Analysts’ Viewpoint

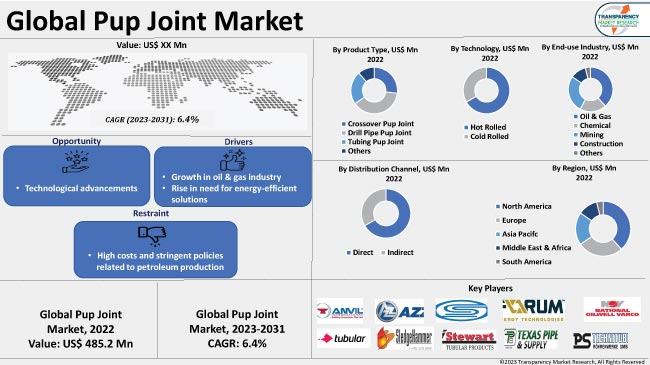

Growth in the oil & gas sector and rise in need for energy-efficient solutions are fueling pup joint market demand. Technological advancements in product development are expected to boost the pup joint market value in the near future.

Key pup joint manufacturers are investing substantially in marketing plans and promotions in order to enhance their product sales. Manufacturers are likely to gain lucrative pup joint market opportunities by developing efficient pup joints for end-use industries such as construction, mining, oil & gas, and chemical. However, high cost of pup joints is anticipated to hamper market progress in the near future.

Pup joints are short sections of pipe or tubing used in drilling operations in several end-use industries. They can also be employed in the production of oil and gas walls. Pup joint pipes are typically made up of small materials as the main tubing or drill pipe and have threaded connections on each end that allow them to be easily connected or disconnected.

Pup joints are called pups, as they are smaller in length compared to regular tubing or drill pipe. They are typically a few feet long; however, their length can vary depending upon specific applications.

Pup joints are usually built in accordance with the API Spec 5CT using premier API-branded, seamless oil country tubing. They are also used to raise and lower full-length casing and tubing. These joints play an important role in attaining the exact reservoir depth, spacing out the string before hanging it, and positioning packers within the borehole. Pup joints are also known as saver subs, spacers, and pups.

Growth in exploration and production activities in the oil & gas sector has a significant impact on the demand for pup joints. Increase in drilling and well completion activities is fueling the need for pup joints to facilitate proper fitting and adjustment of tubing and casing strings.

Expansion in construction and mining industries is a key factor contributing to the demand for pup joints. Oil & gas companies have more capital to invest in drilling operations when prices of oil and gas are high and stable. Thus, rise in construction and mining activities is boosting market dynamics.

Increase in energy consumption across the globe is accelerating the need for drilling and exploration activities, thus driving the demand for pup joints. Technological advancements in drilling techniques, such as horizontal drilling and hydraulic fracturing, have led to an increase in complexity of well designs. This is augmenting the demand for specialized equipment such as pup joints to accommodate these advanced drilling methods.

Leading companies are focusing on developing innovative products for end-use industries. In May 2020, Ace Oil Tools launched its new Ace Splice Clamp (ASC). Other advancements such as precision machining, coatings and treatments, non-destructive testing, and digital integration and monitoring are expected to fuel the pup joint industry growth in the next few years.

Based on product type, the global market has been classified into crossover pup joint, drill pipe pup joint, tubing pup joint, and others (casing pup joint, etc.). As per the pup joint industry research report, the drill pipe pup joint segment is likely to lead the global landscape during the forecast period.

Drill pipe pup joints, also known as drill collar pup joints, are short sections of drill pipe that are used to adjust the length of the drill string during drilling operations. They offer benefits such as length adjustment, tool compatibility, cost savings, drill string maintenance, and rig configuration optimization. These advantages contribute to the increase in operational flexibility, decrease in costs, improvement in efficiency, and enhancement of drilling performance in industries. Thus, demand for drill pipe pup joints is estimated to rise across the globe in the near future.

According to the pup joint industry analysis, the oil & gas end-use segment is estimated to lead the global landscape during the forecast period.

Drilling and production activities are rising across the globe, especially in end-use industries such as construction, mining, and oil & gas. Oil and gas are major sources of energy worldwide. Growth in the oil & gas sector is fueling the demand for tubular products, including pup joints.

Pup joints are essential components in drilling and production processes. Hence, demand for pup joints is directly correlated with the level of activity in the oil & gas sector.

As per the latest pup joint market forecast, North America is likely to dominate the global landscape during the forecast period. Development of shale gas and oil resources is a significant factor fueling the market trajectory of the region.

Shale gas fields such as the Permian Basin in Texas and the Marcellus Shale in the Eastern United States have experienced substantial growth in the recent past. Shale drilling operations require pup joins for well construction and maintenance. Thus, increase in use of pup joints for drilling operations in industries is augmenting market expansion in North America.

The pup joint market size in Europe is anticipated to increase in the near future, owing to the rise in production and exploration activities in the region. Growth in number of oil & gas reserves in the region is fueling demand for equipment and components, including pup joints.

The global landscape is fragmented, with the presence of several local and global players controlling majority of the pup joint market share. According to the pup joint market research analysis, companies are adopting various marketing strategies such as new product development and mergers and acquisitions to expand their global footprint. Manufacturers are also introducing more efficient products at reasonable prices.

Some of the companies operating in the global market are Anvil International, DMH United Steel Industry Co., Ltd, AZZ Inc., National Oilwell Varco, Forum Energy Technologies, Inc., Oil Country Tubular Limited, Stewart Tubular Products, Sledgehammer Oil Tools Pvt Ltd, TPS-Technitube Röhrenwerke GmbH, and Texas Pipe Works Inc. These players are following the latest pup joint market trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the pup joint market report based on parameters such as business segments, company overview, latest developments, financial overview, product portfolio, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 485.2 Mn |

|

Market Value in 2031 |

US$ 903.7 Mn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 485.2 Mn in 2022

It would be worth US$ 903.7 Mn by 2031

It is estimated to grow at a CAGR of 6.4% by 2031

Increase in demand for pup joints in the oil & gas sector, rise in need for energy-efficient solutions, and technological advancements

The drill pipe pup joint segment held major share in 2022

North America is a more attractive region for vendors

Anvil International, AZZ Inc., DMH United Steel Industry Co., Ltd, Forum Energy Technologies, Inc., National Oilwell Varco, Oil Country Tubular Limited, Sledgehammer Oil Tools Pvt Ltd, Stewart Tubular Products, Texas Pipe Works Inc., and TPS-Technitube Röhrenwerke GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Pup Joint Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Mn)

5.9.2. Market Volume Projection (Thousand Units)

6. Global Pup Joint Market Analysis and Forecast, By Product Type

6.1. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Product Type 2017 - 2031

6.1.1. Crossover Pup Joint

6.1.2. Drill Pipe Pup Joint

6.1.3. Tubing Pup Joint

6.1.4. Others

6.2. Incremental Opportunity, By Product Type

7. Global Pup Joint Market Analysis and Forecast, By Technology

7.1. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Technology, 2017 - 2031

7.1.1. Hot Rolled

7.1.2. Cold Rolled

7.2. Incremental Opportunity, By Technology

8. Global Pup Joint Market Analysis and Forecast, By End-use Industry

8.1. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

8.1.1. Oil & Gas

8.1.2. Chemical

8.1.3. Mining

8.1.4. Construction

8.1.5. Others

8.2. Incremental Opportunity, By End Us

9. Global Pup Joint Market Analysis and Forecast, By Distribution Channel

9.1. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct

9.1.2. Indirect

9.2. Incremental Opportunity, By Distribution Channel

10. Global Pup Joint Market Analysis and Forecast, By Region

10.1. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Pup Joint Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Price

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Key Supplier Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

11.6.1. Crossover Pup Joint

11.6.2. Drill Pipe Pup Joint

11.6.3. Tubing Pup Joint

11.6.4. Others

11.7. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Technology, 2017 - 2031

11.7.1. Hot Rolled

11.7.2. Cold Rolled

11.8. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

11.8.1. Oil & Gas

11.8.2. Chemical

11.8.3. Mining

11.8.4. Construction

11.8.5. Others

11.9. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.9.1. Direct

11.9.2. Indirect

11.10. Pup Joint Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2027

11.10.1. The U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Pup Joint Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Regional Snapshot

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Key Supplier Analysis

12.6. Consumer Buying Behavior Analysis

12.7. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

12.7.1. Crossover Pup Joint

12.7.2. Drill Pipe Pup Joint

12.7.3. Tubing Pup Joint

12.7.4. Others

12.8. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Technology, 2017 - 2031

12.8.1. Hot Rolled

12.8.2. Cold Rolled

12.9. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

12.9.1. Oil & Gas

12.9.2. Chemical

12.9.3. Mining

12.9.4. Construction

12.9.5. Others

12.10. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.10.1. Direct

12.10.2. Indirect

12.11. Pup Joint Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

12.11.1. U.K.

12.11.2. Germany

12.11.3. France

12.11.4. Rest of Europe

12.12. Incremental Opportunity Analysis

13. Asia Pacific Pup Joint Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.6.1. Crossover Pup Joint

13.6.2. Drill Pipe Pup Joint

13.6.3. Tubing Pup Joint

13.6.4. Others

13.7. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Technology, 2017 - 2031

13.7.1. Hot Rolled

13.7.2. Cold Rolled

13.8. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

13.8.1. Oil & Gas

13.8.2. Chemical

13.8.3. Mining

13.8.4. Construction

13.8.5. Others

13.9. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.9.1. Direct

13.9.2. Indirect

13.10. Pup Joint Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Pup Joint Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Regional Snapshot

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Key Supplier Analysis

14.6. Consumer Buying Behavior Analysis

14.7. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.7.1. Crossover Pup Joint

14.7.2. Drill Pipe Pup Joint

14.7.3. Tubing Pup Joint

14.7.4. Others

14.8. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Technology, 2017 - 2031

14.8.1. Hot Rolled

14.8.2. Cold Rolled

14.9. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

14.9.1. Oil & Gas

14.9.2. Chemical

14.9.3. Mining

14.9.4. Construction

14.9.5. Others

14.10. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.10.1. Direct

14.10.2. Indirect

14.11. Pup Joint Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017 - 2031

14.11.1. GCC

14.11.2. South Africa

14.11.3. Rest of Middle East & Africa

14.12. Incremental Opportunity Analysis

15. South America Pup Joint Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Key Supplier Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 - 2031

15.6.1. Crossover Pup Joint

15.6.2. Drill Pipe Pup Joint

15.6.3. Tubing Pup Joint

15.6.4. Others

15.7. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Technology, 2017 - 2031

15.7.1. Hot Rolled

15.7.2. Cold Rolled

15.8. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

15.8.1. Oil & Gas

15.8.2. Chemical

15.8.3. Mining

15.8.4. Construction

15.8.5. Others

15.9. Pup Joint Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Direct

15.9.2. Indirect

15.10. Pup Joint Market Size (US$ Mn) (Thousand Units) Forecast, by Country, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis - 2022 (%)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Anvil International

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. AZZ Inc.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. DMH United Steel Industry Co., Ltd.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Forum Energy Technologies, Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. National Oilwell Varco

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Oil Country Tubular Limited

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Sledgehammer Oil Tools Pvt Ltd

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Stewart Tubular Products

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Texas Pipe Works Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. TPS-Technitube Röhrenwerke GmbH

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Technology

17.1.3. End-use Industry

17.1.4. Distribution channel

17.1.5. Region

17.2. Understanding the Procurement Process of End-users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Pup Joint Market by Product Type, Thousand Units 2017-2031

Table 2: Global Pup Joint Market by Product Type, US$ Mn, 2017-2031

Table 3: Global Pup Joint Market by Technology, Thousand Units, 2017-2031

Table 4: Global Pup Joint Market by Technology, US$ Mn, 2017-2031

Table 5: Global Pup Joint Market By End-use Industry, Thousand Units, 2017-2031

Table 6: Global Pup Joint Market By End-use Industry, US$ Mn, 2017-2031

Table 7: Global Pup Joint Market by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Pup Joint Market by Distribution Channel, US$ Mn, 2017-2031

Table 9: Global Pup Joint Market by Region, Thousand Units, 2017-2031

Table 10: Global Pup Joint Market by Region, US$ Mn, 2017-2031

Table 11: North America Pup Joint Market by Product Type, Thousand Units 2017-2031

Table 12: North America Pup Joint Market by Product Type, US$ Mn, 2017-2031

Table 13: North America Pup Joint Market by Technology, Thousand Units, 2017-2031

Table 14: North America Pup Joint Market by Technology, US$ Mn, 2017-2031

Table 15: North America Pup Joint Market By End-use Industry, Thousand Units, 2017-2031

Table 16: North America Pup Joint Market By End-use Industry, US$ Mn, 2017-2031

Table 17: North America Pup Joint Market by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Pup Joint Market by Distribution Channel, US$ Mn, 2017-2031

Table 19: Europe Pup Joint Market by Product Type, Thousand Units 2017-2031

Table 20: Europe Pup Joint Market by Product Type, US$ Mn, 2017-2031

Table 21: Europe Pup Joint Market by Technology, Thousand Units, 2017-2031

Table 22: Europe Pup Joint Market by Technology, US$ Mn, 2017-2031

Table 23: Europe Pup Joint Market By End-use Industry, Thousand Units, 2017-2031

Table 24: Europe Pup Joint Market By End-use Industry, US$ Mn, 2017-2031

Table 25: Europe Pup Joint Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: Europe Pup Joint Market by Distribution Channel, US$ Mn, 2017-2031

Table 27: Asia Pacific Pup Joint Market by Product Type, Thousand Units 2017-2031

Table 28: Asia Pacific Pup Joint Market by Product Type, US$ Mn, 2017-2031

Table 29: Asia Pacific Pup Joint Market by Technology, Thousand Units, 2017-2031

Table 30: Asia Pacific Pup Joint Market by Technology, US$ Mn, 2017-2031

Table 31: Asia Pacific Pup Joint Market By End-use Industry, Thousand Units, 2017-2031

Table 32: Asia Pacific Pup Joint Market By End-use Industry, US$ Mn, 2017-2031

Table 33: Asia Pacific Pup Joint Market by Distribution Channel, Thousand Units, 2017-2031

Table 34: Asia Pacific Pup Joint Market by Distribution Channel, US$ Mn, 2017-2031

Table 35: Middle East & Africa Pup Joint Market by Product Type, Thousand Units 2017-2031

Table 36: Middle East & Africa Pup Joint Market by Product Type, US$ Mn, 2017-2031

Table 37: Middle East & Africa Pup Joint Market by Technology, Thousand Units, 2017-2031

Table 38: Middle East & Africa Pup Joint Market by Technology, US$ Mn, 2017-2031

Table 39: Middle East & Africa Pup Joint Market By End-use Industry, Thousand Units, 2017-2031

Table 40: Middle East & Africa Pup Joint Market By End-use Industry, US$ Mn, 2017-2031

Table 41: Middle East & Africa Pup Joint Market by Distribution Channel, Thousand Units, 2017-2031

Table 42: Middle East & Africa Pup Joint Market by Distribution Channel, US$ Mn, 2017-2031

Table 43: South America Pup Joint Market by Product Type, Thousand Units 2017-2031

Table 44: South America Pup Joint Market by Product Type, US$ Mn, 2017-2031

Table 45: South America Pup Joint Market by Technology, Thousand Units, 2017-2031

Table 46: South America Pup Joint Market by Technology, US$ Mn, 2017-2031

Table 47: South America Pup Joint Market By End-use Industry, Thousand Units, 2017-2031

Table 48: South America Pup Joint Market By End-use Industry, US$ Mn, 2017-2031

Table 49: South America Pup Joint Market by Distribution Channel, Thousand Units, 2017-2031

Table 50: South America Pup Joint Market by Distribution Channel, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Pup Joint Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 2: Global Pup Joint Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 3: Global Pup Joint Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 4: Global Pup Joint Market Projection, by Technology, Thousand Units, 2017-2031

Figure 5: Global Pup Joint Market Projection, by Technology, US$ Mn, 2017-2031

Figure 6: Global Pup Joint Market, Incremental Opportunity, by Technology, US$ Mn, 2023 -2031

Figure 7: Global Pup Joint Market Projection, By End-use Industry, Thousand Units, 2017-2031

Figure 8: Global Pup Joint Market Projection, By End-use Industry, US$ Mn, 2017-2031

Figure 9: Global Pup Joint Market, Incremental Opportunity, By End-use Industry, US$ Mn, 2023 -2031

Figure 10: Global Pup Joint Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Pup Joint Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 12: Global Pup Joint Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 13: Global Pup Joint Market Projection, by Region, Thousand Units, 2017-2031

Figure 14: Global Pup Joint Market Projection, by Region, US$ Mn, 2017-2031

Figure 15: Global Pup Joint Market, Incremental Opportunity, by Region, US$ Mn, 2023 -2031

Figure 16: North America Pup Joint Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 17: North America Pup Joint Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 18: North America Pup Joint Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 19: North America Pup Joint Market Projection, by Technology, Thousand Units, 2017-2031

Figure 20: North America Pup Joint Market Projection, by Technology, US$ Mn, 2017-2031

Figure 21: North America Pup Joint Market, Incremental Opportunity, by Technology, US$ Mn, 2023 -2031

Figure 22: North America Pup Joint Market Projection, By End-use Industry, Thousand Units, 2017-2031

Figure 23: North America Pup Joint Market Projection, By End-use Industry, US$ Mn, 2017-2031

Figure 24: North America Pup Joint Market, Incremental Opportunity, By End-use Industry, US$ Mn, 2023 -2031

Figure 25: North America Pup Joint Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Pup Joint Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 27: North America Pup Joint Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 28: Europe Pup Joint Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 29: Europe Pup Joint Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 30: Europe Pup Joint Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 31: Europe Pup Joint Market Projection, by Technology, Thousand Units, 2017-2031

Figure 32: Europe Pup Joint Market Projection, by Technology, US$ Mn, 2017-2031

Figure 33: Europe Pup Joint Market, Incremental Opportunity, by Technology, US$ Mn, 2023 -2031

Figure 34: Europe Pup Joint Market Projection, By End-use Industry, Thousand Units, 2017-2031

Figure 35: Europe Pup Joint Market Projection, By End-use Industry, US$ Mn, 2017-2031

Figure 36: Europe Pup Joint Market, Incremental Opportunity, By End-use Industry, US$ Mn, 2023 -2031

Figure 37: Europe Pup Joint Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: Europe Pup Joint Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 39: Europe Pup Joint Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 40: Asia Pacific Pup Joint Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 41: Asia Pacific Pup Joint Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 42: Asia Pacific Pup Joint Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 43: Asia Pacific Pup Joint Market Projection, by Technology, Thousand Units, 2017-2031

Figure 44: Asia Pacific Pup Joint Market Projection, by Technology, US$ Mn, 2017-2031

Figure 45: Asia Pacific Pup Joint Market, Incremental Opportunity, by Technology, US$ Mn, 2023 -2031

Figure 46: Asia Pacific Pup Joint Market Projection, By End-use Industry, Thousand Units, 2017-2031

Figure 47: Asia Pacific Pup Joint Market Projection, By End-use Industry, US$ Mn, 2017-2031

Figure 48: Asia Pacific Pup Joint Market, Incremental Opportunity, By End-use Industry, US$ Mn, 2023 -2031

Figure 49: Asia Pacific Pup Joint Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 50: Asia Pacific Pup Joint Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 51: Asia Pacific Pup Joint Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 52: Middle East & Africa Pup Joint Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 53: Middle East & Africa Pup Joint Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 54: Middle East & Africa Pup Joint Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 55: Middle East & Africa Pup Joint Market Projection, by Technology, Thousand Units, 2017-2031

Figure 56: Middle East & Africa Pup Joint Market Projection, by Technology, US$ Mn, 2017-2031

Figure 57: Middle East & Africa Pup Joint Market, Incremental Opportunity, by Technology, US$ Mn, 2023 -2031

Figure 58: Middle East & Africa Pup Joint Market Projection, By End-use Industry, Thousand Units, 2017-2031

Figure 59: Middle East & Africa Pup Joint Market Projection, By End-use Industry, US$ Mn, 2017-2031

Figure 60: Middle East & Africa Pup Joint Market, Incremental Opportunity, By End-use Industry, US$ Mn, 2023 -2031

Figure 61: Middle East & Africa Pup Joint Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Pup Joint Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 63: Middle East & Africa Pup Joint Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031

Figure 64: South America Pup Joint Market Projection, by Product Type, Thousand Units, 2017-2031

Figure 65: South America Pup Joint Market Projection, by Product Type, US$ Mn, 2017-2031

Figure 66: South America Pup Joint Market, Incremental Opportunity, by Product Type, US$ Mn, 2023 -2031

Figure 67: South America Pup Joint Market Projection, by Technology, Thousand Units, 2017-2031

Figure 68: South America Pup Joint Market Projection, by Technology, US$ Mn, 2017-2031

Figure 69: South America Pup Joint Market, Incremental Opportunity, by Technology, US$ Mn, 2023 -2031

Figure 70: South America Pup Joint Market Projection, By End-use Industry, Thousand Units, 2017-2031

Figure 71: South America Pup Joint Market Projection, By End-use Industry, US$ Mn, 2017-2031

Figure 72: South America Pup Joint Market, Incremental Opportunity, By End-use Industry, US$ Mn, 2023 -2031

Figure 73: South America Pup Joint Market Projection, by Distribution Channel, Thousand Units, 2017-2031

Figure 74: South America Pup Joint Market Projection, by Distribution Channel, US$ Mn, 2017-2031

Figure 75: South America Pup Joint Market, Incremental Opportunity, by Distribution Channel, US$ Mn, 2023 -2031