Reports

Reports

Probiotic Ingredients Market – The Era of ‘Customization’

Product innovation has been a regular feature in the food and beverage industry, as manufacturers continue to approach consumer health woes head-on. Since consumers leading a demanding lifestyle put their health concerns on the back burner, probiotic ingredients have been the on-the-go nutrition boosters. With 'capsuled health' taking over the 'health in the plate' ideology, probiotic ingredients sales have remained steady in developed countries, with sales in developing countries complementing overall revenues.

Customization, being the new business adage, comes into play as market players look to consolidate. This has unlocked a free space for probiotic ingredients manufacturers to expend their efforts towards the development of ailment-specific products, thereby implementing a strong customer acquisition strategy. However, the probiotic ingredients market is yet to explore its full potential in developing countries. This, when looked through a manufacturer’s lens, could serve as a crucial business opportunity for expansion, if picked up well with a thoughtful marketing campaign.

Sensing the obvious and the latent potential of the probiotic ingredients market, Transparency Market Research (TMR) carried out extensive research by taking a macroscopic as well as a microscopic view of the landscape. The insights presented in the report can help stakeholders in gaining a better understanding of the market.

Probiotic Ingredients Market: Expanding Applications Present New Opportunities

Probiotic ingredients market, currently valued at nearly US$ 4,200 Mn in 2018, is on a steady course, however, in some pockets, growth has plateaued as novel, and arguably safer, and alternatives have emerged.

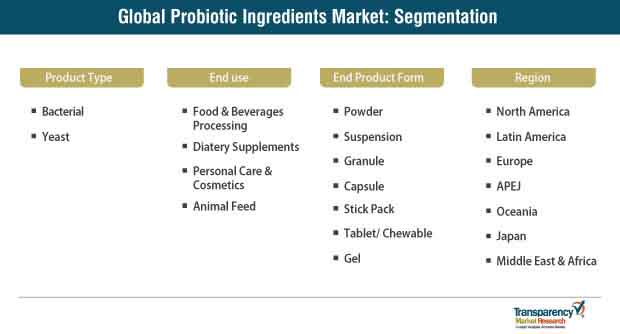

Food and beverage manufacturers are being considerate of the fact that, consumer liking is fickle, and only food products with a blend of health and taste will make it to the table. This has been popularizing the use of probiotic ingredients in almost all the F&B segments, encompassing but not confined to infant nutrition, cultured dairy products, bakery & confectionery, breakfast solutions, and snacks & bars. In the recent past, growing adoption in dietary supplements, personal care & cosmetics, and animal feed in probiotic ingredients, has created new opportunities for manufacturers.

‘Preventive’ rather than ‘reactive’ – consumer sentiment that drove probiotic and functional food sales in the developed world – is also becoming increasingly palpable in many developing countries of Asia Pacific. Average consumer spending on health and wellness products has witnessed an increase, especially among some of the fastest growing economies in the region. Stakeholders have responded by broadening their portfolio, and this has been backed by strategic marketing campaigns focusing on ‘more information less sales’. The surge in demand has been felt all across the supply chain, and ingredient suppliers are witnessing a period of bullishness.

Probiotic Ingredients Manufacturers Benefitting from Convergence of Food and Pharmaceuticals

In recent times, the convergence of ‘food-pharma’ industry has been directed towards enhancing a consumer’s general health condition. Keeping the consumers at the center, in future, the intersection will blur the point of separation between these differing landscapes. The surge in the consumption of probiotic ingredients-infused food and beverages products as 'one attack to defend health' is being witnessed among consumers, which has encouraged the food and pharma companies to progress towards developing flavorful products. The availability of probiotic ingredients in multiple forms is likely to offer the ease to the food and beverages manufacturers to blend it to further foster product innovation.

Traditionally, probiotic ingredients in the powdered form have acquired a majority of the market share. However, a dramatic shift towards the 'health in a pill' concept and the growth in the consumption of dietary supplements as a ‘preventive measure’ has offered a center stage to capsules. Currently, capsules remain the preferred consumable form of probiotic ingredients. However, the stick pack segment is expected to gain speed with time, and is likely to grow at a significant pace over the course of the forecast period.

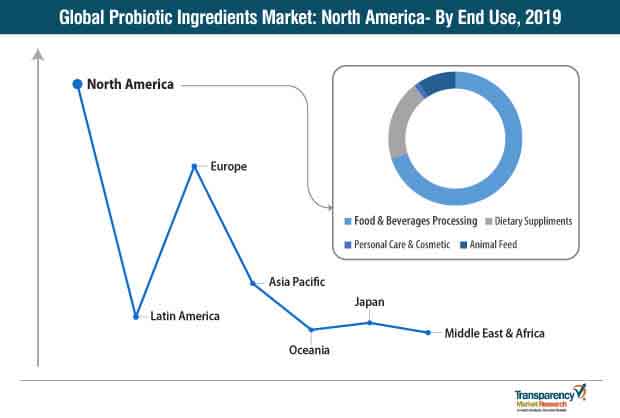

For years, probiotic demand has been attributed to favorable consumer ‘perception’. Consumers, without looking too much into the actual health benefits of probiotics, led to a demand boom. However, in the last few years, as scientific evidence has been forthcoming, and usually, unfavorable to probiotic industry, a significant section has now started looking elsewhere. For example, a study published by National Center for Complementary and Integrative Health (NCCIH) shows that a specific type of Lactobacillus remains safe in healthy adults age 65 and older, however, all probiotics would not necessarily be safe for people in this batch of age. ‘Perception’ is now driving consumers away from probiotics, towards products where scientific literature is relatively convincing.

Probiotic Ingredients Market – Graze-worthy Opportunities on the Greener Meadows of Developing Countries

In the probiotic ingredients market, the business game intensifies as a varied batch of players play to acquire a significant market share. Customization and ailment-specific product development remain the top game plans of manufacturers operating in the dietary supplement landscape. This has led to the increase in the number of marketing and distribution partnership in the probiotics ingredients market.

However, in developing regions such as Asia Pacific, where literature leading to education regarding the benefits of probiotic ingredients is inadequate, players can shift their manufacturing-distributor partnership to the top gear and accelerate with expansion opportunities. Since consumers in such regions exhibit skeptical behavior towards novel products, squeezing profit margins by reducing prices could help manufacturers form their initial base of consumers.

Competition Intensity – Fragmented

The probiotic ingredients market remains fragmented, with numerous partakers at play at varying levels. Chr. Hansen holds a major revenue chunk of the probiotic ingredients market (nearly 15%), with Probi AB and Lallemand following, respectively. The big shots account for approximately 20-22% share of the probiotic ingredients market, with research and development activities being their key differentiating strategy.

With a view towards strengthening the product portfolio, launching novel products and filing patents help them gain the desired exposure in the probiotic ingredients market. For example, Chr. Hansen A/S announced the launch of a uniquely developed multi-strain probiotic product – Galli Pro Fit, which limits the growth of pathogens, improves gut health, and enhances the immunity of poultry animals.

However, the strategies of regional players differ to those of global players. Regional players occupy nearly 33-35% share of the probiotic ingredients market. Sensing the enormous potential of emerging countries, this batch of players diligently work towards expanding their customer base by developing customized products. For instance, Novozymes A/S inaugurated an Innovation and Technology Center in Istanbul to focus on the development of enzymes, to reduce food wastage in the MEA region.

With the adoption of multiple strategies, the probiotic ingredients market is likely to scale new highs by the end of the foreseeable timeframe.

The Analyst Viewpoint

The authors of the report foresee the probiotic ingredients market in bright light through to 2027. Manufacturers who develop customized probiotic ingredients are expected to gain higher sales prospects, as they put end-user industries’ demand at the center. Limited penetration and exposure of probiotic ingredients in emerging countries remains a lucrative opportunity pocket for manufacturers in disguise of a long-standing challenge.

While the food and beverage industry remains a crucial revenue-enabler for the probiotic ingredients market, the personal care and cosmetics industry is likely to encourage manufacturers to dive into the business opportunity and explore the deep-seated opportunities created by consumers’ drift towards organic products. Though the probiotic ingredients market remains out of the radar of any potential threat from any alternatives, the growth of the prebiotic ingredients market could have some sort of impact on its otherwise anticipated pace.

Combination Therapy of Antibiotics and Probiotic Ingredients to Combat Antibiotic Resistance

In today’s era, where medical treatment and technology have reached new heights of success, consumer reliance on antibiotics and allopathic treatment has also reached an ultimate high. However, antibiotics need to be redesigned to combat resistant mutant strains in microorganisms. This scenario has compelled biotechnologists to come up with combination therapies to effectuate the necessary treatment amongst patients. Probiotic ingredients and antibiotic have emerged as a hopeful strategy to tackle the resistance in disease-causing microbes, since developing newer antibiotics is an expensive, lengthy, and potentially dangerous technique.

Probiotic ingredients help replenish the gut with friendly bacteria. To support these positive factors, many consumers, especially in developing regions, have come to terms with the importance and benefits of probiotic ingredients, further fuelling the growth of the probiotic ingredients market. Among the developing regions, BRICS countries have shown high potential within the probiotic ingredients market.

The human gut houses over 400 million different bacterial species, which are generally referred to as friendly bacteria. These friendly bacteria are responsible for maintaining gut health and maintenance of the digestive system. Probiotic ingredients are live microbes that are cultured for human consumption. These probiotic ingredients effectuate an enhanced condition of the gut bacteria, which results in better health.

As such, a healthy balance of intestinal flora and infection control can be achieved by consuming food or food supplement products that contain friendly, live bacteria cultures, commonly referred to as 'probiotics'. In terms of value, the global probiotic ingredients market is expected to reach a market value of nearly US$ 4,500 Mn by the end of 2027, with an expected CAGR of more than 6% over the forecast period. Drivers for the growth of the probiotic ingredients market include the increasing demand for natural products with natural alternatives to synthetic food additives such as probiotic ingredients, growing disposable income of consumers, health benefits associated with probiotic ingredients, and innovation in the health food sector.

Probiotic Ingredients as a Solution for Vaginal and Digestive Tract Infections

According to health organizations such as the National Health Service, vaginal and urinary tract diseases are amongst the most common indications reported in the U.S., in the area of bacterial infections. This problem is prevalent amongst females, and in some countries, women follow a highly conservative approach towards the treatment of these problems. Hence, the consumption of probiotic ingredients offers a feasible and comfortable solution to such individuals. Probiotic ingredients provide a natural and safe remedy for their problems as compared to harsh pharmaceutical treatments. Hence, manufacturers have effectively launched probiotic ingredient products targeting the female demo graph, further boosting the growth of the probiotic ingredients market.

Opportunities in Probiotic Ingredients Market Participants

For consumers to adopt the use of probiotic ingredient-based products, it is important that they realize the complete significance of probiotic ingredients, which is a challenging task for probiotic ingredient manufacturers and marketers alike. Hence, probiotic ingredient marketers must focus on the product positioning of probiotic ingredient-based products to enhance visibility on shelves. This strategy must be implemented at regional levels, due to difference in consumer opinions about probiotic ingredients. In developed regions, consumers are more likely to opt for labelled products that also exhibit a pricy tag. However, in developing regions, consumers look for new products in the regular products aisle. This will ensure the integration of the consumption of probiotic ingredients in the daily lives of consumers.

Probiotic Ingredients Market: Natural Alternatives to Synthetic Additives a Key Strategy

Probiotic ingredients outrun chemical additives in food fortification ingredients due to their natural tag. Even amongst natural ingredients, botanical extracts are often a costlier choice for food manufacturers, and probiotic ingredients present a better option. Probiotic ingredients offer both, cost-competitive and good quality benefits to food manufacturers.

Also, manufacturers are constantly looking for an ingredient revamp in end-use products, and probiotic ingredients are an ideal choice. Developed regions also house a high number of health-conscious people, further propelling the growth of the probiotic ingredients market.

Probiotic Ingredients Market Remains Consolidated among Established Brands

The global probiotic ingredients market is dominated by five key players, who collectively account for approximately ~40% share of the global market. The probiotics market is fragmented, and is mostly in the form of partnerships and business relationships between various players. Chr. Hansen accounts for the highest revenue share of 15.2% of the global probiotics market, followed by Probi AB and Lallemand, respectively.

1. Global Probiotic Ingredients Market - Executive Summary

1.1. Global Probiotic Ingredients Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Food Items across Globe

3.1.2. Global and Regional Per Capita Food Consumption (kcal per capita per day)

3.1.3. Population of Key Countries

3.1.4. Organic Agriculture Worldwide Statistics, 2017 (Million Hectares)

3.1.4.1. Top 10 Countries with Largest Areas of Organic Agricultural Land, 2016, Million Hectares

3.1.5. Global Modern Trade Penetration and Grocery Market by Key Countries

3.1.6. Change in Consumer Price Indexes (Percentage Change) 2018 (Forecast)

3.1.7. Global Retail Dynamics

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.4. Market Trends

3.5. Trend Analysis- Impact on Time Line (2019-2028)

3.6. Forecast Factors – Relevance and Impact

3.7. Key Regulations By Region

4. Sentiment Analysis

4.1. Consumer Sentiment Analysis

4.1.1. Consumer Buying Pattern

4.1.2. Development of the Specification

4.1.3. Social & Economic Influencers – Factors

4.1.4. Consumer preferences: Historical Scenario and Futuristic Approach

4.1.5. Prime Tendencies

4.1.6. Factors Affecting Consumer Preferences

4.1.7. Impact of labelling, claims, and certifications

4.1.8. Others

4.2. Social Media Sentiment Analysis

4.2.1. Consumer perception for products on social media platforms- Positive and Negative Mentions

4.2.2. Trending Brands

4.2.3. Social Media Platform Mentions (% of total mentions)

4.2.4. Trending Subject Titles

4.2.5. Others

5. Associated Industry and Key Indicator Assessment

5.1. Food & Beverages Industry Overview

5.1.1. Market Size and Forecast

5.1.2. Market Size and Y-o-Y Growth

5.1.3. Absolute $ Opportunity

6. Supply Chain Analysis

6.1. Profitability and Gross Margin Analysis By Competition

6.2. List of Active Participants- By Region

6.2.1. Raw Material Suppliers

6.2.2. Key Manufacturers

6.2.3. Integrators

6.2.4. Key Distributor/Retailers

7. Global Probiotic Ingredients Market Pricing Analysis

7.1. Price Point Assessment by Product Type

7.2. Regional Average Pricing Analysis

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific Ex. Japan (APEJ)

7.2.5. Japan

7.2.6. Oceania

7.2.7. Middle East and Africa

7.3. Price Forecast till 2027

7.4. Factors Influencing Pricing

8. Global Probiotic Ingredients Market Analysis and Forecast

8.1. Market Size Analysis (2013-2018) and Forecast (2019-2028)

8.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

8.1.2. Absolute $ Opportunity

8.2. Global Probiotic Ingredients Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

8.2.1. Forecast Factors and Relevance of Impact

8.2.2. Regional Probiotic Ingredients Market Business Performance Summary

9. Global Probiotic Ingredients Market Analysis By Culture Type

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Culture Type

9.1.2. Basis Point Share (BPS) Analysis By Culture Type

9.2. Probiotic Ingredients Market Size (US$ Mn) and Volume (MT) Analysis (2013-2018) & Forecast (2019-2028) By Culture Type

9.2.1. Bacterial

9.2.1.1. Lactobacillus

9.2.1.2. Bacillus

9.2.1.3. Enterococcus

9.2.1.4. Bifidobacterium

9.2.1.5. Streptococcus

9.2.1.6. Others (Pediococcus, etc.)

9.2.2. Yeast

9.2.2.1. Saccharomyces cerevisiae

9.2.2.2. Saccharomyces boulardii

9.3. Market Attractiveness Analysis By Culture Type

10. Global Probiotic Ingredients Market Analysis By End Product Form

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By End Product Form

10.1.2. Basis Point Share (BPS) Analysis By End Product Form

10.2. Probiotic Ingredients Market Size (US$ Mn) and Volume (MT) Analysis (2013-2018) & Forecast (2019-2028) By End Product Form

10.2.1. Powder

10.2.2. Suspension

10.2.3. Granule

10.2.4. Capsule

10.2.5. Stick Pack

10.2.6. Tablet/Chewable

10.2.7. Gel

10.3. Market Attractiveness Analysis By End Product Form

11. Global Probiotic Ingredients Market Analysis By End Use

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By End Use

11.1.2. Basis Point Share (BPS) Analysis By End Use

11.2. Probiotic Ingredients Market Size (US$ Mn) and Volume (MT) Analysis (2013-2018) & Forecast (2019-2028) By End Use

11.2.1. Food & Beverage Processing

11.2.1.1. Bakery & Confectionery

11.2.1.2. Breakfast Solutions

11.2.1.3. Cultured Dairy Products

11.2.1.4. Ice-Cream & Frozen Desserts

11.2.1.5. Snacks & Bars

11.2.1.6. Infant Nutrition

11.2.1.7. Beverages & Dairy Drinks

11.2.2. Dietary Supplements

11.2.2.1. Immune Health

11.2.2.2. Gut & Digestive Health

11.2.2.3. Women’s Health

11.2.3. Personal Care & Cosmetics

11.2.4. Animal Feed

11.3. Market Attractiveness Analysis By End Use

12. Global Probiotic Ingredients Market Analysis and Forecast, By Region

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Region

12.1.2. Y-o-Y Growth Projections By Region

12.2. Probiotic Ingredients Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2028) Analysis By Region

12.2.1. North America

12.2.2. Europe

12.2.3. APEJ

12.2.4. Japan

12.2.5. Oceania

12.2.6. Latin America

12.2.7. Middle East and Africa

12.3. Market Attractiveness Analysis By Region

13. North America Probiotic Ingredients Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

13.2.1. Market Attractiveness By Country

13.2.1.1. U.S.

13.2.1.2. Canada

13.2.2. By Culture Type

13.2.3. By End Product Form

13.2.4. By End Use

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Culture Type

13.3.3. By End Product Form

13.3.4. By End Use

13.4. Drivers and Restraints: Impact Analysis

14. Latin America Probiotic Ingredients Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

14.2.1. By Country

14.2.1.1. Brazil

14.2.1.2. Mexico

14.2.1.3. Chile

14.2.1.4. Peru

14.2.1.5. Argentina

14.2.1.6. Rest of Latin America

14.2.2. By Culture Type

14.2.3. By End Product Form

14.2.4. By End Use

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Culture Type

14.3.3. By End Product Form

14.3.4. By End Use

14.4. Drivers and Restraints: Impact Analysis

15. Europe Probiotic Ingredients Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

15.2.1. By Country

15.2.1.1. EU-4 (Germany, France, Italy, Spain)

15.2.1.2. U.K.

15.2.1.3. BENELUX

15.2.1.4. Nordic

15.2.1.5. Russia

15.2.1.6. Poland

15.2.1.7. Rest of Europe

15.2.2. By Culture Type

15.2.3. By End Product Form

15.2.4. By End Use

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Culture Type

15.3.3. By End Product Form

15.3.4. By End Use

15.4. Drivers and Restraints: Impact Analysis

16. APEJ Probiotic Ingredients Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

16.2.1. By Country

16.2.1.1. China

16.2.1.2. India

16.2.1.3. South Korea

16.2.1.4. ASEAN

16.2.2. By Culture Type

16.2.3. By End Product Form

16.2.4. By End Use

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Culture Type

16.3.3. By End Product Form

16.3.4. By End Use

16.4. Drivers and Restraints: Impact Analysis

17. Japan Probiotic Ingredients Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

17.2.1. By Culture Type

17.2.2. By End Product Form

17.2.3. By End Use

17.3. Market Attractiveness Analysis

17.3.1. By Culture Type

17.3.2. By End Product Form

17.3.3. By End Use

17.4. Drivers and Restraints: Impact Analysis

18. Oceania Probiotic Ingredients Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

18.2.1. By Culture Type

18.2.2. By End Product Form

18.2.3. By End Use

18.3. Market Attractiveness Analysis

18.3.1. By Culture Type

18.3.2. By End Product Form

18.3.3. By End Use

18.4. Drivers and Restraints: Impact Analysis

19. Middle East and Africa (MEA) Probiotic Ingredients Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Probiotic Ingredients Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2019-2028)

19.2.1. By Country

19.2.1.1. GCC Countries

19.2.1.2. South Africa

19.2.1.3. North Africa

19.2.1.4. Rest of MEA

19.2.2. By Culture Type

19.2.3. By End Product Form

19.2.4. By End Use

19.3. Market Attractiveness Analysis

19.3.1. By Country

19.3.2. By Culture Type

19.3.3. By End Product Form

19.3.4. By End Use

19.4. Drivers and Restraints: Impact Analysis

20. Competition Assessment

20.1. Global Probiotic Ingredients Market Competition - a Dashboard View

20.2. Global Probiotic Ingredients Market Structure Analysis

20.3. Global Probiotic Ingredients Market Company Share Analysis

20.3.1. For Tier 1 Market Players, 2017

20.3.2. Company Market Share Analysis of Top 10 Players, By Region

20.4. Key Participants Market Presence (Intensity Mapping) by Region

21. Brand Assessment

21.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

21.2. Probiotic Ingredients Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

21.3. Brand Strategy

22. Competition Deep-pe (Manufacturers/Suppliers)

22.1. Chr. Hansen A/S

22.1.1. Overview

22.1.2. Product Portfolio

22.1.3. Sales Footprint

22.1.4. Channel Footprint

22.1.4.1. Distributors List

22.1.4.2. Form (Clients)

22.1.5. Strategy Overview

22.1.5.1. Marketing Strategy

22.1.5.2. Culture Strategy

22.1.5.3. Channel Strategy

22.1.6. SWOT Analysis

22.1.7. Financial Analysis

22.1.8. Revenue Share

22.1.8.1. By Nature

22.1.8.2. By Region

22.1.9. Key Clients

22.1.10. Analyst Comments

22.2. Danisco A/S (E.I. du Pont de Nemours & Company)

22.2.1. Overview

22.2.2. Product Portfolio

22.2.3. Sales Footprint

22.2.4. Channel Footprint

22.2.4.1. Distributors List

22.2.4.2. Form (Clients)

22.2.5. Strategy Overview

22.2.5.1. Marketing Strategy

22.2.5.2. Culture Strategy

22.2.5.3. Channel Strategy

22.2.6. SWOT Analysis

22.2.7. Financial Analysis

22.2.8. Revenue Share

22.2.8.1. By Nature

22.2.8.2. By Region

22.2.9. Key Clients

22.2.10. Analyst Comments

22.3. Lallemand, Inc.

22.3.1. Overview

22.3.2. Product Portfolio

22.3.3. Sales Footprint

22.3.4. Channel Footprint

22.3.4.1. Distributors List

22.3.4.2. Form (Clients)

22.3.5. Strategy Overview

22.3.5.1. Marketing Strategy

22.3.5.2. Culture Strategy

22.3.5.3. Channel Strategy

22.3.6. SWOT Analysis

22.3.7. Financial Analysis

22.3.8. Revenue Share

22.3.8.1. By Nature

22.3.8.2. By Region

22.3.9. Key Clients

22.3.10. Analyst Comments

22.4. LeSaffre, S.A.

22.4.1. Overview

22.4.2. Product Portfolio

22.4.3. Sales Footprint

22.4.4. Channel Footprint

22.4.4.1. Distributors List

22.4.4.2. Form (Clients)

22.4.5. Strategy Overview

22.4.5.1. Marketing Strategy

22.4.5.2. Culture Strategy

22.4.5.3. Channel Strategy

22.4.6. SWOT Analysis

22.4.7. Financial Analysis

22.4.8. Revenue Share

22.4.8.1. By Nature

22.4.8.2. By Region

22.4.9. Key Clients

22.4.10. Analyst Comments

22.5. Probi AB

22.5.1. Overview

22.5.2. Product Portfolio

22.5.3. Sales Footprint

22.5.4. Channel Footprint

22.5.4.1. Distributors List

22.5.4.2. Form (Clients)

22.5.5. Strategy Overview

22.5.5.1. Marketing Strategy

22.5.5.2. Culture Strategy

22.5.5.3. Channel Strategy

22.5.6. SWOT Analysis

22.5.7. Financial Analysis

22.5.8. Revenue Share

22.5.8.1. By Nature

22.5.8.2. By Region

22.5.9. Key Clients

22.5.10. Analyst Comments

22.6. Novozymes A/S

22.6.1. Overview

22.6.2. Product Portfolio

22.6.3. Sales Footprint

22.6.4. Channel Footprint

22.6.4.1. Distributors List

22.6.4.2. Form (Clients)

22.6.5. Strategy Overview

22.6.5.1. Marketing Strategy

22.6.5.2. Culture Strategy

22.6.5.3. Channel Strategy

22.6.6. SWOT Analysis

22.6.7. Financial Analysis

22.6.8. Revenue Share

22.6.8.1. By Nature

22.6.8.2. By Region

22.6.9. Key Clients

22.6.10. Analyst Comments

22.7. Ganeden, Inc. (Kerry Plc)

22.7.1. Overview

22.7.2. Product Portfolio

22.7.3. Sales Footprint

22.7.4. Channel Footprint

22.7.4.1. Distributors List

22.7.4.2. Form (Clients)

22.7.5. Strategy Overview

22.7.5.1. Marketing Strategy

22.7.5.2. Culture Strategy

22.7.5.3. Channel Strategy

22.7.6. SWOT Analysis

22.7.7. Financial Analysis

22.7.8. Revenue Share

22.7.8.1. By Nature

22.7.8.2. By Region

22.7.9. Key Clients

22.7.10. Analyst Comments

22.8. Probiotics International Ltd. (Archer Daniels Midland)

22.8.1. Overview

22.8.2. Product Portfolio

22.8.3. Sales Footprint

22.8.4. Channel Footprint

22.8.4.1. Distributors List

22.8.4.2. Form (Clients)

22.8.5. Strategy Overview

22.8.5.1. Marketing Strategy

22.8.5.2. Culture Strategy

22.8.5.3. Channel Strategy

22.8.6. SWOT Analysis

22.8.7. Financial Analysis

22.8.8. Revenue Share

22.8.8.1. By Nature

22.8.8.2. By Region

22.8.9. Key Clients

22.8.10. Analyst Comments

22.9. Deerland Enzymes, Inc.

22.9.1. Overview

22.9.2. Product Portfolio

22.9.3. Sales Footprint

22.9.4. Channel Footprint

22.9.4.1. Distributors List

22.9.4.2. Form (Clients)

22.9.5. Strategy Overview

22.9.5.1. Marketing Strategy

22.9.5.2. Culture Strategy

22.9.5.3. Channel Strategy

22.9.6. SWOT Analysis

22.9.7. Financial Analysis

22.9.8. Revenue Share

22.9.8.1. By Nature

22.9.8.2. By Region

22.9.9. Key Clients

22.9.10. Analyst Comments

22.10. FutureCeuticals, Inc.

22.10.1. Overview

22.10.2. Product Portfolio

22.10.3. Sales Footprint

22.10.4. Channel Footprint

22.10.4.1. Distributors List

22.10.4.2. Form (Clients)

22.10.5. Strategy Overview

22.10.5.1. Marketing Strategy

22.10.5.2. Culture Strategy

22.10.5.3. Channel Strategy

22.10.6. SWOT Analysis

22.10.7. Financial Analysis

22.10.8. Revenue Share

22.10.8.1. By Nature

22.10.8.2. By Region

22.10.9. Key Clients

22.10.10. Analyst Comments

22.11. Sabinsa Corporation

22.11.1. Overview

22.11.2. Product Portfolio

22.11.3. Sales Footprint

22.11.4. Channel Footprint

22.11.4.1. Distributors List

22.11.4.2. Form (Clients)

22.11.5. Strategy Overview

22.11.5.1. Marketing Strategy

22.11.5.2. Culture Strategy

22.11.5.3. Channel Strategy

22.11.6. SWOT Analysis

22.11.7. Financial Analysis

22.11.8. Revenue Share

22.11.8.1. By Nature

22.11.8.2. By Region

22.11.9. Key Clients

22.11.10. Analyst Comments

22.12. Bifodan A/S

22.12.1. Overview

22.12.2. Product Portfolio

22.12.3. Sales Footprint

22.12.4. Channel Footprint

22.12.4.1. Distributors List

22.12.4.2. Form (Clients)

22.12.5. Strategy Overview

22.12.5.1. Marketing Strategy

22.12.5.2. Culture Strategy

22.12.5.3. Channel Strategy

22.12.6. SWOT Analysis

22.12.7. Financial Analysis

22.12.8. Revenue Share

22.12.8.1. By Nature

22.12.8.2. By Region

22.12.9. Key Clients

22.12.10. Analyst Comments

22.13. Others (On additional request)

22.13.1. Overview

22.13.2. Product Portfolio

22.13.3. Sales Footprint

22.13.4. Channel Footprint

22.13.4.1. Distributors List

22.13.4.2. Form (Clients)

22.13.5. Strategy Overview

22.13.5.1. Marketing Strategy

22.13.5.2. Culture Strategy

22.13.5.3. Channel Strategy

22.13.6. SWOT Analysis

22.13.7. Financial Analysis

22.13.8. Revenue Share

22.13.8.1. By Nature

22.13.8.2. By Region

22.13.9. Key Clients

22.13.10. Analyst Comments

23. Recommendation- Critical Success Factors

24. Research Methodology

25. Assumptions & Acronyms Used

List of Table

Table 1: Global Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Region, 2014-2027

Table 2: Global Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Region, 2014-2027

Table 3: Global Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 4: Global Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 5: Global Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 6: Global Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 7: Global Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 8: Global Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 9: Global Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 10: Global Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 11: North America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 12: North America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 13: North America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 14: North America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 15: North America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 16: North America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 17: North America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 18: North America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 19: North America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 20: North America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 21: Latin America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 22: Latin America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 23: Latin America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 24: Latin America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 25: Latin America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 26: Latin America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 27: Latin America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 28: Latin America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 29: Latin America Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 30 : Latin America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 31: Europe Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 32: Europe Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 33: Europe Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 34: Europe Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 35: Europe Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 36: Europe Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 37: Europe Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 38: Europe Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 39: Global Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 40: Global Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 41: APEJ Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 42: APEJ Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 43: APEJ Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 44: APEJ Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 45: APEJ Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 46: APEJ Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 47: APEJ Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 48: APEJ Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 49: APEJ Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 50: APEJ Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 51: Oceania Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 52: North America Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 53: Oceania Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 54: Oceania Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 55: Oceania Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 56: Oceania Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 57: Oceania Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 58: Oceania Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 59: Oceania Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 60: Oceania Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 61: Japan Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 62: Japan Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 63: Japan Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 64: Japan Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 65: Japan Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 66: Japan Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 67: Japan Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 68: Japan Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

Table 69: MEA Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Country, 2014-2027

Table 70: MEA Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Country, 2014-2027

Table 71: MEA Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by Product Type, 2014-2027

Table 72: MEA Probiotic Ingredients Market Volume (MT) Analysis and Forecast by Product Type, 2014-2027

Table 73: MEA Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 74: MEA Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Use, 2014-2027

Table 75: MEA Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 76: MEA Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Use, 2014-2027

Table 77: MEA Probiotic Ingredients Market Value (US$ Mn) Analysis and Forecast by End Product Form , 2014-2027

Table 78: MEA Probiotic Ingredients Market Volume (MT) Analysis and Forecast by End Product Form , 2014-2027

List of Figure

Figure 1: Global Probiotic Ingredients Market Value (US$ Mn) and Volume (MT) Forecast, 2019–2027

Figure 2: Global Probiotic Ingredients Market Absolute $ Opportunity (US$ Mn), 2019–2027

Figure 3: Global Probiotic Ingredients Market Share (%) & BPS Analysis by Region, 2019 & 2027

Figure 4: Global Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Region, 2019-2027

Figure 5: Global Probiotic Ingredients Market Value (US$ Mn) Analysis & Forecast by Region, 2019–2027

Figure 6: Global Probiotic Ingredients Market Attractiveness Index by Region, 2019-2027

Figure 7: Global Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 8: Global Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 9: Global Probiotic Ingredients Market Value (US$ Mn) Analysis & Forecast by Product Type, 2019–2027

Figure 10: Global Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 11: Global Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 12: Global Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 13: Global Probiotic Ingredients Market Value (US$ Mn) Analysis & Forecast by End Use, 2019–2027

Figure 14: Global Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 15: Global Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 16: Global Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 17: Global Probiotic Ingredients Market Value (US$ Mn) Analysis & Forecast by End Product Form, 2019–2027

Figure 18: Global Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 19: North America Probiotic Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 20: North America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 21: North America Probiotic Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 22: North America Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 23: North America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 24: North America Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 25: North America Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 26: North America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 27: North America Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 28: North America Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 29: North America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 30: North America Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 31: Latin America Probiotic Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 32: Latin America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 33: Latin America Probiotic Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 34: Latin America Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 35: Latin America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 36: Latin America Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 37: Latin America Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 38: Latin America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 39: Latin America Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 40: Latin America Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 41: Latin America Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 42: Latin America Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 43: Europe Probiotic Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 44: Europe Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 45: Europe Probiotic Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 46: Europe Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 47: Europe Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 48: Europe Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 49: Europe Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 50: Europe Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 51: Europe Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 52: Europe Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 53: Europe Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 54: Europe Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 55: APEJ Probiotic Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 56: APEJ Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 57: APEJ Probiotic Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 58: APEJ Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 59: APEJ Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 60: APEJ Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 61: APEJ Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 62: APEJ Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 63: APEJ Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 64: APEJ Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 65: APEJ Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 66: APEJ Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 67: Oceania Probiotic Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 68: Oceania Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 69: Oceania Probiotic Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 70: Oceania Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 71: Oceania Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 72: Oceania Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 73: Oceania Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 74: Oceania Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 75: Oceania Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 76: Oceania Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 77: Oceania Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 78: Oceania Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 79: Japan Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 80: Japan Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 81: Japan Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 82: Japan Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 83: Japan Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 84: Japan Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 85: Japan Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 86: Japan Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 87: Japan Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027

Figure 88: MEA Probiotic Ingredients Market Share (%) & BPS Analysis by Country, 2019 & 2027

Figure 89: MEA Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Country, 2019-2027

Figure 90: MEA Probiotic Ingredients Market Attractiveness Index by Country, 2019-2027

Figure 91: MEA Probiotic Ingredients Market Share (%) & BPS Analysis by Product Type, 2019 & 2027

Figure 92: MEA Probiotic Ingredients Market Y-o-Y Growth Rate (%) by Product Type, 2019-2027

Figure 93: MEA Probiotic Ingredients Market Attractiveness Index by Product Type, 2019-2027

Figure 94: MEA Probiotic Ingredients Market Share (%) & BPS Analysis by End Use, 2019 & 2027

Figure 95: MEA Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Use, 2019-2027

Figure 96: MEA Probiotic Ingredients Market Attractiveness Index by End Use, 2019-2027

Figure 97: MEA Probiotic Ingredients Market Share (%) & BPS Analysis by End Product Form, 2019 & 2027

Figure 98: MEA Probiotic Ingredients Market Y-o-Y Growth Rate (%) by End Product Form, 2019-2027

Figure 99: MEA Probiotic Ingredients Market Attractiveness Index by End Product Form, 2019-2027