Buyers constantly look for latest features and functionalities with quick turnaround times, and businesses push for better quality and cost benefits from product manufacturers. The growing demand for quick product deliveries has led to the creation of an entirely new engineering service by businesses dedicated to launching products faster into the product engineering services market. Product engineering service can be defined as an engineering consulting practice, which uses various hardware, embedded, software, and IT services solution for the designing and development of products. The product engineering services come in different phases from inception to the end of the lifecycle of a product.

In today’s deeply competitive business setting, Independent Software Vendors (ISVs) are rapidly utilizing Social, Mobile, Cloud technologies to propel innovation, stimulate product development, and decrease costs. Various product engineering businesses offer software product companies to grow more agile and responsive to evolving product engineering services market and competitive landscape with the product engineering solutions. Product engineering services also offer the training of managing product development applications by following a predefined program, while analyzing the entire realization-cycle, starting from its idea to the marketable product. Rise in need for technological solutions and advancements in technological devices have increased the use of such products with consumers growing dependable. Thus, growing number of consumers demanding smart homes, smart electronic devices, and in-vehicle networking systems is expected to generate huge demand in the global product engineering services market during the forecast period.

The spread of the COVID-19 pandemic has crippled various industries, including software and product development businesses. As technology product consumers halt spending due to the severe impact of COVID-19 on their market and sales, they are most likely to expect their product engineering services to assist with reduced billing rates and additional support to keep innovating. However, with reduced global investments and losses across every industry, small and medium enterprises have no other options left but to provide services at reduced costs. On the contrary, product engineering services market players have the opportunity to plan and conduct innovative technology product solutions with their clients. This is to assure that when global economies restore their working to the full capacity, the product engineering services vendors will have the expertise to provide differentiated and transformed products to buyers.

Several businesses still hold great power in fulfilling business requirements with its enhanced productivity levels at cost-effective terms. Most product engineering companies have adjusted to the pandemic situation by having work-at-home arrangements for most of their employees, while the others remain in the office with social distancing and sanitizing rules and regulations. Moreover, many product engineering services are being outsourced from 3D drafting services, engineering analysis to product design and testing. This is playing an important part in design automation, control engineering, manufacturing engineering, embedded systems, and plant design engineering amidst the pandemic. However, many crucial end users such as the aerospace, automotive, construction for construction plans, and semiconductor are presently dealing with the slowdown in the demand and sales hampering the product engineering services market.

The information technology industry offers opportunities for any business and can improve its performance significantly. On the other hand, it can be a challenge to design a great software product that can be affordable and time-effective. The product engineering services help to assist such businesses using phases of the product engineering approach. The phases start with designing the strategy of a software product development. There are usually more risks when designing something new. Thus, hiring a product engineering service provider can be particularly useful for such businesses. It can help by collecting data on future product’s functionality and analyze the feasibility of the idea. This is likely to drive the product engineering services market during the forecast period.

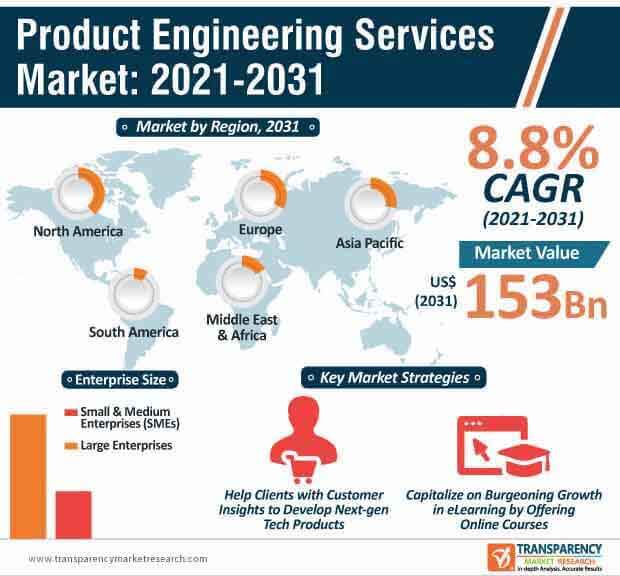

Software is now an indispensable part of any business development and takes a vital place in ROI spending. Therefore, advanced software testing processes can allow businesses to achieve their objectives in the shortest time but with a high-quality end-product. With product engineering services, there is an assurance that product is assessed and examined to ensure the most reliable quality to grant the best user experience. By leaving the product development process to the product engineering services, a business can focus on goals achievement, marketing, and, overall, implementing the business strategy successfully. Owing to all such factors, the global product engineering services market is projected to reach the value of US$ 153 Bn by 2031, expanding at a CAGR of 8.8% during the forecast period.

Analysts’ Viewpoint

The need of product development for product complexity and system engineering is increasing with emerging businesses in the product engineering services market. Developing economies such as China, Brazil, India, and South Africa are rapidly progressing in terms of software and technological innovations. The world is presently witnessing a need for intelligent products for daily activities. The future world is expected to witness various major developments, including integrated capabilities, moving further inside the product lifecycle, enabling technologies, and supply network integration. The use of product engineering services in such applications can enhance the response time by analyzing the market situation in terms of sales. Thus, the global product engineering services market is anticipated to witness a heavy surge in the demand during the forecast period.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Product Engineering Services Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on the Product Engineering Services Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.4.4. Recovery Period (3 Months/6 Months/12 Months)

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Service Type

4.5.2. By Enterprise Size

4.5.3. By Industry

4.6. Competitive Scenario

4.6.1. List of Emerging, Prominent and Leading Players

4.6.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, Etc.

5. Global Product Engineering Services Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2020

5.1.2. Forecast Trends, 2021-2031

6. Global Product Engineering Services Market Analysis, by Service Type

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Product (US$ Bn) Forecast Engineering Services Market Size, by Service Type, 2018 - 2031

6.3.1. Product and Component Design

6.3.1.1. New Product Development

6.3.1.2. Design Support

6.3.1.3. Software Engineering

6.3.1.3.1. Embedded Software Services

6.3.1.3.2. Independent Software Services

6.3.2. Hardware Engineering

6.3.3. Prototype Testing

6.3.4. Process Engineering

6.3.4.1. Manufacturing Engineering Support

6.3.4.2. Knowledge-Based Engineering (KBE)

6.3.5. Maintenance, Repair, and Operations

6.3.6. Others

7. Global Product Engineering Services Market Analysis, by Enterprise Size

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

7.3.1. Small & Medium Enterprises

7.3.2. Large Enterprises

8. Global Product Engineering Services Market Analysis, by Industry

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Industry, 2018 - 2031

8.3.1. Aerospace and Defense

8.3.2. Automotive

8.3.3. BFSI

8.3.4. Energy and Utilities

8.3.5. Healthcare

8.3.6. Industrial Manufacturing

8.3.7. IT & Telecom

8.3.8. Others

9. Global Product Engineering Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Product Engineering Services Market Size (US$ Bn) Forecast, by Region, 2018 - 2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Product Engineering Services Market Analysis

10.1. Regional Outlook

10.2. Product Engineering Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

10.2.1. By Service Type

10.2.2. By Enterprise Size

10.2.3. By Industry

10.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Product Engineering Services Market Analysis and Forecast

11.1. Regional Outlook

11.2. Product Engineering Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Service Type

11.2.2. By Enterprise Size

11.2.3. By Industry

11.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Spain

11.3.5. Italy

11.3.6. Rest of Europe

12. APAC Product Engineering Services Market Analysis and Forecast

12.1. Regional Outlook

12.2. Product Engineering Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

12.2.1. By Service Type

12.2.2. By Enterprise Size

12.2.3. By Industry

12.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa (MEA) Product Engineering Services Market Analysis and Forecast

13.1. Regional Outlook

13.2. Product Engineering Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Service Type

13.2.2. By Enterprise Size

13.2.3. By Industry

13.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. Kuwait

13.3.3. The United Arab Emirates

13.3.4. South Africa

13.3.5. Rest of Middle East & Africa (MEA)

14. South America Product Engineering Services Market Analysis and Forecast

14.1. Regional Outlook

14.2. Product Engineering Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

14.2.1. By Service Type

14.2.2. By Enterprise Size

14.2.3. By Industry

14.3. Product Engineering Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2020)

16. Company Profiles

16.1. Accenture PLC

16.1.1. Business Overview

16.1.2. Product Portfolio

16.1.3. Geographical Footprint

16.1.4. Revenue and Strategy

16.2. Akka Technologies

16.2.1. Business Overview

16.2.2. Product Portfolio

16.2.3. Geographical Footprint

16.2.4. Revenue and Strategy

16.3. ALTEN

16.3.1. Business Overview

16.3.2. Product Portfolio

16.3.3. Geographical Footprint

16.3.4. Revenue and Strategy

16.4. Altran Technologies, SA (part of Capgemini)

16.4.1. Business Overview

16.4.2. Product Portfolio

16.4.3. Geographical Footprint

16.4.4. Revenue and Strategy

16.5. AVL

16.5.1. Business Overview

16.5.2. Product Portfolio

16.5.3. Geographical Footprint

16.5.4. Revenue and Strategy

16.6. Calsoft Inc.

16.6.1. Business Overview

16.6.2. Product Portfolio

16.6.3. Geographical Footprint

16.6.4. Revenue and Strategy

16.7. Capgemini

16.7.1. Business Overview

16.7.2. Product Portfolio

16.7.3. Geographical Footprint

16.7.4. Revenue and Strategy

16.8. CloudMoyo

16.8.1. Business Overview

16.8.2. Product Portfolio

16.8.3. Geographical Footprint

16.8.4. Revenue and Strategy

16.9. Happiest Minds Technologies

16.9.1. Business Overview

16.9.2. Product Portfolio

16.9.3. Geographical Footprint

16.9.4. Revenue and Strategy

16.10. HCL Technologies Limited

16.10.1. Business Overview

16.10.2. Product Portfolio

16.10.3. Geographical Footprint

16.10.4. Revenue and Strategy

16.11. IBM Corporation

16.11.1. Business Overview

16.11.2. Product Portfolio

16.11.3. Geographical Footprint

16.11.4. Revenue and Strategy

16.12. Infinite Computer Solutions Inc.

16.12.1. Business Overview

16.12.2. Product Portfolio

16.12.3. Geographical Footprint

16.12.4. Revenue and Strategy

16.13. ITC InfoTech

16.13.1. Business Overview

16.13.2. Product Portfolio

16.13.3. Geographical Footprint

16.13.4. Revenue and Strategy

16.14. Nous Infosystems

16.14.1. Business Overview

16.14.2. Product Portfolio

16.14.3. Geographical Footprint

16.14.4. Revenue and Strategy

16.15. Tata Consultancy Services (TCS) Limited

16.15.1. Business Overview

16.15.2. Product Portfolio

16.15.3. Geographical Footprint

16.15.4. Revenue and Strategy

16.16. VOLANSYS Technologies

16.16.1. Business Overview

16.16.2. Product Portfolio

16.16.3. Geographical Footprint

16.16.4. Revenue and Strategy

16.17. Wipro Limited

16.17.1. Business Overview

16.17.2. Product Portfolio

16.17.3. Geographical Footprint

16.17.4. Revenue and Strategy

16.18. Xoriant Corporation

16.18.1. Business Overview

16.18.2. Product Portfolio

16.18.3. Geographical Footprint

16.18.4. Revenue and Strategy

17. Key Takeaways

List of Tables

Table 1: Acronyms Used

Table 2: North America Product Engineering Services Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 3: Europe Product Engineering Services Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 4: Asia Pacific Product Engineering Services Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 5: Middle East & Africa Product Engineering Services Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 6: South America Product Engineering Services Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Mergers & Acquisitions, Expansions, Partnership (1/3)

Table 10: Mergers & Acquisitions, Expansions, Partnership (2/3)

Table 11: Mergers & Acquisitions, Expansions, Partnership (3/3)

Table 12: Global Product Engineering Services Market (US$ Bn) Forecast, by Service Type, 2018 - 2031

Table 13: Global Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Software Engineering, 2018 - 2031

Table 14: Global Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Process Engineering, 2018 - 2031

Table 15: Global Product Engineering Services Market (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

Table 16: Global Product Engineering Services Market (US$ Bn) Forecast, by Industry, 2018 - 2031

Table 17: Global Product Engineering Services (US$ Bn) Forecast, by Region, 2018 - 2031

Table 18: North America Product Engineering Services Market (US$ Bn) Forecast, by Service Type, 2018 - 2031

Table 19: North America Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Software Engineering, 2018 - 2031

Table 20: North America Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Process Engineering, 2018 - 2031

Table 21: North America Product Engineering Services Market (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

Table 22: North America Product Engineering Services Market (US$ Bn) Forecast, by Industry, 2018 - 2031

Table 23: North America Product Engineering Services Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 24: U.S. Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 25: Canada Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 26: Mexico Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 27: Europe Product Engineering Services Market (US$ Bn) Forecast, by Service Type, 2018 - 2031

Table 28: Europe Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Software Engineering, 2018 - 2031

Table 29: Europe Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Process Engineering, 2018 - 2031

Table 30: Europe Product Engineering Services Market (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

Table 31: Europe Product Engineering Services Market (US$ Bn) Forecast, by Industry, 2018 - 2031

Table 32: Europe Product Engineering Services Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 33: Germany Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 34: U.K. Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 35: France Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 36: Spain Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 37: Italy Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 38: Asia Pacific Product Engineering Services Market (US$ Bn) Forecast, by Service Type, 2018 - 2031

Table 39: Asia Pacific Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Software Engineering, 2018 - 2031

Table 40: Asia Pacific Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Process Engineering, 2018 - 2031

Table 41: Asia Pacific Product Engineering Services Market (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

Table 42: Asia Pacific Product Engineering Services Market (US$ Bn) Forecast, by Industry, 2018 - 2031

Table 43: Asia Pacific Product Engineering Services Market (US$ Bn) Forecast, by Country, 2018 - 2031

Table 44: China Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 45: Japan Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 46: India Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 47: ASEAN Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 48: Middle East & Africa Product Engineering Services Market (US$ Bn) Forecast, by Service Type, 2018 - 2031

Table 49: Middle East & Africa Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Software Engineering, 2018 - 2031

Table 50: Middle East & Africa Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Process Engineering, 2018 - 2031

Table 51: Middle East & Africa (MEA) Product Engineering Services Market (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

Table 52: Middle East & Africa (MEA) Product Engineering Services Market (US$ Bn) Forecast, by Industry, 2018 - 2031

Table 53: Middle East & Africa Product Engineering Services Market (US$ Bn) Forecast, by Country, 2018 - 2031

Table 54: UAE Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 55: South Africa Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 56: South America Product Engineering Services Market (US$ Bn) Forecast, by Service Type, 2018 - 2031

Table 57: South America Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Software Engineering, 2018 - 2031

Table 58: South America Product Engineering Services Market (US$ Bn) Forecast, by Service Type, by Process Engineering, 2018 - 2031

Table 59: South America Product Engineering Services Market (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

Table 60: South America Product Engineering Services Market (US$ Bn) Forecast, by Industry, 2018 - 2031

Table 61: South America Product Engineering Services Market (US$ Bn) Forecast, by Country, 2018 - 2031

Table 62: Brazil Emirates Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

Table 63: Argentina Product Engineering Services Revenue CAGR Breakdown (%), by Growth Term

List of Figures

Figure 1: Global Product Engineering Services Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Product Engineering Services Revenue (US$ Bn) Opportunity Assessment, by Region, 2021E

Figure 3: Top Segment Analysis of Product Engineering Services Market

Figure 4: Global Product Engineering Services Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Product Engineering Services Revenue Forecast, by Region, 2021–2031

Figure 6: Global Product Engineering Services Market Opportunity Assessment, by Service Type

Figure 7: Global Product Engineering Services Market Opportunity Assessment, by Enterprise Size

Figure 8: Global Product Engineering Services Market Opportunity Assessment, by Industry

Figure 9: Global Product Engineering Services Market Opportunity Assessment, by Region

Figure 10: Global Product Engineering Services Revenue (US$ Bn) Historic Trends, 2016 - 2020

Figure 11: Global Product Engineering Services Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2020

Figure 12: Global Product Engineering Services Revenue (US$ Bn) and Y-o-Y Growth (Revenue %) Forecast, 2021 - 2031

Figure 13: Global Product Engineering Services Revenue Opportunity (US$ Bn) Forecast, 2021 - 2031

Figure 14: Global Product Engineering Services Market Value Share Analysis, by Services, 2021

Figure 15: Global Product Engineering Services Market Value Share Analysis, by Services, 2031

Figure 16: Product and Component Design Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 17: Process Engineering Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 18: Maintenance, Repair, and Operations Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 19: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 20: Global Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 21: Global Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 22: Small & Medium Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 23: Large Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 24: Global Product Engineering Services Market Value Share Analysis, by Industry, 2021

Figure 25: Global Product Engineering Services Market Value Share Analysis, by Industry, 2031

Figure 26: Aerospace and Defense Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 27: Automotive Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 28: BFSI Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 29: Energy and Utilities Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 30: Healthcare Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 31: Industrial Manufacturing Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 32: IT & Telecom Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 33: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 34 Global Product Engineering Services CAGR Breakdown (%), by Growth Term, by Region

Figure 35: Global Product Engineering Services Opportunity Share (%), by Region, 2021–2031

Figure 36: Global Product Engineering Services Size (US$ Bn), by Region, 2021 & 2031

Figure 37: Global Product Engineering Services Value Share Analysis, by Region, 2021

Figure 38: Global Product Engineering Services Value Share Analysis, by Region, 2031

Figure 39: North America Product Engineering Services Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 40: Europe Product Engineering Services Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 41: Asia Pacific Product Engineering Services Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 42: Middle East & Africa Product Engineering Services Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 43: South America Product Engineering Services Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 44: North America Product Engineering Services Market Revenue Opportunity Share, by Enterprise Size

Figure 45: North America Product Engineering Services Market Revenue Opportunity Share, by Industry

Figure 46: North America Product Engineering Services Market Revenue Opportunity Share, by Services

Figure 47: North America Product Engineering Services Market Revenue Opportunity Share, by Country

Figure 48: North America Product Engineering Services Market Value Share Analysis, by Services, 2021

Figure 49: North America Product Engineering Services Market Value Share Analysis, by Services, 2031

Figure 50: Product and Component Design Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 51: Process Engineering Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 52: Maintenance, Repair, and Operations Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 53: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 54: North America Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 55: North America Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 56: Small & Medium Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 57: Large Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 58: North America Product Engineering Services Market Value Share Analysis, by Industry, 2021

Figure 59: North America Product Engineering Services Market Value Share Analysis, by Industry, 2031

Figure 60: Aerospace and Defense Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 61: Automotive Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 62: BFSI Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 63: Energy and Utilities Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 64: Healthcare Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 65: Industrial Manufacturing Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 66: IT & Telecom Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 67: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 68: North America Product Engineering Services Value Share Analysis, by Country, 2021

Figure 69: North America Product Engineering Services Value Share Analysis, by Country, 2031

Figure 70: U.S. Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 71: Canada Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 72: Mexico Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 73: Europe Product Engineering Services Market Revenue Opportunity Share, by Enterprise Size

Figure 74: Europe Product Engineering Services Market Revenue Opportunity Share, by Industry

Figure 75: Europe Product Engineering Services Market Revenue Opportunity Share, by Services

Figure 76: Europe Product Engineering Services Market Revenue Opportunity Share, by Country

Figure 77: Europe Product Engineering Services Market Value Share Analysis, by Services, 2021

Figure 78: Europe Product Engineering Services Market Value Share Analysis, by Services, 2031

Figure 79: Product and Component Design Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 80: Process Engineering Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 81: Maintenance, Repair, and Operations Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 82: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 83: Europe Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 84: Europe Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 85: Small & Medium Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 86: Large Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 87: Europe Product Engineering Services Market Value Share Analysis, by Industry, 2021

Figure 88: Europe Product Engineering Services Market Value Share Analysis, by Industry, 2031

Figure 89: Aerospace and Defense Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 90: Automotive Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 91: BFSI Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 92: Energy and Utilities Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 93: Healthcare Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 94: Industrial Manufacturing Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 95: IT & Telecom Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 96: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 97: Europe Product Engineering Services Value Share Analysis, by Country, 2021

Figure 98: Europe Product Engineering Services Value Share Analysis, by Country, 2031

Figure 99: Germany Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 100: U.K. Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 101: France Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 102: Spain Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 103: Italy Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 104: Asia Pacific Product Engineering Services Market Revenue Opportunity Share, by Enterprise Size

Figure 105: Asia Pacific Product Engineering Services Market Revenue Opportunity Share, by Industry

Figure 106: Asia Pacific Product Engineering Services Market Revenue Opportunity Share, by Services

Figure 107: Asia Pacific Product Engineering Services Market Revenue Opportunity Share, by Country

Figure 108: Asia Pacific Product Engineering Services Market Value Share Analysis, by Services, 2021

Figure 109: Asia Pacific Product Engineering Services Market Value Share Analysis, by Services, 2031

Figure 110: Product and Component Design Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 111: Process Engineering Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 112: Maintenance, Repair, and Operations Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 113: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 114: Asia Pacific Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 115: Asia Pacific Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 116: Small & Medium Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 117: Large Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 118: Asia Pacific Product Engineering Services Market Value Share Analysis, by Industry, 2021

Figure 119: Asia Pacific Product Engineering Services Market Value Share Analysis, by Industry, 2031

Figure 120: Aerospace and Defense Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 121: Automotive Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 122: BFSI Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 123: Energy and Utilities Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 124: Healthcare Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 125: Industrial Manufacturing Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 126: IT & Telecom Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 127: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 128: Asia Pacific Product Engineering Services Market Value Share Analysis, by Country, 2021

Figure 129: Asia Pacific Product Engineering Services Market Value Share Analysis, by Country, 2031

Figure 130: China Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 131: India Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 132: Japan Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 133: ASEAN Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 134: Middle East & Africa Product Engineering Services Market Revenue Opportunity Share, by Enterprise Size

Figure 135: Middle East & Africa Product Engineering Services Market Revenue Opportunity Share, by Industry

Figure 136: Middle East & Africa Product Engineering Services Market Revenue Opportunity Share, by Services

Figure 137: Middle East & Africa Product Engineering Services Market Revenue Opportunity Share, by Country

Figure 138: Middle East & Africa (MEA) Product Engineering Services Market Value Share Analysis, by Services, 2021

Figure 139: Middle East & Africa (MEA) Product Engineering Services Market Value Share Analysis, by Services, 2031

Figure 140: Product and Component Design Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 141: Process Engineering Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 142: Maintenance, Repair, and Operations Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 143: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 144: Middle East & Africa (MEA) Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 145: Middle East & Africa (MEA) Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 146: Small & Medium Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 147: Large Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 148: Middle East & Africa (MEA) Product Engineering Services Market Value Share Analysis, by Industry, 2021

Figure 149: Middle East & Africa (MEA) Product Engineering Services Market Value Share Analysis, by Industry, 2031

Figure 150: Aerospace and Defense Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 151: Automotive Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 152: BFSI Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 153: Energy and Utilities Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 154: Healthcare Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 155: Industrial Manufacturing Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 156: IT & Telecom Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 157: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 158: Middle East & Africa Product Engineering Services Market Value Share Analysis, by Country, 2021

Figure 159: Middle East & Africa Product Engineering Services Market Value Share Analysis, by Country, 2031

Figure 160: Saudi Arabia Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 161: Kuwait Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 162: The United Arab Emirates Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 163: South Africa Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 164: South America Product Engineering Services Market Revenue Opportunity Share, by Enterprise Size

Figure 165: South America Product Engineering Services Market Revenue Opportunity Share, by Industry

Figure 166: South America Product Engineering Services Market Revenue Opportunity Share, by Services

Figure 167: South America Product Engineering Services Market Revenue Opportunity Share, by Country

Figure 168: South America Product Engineering Services Market Value Share Analysis, by Services, 2021

Figure 169: South America Product Engineering Services Market Value Share Analysis, by Services, 2031

Figure 170: Product and Component Design Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 171: Process Engineering Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 172: Maintenance, Repair, and Operations Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 173: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 174: South America Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 175: South America Product Engineering Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 176: Small & Medium Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 177: Large Enterprises Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 178: South America Product Engineering Services Market Value Share Analysis, by Industry, 2021

Figure 179: South America Product Engineering Services Market Value Share Analysis, by Industry, 2031

Figure 180: Aerospace and Defense Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 181: Automotive Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 182: BFSI Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 183: Energy and Utilities Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 184: Healthcare Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 185: Industrial Manufacturing Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 186: IT & Telecom Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 187: Others Product Engineering Services Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 188: South America Product Engineering Services Market Value Share Analysis, by Country, 2021

Figure 189: South America Product Engineering Services Market Value Share Analysis, by Country, 2031

Figure 190: Brazil Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 191: Argentina Product Engineering Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031