Analysts’ Viewpoint on Market Scenario

Rise in adoption of rapid prototyping for the R&D of consumer goods, vehicles, medical products, aerospace & defense parts, and industrial parts is driving the rapid prototyping market size. Rapid prototyping helps in the development and approval of new products or concepts. It enables designers to gain ready feedback from clients based on an actual physical model of the product rather than a concept.

The industry in Asia Pacific is expected to grow at a rapid pace, owing to government policies fueling expansion of the manufacturing sector in the region. Major rapid prototyping companies are investing significantly in the R&D of new products and solutions to remain competitive in the market.

Rapid prototyping is a fabrication process of physical parts and models. It facilities the assembly of various products using Computer-aided Design (CAD). Rapid tooling and rapid prototyping use additive manufacturing for the fast fabrication of physical parts. Rapid prototyping can be integrated with investment casting to facilitate rapid casting. ABS, polystyrene, or rigid polyurethane foam are often used in plastic prototyping.

Rapid prototyping offers several benefits such as reduced design & development time, low overall product development and functionality testing costs, and elimination of risk. It enables greater user involvement during the design stages of product development and can help evaluate human factors and ergonomics.

Artificial Intelligence (AI), Augmented Reality (AR), advanced robotics, smart devices, and 3D printing are revolutionizing the manufacturing process in various industries. Decentralization in 3D printing is expected to determine the future of rapid prototyping in the next few years. 3D printing has led to significant advancements in heavy industry, automotive, consumer products, medical, healthcare, and aerospace sectors. These five industries account for 76% of the global manufacturing sector.

Rapid prototyping services help the manufacturing industry by promoting quick product development. They enable lean manufacturing and boost product adaptability. These technological advancements in the sector assure high product customizations and boost revenues.

Increase in adoption of digital manufacturing is anticipated to fuel market expansion during the forecast period. Digital manufacturing relies on computer-based systems for simulation, 3D visualization, and analytics. These tools help ease the product manufacturing process. AI is gradually becoming a necessary component in rapid prototype development. The ability to make data-driven decisions and conduct seamless testing are some of the most important characteristics of excellent rapid prototyping.

Surge in the R&D of autonomous driving is also expected to fuel the rapid prototyping market statistics in the next few years. Rapid development of autonomous vehicles boosts the demand for new control platforms and sensor technologies. Adoption of rapid prototyping in the automotive sector can fulfill these requirements and help establish the necessary testing and development framework.

The manufacturing industry in the U.S. represents around 11% of the country’s gross domestic product, yet it accounts for 35% of the productivity growth and 60% of exports. The manufacturing sector plays a major role in innovation in the U.S., as it is responsible for 55% of all patents and 70% of all R&D expenditures.

Top rapid prototyping companies in the U.S. are launching new products to enhance their market share. In February 2022, Fictiv, a leading provider of 3D printing & rapid prototyping services in the U.S., launched its Enterprise Business Solutions portfolio to address the most pressing challenges faced in product manufacturing. This portfolio has three digitally-enabled solutions that solve new product development, engineer-to-order, and MRO challenges relating to efficiency, speed, and quality. These three parameters include NPD acceleration (supports engineering teams from early-stage prototypes to production-grade tests), ETO rapid production, and MRO digital inventory. Thus, expansion in the manufacturing sector is propelling the market.

The aerospace industry has significant regulatory requirements as well as expectations of quality and top-of-the-line performance. Complying with all these demands can be challenging. However, rapid prototyping is uniquely positioned to address these challenges.

3D printing and rapid prototyping services can contribute to nearly every aspect of aerospace design, including electronics, lighting, interior and exterior components, and mechanical parts. They can assist the aerospace sector with everything from the basic design concept to specific production parts and even maintenance.

The aerospace & defense industry continues to boast impressive contributions to the world economy despite the adverse impact of the COVID-19 pandemic. The industry accounted for 1.8% of the total U.S. GDP, recording around US$ 382 Bn in revenue. Thus, expansion in the aerospace & defense industry is likely to drive the rapid prototyping industry during the forecast period.

Rapid prototyping is employed in the aerospace & defense industry for diverse functions such as production of lightweight parts, reduction of assembly part numbers, and improvement in workflow and production quality with custom-made jigs and fixtures. It is also utilized to evaluate the design variations of parts through 3D visualization and estimate the surface quality of models. These methods make it possible to create complex patterns more quickly and affordably.

Several materials used in the production of aerospace products are significantly expensive. Rapid prototyping allows for testing and evaluation with less expensive alternatives before investing in tooling and committing to molding parts in the production materials. Therefore, rapid prototyping enables companies to reduce the cost of design and create products by reducing manufacturing time and wastage of materials.

According to the latest rapid prototyping market trends, the Fused Deposition Modeling (FDM) process segment held major share of 31.0% of the industry in 2021. FDM is an additive manufacturing process, which builds parts layer-by-layer by selectively depositing melted materials in a predetermined path. It is the most cost-effective method of manufacturing bespoke thermoplastic prototypes due to the wide availability of FDM printers at low cost. Thus, FDM offers cheaper manufacturing processes than other additive manufacturing techniques. It is increasingly being used for the development of functional prototypes, production and manufacturing tools, concept models, and quality parts.

According to the latest global rapid prototyping market analysis, the polymer material segment dominated the industry and held 44.0% share in 2021. Polymer offers various benefits such as low cost, robustness, and simple fabrication, which are beneficial in the exploratory stages of research.

Designers often use rapid prototype plastic parts to replace metal prototypes in order to save production costs. Acrylonitrile Butadiene Styrene (ABS) is a general-purpose thermoplastic polymer, which offers good rigidity, high impact strength, heat resistance, low-temperature resistance, chemical resistance, high mechanical strength, and ease of processing.

According to the latest rapid prototyping market forecast, North America is expected to hold largest share of the industry during 2022-2031. The region held around 34.0% share of the industry, in terms of value, in 2021. Presence of well-established players and rise in investment in R&D activities across automotive, aerospace & defense, and healthcare industries are driving market revenue in the region. According to the National Center for Science and Engineering Statistics (NCSES) within the National Science Foundation, investment in R&D activities in the U.S. totaled around US$ 606.1 Bn in 2018.

Asia Pacific and Europe are prominent regions and held 30.0% and 25.0% share, respectively, of the global rapid prototyping business in 2021. Surge in public and private investments in 3D printing technologies and applications and increase in acceptance of 3D-printed organs and implants are driving the market in these regions. Market vendors in Europe are launching new products to expand their revenues. In January 2020, Xometry Europe GmbH launched an instant quote 3D printing service in Europe.

The industry is fragmented, with a large number of large-medium scale vendors controlling minority share. Vendors are engaged in product development through comprehensive investments in R&D activities. They are expanding their rapid prototyping market share through various growth strategies such as collaborations, partnerships, and mergers and acquisitions.

Major players operating in the industry include 3E Rapid Prototyping Ltd., ARRK Corporation, Avid Product Development, LLC, CADX Tools & Technologies Pvt. Ltd., Dassault Systemes, Fathom Digital Manufacturing Corporation, Fictiv, Laser Prototypes Europe Ltd., Materialise NV, Proto Labs, Inc., ProtoCAM, Sandvik AB, and Xometry Europe GmbH. These vendors have been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

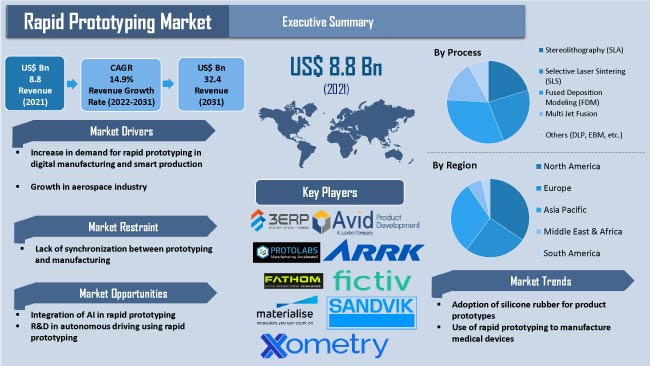

Market Size Value in 2021 |

US$ 8.8 Bn |

|

Market Forecast Value in 2031 |

US$ 32.4 Bn |

|

Growth Rate (CAGR) |

14.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 8.8 Bn in 2021

It is expected to be 14.9% from 2022 to 2031

Increase in demand for rapid prototyping in digital manufacturing and smart production and growth in aerospace industry

The automotive segment accounted for major share of 28.0% in 2021

North America is a more attractive region for vendors

3E Rapid Prototyping Ltd., ARRK Corporation, Avid Product Development, LLC, CADX Tools & Technologies Pvt. Ltd., Dassault Systemes, Fathom Digital Manufacturing Corporation, Fictiv, Laser Prototypes Europe Ltd., Materialise NV, Proto Labs, Inc., ProtoCAM, Sandvik AB, and Xometry Europe GmbH

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Rapid Prototyping Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Additive Manufacturing Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global Rapid Prototyping Market Analysis, By Process

5.1. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Process, 2017–2031

5.1.1. Stereolithography (SLA)

5.1.2. Selective Laser Sintering (SLS)

5.1.3. Fused Deposition Modeling (FDM)

5.1.4. Multi Jet Fusion (MJF)

5.1.5. Others (Digital Light Processing [DLP], Electron Beam Melting [EBM], etc.)

5.2. Market Attractiveness Analysis, By Process

6. Global Rapid Prototyping Market Analysis, By Type

6.1. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Type, 2017–2031

6.1.1. Proof-of-Concept (PoC) Prototype

6.1.2. Functional Prototype

6.1.3. Visual Prototype

6.1.4. User Experience Prototype

6.2. Market Attractiveness Analysis, By Type

7. Global Rapid Prototyping Market Analysis, By Material

7.1. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Material, 2017–2031

7.1.1. Metal

7.1.2. Polymer

7.1.3. Ceramic

7.1.4. Others (Plaster & Starch, Liquid Silicone Rubber (LSR), etc.)

7.2. Market Attractiveness Analysis, By Material

8. Global Rapid Prototyping Market Analysis, By End-use Industry

8.1. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

8.1.1. Aerospace & Defense

8.1.2. Consumer Goods & Electronics

8.1.3. Automotive

8.1.4. Healthcare

8.1.5. Others (Film & Animation, Architecture, etc.)

8.2. Market Attractiveness Analysis, By End-use Industry

9. Global Rapid Prototyping Market Analysis and Forecast, By Region

9.1. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Rapid Prototyping Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Process, 2017–2031

10.3.1. Stereolithography (SLA)

10.3.2. Selective Laser Sintering (SLS)

10.3.3. Fused Deposition Modeling (FDM)

10.3.4. Multi Jet Fusion (MJF)

10.3.5. Others (Digital Light Processing [DLP], Electron Beam Melting [EBM], etc.)

10.4. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Type, 2017–2031

10.4.1. Proof-of-Concept (PoC) Prototype

10.4.2. Functional Prototype

10.4.3. Visual Prototype

10.4.4. User Experience Prototype

10.5. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Material, 2017–2031

10.5.1. Metal

10.5.2. Polymer

10.5.3. Ceramic

10.5.4. Others (Plaster & Starch, Liquid Silicone Rubber (LSR), etc.)

10.6. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

10.6.1. Aerospace & Defense

10.6.2. Consumer Goods & Electronics

10.6.3. Automotive

10.6.4. Healthcare

10.6.5. Others (Film & Animation, Architecture, etc.)

10.7. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Process

10.8.2. By Type

10.8.3. By Material

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Rapid Prototyping Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Process, 2017–2031

11.3.1. Stereolithography (SLA)

11.3.2. Selective Laser Sintering (SLS)

11.3.3. Fused Deposition Modeling (FDM)

11.3.4. Multi Jet Fusion (MJF)

11.3.5. Others (Digital Light Processing [DLP], Electron Beam Melting [EBM], etc.)

11.4. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Type, 2017–2031

11.4.1. Proof-of-Concept (PoC) Prototype

11.4.2. Functional Prototype

11.4.3. Visual Prototype

11.4.4. User Experience Prototype

11.5. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Material, 2017–2031

11.5.1. Metal

11.5.2. Polymer

11.5.3. Ceramic

11.5.4. Others (Plaster & Starch, Liquid Silicone Rubber (LSR), etc.)

11.6. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

11.6.1. Aerospace & Defense

11.6.2. Consumer Goods & Electronics

11.6.3. Automotive

11.6.4. Healthcare

11.6.5. Others (Film & Animation, Architecture, etc.)

11.7. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Process

11.8.2. By Type

11.8.3. By Material

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Rapid Prototyping Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Process, 2017–2031

12.3.1. Stereolithography (SLA)

12.3.2. Selective Laser Sintering (SLS)

12.3.3. Fused Deposition Modeling (FDM)

12.3.4. Multi Jet Fusion (MJF)

12.3.5. Others (Digital Light Processing [DLP], Electron Beam Melting [EBM], etc.)

12.4. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Type, 2017–2031

12.4.1. Proof-of-Concept (PoC) Prototype

12.4.2. Functional Prototype

12.4.3. Visual Prototype

12.4.4. User Experience Prototype

12.5. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Material, 2017–2031

12.5.1. Metal

12.5.2. Polymer

12.5.3. Ceramic

12.5.4. Others (Plaster & Starch, Liquid Silicone Rubber (LSR), etc.)

12.6. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

12.6.1. Aerospace & Defense

12.6.2. Consumer Goods & Electronics

12.6.3. Automotive

12.6.4. Healthcare

12.6.5. Others (Film & Animation, Architecture, etc.)

12.7. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. Taiwan

12.7.6. ASEAN

12.7.7. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Process

12.8.2. By Type

12.8.3. By Material

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa Rapid Prototyping Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Process, 2017–2031

13.3.1. Stereolithography (SLA)

13.3.2. Selective Laser Sintering (SLS)

13.3.3. Fused Deposition Modeling (FDM)

13.3.4. Multi Jet Fusion (MJF)

13.3.5. Others (Digital Light Processing [DLP], Electron Beam Melting [EBM], etc.)

13.4. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Type, 2017–2031

13.4.1. Proof-of-Concept (PoC) Prototype

13.4.2. Functional Prototype

13.4.3. Visual Prototype

13.4.4. User Experience Prototype

13.5. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Material, 2017–2031

13.5.1. Metal

13.5.2. Polymer

13.5.3. Ceramic

13.5.4. Others (Plaster & Starch, Liquid Silicone Rubber (LSR), etc.)

13.6. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

13.6.1. Aerospace & Defense

13.6.2. Consumer Goods & Electronics

13.6.3. Automotive

13.6.4. Healthcare

13.6.5. Others (Film & Animation, Architecture, etc.)

13.7. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Process

13.8.2. By Type

13.8.3. By Material

13.8.4. By End-use Industry

13.8.5. By Country/Sub-region

14. South America Rapid Prototyping Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Process, 2017–2031

14.3.1. Stereolithography (SLA)

14.3.2. Selective Laser Sintering (SLS)

14.3.3. Fused Deposition Modeling (FDM)

14.3.4. Multi Jet Fusion (MJF)

14.3.5. Others (Digital Light Processing [DLP], Electron Beam Melting [EBM], etc.)

14.4. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Type, 2017–2031

14.4.1. Proof-of-Concept (PoC) Prototype

14.4.2. Functional Prototype

14.4.3. Visual Prototype

14.4.4. User Experience Prototype

14.5. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Material, 2017–2031

14.5.1. Metal

14.5.2. Polymer

14.5.3. Ceramic

14.5.4. Others (Plaster & Starch, Liquid Silicone Rubber (LSR), etc.)

14.6. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

14.6.1. Aerospace & Defense

14.6.2. Consumer Goods & Electronics

14.6.3. Automotive

14.6.4. Healthcare

14.6.5. Others (Film & Animation, Architecture, etc.)

14.7. Rapid Prototyping Market Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Process

14.8.2. By Type

14.8.3. By Material

14.8.4. By End-use Industry

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Rapid Prototyping Market Competition Matrix - a Dashboard View

15.1.1. Global Rapid Prototyping Market Company Share Analysis, By Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. 3E Rapid Prototyping Ltd.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. ARRK Corporation

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Avid Product Development, LLC

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. CADX Tools & Technologies Pvt. Ltd.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Dassault Systemes

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Fathom Digital Manufacturing Corporation

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Fictiv

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Laser Prototypes Europe Ltd.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Materialise NV

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Proto Labs, Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. ProtoCAM

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Sandvik AB

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Xometry Europe GmbH

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Process

17.1.2. By Type

17.1.3. By Material

17.1.4. By End-use Industry

17.1.5. By Region

List of Tables

Table 01: Global Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Table 02: Global Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 03: Global Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 04: Global Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Table 05: Global Rapid Prototyping Market Size & Forecast, By Region, Value (US$ Bn), 2017-2031

Table 06: North America Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Table 07: North America Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 08: North America Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 09: North America Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Table 10: North America Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 11: Europe Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Table 12: Europe Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 13: Europe Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 14: Europe Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Table 15: Europe Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 16: Asia Pacific Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Table 17: Asia Pacific Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 18: Asia Pacific Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 19: Asia Pacific Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Table 20: Asia Pacific Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 21: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Table 22: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 23: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 24: Middle East & Africa Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Table 25: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 26: South America Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Table 27: South America Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Table 28: South America Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 29: South America Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Table 30: South America Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

List of Figures

Figure 01: Global Rapid Prototyping Market, Value (US$ Bn), 2017-2031

Figure 02: Global Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Figure 03: Global Rapid Prototyping Market Attractiveness, By Process, Value (US$ Bn), 2022-2031

Figure 04: Global Rapid Prototyping Market Share Analysis, By Process, 2022

Figure 05: Global Rapid Prototyping Market Share Analysis, By Process, 2031

Figure 06: Global Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Figure 07: Global Rapid Prototyping Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 08: Global Rapid Prototyping Market Share Analysis, By Type, 2022

Figure 09: Global Rapid Prototyping Market Share Analysis, By Type, 2031

Figure 10: Global Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Figure 11: Global Rapid Prototyping Market Attractiveness, By Material, Value (US$ Bn), 2022-2031

Figure 12: Global Rapid Prototyping Market Share Analysis, By Material, 2022

Figure 13: Global Rapid Prototyping Market Share Analysis, By Material, 2031

Figure 14: Global Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Figure 15: Global Rapid Prototyping Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 16: Global Rapid Prototyping Market Share Analysis, By End-use Industry, 2022

Figure 17: Global Rapid Prototyping Market Share Analysis, By End-use Industry, 2031

Figure 18: Global Rapid Prototyping Market Size & Forecast, By Region, Value (US$ Bn), 2017-2031

Figure 19: Global Rapid Prototyping Market Attractiveness, By Region, Value (US$ Bn), 2022-2031

Figure 20: Global Rapid Prototyping Market Share Analysis, By Region, 2022

Figure 21: Global Rapid Prototyping Market Share Analysis, By Region, 2031

Figure 22: North America Rapid Prototyping Market, Value (US$ Bn), 2017-2031

Figure 23: North America Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Figure 24: North America Rapid Prototyping Market Attractiveness, By Process, Value (US$ Bn), 2022-2031

Figure 25: North America Rapid Prototyping Market Share Analysis, By Process, 2022

Figure 26: North America Rapid Prototyping Market Share Analysis, By Process, 2031

Figure 27: North America Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Figure 28: North America Rapid Prototyping Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 29: North America Rapid Prototyping Market Share Analysis, By Type, 2022

Figure 30: North America Rapid Prototyping Market Share Analysis, By Type, 2031

Figure 31: North America Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Figure 32: North America Rapid Prototyping Market Attractiveness, By Material, Value (US$ Bn), 2022-2031

Figure 33: North America Rapid Prototyping Market Share Analysis, By Material, 2022

Figure 34: North America Rapid Prototyping Market Share Analysis, By Material, 2031

Figure 35: North America Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Figure 36: North America Rapid Prototyping Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 37: North America Rapid Prototyping Market Share Analysis, By End-use Industry, 2022

Figure 38: North America Rapid Prototyping Market Share Analysis, By End-use Industry, 2031

Figure 39: North America Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Figure 40: North America Rapid Prototyping Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 41: North America Rapid Prototyping Market Share Analysis, By Country, 2022

Figure 42: North America Rapid Prototyping Market Share Analysis, By Country, 2031

Figure 43: Europe Rapid Prototyping Market, Value (US$ Bn), 2017-2031

Figure 44: Europe Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Figure 45: Europe Rapid Prototyping Market Attractiveness, By Process, Value (US$ Bn), 2022-2031

Figure 46: Europe Rapid Prototyping Market Share Analysis, By Process, 2022

Figure 47: Europe Rapid Prototyping Market Share Analysis, By Process, 2031

Figure 48: Europe Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Figure 49: Europe Rapid Prototyping Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 50: Europe Rapid Prototyping Market Share Analysis, By Type, 2022

Figure 51: Europe Rapid Prototyping Market Share Analysis, By Type, 2031

Figure 52: Europe Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Figure 53: Europe Rapid Prototyping Market Attractiveness, By Material, Value (US$ Bn), 2022-2031

Figure 54: Europe Rapid Prototyping Market Share Analysis, By Material, 2022

Figure 55: Europe Rapid Prototyping Market Share Analysis, By Material, 2031

Figure 56: Europe Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Figure 57: Europe Rapid Prototyping Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 58: Europe Rapid Prototyping Market Share Analysis, By End-use Industry, 2022

Figure 59: Europe Rapid Prototyping Market Share Analysis, By End-use Industry, 2031

Figure 60: Europe Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Figure 61: Europe Rapid Prototyping Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 62: Europe Rapid Prototyping Market Share Analysis, By Country, 2022

Figure 63: Europe Rapid Prototyping Market Share Analysis, By Country, 2031

Figure 64: Asia Pacific Rapid Prototyping Market, Value (US$ Bn), 2017-2031

Figure 65: Asia Pacific Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Figure 66: Asia Pacific Rapid Prototyping Market Attractiveness, By Process, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Rapid Prototyping Market Share Analysis, By Process, 2022

Figure 68: Asia Pacific Rapid Prototyping Market Share Analysis, By Process, 2031

Figure 69: Asia Pacific Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Figure 70: Asia Pacific Rapid Prototyping Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 71: Asia Pacific Rapid Prototyping Market Share Analysis, By Type, 2022

Figure 72: Asia Pacific Rapid Prototyping Market Share Analysis, By Type, 2031

Figure 73: Asia Pacific Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Figure 74: Asia Pacific Rapid Prototyping Market Attractiveness, By Material, Value (US$ Bn), 2022-2031

Figure 75: Asia Pacific Rapid Prototyping Market Share Analysis, By Material, 2022

Figure 76: Asia Pacific Rapid Prototyping Market Share Analysis, By Material, 2031

Figure 77: Asia Pacific Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Figure 78: Asia Pacific Rapid Prototyping Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 79: Asia Pacific Rapid Prototyping Market Share Analysis, By End-use Industry, 2022

Figure 80: Asia Pacific Rapid Prototyping Market Share Analysis, By End-use Industry, 2031

Figure 81: Asia Pacific Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Figure 82: Asia Pacific Rapid Prototyping Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 83: Asia Pacific Rapid Prototyping Market Share Analysis, By Country, 2022

Figure 84: Asia Pacific Rapid Prototyping Market Share Analysis, By Country, 2031

Figure 85: Middle East & Africa Rapid Prototyping Market, Value (US$ Bn), 2017-2031

Figure 86: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Figure 87: Middle East & Africa Rapid Prototyping Market Attractiveness, By Process, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Rapid Prototyping Market Share Analysis, By Process, 2022

Figure 89: Middle East & Africa Rapid Prototyping Market Share Analysis, By Process, 2031

Figure 90: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Figure 91: Middle East & Africa Rapid Prototyping Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 92: Middle East & Africa Rapid Prototyping Market Share Analysis, By Type, 2022

Figure 93: Middle East & Africa Rapid Prototyping Market Share Analysis, By Type, 2031

Figure 94: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Figure 95: Middle East & Africa Rapid Prototyping Market Attractiveness, By Material, Value (US$ Bn), 2022-2031

Figure 96: Middle East & Africa Rapid Prototyping Market Share Analysis, By Material, 2022

Figure 97: Middle East & Africa Rapid Prototyping Market Share Analysis, By Material, 2031

Figure 98: Middle East & Africa Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Figure 99: Middle East & Africa Rapid Prototyping Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 100: Middle East & Africa Rapid Prototyping Market Share Analysis, By End-use Industry, 2022

Figure 101: Middle East & Africa Rapid Prototyping Market Share Analysis, By End-use Industry, 2031

Figure 102: Middle East & Africa Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Figure 103: Middle East & Africa Rapid Prototyping Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 104: Middle East & Africa Rapid Prototyping Market Share Analysis, By Country, 2022

Figure 105: Middle East & Africa Rapid Prototyping Market Share Analysis, By Country, 2031

Figure 106: South America Rapid Prototyping Market, Value (US$ Bn), 2017-2031

Figure 107: South America Rapid Prototyping Market Size & Forecast, By Process, Value (US$ Bn), 2017-2031

Figure 108: South America Rapid Prototyping Market Attractiveness, By Process, Value (US$ Bn), 2022-2031

Figure 109: South America Rapid Prototyping Market Share Analysis, By Process, 2022

Figure 110: South America Rapid Prototyping Market Share Analysis, By Process, 2031

Figure 111: South America Rapid Prototyping Market Size & Forecast, By Type, Value (US$ Bn), 2017-2031

Figure 112: South America Rapid Prototyping Market Attractiveness, By Type, Value (US$ Bn), 2022-2031

Figure 113: South America Rapid Prototyping Market Share Analysis, By Type, 2022

Figure 114: South America Rapid Prototyping Market Share Analysis, By Type, 2031

Figure 115: South America Rapid Prototyping Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Figure 116: South America Rapid Prototyping Market Attractiveness, By Material, Value (US$ Bn), 2022-2031

Figure 117: South America Rapid Prototyping Market Share Analysis, By Material, 2022

Figure 118: South America Rapid Prototyping Market Share Analysis, By Material, 2031

Figure 119: South America Rapid Prototyping Market Size & Forecast, By End-use Industry, Value (US$ Bn), 2017-2031

Figure 120: South America Rapid Prototyping Market Attractiveness, By End-use Industry, Value (US$ Bn), 2022-2031

Figure 121: South America Rapid Prototyping Market Share Analysis, By End-use Industry, 2022

Figure 122: South America Rapid Prototyping Market Share Analysis, By End-use Industry, 2031

Figure 123: South America Rapid Prototyping Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Figure 124: South America Rapid Prototyping Market Attractiveness, By Country, Value (US$ Bn), 2022-2031

Figure 125: South America Rapid Prototyping Market Share Analysis, By Country, 2022

Figure 126: South America Rapid Prototyping Market Share Analysis, By Country, 2031