Reports

Reports

Explosive materials are energetic substances that act as an initiating factor in clusters of warfare-related strategies. HMX and RDX are common constituents of military explosives. RDX and HMX are classified as a nitroamine and is a more energetic explosive than TNT. They were widely used in World War 2, and remain common in explosion and military applications. Both RDX and HMT are a subject of much consideration and listed as high melting explosive, her majesty's explosive, and high-velocity military explosives. While RDX is produced by using the Bachmann Process, which usually contains 8–10% HMX. HMX, however, is complicated to manufacture than most explosives, and this confines it to professional applications. RDX and HMX are most commonly used in various end-use industries such as defense, mining, and construction industries. As these industries are growing at a rapid pace, the RDX and HMX market is anticipated to grow during the forecast period.

RDX and HMT have grown in popularity due to their relative stability, which is slightly less than TNT. The explosive power is much greater than TNT and hence, it is commonly used in detonators, primers, mines, rocket boosters, and plastic explosives. However, there is a difference between commercial dynamite and military dynamite, in terms of energy. Military dynamite such as M1, M2, and M3 have a strength of 60 percent of commercial dynamite, but military explosives are relatively insensitive to friction, drop impact, and rifle bullet impact. Among various forms of military explosives, 2,4,6-trinitrotoluene (TNT), hexahydro-1,3,5-trinitro-1,3,5-triazine (RDX), and octahedron-1,3,5,7-tetranitro- 1,3,5,7-tetrazocine (HMX) are increasingly researched and studied to increase their use in other industrial applications. Military expenditure is increasing worldwide, and the rising demand for RDX and HMX for military applications is boosting the global RDX and HMX market in the upcoming years.

The outbreak of the COVID-19 crisis created an unprecedented impact on global industries and the economy. While governments, industries, and the wider society are working together to recognize and approach the challenges caused by the crisis to support COVID-affected families, and stakeholders, the search for treatments and a vaccine took a while. Reasonably, the ongoing impact of the pandemic on the RDX and HMX market remains uncertain, as it might take a while to restore end-use industries. The COVID-19 pandemic has transformed the explosive segment in a variety of ways. Industrial operations have been affected through isolated outbreaks and government-mandated shutdowns, and the demand for many commodities remains low with lower near-term demand on the horizon. The RDX and HMX market report explores the potential long-term impact of the COVID-19 crisis on the future demand for industrial applications as well as the next steps businesses can take to ensure their response to this pandemic is swift and effective.

The ongoing phase of the RDX and HMX market is characterized by the manufacturers responding to new supply-and-demand dynamics by shutting down high-cost supply and high grading, resulting in a new supply-demand equilibrium, often at lower levels than seen previously. Moreover, with the pandemic nearing its end in most regions, the market is witnessing global recovery being led by larger economies and prices rebounding as shortages begin to appear. However, lack of capital expenditures, depletion of existing assets, and differentiated demand patterns lead to commodities reacting differently. As the phase progresses, government investments toward defense, construction, and mining projects are expected to prove propitious for the global RDX and HMX market in the near future. Thus, the RDX and HMX market will expect heavy demand from construction and mining industries.

RDX, also known as hexogen, can be used with other explosives such as HMX, waxes, or oils to make military munitions. The production process of RDX comprises multiple stages varying from raw materials storing and feeding, nitration, decomposition, filtration, and transportation. Businesses are spending extensively on R&D activities to develop innovative products to support defense forces and cater to the ever-increasing product demand. RDX and HMX as a military explosive can either be used with explosives such as TNT to make cyclotrons that create bursting charges for aerial bombs, mines, and torpedoes or can be used as a base charge for detonators. RDX in the civilian application is popularly used as a heating fuel, in fireworks, occasional rodenticide, and in the demolition of blocks. Furthermore, the civil engineering industry plays a major role in economic growth, which is driven by rise in the demand for smart infrastructure and increase in expenditure on infrastructure development in developing countries. This is likely to fuel the demand for RDX and HMX market during the projected timeline.

Explosive materials such as RDX and HMX are energetic substances, when discharged into the atmosphere, contaminate by posing toxic hazards to the environment and biota. Across the world, soils are polluted by such contaminants either due to manufacturing operations, military activities, conflicts of different levels, open burning/open detonation (OB/OD), dumping of munitions, etc. Moreover, these explosives are highly toxic, as various government organizations have recommended restrictions for lifetime contact through drinking water. However, as there are several utilitarian aspects in anthropogenic activities, effective remediation of explosives is very important. Nevertheless, rise in the necessity to defend national borders and increase in safety concerns are the major factors that are compelling governments of different countries to spend more on arms and ammunition, thus driving the global RDX and HMX market.

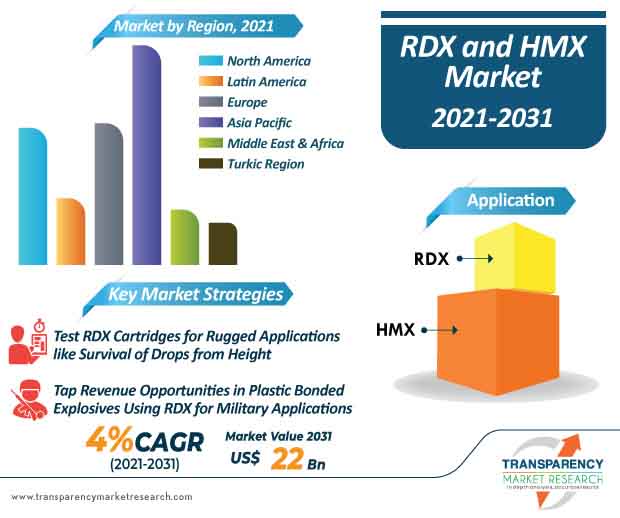

The demand for RDX and HMX is comparatively greater in North America and Asia Pacific, owing to a large number of mining activities and the presence of various international mining companies in these regions. Moreover, presence of major end-use industries and growing demand for mining gold, iron, tin, manganese, coal, tungsten, copper, antimony, mica, lead, zinc, aluminum, silver, and precious stones in the Asia Pacific is aiding the region to grow at highest CAGR during the forecast period. The global RDX and HMX market is projected to reach US$ 22 Bn by 2031, at a CAGR of ~4% during the forecast period.

Analysts’ Viewpoint

The global RDX and HMX market is primarily being driven by the rising demand for metals and minerals across the globe. RDX and HMX have major applications in quarrying, metal mining, coal mining, and non-metal mining. Coal mining is an essential application of RDX and HMX explosions. In addition, China is anticipated to be a highly attractive country of the RDX and HMX market in the Asia Pacific region. End-use industries such as defense and mining are witnessing strong growth across the world. This is most likely to boost the demand for RDX and HMX during the forecast period.

1. Executive Summary

1.1. RDX and HMX Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Definition

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Landscape

2.6. Value Chain Analysis

2.6.1. List of Suppliers/Manufacturers

2.6.2. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis

5. Feasibility Study

6. Price Trend Analysis

7. Global RDX and HMX Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. RDX

7.2.1.1. Military

7.2.1.1.1. Melt-cast Explosives

7.2.1.1.2. Plastic Explosives

7.2.1.1.3. Pyrotechnics

7.2.1.1.4. Others

7.2.1.2. Civilian

7.2.1.2.1. Fireworks

7.2.1.2.2. Demolition Blocks

7.2.1.2.3. Others

7.2.2. HMX

7.2.2.1. Military

7.2.2.1.1. Melt-cast Explosives

7.2.2.1.2. Nuclear Devices

7.2.2.1.3. Plastic Explosives

7.2.2.1.4. Rocket Fuels

7.2.2.1.5. Booster Charges

7.2.2.1.6. Others

7.2.2.2. Civilian

7.2.2.2.1. Fireworks

7.2.2.2.2. Demolition Blocks

7.2.2.2.3. Others

7.3. Global RDX and HMX Market Attractiveness, by Application

8. Global RDX and HMX Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.2.6. Turkic Region

8.3. Global RDX and HMX Market Attractiveness, by Region

9. North America RDX and HMX Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.3. North America RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2021–2031

9.3.1. U.S. RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.3.2. Canada RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America RDX and HMX Market Attractiveness Analysis

10. Europe RDX and HMX Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3. Europe RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

10.3.1. Germany RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.2. U.K. RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.3. France RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.4. Italy RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.5. Spain RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.6. Russia & CIS RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.7. Rest of Europe RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe RDX and HMX Market Attractiveness Analysis

11. Asia Pacific RDX and HMX Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3. Asia Pacific RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.3.1. China RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.2. Japan RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.3. India RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.4. ASEAN RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.5. Rest of Asia Pacific RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific RDX and HMX Market Attractiveness Analysis

12. Latin America RDX and HMX Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.3. Latin America RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.3.1. Brazil RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.3.2. Mexico RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.3.3. Rest of Latin America RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America RDX and HMX Market Attractiveness Analysis

13. Middle East & Africa RDX and HMX Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3. Middle East & Africa RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.3.1. Saudi Arabia RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.2. UAE RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.3. Israel RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.4. Egypt RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.5. Libya RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.6. Iran RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.7. Rest of Middle East & Africa RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa RDX and HMX Market Attractiveness Analysis

14. Turkic Region RDX and HMX Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Turkic Region RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.3. Turkic Region RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

14.3.1. Turkey RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.3.2. Azerbaijan RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.3.3. Turkmenistan RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.3.4. Uzbekistan RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.3.5. Others RDX and HMX Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.4. Turkic Region RDX and HMX Market Attractiveness Analysis

15. Competition Landscape

15.1. Global RDX and HMX Company Market Share Analysis, 2020

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Chemring Group PLC

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.2. Dahana

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.3. Eurenco

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.4. PRVA ISKRA - NAMENSKA A.D.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.5. BAE Systems

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.6. NITRO-CHEM S.A

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.7. Austin Powder

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.8. Nuberg EPC

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.9. Ensign-Bickford Aerospace & Defense Company

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.10. REGENESIS

15.2.10.1. Company Description

15.2.10.2. Business Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 2: Global RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 3: Global RDX and HMX Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 4: Global RDX and HMX Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 5: North America RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 6: North America RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: North America RDX and HMX Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 8: North America RDX and HMX Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 9: U.S. RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 10: U.S. RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: Canada RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 12: Canada RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: Europe RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 14: Europe RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: Europe RDX and HMX Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 16: Europe RDX and HMX Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 17: Germany RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 18: Germany RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: U.K. RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 20: U.K. RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: France RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 22: France RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Italy RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 24: Italy RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Spain RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 26: Spain RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Russia & CIS RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 28: Russia & CIS RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Rest of Europe RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Rest of Europe RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: Asia Pacific RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 32: Asia Pacific RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 33: Asia Pacific RDX and HMX Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 34: Asia Pacific RDX and HMX Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 35: China RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 36: China RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 37: India RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 38: India RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Japan RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 40: Japan RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 41: ASEAN RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: ASEAN RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Rest of Asia Pacific RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 44: Rest of Asia Pacific RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 45: Latin America RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 46: Latin America RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Latin America RDX and HMX Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 48: Latin America RDX and HMX Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 49: Brazil RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 50: Brazil RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: Mexico RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 52: Mexico RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 53: Rest of Latin America RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Latin America RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Middle East & Africa RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 56: Middle East & Africa RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 57: Middle East & Africa RDX and HMX Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 58: Middle East & Africa RDX and HMX Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 59: Saudi Arabia RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 60: Saudi Arabia RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 61: UAE RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 62: UAE RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 63: Israel RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 64: Israel RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 65: Egypt RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 66: Egypt RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Libya RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 68: Libya RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 69: Iran RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 70: Iran RDX and HMX Market Value (US$ Mn ) Forecast, by Application, 2020–2031

Table 71: Rest of Middle East & Africa RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 72: Rest of Middle East & Africa RDX and HMX Market Value (US$ Mn ) Forecast, by Application, 2020–2031

Table 73: Turkic Region RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 74: Turkic Region RDX and HMX Market Value (US$ Mn ) Forecast, by Application, 2020–2031

Table 75: Turkic Region RDX and HMX Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 76: Turkic Region RDX and HMX Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 77: Azerbaijan RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 78: Azerbaijan RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 79: Uzbekistan RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 80: Uzbekistan RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 81: Turkmenistan RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 82: Turkmenistan RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 83: Others RDX and HMX Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 84: Others RDX and HMX Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 2: Global RDX and HMX Market Attractiveness Analysis, by Application

Figure 3: Global RDX and HMX Market Volume Share Analysis, by Region, 2020, 2026, and 2031

Figure 4: Global RDX and HMX Market Attractiveness Analysis, by Region

Figure 5: North America RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 6: North America RDX and HMX Market Attractiveness Analysis, by Application

Figure 7: North America RDX and HMX Market Volume Share Analysis, by Country, 2020, 2026, and 2031

Figure 8: North America RDX and HMX Market Attractiveness Analysis, by Country

Figure 9: Europe RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 10: Europe RDX and HMX Market Attractiveness Analysis, by Application

Figure 11: Europe RDX and HMX Market Volume Share Analysis, by Country and Sub-region, 2020, 2026, and 2031

Figure 12: Europe RDX and HMX Market Attractiveness Analysis, by Country and Sub-region

Figure 13: Asia Pacific RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 14: Asia Pacific RDX and HMX Market Attractiveness Analysis, by Application

Figure 15: Asia Pacific RDX and HMX Market Volume Share Analysis, by Country and Sub-region, 2020, 2026, and 2031

Figure 16: Asia Pacific RDX and HMX Market Attractiveness Analysis, by Country and Sub-region

Figure 17: Latin America RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 18: Latin America RDX and HMX Market Attractiveness Analysis, by Application

Figure 19: Latin America RDX and HMX Market Volume Share Analysis, by Country and Sub-region, 2020, 2026, and 2031

Figure 20: Latin America RDX and HMX Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Middle East & Africa RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 22: Middle East & Africa RDX and HMX Market Attractiveness Analysis, by Application

Figure 23: Middle East & Africa RDX and HMX Market Volume Share Analysis, by Country and Sub-region, 2020, 2026, and 2031

Figure 24: Middle East & Africa RDX and HMX Market Attractiveness Analysis, by Country and Sub-region

Figure 25: Turkic Region RDX and HMX Market Volume Share Analysis, by Application, 2020, 2026, and 2031

Figure 26: Turkic Region RDX and HMX Market Attractiveness Analysis, by Application

Figure 27: Turkic Region RDX and HMX Market Volume Share Analysis, by Country and Sub-region, 2020, 2026, and 2031

Figure 28: Turkic Region RDX and HMX Market Attractiveness Analysis, by Country and Sub-region