Analyst Viewpoint

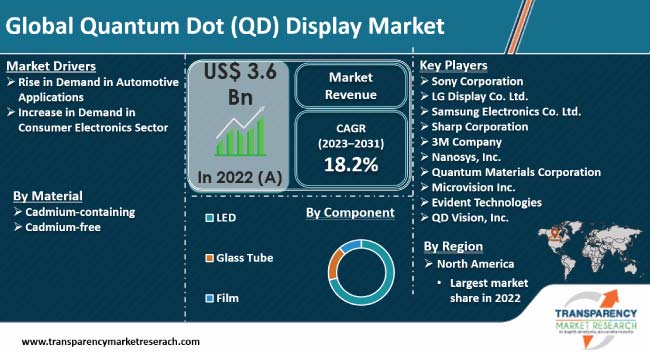

Rising demand for high-quality displays in electronic devices, such as televisions, smartphones, tablets, and monitors; growing trend of high-resolution displays; and increasing consumer preference for enhanced visual experiences are driving the global quantum dot (QD) display market. Furthermore, increased demand for larger-sized and higher-resolution displays is expected to prompt manufacturers of quantum dot (QD) displays to develop state-of-the-art, energy-efficient display panels that deliver enhanced color quality. This, in turn, is likely to positively influence the future analysis of quantum dot (QD) display industry during the forecast period.

Key manufacturers need to increase investments in research and development activities related to quantum dot technology, such as the development of cadmium-free quantum dots, to address environmental concerns. Additionally, integration of quantum dot displays in emerging technologies, such as augmented reality (AR) and virtual reality (VR) devices, is anticipated to create lucrative quantum dot (QD) display market opportunities in the next few years.

Nano-sized quantum dot particles for displays have a higher luminous efficacy and lower power consumption. Moreover, as inorganic materials are used to produce quantum dots, burn-ins could be prevented. Their narrow emission spectra and broader excitation profiles help them in changing light into any color in the visible spectrum, that too, with higher efficiency. These properties render quantum dots ideal for applications in automotive, medical, and consumer electronics sectors. Thus, they are being widely employed in automotive and consumer electronic sectors; however, penetration in the medical sector in developing countries is expected to be sluggish due to lack of awareness and higher cost involved in enhancement of display infrastructure.

Cadmium was extensively being used to manufacture quantum dots for the last few years. However, toxicity of cadmium has prompted regulatory authorities to impose a ban on the usage of cadmium. For instance, in 2015, the European Parliament, voted in favor of banning the use of cadmium in lighting and display applications. Consequently, manufacturers of quantum dots are trying to switch to cadmium-free quantum dot displays to comply with regulations related to safeguarding the environment.

Researchers suggest replacement of cadmium with zinc and indium to develop quantum dots. They are reported to display equal efficiency, but with environmental benefits. This transformation is expected to gain acceptance at a broader level in the near future.

Currently, automotive manufacturers emphasize enhancement of in-car infotainment systems and instrument clusters. Quantum dot displays improve legibility and visibility, thereby facilitating access to critical information. The automotive sector is also witnessing transition toward autonomous driving and electric vehicles (EVs). Quantum dots displays provide immersive and seamless displays in EVs.

Quantum dot materials, apart from offering an improvised visual experience, also offer longevity and durability, as they can perform in harsh environmental conditions. Statista states that autonomous vehicles’ market is estimated to reach US$ 2.3 Tn by the year 2030. It further states that electric vehicles market is likely to reach US$ 906.7 Bn by the year 2028. Commercialization of quantum dot displays to upgrade the automotive sector is thus expected to positively influence the quantum dot (QD) display market forecast in the next few years.

Presently, demand for high-resolution displays with superlative picture quality and vibrant colors is rising in smartphones and television sets. Quantum dots offer a broad spectrum of colors, thereby offering precise and more life-like reproduction of colors. This better viewing experience has prompted manufacturers of television sets to incorporate high-resolution quantum dot display technology into their products.

Samsung has launched its Neo QLED models in 8K and 4K resolution, the Serif, the Frame art TV, and the Sero rotating TV. Amazon has introduced its Fire TV Omni QLED television. QLED TV sets are also cost-effective, as compared to OLED TV sets, as they consume less power and have a quicker response time. These energy-efficient quantum dot display solutions are expected to fuel the quantum dot (QD) display market development in the next few years.

Analysis of the regional quantum dot (QD) display market trends reveals that North America accounted for a major share of the global demand for QD LED displays. This is due to rising demand for QLEDs in the aerospace & defense sector in the U.S. Quantum technologies are leveraged to provide better decryption and encryption for secured communications through enhanced detection of threats, by sea, land, or air. For instance, Apple Inc. is credited with inventing quantum dot hybrid pixels technology that offers an efficient QD LED display to consumer electronics sector.

Leading manufacturers in Europe are focused on offering energy-efficient quantum dot (QD) display solutions and providing electroluminescent quantum material-based displays, thereby improving quality of images and visual experience. Furthermore, demand for smart homes is rising significantly in the U.K. and Germany. This is estimated to offer quantum dot (QD) display business opportunities for manufacturers across Europe.

Asia Pacific is expected to account for a notable Quantum Dot (QD) display market share during the forecast period due to growing demand for energy-efficient technologies in India, China, Japan, Korea, Malaysia, Singapore, and Philippines in order to cater to tech-savvy young population who demand smarter television sets, laptops, and smartphones with higher resolution. In the automotive sector, in December 2023, Hyundai Mobis announced that it had developed the first quantum dot display for automobiles abreast with local dimming technology. Therefore, applications of high-resolution quantum dot (QD) display technology in the automotive sector is expected to drive the quantum dot (QD) display industry revenue in the region.

As per the latest quantum dot (QD) display market analysis, leading manufacturers of quantum dot (QD) display are investing substantially in the development of Prominent players are also engaging in new product launches and partnerships to expand their customer base and consolidate their position in the global market.

Sony Corporation, LG Display Co. Ltd., Samsung Electronics Co. Ltd., Sharp Corporation, 3M Company, Nanosys, Inc., Quantum Materials Corporation, Microvision Inc., Evident Technologies, and QD Vision, Inc are a few notable entities operating the global quantum dot (QD) display business.

Key players in the quantum dot (QD) display market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 3.6 Bn |

| Forecast (Value) in 2031 | US$ 8.6 Bn |

| Growth Rate (CAGR) | 18.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Quantum Dot (QD) Display Industry Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

The global market was valued at US$ 3.6 Bn in 2022

It is projected to advance at a whopping CAGR of 18.2% from 2023 to 2031

Rise in demand in automotive applications and consumer electronics sector

In terms of component, the LED segment held largest share in 2022

North America is estimated to dominate in the next few years

Sony Corporation, LG Display Co. Ltd., Samsung Electronics Co. Ltd., Sharp Corporation, 3M Company, Nanosys, Inc., Quantum Materials Corporation, Microvision Inc., Evident Technologies, and QD Vision, Inc.

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Quantum Dot (QD) Display Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Quantum Dot (QD) Display Market Analysis, by Material

5.1. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Material, 2023–2031

5.1.1. Cadmium-containing

5.1.2. Cadmium-free

5.2. Market Attractiveness Analysis, by Material

6. Global Quantum Dot (QD) Display Market Analysis, by Component

6.1. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Component, 2023–2031

6.1.1. LED

6.1.2. Glass Tube

6.1.3. Film

6.2. Market Attractiveness Analysis, by Component

7. Global Quantum Dot (QD) Display Market Analysis, by Device

7.1. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Device, 2023–2031

7.1.1. Consumer Electronics

7.1.1.1. Television

7.1.1.2. Smartphone

7.1.1.3. Laptop

7.1.1.4. Wearable Devices

7.1.1.5. Others

7.1.2. Medical Devices

7.1.3. Others

7.2. Market Attractiveness Analysis, by Device

8. Global Quantum Dot (QD) Display Market Analysis and Forecast, by Region

8.1. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Region, 2023–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Quantum Dot (QD) Display Market Analysis and Forecast

9.1. Market Snapshot

9.2. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Material, 2023–2031

9.2.1. Cadmium-containing

9.2.2. Cadmium-free

9.3. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Component, 2023–2031

9.3.1. LED

9.3.2. Glass Tube

9.3.3. Film

9.4. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Device, 2023–2031

9.4.1. Consumer Electronics

9.4.1.1. Television

9.4.1.2. Smartphone

9.4.1.3. Laptop

9.4.1.4. Wearable Devices

9.4.1.5. Others

9.4.2. Medical Devices

9.4.3. Others

9.5. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Country, 2023–2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Material

9.6.2. By Component

9.6.3. By Device

9.6.4. By Country/Sub-region

10. Europe Quantum Dot (QD) Display Market Analysis and Forecast

10.1. Market Snapshot

10.2. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Material, 2023–2031

10.2.1. Cadmium-containing

10.2.2. Cadmium-free

10.3. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Component, 2023–2031

10.3.1. LED

10.3.2. Glass Tube

10.3.3. Film

10.4. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Device, 2023–2031

10.4.1. Consumer Electronics

10.4.1.1. Television

10.4.1.2. Smartphone

10.4.1.3. Laptop

10.4.1.4. Wearable Devices

10.4.1.5. Others

10.4.2. Medical Devices

10.4.3. Others

10.5. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Material

10.6.2. By Component

10.6.3. By Device

10.6.4. By Country/Sub-region

11. Asia Pacific Quantum Dot (QD) Display Market Analysis and Forecast

11.1. Market Snapshot

11.2. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Material, 2023–2031

11.2.1. Cadmium-containing

11.2.2. Cadmium-free

11.3. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Component, 2023–2031

11.3.1. LED

11.3.2. Glass Tube

11.3.3. Film

11.4. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Device, 2023–2031

11.4.1. Consumer Electronics

11.4.1.1. Television

11.4.1.2. Smartphone

11.4.1.3. Laptop

11.4.1.4. Wearable Devices

11.4.1.5. Others

11.4.2. Medical Devices

11.4.3. Others

11.5. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Material

11.6.2. By Component

11.6.3. By Device

11.6.4. By Country/Sub-region

12. Middle East & Africa Quantum Dot (QD) Display Market Analysis and Forecast

12.1. Market Snapshot

12.2. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Material, 2023–2031

12.2.1. Cadmium-containing

12.2.2. Cadmium-free

12.3. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Component, 2023–2031

12.3.1. LED

12.3.2. Glass Tube

12.3.3. Film

12.4. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Device, 2023–2031

12.4.1. Consumer Electronics

12.4.1.1. Television

12.4.1.2. Smartphone

12.4.1.3. Laptop

12.4.1.4. Wearable Devices

12.4.1.5. Others

12.4.2. Medical Devices

12.4.3. Others

12.5. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Material

12.6.2. By Component

12.6.3. By Device

12.6.4. By Country/Sub-region

13. South America Quantum Dot (QD) Display Market Analysis and Forecast

13.1. Market Snapshot

13.2. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Material, 2023–2031

13.2.1. Cadmium-containing

13.2.2. Cadmium-free

13.3. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Component, 2023–2031

13.3.1. LED

13.3.2. Glass Tube

13.3.3. Film

13.4. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Device, 2023–2031

13.4.1. Consumer Electronics

13.4.1.1. Television

13.4.1.2. Smartphone

13.4.1.3. Laptop

13.4.1.4. Wearable Devices

13.4.1.5. Others

13.4.2. Medical Devices

13.4.3. Others

13.5. Quantum Dot (QD) Display Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2023–2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Material

13.6.2. By Component

13.6.3. By Device

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Quantum Dot (QD) Display Market Competition Matrix - a Dashboard View

14.1.1. Global Quantum Dot (QD) Display Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Sony Corporation

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. LG Display Co. Ltd.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Samsung Electronics Co. Ltd.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Sharp Corporation

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. 3M Company

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Nanosys, Inc.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Quantum Materials Corporation

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Microvision Inc.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Evident Technologies

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. QD Vision, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Material, 2023‒2031

Table 2: Global Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Component, 2023‒2031

Table 3: Global Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Device, 2023‒2031

Table 4: Global Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Region, 2023‒2031

Table 5: North America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Material, 2023‒2031

Table 6: North America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Component, 2023‒2031

Table 7: North America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Device, 2023‒2031

Table 8: North America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Country, 2023‒2031

Table 9: Europe Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Material, 2023‒2031

Table 10: Europe Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Component, 2023‒2031

Table 11: Europe Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Device, 2023‒2031

Table 12: Europe Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 13: Asia Pacific Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Material, 2023‒2031

Table 14: Asia Pacific Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Component, 2023‒2031

Table 15: Asia Pacific Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Device, 2023‒2031

Table 16: Asia Pacific Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 17: Middle East & Africa Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Material, 2023‒2031

Table 18: Middle East & Africa Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Component, 2023‒2031

Table 19: Middle East & Africa Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Device, 2023‒2031

Table 20: Middle East & Africa Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

Table 21: South America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Material, 2023‒2031

Table 22: South America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Component, 2023‒2031

Table 23: South America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Device, 2023‒2031

Table 24: South America Quantum Dot (QD) Display Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2023‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Quantum Dot (QD) Display Market

Figure 02: Porter Five Forces Analysis – Global Quantum Dot (QD) Display Market

Figure 03: Technology Road Map - Global Quantum Dot (QD) Display Market

Figure 04: Global Quantum Dot (QD) Display Market, Value (US$ Mn), 2023-2031

Figure 05: Global Quantum Dot (QD) Display Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 06: Global Quantum Dot (QD) Display Market Projections, by Material, Value (US$ Mn), 2023‒2031

Figure 07: Global Quantum Dot (QD) Display Market Projections, by Component, Value (US$ Mn), 2023‒2031

Figure 08: Global Quantum Dot (QD) Display Market Projections, by Device, Value (US$ Mn), 2023‒2031

Figure 09: Global Quantum Dot (QD) Display Market, Incremental Opportunity, by Material, 2023‒2031

Figure 10: Global Quantum Dot (QD) Display Market, Incremental Opportunity, by Component, 2023‒2031

Figure 11: Global Quantum Dot (QD) Display Market, Incremental Opportunity, by Device, 2023‒2031

Figure 12: Global Quantum Dot (QD) Display Market Share Analysis, by Material, 2023 and 2031

Figure 13: Global Quantum Dot (QD) Display Market Share Analysis, by Component, 2023 and 2031

Figure 14: Global Quantum Dot (QD) Display Market Share Analysis, by Device, 2023 and 2031

Figure 15: Global Quantum Dot (QD) Display Market Projections, by Region, Value (US$ Mn), 2023‒2031

Figure 16: Global Quantum Dot (QD) Display Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Quantum Dot (QD) Display Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Quantum Dot (QD) Display Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 19: North America Quantum Dot (QD) Display Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 20: North America Quantum Dot (QD) Display Market Projections, by Material (US$ Mn), 2023‒2031

Figure 21: North America Quantum Dot (QD) Display Market Projections, by Component (US$ Mn), 2023‒2031

Figure 22: North America Quantum Dot (QD) Display Market Projections, by Device (US$ Mn), 2023‒2031

Figure 23: North America Quantum Dot (QD) Display Market, Incremental Opportunity, by Material, 2023‒2031

Figure 24: North America Quantum Dot (QD) Display Market, Incremental Opportunity, by Component, 2023‒2031

Figure 25: North America Quantum Dot (QD) Display Market, Incremental Opportunity, by Device, 2023‒2031

Figure 26: North America Quantum Dot (QD) Display Market Share Analysis, by Material, 2023 and 2031

Figure 27: North America Quantum Dot (QD) Display Market Share Analysis, by Component, 2023 and 2031

Figure 28: North America Quantum Dot (QD) Display Market Share Analysis, by Device, 2023 and 2031

Figure 29: North America Quantum Dot (QD) Display Market Projections, by Country, Value (US$ Mn), 2023‒2031

Figure 30: North America Quantum Dot (QD) Display Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 31: North America Quantum Dot (QD) Display Market Share Analysis, by Country, 2023 and 2031

Figure 32: Europe Quantum Dot (QD) Display Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 33: Europe Quantum Dot (QD) Display Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 34: Europe Quantum Dot (QD) Display Market Projections, by Material, Value (US$ Mn), 2023‒2031

Figure 35: Europe Quantum Dot (QD) Display Market Projections, by Component, Value (US$ Mn), 2023‒2031

Figure 36: Europe Quantum Dot (QD) Display Market Projections, by Device, Value (US$ Mn), 2023‒2031

Figure 37: Europe Quantum Dot (QD) Display Market, Incremental Opportunity, by Material, 2023‒2031

Figure 38: Europe Quantum Dot (QD) Display Market, Incremental Opportunity, by Component, 2023‒2031

Figure 39: Europe Quantum Dot (QD) Display Market, Incremental Opportunity, by Device, 2023‒2031

Figure 40: Europe Quantum Dot (QD) Display Market Share Analysis, by Material, 2023 and 2031

Figure 41: Europe Quantum Dot (QD) Display Market Share Analysis, by Component, 2023 and 2031

Figure 42: Europe Quantum Dot (QD) Display Market Share Analysis, by Device, 2023 and 2031

Figure 43: Europe Quantum Dot (QD) Display Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 44: Europe Quantum Dot (QD) Display Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Quantum Dot (QD) Display Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Quantum Dot (QD) Display Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 47: Asia Pacific Quantum Dot (QD) Display Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 48: Asia Pacific Quantum Dot (QD) Display Market Projections, by Material, Value (US$ Mn), 2023‒2031

Figure 49: Asia Pacific Quantum Dot (QD) Display Market Projections, by Component, Value (US$ Mn), 2023‒2031

Figure 50: Asia Pacific Quantum Dot (QD) Display Market Projections, by Device, Value (US$ Mn), 2023‒2031

Figure 51: Asia Pacific Quantum Dot (QD) Display Market, Incremental Opportunity, by Material, 2023‒2031

Figure 52: Asia Pacific Quantum Dot (QD) Display Market, Incremental Opportunity, by Component, 2023‒2031

Figure 53: Asia Pacific Quantum Dot (QD) Display Market, Incremental Opportunity, by Device, 2023‒2031

Figure 54: Asia Pacific Quantum Dot (QD) Display Market Share Analysis, by Material, 2023 and 2031

Figure 55: Asia Pacific Quantum Dot (QD) Display Market Share Analysis, by Component, 2023 and 2031

Figure 56: Asia Pacific Quantum Dot (QD) Display Market Share Analysis, by Device, 2023 and 2031

Figure 57: Asia Pacific Quantum Dot (QD) Display Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 58: Asia Pacific Quantum Dot (QD) Display Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Quantum Dot (QD) Display Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Quantum Dot (QD) Display Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 61: Middle East & Africa Quantum Dot (QD) Display Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 62: Middle East & Africa Quantum Dot (QD) Display Market Projections, by Material, Value (US$ Mn), 2023‒2031

Figure 63: Middle East & Africa Quantum Dot (QD) Display Market Projections, by Component, Value (US$ Mn), 2023‒2031

Figure 64: Middle East & Africa Quantum Dot (QD) Display Market Projections, by Device, Value (US$ Mn), 2023‒2031

Figure 65: Middle East & Africa Quantum Dot (QD) Display Market, Incremental Opportunity, by Material, 2023‒2031

Figure 66: Middle East & Africa Quantum Dot (QD) Display Market, Incremental Opportunity, by Component, 2023‒2031

Figure 67: Middle East & Africa Quantum Dot (QD) Display Market, Incremental Opportunity, by Device, 2023‒2031

Figure 68: Middle East & Africa Quantum Dot (QD) Display Market Share Analysis, by Material, 2023 and 2031

Figure 69: Middle East & Africa Quantum Dot (QD) Display Market Share Analysis, by Component, 2023 and 2031

Figure 70: Middle East & Africa Quantum Dot (QD) Display Market Share Analysis, by Device, 2023 and 2031

Figure 71: Middle East & Africa Quantum Dot (QD) Display Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 72: Middle East & Africa Quantum Dot (QD) Display Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Quantum Dot (QD) Display Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America Quantum Dot (QD) Display Market Size & Forecast, Value (US$ Mn), 2023‒2031

Figure 75: South America Quantum Dot (QD) Display Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 76: South America Quantum Dot (QD) Display Market Projections, by Material, Value (US$ Mn), 2023‒2031

Figure 77: South America Quantum Dot (QD) Display Market Projections, by Component, Value (US$ Mn), 2023‒2031

Figure 78: South America Quantum Dot (QD) Display Market Projections, by Device, Value (US$ Mn), 2023‒2031

Figure 79: South America Quantum Dot (QD) Display Market, Incremental Opportunity, by Material, 2023‒2031

Figure 80: South America Quantum Dot (QD) Display Market, Incremental Opportunity, by Component, 2023‒2031

Figure 81: South America Quantum Dot (QD) Display Market, Incremental Opportunity, by Device, 2023‒2031

Figure 82: South America Quantum Dot (QD) Display Market Share Analysis, by Material, 2023 and 2031

Figure 83: South America Quantum Dot (QD) Display Market Share Analysis, by Component, 2023 and 2031

Figure 84: South America Quantum Dot (QD) Display Market Share Analysis, by Device, 2023 and 2031

Figure 85: South America Quantum Dot (QD) Display Market Projections, by Country and Sub-region, Value (US$ Mn), 2023‒2031

Figure 86: South America Quantum Dot (QD) Display Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America Quantum Dot (QD) Display Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Quantum Dot (QD) Display Market Competition

Figure 89: Global Quantum Dot (QD) Display Market Company Share Analysis