As the COVID-19 outbreak is still prevalent in India, the contagion is likely to affect leather exports from India, which is considered to be the second-largest leather and leather goods producer in the world. This is expected to cause a slowdown in economic activities within the India printed leather market. Indian exporters are feeling the heat as certain overseas customers want shipments held back due to poor market sentiments. An increasing number of customers is expecting a slash in prices, owing to logistics issues such as cancellation of flights.

Even though leather products are being exported, many overseas customers have asked for curbs on consignments. Such findings are emerging as business challenges for stakeholders in the India printed leather market. The Indian exporters are facing problems in ferrying consignments to certain countries. Thus, stakeholders are adapting their production and trade activities as per the volatile demand and supply.

Customization of products is a fast growing phenomenon in the printed leather market. However, there are certain disadvantages to custom leather wallets, since it is potentially challenging to distinguish the method of obtaining materials for production. Moreover, the skin is exposed to possible mechanical damages such as scratching with a zipper or even a ring, which might damage it permanently. As such, customers are gaining awareness that natural leather custom wallets offer value for money. Brands are creating awareness among customers about proper care and maintenance of leather products.

Classic elegance and add-on in the wardrobe can be attributed to custom leather wallets. Teenagers and business professionals are opting for custom leather wallets, owing to the variety in color, texture, and design.

Printed leather jackets are the new rage in the global printed leather market. The increasing number of millennial, Gen Y, and Gen Z population is gravitating toward printed leather jackets. Justtanned is among the many online brands that are capitalizing on business opportunities through eCommerce websites with the help of digital marketing. Biker, quilted, casual, and formal leather jackets are growing popular among the male population. Bags, bagpacks, clutches, and laptop sleeves, among others, are being highly publicized for women.

Brands in the printed leather market are incorporating graffiti prints, notched collars, and belted waists to fulfil fashion demands of customers. Satchels and slings are other products that are helping manufacturers to expand their production and supply chains. Manufacturers are increasing their production capabilities in genuine leather jackets as well.

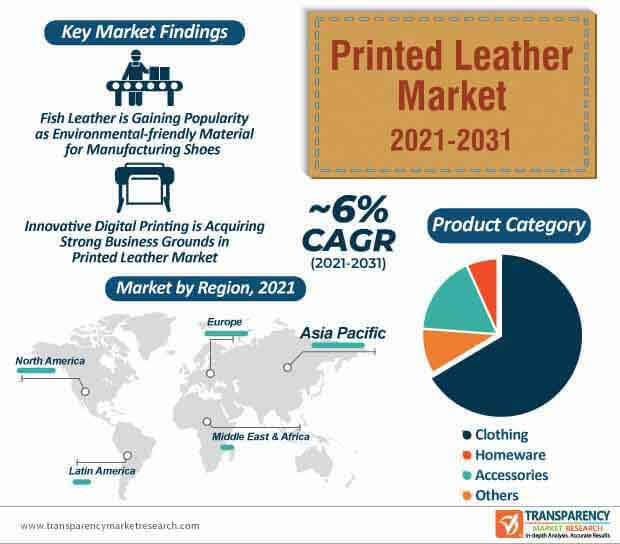

Fish leather is gaining popularity as an environment-friendly material for manufacturing shoes and clutches. Such innovations explain why the printed leather market is predicted to expand at a favorable CAGR of ~6% during the forecast period. The Fishskinlab project has been gaining recognition to generate a deeper understanding of fish leather as an alternative to conventional leather, which is encouraging customers to opt for sustainable fashion practices.

In order to boost credibility credentials, brands and manufacturers in the printed leather market are projected to increase their research and create aesthetically relevant fish leather products that illuminate sustainability thinking as a driver for innovation. Collaborations among researchers, analytical laboratories, and leather manufacturers are likely to increase the scope for fish leather products. Such collaborations are connecting fashion designers with scientists and leather technicians in order to advance in material innovations.

The printed leather market is projected to reach US$ 500 Mn by 2031. Ecology has been at the forefront of tanneries’ concerns. Whilst multiplying their innovations to surprise and inspire their clients, tanneries are making investments to save water & energy in order to process waste, effluents, and eliminate dangerous substances. Stakeholders are adhering to the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) standards that have helped to greatly reduce the impact of leather on the environment.

Companies in the printed leather market are aiming to acquire certification from various bodies working in the ecology sector such as the Italian, Masoni. The traceability of skins is increasingly becoming a reality in France and Italy.

Ink innovations is one of the key drivers contributing to the growth of the printed leather market. Staedtler - a manufacturer and supplier of writing, painting, drawing, and creative products, is expanding its portfolio in inks with the help of its Lumocolor Jet Ink meant for printed leather. Leather manufacturers are gaining awareness about such inks and expanding their focus on design, fashion, and decoration. They are using water-based ink to print leather without affecting the feel or look of the material in any way.

Accessories, shoes, furniture, and automobile industries are generating value grab opportunities for companies in the printed leather market. End users are making use of water-based inks to enhance the aesthetics of leather products. On the other hand, tanning methods are becoming more diverse in order to accommodate sustainable products of leather goods.

Innovative digital printing is gaining strong business grounds in the printed leather market. Stakeholders are acquiring proficiency in fine art printing, whilst protecting the environment. Agile srl - a creator of personalized printed leather products is gaining recognition for collaborating with prestigious fashion and interior design brands, since it strikes the right balance between sustainability and innovation. Innovative techniques and applications, including high frequency and direct printing, gloss, and 3D effects are gaining prominence in leather products.

Cambering and relief designs on shoes, bags, and apparel are translating into revenue opportunities for leather product manufacturers. Stakeholders are increasing efforts to adhere with the 4sustainability® Chemical Management Protocol to comply with environmental protection and consumer health guidelines. Such developments are gradually eliminating toxic and harmful chemicals in line with specifications from luxury brands.

Analysts’ Viewpoint

Since the travel & tourism industry has come to a standstill in many regions of the world, the sales of leather bagpacks, wallets, and jackets have been affected amid the ongoing COVID-19 outbreak. However, the ever-changing nature of furniture, apparel, and automobile industries has intensified competition for environment-friendly and sustainable production practices. Hence, stakeholders in the printed leather market should increase their focus on fish leather, metal-free calf leather, and the ZDHC - Zero Discharge of Hazardous Chemicals approach to boost their ecology and sustainability credentials. A high number of luxury brands is aiming to acquire REACH certifications and comply with GRS (Global Recycle Standard).

Printed Leather Market to Reach Valuation Of US$ 500 Mn By 2031

Globally, revenue generated by the printed leather market was valued at over US$ 250 Mn in 2020, which is expected to expand at a CAGR of ~6%, in terms of value, during the forecast period

Key factors that are driving the printed leather market growth include rising applications across furnishing, automotive, clothing, bags, and also artificial alternatives leather can also be used in marine furnishing as it is saltwater resistant is better comparatively.

The printed leather market in Asia Pacific is expected to expand at a fast-paced CAGR due to the significant growth in footwear and automobile industries in China and India. The leather market size in Asia Pacific was valued at US$ 123.1 Bn in 2019 and is expected to expand at a CAGR of 7.3% during the forecast period, in terms of value.

Key players operating in the global printed leather market include Agfa-Gevaert Group, Leather Hunte Pvt. Ltd., CMYKING, Bags Of Love, Contrado Imaging Ltd., MAHI Leather, Rainbow Leather, Negma Leather, Inc., Agile, and Leathergenix.

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.4.1. Digital Fabric Printing Market Overview

5.4.2. Overview of Leather Market

5.4.2.1. Raw Leather

5.4.2.2. Semi-finished Leather

5.4.2.3. Finished Leather

5.5. Printing Technology Overview & Analysis

5.5.1. Analog Printing (Screen Printing, Roto Gravure, etc.)

5.5.2. Digital Printing

5.5.2.1. Brand Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. Industry SWOT Analysis

5.9. COVID-19 Impact Analysis

5.10. Technology Analysis

5.11. Market Strategy

5.11.1. Entry Strategy

5.11.2. Entry Barriers

5.12. Global Printed Leather Market Analysis and Forecast, 2017 - 2031

5.12.1. Market Value Projections (US$ Bn)

5.12.2. Market Volume Projections (Mn Sq. Meter)

6. Global Printed Leather Market Analysis and Forecast, by Leather Type

6.1. Printed Leather Market (US$ Bn and Mn Sq. Meter), by Leather Type, 2017 - 2031

6.1.1. Real Leather

6.1.1.1. Printed

6.1.1.1.1. Analog

6.1.1.1.2. Digital

6.1.1.2. Without Print

6.1.2. Synthetic Leather

6.1.2.1. Printed

6.1.2.1.1. Analog

6.1.2.1.2. Digital

6.1.2.2. Without Print

6.2. Incremental Opportunity, by Leather Type

7. Global Printed Leather Market Analysis and Forecast, by Leather Category

7.1. Printed Leather Market (US$ Bn and Mn Sq. Meter), by Leather Category, 2017 - 2031

7.1.1. Real Leather

7.1.1.1. Bovine (Cattle)

7.1.1.2. Sheep

7.1.1.3. Lamb

7.1.1.4. Pigs

7.1.1.5. Goats

7.1.1.6. Others (Horses, etc.)

7.1.2. Synthetic Leather

7.1.2.1. Poly Vinyl Chloride (PVC) leather

7.1.2.2. Polyurethane leather (PU leather)

7.2. Incremental Opportunity, by Leather Category

8. Global Printed Leather Market Analysis and Forecast, by Product Category

8.1. Printed Leather Market (US$ Bn and Mn Sq. Meter), by Product Category , 2017 - 2031

8.1.1. Clothing

8.1.1.1. T Shirts

8.1.1.2. Trousers

8.1.1.3. Coats & Jackets

8.1.1.4. Skirts & Dresses

8.1.1.5. Footwear

8.1.1.6. Others

8.1.2. Homeware

8.1.2.1. Blankets

8.1.2.2. Curtains

8.1.2.3. Wall art & Prints

8.1.2.4. Upholstery

8.1.2.5. Decorative Accessories

8.1.3. Accessories

8.1.3.1. Handbags & Purses

8.1.3.2. Gloves

8.1.3.3. Bags & Wallets

8.1.3.4. Covers & Cases

8.1.3.5. Others

8.1.4. Others

8.1.4.1. Automotive

8.1.4.2. Sports Product

8.1.4.3. Holsters

8.2. Incremental Opportunity, by Product Category

9. Global Printed Leather Market Analysis and Forecast, by Region

9.1. Printed Leather Market (US$ Bn and Mn Sq. Meter), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Printed Leather Market Analysis and Forecast

10.1. Regional Snapshot

10.1.1. By Leather Type

10.1.2. By Leather Category

10.1.3. By Product Category

10.1.4. By Country

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Key Supplier Analysis

10.3.1. Distributors, Traders, and Dealers of the Printed Leather Market

10.4. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Type, 2017 - 2031

10.4.1. Real Leather

10.4.1.1. Printed

10.4.1.1.1. Analog

10.4.1.1.2. Digital

10.4.1.2. Without Print

10.4.2. Synthetic Leather

10.4.2.1. Printed

10.4.2.1.1. Analog

10.4.2.1.2. Digital

10.4.2.2. Without Print

10.5. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Category, 2017 - 2031

10.5.1. Real Leather

10.5.1.1. Bovine (Cattle)

10.5.1.2. Sheep

10.5.1.3. Lamb

10.5.1.4. Pigs

10.5.1.5. Goats

10.5.1.6. Others (Horses, etc.)

10.5.2. Synthetic Leather

10.5.2.1. Poly Vinyl Chloride (PVC) leather

10.5.2.2. Polyurethane leather (PU leather)

10.6. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Product Category, 2017 - 2031

10.6.1. Clothing

10.6.1.1. T Shirts

10.6.1.2. Trousers

10.6.1.3. Coats & Jackets

10.6.1.4. Skirts & Dresses

10.6.1.5. Footwear

10.6.1.6. Others

10.6.2. Homeware

10.6.2.1. Blankets

10.6.2.2. Curtains

10.6.2.3. Wall art & Prints

10.6.2.4. Upholstery

10.6.2.5. Decorative Accessories

10.6.3. Accessories

10.6.3.1. Handbags & Purses

10.6.3.2. Gloves

10.6.3.3. Bags & Wallets

10.6.3.4. Covers & Cases

10.6.3.5. Others

10.6.4. Others

10.6.4.1. Automotive

10.6.4.2. Sports Product

10.6.4.3. Holsters

10.7. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Country & Sub-region, 2017 - 2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Incremental Opportunity Analysis

11. Europe Printed Leather Market Analysis and Forecast

11.1. Regional Snapshot

11.1.1. By Leather Type

11.1.2. By Leather Category

11.1.3. By Product Category

11.1.4. By Country

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Supplier Analysis

11.3.1. Distributors, Traders, and Dealers of the Printed Leather Market

11.4. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Type, 2017 - 2031

11.4.1. Real Leather

11.4.1.1. Printed

11.4.1.1.1. Analog

11.4.1.1.2. Digital

11.4.1.2. Without Print

11.4.2. Synthetic Leather

11.4.2.1. Printed

11.4.2.1.1. Analog

11.4.2.1.2. Digital

11.4.2.2. Without Print

11.5. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Category, 2017 - 2031

11.5.1. Real Leather

11.5.1.1. Bovine (Cattle)

11.5.1.2. Sheep

11.5.1.3. Lamb

11.5.1.4. Pigs

11.5.1.5. Goats

11.5.1.6. Others (Horses, etc.)

11.5.2. Synthetic Leather

11.5.2.1. Poly Vinyl Chloride (PVC) leather

11.5.2.2. Polyurethane leather (PU leather)

11.6. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Product Category, 2017 - 2031

11.6.1. Clothing

11.6.1.1. T Shirts

11.6.1.2. Trousers

11.6.1.3. Coats & Jackets

11.6.1.4. Skirts & Dresses

11.6.1.5. Footwear

11.6.1.6. Others

11.6.2. Homeware

11.6.2.1. Blankets

11.6.2.2. Curtains

11.6.2.3. Wall art & Prints

11.6.2.4. Upholstery

11.6.2.5. Decorative Accessories

11.6.3. Accessories

11.6.3.1. Handbags & Purses

11.6.3.2. Gloves

11.6.3.3. Bags & Wallets

11.6.3.4. Covers & Cases

11.6.3.5. Others

11.6.4. Others

11.6.4.1. Automotive

11.6.4.2. Sports Product

11.6.4.3. Holsters

11.7. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Country & Sub-region, 2017 - 2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Incremental Opportunity Analysis

12. Asia Pacific Printed Leather Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Leather Type

12.1.2. By Leather Category

12.1.3. By Product Category

12.1.4. By Country

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Supplier Analysis

12.3.1. Distributors, Traders, and Dealers of the Printed Leather Market

12.4. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Type, 2017 - 2031

12.4.1. Real Leather

12.4.1.1. Printed

12.4.1.1.1. Analog

12.4.1.1.2. Digital

12.4.1.2. Without Print

12.4.2. Synthetic Leather

12.4.2.1. Printed

12.4.2.1.1. Analog

12.4.2.1.2. Digital

12.4.2.2. Without Print

12.5. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Category, 2017 - 2031

12.5.1. Real Leather

12.5.1.1. Bovine (Cattle)

12.5.1.2. Sheep

12.5.1.3. Lamb

12.5.1.4. Pigs

12.5.1.5. Goats

12.5.1.6. Others (Horses, etc.)

12.5.2. Synthetic Leather

12.5.2.1. Poly Vinyl Chloride (PVC) leather

12.5.2.2. Polyurethane leather (PU leather)

12.6. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Product Category, 2017 - 2031

12.6.1. Clothing

12.6.1.1. T Shirts

12.6.1.2. Trousers

12.6.1.3. Coats & Jackets

12.6.1.4. Skirts & Dresses

12.6.1.5. Footwear

12.6.1.6. Others

12.6.2. Homeware

12.6.2.1. Blankets

12.6.2.2. Curtains

12.6.2.3. Wall art & Prints

12.6.2.4. Upholstery

12.6.2.5. Decorative Accessories

12.6.3. Accessories

12.6.3.1. Handbags & Purses

12.6.3.2. Gloves

12.6.3.3. Bags & Wallets

12.6.3.4. Covers & Cases

12.6.3.5. Others

12.6.4. Others

12.6.4.1. Automotive

12.6.4.2. Sports Product

12.6.4.3. Holsters

12.7. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Country & Sub-region, 2017 - 2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. Rest of Asia Pacific

12.8. Incremental Opportunity Analysis

13. Middle East & Africa Printed Leather Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Leather Type

13.1.2. By Leather Category

13.1.3. By Product Category

13.1.4. By Country

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Supplier Analysis

13.3.1. Distributors, Traders, and Dealers of the Printed Leather Market

13.4. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Type, 2017 - 2031

13.4.1. Real Leather

13.4.1.1. Printed

13.4.1.1.1. Analog

13.4.1.1.2. Digital

13.4.1.2. Without Print

13.4.2. Synthetic Leather

13.4.2.1. Printed

13.4.2.1.1. Analog

13.4.2.1.2. Digital

13.4.2.2. Without Print

13.5. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Category, 2017 - 2031

13.5.1. Real Leather

13.5.1.1. Bovine (Cattle)

13.5.1.2. Sheep

13.5.1.3. Lamb

13.5.1.4. Pigs

13.5.1.5. Goats

13.5.1.6. Others (Horses, etc.)

13.5.2. Synthetic Leather

13.5.2.1. Poly Vinyl Chloride (PVC) leather

13.5.2.2. Polyurethane leather (PU leather)

13.6. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Product Category, 2017 - 2031

13.6.1. Clothing

13.6.1.1. T Shirts

13.6.1.2. Trousers

13.6.1.3. Coats & Jackets

13.6.1.4. Skirts & Dresses

13.6.1.5. Footwear

13.6.1.6. Others

13.6.2. Homeware

13.6.2.1. Blankets

13.6.2.2. Curtains

13.6.2.3. Wall art & Prints

13.6.2.4. Upholstery

13.6.2.5. Decorative Accessories

13.6.3. Accessories

13.6.3.1. Handbags & Purses

13.6.3.2. Gloves

13.6.3.3. Bags & Wallets

13.6.3.4. Covers & Cases

13.6.3.5. Others

13.6.4. Others

13.6.4.1. Automotive

13.6.4.2. Sports Product

13.6.4.3. Holsters

13.7. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Country & Sub-region, 2017 - 2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Incremental Opportunity Analysis

14. South America Printed Leather Market Analysis and Forecast

14.1. Regional Snapshot

14.1.1. By Leather Type

14.1.2. By Leather Category

14.1.3. By Product Category

14.1.4. By Country

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Supplier Analysis

14.3.1. Distributors, Traders, and Dealers of the Printed Leather Market

14.4. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Type, 2017 - 2031

14.4.1. Real Leather

14.4.1.1. Printed

14.4.1.1.1. Analog

14.4.1.1.2. Digital

14.4.1.2. Without Print

14.4.2. Synthetic Leather

14.4.2.1. Printed

14.4.2.1.1. Analog

14.4.2.1.2. Digital

14.4.2.2. Without Print

14.5. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Leather Category, 2017 - 2031

14.5.1. Real Leather

14.5.1.1. Bovine (Cattle)

14.5.1.2. Sheep

14.5.1.3. Lamb

14.5.1.4. Pigs

14.5.1.5. Goats

14.5.1.6. Others (Horses, etc.)

14.5.2. Synthetic Leather

14.5.2.1. Poly Vinyl Chloride (PVC) leather

14.5.2.2. Polyurethane leather (PU leather)

14.6. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Product Category, 2017 - 2031

14.6.1. Clothing

14.6.1.1. T Shirts

14.6.1.2. Trousers

14.6.1.3. Coats & Jackets

14.6.1.4. Skirts & Dresses

14.6.1.5. Footwear

14.6.1.6. Others

14.6.2. Homeware

14.6.2.1. Blankets

14.6.2.2. Curtains

14.6.2.3. Wall art & Prints

14.6.2.4. Upholstery

14.6.2.5. Decorative Accessories

14.6.3. Accessories

14.6.3.1. Handbags & Purses

14.6.3.2. Gloves

14.6.3.3. Bags & Wallets

14.6.3.4. Covers & Cases

14.6.3.5. Others

14.6.4. Others

14.6.4.1. Automotive

14.6.4.2. Sports Product

14.6.4.3. Holsters

14.7. Printed Leather Market (US$ Bn and Mn Sq. Meter) Forecast, By Country & Sub-region, 2017 - 2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2020)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Agfa-Gevaert Group

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. Agile

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. Bags Of Love

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. CMYKING

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Contrado Imaging Ltd.

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. Leather Hunte Pvt. Ltd.

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Leathergenix

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. MAHI Leather

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. Negma Leather, Inc.

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Rainbow Leather

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Leather Type

16.1.2. By Leather Category

16.1.3. By Product Category

16.1.4. By Region

16.2. Preferred Sales & Marketing Strategy

16.3. Prevailing Market Risk

List of Tables

Table 1: Global Printed Leather Market Volume Size & Forecast – By Leather Type (Mn Sq. Meter)

Table 2: Global Printed Leather Market Value Size & Forecast – By Leather Type (US$ Bn)

Table 3: Global Printed Leather Market Volume Size & Forecast – By Leather Category (Mn Sq. Meter)

Table 4: Global Printed Leather Market Value Size & Forecast – By Leather Category (US$ Bn)

Table 5: Global Printed Leather Market Volume Size & Forecast – By Product Category (Mn Sq. Meter)

Table 6: Global Printed Leather Market Value Size & Forecast – By Product Category (US$ Bn)

Table 7: Global Printed Leather Market Volume Size & Forecast – By Region (Mn Sq. Meter)

Table 8: Global Printed Leather Market Value Size & Forecast – By Region (US$ Bn)

Table 9: North America Printed Leather Market Volume Size & Forecast – By Leather Type (Mn Sq. Meter)

Table 10: North America Printed Leather Market Value Size & Forecast – By Leather Type (US$ Bn)

Table 11: North America Printed Leather Market Volume Size & Forecast – By Leather Category (Mn Sq. Meter)

Table 12: North America Printed Leather Market Value Size & Forecast – By Leather Category (US$ Bn)

Table 13: North America Printed Leather Market Volume Size & Forecast – By Product Category (Mn Sq. Meter)

Table 14: North America Printed Leather Market Value Size & Forecast – By Product Category (US$ Bn)

Table 15: North America Printed Leather Market Volume Size & Forecast – By Country (Mn Sq. Meter)

Table 16: North America Printed Leather Market Value Size & Forecast – By Country (US$ Bn)

Table 17: Europe Printed Leather Market Volume Size & Forecast – By Leather Type (Mn Sq. Meter)

Table 18: Europe Printed Leather Market Value Size & Forecast – By Leather Type (US$ Bn)

Table 19: Europe Printed Leather Market Volume Size & Forecast – By Leather Category (Mn Sq. Meter)

Table 20: Europe Printed Leather Market Value Size & Forecast – By Leather Category (US$ Bn)

Table 21: Europe Printed Leather Market Volume Size & Forecast – By Product Category (Mn Sq. Meter)

Table 22: Europe Printed Leather Market Value Size & Forecast – By Product Category (US$ Bn)

Table 23: Europe Printed Leather Market Volume Size & Forecast – By Country (Mn Sq. Meter)

Table 24: Europe Printed Leather Market Value Size & Forecast – By Country (US$ Bn)

Table 25: Asia Pacific Printed Leather Market Volume Size & Forecast – By Leather Type (Mn Sq. Meter)

Table 26: Asia Pacific Printed Leather Market Value Size & Forecast – By Leather Type (US$ Bn)

Table 27: Asia Pacific Printed Leather Market Volume Size & Forecast – By Leather Category (Mn Sq. Meter)

Table 28: Asia Pacific Printed Leather Market Value Size & Forecast – By Leather Category (US$ Bn)

Table 29: Asia Pacific Printed Leather Market Volume Size & Forecast – By Product Category (Mn Sq. Meter)

Table 30: Asia Pacific Printed Leather Market Value Size & Forecast – By Product Category (US$ Bn)

Table 31: Asia Pacific Printed Leather Market Volume Size & Forecast – By Country (Mn Sq. Meter)

Table 32: Asia Pacific Printed Leather Market Value Size & Forecast – By Country (US$ Bn)

Table 33: Middle East & Africa Printed Leather Market Volume Size & Forecast – By Leather Type (Mn Sq. Meter)

Table 34: Middle East & Africa Printed Leather Market Value Size & Forecast – By Leather Type (US$ Bn)

Table 35: Middle East & Africa Printed Leather Market Volume Size & Forecast – By Leather Category (Mn Sq. Meter)

Table 36: Middle East & Africa Printed Leather Market Value Size & Forecast – By Leather Category (US$ Bn)

Table 37: Middle East & Africa Printed Leather Market Volume Size & Forecast – By Product Category (Mn Sq. Meter)

Table 38: Middle East & Africa Printed Leather Market Value Size & Forecast – By Product Category (US$ Bn)

Table 39: Middle East & Africa Printed Leather Market Volume Size & Forecast – By Country (Mn Sq. Meter)

Table 40: Middle East & Africa Printed Leather Market Value Size & Forecast – By Country (US$ Bn)

Table 41: South America Printed Leather Market Volume Size & Forecast – By Leather Type (Mn Sq. Meter)

Table 42: South America Printed Leather Market Value Size & Forecast – By Leather Type (US$ Bn)

Table 43: South America Printed Leather Market Volume Size & Forecast – By Leather Category (Mn Sq. Meter)

Table 44: South America Printed Leather Market Value Size & Forecast – By Leather Category (US$ Bn)

Table 45: South America Printed Leather Market Volume Size & Forecast – By Product Category (Mn Sq. Meter)

Table 46: South America Printed Leather Market Value Size & Forecast – By Product Category (US$ Bn)

Table 47: South America Printed Leather Market Volume Size & Forecast – By Country (Mn Sq. Meter)

Table 48: South America Printed Leather Market Value Size & Forecast – By Country (US$ Bn)

List of Figures

Figure 1: Global Printed Leather Market Projections by Leather Type, Mn Sq. Meter, 2017-2031

Figure 2: Global Printed Leather Market Projections by Leather Type, US$ Bn, 2017-2031

Figure 3: Global Printed Leather Market, Incremental Opportunity, by Leather Type, US$ Bn

Figure 4: Global Printed Leather Market Projections by Leather Category, Mn Sq. Meter, 2017-2031

Figure 5: Global Printed Leather Market Projections by Leather Category, US$ Bn, 2017-2031

Figure 6: Global Printed Leather Market, Incremental Opportunity, by Leather Category, US$ Bn

Figure 7: Global Printed Leather Market Projections by Product Category, Mn Sq. Meter, 2017-2031

Figure 8: Global Printed Leather Market Projections by Product Category, US$ Bn, 2017-2031

Figure 9: Global Printed Leather Market, Incremental Opportunity, by Product Category, US$ Bn

Figure 10: Global Printed Leather Market Projections by Region, Mn Sq. Meter, 2017-2031

Figure 11: Global Printed Leather Market Projections by Region, US$ Bn, 2017-2031

Figure 12: Global Printed Leather Market, Incremental Opportunity, by Region, US$ Bn

Figure 13: North America Printed Leather Market Projections by Leather Type, Mn Sq. Meter, 2017-2031

Figure 14: North America Printed Leather Market Projections by Leather Type, US$ Bn, 2017-2031

Figure 15: North America Printed Leather Market, Incremental Opportunity, by Leather Type, US$ Bn

Figure 16: North America Printed Leather Market Projections by Leather Category, Mn Sq. Meter, 2017-2031

Figure 17: North America Printed Leather Market Projections by Leather Category, US$ Bn, 2017-2031

Figure 18: North America Printed Leather Market, Incremental Opportunity, by Leather Category, US$ Bn

Figure 19: North America Printed Leather Market Projections by Product Category, Mn Sq. Meter, 2017-2031

Figure 20: North America Printed Leather Market Projections by Product Category, US$ Bn, 2017-2031

Figure 21: North America Printed Leather Market, Incremental Opportunity, by Product Category, US$ Bn

Figure 22: North America Printed Leather Market Projections by Country, Mn Sq. Meter, 2017-2031

Figure 23: North America Printed Leather Market Projections by Country, US$ Bn, 2017-2031

Figure 24: North America Printed Leather Market, Incremental Opportunity, by Country, US$ Bn

Figure 25: Europe Printed Leather Market Projections by Leather Type, Mn Sq. Meter, 2017-2031

Figure 26: Europe Printed Leather Market Projections by Leather Type, US$ Bn, 2017-2031

Figure 27: Europe Printed Leather Market, Incremental Opportunity, by Leather Type, US$ Bn

Figure 28: Europe Printed Leather Market Projections by Leather Category, Mn Sq. Meter, 2017-2031

Figure 29: Europe Printed Leather Market Projections by Leather Category, US$ Bn, 2017-2031

Figure 30: Europe Printed Leather Market, Incremental Opportunity, by Leather Category, US$ Bn

Figure 31: Europe Printed Leather Market Projections by Product Category, Mn Sq. Meter, 2017-2031

Figure 32: Europe Printed Leather Market Projections by Product Category, US$ Bn, 2017-2031

Figure 33: Europe Printed Leather Market, Incremental Opportunity, by Product Category, US$ Bn

Figure 34: Europe Printed Leather Market Projections by Country, Mn Sq. Meter, 2017-2031

Figure 35: Europe Printed Leather Market Projections by Country, US$ Bn, 2017-2031

Figure 36: Europe Printed Leather Market, Incremental Opportunity, by Country, US$ Bn

Figure 37: Asia Pacific Printed Leather Market Projections by Leather Type, Mn Sq. Meter, 2017-2031

Figure 38: Asia Pacific Printed Leather Market Projections by Leather Type, US$ Bn, 2017-2031

Figure 39: Asia Pacific Printed Leather Market, Incremental Opportunity, by Leather Type, US$ Bn

Figure 40: Asia Pacific Printed Leather Market Projections by Leather Category, Mn Sq. Meter, 2017-2031

Figure 41: Asia Pacific Printed Leather Market Projections by Leather Category, US$ Bn, 2017-2031

Figure 42: Asia Pacific Printed Leather Market, Incremental Opportunity, by Leather Category, US$ Bn

Figure 43: Asia Pacific Printed Leather Market Projections by Product Category, Mn Sq. Meter, 2017-2031

Figure 44: Asia Pacific Printed Leather Market Projections by Product Category, US$ Bn, 2017-2031

Figure 45: Asia Pacific Printed Leather Market, Incremental Opportunity, by Product Category, US$ Bn

Figure 46: Asia Pacific Printed Leather Market Projections by Country, Mn Sq. Meter, 2017-2031

Figure 47: Asia Pacific Printed Leather Market Projections by Country, US$ Bn, 2017-2031

Figure 48: Asia Pacific Printed Leather Market, Incremental Opportunity, by Country, US$ Bn

Figure 49: Middle East & Africa Printed Leather Market Projections by Leather Type, Mn Sq. Meter, 2017-2031

Figure 50: Middle East & Africa Printed Leather Market Projections by Leather Type, US$ Bn, 2017-2031

Figure 51: Middle East & Africa Printed Leather Market, Incremental Opportunity, by Leather Type, US$ Bn

Figure 52: Middle East & Africa Printed Leather Market Projections by Leather Category, Mn Sq. Meter, 2017-2031

Figure 53: Middle East & Africa Printed Leather Market Projections by Leather Category, US$ Bn, 2017-2031

Figure 54: Middle East & Africa Printed Leather Market, Incremental Opportunity, by Leather Category, US$ Bn

Figure 55: Middle East & Africa Printed Leather Market Projections by Product Category, Mn Sq. Meter, 2017-2031

Figure 56: Middle East & Africa Printed Leather Market Projections by Product Category, US$ Bn, 2017-2031

Figure 57: Middle East & Africa Printed Leather Market, Incremental Opportunity, by Product Category, US$ Bn

Figure 58: Middle East & Africa Printed Leather Market Projections by Country, Mn Sq. Meter, 2017-2031

Figure 59: Middle East & Africa Printed Leather Market Projections by Country, US$ Bn, 2017-2031

Figure 60: Middle East & Africa Printed Leather Market, Incremental Opportunity, by Country, US$ Bn

Figure 61: South America Printed Leather Market Projections by Leather Type, Mn Sq. Meter, 2017-2031

Figure 62: South America Printed Leather Market Projections by Leather Type, US$ Bn, 2017-2031

Figure 63: South America Printed Leather Market, Incremental Opportunity, by Leather Type, US$ Bn

Figure 64: South America Printed Leather Market Projections by Leather Category, Mn Sq. Meter, 2017-2031

Figure 65: South America Printed Leather Market Projections by Leather Category, US$ Bn, 2017-2031

Figure 66: South America Printed Leather Market, Incremental Opportunity, by Leather Category, US$ Bn

Figure 67: South America Printed Leather Market Projections by Product Category, Mn Sq. Meter, 2017-2031

Figure 68: South America Printed Leather Market Projections by Product Category, US$ Bn, 2017-2031

Figure 69: South America Printed Leather Market, Incremental Opportunity, by Product Category, US$ Bn

Figure 70: South America Printed Leather Market Projections by Country, Mn Sq. Meter, 2017-2031

Figure 71: South America Printed Leather Market Projections by Country, US$ Bn, 2017-2031

Figure 72: South America Printed Leather Market, Incremental Opportunity, by Country, US$ Bn