The COVID-19 pandemic poses a serious challenge for the management of patients with different pre-existing conditions, including autoimmune diseases such as systemic sclerosis. Companies in the rare dermatological disease treatment market are under scrutiny for robust supply of treatments and medications such as antibiotics, immunosuppressants, and corticosteroids, among others, to support the health of patients.

Systemic sclerosis represents one of the most severe connective tissue diseases with multi-organ involvement, owing to concomitancy of fibrosing and microvascular alterations. Hence, companies in the rare dermatological disease treatment market are boosting their production capacities in medications to reduce morbidity and mortality rates. The deep investigation on the possible interactions between SARS-CoV-2 infection and a compromised host immune system might provide useful pathogenic and therapeutic insights into both coronavirus and systemic sclerosis.

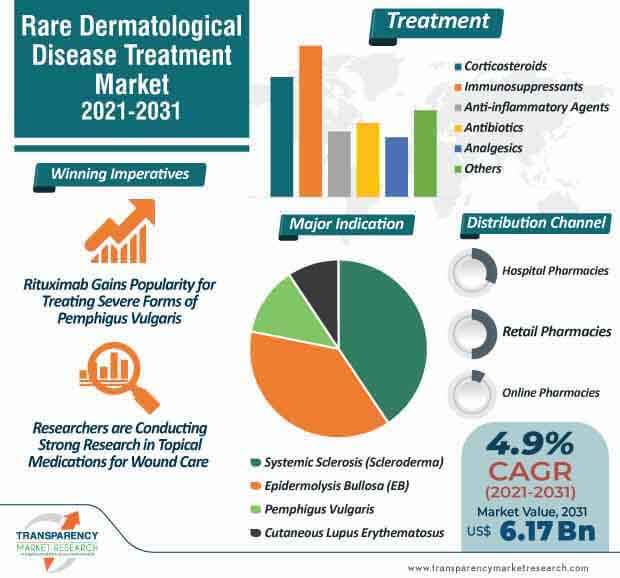

The rare dermatological disease treatment market is expected to surpass US$ 6.17 Bn by 2031. Since there is no curative treatment for epidermolysis bullosa (EB), there is a need for advances in understanding molecular genetics and underlying pathomechanisms of different forms of EB. Companies are expected to team with researchers to deploy promising R&D for exploring novel treatments for EB.

Stakeholders and researchers are gaining a strong research base in topical medications for wound care in order to accelerate wound healing. This has the potential in wound care across different forms of EB.

The rare dermatological disease treatment market is estimated to clock a CAGR of 4.9% from 2021 to 2031. The therapeutic management of pemphigus vulgaris (PV) involves the combination of systemic corticosteroids and potentially corticosteroid-sparing immunosuppressive drugs, namely azathioprine and mycophenolate mofetil as the standard first-line therapy by most clinicians.

Manufacturers in the rare dermatological disease treatment market are bolstering their output capabilities of Rituximab in order to treat severe forms of pemphigus vulgaris. Patients initially treated with prednisone/prednisolone plus Rituximab and who have persistent active lesions are being recommended to increase the doses of prednisone/prednisolone. Moderate and severe types of pemphigus vulgaris are being treated with Rituximab administered as a monotherapy or associated with topical corticosteroids in patients with absolute contraindication to systemic corticosteroid therapy.

The use of cyclophosphamide at very high doses during intensive conditioning procedures for myelosuppressive or myeloablative purposes, with or without antilymphocytic serum followed by autologous hematopoietic stem cell (HSC) transplantation has proved effective in the systemic sclerosis treatment. Companies in the rare dermatological disease treatment market are increasing their focus on these treatment options for severe and rapidly progressive forms of systemic sclerosis.

In order to improve patient quality of life, non-pharmacological therapies such as functional rehabilitation are being recommended to combat systemic sclerosis. Companies and healthcare providers in the rare dermatological disease treatment market are increasing awareness about therapeutic patient education (TPE) to obtain a better understanding of the disease.

Analysts’ Viewpoint

Given the unpredictable and threatening course of the COVID-19 pandemic, valuable prevention and management strategies are being implemented at healthcare facilities for systemic sclerosis patients. Therapeutic patient education is emerging as an effective strategy to acquire and maintain the skills to better manage systemic sclerosis. There is a need to limit common side effects usually associated with long-term immunosuppressive or corticosteroid treatment for pemphigus vulgaris. Companies in the rare dermatological disease treatment market should increase investments in research to develop novel treatment options for pemphigus vulgaris. Additional supportive treatments such as intralesional injections of corticosteroids are being considered for isolated lesions of oral mucosa, lips, and skin of pemphigus vulgaris patients.

Rare dermatological disease treatment market is expected to surpass US$ 6.17 Bn by 2031

Rare dermatological disease treatment market is estimated to clock a CAGR of 4.9% from 2021 to 2031

Rare dermatological disease treatment market is driven by increase in incidence of rare diseases and surge in research & development for orphan drugs

The systemic sclerosis segment dominated the global rare dermatological disease treatment market in 2020, and the trend is projected to continue during the forecast period

Key players in the global rare dermatological disease treatment market include Sanofi, GlaxoSmithKline plc, Novartis AG, Castle Creek Biosciences, Inc., Merck & Co.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Rare Dermatological Disease Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Rare Dermatological Disease Treatment Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. Novel Therapies for Rare Dermatological Disease

5.3. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

6. Global Rare Dermatological Disease Treatment Market Analysis and Forecast, by Major Indication

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Rare Dermatological Disease Treatment Market Value Forecast, by Major Indication, 2017–2031

6.3.1. Systemic Sclerosis (Scleroderma)

6.3.2. Epidermolysis Bullosa (EB)

6.3.3. Pemphigus Vulgaris

6.3.4. Cutaneous Lupus Erythematosus

6.4. Global Rare Dermatological Disease Treatment Market Attractiveness, by Major Indication

7. Global Rare Dermatological Disease Treatment Market Analysis and Forecast, by Treatment

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Rare Dermatological Disease Treatment Market Value Forecast, by Treatment, 2017–2031

7.3.1. Corticosteroids

7.3.2. Immunosuppressants

7.3.3. Anti-inflammatory Agents

7.3.4. Antibiotics

7.3.5. Analgesics

7.3.6. Others

7.4. Global Rare Dermatological Disease Treatment Market Attractiveness, by Treatment

8. Global Rare Dermatological Disease Treatment Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Global Rare Dermatological Disease Treatment Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Global Rare Dermatological Disease Treatment Market Attractiveness, by Distribution Channel

9. Global Rare Dermatological Disease Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Rare Dermatological Disease Treatment Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Rare Dermatological Disease Treatment Market Attractiveness, by Country/Region

10. North America Rare Dermatological Disease Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Rare Dermatological Disease Treatment Market Value Forecast, by Major Indication, 2017–2031

10.2.1. Systemic Sclerosis (Scleroderma)

10.2.2. Epidermolysis Bullosa (EB)

10.2.3. Pemphigus Vulgaris

10.2.4. Cutaneous Lupus Erythematosus

10.3. Market Value Forecast, by Treatment, 2017–2031

10.3.1. Corticosteroids

10.3.2. Immunosuppressants

10.3.3. Anti-inflammatory Agents

10.3.4. Antibiotics

10.3.5. Analgesics

10.3.6. Others

10.4. North America Rare Dermatological Disease Treatment Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. North America Rare Dermatological Disease Treatment Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. North America Rare Dermatological Disease Treatment Market Attractiveness Analysis

10.6.1. By Major Indication

10.6.2. By Treatment

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Rare Dermatological Disease Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Rare Dermatological Disease Treatment Market Value Forecast, by Major Indication, 2017–2031

11.2.1. Systemic Sclerosis (Scleroderma)

11.2.2. Epidermolysis Bullosa (EB)

11.2.3. Pemphigus Vulgaris

11.2.4. Cutaneous Lupus Erythematosus

11.3. Europe Rare Dermatological Disease Treatment Market Value Forecast, by Treatment, 2017–2031

11.3.1. Corticosteroids

11.3.2. Immunosuppressants

11.3.3. Anti-inflammatory Agents

11.3.4. Antibiotics

11.3.5. Analgesics

11.3.6. Others

11.4. Europe Rare Dermatological Disease Treatment Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Europe Rare Dermatological Disease Treatment Market Value Forecast, by Country/Sub-Region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Europe Rare Dermatological Disease Treatment Market Attractiveness Analysis

11.6.1. By Major Indication

11.6.2. By Treatment

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-Region

12. Asia Pacific Rare Dermatological Disease Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Rare Dermatological Disease Treatment Market Value Forecast, by Major Indication, 2017–2031

12.2.1. Systemic Sclerosis (Scleroderma)

12.2.2. Epidermolysis Bullosa (EB)

12.2.3. Pemphigus Vulgaris

12.2.4. Cutaneous Lupus Erythematosus

12.3. Asia Pacific Rare Dermatological Disease Treatment Market Value Forecast, by Treatment, 2017–2031

12.3.1. Corticosteroids

12.3.2. Immunosuppressants

12.3.3. Anti-inflammatory Agents

12.3.4. Antibiotics

12.3.5. Analgesics

12.3.6. Others

12.4. Asia Pacific Rare Dermatological Disease Treatment Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Asia Pacific Rare Dermatological Disease Treatment Market Value Forecast, by Country/Sub-Region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Asia Pacific Rare Dermatological Disease Treatment Market Attractiveness Analysis

12.6.1. By Major Indication

12.6.2. By Treatment

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-Region

13. Latin America Rare Dermatological Disease Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Rare Dermatological Disease Treatment Market Value Forecast, by Major Indication, 2017–2031

13.2.1. Systemic Sclerosis (Scleroderma)

13.2.2. Epidermolysis Bullosa (EB)

13.2.3. Pemphigus Vulgaris

13.2.4. Cutaneous Lupus Erythematosus

13.3. Latin America Rare Dermatological Disease Treatment Market Value Forecast, by Treatment, 2017–2031

13.3.1. Corticosteroids

13.3.2. Immunosuppressants

13.3.3. Anti-inflammatory Agents

13.3.4. Antibiotics

13.3.5. Analgesics

13.3.6. Others

13.4. Latin America Rare Dermatological Disease Treatment Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Latin America Rare Dermatological Disease Treatment Market Value Forecast, by Country/Sub-Region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Latin America Rare Dermatological Disease Treatment Market Attractiveness Analysis

13.6.1. By Major Indication

13.6.2. By Treatment

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-Region

14. Middle East & Africa Rare Dermatological Disease Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Rare Dermatological Disease Treatment Market Value Forecast, by Major Indication, 2017–2031

14.2.1. Systemic Sclerosis (Scleroderma)

14.2.2. Epidermolysis Bullosa (EB)

14.2.3. Pemphigus Vulgaris

14.2.4. Cutaneous Lupus Erythematosus

14.3. Middle East & Africa Rare Dermatological Disease Treatment Market Value Forecast, by Treatment, 2017–2031

14.3.1. Corticosteroids

14.3.2. Immunosuppressants

14.3.3. Anti-inflammatory Agents

14.3.4. Antibiotics

14.3.5. Analgesics

14.3.6. Others

14.4. Middle East & Africa Rare Dermatological Disease Treatment Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Middle East & Africa Rare Dermatological Disease Treatment Market Value Forecast, by Country/Sub-Region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Middle East & Africa Rare Dermatological Disease Treatment Market Attractiveness Analysis

14.6.1. By Major Indication

14.6.2. By Treatment

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-Region

15. Competition Landscape

15.1. Company Profiles

15.1.1. Sanofi

15.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.1.2. Growth Strategies

15.1.1.3. SWOT Analysis

15.1.2. GlaxoSmithKline plc

15.1.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.2.2. Growth Strategies

15.1.2.3. SWOT Analysis

15.1.3. Novartis AG

15.1.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.3.2. Growth Strategies

15.1.3.3. SWOT Analysis

15.1.4. Castle Creek Biosciences, Inc.

15.1.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.4.2. Growth Strategies

15.1.4.3. SWOT Analysis

15.1.5. Merck & Co., Inc.

15.1.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.5.2. Growth Strategies

15.1.5.3. SWOT Analysis

15.1.6. Bristol-Myers Squibb Company

15.1.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.6.2. Growth Strategies

15.1.6.3. SWOT Analysis

15.1.7. Pfizer, Inc.

15.1.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.7.2. Growth Strategies

15.1.7.3. SWOT Analysis

15.1.8. F. Hoffmann-La Roche Ltd.

15.1.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.8.2. Growth Strategies

15.1.8.3. SWOT Analysis

15.1.9. Merck KGaA

15.1.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.9.2. Growth Strategies

15.1.9.3. SWOT Analysis

15.1.10. Eli Lilly and Company

15.1.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.10.2. Growth Strategies

15.1.10.3. SWOT Analysis

15.1.11. AbbVie, Inc.

15.1.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.11.2. Growth Strategies

15.1.11.3. SWOT Analysis

15.1.12. Krystal Biotech, Inc.

15.1.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.12.2. Growth Strategies

15.1.12.3. SWOT Analysis

15.1.13. Amryt Pharma plc

15.1.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.1.13.2. Growth Strategies

15.1.13.3. SWOT Analysis

List of Tables

Table 01: Global Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Major Indication, 2017–2031

Table 02: Global Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 03: Global Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Major Indication, 2017–2031

Table 07: North America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 08: North America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Major Indication, 2017–2031

Table 11: Europe Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 12: Europe Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Major Indication, 2017–2031

Table 15: Asia Pacific Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 16: Asia Pacific Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 18: Latin America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Major Indication, 2017–2031

Table 19: Latin America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 20: Latin America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Major Indication, 2017–2031

Table 23: Middle East & Africa Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Treatment, 2017–2031

Table 24: Middle East & Africa Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Rare Dermatological Disease Treatment Market Value Share, by Major Indication, 2020

Figure 03: Rare Dermatological Disease Treatment Market Value Share, by Treatment, 2020

Figure 04: Rare Dermatological Disease Treatment Market Value Share, by Distribution Channel, 2020

Figure 05: Global Rare Dermatological Disease Treatment Market Value Share Analysis, by Major Indication, 2020 and 2031

Figure 06: Global Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Major Indication, 2021–2031

Figure 07: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Systemic Sclerosis (Scleroderma), 2017–2031

Figure 08: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Epidermolysis Bullosa (EB), 2017–2031

Figure 09: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Pemphigus Vulgaris, 2017–2031

Figure 10: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Cutaneous Lupus Erythematosus, 2017–2031

Figure 11: Global Rare Dermatological Disease Treatment Market Value Share Analysis, by Treatment, 2020 and 2031

Figure 12: Global Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Treatment, 2021–2031

Figure 13: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Corticosteroids, 2017–2031

Figure 14: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Immunosuppressants, 2017–2031

Figure 15: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Anti-inflammatory Agents, 2017–2031

Figure 16: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Antibiotics, 2017–2031

Figure 17: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Analgesics, 2017–2031

Figure 18: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Others, 2017–2031

Figure 19: Global Rare Dermatological Disease Treatment Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 20: Global Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 21: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 22: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 23: Global Rare Dermatological Disease Treatment Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031

Figure 24: Global Rare Dermatological Disease Treatment Market Value Share Analysis, by Region, 2020 and 2031

Figure 25: Global Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Region, 2021–2031

Figure 26: North America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 27: North America Rare Dermatological Disease Treatment Market Value Share, by Country, 2020 & 2031

Figure 28: North America Rare Dermatological Disease Treatment Market Attractiveness, by Country, 2021–2031

Figure 29: North America Rare Dermatological Disease Treatment Market Value Share Analysis, by Major Indication, 2020 and 2031

Figure 30: North America Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Major Indication, 2021–2031

Figure 31: North America Rare Dermatological Disease Treatment Market Value Share (%), by Treatment, 2020 and 2031

Figure 32: North America Rare Dermatological Disease Treatment Market Attractiveness, by Treatment, 2021–2031

Figure 33: North America Rare Dermatological Disease Treatment Market Value Share (%), by Distribution Channel, 2020 and 2031

Figure 34: North America Rare Dermatological Disease Treatment Market Attractiveness, by Distribution Channel, 2021–2031

Figure 35: Europe Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 36: Europe Rare Dermatological Disease Treatment Market Value Share, by Country/Sub-region, 2020 & 2031

Figure 37: Europe Rare Dermatological Disease Treatment Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 38: Europe Rare Dermatological Disease Treatment Market Value Share Analysis, by Major Indication, 2020 and 2031

Figure 39: Europe Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Major Indication, 2021–2031

Figure 40: Europe Rare Dermatological Disease Treatment Market Value Share (%), by Treatment, 2020 and 2031

Figure 41: Europe Rare Dermatological Disease Treatment Market Attractiveness, by Treatment, 2021–2031

Figure 42: Europe Rare Dermatological Disease Treatment Market Value Share (%), by Distribution Channel, 2020 and 2031

Figure 43: Europe Rare Dermatological Disease Treatment Market Attractiveness, by Distribution Channel, 2021–2031

Figure 44: Asia Pacific Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 45: Asia Pacific Rare Dermatological Disease Treatment Market Value Share, by Country/Sub-region, 2020 & 2031

Figure 46: Asia Pacific Rare Dermatological Disease Treatment Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 47: Asia Pacific Rare Dermatological Disease Treatment Market Value Share Analysis, by Major Indication, 2020 and 2031

Figure 48: Asia Pacific Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Major Indication, 2021–2031

Figure 49: Asia Pacific Rare Dermatological Disease Treatment Market Value Share (%), by Treatment, 2020 and 2031

Figure 50: Asia Pacific Rare Dermatological Disease Treatment Market Attractiveness, by Treatment, 2021–2031

Figure 51: Asia Pacific Rare Dermatological Disease Treatment Market Value Share (%), by Distribution Channel, 2020 and 2031

Figure 52: Asia Pacific Rare Dermatological Disease Treatment Market Attractiveness, by Distribution Channel, 2021–2031

Figure 53: Latin America Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 54: Latin America Rare Dermatological Disease Treatment Market Value Share, by Country, 2020 & 2031

Figure 55: Latin America Rare Dermatological Disease Treatment Market Attractiveness, by Country, 2021–2031

Figure 56: Latin America Rare Dermatological Disease Treatment Market Value Share Analysis, by Major Indication, 2020 and 2031

Figure 57: Latin America Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Major Indication, 2021–2031

Figure 58: Latin America Rare Dermatological Disease Treatment Market Value Share (%), by Treatment, 2020 and 2031

Figure 59: Latin America Rare Dermatological Disease Treatment Market Attractiveness, by Treatment, 2021–2031

Figure 60: Latin America Rare Dermatological Disease Treatment Market Value Share (%), by Distribution Channel, 2020 and 2031

Figure 61: Latin America Rare Dermatological Disease Treatment Market Attractiveness, by Distribution Channel, 2021–2031

Figure 62: Middle East Rare Dermatological Disease Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 63: Middle East Rare Dermatological Disease Treatment Market Value Share, by Country/Sub-region, 2020 & 2031

Figure 64: Middle East Rare Dermatological Disease Treatment Market Attractiveness, by Country/Sub-region, 2021–2031

Figure 65: Middle East & Africa Rare Dermatological Disease Treatment Market Value Share Analysis, by Major Indication, 2020 and 2031

Figure 66: Middle East & Africa Rare Dermatological Disease Treatment Market Attractiveness Analysis, by Major Indication, 2021–2031

Figure 67: Middle East & Africa Rare Dermatological Disease Treatment Market Value Share (%), by Treatment, 2020 and 2031

Figure 68: Middle East & Africa Rare Dermatological Disease Treatment Market Attractiveness, by Treatment, 2021–2031

Figure 69: Middle East & Africa Rare Dermatological Disease Treatment Market Value Share (%), by Distribution Channel, 2020 and 2031

Figure 70: Middle East & Africa Rare Dermatological Disease Treatment Market Attractiveness, by Distribution Channel, 2021–2031