Analysts’ Viewpoint on Global PRP and PRF in Cosmetics Market Scenario

Increase in interest for personal grooming among the young generation has been driving the PRP and PRF in cosmetics market in various emerging economies. Companies are considering capacity expansions in anticipation of rapidly increasing demand for different types of cosmetic applications such as PRF for facial rejuvenation. Demand for PRP & PRF facial therapy is expected to rise at a fast pace during the forecast period. The spending capacity of the people has been increasing post the peak of the COVID-19 pandemic; therefore, companies operating in the market are capitalizing on this opportunity to increase the awareness about the benefits of PRP and PRF in clinics to encourage their adoption.

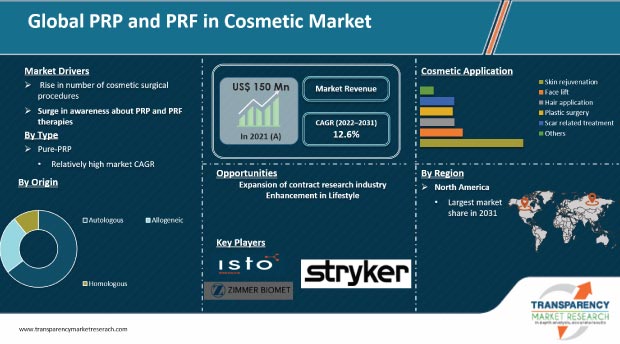

Rise in number of cosmetic surgical procedures, surge in awareness about PRP and PRF therapies, and increase in applications of PRP & PRF in cosmetics are propelling the global market. Developed economies such as the U.S. and countries in Europe accounted for substantial share of the global PRP and PRF in cosmetics market in 2021. However, high cost of products and possibility of complications in cosmetic surgeries are expected to restrain the global PRP and PRF in cosmetics market. Nevertheless, the platelet-rich plasma (PRP) treatment shows improvement in volume, tone, and texture of the skin. It also reduces the appearance of wrinkles. Hence, PRP therapy is becoming quite popular in skin treatment. Thus, demand for PRP and PRF in cosmetics is likely to increase during the forecast period.

Over the last few years, small and large biopharmaceutical companies have become increasingly reliant on contract research organizations (CROs) and other clinical service specialists to provide research services for their R&D operations. Changing lifestyles of the people in developing regions, increase in per capita income, and rise in awareness about beautification contribute to the growth of the global PRP and PRF in cosmetics market. Outsourcing of stem cell trials is also expected to drive the market by the end of the forecast period.

PRP was first used in cardiac surgery in 1987. Awareness about the advantages and applications of PRP was limited to research laboratories. Currently, value-added advantages and applications of PRP therapy over conventional wound healing & disease treatments, such as surgery and medicines, have resulted in higher demand for PRP products globally. This is offsetting the limitations of PRP and PRF in cosmetics.

PRP therapy is used in cosmetics to reduce wrinkles, plump up the sagging skin, get rid of deep creases, improve complexion, and diminish acne scars. The middle-aged and elderly population is increasingly opting for plastic surgeries to look esthetically appealing and young. Thus, rise in awareness about these surgeries among the population is projected to boost the market during the forecast period.

Increase in awareness has also been driving the demand for platelet rich plasma therapy since the last few years in emerging economies such as China, India, Brazil, and Russia as well as in developed regions including North America and Europe. Global players such as Cesca, Harvest, Arthrex, and Biomet are strengthening their existing distribution networks in these regions in order to increase their market presence.

PRP and PRF exhibit high potential in cosmetic treatments. PRP therapy can be used as a dermal filler for rapid healing of injuries. It is an effective substitute for hyaluronic acid. According to the International Society of Aesthetic Plastic Surgery (ISAPS), around 10,129,529 cosmetic surgeries were performed in 2020 across the world, which included 1,601,713 breast augmentation procedures, 968,381 eyelid surgeries, and 1,300,020 liposuction procedures. As per the American Society of Plastic Surgeons (ASPS), about 1,811,754 cosmetic surgical procedures were performed in the U.S. in 2020. Thus, increase in the number of cosmetic surgeries is likely to drive the demand for PRP and PRF in cosmetics during the forecast period.

According to the American Society of Plastic Surgeons (ASPS), plastic surgery gained popularity in 2020, with around 18.1 million cosmetic procedures performed in the same year, along with 16.23 million cosmetic minimally-invasive procedures. Adoption of platelet rich plasma therapy is increasing due to its effectiveness in facial therapy, rhytides treatment, oral-maxillofacial surgery, and augmentation of soft tissue repair. This is likely to propel the market during the forecast period.

The pure-PRP segment is projected to account for around 61% share of the global market in 2021. The trend is projected to continue during the forecast period. Pure PRP has platelet and growth factor concentrations, which promote skin rejuvenation. Hence, the demand for pure PRP is increasing.

Technological advancements leading to the use of pure PRP in various applications and rich platelet content are expected to drive the segment in the next few years. Furthermore, ease of production and cost-effectiveness are expected to propel the segment in the near future. Applications of leukocyte-rich PRP include enhancement of wound healing, bone regeneration, and repair of the soft tissue. Distinct advantages of pure PRF over pure PRP & L-PRP and continuous innovation to improve the effectiveness of PRF are the key factors anticipated to fuel the pure-PRF segment during the forecast period.

The autologous segment is driven by the cost-effectiveness of autologous PRP and PRF. Platelet rich plasma (PRP) has been proven to be a prominent source of autologous products in the field of regenerative medicine and a true precursor for the healing process along with scaffold & stem cells.

Demand for PRP and PRF cosmetic treatments such as that in skin rejuvenation is largely driven by the increase in number of cosmetic surgeries, presence of a well-established health care infrastructure, and rise in applications of PRP therapies in cosmetic surgeries for facial therapy. Growth in need for skin rejuvenation treatment is augmenting the demand for PRP therapies across the globe.

North America constituted the major share of more than 38% of the global market in 2021. The trend is expected to continue during the forecast period due to new product approvals, technological advancements, and increase in applications of PRP in cosmetic surgeries in the region. Increase in investments by governments in the health care sector and innovations in PRP & PRF in cosmetics are projected to augment the market in North America during the forecast period.

The U.S. dominated the market in North America, with more than 87% share in 2021. The trend is projected to continue during the forecast period. Rise in awareness about PRP devices along with the launch of FDA-approved devices is anticipated to propel the market in the U.S. during the forecast period.

Europe held the second-largest share of the global market in 2021. Demand for PRP & PRF in cosmetics in Europe is fueled by cosmetic interventions and rise in esthetic surgeries in the region. Well-established health care infrastructure, rise in adoption of platelet-rich plasma for hair therapy, surge in the number of general as well as cosmetic surgeries, and usage of injectable PRF for facial rejuvenation are expected to augment the market in Europe.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 150 Mn |

|

Market Forecast Value in 2031 |

US$ 483 Mn |

|

Growth Rate |

CAGR of 12.6% from Year-to-Year |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global PRP and PRF in cosmetic market is projected to exceed US$ 483 Mn by 2031

The global PRP and PRF in cosmetic market is anticipated to grow at a CAGR of 12.6% during the forecast period

The pure-PRP segment accounted for nearly 61% share in the global PRP and PRF in cosmetic market in 2021

North America is expected to account for the key share of the global market during the forecast period

Prominent players in the global PRP and PRF in cosmetics market include Stryker Corporation, Croma-Pharma GmbH, Zimmer Biomet, Isto Biologics, Exactech, Inc., EmCyte Corporation, Regen Lab, APEX Biologix, and ThermoGenesis Holdings, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global PRP and PRF in Cosmetics

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global PRP and PRF in Cosmetics Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Installed Base Scenario (2019)

5.1.1. Installed Base Scenario

5.1.1.1. By Type

5.1.1.2. By Origin Type

5.1.1.3. By Region

5.1.1.4. By Major Players

5.1.2. New versus Replacement Unit Shipments

5.2. Export-Import Scenario

5.2.1. Export-Import Scenario by Region

5.3. Price Comparison Analysis (2019)

5.3.1. By Type

5.3.2. By Origin Type

5.3.3. By Region

5.3.4. By Major Players

5.4. Key Potential Customers

5.4.1. Key Potential Customers by Region

5.5. Key Vendor and Distributor Analysis

5.5.1. Key Vendor Analysis by Major Players

5.5.2. Key Distributor Analysis by Major Players

5.6. Technological Advancements

5.7. Regulatory Scenario, by Region/globally

5.8. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.9. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global PRP and PRF in Cosmetics Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Pure-PRP

6.3.2. Leukocyte-rich PRP

6.3.3. Pure-PRF

6.4. Market Attractiveness Analysis, by Type

7. Global PRP and PRF in Cosmetics Analysis and Forecast, by Origin

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Origin, 2017–2031

7.3.1. Autologous

7.3.2. Allogeneic

7.3.3. Homologous

7.3.4. Others

7.4. Market Attractiveness Analysis, by Origin

8. Global PRP and PRF in Cosmetics Analysis and Forecast, by Cosmetic Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Cosmetic Application, 2017–2031

8.3.1. Skin Rejuvenation

8.3.2. Face Lift

8.3.3. Hair Application

8.3.4. Plastic Surgery

8.3.5. Scar-related Treatment

8.3.6. Others

8.4. Market Attractiveness Analysis, by Cosmetic Application

9. Global PRP and PRF in Cosmetics Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America PRP and PRF in Cosmetics Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Pure-PRP

10.2.2. Leukocyte-rich PRP

10.2.3. Pure-PRF

10.3. Market Value Forecast, by Origin, 2017–2031

10.3.1. Autologous

10.3.2. Allogeneic

10.3.3. Homologous

10.3.4. Others

10.4. Market Value Forecast, by Cosmetic Application, 2017–2031

10.4.1. Skin Rejuvenation

10.4.2. Face Lift

10.4.3. Hair Application

10.4.4. Plastic Surgery

10.4.5. Scar-related Treatment

10.4.6. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Origin

10.6.3. By Cosmetic Application

10.6.4. By Country

11. Europe PRP and PRF in Cosmetics Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Pure-PRP

11.2.2. Leukocyte-rich PRP

11.2.3. Pure-PRF

11.3. Market Value Forecast, by Origin, 2017–2031

11.3.1. Autologous

11.3.2. Allogeneic

11.3.3. Homologous

11.3.4. Others

11.4. Market Value Forecast, by Cosmetic Application, 2017–2031

11.4.1. Skin Rejuvenation

11.4.2. Face Lift

11.4.3. Hair Application

11.4.4. Plastic Surgery

11.4.5. Scar-related Treatment

11.4.6. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Origin

11.6.3. By Cosmetic Application

11.6.4. By Country/Sub-region

12. Asia Pacific PRP and PRF in Cosmetics Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Pure-PRP

12.2.2. Leukocyte-rich PRP

12.2.3. Pure-PRF

12.3. Market Value Forecast, by Origin, 2017–2031

12.3.1. Autologous

12.3.2. Allogeneic

12.3.3. Homologous

12.3.4. Others

12.4. Market Value Forecast, by Cosmetic Application, 2017–2031

12.4.1. Skin Rejuvenation

12.4.2. Face Lift

12.4.3. Hair Application

12.4.4. Plastic Surgery

12.4.5. Scar-related Treatment

12.4.6. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Japan

12.5.2. China

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Origin

12.6.3. By Cosmetic Application

12.6.4. By Country/Sub-region

13. Latin America PRP and PRF in Cosmetics Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Pure-PRP

13.2.2. Leukocyte-rich PRP

13.2.3. Pure-PRF

13.3. Market Value Forecast, by Origin, 2017–2031

13.3.1. Autologous

13.3.2. Allogeneic

13.3.3. Homologous

13.3.4. Others

13.4. Market Value Forecast, by Cosmetic Application, 2017–2031

13.4.1. Skin Rejuvenation

13.4.2. Face Lift

13.4.3. Hair Application

13.4.4. Plastic Surgery

13.4.5. Scar-related Treatment

13.4.6. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Origin

13.6.3. By Cosmetic Application

13.6.4. By Country/Sub-region

14. Middle East & Africa PRP and PRF in Cosmetics Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Pure-PRP

14.2.2. Leukocyte-rich PRP

14.2.3. Pure-PRF

14.3. Market Value Forecast, by Origin, 2017–2031

14.3.1. Autologous

14.3.2. Allogeneic

14.3.3. Homologous

14.3.4. Others

14.4. Market Value Forecast, by Cosmetic Application, 2017–2031

14.4.1. Skin Rejuvenation

14.4.2. Face Lift

14.4.3. Hair Application

14.4.4. Plastic Surgery

14.4.5. Scar-related Treatment

14.4.6. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Origin

14.6.3. By Cosmetic Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Market Footprint Analysis

15.3.1. By Region

15.3.2. By Type

15.4. Competitive Business Strategies

15.5. Company Profiles

15.5.1. Stryker Corporation

15.5.1.1. Company Overview

15.5.1.2. Financial Overview

15.5.1.3. Product Portfolio

15.5.1.4. Business Strategies

15.5.2. Croma-Pharma GmbH

15.5.2.1. Company Overview

15.5.2.2. Financial Overview

15.5.2.3. Product Portfolio

15.5.2.4. Business Strategies

15.5.3. Zimmer Biomet

15.5.3.1. Company Overview

15.5.3.2. Financial Overview

15.5.3.3. Product Portfolio

15.5.3.4. Business Strategies

15.5.4. Isto Biologics

15.5.4.1. Company Overview

15.5.4.2. Financial Overview

15.5.4.3. Product Portfolio

15.5.4.4. Business Strategies

15.5.5. Exactech, Inc.

15.5.5.1. Company Overview

15.5.5.2. Financial Overview

15.5.5.3. Product Portfolio

15.5.5.4. Business Strategies

15.5.6. EmCyte Corporation

15.5.6.1. Company Overview

15.5.6.2. Financial Overview

15.5.6.3. Product Portfolio

15.5.6.4. Business Strategies

15.5.7. Regen Lab

15.5.7.1. Company Overview

15.5.7.2. Financial Overview

15.5.7.3. Product Portfolio

15.5.7.4. Business Strategies

15.5.8. APEX Biologix

15.5.8.1. Company Overview

15.5.8.2. Financial Overview

15.5.8.3. Product Portfolio

15.5.8.4. Business Strategies

15.5.9. ThermoGenesis Holdings, Inc.

15.5.9.1. Company Overview

15.5.9.2. Financial Overview

15.5.9.3. Product Portfolio

15.5.9.4. Business Strategies

List of Tables

Table 01: Global PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 02: Global PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 03: Global PRP and PRF in Cosmetic Market Value Forecast, by Cosmetic Application, 2017–2031

Table 04: Global PRP and PRF in Cosmetic Market Value Forecast, by Region, 2017–2031

Table 05: North America PRP and PRF in Cosmetic Market Value Forecast, by Country, 2017–2031

Table 06: North America PRP and PRF in Cosmetic Market Value Forecast, by Type, 2017–2031

Table 07: North America PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 08: North America PRP and PRF in Cosmetic Market Value Forecast, by Cosmetic Application, 2017–2031

Table 09: Europe PRP and PRF in Cosmetic Market Value Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe PRP and PRF in Cosmetic Market Value Forecast, by Type, 2017–2031

Table 11: Europe PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 12: Europe PRP and PRF in Cosmetic Market Value Forecast, by Cosmetic Application, 2017–2031

Table 13: Asia Pacific PRP and PRF in Cosmetic Market Value Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific PRP and PRF in Cosmetic Market Value Forecast, by Type, 2017–2031

Table 15: Asia Pacific PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 16: Asia Pacific PRP and PRF in Cosmetic Market Value Forecast, by Cosmetic Application, 2017–2031

Table 17: Latin America PRP and PRF in Cosmetic Market Value Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America PRP and PRF in Cosmetic Market Value Forecast, by Type, 2017–2031

Table 19: Latin America PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 20: Latin America PRP and PRF in Cosmetic Market Value Forecast, by Cosmetic Application, 2017–2031

Table 21: Middle East and Africa PRP and PRF in Cosmetic Market Value Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East and Africa PRP and PRF in Cosmetic Market Value Forecast, by Type, 2017–2031

Table 23: Middle East and Africa PRP and PRF in Cosmetic Market Value Forecast, by Origin, 2017–2031

Table 24: Middle East and Africa PRP and PRF in Cosmetic Market Value Forecast, by Cosmetic Application, 2017–2031

List of Figures

Figure 01: Global PRP and PRF in Cosmetic Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global PRP and PRF in Cosmetic Market, by Type, 2021 and 2031

Figure 03: Global PRP and PRF in Cosmetic Market Attractiveness Analysis, by Type, 2022–2031

Figure 04: Global PRP and PRF in Cosmetic Market (US$ Mn), by Pure-PRP, 2017–2031

Figure 05: Global PRP and PRF in Cosmetic Market (US$ Mn), by Leukocyte-rich PRP, 2017–2031

Figure 06: Global PRP and PRF in Cosmetic Market (US$ Mn), by Pure-PRF, 2017–2031

Figure 07: Global PRP and PRF in Cosmetic Market, by Origin, 2021 and 2031

Figure 08: Global PRP and PRF in Cosmetic Market Attractiveness Analysis, by Origin, 2022–2031

Figure 09: Global PRP and PRF in Cosmetic Market (US$ Mn), by Autologous, 2017–2031

Figure 10: Global PRP and PRF in Cosmetic Market (US$ Mn), by Allogeneic, 2017–2031

Figure 11: Global PRP and PRF in Cosmetic Market (US$ Mn), by Homologous, 2017–2031

Figure 12: Global PRP and PRF in Cosmetic Market, by Cosmetic Application, 2021 and 2031

Figure 13: Global PRP and PRF in Cosmetic Market Attractiveness Analysis, by Cosmetic Application, 2022–2031

Figure 14: Global PRP and PRF in Cosmetic Market (US$ Mn), by Skin Rejuvenation, 2017–2031

Figure 15: Global PRP and PRF in Cosmetic Market (US$ Mn), by Face Lift, 2017–2031

Figure 16: Global PRP and PRF in Cosmetic Market (US$ Mn), by Hair Application, 2017–2031

Figure 17: Global PRP and PRF in Cosmetic Market (US$ Mn), by Plastic Surgery, 2017–2031

Figure 18: Global PRP and PRF in Cosmetic Market (US$ Mn), by Scar-related Treatment, 2017–2031

Figure 19: Global PRP and PRF in Cosmetic Market (US$ Mn), by Others, 2017–2031

Figure 20: Global PRP and PRF in Cosmetic Market, by Region, 2021 and 2031

Figure 21: Global PRP and PRF in Cosmetic Market Attractiveness Analysis, by Region, 2022–2031

Figure 22: North America PRP and PRF in Cosmetic Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: North America PRP and PRF in Cosmetic Market, by Country, 2021 and 2031

Figure 24: North America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America PRP and PRF in Cosmetic Market, by Type, 2021 and 2031

Figure 26: North America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Type, 2022–2031

Figure 27: North America PRP and PRF in Cosmetic Market, by Origin, 2021 and 2031

Figure 28: North America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Origin, 2022–2031

Figure 29: North America PRP and PRF in Cosmetic Market, by Cosmetic Application, 2021 and 2031

Figure 30: North America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Cosmetic Application, 2022–2031

Figure 31: Europe PRP and PRF in Cosmetic Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Europe PRP and PRF in Cosmetic Market, by Country/Sub-region, 2021 and 2031

Figure 33: Europe PRP and PRF in Cosmetic Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe PRP and PRF in Cosmetic Market, by Type, 2021 and 2031

Figure 35: Europe PRP and PRF in Cosmetic Market Attractiveness Analysis, by Type, 2022–2031

Figure 36: Europe PRP and PRF in Cosmetic Market, by Origin, 2021 and 2031

Figure 37: Europe PRP and PRF in Cosmetic Market Attractiveness Analysis, by Origin, 2022–2031

Figure 38: Europe PRP and PRF in Cosmetic Market, by Cosmetic Application, 2021 and 2031

Figure 39: Europe PRP and PRF in Cosmetic Market Attractiveness Analysis, by Cosmetic Application, 2022–2031

Figure 40: Asia Pacific PRP and PRF in Cosmetic Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Asia Pacific PRP and PRF in Cosmetic Market, by Country/Sub-region, 2021 and 2031

Figure 42: Asia Pacific PRP and PRF in Cosmetic Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific PRP and PRF in Cosmetic Market, by Type, 2021 and 2031

Figure 44: Asia Pacific PRP and PRF in Cosmetic Market Attractiveness Analysis, by Type, 2022–2031

Figure 45: Asia Pacific PRP and PRF in Cosmetic Market, by Origin, 2021 and 2031

Figure 46: Asia Pacific PRP and PRF in Cosmetic Market Attractiveness Analysis, by Origin, 2022–2031

Figure 47: Asia Pacific PRP and PRF in Cosmetic Market, by Cosmetic Application, 2021 and 2031

Figure 48: Asia Pacific PRP and PRF in Cosmetic Market Attractiveness Analysis, by Cosmetic Application, 2022–2031

Figure 49: Latin America PRP and PRF in Cosmetic Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America PRP and PRF in Cosmetic Market, by Country/Sub-region, 2021 and 2031

Figure 51: Latin America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Latin America PRP and PRF in Cosmetic Market, by Type, 2021 and 2031

Figure 53: Latin America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Type, 2022–2031

Figure 54: Latin America PRP and PRF in Cosmetic Market, by Origin, 2021 and 2031

Figure 55: Latin America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Origin, 2022–2031

Figure 56: Latin America PRP and PRF in Cosmetic Market, by Cosmetic Application, 2021 and 2031

Figure 57: Latin America PRP and PRF in Cosmetic Market Attractiveness Analysis, by Cosmetic Application, 2022–2031

Figure 58: Middle East and Africa PRP and PRF in Cosmetic Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East and Africa PRP and PRF in Cosmetic Market, by Country/Sub-region, 2021 and 2031

Figure 60: Middle East and Africa PRP and PRF in Cosmetic Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East and Africa PRP and PRF in Cosmetic Market, by Type, 2021 and 2031

Figure 62: Middle East and Africa PRP and PRF in Cosmetic Market Attractiveness Analysis, by Type, 2022–2031

Figure 63: Middle East and Africa PRP and PRF in Cosmetic Market, by Origin, 2021 and 2031

Figure 64: Middle East and Africa PRP and PRF in Cosmetic Market Attractiveness Analysis, by Origin, 2022–2031

Figure 65: Middle East and Africa PRP and PRF in Cosmetic Market, by Cosmetic Application, 2021 and 2031

Figure 66: Middle East and Africa PRP and PRF in Cosmetic Market Attractiveness Analysis, by Cosmetic Application, 2022–2031