Analysts’ Viewpoint on Property Management Software Market Scenario

Property management software has evolved over time to effectively address the needs of the real estate industry. Property management software providers are increasingly adopting artificial intelligence (AI) to gain a competitive edge in the market. AI supports a multiverse of activities, from automating renter communication and lead generation to screening of pre-qualified and interested potential clientele, in the property management sector. The market has been facing issues including affordability, work from home, data security threats, rent price trends, and rise in interest rates since the last few years. It has also been facing various external economic challenges, especially during the Covid-19 pandemic; however, virtual showings, tenant apps, and online rent payments have eased the workload of property managers and caretakers. As the demographic trend shifts to tech-savvy millennials and Gen Z tenants, property management software vendors need to work on strengthening their software efficiency and capacity to effectively serve the industry at large. Rise in demand for property management software, which supports workflow automation, accommodates rental regulations, optimizes financial management, and reduces administration, in commercial and residential sectors is creating lucrative opportunities for market players.

Property management software is a cloud-based or on-premise application that provides efficient management of properties to simplify legalities, personnel, and maintenance all under one platform. Property management software offers services such as financial reporting, online maintenance of requests & information tracking, online document storage & sharing, accounting capabilities, electronic lease agreements, and integrated banking. It helps property managers and owners to simplify property management processes such as establishing strong communication, tracing finances, storing leasing documents and contracts, centralization and digitization of information, and ensuring an efficient rent collection process. Furthermore, the software facilitates the management of unexpected repairs of buildings, hospitals, and hotels. This enables tenants to request repairs, and property managers can immediately assign staff to address the issue. Rise in adoption of online property management software, such as rental property management software, landlord property management software, and cloud-based hotel property management software, is providing lucrative opportunities for market players.

Property management involves controlling operations and supervision of the property. Individuals with personal property or property managers can administer the property remotely, supervising daily operations such as reporting, accounting, lease tracking, repairing, planning, and sales. Property managers and owners prefer using property management software primarily due to the transparency offered by the application. The software can manage and control all types and sizes of properties with ease. Property management vendors also provide legal executives to handle legal formalities. This is crucial especially for the management of distant properties. Additionally, property owners and managers are emphasizing on collecting and maintaining property information for enhanced data administration and accessibility with the help of a centralized property management software. This is expected to drive the demand for real estate property management software during the forecast period.

Rise in penetration of artificial intelligence (AI) and machine learning technology in property management helps monitor real-time information that concerns occupants and location. AI-based property management software provides realistic valuations and valuable insights to users. Augmented reality (AR) and virtual reality (VR) technologies in the property management industry offer a virtual tour of multiple properties to buyers to improve their experience. This is augmenting the adoption of property management software in the real estate industry.

Cloud technology is also enabling property as a service (PaaS) platform that takes a customer-focused approach so that tenants use the building space and services as per the requirements. The function of an AI-enabled tool is to collect data through Wi-Fi and automatically respond to leads. This helps enhance customer service and lower operational risks. Increase in usage of AI chatbots in the property management industry helps real estate agents stay connected with customers and solve their queries. Finance management and tax management operations are also carried out with the help of property management software. These factors are estimated to generate significant opportunities for players in the property management software market during the forecast period.

The property management software market in North America is expected to provide maximum growth opportunities to active vendors during the forecast period. Increase in adoption of property management software by property managers and owners is likely to create strong demand for system integration services such as design, development, and deployment. Digitization is also fueling the demand for property management software to cover the population in prime growth countries such as the U.S. and Canada. The U.S. dominates the market in North America due to the rise in number of hotel spaces in the country. Growth of the market in the region can also be ascribed to the rapidly evolving infrastructure and rise in demand for better data management. Increase in population, growth of cloud-based solutions, implementation of government regulations, and availability of outsourcing services are key factors augmenting the market in North America.

The property management software market is highly fragmented. Vendors are striving to successfully tap into growth opportunities and strengthen their presence in the market. The influence of technology, cyber risk management, capital flow, evolution of talent, and PropTech are some of the factors expected to increase investments in commercial real estate property management software, thus driving the global market. Players operating in the real estate management software market are increasingly focusing on offering customized software as per the needs of end-users. Additionally, some companies are launching affordable and innovative mobile application software with advanced features such as built-in analytics. Several organizations are adopting strategies such as acquisitions and partnerships to expand their product portfolio in order to contribute to the growth of the property management software market in the near future.

Each of these players has been profiled in the property management software market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 14.89 Bn |

|

Market Forecast Value in 2031 |

US$ 32.61 Bn |

|

Growth Rate (CAGR) |

8.21% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at the global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, ecosystem analysis, and COVID-19 impact analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

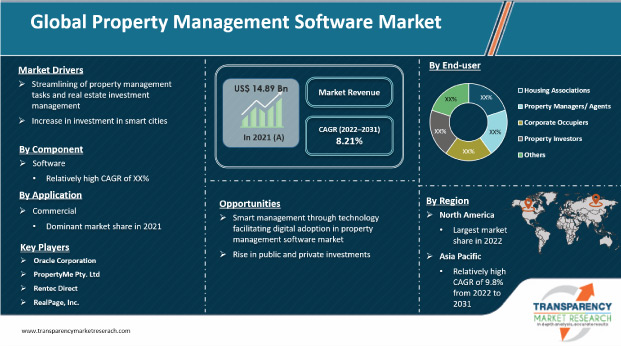

The property management software market stood at US$ 14.89 Bn in 2021.

The property management software market is estimated to expand at a CAGR of 8.21% during the forecast period.

Influence of technology, cyber risk management, capital flow, evolution of talent, and PropTech are expected to increase investment in commercial real-estate property management software, and consequently, drive the property management software market.

The multi-family housing/apartments segment accounted for 46.12% share of the property management software market in 2021.

North America is a more attractive region for vendors in the property management software market.

Key players operating in the property management software market include AppFolio, Inc., RealPage, Inc., CoreLogic, Chetu Inc., Oracle Corporation, Alibaba Cloud International, Eco Community Sdn Bhd, Yardi Systems, Inc., MRI Software, LLC, ResMan, Maintenance Connection, Rockend Pty. Ltd., ABACUS GROUP.SG, PropertyMe Pty. Ltd., DJUBO, HiRUM Software Applications, Property Brands, and REI Master Pty. Ltd.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Property Management Software Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Property Management Software Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East and Africa/ South America)

4.5.1. By Component

4.5.2. By Application

4.5.3. By End-user

5. Global Property Management Software Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Property Management Software Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Property Management Software Market Size (US$ Bn) Forecast, by Component, 2018‒2031

6.3.1. Software

6.3.1.1. On-premise

6.3.1.2. Cloud

6.3.2. Services

7. Global Property Management Software Market Analysis, by Application

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Property Management Software Market Size (US$ Bn) Forecast, by Application, 2018‒2031

7.3.1. Commercial

7.3.1.1. Retail Spaces

7.3.1.2. Office Spaces

7.3.1.3. Hotels

7.3.1.4. Others (Airports, Seaports etc.)

7.3.2. Residential

7.3.2.1. Multi-Family Housing/ Apartments

7.3.2.1.1. Apartment Building (Low rise)

7.3.2.1.2. Apartment Tower (High rise)

7.3.3. Single Family Housing

7.3.4. Others (Student Housing etc.)

8. Global Property Management Software Market Analysis and Forecasts, by End-user

8.1. Key Findings

8.2. Property Management Software Market Size (US$ Bn) Forecast by End-user, 2018‒2031

8.2.1. Housing Associations

8.2.2. Property Managers/ Agents

8.2.3. Corporate Occupiers

8.2.4. Property Investors

8.2.5. Others

9. Global Property Management Software Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Property Management Software Market Size (US$ Bn) Forecast by Region, 2018‒2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Property Management Software Market Analysis and Forecast

10.1. Regional Outlook

10.2. Property Management Software Market Size (US$ Bn) Analysis and Forecast, 2018‒2031

10.2.1. By Component

10.2.2. By Application

10.2.3. By End-user

10.3. Property Management Software Market Size (US$ Bn) Forecast, by Country, 2018‒2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Property Management Software Market Analysis and Forecast

11.1. Regional Outlook

11.2. Property Management Software Market Size (US$ Bn) Analysis and Forecast, 2018‒2031

11.2.1. By Component

11.2.2. By Application

11.2.3. By End-user

11.3. Property Management Software Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018‒2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Property Management Software Market Analysis and Forecast

12.1. Regional Outlook

12.2. Property Management Software Market Size (US$ Bn) Analysis and Forecast, 2018‒2031

12.2.1. By Component

12.2.2. By Application

12.2.3. By End-user

12.3. Property Management Software Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018‒2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Property Management Software Market Analysis and Forecast

13.1. Regional Outlook

13.2. Property Management Software Market Size (US$ Bn) Analysis and Forecast, 2018‒2031

13.2.1. By Component

13.2.2. By Application

13.2.3. By End-user

13.3. Property Management Software Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018‒2031

13.3.1. Saudi Arabia

13.3.2. UAE

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Property Management Software Market Analysis and Forecast

14.1. Regional Outlook

14.2. Property Management Software Market Size (US$ Bn) Analysis and Forecast, 2018‒2031

14.2.1. By Component

14.2.2. By Application

14.2.3. By End-user

14.3. Property Management Software Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018‒2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. AppFolio, Inc.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.2. Alibaba Cloud International

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.3. CoreLogic

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.4. Chetu Inc.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.5. HiRUM Software Applications

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.6. MRI Software, LLC

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.7. Oracle Corporation

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.8. PropertyMe Pty. Ltd

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.9. Rentec Direct

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.10. RealPage, Inc.

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.11. ResMan, LLC.

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.12. SS&C Technologies, Inc. (SKYLINE)

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.13. Yardi Systems, Inc.

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.14. Others

16.14.1. Business Overview

16.14.2. Company Revenue

16.14.3. Product Portfolio

16.14.4. Geographic Footprint

16.14.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Property Management Software Market

Table 2: North America Property Management Software Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 3: Europe Property Management Software Market Revenue Analysis, by Country & Sub-region, 2021 - 2031 (US$ Bn)

Table 4: Asia Pacific Property Management Software Market Revenue Analysis, by Country & Sub-region, 2021 - 2031 (US$ Bn)

Table 5: Middle East & Africa Property Management Software Market Revenue Analysis, by Country & Sub-region, 2021 and 2031 (US$ Bn)

Table 6: South America Property Management Software Market Revenue Analysis, by Country & Sub-region, 2021 - 2031 (US$ Bn)

Table 7: Forecast Factors Relevance and Impact (1/2)

Table 8: Forecast Factors Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Property Management Software Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 11: Global Property Management Software Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 12: Global Property Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 13: Global Property Management Software Market Volume (US$ Bn) Forecast, by Region, 2018 – 2031

Table 14: North America Property Management Software Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 15: North America Property Management Software Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 16: North America Property Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 17: North America Property Management Software Market Volume (US$ Bn) Forecast, by Country, 2018 – 2031

Table 18: U.S. Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe Property Management Software Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 22: Europe Property Management Software Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 23: Europe Property Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 24: Europe Property Management Software Market Volume (US$ Bn) Forecast, by Country & Sub-region, 2018 – 2031

Table 25: Germany Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: U.K. Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: France Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Spain Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Italy Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Asia Pacific Property Management Software Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 31: Asia Pacific Property Management Software Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 32: Asia Pacific Property Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 33: Asia Pacific Property Management Software Market Volume (US$ Bn) Forecast, by Country & Sub-region, 2018 – 2031

Table 34: China Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: India Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Japan Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: ASEAN Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Middle East & Africa Property Management Software Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 39: Middle East & Africa Property Management Software Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 40: Middle East & Africa Property Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 41: Middle East & Africa Property Management Software Market Volume (US$ Bn) Forecast, by Country & Sub-region, 2018 – 2031

Table 42: Saudi Arabia Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: The United Arab Emirates Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: South Africa Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: South America Property Management Software Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 46: South America Property Management Software Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 47: South America Property Management Software Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 48: South America Property Management Software Market Volume (US$ Bn) Forecast, by Country & Sub-region, 2018 – 2031

Table 49: Brazil Emirates Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: Argentina Property Management Software Market Revenue CAGR Breakdown (%), by Growth Term

List of Figures

Figure 1: Global Property Management Software Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Property Management Software Market Value (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Property Management Software Market

Figure 4: Global Property Management Software Market Value (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Property Management Software Market Attractiveness Assessment, by Component

Figure 6: Global Property Management Software Market Attractiveness Assessment, by Application

Figure 7: Global Property Management Software Market Attractiveness Assessment, by End-user

Figure 8: Global Property Management Software Market Attractiveness Assessment, by Region

Figure 9: Global Property Management Software Market, by Component, CAGR (%) (2021 – 2031)

Figure 10: Global Property Management Software Market, by Application, CAGR (%) (2021 – 2031)

Figure 11: Global Property Management Software Market, by End-user, CAGR (%) (2021 – 2031)

Figure 12: Global Property Management Software Market, by Region, CAGR (%) (2021 – 2031)

Figure 13: Global Property Management Software Market Value (US$ Bn) Historic Trends, 2016 - 2021

Figure 14: Global Property Management Software Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2021

Figure 15: Global Property Management Software Market Value Share Analysis, by Component, 2021

Figure 16: Global Property Management Software Market Value Share Analysis, by Component, 2031

Figure 17: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 18: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 19: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 20: Global Property Management Software Market Value Share Analysis, by Application, 2021

Figure 21: Global Property Management Software Market Value Share Analysis, by Application, 2031

Figure 22: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Commercial, 2021 – 2031

Figure 23: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Residential, 2021 – 2031

Figure 24: Global Property Management Software Market Value Share Analysis, by End-user, 2021

Figure 25: Global Property Management Software Market Value Share Analysis, by End-user, 2031

Figure 26: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Housing Associations, 2021 – 2031

Figure 27: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Property Managers/ Agents, 2021 – 2031

Figure 28: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Corporate Occupiers, 2021 – 2031

Figure 29: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Property Investors, 2021 – 2031

Figure 30: Global Property Management Software Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 31: Global Property Management Software Market Opportunity (US$ Bn), by Region

Figure 32: Global Property Management Software Market Opportunity Share (%), by Region, 2021–2031

Figure 33: Global Property Management Software Market Size (US$ Bn), by Region, 2021 & 2031

Figure 34: Global Property Management Software Market Value Share Analysis, by Region, 2021

Figure 35: Global Property Management Software Market Value Share Analysis, by Region, 2031

Figure 36: North America Property Management Software Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 37: Europe Property Management Software Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 38: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 39: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 40: South America Property Management Software Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 41: North America Property Management Software Revenue Opportunity Share, by Application

Figure 42: North America Property Management Software Revenue Opportunity Share, by Country

Figure 43: North America Property Management Software Revenue Opportunity Share, by Component

Figure 44: North America Property Management Software Revenue Opportunity Share, by End-user

Figure 45: North America Property Management Software Market Value Share Analysis, by Component, 2021

Figure 46: North America Property Management Software Market Value Share Analysis, by Component, 2031

Figure 47: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 48: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 49: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 50: North America Property Management Software Market Value Share Analysis, by Application, 2021

Figure 51: North America Property Management Software Market Value Share Analysis, by Application, 2031

Figure 52: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Commercial, 2021 – 2031

Figure 53: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Residential, 2021 – 2031

Figure 54: North America Property Management Software Market Value Share Analysis, by End-user, 2021

Figure 55: North America Property Management Software Market Value Share Analysis, by End-user, 2031

Figure 56: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Housing Associations, 2021 – 2031

Figure 57: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Property Managers/ Agents, 2021 – 2031

Figure 58: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Corporate Occupiers, 2021 – 2031

Figure 59: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Property Investors, 2021 – 2031

Figure 60: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 61: North America Property Management Software Market Value Share Analysis, by Country, 2021

Figure 62: North America Property Management Software Market Value Share Analysis, by Country, 2031

Figure 63: North America Property Management Software Market Absolute Opportunity (US$ Bn), by U.S. 2021 – 2031

Figure 64: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Canada 2021 – 2031

Figure 65: North America Property Management Software Market Absolute Opportunity (US$ Bn), by Mexico 2021 – 2031

Figure 66: U.S. Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 67: Canada Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 68: Mexico Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 69: Europe Property Management Software Revenue Opportunity Share, by Application

Figure 70: Europe Property Management Software Revenue Opportunity Share, by Country & Sub-region

Figure 71: Europe Property Management Software Revenue Opportunity Share, by Component

Figure 72: Europe Property Management Software Revenue Opportunity Share, by End-user

Figure 73: Europe Property Management Software Market Value Share Analysis, by Component, 2021

Figure 74: Europe Property Management Software Market Value Share Analysis, by Component, 2031

Figure 75: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 76: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 77: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 78: Europe Property Management Software Market Value Share Analysis, by Application, 2021

Figure 79: Europe Property Management Software Market Value Share Analysis, by Application, 2031

Figure 80: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Commercial, 2021 – 2031

Figure 81: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Residential, 2021 – 2031

Figure 82: Europe Property Management Software Market Value Share Analysis, by End-user, 2021

Figure 83: Europe Property Management Software Market Value Share Analysis, by End-user, 2031

Figure 84: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Housing Associations, 2021 – 2031

Figure 85: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Property Managers/ Agents, 2021 – 2031

Figure 86: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Corporate Occupiers, 2021 – 2031

Figure 87: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Property Investors, 2021 – 2031

Figure 88: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 89: Europe Property Management Software Market Value Share Analysis, by Country, 2021

Figure 90: Europe Property Management Software Market Value Share Analysis, by Country, 2031

Figure 91: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Germany. 2021 – 2031

Figure 92: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by U.K. 2021 – 2031

Figure 93: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by France. 2021 – 2031

Figure 94: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Spain. 2021 – 2031

Figure 95: Europe Property Management Software Market Absolute Opportunity (US$ Bn), by Italy 2021 – 2031

Figure 96: Germany Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 97: U.K. Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 98: France Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 99: Spain Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 100: Italy Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 101: Asia Pacific Property Management Software Revenue Opportunity Share, by Application

Figure 102: Asia Pacific Property Management Software Revenue Opportunity Share, by Country & Sub-region

Figure 103: Asia Pacific Property Management Software Revenue Opportunity Share, by Component

Figure 104: Asia Pacific Property Management Software Revenue Opportunity Share, by End-user

Figure 105: Asia Pacific Property Management Software Market Value Share Analysis, by Component, 2021

Figure 106: Asia Pacific Property Management Software Market Value Share Analysis, by Component, 2031

Figure 107: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 108: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 109: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 110: Asia Pacific Property Management Software Market Value Share Analysis, by Application, 2021

Figure 111: Asia Pacific Property Management Software Market Value Share Analysis, by Application, 2031

Figure 112: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Commercial, 2021 – 2031

Figure 113: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Residential, 2021 – 2031

Figure 114: Asia Pacific Property Management Software Market Value Share Analysis, by End-user, 2021

Figure 115: Asia Pacific Property Management Software Market Value Share Analysis, by End-user, 2031

Figure 116: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Housing Associations, 2021 – 2031

Figure 117: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Property Managers/ Agents, 2021 – 2031

Figure 118: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Corporate Occupiers, 2021 – 2031

Figure 119: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Property Investors, 2021 – 2031

Figure 120: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 121: Asia Pacific Property Management Software Market Value Share Analysis, by Country, 2021

Figure 122: Asia Pacific Property Management Software Market Value Share Analysis, by Country, 2031

Figure 123: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by China. 2021 – 2031

Figure 124: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by India. 2021 – 2031

Figure 125: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by Japan. 2021 – 2031

Figure 126: Asia Pacific Property Management Software Market Absolute Opportunity (US$ Bn), by ASEAN. 2021 – 2031

Figure 127: China Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 128: India Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 129: Japan Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 130: ASEAN Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 131: Middle East & Africa Property Management Software Revenue Opportunity Share, by Application

Figure 132: Middle East & Africa Property Management Software Revenue Opportunity Share, by Country & Sub-region

Figure 133: Middle East & Africa Property Management Software Revenue Opportunity Share, by Component

Figure 134: Middle East & Africa Property Management Software Revenue Opportunity Share, by End-user

Figure 135: Middle East & Africa Property Management Software Market Value Share Analysis, by Component, 2021

Figure 136: Middle East & Africa Property Management Software Market Value Share Analysis, by Component, 2031

Figure 137: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 138: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 139: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 140: Middle East & Africa Property Management Software Market Value Share Analysis, by Application, 2021

Figure 141: Middle East & Africa Property Management Software Market Value Share Analysis, by Application, 2031

Figure 142: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Commercial, 2021 – 2031

Figure 143: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Residential, 2021 – 2031

Figure 144: Middle East & Africa Property Management Software Market Value Share Analysis, by End-user, 2021

Figure 145: Middle East & Africa Property Management Software Market Value Share Analysis, by End-user, 2031

Figure 146: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Housing Associations, 2021 – 2031

Figure 147: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Property Managers/ Agents, 2021 – 2031

Figure 148: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Corporate Occupiers, 2021 – 2031

Figure 149: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Property Investors, 2021 – 2031

Figure 150: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 151: Middle East & Africa Property Management Software Market Value Share Analysis, by Country, 2021

Figure 152: Middle East & Africa Property Management Software Market Value Share Analysis, by Country, 2031

Figure 153: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by Saudi Arabia. 2021 – 2031

Figure 154: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by The United Arab Emirates. 2021 – 2031

Figure 155: Middle East & Africa Property Management Software Market Absolute Opportunity (US$ Bn), by South Africa2021 – 2031

Figure 156: Saudi Arabia Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 157: The United Arab Emirates Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 158: South Africa Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 159: South America Property Management Software Revenue Opportunity Share, by Application

Figure 160: South America Property Management Software Revenue Opportunity Share, by Country & Sub-region

Figure 161: South America Property Management Software Revenue Opportunity Share, by Component

Figure 162: South America Property Management Software Revenue Opportunity Share, by End-user

Figure 163: South America Property Management Software Market Value Share Analysis, by Component, 2021

Figure 164: South America Property Management Software Market Value Share Analysis, by Component, 2031

Figure 165: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 166: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Software, 2021 – 2031

Figure 167: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Services, 2021 – 2031

Figure 168: South America Property Management Software Market Value Share Analysis, by Application, 2021

Figure 169: South America Property Management Software Market Value Share Analysis, by Application, 2031

Figure 170: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Commercial, 2021 – 2031

Figure 171: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Residential, 2021 – 2031

Figure 172: South America Property Management Software Market Value Share Analysis, by End-user, 2021

Figure 173: South America Property Management Software Market Value Share Analysis, by End-user, 2031

Figure 174: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Housing Associations, 2021 – 2031

Figure 175: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Property Managers/ Agents, 2021 – 2031

Figure 176: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Corporate Occupiers, 2021 – 2031

Figure 177: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Property Investors, 2021 – 2031

Figure 178: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 179: South America Property Management Software Market Value Share Analysis, by Country, 2021

Figure 180: South America Property Management Software Market Value Share Analysis, by Country, 2031

Figure 181: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Brazil. 2021 – 2031

Figure 182: South America Property Management Software Market Absolute Opportunity (US$ Bn), by Argentina. 2021 – 2031

Figure 183: Brazil Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 184: Argentina Property Management Software Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031