Analysts’ Viewpoint

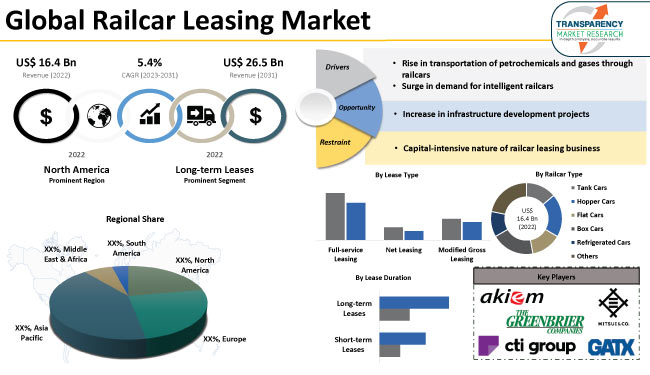

Rise in transportation of petrochemicals & gases through railcars and surge in demand for intelligent railcars are the key factors fueling the global railcar leasing market. Cost advantage of leasing railcars is another primary factor driving market progress. The convenience of using a railcar when needed, without concerns about ownership costs, depreciation, or maintenance expenses, is creating lucrative railcar leasing market opportunities for industry participants who prefer contractual arrangements.

Significant developments in railway infrastructure and rise in cross-border transportation activities are estimated to drive demand for leasing railcars. Development and expansion of rail networks, both in developed and developing economies is fueling market expansion. Key players are entering into collaborations with leading railcar manufacturers to increase revenue and market share.

Railcar leasing is a business practice in the transportation industry where companies or individuals lease railcars to transport goods and commodities by rail. Railcar leasing provides a flexible and cost-effective alternative to purchasing railcars outright.

Railcars are specialized vehicles designed to transport a range of goods, such as bulk commodities (coal, grain & chemicals), liquids (petroleum & ethanol), intermodal containers, and various other products. Instead of investing significant capital in purchasing railcars, businesses choose to lease them from railcar leasing companies.

Railcar leasing market demand is anticipated to rise in the next few years, as countries invest in improving their transportation infrastructure. Rail transportation is a cost-effective and efficient mode for moving goods, especially for long-haul and bulk shipments. Rise in global demand for freight transportation is fueling market dynamics.

The overall economic growth and industrial activities have a significant impact on the global railcar leading market. Growth of the manufacturing and construction sectors drives the demand for railcars to transport raw materials, finished goods, and equipment.

Railcars are commonly used to transport various commodities, including petrochemicals, liquefied petroleum gases (LPG), and other gases. This mode of transportation offers several advantages, such as cost-effectiveness, efficiency, and reliability.

Rail transportation is considered more environmentally friendly compared to other modes of transportation. It has a lower carbon footprint and can help companies meet their sustainability goals. As environmental concerns continue to grow, the demand for railcar leasing for petrochemical and gas transportation could increase due to its eco-friendly nature.

Rail networks often have well-established infrastructure for transporting bulk materials that include petrochemicals and gases. Rail lines are interconnected, allowing for efficient movement across different regions. Infrastructure availability makes railcar leasing a viable choice for companies looking to transport these products over long distances.

Intelligent railcars have the potential to revolutionize the global market for railcar leasing by linking the entire supply chain and digitalizing railcar operations. These advanced railcars are equipped with various sensors, telematics systems, and communication technologies that enable real-time tracking, monitoring, and data collection throughout the railcar's journey.

Intelligent railcars generate a vast amount of data related to operations, maintenance, and performance. By leveraging advanced analytics and artificial intelligence, leasing companies can derive valuable insights from this data. They can identify patterns, optimize maintenance schedules, predict failures, and make data-driven decisions to improve operational efficiency and reduce costs.

Intelligent railcars contribute to sustainability efforts in the transportation sector. By optimizing routing, improving asset utilization, and enabling efficient maintenance practices, they can help reduce fuel consumption, emissions, and overall environmental impact. This aligns with the growing demand for greener and more sustainable logistics solutions.

Based on lease duration, the global market has been bifurcated into short-term leases and long-term leases. As per the railcar leasing market research, the long-term leases segment is estimated to lead the global industry in the near future. According to the latest railcar leasing market analysis, the segment is likely to account for major share during the forecast period.

The railcar leasing market has witnessed significant growth in the past few years, largely driven by rise in demand for long-term lease agreements. As companies across various industries seek reliable, flexible, efficient, and cost-effective transportation solutions, railcar leasing has emerged as an attractive option.

Several businesses, especially those involved in the manufacturing, energy, and agricultural sectors, require a consistent and efficient mode of transporting their products over long distances. Rail transportation offers several advantages, including higher load capacity, lower fuel consumption, and reduced carbon emissions compared to other modes such as trucks or ships.

Long-term leases offer companies the flexibility to adjust their transportation capacity according to market demand. In industries where seasonal fluctuations or varying production volumes are common, having the ability to scale up or down the railcar fleet becomes crucial. Leasing companies can accommodate these dynamic requirements by offering flexible lease terms and the option to add or remove railcars from the fleet as needed. This scalability not only optimizes operational efficiency, but also helps businesses manage costs effectively.

Asia Pacific is likely to account for significant railcar leasing market share during the forecast period. Increase in government investment to improve railway transport infrastructure is contributing to the railcar leasing market growth in the region.

With government support, railcar leasing companies can introduce the latest technological advancements in their leased railcars. Governments often encourage the adoption of energy-efficient and eco-friendly railcar designs, such as those with improved aerodynamics, reduced energy consumption, and enhanced safety features. These technological advancements align with the sustainability goals of governments and contribute to the growth of the market in Asia Pacific.

The railcar leasing market size in North America is anticipated to increase in the next few years, owing to rise in investment in rail infrastructure development, including the expansion and improvement of rail networks. These investments increase the efficiency and capacity of rail transportation, leading to higher demand for leased railcars.

The industrial and manufacturing sectors in North America continue to grow, driving the need for efficient transportation of raw materials, components, and finished products. Rail transportation is well-suited for bulk shipments and long-haul distances, making it a preferred choice for many companies in these sectors.

The global market for railcar leasing is characterized by intense competition, with the presence of large number of prominent companies. According to the latest railcar leasing market trends, companies are employing diverse tactics to expand their global presence.

Some of the manufacturers identified in the market across the globe are The Greenbrier Companies, Inc., GATX Corporation, Beacon Rail Leasing Ltd., Rail Innovators Group B.V., Akiem Group SAS, Porterbrook Leasing Co. Ltd., Alpha Trains Luxembourg Sarl, Touax SCA, American Railcar Industries, Inc., Angel Trains Ltd., Mitsui and Co. Ltd., ERR European Rail Rent GmbH, TRANSCHEM Sp zoo, TRANSWAGGON GmbH, VTG GmbH, Ermewa Interservices, CTI Group, Inc., and Wells Fargo Company.

Each of these players has been profiled in the railcar leasing market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 16.4 Bn |

|

Market Forecast Value in 2031 |

US$ 26.5 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis as well as regional analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 16.4 Bn in 2022

It is expected to expand at a CAGR of 5.4% by 2031

The market is projected to reach US$ 26.5 Bn by 2031

Development and expansion of rail networks in both developed and developing economies; rise in transportation of petrochemicals and gases through railcars; and surge in demand for intelligent railcars

The long-term leases segment accounted for leading share in 2022

Asia Pacific is anticipated to be a highly lucrative region in the next few years

Akiem Group SAS, Alpha Trains Luxembourg Sarl, Angel Trains Ltd., Beacon Rail Leasing Ltd., Ermewa Interservices, ERR European Rail Rent GmbH, GATX Corporation, Mitsui and Co. Ltd., Porterbrook Leasing Co. Ltd., Rail Innovators Group B.V., The Greenbrier Companies Inc., Touax SCA, TRANSCHEM Sp zoo, TRANSWAGGON GmbH, VTG GmbH, CTI Group Inc., American Railcar Industries Inc., The Greenbrier Companies, and Wells Fargo Company are the prominent players in the market

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Railcar Leasing Market, by Railcar Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Railcar Leasing Market Size & Forecast, 2017-2031, by Railcar Type

3.2.1. Tank Cars

3.2.2. Hopper Cars

3.2.3. Flat Cars

3.2.4. Box Cars

3.2.5. Refrigerated Cars

3.2.6. Others

4. Global Railcar Leasing Market, by Lease Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Type

4.2.1. Full-service Leasing

4.2.2. Net Leasing

4.2.3. Modified Gross Leasing

5. Global Railcar Leasing Market, by Lease Duration

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Duration

5.2.1. Short-term Leases

5.2.2. Long-term Leases

6. Global Railcar Leasing Market, by End-use Industry

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Railcar Leasing Market Size & Forecast, 2017-2031, by End-use Industry

6.2.1. Chemical

6.2.2. Petroleum and Gas

6.2.3. Agriculture

6.2.4. Construction

6.2.5. Automotive

6.2.6. Food and Beverage

6.2.7. Others

7. Global Railcar Leasing Market, by Ownership Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Railcar Leasing Market Size & Forecast, 2017-2031, by Ownership Type

7.2.1. Private Leasing Companies

7.2.2. Railroads

7.2.3. Financial Institutions

8. Global Railcar Leasing Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Railcar Leasing Market Size & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Railcar Leasing Market

9.1. Market Snapshot

9.2. North America Railcar Leasing Market Size & Forecast, 2017-2031, by Railcar Type

9.2.1. Tank Cars

9.2.2. Hopper Cars

9.2.3. Flat Cars

9.2.4. Box Cars

9.2.5. Refrigerated Cars

9.2.6. Others

9.3. North America Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Type

9.3.1. Full-service Leasing

9.3.2. Net Leasing

9.3.3. Modified Gross Leasing

9.4. North America Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Duration

9.4.1. Short-term Leases

9.4.2. Long-term Leases

9.5. North America Railcar Leasing Market Size & Forecast, 2017-2031, by End-use Industry

9.5.1. Chemical

9.5.2. Petroleum and Gas

9.5.3. Agriculture

9.5.4. Construction

9.5.5. Automotive

9.5.6. Food and Beverage

9.5.7. Others

9.6. North America Railcar Leasing Market Size & Forecast, 2017-2031, by Ownership Type

9.6.1. Private Leasing Companies

9.6.2. Railroads

9.6.3. Financial Institutions

9.7. North America Railcar Leasing Market Size & Forecast, 2017-2031, by Country

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Railcar Leasing Market

10.1. Market Snapshot

10.2. Europe Railcar Leasing Market Size & Forecast, 2017-2031, by Railcar Type

10.2.1. Tank Cars

10.2.2. Hopper Cars

10.2.3. Flat Cars

10.2.4. Box Cars

10.2.5. Refrigerated Cars

10.2.6. Others

10.3. Europe Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Type

10.3.1. Full-service Leasing

10.3.2. Net Leasing

10.3.3. Modified Gross Leasing

10.4. Europe Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Duration

10.4.1. Short-term Leases

10.4.2. Long-term Leases

10.5. Europe Railcar Leasing Market Size & Forecast, 2017-2031, by End-use Industry

10.5.1. Chemical

10.5.2. Petroleum and Gas

10.5.3. Agriculture

10.5.4. Construction

10.5.5. Automotive

10.5.6. Food and Beverage

10.5.7. Others

10.6. Europe Railcar Leasing Market Size & Forecast, 2017-2031, by Ownership Type

10.6.1. Private Leasing Companies

10.6.2. Railroads

10.6.3. Financial Institutions

10.7. Europe Railcar Leasing Market Size & Forecast, 2017-2031, by Country

10.7.1. Germany

10.7.2. U.K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Nordic Countries

10.7.7. Russia & CIS

10.7.8. Rest of Europe

11. Asia Pacific Railcar Leasing Market

11.1. Market Snapshot

11.2. Asia Pacific Railcar Leasing Market Size & Forecast, 2017-2031, by Railcar Type

11.2.1. Tank Cars

11.2.2. Hopper Cars

11.2.3. Flat Cars

11.2.4. Box Cars

11.2.5. Refrigerated Cars

11.2.6. Others

11.3. Asia Pacific Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Type

11.3.1. Full-service Leasing

11.3.2. Net Leasing

11.3.3. Modified Gross Leasing

11.4. Asia Pacific Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Duration

11.4.1. Short-term Leases

11.4.2. Long-term Leases

11.5. Asia Pacific Railcar Leasing Market Size & Forecast, 2017-2031, by End-use Industry

11.5.1. Chemical

11.5.2. Petroleum and Gas

11.5.3. Agriculture

11.5.4. Construction

11.5.5. Automotive

11.5.6. Food and Beverage

11.5.7. Others

11.6. Asia Pacific Railcar Leasing Market Size & Forecast, 2017-2031, by Ownership Type

11.6.1. Private Leasing Companies

11.6.2. Railroads

11.6.3. Financial Institutions

11.7. Asia Pacific Railcar Leasing Market Size & Forecast, 2017-2031, by Country

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN Countries

11.7.5. South Korea

11.7.6. ANZ

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Railcar Leasing Market

12.1. Market Snapshot

12.2. Middle East & Africa Railcar Leasing Market Size & Forecast, 2017-2031, by Railcar Type

12.2.1. Tank Cars

12.2.2. Hopper Cars

12.2.3. Flat Cars

12.2.4. Box Cars

12.2.5. Refrigerated Cars

12.2.6. Others

12.3. Middle East & Africa Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Type

12.3.1. Full-service Leasing

12.3.2. Net Leasing

12.3.3. Modified Gross Leasing

12.4. Middle East & Africa Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Duration

12.4.1. Short-term Leases

12.4.2. Long-term Leases

12.5. Middle East & Africa Railcar Leasing Market Size & Forecast, 2017-2031, by End-use Industry

12.5.1. Chemical

12.5.2. Petroleum and Gas

12.5.3. Agriculture

12.5.4. Construction

12.5.5. Automotive

12.5.6. Food and Beverage

12.5.7. Others

12.6. Middle East & Africa Railcar Leasing Market Size & Forecast, 2017-2031, by Ownership Type

12.6.1. Private Leasing Companies

12.6.2. Railroads

12.6.3. Financial Institutions

12.7. Middle East & Africa Railcar Leasing Market Size & Forecast, 2017-2031, by Country

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. South America Railcar Leasing Market

13.1. Market Snapshot

13.2. South America Railcar Leasing Market Size & Forecast, 2017-2031, by Railcar Type

13.2.1. Tank Cars

13.2.2. Hopper Cars

13.2.3. Flat Cars

13.2.4. Box Cars

13.2.5. Refrigerated Cars

13.2.6. Others

13.3. South America Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Type

13.3.1. Full-service Leasing

13.3.2. Net Leasing

13.3.3. Modified Gross Leasing

13.4. South America Railcar Leasing Market Size & Forecast, 2017-2031, by Lease Duration

13.4.1. Short-term Leases

13.4.2. Long-term Leases

13.5. South America Railcar Leasing Market Size & Forecast, 2017-2031, by End-use Industry

13.5.1. Chemical

13.5.2. Petroleum and Gas

13.5.3. Agriculture

13.5.4. Construction

13.5.5. Automotive

13.5.6. Food and Beverage

13.5.7. Others

13.6. South America Railcar Leasing Market Size & Forecast, 2017-2031, by Ownership Type

13.6.1. Private Leasing Companies

13.6.2. Railroads

13.6.3. Financial Institutions

13.7. South America Railcar Leasing Market Size & Forecast, 2017-2031, by Country

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Akiem Group SAS

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. Alpha Trains Luxembourg Sarl

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. American Railcar Industries Inc.

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Angel Trains Ltd.

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Beacon Rail Leasing Ltd.

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. CTI Group Inc.

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Ermewa Interservices

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. ERR European Rail Rent GmbH

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. GATX Corporation

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Mitsui and Co. Ltd.

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. Porterbrook Leasing Co. Ltd.

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Rail Innovators Group B.V.

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. The Greenbrier Companies Inc.

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Touax SCA

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. TRANSCHEM Sp zoo

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. TRANSWAGGON GmbH

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

15.17. VTG GmbH

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Production Locations

15.17.4. Product Portfolio

15.17.5. Competitors & Customers

15.17.6. Subsidiaries & Parent Organization

15.17.7. Recent Developments

15.17.8. Financial Analysis

15.17.9. Profitability

15.17.10. Revenue Share

15.18. Wells Fargo Company

15.18.1. Company Overview

15.18.2. Company Footprints

15.18.3. Production Locations

15.18.4. Product Portfolio

15.18.5. Competitors & Customers

15.18.6. Subsidiaries & Parent Organization

15.18.7. Recent Developments

15.18.8. Financial Analysis

15.18.9. Profitability

15.18.10. Revenue Share

List of Tables

Table 1: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, Railcar Type, 2017-2031

Table 2: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 3: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Table 4: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 5: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Table 6: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 7: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, Railcar Type, 2017-2031

Table 8: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 9: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Table 10: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 11: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Table 12: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, Railcar Type, 2017-2031

Table 14: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 15: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Table 16: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 17: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Table 18: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, Railcar Type, 2017-2031

Table 20: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 21: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Table 22: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 23: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Table 24: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, Railcar Type, 2017-2031

Table 26: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 27: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Table 28: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 29: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Table 30: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, Railcar Type, 2017-2031

Table 32: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Table 33: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Table 34: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 35: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Table 36: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Railcar Type, 2017-2031

Figure 2: Global Railcar Leasing Market, Incremental Opportunity, by Railcar Type, Value (US$ Bn), 2023-2031

Figure 3: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 4: Global Railcar Leasing Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 5: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Figure 6: Global Railcar Leasing Market, Incremental Opportunity, by Lease Duration, Value (US$ Bn), 2023-2031

Figure 7: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 8: Global Railcar Leasing Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 9: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Figure 10: Global Railcar Leasing Market, Incremental Opportunity, by Ownership Type, Value (US$ Bn), 2023-2031

Figure 11: Global Railcar Leasing Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Railcar Leasing Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Railcar Type, 2017-2031

Figure 14: North America Railcar Leasing Market, Incremental Opportunity, by Railcar Type, Value (US$ Bn), 2023-2031

Figure 15: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 16: North America Railcar Leasing Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 17: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Figure 18: North America Railcar Leasing Market, Incremental Opportunity, by Lease Duration, Value (US$ Bn), 2023-2031

Figure 19: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 20: North America Railcar Leasing Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 21: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Figure 22: North America Railcar Leasing Market, Incremental Opportunity, by Ownership Type, Value (US$ Bn), 2023-2031

Figure 23: North America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Railcar Leasing Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Railcar Type, 2017-2031

Figure 26: Europe Railcar Leasing Market, Incremental Opportunity, by Railcar Type, Value (US$ Bn), 2023-2031

Figure 27: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 28: Europe Railcar Leasing Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 29: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Figure 30: Europe Railcar Leasing Market, Incremental Opportunity, by Lease Duration, Value (US$ Bn), 2023-2031

Figure 31: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 32: Europe Railcar Leasing Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 33: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Figure 34: Europe Railcar Leasing Market, Incremental Opportunity, by Ownership Type, Value (US$ Bn), 2023-2031

Figure 35: Europe Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Railcar Leasing Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Railcar Type, 2017-2031

Figure 38: Asia Pacific Railcar Leasing Market, Incremental Opportunity, by Railcar Type, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 40: Asia Pacific Railcar Leasing Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 41: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Figure 42: Asia Pacific Railcar Leasing Market, Incremental Opportunity, by Lease Duration, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 44: Asia Pacific Railcar Leasing Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Figure 46: Asia Pacific Railcar Leasing Market, Incremental Opportunity, by Ownership Type, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Railcar Leasing Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Railcar Type, 2017-2031

Figure 50: Middle East & Africa Railcar Leasing Market, Incremental Opportunity, by Railcar Type, Value (US$ Bn), 2023-2031

Figure 51: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 52: Middle East & Africa Railcar Leasing Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 53: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Figure 54: Middle East & Africa Railcar Leasing Market, Incremental Opportunity, by Lease Duration, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 56: Middle East & Africa Railcar Leasing Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Figure 58: Middle East & Africa Railcar Leasing Market, Incremental Opportunity, by Ownership Type, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Railcar Leasing Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Railcar Type, 2017-2031

Figure 62: South America Railcar Leasing Market, Incremental Opportunity, by Railcar Type, Value (US$ Bn), 2023-2031

Figure 63: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Type, 2017-2031

Figure 64: South America Railcar Leasing Market, Incremental Opportunity, by Lease Type, Value (US$ Bn), 2023-2031

Figure 65: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Lease Duration, 2017-2031

Figure 66: South America Railcar Leasing Market, Incremental Opportunity, by Lease Duration, Value (US$ Bn), 2023-2031

Figure 67: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 68: South America Railcar Leasing Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 69: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Ownership Type, 2017-2031

Figure 70: South America Railcar Leasing Market, Incremental Opportunity, by Ownership Type, Value (US$ Bn), 2023-2031

Figure 71: South America Railcar Leasing Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Railcar Leasing Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031