Analysts’ Viewpoint on Global Pulp Market Scenario

The global pulp market is estimated to be driven by rising application of pulp in the packaging of food and beverage, personal care, pharmaceutical, and other products. Leading players in the global pulp market are investing heavily to advance their production technologies and increase their production capacities to meet the growing demand for pulp. They are also focusing on the diversification of their product portfolio to improve global presence. The increasing demand for paper packaging products from the food & beverage industry is projected to be the key growth driver for the pulp market. Moreover, the growing trend of sustainability among the packaging manufacturers is expected to further drive the global pulp market.

The global pulp market is expected to grow, owing to the rising demand for eco-friendly packaging products from end users and developments in the recycling infrastructure in the pulp industry. Moreover, growing anti-plastic sentiments and government initiatives to curb single-use plastics are likely to fuel the demand for pulp-based packaging products in the near future, thereby driving the global pulp market.

The pulp market is anticipated to create an incremental opportunity of US$ 57.1 Bn by 2030, growing at a CAGR of 3.7% between 2022 and 2030. The consumer inclination toward pulp-based products is increasing due to the eco-friendly characteristics of the pulp material. This has created a positive impact on the global demand for pulp-based packaging products. Moreover, the demand for sustainable packaging formats such as “Green Packaging” across the value chain is likely to augment the demand for pulp-based packaging products over the next few years.

Packaging manufacturers across the globe are shifting toward pulp-based packaging, while achieving their sustainability objectives. Packaging experts and consumer product companies are focusing on green packaging formats, as these are biodegradable and help reduce carbon footprint. The ongoing initiatives by government authorities and pulp & paper industries for sustainability are likely to further accelerate the pulp market.

The burgeoning retail sector across the globe is expected to boost the demand for sustainable pulp-based packaging formats in the upcoming years. Sustainable pulp-based packaging maintains the shelf life of the product, while reducing the negative impact of plastic packaging on the environment. Thus, environmental concerns have compelled manufacturers to move toward pulp and paper packaging. This is the main reason for the growing demand for pulp in the past few years.

Although digital marketing turns out to be the cost-effective promotional strategy, print magazines or newspaper ads give more exposure to the brand compared to online advertising. Printed advertisements also increase the brand's favorability and purchase intent toward the product. Printed media is easily re-readable and gives a visual appearance, which increase trust for the content/product. Most of the respondents prefer print media to be tactile and more genuine. All these factors are contributing to the escalating growth of the pulp market.

There have been continuous efforts to reduce or eliminate the usage of plastics in packaging. The anti-plastic sentiment is advantageous to pulp and paper manufacturers, as it encourages the use of biodegradable alternatives. This is being driven by the increasing government initiatives against single-use ban on plastics and the rising awareness among consumers regarding environmental conservation. Moreover, the commitment by consumers to find eco-friendly packaging formats is also one of the factors driving the demand for pulp. The harm caused by plastics to the environment results in tremendous opportunities in the pulp industry. Overall, the growing anti-plastic sentiments among consumers are likely to create significant revenue opportunities for pulp manufacturers during the forecast period.

Chemical pulping accounts for more than ¾ of the pulp market and is estimated to witness growth of 1.5x its current market value by the end of the forecast period. The upsurge in the consumption of high-quality white paper and other quality paper products leads to the increased demand for chemical pulp in the market. Furthermore, the rise in the consumption of paper in the institutional and corporate sectors as well as the increase in application of packaging paper in the food & beverage, pharmaceutical, and personal care industries are factors driving the demand for chemical pulping.

Pulp is used for a diverse range of purposes, making it an integral part of our daily lives. However, the pulp industry is listed as one of the key contributors to pollution. This is partly due to the high consumption of water, which is at the epicentre of the pulp and paper manufacturing process. Thus, there is a need for efficient utilization of pulp to reduce the harmful effects on the environment. The use of recycled paper results in responsible pulp consumption practices. The recycling process reduces the negative impact on the environment, as the sludge produced is repeatedly tested for toxicity. The global push for the use of sustainable materials is expected to aid in the demand for recycled pulp.

The global outbreak of COVID-19 had a negative impact on the pulp market. Key players in the global pulp market have suffered losses amid the pandemic due to supply-chain disruptions, raw material unavailability, and halts in production activities across manufacturing facilities. The demand for pulp is generated mainly by the packaging industry, but amid the pandemic, the demand for packaging products witnessed a decline as people became more aware of spending on essential items only.

The pulp market has witnessed a considerable downfall, mainly due to the decline in the demand for packaging from the food & beverage industry. The increasing awareness among consumers about sustainable packaging is expected to accelerate the demand for pulp. Moreover, the rise in demand for paper and paperboard packaging from end-use industries is likely to augment the growth of the pulp market. As the economy commences its recovery from the pandemic, the pulp market is projected to have a positive outlook in the next few years.

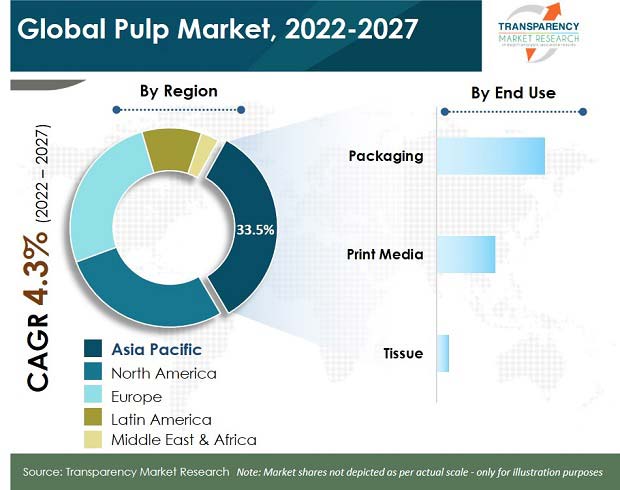

Packaging as an end user holds more than half of the total market share by value and is expected to create the highest incremental opportunity of US$ 22.2 Bn by the end of 2030. Increasing demand for paper-based packaging from the food & beverage, personal care, and pharmaceutical industries is allowing the pulp market to gain impetus over the past few years. Additionally, the increasing consumer shift from plastic packaging to sustainable and eco-friendly packaging is likely to augment the demand for pulp during the forecast period.

The Asia Pacific is expected to remain the dominant region, and the market in the region is projected to grow 1.5x its current market value by 2030. This region is anticipated to represent the highest CAGR of 5.2% over the forecast period. Emerging and developing countries in this region are responsible for shaping the growth of the market.

The increasing consumption of pulp-based products such as tissues, magazines and other paper-based packaging is driving the market in this region. Furthermore, the growing penetration of modern retail formats plays a significant role in fuelling the Asia Pacific pulp market growth.

China is expected to create lucrative opportunities for the manufacturers of pulp. The pulp market in China is estimated to create the highest incremental opportunity of US$ 13.5 Bn by 2030. China holds almost 41.3% of the product market by value. The growth of this market in China can be largely attributed to the huge population base, rapid urbanization rate, and growing penetration of the retail sector. Moreover, rising awareness among end users regarding environmental concerns and favorable government policies are driving the growth of the pulp market in the country.

North America is expected to witness moderate growth during the forecast period. The ongoing efforts by governments in the region against the single-use ban on plastics and the rising preference of consumers for sustainable packaging solutions are driving the pulp market growth in this region.

The global pulp market is highly competitive due to the presence of a large number of regional and local players. Moreover, they are focusing on inorganic growth strategies such as mergers and acquisitions to increase their business reach. The pulp market report concludes with the company profiles section, which includes significant information about key players operating in the global pulp market. Leading players analyzed in the report include Domtar Corporation, International Paper, Stora Enso, UPM Global, WestRock Company, Georgia-Pacific, Mondi plc, Nippon Paper Industries co., ltd., Oji Holdings Corporation, Sappi Global and other prominent players.

Each of these players has been profiled in the pulp market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

There is an upsurge in investments to acquire mills, and expand and restructure production units by global manufacturers of pulp.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 146.7 Bn |

|

Market Forecast Value in 2030 |

US$ 203.8 Bn |

|

Growth Rate (CAGR) |

3.7% from Year-to-Year |

|

Forecast Period |

2022–2030 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The pulp market was valued at US$ 146.7 Bn in 2021 and is expected to reach US$ 203.8 Bn by 2030.

The pulp market is expected to grow at a CAGR of 3.7% during the forecast period.

Increased consumer preference for sustainable and green packaging products, and recycling reforms in the pulp industry are projected to drive the global pulp market.

Chemical grade of pulp is preferred the most in the global pulp market.

The pulp market in the Asia Pacific is likely to grow at the fastest CAGR of 5.2% during the forecast period.

The packaging end use segment is likely to generate the highest revenue in 2030.

Top three countries contribute around approximately 40% to the total global pulp market.

Georgia-Pacific, WestRock Company, Mondi plc, International Paper, and Stora Enso are the prominent players in the global market.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Pulp Market Overview

3.1. Introduction

3.2. Global Pulp Market Overview

3.3. Value Chain Analysis

3.3.1. Exhaustive List of Active Participants

3.3.1.1. Raw Material Suppliers

3.3.1.2. Pulp Manufacturers

3.3.1.3. End Users

3.3.2. Profitability Margins

3.4. Macro-economic Factors – Correlation Analysis

3.5. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Pulp Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Pulp Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Pulp Market Analysis and Forecast, By Source

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Source

7.1.2. Y-o-Y Growth Projections, By Source

7.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Source

7.2.1. Wood Pulp / Virgin Fiber Pulp

7.2.1.1. Soft Wood

7.2.1.2. Hard Wood

7.2.2. Non-Wood Pulp

7.2.2.1. Straw (Corn, Wheat, Rice etc.)

7.2.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

7.2.2.3. Leaf (Sisal, Palm, etc.)

7.2.2.4. Seeds (Cotton, Coir, etc.)

7.2.2.5. Grass (Bamboo, Reeds)

7.2.2.6. Others

7.2.3. Recycled Pulp / De-Inked Pulp

7.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By Source

7.3.1. Wood Pulp / Virgin Fiber Pulp

7.3.1.1. Soft Wood

7.3.1.2. Hard Wood

7.3.2. Non-Wood Pulp

7.3.2.1. Straw (Corn, Wheat, Rice etc.)

7.3.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

7.3.2.3. Leaf (Sisal, Palm, etc.)

7.3.2.4. Seeds (Cotton, Coir, etc.)

7.3.2.5. Grass (Bamboo, Reeds)

7.3.2.6. Others

7.3.3. Recycled Pulp / De-Inked Pulp

7.4. Market Attractiveness Analysis, By Source

8. Global Pulp Market Analysis and Forecast, By Grade

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Grade

8.1.2. Y-o-Y Growth Projections, By Grade

8.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Grade

8.2.1. Mechanical Pulping

8.2.2. Chemical Pulping

8.2.3. Others

8.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By Grade

8.3.1. Mechanical Pulping

8.3.2. Chemical Pulping

8.3.3. Others

8.4. Market Attractiveness Analysis, By Grade

9. Global Pulp Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By End Use

9.2.1. Packaging

9.2.1.1. Food & Beverages

9.2.1.2. Personal Care & Cosmetics

9.2.1.3. Pharmaceutical

9.2.1.4. Automotive

9.2.1.5. Others

9.2.2. Print Media

9.2.2.1. News Printing

9.2.2.2. Book / Magazine Printing

9.2.2.3. Advanced Printing

9.2.3. Tissue & Hygiene Paper

9.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By End Use

9.3.1. Packaging

9.3.1.1. Food & Beverages

9.3.1.2. Personal Care & Cosmetics

9.3.1.3. Pharmaceutical

9.3.1.4. Automotive

9.3.1.5. Others

9.3.2. Print Media

9.3.2.1. News Printing

9.3.2.2. Book / Magazine Printing

9.3.2.3. Advanced Printing

9.3.3. Tissue & Hygiene Paper

9.4. Market Attractiveness Analysis, By End Use

9.5. Prominent Trends

10. Global Pulp Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East and Africa

10.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East and Africa

10.4. Market Attractiveness Analysis By Region

11. North America Pulp Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Country

11.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Source

11.5. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Source

11.5.1. Wood Pulp / Virgin Fiber Pulp

11.5.1.1. Soft Wood

11.5.1.2. Hard Wood

11.5.2. Non-Wood Pulp

11.5.2.1. Straw (Corn, Wheat, Rice etc.)

11.5.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

11.5.2.3. Leaf (Sisal, Palm, etc.)

11.5.2.4. Seeds (Cotton, Coir, etc.)

11.5.2.5. Grass (Bamboo, Reeds)

11.5.2.6. Others

11.5.3. Recycled Pulp / De-Inked Pulp

11.6. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Grade

11.7. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Grade

11.7.1. Mechanical Pulping

11.7.2. Chemical Pulping

11.7.3. Others

11.8. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By End Use

11.9. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By End Use

11.9.1. Packaging

11.9.1.1. Food & Beverages

11.9.1.2. Personal Care & Cosmetics

11.9.1.3. Pharmaceutical

11.9.1.4. Automotive

11.9.1.5. Others

11.9.2. Print Media

11.9.2.1. News Printing

11.9.2.2. Book / Magazine Printing

11.9.2.3. Advanced Printing

11.9.3. Tissue & Hygiene Paper

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Source

11.10.3. By Grade

11.10.4. By End Use

12. Latin America Pulp Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Country

12.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Source

12.5. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Source

12.5.1. Wood Pulp / Virgin Fiber Pulp

12.5.1.1. Soft Wood

12.5.1.2. Hard Wood

12.5.2. Non-Wood Pulp

12.5.2.1. Straw (Corn, Wheat, Rice etc.)

12.5.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

12.5.2.3. Leaf (Sisal, Palm, etc.)

12.5.2.4. Seeds (Cotton, Coir, etc.)

12.5.2.5. Grass (Bamboo, Reeds)

12.5.2.6. Others

12.5.3. Recycled Pulp / De-Inked Pulp

12.6. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Grade

12.7. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Grade

12.7.1. Mechanical Pulping

12.7.2. Chemical Pulping

12.7.3. Others

12.8. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By End Use

12.9. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By End Use

12.9.1. Packaging

12.9.1.1. Food & Beverages

12.9.1.2. Personal Care & Cosmetics

12.9.1.3. Pharmaceutical

12.9.1.4. Automotive

12.9.1.5. Others

12.9.2. Print Media

12.9.2.1. News Printing

12.9.2.2. Book / Magazine Printing

12.9.2.3. Advanced Printing

12.9.3. Tissue & Hygiene Paper

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Source

12.10.3. By Grade

12.10.4. By End Use

13. Europe Pulp Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Country

13.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 By Country

13.3.1. Germany

13.3.2. Italy

13.3.3. Spain

13.3.4. Russia

13.3.5. U.K.

13.3.6. France

13.3.7. Benelux

13.3.8. Nordic

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Source

13.5. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Source

13.5.1. Wood Pulp / Virgin Fiber Pulp

13.5.1.1. Soft Wood

13.5.1.2. Hard Wood

13.5.2. Non-Wood Pulp

13.5.2.1. Straw (Corn, Wheat, Rice etc.)

13.5.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

13.5.2.3. Leaf (Sisal, Palm, etc.)

13.5.2.4. Seeds (Cotton, Coir, etc.)

13.5.2.5. Grass (Bamboo, Reeds)

13.5.2.6. Others

13.5.3. Recycled Pulp / De-Inked Pulp

13.6. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Grade

13.7. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Grade

13.7.1. Mechanical Pulping

13.7.2. Chemical Pulping

13.7.3. Others

13.8. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By End Use

13.9. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By End Use

13.9.1. Packaging

13.9.1.1. Food & Beverages

13.9.1.2. Personal Care & Cosmetics

13.9.1.3. Pharmaceutical

13.9.1.4. Automotive

13.9.1.5. Others

13.9.2. Print Media

13.9.2.1. News Printing

13.9.2.2. Book / Magazine Printing

13.9.2.3. Advanced Printing

13.9.3. Tissue & Hygiene Paper

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Source

13.10.3. By Grade

13.10.4. By End Use

14. Asia Pacific Pulp Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Country

14.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 By Country

14.3.1. China

14.3.2. India

14.3.3. ASEAN

14.3.4. Australia & New Zealand

14.3.5. Japan

14.3.6. South Korea

14.3.7. Rest of Asia Pacific

14.4. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Source

14.5. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Source

14.5.1. Wood Pulp / Virgin Fiber Pulp

14.5.1.1. Soft Wood

14.5.1.2. Hard Wood

14.5.2. Non-Wood Pulp

14.5.2.1. Straw (Corn, Wheat, Rice etc.)

14.5.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

14.5.2.3. Leaf (Sisal, Palm, etc.)

14.5.2.4. Seeds (Cotton, Coir, etc.)

14.5.2.5. Grass (Bamboo, Reeds)

14.5.2.6. Others

14.5.3. Recycled Pulp / De-Inked Pulp

14.6. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Grade

14.7. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Grade

14.7.1. Mechanical Pulping

14.7.2. Chemical Pulping

14.7.3. Others

14.8. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By End Use

14.9. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By End Use

14.9.1. Packaging

14.9.1.1. Food & Beverages

14.9.1.2. Personal Care & Cosmetics

14.9.1.3. Pharmaceutical

14.9.1.4. Automotive

14.9.1.5. Others

14.9.2. Print Media

14.9.2.1. News Printing

14.9.2.2. Book / Magazine Printing

14.9.2.3. Advanced Printing

14.9.3. Tissue & Hygiene Paper

14.10. Market Attractiveness Analysis

14.10.1. By Country

14.10.2. By Source

14.10.3. By Grade

14.10.4. By End Use

15. Middle East and Africa Pulp Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Country

15.3. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By Country

15.3.1. North Africa

15.3.2. GCC countries

15.3.3. South Africa

15.3.4. Turkey

15.3.5. Rest of MEA

15.4. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Source

15.5. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Source

15.5.1. Wood Pulp / Virgin Fiber Pulp

15.5.1.1. Soft Wood

15.5.1.2. Hard Wood

15.5.2. Non-Wood Pulp

15.5.2.1. Straw (Corn, Wheat, Rice etc.)

15.5.2.2. Bast (Flex, Jute, Hemp, Kenaf, etc.)

15.5.2.3. Leaf (Sisal, Palm, etc.)

15.5.2.4. Seeds (Cotton, Coir, etc.)

15.5.2.5. Grass (Bamboo, Reeds)

15.5.2.6. Others

15.5.3. Recycled Pulp / De-Inked Pulp

15.6. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By Grade

15.7. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030 Analysis 2022-2030, By Grade

15.7.1. Mechanical Pulping

15.7.2. Chemical Pulping

15.7.3. Others

15.8. Historical Market Value (US$ Mn) and Volume (Mn Tonnes), 2017-2021, By End Use

15.9. Market Size (US$ Mn) and Volume (Mn Tonnes) Forecast Analysis 2022-2030, By End Use

15.9.1. Packaging

15.9.1.1. Food & Beverages

15.9.1.2. Personal Care & Cosmetics

15.9.1.3. Pharmaceutical

15.9.1.4. Automotive

15.9.1.5. Others

15.9.2. Print Media

15.9.2.1. News Printing

15.9.2.2. Book / Magazine Printing

15.9.2.3. Advanced Printing

15.9.3. Tissue & Hygiene Paper

15.10. Market Attractiveness Analysis

15.10.1. By Country

15.10.2. By Source

15.10.3. By Grade

15.10.4. By End Use

16. Country wise Pulp Market Analysis, 2022-2030

16.1. U.S. Rigid Packaging Containers Market Analysis

16.1.1. By Source

16.1.2. By Grade

16.1.3. By End Use

16.2. Canada Rigid Packaging Containers Market Analysis

16.2.1. By Source

16.2.2. By Grade

16.2.3. By End Use

16.3. Brazil Rigid Packaging Containers Market Analysis

16.3.1. By Source

16.3.2. By Grade

16.3.3. By End Use

16.4. Mexico Rigid Packaging Containers Market Analysis

16.4.1. By Source

16.4.2. By Grade

16.4.3. By End Use

16.5. Argentina Rigid Packaging Containers Market Analysis

16.5.1. By Source

16.5.2. By Grade

16.5.3. By End Use

16.6. Germany Rigid Packaging Containers Market Analysis

16.6.1. By Source

16.6.2. By Grade

16.6.3. By End Use

16.7. Spain Rigid Packaging Containers Market Analysis

16.7.1. By Source

16.7.2. By Grade

16.7.3. By End Use

16.8. France Rigid Packaging Containers Market Analysis

16.8.1. By Source

16.8.2. By Grade

16.8.3. By End Use

16.9. U K Rigid Packaging Containers Market Analysis

16.9.1. By Source

16.9.2. By Grade

16.9.3. By End Use

16.10. Italy Rigid Packaging Containers Market Analysis

16.10.1. By Source

16.10.2. By Grade

16.10.3. By End Use

16.11. Benelux Rigid Packaging Containers Market Analysis

16.11.1. By Source

16.11.2. By Grade

16.11.3. By End Use

16.12. Russia Rigid Packaging Containers Market Analysis

16.12.1. By Source

16.12.2. By Grade

16.12.3. By End Use

16.13. China Rigid Packaging Containers Market Analysis

16.13.1. By Source

16.13.2. By Grade

16.13.3. By End Use

16.14. India Rigid Packaging Containers Market Analysis

16.14.1. By Source

16.14.2. By Grade

16.14.3. By End Use

16.15. Japan Rigid Packaging Containers Market Analysis

16.15.1. By Source

16.15.2. By Grade

16.15.3. By End Use

17. Competitive Landscape

17.1. Market Structure

17.2. Competition Dashboard

17.3. Company Market Share Analysis

17.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.5. Competition Deep Dive (Key Global Market Players)

17.5.1. International Paper

17.5.1.1. Overview

17.5.1.2. Financials

17.5.1.3. Strategy

17.5.1.4. Recent Developments

17.5.1.5. SWOT Analysis

17.5.2. Domtar Corporation

17.5.2.1. Overview

17.5.2.2. Financials

17.5.2.3. Strategy

17.5.2.4. Recent Developments

17.5.2.5. SWOT Analysis

17.5.3. Stora Enso

17.5.3.1. Overview

17.5.3.2. Financials

17.5.3.3. Strategy

17.5.3.4. Recent Developments

17.5.3.5. SWOT Analysis

17.5.4. UPM Global

17.5.4.1. Overview

17.5.4.2. Financials

17.5.4.3. Strategy

17.5.4.4. Recent Developments

17.5.4.5. SWOT Analysis

17.5.5. WestRock Company

17.5.5.1. Overview

17.5.5.2. Financials

17.5.5.3. Strategy

17.5.5.4. Recent Developments

17.5.5.5. SWOT Analysis

17.5.6. BillerudKorsnäs AB

17.5.6.1. Overview

17.5.6.2. Financials

17.5.6.3. Strategy

17.5.6.4. Recent Developments

17.5.6.5. SWOT Analysis

17.5.7. Ahlstrom-Munksjö

17.5.7.1. Overview

17.5.7.2. Financials

17.5.7.3. Strategy

17.5.7.4. Recent Developments

17.5.7.5. SWOT Analysis

17.5.8. Georgia-Pacific

17.5.8.1. Overview

17.5.8.2. Financials

17.5.8.3. Strategy

17.5.8.4. Recent Developments

17.5.8.5. SWOT Analysis

17.5.9. Mondi plc

17.5.9.1. Overview

17.5.9.2. Financials

17.5.9.3. Strategy

17.5.9.4. Recent Developments

17.5.9.5. SWOT Analysis

17.5.10. Mercer International Inc.

17.5.10.1. Overview

17.5.10.2. Financials

17.5.10.3. Strategy

17.5.10.4. Recent Developments

17.5.10.5. SWOT Analysis

17.5.11. Nippon Paper Industries co., Ltd.

17.5.11.1. Overview

17.5.11.2. Financials

17.5.11.3. Strategy

17.5.11.4. Recent Developments

17.5.11.5. SWOT Analysis

17.5.12. Oji Holdings Corporation

17.5.12.1. Overview

17.5.12.2. Financials

17.5.12.3. Strategy

17.5.12.4. Recent Developments

17.5.12.5. SWOT Analysis

17.5.13. Mitsubishi Paper Mills Limited

17.5.13.1. Overview

17.5.13.2. Financials

17.5.13.3. Strategy

17.5.13.4. Recent Developments

17.5.13.5. SWOT Analysis

17.5.14. Resolute Forest Products

17.5.14.1. Overview

17.5.14.2. Financials

17.5.14.3. Strategy

17.5.14.4. Recent Developments

17.5.14.5. SWOT Analysis

17.5.15. Svenska Cellulosa AB SCA

17.5.15.1. Overview

17.5.15.2. Financials

17.5.15.3. Strategy

17.5.15.4. Recent Developments

17.5.15.5. SWOT Analysis

17.5.16. Sappi Global

17.5.16.1. Overview

17.5.16.2. Financials

17.5.16.3. Strategy

17.5.16.4. Recent Developments

17.5.16.5. SWOT Analysis

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global Pulp Market Historic Value (US$ Mn), By Source 2017(H)-2021(A)

Table 02: Global Pulp Market Forecast Value (US$ Mn), By Source 2022(E)-2030(F)

Table 03: Global Pulp Market Historic Volume (Mn Tonnes), By Source 2017(H)-2021(A)

Table 04: Global Pulp Market Forecast Volume (Mn Tonnes), By Source 2022(E)-2030(F)

Table 05: Global Pulp Market Historic Value (US$ Mn), By Grade 2017(H)-2021(A)

Table 06: Global Pulp Market Forecast Value (US$ Mn), By Grade 2022(E)-2030(F)

Table 07: Global Pulp Market Historic Volume (Mn Tonnes), By Grade 2017(H)-2021(A)

Table 08: Global Pulp Market Forecast Volume (Mn Tonnes), By Grade 2022(E)-2030(F)

Table 09: Global Pulp Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 10: Global Pulp Market Forecast Value (US$ Mn), By End Use 2022(E)-2030(F)

Table 11: Global Pulp Market Historic Volume (Mn Tonnes), By End Use 2017(H)-2021(A)

Table 12: Global Pulp Market Forecast Volume (Mn Tonnes), By End Use 2022(E)-2030(F)

Table 13: Global Pulp Market Historic Value (US$ Mn), By Region Type 2017(H)-2021(A)

Table 14: Global Pulp Market Forecast Value (US$ Mn), By Region Type 2022(E)-2030(F)

Table 15: Global Pulp Market Historic Volume (Mn Tonnes), By Region Type 2017(H)-2021(A)

Table 16: Global Pulp Market Forecast Volume (Mn Tonnes), By Region Type 2022(E)-2030(F)

Table 17: North America Pulp Market Historic Value (US$ Mn), By Source 2017(H)-2021(A)

Table 18: North America Pulp Market Forecast Value (US$ Mn), By Source 2022(E)-2030(F)

Table 19: North America Pulp Market Historic Volume (Mn Tonnes), By Source 2017(H)-2021(A)

Table 20: North America Pulp Market Forecast Volume (Mn Tonnes), By Source 2022(E)-2030(F)

Table 21: North America Pulp Market Historic Value (US$ Mn), By Grade 2017(H)-2021(A)

Table 22: North America Pulp Market Forecast Value (US$ Mn), By Grade 2022(E)-2030(F)

Table 23: North America Pulp Market Historic Volume (Mn Tonnes), By Grade 2017(H)-2021(A)

Table 24: North America Pulp Market Forecast Volume (Mn Tonnes), By Grade 2022(E)-2030(F)

Table 25: North America Pulp Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 26: North America Pulp Market Forecast Value (US$ Mn), By End Use 2022(E)-2030(F)

Table 27: North America Pulp Market Historic Volume (Mn Tonnes), By End Use 2017(H)-2021(A)

Table 28: North America Pulp Market Forecast Volume (Mn Tonnes), By End Use 2022(E)-2030(F)

Table 29: Latin America Pulp Market Historic Value (US$ Mn), By Source 2017(H)-2021(A)

Table 30: Latin America Pulp Market Forecast Value (US$ Mn), By Source 2022(E)-2030(F)

Table 31: Latin America Pulp Market Historic Volume (Mn Tonnes), By Source 2017(H)-2021(A)

Table 32: Latin America Pulp Market Forecast Volume (Mn Tonnes), By Source 2022(E)-2030(F)

Table 33: Latin America Pulp Market Historic Value (US$ Mn), By Grade 2017(H)-2021(A)

Table 34: Latin America Pulp Market Forecast Value (US$ Mn), By Grade 2022(E)-2030(F)

Table 35: Latin America Pulp Market Historic Volume (Mn Tonnes), By Grade 2017(H)-2021(A)

Table 36: Latin America Pulp Market Forecast Volume (Mn Tonnes), By Grade 2022(E)-2030(F)

Table 37: Latin America Pulp Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 38: Latin America Pulp Market Forecast Value (US$ Mn), By End Use 2022(E)-2030(F)

Table 39: Latin America Pulp Market Historic Volume (Mn Tonnes), By End Use 2017(H)-2021(A)

Table 40: Latin America Pulp Market Forecast Volume (Mn Tonnes), By End Use 2022(E)-2030(F)

Table 41: Europe Pulp Market Historic Value (US$ Mn), By Source 2017(H)-2021(A)

Table 42: Europe Pulp Market Forecast Value (US$ Mn), By Source 2022(E)-2030(F)

Table 43: Europe Pulp Market Historic Volume (Mn Tonnes), By Source 2017(H)-2021(A)

Table 44: Europe Pulp Market Forecast Volume (Mn Tonnes), By Source 2022(E)-2030(F)

Table 45: Europe Pulp Market Historic Value (US$ Mn), By Grade 2017(H)-2021(A)

Table 46: Europe Pulp Market Forecast Value (US$ Mn), By Grade 2022(E)-2030(F)

Table 47: Europe Pulp Market Historic Volume (Mn Tonnes), By Grade 2017(H)-2021(A)

Table 48: Europe Pulp Market Forecast Volume (Mn Tonnes), By Grade 2022(E)-2030(F)

Table 49: Europe Pulp Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 50: Europe Pulp Market Forecast Value (US$ Mn), By End Use 2022(E)-2030(F)

Table 51: Europe Pulp Market Historic Volume (Mn Tonnes), By End Use 2017(H)-2021(A)

Table 52: Europe Pulp Market Forecast Volume (Mn Tonnes), By End Use 2022(E)-2030(F)

Table 53: Asia Pacific Pulp Market Historic Value (US$ Mn), By Source 2017(H)-2021(A)

Table 54: Asia Pacific Pulp Market Forecast Value (US$ Mn), By Source 2022(E)-2030(F)

Table 55: Asia Pacific Pulp Market Historic Volume (Mn Tonnes), By Source 2017(H)-2021(A)

Table 56: Asia Pacific Pulp Market Forecast Volume (Mn Tonnes), By Source 2022(E)-2030(F)

Table 57: Asia Pacific Pulp Market Historic Value (US$ Mn), By Grade 2017(H)-2021(A)

Table 58: Asia Pacific Pulp Market Forecast Value (US$ Mn), By Grade 2022(E)-2030(F)

Table 59: Asia Pacific Pulp Market Historic Volume (Mn Tonnes), By Grade 2017(H)-2021(A)

Table 60: Asia Pacific Pulp Market Forecast Volume (Mn Tonnes), By Grade 2022(E)-2030(F)

Table 61: Asia Pacific Pulp Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 62: Asia Pacific Pulp Market Forecast Value (US$ Mn), By End Use 2022(E)-2030(F)

Table 63: Asia Pacific Pulp Market Historic Volume (Mn Tonnes), By End Use 2017(H)-2021(A)

Table 64: Asia Pacific Pulp Market Forecast Volume (Mn Tonnes), By End Use 2022(E)-2030(F)

Table 65: MEA Pulp Market Historic Value (US$ Mn), By Source 2017(H)-2021(A)

Table 66: MEA Pulp Market Forecast Value (US$ Mn), By Source 2022(E)-2030(F)

Table 67: MEA Pulp Market Historic Volume (Mn Tonnes), By Source 2017(H)-2021(A)

Table 68: MEA Pulp Market Forecast Volume (Mn Tonnes), By Source 2022(E)-2030(F)

Table 69: MEA Pulp Market Historic Value (US$ Mn), By Grade 2017(H)-2021(A)

Table 70: MEA Pulp Market Forecast Value (US$ Mn), By Grade 2022(E)-2030(F)

Table 71: MEA Pulp Market Historic Volume (Mn Tonnes), By Grade 2017(H)-2021(A)

Table 72: MEA Pulp Market Forecast Volume (Mn Tonnes), By Grade 2022(E)-2030(F)

Table 73: MEA Pulp Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 74: MEA Pulp Market Forecast Value (US$ Mn), By End Use 2022(E)-2030(F)

Table 75: MEA Pulp Market Historic Volume (Mn Tonnes), By End Use 2017(H)-2021(A)

Table 76: MEA Pulp Market Forecast Volume (Mn Tonnes), By End Use 2022(E)-2030(F)

List of Figures

Figure 01: Global Pulp Market Value Share Analysis, By Source 2022(E) & 2030(F)

Figure 02: Global Pulp Market Attractiveness Analysis, By Source 2022(E)-2030(F)

Figure 03: Global Pulp Market YoY Growth Analysis, By Source 2017(H)-2030(F)

Figure 04: Global Pulp Market Value Share Analysis, By Grade 2022(E) & 2030(F)

Figure 05: Global Pulp Market Attractiveness Analysis, By Grade 2022(E)-2030(F)

Figure 06: Global Pulp Market YoY Growth Analysis, By Grade 2017(H)-2030(F)

Figure 07: Global Pulp Market Value Share Analysis, By End Use 2022(E) & 2030(F)

Figure 08: Global Pulp Market Attractiveness Analysis, By End Use 2022(E)-2030(F)

Figure 09: Global Pulp Market YoY Growth Analysis, By End Use 2017(H)-2030(F)

Figure 10: Global Pulp Market Value Share Analysis, By Region 2022(E) & 2030(F)

Figure 11: Global Pulp Market Attractiveness Analysis, By Region 2022(E)-2030(F)

Figure 12: Global Pulp Market YoY Growth Analysis, By Region 2017(H)-2030(F)

Figure 13: North America Pulp Market Value Share Analysis, By Country, 2022(E) & 2030(F)

Figure 14: North America Pulp Market Value Share Analysis, By Source, 2022(E) & 2030(F)

Figure 15: North America Pulp Market Value Share Analysis, By Grade, 2022(E) & 2030(F)

Figure 16: North America Pulp Market Value Share Analysis, By End Use, 2022(E) & 2030(F)

Figure 17: North America Pulp Market Attractiveness Analysis, By Country, 2022(E) & 2030(F)

Figure 18: North America Pulp Market Attractiveness Analysis, By Source, 2022(E) & 2030(F)

Figure 19: North America Pulp Market Attractiveness Analysis, By Grade, 2022(E) & 2030(F)

Figure 20: North America Pulp Market Attractiveness Analysis, By End Use, 2022(E) & 2030(F)

Figure 21: Latin America Pulp Market Value Share Analysis, By Country, 2022(E) & 2030(F)

Figure 22: Latin America Pulp Market Value Share Analysis, By Source, 2022(E) & 2030(F)

Figure 23: Latin America Pulp Market Value Share Analysis, By Grade, 2022(E) & 2030(F)

Figure 24: Latin America Pulp Market Value Share Analysis, By End Use, 2022(E) & 2030(F)

Figure 25: Latin America Pulp Market Attractiveness Analysis, By Country, 2022(E) & 2030(F)

Figure 26: Latin America Pulp Market Attractiveness Analysis, By Source, 2022(E) & 2030(F)

Figure 27: Latin America Pulp Market Attractiveness Analysis, By Grade, 2022(E) & 2030(F)

Figure 28: Latin America Pulp Market Attractiveness Analysis, By End Use, 2022(E) & 2030(F)

Figure 29: Europe Pulp Market Value Share Analysis, By Country, 2022(E) & 2030(F)

Figure 30: Europe Pulp Market Value Share Analysis, By Source, 2022(E) & 2030(F)

Figure 31: Europe Pulp Market Value Share Analysis, By Grade, 2022(E) & 2030(F)

Figure 32: Europe Pulp Market Value Share Analysis, By End Use, 2022(E) & 2030(F)

Figure 33: Europe Pulp Market Attractiveness Analysis, By Country, 2022(E) & 2030(F)

Figure 34: Europe Pulp Market Attractiveness Analysis, By Source, 2022(E) & 2030(F)

Figure 35: Europe Pulp Market Attractiveness Analysis, By Grade, 2022(E) & 2030(F)

Figure 36: Europe Pulp Market Attractiveness Analysis, By End Use, 2022(E) & 2030(F)

Figure 37: Asia Pacific Pulp Market Value Share Analysis, By Country, 2022(E) & 2030(F)

Figure 38: Asia Pacific Pulp Market Value Share Analysis, By Source, 2022(E) & 2030(F)

Figure 39: Asia Pacific Pulp Market Value Share Analysis, By Grade, 2022(E) & 2030(F)

Figure 40: Asia Pacific Pulp Market Value Share Analysis, By End Use, 2022(E) & 2030(F)

Figure 41: Asia Pacific Pulp Market Attractiveness Analysis, By Country, 2022(E) & 2030(F)

Figure 42: Asia Pacific Pulp Market Attractiveness Analysis, By Source, 2022(E) & 2030(F)

Figure 43: Asia Pacific Pulp Market Attractiveness Analysis, By Grade, 2022(E) & 2030(F)

Figure 44: Asia Pacific Pulp Market Attractiveness Analysis, By End Use, 2022(E) & 2030(F)

Figure 45: MEA Pulp Market Value Share Analysis, By Country, 2022(E) & 2030(F)

Figure 46: MEA Pulp Market Value Share Analysis, By Source, 2022(E) & 2030(F)

Figure 47: MEA Pulp Market Value Share Analysis, By Grade, 2022(E) & 2030(F)

Figure 48: MEA Pulp Market Value Share Analysis, By End Use, 2022(E) & 2030(F)

Figure 49: MEA Pulp Market Attractiveness Analysis, By Country, 2022(E) & 2030(F)

Figure 50: MEA Pulp Market Attractiveness Analysis, By Source, 2022(E) & 2030(F)

Figure 51: MEA Pulp Market Attractiveness Analysis, By Grade, 2022(E) & 2030(F)

Figure 52: MEA Pulp Market Attractiveness Analysis, By End Use, 2022(E) & 2030(F)