Digital transformation is the key to address challenges created by the COVID-19 (coronavirus) outbreak. Users in the manufacturing and retail sectors are participating in webinars to stay ahead in competition amidst the coronavirus era. For instance, Centric Software- a Silicon Valley-based software company conducted a seminar in March 2020 that shed light on how digitalization drives business growth with the help of the product lifecycle management software.

Companies in the Product Lifecycle Management (PLM) market should increase efforts to conduct online events that educate users on how they can deploy better collaborations and communication with the help of the PLM software. As such, decline in costs and streamlining of production processes are catalyzing the adoption of PLM. Remote monitoring of production activities is another advantage for users amidst the COVID-19 pandemic that will, in turn, drive the Product Lifecycle Management (PLM) market.

Product Lifecycle Management (PLM) is being adopted by F&B (Food & Beverage) manufacturers for product innovation and transparency in production practices. Stringent compliance pressures and the ever-increasing demand for quality products have catalyzed the adoption of PLM in F&B companies. F&B manufacturers are benefitting from PLM, since these software deliver important data about the likelihood of projects being successful. Product lifecycle management helps in regulatory compliance for labels and ingredients, which helps to increase product uptake.

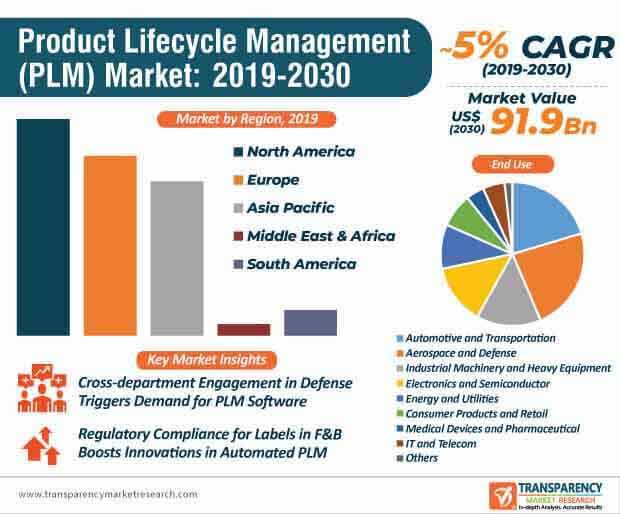

Efficient information management has become instrumental to achieve transparency in internal and external processes. Hence, companies in the Product Lifecycle Management (PLM) market are innovating in software that effectively manage customer inquiries. Automated management of labels is another key driver that is bolstering growth for the Product Lifecycle Management (PLM) market, which is estimated to cross a value of US$ 91.9 Bn by the end of 2030.

Cloud product lifecycle management software are being highly publicized in various end markets. This explains why the product lifecycle management (PLM) market is estimated to advance at a favorable CAGR of 5.2% during the assessment period. Easy to implement and real-time collaboration provided by cloud product lifecycle management software is generating value-grab opportunities for companies. As such, PLM helps internal teams and supply chain partners design, develop, and produce high-quality products for its target customers.

Product lifecycle management supports new product development (NPD) and new product introduction (NPI) in a budget-friendly manner. Companies in the Product Lifecycle Management (PLM) market are capitalizing on the trend of real-time collaboration, which requires information sharing between internal and external teams. Cloud PLM is increasingly replacing on-premises solutions, owing to its advantages of low cost implementation and cheaper maintenance.

Apart from consumer goods and the retail sector, vendors in the product lifecycle management (PLM) market are tapping into opportunities in the aerospace & defense sector. Since products used in the aerospace & defense industry are potentially complex and interdependent, end users are raising the demand for PLM software. In the face of constant innovation in the aerospace & defense sector, companies are making available advanced PLM systems that are capable of streamlining the flow of information. With the help of the product lifecycle management, users in the aerospace & defense sector can better engage with the extended supply chain and practice simultaneous development among cross-department teams.

Companies in the product lifecycle management market are innovating in software that help to improvise the performance in aircraft production and reduce costs. For instance, UEC Saturn— a Russian aircraft engine manufacturer is acquiring global recognition with its PLM software NPO Saturn by joining forces with the Siemens PLM Software technologies.

Most manufacturing organizations use the product lifecycle management software after some point in their company’s lifetime. However, several PLM software are rigid structures that lead to wasted time and costly workarounds. Hence, companies in the product lifecycle management market are increasing their R&D capabilities to develop flexible and adaptable software solutions that work efficiently. This can be attributed to the ever-evolving technology in PLM is constantly changing.

The next-gen product lifecycle management software is capable of deploying analytical and data-driven approaches in today’s fast-paced and customer-centric businesses. The Product Lifecycle Management (PLM) market is undergoing a sea change with the outside-in approach the vendors are adopting in order to ensure customer satisfaction. With the help of PLM, end users are able to calculate and anticipate changing demands of customers.

PLM is primarily used to manage organizational workflows and deploy cross-department engagement. However, product data management (PDM) is a tool to manage product data and keep CAD (Computer-aided Design) files in organized and version-controlled manner. However, companies in the Product Lifecycle Management (PLM) market are increasing efforts to tackle the issue of incompatible formats such as CAD files in PLM, as users create and manage information in native CAD formats and other neutral file formats. In such cases, PDM helps to manage all formats of CAD files.

On the other hand, PDM and PLM are two sides of the same coin, as organizations who are using CAD software need to purchase a PDM system. Moreover, the momentum created by Industry 4.0 exposes the vulnerability of PLM. Hence, companies in the Product Lifecycle Management (PLM) market are suggesting users to make combined use of PDM and PLM to establish better efficiency in organizations.

Analysts’ Viewpoint

Although the coronavirus outbreak has had a crippling effect on the Product Lifecycle Management (PLM) market, the business isn’t resting everywhere. For instance, Finnish private equity fund manager CapMan has announced to acquire a major stake in IT service management company PDSVISION, which is a leading PLM player in Europe. However, PLM alone poses limitations in resolving problems involved in the Industry 4.0. Hence, companies should educate users to use PLM, along with PDM to streamline processes in Industry 4.0. They should increase the availability of cloud software solutions, owing to its advantages of easy implementation and low cost installation attributes.

Product Lifecycle Management (PLM) Market – Segmentation

TMR’s research study assesses the Product Lifecycle Management (PLM) market on the basis of software, end use, and region. The report presents extensive market dynamics and progressive trends associated with different segments, and how they influence the growth prospects of the Product Lifecycle Management (PLM) market.

|

Software |

On Premise

Cloud-based

|

|

End Use |

|

|

Region |

|

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Product Lifecycle Management (PLM) Market

4. Market Overview

4.1. Market Definition

4.2. Macroeconomic Factors

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Bn)

4.3. Technology/ Product Roadmap

4.4. Market Factor Analysis

4.4.1. Forecast Factors

4.4.2. Ecosystem/ Value Chain Analysis

4.4.3. Market Dynamics (Growth Influencers)

4.4.3.1. Drivers

4.4.3.2. Restraints

4.4.3.3. Opportunities

4.4.3.4. Impact Analysis of Drivers and Restraints

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By End-use

4.6. COVID-19 Impact Analysis

4.6.1. End-user Sentiment Analysis: Comparative Analysis on Spending

4.6.1.1. Increase in Spending

4.6.1.2. Decrease in Spending

4.6.2. Short Term and Long Term Impact on the Market

4.6.3. Recovery Period (3 Months/6 Months/12 Months)

4.7. Competitive Scenario and Trends

4.7.1. List of Emerging, Prominent, and Leading Players

4.7.2. Mergers & Acquisitions, Expansions

4.8. Market Outlook

5. Global Product Lifecycle Management (PLM) Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2015-2030

5.1.1. Historic Growth Trends, 2015-2019

5.1.2. Forecast Trends, 2020-2030

6. Global Product Lifecycle Management (PLM) Market Analysis, by Component

6.1. Key Segment Analysis

6.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Component, 2018 - 2030

6.2.1. Software

6.2.1.1. On-Premise

6.2.1.1.1. CAD/CAM/CAE (CAx)

6.2.1.1.2. Numerical Control (NC)

6.2.1.1.3. Simulation and Analysis (S&A)

6.2.1.1.4. Electronic Design and Automation (EDA)

6.2.1.1.5. Architecture, Engineering and Construction (AEC)

6.2.1.1.6. Collaborative Product Definition Management (CPDM)

6.2.1.1.7. Digital Manufacturing

6.2.1.1.8. Others

6.2.1.2. Cloud-based

6.2.1.2.1. CAD/CAM/CAE (CAx)

6.2.1.2.2. Numerical Control (NC)

6.2.1.2.3. Simulation and Analysis (S&A)

6.2.1.2.4. Electronic Design and Automation (EDA)

6.2.1.2.5. Architecture, Engineering and Construction (AEC)

6.2.1.2.6. Collaborative Product Definition Management (CPDM)

6.2.1.2.7. Digital Manufacturing

6.2.1.2.8. Others

6.2.2. Services

6.2.2.1. Consulting

6.2.2.2. Integration

6.2.2.3. Operation and Maintenance

7. Global Product Lifecycle Management (PLM) Market Analysis, by End-use

7.1. Key Segment Analysis

7.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by End-use, 2018 - 2030

7.2.1. Automotive and Transportation

7.2.2. Aerospace and Defense

7.2.3. Industrial Machinery and Heavy Equipment

7.2.4. Electronics and Semiconductor

7.2.5. Energy and Utilities

7.2.6. Consumer Products and Retail

7.2.7. Medical Devices and Pharmaceutical

7.2.8. IT and Telecom

7.2.9. Others

8. Global Product Lifecycle Management (PLM) Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Region, 2018 - 2030

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Product Lifecycle Management (PLM) Market Analysis

9.1. Regional Outlook

9.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

9.2.1. By Component

9.2.2. By End-use

9.3. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Country, 2018 - 2030

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe Product Lifecycle Management (PLM) Market Analysis and Forecast

10.1. Regional Outlook

10.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

10.2.1. By Component

10.2.2. By End-use

10.3. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Rest of Europe

11. APAC Product Lifecycle Management (PLM) Market Analysis and Forecast

11.1. Regional Outlook

11.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

11.2.1. By Component

11.2.2. By End-use

11.3. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

11.3.1. Japan

11.3.2. China

11.3.3. India

11.3.4. Australia

11.3.5. Rest of Asia Pacific

12. Middle East & Africa (MEA) Product Lifecycle Management (PLM) Market Analysis and Forecast

12.1. Regional Outlook

12.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

12.2.1. By Component

12.2.2. By End-use

12.3. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

12.3.1. GCC

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa (MEA)

13. South America Product Lifecycle Management (PLM) Market Analysis and Forecast

13.1. Regional Outlook

13.2. Product Lifecycle Management (PLM) Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

13.2.1. By Component

13.2.2. By End-use

13.3. Product Lifecycle Management (PLM) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

13.3.1. Brazil

13.3.2. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2019)

15. Company Profiles

15.1. Accenture PLC

15.1.1. Business Overview

15.1.2. Product Portfolio

15.1.3. Geographical Footprint

15.1.4. Revenue and Strategy

15.2. Atos SE

15.2.1. Business Overview

15.2.2. Product Portfolio

15.2.3. Geographical Footprint

15.2.4. Revenue and Strategy

15.3. Autodesk, Inc.

15.3.1. Business Overview

15.3.2. Product Portfolio

15.3.3. Geographical Footprint

15.3.4. Revenue and Strategy

15.4. Dassault Systemes

15.4.1. Business Overview

15.4.2. Product Portfolio

15.4.3. Geographical Footprint

15.4.4. Revenue and Strategy

15.5. Hewlett-Packard Company.

15.5.1. Business Overview

15.5.2. Product Portfolio

15.5.3. Geographical Footprint

15.5.4. Revenue and Strategy

15.6. iBASEt

15.6.1. Business Overview

15.6.2. Product Portfolio

15.6.3. Geographical Footprint

15.6.4. Revenue and Strategy

15.7. IBM Corporation

15.7.1. Business Overview

15.7.2. Product Portfolio

15.7.3. Geographical Footprint

15.7.4. Revenue and Strategy

15.8. PTC, Inc.

15.8.1. Business Overview

15.8.2. Product Portfolio

15.8.3. Geographical Footprint

15.8.4. Revenue and Strategy

15.9. SAP SE

15.9.1. Business Overview

15.9.2. Product Portfolio

15.9.3. Geographical Footprint

15.9.4. Revenue and Strategy

15.10. Siemens AG

15.10.1. Business Overview

15.10.2. Product Portfolio

15.10.3. Geographical Footprint

15.10.4. Revenue and Strategy

16. Key Takeaways

List of Tables

Table 1: North America ICT Spending (US$ Mn)

Table 2: Europe ICT Spending (US$ Mn)

Table 3: Asia Pacific ICT Spending (US$ Mn)

Table 4: MEA ICT Spending (US$ Mn)

Table 5: South America ICT Spending (US$ Mn)

Table 6: Emerging and Prominent Vendors

Table 7: Key Alliances in the Global PLM Market

Table 8: Global Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, 2018-2030

Table 9: Global Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 10: Global Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 11: Global Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by End-use 2018-2030

Table 12: Global Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Region, 2018-2030

Table 13: North America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, 2018-2030

Table 14: North America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 15: North America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 16: North America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by End-use 2018-2030

Table 17: North America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Country, 2018-2030

Table 18: Europe Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, 2018-2030

Table 19: Europe Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 20: Europe Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 21: Europe Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by End-use 2018-2030

Table 22: Europe Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Country, 2018-2030

Table 23: Asia Pacific Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, 2018-2030

Table 24: Asia Pacific Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 25: Asia Pacific Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 26: Asia Pacific Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by End-use 2018-2030

Table 27: Asia Pacific Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Country, 2018-2030

Table 28: Middle East & Africa (MEA) Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, 2018-2030

Table 29: Middle East & Africa (MEA) Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 30: Middle East & Africa (MEA) Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 31: Middle East & Africa (MEA) Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by End-use 2018-2030

Table 32: Middle East & Africa (MEA) Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Country, 2018-2030

Table 33: South America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, 2018-2030

Table 34: South America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 35: South America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Component, by Software 2018-2030

Table 36: South America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by End-use 2018-2030

Table 37: South America Product Lifecycle Management Market Revenue (US$ Bn) and Forecast, by Country, 2018-2030

List of Figures

Figure 1: Global Product Lifecycle Management Market Size (US$ Mn) and Forecast, 2015–2030

Figure 2: Global CAGR Breakdown

Figure 3: Country Abstract

Figure 4: Regional Outline

Figure 5: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 6: Top Economies GDP Landscape, 2019

Figure 7: Global ICT Spending (US$ Bn) 2018 - 2030

Figure 8: Global ICT Spending (%), by Region, 2019

Figure 9: Global ICT Spending (US$ Bn), Regional Contribution, 2019

Figure 10: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019

Figure 11: Global ICT Spending (%), by Type, 2019

Figure 12: Product Roadmap

Figure 13: Porter’s Five Forces

Figure 14: Ecosystem

Figure 15: Market Dynamics

Figure 16: Impact Analysis of Market dynamics

Figure 17: Global Product Lifecycle Management Market Forecast trends, 2020 - 2030 (US$ Mn)

Figure 18: Global Product Lifecycle Management Market, Absolute Incremental Opportunity Analysis, 2015 - 2030

Figure 19: Global Product Lifecycle Management Market Opportunity Assessment, by Component

Figure 20: Global Product Lifecycle Management Market Opportunity Assessment, by End-use

Figure 21: Opportunity Assessment, By Region

Figure 22: Global Product Lifecycle Management Market Share Analysis, by Component, 2020

Figure 23: Global Product Lifecycle Management Market Share Analysis, by Component, 2030

Figure 24: Global Product Lifecycle Management Market Share Analysis, by End-use, 2020

Figure 25: Global Product Lifecycle Management Market Share Analysis, by End-use, 2030

Figure 26: Global Product Lifecycle Management Market Share Analysis, by Region, 2020

Figure 27: Global Product Lifecycle Management Market Share Analysis, by Region, 2030

Figure 28: North America Product Lifecycle Management Market Share Analysis, by Component, 2020

Figure 29: North America Product Lifecycle Management Market Share Analysis, by Component, 2030

Figure 30: North America Product Lifecycle Management Market Share Analysis, by End-use, 2020

Figure 31: North America Product Lifecycle Management Market Share Analysis, by End-use, 2030

Figure 32: North America Product Lifecycle Management Market Share Analysis, by Country, 2020

Figure 33: North America Product Lifecycle Management Market Share Analysis, by Country, 2030

Figure 33: U.S. Leading Segments

Figure 34: U.S. Market Share - 2019

Figure 35: Canada Leading Segments

Figure 36: Canada Market Share - 2019

Figure 38: Mexico Leading Segments

Figure 39: Mexico Market Share - 2019

Figure 40: Europe Product Lifecycle Management Market Share Analysis, by Component, 2020

Figure 41: Europe Product Lifecycle Management Market Share Analysis, by Component, 2030

Figure 42: Europe Product Lifecycle Management Market Share Analysis, by End-use, 2020

Figure 43: Europe Product Lifecycle Management Market Share Analysis, by End-use, 2030

Figure 44: Europe Product Lifecycle Management Market Share Analysis, by Country, 2020

Figure 45: Europe Product Lifecycle Management Market Share Analysis, by Country, 2030

Figure 46: Germany LEADING SEGMENTS

Figure 47: Germany Market Share - 2019

Figure 48: UK Leading Segments

Figure 49: UK Market Share - 2019

Figure 50: France Leading Segments

Figure 51: France Market Share - 2019

Figure 52: Asia Pacific Product Lifecycle Management Market Share Analysis, by Component, 2020

Figure 53: Asia Pacific Product Lifecycle Management Market Share Analysis, by Component, 2030

Figure 54: Asia Pacific Product Lifecycle Management Market Share Analysis, by End-use, 2020

Figure 55: Asia Pacific Product Lifecycle Management Market Share Analysis, by End-use, 2030

Figure 56: Asia Pacific Product Lifecycle Management Market Share Analysis, by Country, 2020

Figure 57: Asia Pacific Product Lifecycle Management Market Share Analysis, by Country, 2030

Figure 58: Japan Leading Segments

Figure 59: Japan Market Share - 2019

Figure 60: China Leading Segments

Figure 61: China Market Share - 2019

Figure 62: India Leading Segments

Figure 63: India Market Share - 2019

Figure 64: Australia Leading Segments

Figure 65: Australia Market Share - 2019

Figure 66: Middle East & Africa (MEA) Product Lifecycle Management Market Share Analysis, by Component, 2020

Figure 67: Middle East & Africa (MEA) Product Lifecycle Management Market Share Analysis, by Component, 2030

Figure 68: Middle East & Africa (MEA) Product Lifecycle Management Market Share Analysis, by End-use, 2020

Figure 69: Middle East & Africa (MEA) Product Lifecycle Management Market Share Analysis, by End-use, 2030

Figure 70: Middle East & Africa (MEA) Product Lifecycle Management Market Share Analysis, by Country, 2020

Figure 71: Middle East & Africa (MEA) Product Lifecycle Management Market Share Analysis, by Country, 2030

Figure 72: GCC Leading Segments

Figure 73: GCC Market Share - 2019

Figure 74: South Africa Leading Segments

Figure 75: South Africa Market Share - 2019

Figure 76: South America Product Lifecycle Management Market Share Analysis, by Component, 2020

Figure 77: South America Product Lifecycle Management Market Share Analysis, by Component, 2030

Figure 78: South America Product Lifecycle Management Market Share Analysis, by End-use, 2020

Figure 79: South America Product Lifecycle Management Market Share Analysis, by End-use, 2030

Figure 80: South America Product Lifecycle Management Market Share Analysis, by Country, 2020

Figure 81: South America Product Lifecycle Management Market Share Analysis, by Country, 2030

Figure 82: Brazil Leading Segments

Figure 83: Brazil Market Share – 2019

Figure 84: Competition Matrix

Figure 85: Market Share Analysis