Analysts’ Viewpoint

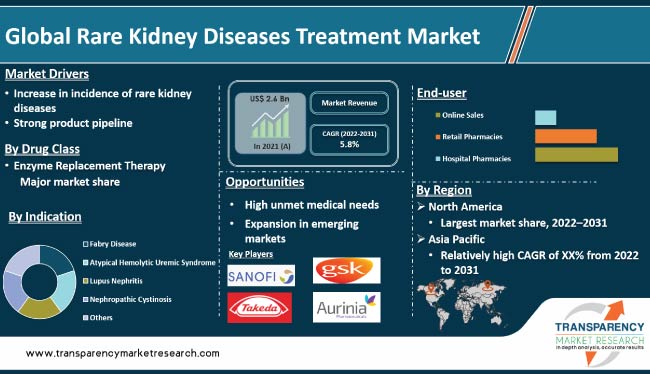

Incidence of acute renal failure and rare kidney diseases is rising significantly across the globe. Just a few treatment options have been approved for rare urinary diseases. New product launch and cost-effective treatments & services are likely to create lucrative opportunities for manufacturers in the global rare kidney diseases treatment market in the next few years, especially in developing countries.

Demand for rare kidney diseases treatment is rising across the globe, primarily in countries in Asia such as China and India, due to high incidence rate and need for effective kidney disease management. Leading players are focusing on developing new treatment options for rare kidney diseases.

Of the 150 different rare kidney diseases, majority are inherited. Each uncommon kidney disease has a unique set of symptoms; however, these rare diseases could collectively present overlapping diagnostic and therapeutic difficulties.

Small number of affected people, unknown disease causes, lack of biomarkers for diagnosis, and requirement of complex care are the key obstacles during diagnosis and treatment of these diseases. Rare kidney diseases are also known as rare urinary diseases. Rare kidney diseases include Fabry disease, atypical hemolytic uremic syndrome, lupus nephritis, nephropathic cystinosis, renal nutcracker syndrome, and others. Polycystic kidney disease (PKD) is a rare genetic kidney disease, in which clusters of cysts develop primarily within kidneys, resulting in an increase in size of the kidney.

Treatments for rare urinary diseases include enzyme replacement therapy, monoclonal antibodies, and others. Renal nutcracker syndrome is a rare vein compression disorder. It mostly affects left renal (kidney) vein. Symptoms of this disease include flank pain and blood in the urine. Increase in incidence of kidney diseases and rise in awareness among the people are the other factors driving market progress. Surge in geriatric population is likely to augment the global rare kidney diseases treatment market share in the near future.

The burden of various rare kidney diseases is expected to rise significantly across the globe in the next few years. Kidney-related problems, such as Fabry disease, atypical hemolytic uremic syndrome, lupus nephritis, nephropathic cystinosis, renal nutcracker syndrome, polycystic kidney disease (PKD), distal renal tubular acidosis, and IgA nephropathy disease, have increased.

Several rare kidney diseases remain untreated, which could cause serious health issues in future. According to the World Health Organization, the Fabry disease is estimated to affect approximately 1 in 40,000 men and around 1 in 20,000 women in the U.S. As per the National Organization for Rare Disorders, Inc., the incidence rate of atypical hemolytic uremic syndrome is 2 individuals per 1 million among the general population in the country.

Major players are focusing on designing and developing new products for rare kidney diseases. For instance, Reata Pharmaceuticals has one innovative product, Bardoxolone methyl, in phase 3 for the treatment of polycystic kidney disease. Amicus Therapeutics has one product, Migalastat Monotherapy, in phase 3 for the treatment of the Fabry disease.

In terms of drug class, the enzyme replacement therapy segment accounted for significant market share in 2021. Enzyme replacement therapy products are primarily used for the Fabry disease. These products include Galafold, Replagal, and Fabrazyme.

Increase in usage of enzyme replacement therapy in the treatment of the Fabry disease is likely to drive the segment during the forecast period. Strong enzyme replacement product pipeline is another major factor propelling the segment. Companies are focusing on launching enzyme replacement therapy products in untapped regions. This is likely to augment the segment in the near future.

Based on indication, the Fabry disease segment is projected to account for major share of the industry during the forecast period. Rise in patient population with the Fabry disease and increase in usage of novel treatments, such as chaperone therapy, are driving the segment. Intensive R&D activities, strong product pipeline, and rise in usage of substrate reduction therapies & enzyme replacement therapies are likely to propel the segment.

Galafold, Replagal, and Fabrazyme are the products approved for Fabry disease treatment; more products in phase 3 are projected to be launched in the near future. Furthermore, surge in number of people diagnosed with the Fabry disease is anticipated to increase the demand for innovative treatment options.

In terms of distribution channel, the hospital pharmacies segment is likely to account for significant share during the forecast period. Preference for hospitals for the treatment of rare urinary diseases has increased due to favorable reimbursement policies. Therefore, the segment is anticipated to grow at a rapid pace during the forecast period.

Rise in awareness about rare kidney diseases & novel treatment options and the trend of utilization of new & improved drugs by patients and physicians are projected to propel the segment in the next few years.

As per global rare kidney diseases treatment market forecast, North America accounted for the largest share of around 45% in 2021. The region's dominance can be ascribed to the increase in incidence rate of the Fabry disease, atypical hemolytic uremic syndrome, lupus nephritis, nephropathic cystinosis, and others kidney diseases. Increase in acceptance of technologically advanced products, surge in healthcare expenditure, early access to advanced technologies, and favorable funding by governments & charitable trusts for healthcare research are anticipated to accelerate market development in North America during the forecast period. The U.S. dominated the market in the region owing to factors such as presence of major players and increase in new product approvals from the U.S. FDA.

Asia Pacific is anticipated to be the fastest growing region for rare kidney diseases treatment during the forecast period. The region is anticipated to record significant market expansion from 2022 to 2031 due to large patient base in countries such as India and China and rise in awareness about rare urinary diseases.

The global rare kidney diseases treatment market is consolidated, with the presence of small number of leading players. Most of the companies are investing significantly in research & development, primarily to develop innovative rare kidney diseases treatment. Companies in business have adopted growth strategies such as expansion of product portfolio and mergers & acquisitions.

Calliditas Therapeutics AB, GSK plc., Aurinia Pharmaceuticals, Inc., Amicus Therapeutics, Inc., Shire (Takeda Pharmaceutical Company Limited), Sanofi, Advicenne, Alexion Pharmaceuticals, Inc., Horizon Therapeutics plc, Otsuka Pharmaceutical Co., Ltd. and Reata Pharmaceuticals, Inc. are the prominent players in the global rare kidney diseases treatment market.

These players have been profiled in the market report based on parameters such as company overview, portfolio, segments, strategies, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 2.6 Bn |

|

Forecast (Value) in 2031 |

More than US$ 4.6 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 2.6 Bn in 2021.

It is projected to reach more than US$ 4.6 Bn by 2031.

The CAGR is anticipated to be 5.8% from 2022 to 2031.

Increase in incidence of rare kidney diseases and strong product pipeline.

North America is likely to account for major share from 2022 to 2031.

Calliditas Therapeutics AB, GSK plc, Aurinia Pharmaceuticals, Inc., Amicus Therapeutics, Inc., Shire (Takeda Pharmaceutical Company Limited), Sanofi, Advicenne, Alexion Pharmaceuticals, Inc., Horizon Therapeutics plc, Otsuka Pharmaceutical Co., Ltd., and Reata Pharmaceuticals, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Rare Kidney Diseases Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Rare Kidney Diseases Treatment Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Epidemiology

5.3. Key Industry Events

5.4. COVID-19 Impact Analysis

6. Global Rare Kidney Diseases Treatment Market Analysis and Forecast, by Indication

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Indication, 2017–2031

6.3.1. Fabry Disease

6.3.2. Atypical Hemolytic Uremic Syndrome

6.3.3. Lupus Nephritis

6.3.4. Nephropathic Cystinosis

6.3.5. Others

6.4. Market Attractiveness Analysis, by Indication

7. Global Rare Kidney Diseases Treatment Market Analysis and Forecast, by Drug Class

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Drug Class, 2017–2031

7.3.1. Enzyme Replacement Therapy

7.3.2. Monoclonal Antibodies

7.3.3. Others

7.4. Market Attractiveness Analysis, by Drug Class

8. Global Rare Kidney Diseases Treatment Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Sales

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Rare Kidney Diseases Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Rare Kidney Diseases Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Indication, 2017–2031

10.2.1. Fabry Disease

10.2.2. Atypical Hemolytic Uremic Syndrome

10.2.3. Lupus Nephritis

10.2.4. Nephropathic Cystinosis

10.2.5. Others

10.3. Market Value Forecast, by Drug Class, 2017–2031

10.3.1. Enzyme Replacement Therapy

10.3.2. Monoclonal Antibodies

10.3.3. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Sales

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Indication

10.6.2. By Drug Class

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Rare Kidney Diseases Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Indication, 2017–2031

11.2.1. Fabry Disease

11.2.2. Atypical Hemolytic Uremic Syndrome

11.2.3. Lupus Nephritis

11.2.4. Nephropathic Cystinosis

11.2.5. Others

11.3. Market Value Forecast, by Drug Class, 2017–2031

11.3.1. Enzyme Replacement Therapy

11.3.2. Monoclonal Antibodies

11.3.3. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Sales

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Indication

11.6.2. By Drug Class

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Rare Kidney Diseases Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Indication, 2017–2031

12.2.1. Fabry Disease

12.2.2. Atypical Hemolytic Uremic Syndrome

12.2.3. Lupus Nephritis

12.2.4. Nephropathic Cystinosis

12.2.5. Others

12.3. Market Value Forecast, by Drug Class, 2017–2031

12.3.1. Enzyme Replacement Therapy

12.3.2. Monoclonal Antibodies

12.3.3. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Sales

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Indication

12.6.2. By Drug Class

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Rare Kidney Diseases Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Indication, 2017–2031

13.2.1. Fabry Disease

13.2.2. Atypical Hemolytic Uremic Syndrome

13.2.3. Lupus Nephritis

13.2.4. Nephropathic Cystinosis

13.2.5. Others

13.3. Market Value Forecast, by Drug Class, 2017–2031

13.3.1. Enzyme Replacement Therapy

13.3.2. Monoclonal Antibodies

13.3.3. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Sales

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Indication

13.6.2. By Drug Class

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Rare Kidney Diseases Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Indication, 2017–2031

14.2.1. Fabry Disease

14.2.2. Atypical Hemolytic Uremic Syndrome

14.2.3. Lupus Nephritis

14.2.4. Nephropathic Cystinosis

14.2.5. Others

14.3. Market Value Forecast, by Drug Class, 2017–2031

14.3.1. Enzyme Replacement Therapy

14.3.2. Monoclonal Antibodies

14.3.3. Others

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Sales

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Indication

14.6.2. By Drug Class

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Calliditas Therapeutics AB

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Overview

15.3.1.3. Financial Overview

15.3.1.4. Strategy Overview

15.3.1.5. SWOT Analysis

15.3.2. GSK plc

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Overview

15.3.2.3. Financial Overview

15.3.2.4. Strategy Overview

15.3.2.5. SWOT Analysis

15.3.3. Aurinia Pharmaceuticals, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Overview

15.3.3.3. Financial Overview

15.3.3.4. Strategy Overview

15.3.3.5. SWOT Analysis

15.3.4. Amicus Therapeutics, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Overview

15.3.4.3. Financial Overview

15.3.4.4. Strategy Overview

15.3.4.5. SWOT Analysis

15.3.5. Shire (Takeda Pharmaceutical Company Limited)

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Overview

15.3.5.3. Financial Overview

15.3.5.4. Strategy Overview

15.3.5.5. SWOT Analysis

15.3.6. Sanofi

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Overview

15.3.6.3. Financial Overview

15.3.6.4. Strategy Overview

15.3.6.5. SWOT Analysis

15.3.7. Advicenne

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Overview

15.3.7.3. Financial Overview

15.3.7.4. Strategy Overview

15.3.7.5. SWOT Analysis

15.3.8. Alexion Pharmaceuticals, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Overview

15.3.8.3. Financial Overview

15.3.8.4. Strategy Overview

15.3.8.5. SWOT Analysis

15.3.9. Horizon Therapeutics plc

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Overview

15.3.9.3. Financial Overview

15.3.9.4. Strategy Overview

15.3.9.5. SWOT Analysis

15.3.10. Otsuka Pharmaceutical Co., Ltd.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Overview

15.3.10.3. Financial Overview

15.3.10.4. Strategy Overview

15.3.10.5. SWOT Analysis

15.3.11. Reata Pharmaceuticals, Inc.

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Overview

15.3.11.3. Financial Overview

15.3.11.4. Strategy Overview

15.3.11.5. SWOT Analysis

List of Tables

Table 01: Global Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 02: Global Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 03: Global Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 07: North America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 08: North America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 11: Europe Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 12: Europe Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 15: Asia Pacific Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 16: Asia Pacific Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Country/Sun-region, 2017–2031

Table 18: Latin America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 19: Latin America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 20: Latin America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle east and Africa Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Country/Sun-region, 2017–2031

Table 22: Middle east and Africa Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Middle east and Africa Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 24: Middle east and Africa Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 25: Business Overview (Calliditas Therapeutics AB)

Table 26: Business Overview (GSK plc)

Table 27: Business Overview (Aurinia Pharmaceuticals, Inc.)

Table 28: Business Overview (Amicus Therapeutics, Inc.)

Table 29: Business Overview (Shire (Takeda Pharmaceutical Company Limited)

Table 30: Business Overview (Sanofi)

Table 31: Business Overview (Advicenne)

Table 32: Business Overview (Alexion Pharmaceuticals, Inc.)

Table 33: Business Overview (Horizon Therapeutics plc)

Table 34: Business Overview (Otsuka Pharmaceutical Co., Ltd.)

Table 35: Business Overview (Reata Pharmaceuticals, Inc.)

List of Figures

Figure 01: Global Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Rare Kidney Diseases Treatment Market Value Share, by Indication (2021)

Figure 03: Global Rare Kidney Diseases Treatment Market Value Share, by Drug Class (2021)

Figure 04: Global Rare Kidney Diseases Treatment Market Value Share, by Distribution Channel (2021)

Figure 05: Global Rare Kidney Diseases Treatment Market Value Share, by Region (2021)

Figure 06: Global Rare Kidney Diseases Treatment Market Value Share Analysis, by Indication, 2021 and 2031

Figure 07: Global Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Indication, 2022–2031

Figure 08: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Fabry Disease, 2017–2031

Figure 09: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Atypical Hemolytic Uremic Syndrome, 2017–2031

Figure 10: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Lupus Nephritis, 2017–2031

Figure 11: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Nephropathic Cystinosis, 2017–2031

Figure 12: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Others, 2017–2031

Figure 13: Global Rare Kidney Diseases Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 14: Global Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 15: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Enzyme Replacement Therapy, 2017–2031

Figure 16: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Monoclonal Antibodies, 2017–2031

Figure 17: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: Global Rare Kidney Diseases Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 19: Global Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 20: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 21: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 22: Global Rare Kidney Diseases Treatment Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031

Figure 23: Global Rare Kidney Diseases Treatment Market Value Share Analysis, by Region, 2021 and 2031

Figure 24: Global Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Region, 2022-2031

Figure 25: North America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 26: North America Rare Kidney Diseases Treatment Market Value Share (%), by Country, 2021 and 2031

Figure 27: North America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Country, 2022–2031

Figure 28: North America Rare Kidney Diseases Treatment Market Value Share Analysis, by Indication, 2021 and 2031

Figure 29: North America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Indication, 2022–2031

Figure 30: North America Rare Kidney Diseases Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 31: North America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 32: North America Rare Kidney Diseases Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 33: North America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 34: Europe Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 35: Europe Rare Kidney Diseases Treatment Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 36: Europe Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Europe Rare Kidney Diseases Treatment Market Value Share Analysis, by Indication, 2021 and 2031

Figure 38: Europe Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Indication, 2022–2031

Figure 39: Europe Rare Kidney Diseases Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 40: Europe Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 41: Europe Rare Kidney Diseases Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 42: Europe Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 43: Asia Pacific Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 44: Asia Pacific Rare Kidney Diseases Treatment Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 45: Asia Pacific Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 46: Asia Pacific Rare Kidney Diseases Treatment Market Value Share Analysis, by Indication, 2021 and 2031

Figure 47: Asia Pacific Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Indication, 2022–2031

Figure 48: Asia Pacific Rare Kidney Diseases Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 49: Asia Pacific Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 50: Asia Pacific Rare Kidney Diseases Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 51: Asia Pacific Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 52: Latin America Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 53: Latin America Rare Kidney Diseases Treatment Market Value Share Analysis, by Indication, 2021 and 2031

Figure 54: Latin America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Indication, 2022–2031

Figure 55: Latin America Rare Kidney Diseases Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 56: Latin America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 57: Latin America Rare Kidney Diseases Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 58: Latin America Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 59: Middle east and Africa Rare Kidney Diseases Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 60: Middle east and Africa Rare Kidney Diseases Treatment Market Value Share Analysis, by Indication, 2021 and 2031

Figure 61: Middle east and Africa Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Indication, 2022–2031

Figure 62: Middle east and Africa Rare Kidney Diseases Treatment Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 63: Middle east and Africa Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 64: Middle east and Africa Rare Kidney Diseases Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 65: Middle east and Africa Rare Kidney Diseases Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 66: Global Rare Kidney Diseases Treatment Market Share, by Company, 2021