Drug Builds Credibility of Healthcare Companies

Companies in the recombinant factor C assay market are gaining competitive edge over other players by introducing FDA-approved drugs using rFC. They are increasing efforts to experiment with humanized monoclonal antibodies such as galcanezumab for the prevention of migraine in adults. Novel rFC methods are being highly publicized as non-animal alternatives for the assessment of contaminating endotoxins in drugs. Though LAL is considered as the gold standard for endotoxin testing, official declarations by the FDA are validating the efficiency of PyroGene in the recombinant factor C assay market landscape. Thus, accuracy, sensitivity, and specificity of recombinant factor C assay is being considered at par with LAL methods.

Analysts’ Viewpoint

Gaining FDA approval for drugs is essential in the recombinant factor C assay market. Advantages of rFC are grabbing the attention of commercial innovators in the field of recombinant technology to explore untapped business potentials.

rFC is ensuring the sustainable evolution of horseshoe crab species. However, it is still unsure whether rFC-based tests outshine LAL assays and other robust test systems. Hence, pharmaceutical test users should increase their efficacy in long-term research studies that validate the efficiency of rFC involving unknown samples and inter-laboratory, -operator, and -lot changes. They should increase research in comparative studies of rFC involving kinetic chromogenic LAL assays that help companies to boost their credibility in the market landscape.

Recombinant factor C assay market to reach a revenue of ~US$ 28 Mn by the end of 2027

Recombinant factor C assay market is driven by rise in need for alternative endotoxin detection tests

North America dominated the global recombinant factor C assay market in 2018 and the trend is anticipated to continue during the forecast period

The PyroGene brand segment is likely to account for a major share of the global recombinant factor C assay market during the forecast period

Key players operating in the global recombinant factor C assay market include Lonza Group and Hyglos GmbH – a bioMérieux Company

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Acronyms

3. Research Methodology

4. Executive Summary: Global Recombinant Factor C Assay Market

5. Market Overview

5.1. Definition

5.2. Market Indicators

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

5.4. Global Recombinant Factor C Assay Market Revenue (US$ Mn) Forecast 2017–2027

5.5. Global Recombinant Factor C Assay Market Outlook

6. Key Insights

6.1. Value Chain Analysis

6.2. Key Industry Events

6.3. Patent Analysis

6.4. Product Features & USPs

6.5. Overview of Pyrogen Testing Products Market

6.5.1. Pyrogen Testing- Service Providers

6.5.2. Pyrogen Testing Products Marketing, by Country/Region

6.6. Overview of Limulus Amoebocyte Lysate (LAL) Tests

6.6.1. Number of Assays Performed

6.6.2. Cost per Assay and Turn Around Time

6.7. Regulatory Scenario, by Country/Region

6.8. Institutes Involved in Research Studies using Horseshoe Crabs

7. Global Recombinant Factor C Assay Market Analysis and Forecast, by Brand

7.1. Introduction

7.2. Global Recombinant Factor C Assay Market Value Share Analysis, by Brand

7.3. Global Recombinant Factor C Assay Market Value Forecast, by Brand, 2017–2027

7.3.1. PyroGene

7.3.1.1. PyroGene Bulk rFC (2,880 tests)

7.3.1.2. PyroGene rFC (192 tests)

7.3.2. EndoNext

7.3.2.1. Endozyme II

7.3.2.2. Endozyme II GO

7.3.2.3. EndoLisa

7.4. Global Recombinant Factor C Assay Market Attractiveness, by Brand

8. Global Recombinant Factor C Assay Market Analysis and Forecast, by End-user

8.1. Introduction

8.2. Global Recombinant Factor C Assay Market Value Share Analysis, by End-user

8.3. Global Recombinant Factor C Assay Market Value Forecast, by End-user, 2017–2027

8.3.1. Pharmaceutical Companies

8.3.2. Biotechnology Companies

8.3.3. Medical Device Companies

8.3.4. Contract Research Organizations (CROs)

8.4. Global Recombinant Factor C Assay Market Attractiveness, by End-user

9. Global Recombinant Factor C Assay Market Analysis and Forecast, by Region

9.1. Regional Outlook

9.2. Introduction

9.3. Global Recombinant Factor C Assay Market Value Forecast, by Region

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Latin America

9.3.5. Middle East & Africa

9.4. Global Recombinant Factor C Assay Market Attractiveness, by Region

10. North America Recombinant Factor C Assay Market Analysis and Forecast

10.1. Key Findings

10.2. North America Recombinant Factor C Assay Market Value Forecast, by Brand, 2017–2027

10.2.1. PyroGene

10.2.1.1. PyroGene Bulk rFC (2,880 tests)

10.2.1.2. PyroGene rFC (192 tests)

10.2.2. EndoNext

10.2.2.1. Endozyme II

10.2.2.2. Endozyme II GO

10.2.2.3. EndoLisa

10.3. North America Recombinant Factor C Assay Market Value Forecast, by End-user, 2017–2027

10.3.1. Pharmaceutical Companies

10.3.2. Biotechnology Companies

10.3.3. Medical Device Companies

10.3.4. Contract Research Organizations (CROs)

10.4. North America Recombinant Factor C Assay Market Value Forecast, by Country, 2017–2027

10.4.1. U.S.

10.4.2. Canada

10.5. North America Recombinant Factor C Assay Market Attractiveness Analysis

10.5.1. By Brand

10.5.2. By End-user

10.5.3. By Country

11. Europe Recombinant Factor C Assay Market Analysis and Forecast

11.1. Key Findings

11.2. Europe Recombinant Factor C Assay Market Value Forecast, by Brand, 2017–2027

11.2.1. PyroGene

11.2.1.1. PyroGene Bulk rFC (2,880 tests)

11.2.1.2. PyroGene rFC (192 tests)

11.2.2. EndoNext

11.2.2.1. Endozyme II

11.2.2.2. Endozyme II GO

11.2.2.3. EndoLisa

11.3. Europe Recombinant Factor C Assay Market Value Forecast, by End-user, 2017–2027

11.3.1. Pharmaceutical Companies

11.3.2. Biotechnology Companies

11.3.3. Medical Device Companies

11.3.4. Contract Research Organizations (CROs)

11.4. Europe Recombinant Factor C Assay Market Value Forecast, by Country/Sub-region, 2017–2027

11.4.1. U.K.

11.4.2. Germany

11.4.3. France

11.4.4. Italy

11.4.5. Spain

11.4.6. Rest of Europe

11.5. Europe Recombinant Factor C Assay Market Attractiveness Analysis

11.5.1. By Brand

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Asia Pacific Recombinant Factor C Assay Market Analysis and Forecast

12.1. Key Findings

12.2. Asia Pacific Recombinant Factor C Assay Market Value Forecast, by Brand, 2017–2027

12.2.1. PyroGene

12.2.1.1. PyroGene Bulk rFC (2,880 tests)

12.2.1.2. PyroGene rFC (192 tests)

12.2.2. EndoNext

12.2.2.1. Endozyme II

12.2.2.2. Endozyme II GO

12.2.2.3. EndoLisa

12.3. Asia Pacific Recombinant Factor C Assay Market Value Forecast, by End-user, 2017–2027

12.3.1. Pharmaceutical Companies

12.3.2. Biotechnology Companies

12.3.3. Medical Device Companies

12.3.4. Contract Research Organizations (CROs)

12.4. Asia Pacific Recombinant Factor C Assay Market Value Forecast, by Country/Sub-region, 2017–2027

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. Australia & New Zealand

12.4.5. Rest of Asia Pacific

12.5. Asia Pacific Recombinant Factor C Assay Market Attractiveness Analysis

12.5.1. By Brand

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Latin America Recombinant Factor C Assay Market Analysis and Forecast

13.1. Key Findings

13.2. Latin America Recombinant Factor C Assay Market Value Forecast, by Brand, 2017–2027

13.2.1. PyroGene

13.2.1.1. PyroGene Bulk rFC (2,880 tests)

13.2.1.2. PyroGene rFC (192 tests)

13.2.2. EndoNext

13.2.2.1. Endozyme II

13.2.2.2. Endozyme II GO

13.2.2.3. EndoLisa

13.3. Latin America Recombinant Factor C Assay Market Value Forecast, by End-user, 2017–2027

13.3.1. Pharmaceutical Companies

13.3.2. Biotechnology Companies

13.3.3. Medical Device Companies

13.3.4. Contract Research Organizations (CROs)

13.4. Latin America Recombinant Factor C Assay Market Value Forecast, by Country/Sub-region, 2017–2027

13.4.1. Brazil

13.4.2. Mexico

13.4.3. Rest of Latin America

13.5. Latin America Recombinant Factor C Assay Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Middle East & Africa Recombinant Factor C Assay Market Analysis and Forecast

14.1. Key Findings

14.2. Middle East & Africa Recombinant Factor C Assay Market Value Forecast, by Brand, 2017–2027

14.2.1. PyroGene

14.2.1.1. PyroGene Bulk rFC (2,880 tests)

14.2.1.2. PyroGene rFC (192 tests)

14.2.2. EndoNext

14.2.2.1. Endozyme II

14.2.2.2. Endozyme II GO

14.2.2.3. EndoLisa

14.3. Middle East & Africa Recombinant Factor C Assay Market Value Forecast, by End-user, 2017–2027

14.3.1. Pharmaceutical Companies

14.3.2. Biotechnology Companies

14.3.3. Medical Device Companies

14.3.4. Contract Research Organizations (CROs)

14.4. Middle East & Africa Recombinant Factor C Assay Market Value Forecast, by Country/Sub-region, 2017–2027

14.4.1. GCC Countries

14.4.2. South Africa

14.4.3. Rest of Middle East & Africa

14.5. Middle East & Africa Recombinant Factor C Assay Market Attractiveness Analysis

14.5.1. By Product

14.5.2. By End-user

14.5.3. By Country/Sub-region

15. Competition Landscape

15.1. Company Share Analysis

15.2. Company Profiles

15.2.1. Lonza Group

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Financial Overview

15.2.1.3. Product Portfolio

15.2.1.4. Strategic Overview

15.2.1.5. SWOT Analysis

15.2.2. Hyglos GmbH – a bioMérieux Company

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Financial Overview

15.2.2.3. Product Portfolio

15.2.2.4. Strategic Overview

15.2.2.5. SWOT Analysis

List of Tables

Table 01: Patent Information – Pyrogene (Lonza)

Table 02: Patent Information – EndoLisa

Table 03: Patent Information – EndoZyme II GO

Table 04: Patent Information – Recombinant Factor C Assay Market

Table 05: Product Features & USPs – Recombinant Factor C Assays

Table 06: Pyrogen Testing- Service Providers

Table 07: Pyrogen Testing- Service Providers

Table 08: Pyrogen Testing Products Marketing

Table 09: Cost per Assay and Turn Around Time (LAL)

Table 10: Institutes Involved in Research Studies using Horseshoe Crabs

Table 11: Institutes Focused on Conversing Horseshoe Crabs

Table 12: Pyrogen Testing Market Offerings, By Company

Table 13: Global Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Brand, 2017–2027

Table 14: Global Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by PyroGene, 2017–2027

Table 15: Global Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by EndoNext, 2017–2027

Table 16: Global Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by End-user, 2017–2027

Table 17: Global Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Region, 2017–2027

Table 18: North America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Country, 2017–2027

Table 19: North America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Brand, 2017–2027

Table 20: North America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by PyroGene, 2017–2027

Table 21: North America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by EndoNext, 2017–2027

Table 22: North America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by End-user, 2017–2027

Table 23: Europe Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Country/Sub-region, 2017–2027

Table 24: Europe Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Brand, 2017–2027

Table 25: Europe Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by PyroGene, 2017–2027

Table 26: Europe Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by EndoNext, 2017–2027

Table 27: Europe Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by End-user, 2017–2027

Table 28: Asia Pacific Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Country/Sub-region, 2017–2027

Table 29: Asia Pacific Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Brand, 2017–2027

Table 30: Asia Pacific Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by PyroGene, 2017–2027

Table 31: Asia Pacific Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by EndoNext, 2017–2027

Table 32: Asia Pacific Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by End-user, 2017–2027

Table 33: Latin America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Country/Sub-region, 2017–2027

Table 34: Latin America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Brand, 2017–2027

Table 35: Latin America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by PyroGene, 2017–2027

Table 36: Latin America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by EndoNext, 2017–2027

Table 37: Latin America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by End-user, 2017–2027

Table 38: Middle East & Africa Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Country/Sub-region, 2017–2027

Table 39: Middle East & Africa Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by Brand, 2017–2027

Table 40: Middle East & Africa Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by PyroGene, 2017–2027

Table 41: Middle East & Africa Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by EndoNext, 2017–2027

Table 42: Middle East & Africa Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Recombinant Factor C Assay Market Snapshot

Figure 02: Global Recombinant Factor C Assay Market Value (US$ Thousand), by Region, 2018 and 2027

Figure 03: Global Recombinant Factor C Assay Market Value (US$ Thousand) and Y-o-Y (%) Forecast, 2017–2027

Figure 04: Global Recombinant Factor C Assay Market Value Share, by Brand, 2019

Figure 05: Global Recombinant Factor C Assay Market Value Share, by End-user, 2019

Figure 06: Global Recombinant Factor C Assay Market Value Share, by Region, 2019

Figure 07: Value Chain Analysis – Recombinant Factor C Assay Market

Figure 08: Key Industry Events – Recombinant Factor C Assays Market

Figure 09: Regulatory Scenario – North America

Figure 10: Regulatory Scenario – Europe

Figure 11: Regulatory Scenario – Asia Pacific

Figure 12: Global Recombinant Factor C Assay Market Value Share Analysis, by Brand, 2018 and 2027

Figure 13: Global Recombinant Factor C Assay Market Attractiveness Analysis, by Brand, 2019–2027

Figure 14: Global Recombinant Factor C Assay Market Revenue (US$ Thousand) and Y-o-Y Growth (%), by PyroGene, 2017–2027

Figure 15: Global Recombinant Factor C Assay Market Revenue (US$ Thousand) and Y-o-Y Growth (%), by EndoNext, 2017–2027

Figure 16: Key Trends – By Brand

Figure 17: Global Recombinant Factor C Assay Market Value Share Analysis, by End-user, 2018 and 2027

Figure 18: Global Recombinant Factor C Assay Market Attractiveness Analysis, by End-user, 2019–2027

Figure 19: Global Recombinant Factor C Assay Market Revenue (US$ Thousand) and Y-o-Y Growth (%), by Pharmaceutical Companies, 2017–2027

Figure 20: Global Recombinant Factor C Assay Market Revenue (US$ Thousand) and Y-o-Y Growth (%), by Biotechnology Companies, 2017–2027

Figure 21: Global Recombinant Factor C Assay Market Revenue (US$ Thousand) and Y-o-Y Growth (%), by Medical Device Companies, 2017–2027

Figure 22: Global Recombinant Factor C Assay Market Revenue (US$ Thousand) and Y-o-Y Growth (%), by Contract Research Organizations (CROs), 2017–2027

Figure 23: Key Trends – By End-user

Figure 24: Recombinant Factor C Assay Market – Regional Outlook

Figure 25: Global Recombinant Factor C Assay Market Value (US$ Thousand) Forecast, 2017–2027

Figure 26: Global Recombinant Factor C Assay Market Value Share Analysis, by Region, 2018 and 2027

Figure 27: Global Recombinant Factor C Assay Market Attractiveness Analysis, by Region, 2019–2027

Figure 28: North America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 29: North America Recombinant Factor C Assay Market Value Share Analysis, by Country, 2018 and 2027

Figure 30: North America Recombinant Factor C Assay Market Attractiveness Analysis, by Country, 2019–2027

Figure 31: North America Recombinant Factor C Assay Market Value Share Analysis, by Brand, 2018 and 2027

Figure 32: North America Recombinant Factor C Assay Market Attractiveness Analysis, by Brand, 2019–2027

Figure 33: North America Recombinant Factor C Assay Market Value Share Analysis, by End-user, 2018 and 2027

Figure 34: North America Recombinant Factor C Assay Market Attractiveness Analysis, by End-user, 2019–2027

Figure 35: Europe Recombinant Factor C Assay Market Value (US$ Thousand) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 36: Europe Recombinant Factor C Assay Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 37: Europe Recombinant Factor C Assay Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 38: Europe Recombinant Factor C Assay Market Value Share Analysis, by Brand, 2018 and 2027

Figure 39: Europe Recombinant Factor C Assay Market Attractiveness Analysis, by Brand, 2019–2027

Figure 40: Europe Recombinant Factor C Assay Market Value Share Analysis, by End-user, 2018 and 2027

Figure 41: Europe Recombinant Factor C Assay Market Attractiveness Analysis, by End-user, 2019–2027

Figure 42: Asia Pacific Recombinant Factor C Assay Market Value (US$ Thousand) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 43: Asia Pacific Recombinant Factor C Assay Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 44: Asia Pacific Recombinant Factor C Assay Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 45: Asia Pacific Recombinant Factor C Assay Market Value Share Analysis, by Brand, 2018 and 2027

Figure 46: Asia Pacific Recombinant Factor C Assay Market Attractiveness Analysis, by Brand, 2019–2027

Figure 47: Asia Pacific Recombinant Factor C Assay Market Value Share Analysis, by End-user, 2018 and 2027

Figure 48: Asia Pacific Recombinant Factor C Assay Market Attractiveness Analysis, by End-user, 2019–2027

Figure 49: Latin America Recombinant Factor C Assay Market Value (US$ Thousand) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 50: Latin America Recombinant Factor C Assay Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 51: Latin America Recombinant Factor C Assay Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 52: Latin America Recombinant Factor C Assay Market Value Share Analysis, by Brand, 2018 and 2027

Figure 53: Latin America Recombinant Factor C Assay Market Attractiveness Analysis, by Brand, 2019–2027

Figure 54: Latin America Recombinant Factor C Assay Market Value Share Analysis, by End-user, 2018 and 2027

Figure 55: Latin America Recombinant Factor C Assay Market Attractiveness Analysis, by End-user, 2019–2027

Figure 56: Middle East & Africa Recombinant Factor C Assay Market Value (US$ Thousand) Forecast and Y-o-Y Growth (%) Projection, 2017–2027

Figure 57: Middle East & Africa Recombinant Factor C Assay Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 58: Middle East & Africa Recombinant Factor C Assay Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 59: Middle East & Africa Recombinant Factor C Assay Market Value Share Analysis, by Brand, 2018 and 2027

Figure 60: Middle East & Africa Recombinant Factor C Assay Market Attractiveness Analysis, by Brand, 2019–2027

Figure 61: Middle East & Africa Recombinant Factor C Assay Market Value Share Analysis, by End-user, 2018 and 2027

Figure 62: Middle East & Africa Recombinant Factor C Assay Market Attractiveness Analysis, by End-user, 2019–2027

Figure 63: Global Recombinant Factor C Assay Market Analysis, by Top Company Ranking, 2018