Analysts’ Viewpoint

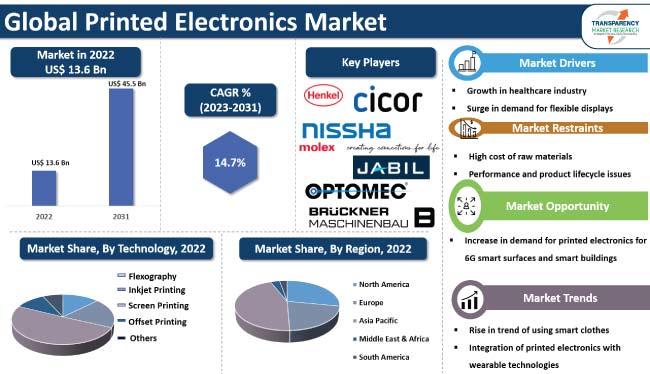

Surge in demand for flexible displays and growth in the healthcare industry are key factors driving the global market for printed electronics. Rise in adoption of OLEDs and lighting systems in consumer electronics, automotive, and signage industries is also contributing to market growth. Furthermore, wide adoption of printed sensors in environmental monitoring and home appliances is accelerating market progress.

Vendors of printed electronics are investing significantly in R&D activities to develop innovative materials and manufacturing processes. Some of the companies are collaborating with research institutions, technology providers, and end-user industries to develop new applications and solutions in order to grab lucrative printed electronics market opportunities.

Printed electronics is a printing process used to manufacture electronic devices on various substrates. This technology is gaining traction due to its ability to fabricate large-scale flexible electronics.

The choice of substrates, whether rigid or flexible, significantly influences the design of printed electronics devices. Some of the key benefits of printed electronics are high production speed, automation, and suitability for mass production.

Printed electronics allow for the manufacture of thin, flexible, lightweight, and affordable electronic products, which align with the development of modern electronic technology. High demand for thin film electronics is also boosting the global market dynamics. Cost-effectiveness of printed electronics makes it an attractive option, especially for applications such as antennas in handheld consumer devices, automobiles, and aircraft.

In consumer electronics, printed electronics are used to create flexible displays, electronic paper devices, decorative displays, OLED luminaires, sensing and signage for white goods, touch and functional surfaces, and wearables.

Printed electronics also enhance the features of vehicles. The market for printed electronics is expected to grow significantly in the near future, owing to the rise in demand for IoT devices, sensors, and displays across the globe.

The healthcare sector presents significant opportunities for printed electronics, as organizations seek innovative technologies to improve patient treatment and alleviate pressure on medical professionals.

Printed electronics, including biosensors and flexible printed heaters, offer cutting-edge solutions for faster recovery, early illness detection, and virtual healthcare. These advancements are augmenting the the demand for printed electronics in healthcare.

Printed flexible heaters are used in wound recovery bandages, while biometric sensors enable remote patient vital tracking, thus supporting the popularity of telemedicine. Wearable sensors manufactured using printed electronics enable continuous health monitoring. Remote patient monitoring using printed electronics allows healthcare professionals to track patient vitals remotely, thus reducing the need for travel and minimizing exposure to contagious environments.

Smart patches incorporating printed electronics aid in managing chronic illnesses. They help in continuous ECG tracking for individuals with heart conditions. This enhances patient comfort, reduces clinic visits, and eases strain on healthcare systems. Rise in healthcare spending across the globe is further accelerating the adoption of printed electronics.

Growth in demand for wearable devices and thin electronics is driving the usage of printed electronics for flexible displays. Organic light-emitting diode (OLED) displays are popular due to their thinness and light weight, making them ideal for high-quality media content.

Printed displays are predominantly used in consumer electronics, such as wearable and portable devices, where thinness and flexibility are crucial. Leading manufacturers adopt the OLED technology to develop a variety of flexible LED displays on paper, fabric, and plastic films, including transparent circuits. Rise in flexible printed electronics applications is contributing to the market growth.

In January 2021, TCL CSOT, a subsidiary of TCL Technology, launched a 17-inch printed OLED scrolling display and a 6.7-inch AMOLED rollable display at the Consumer Electronics Show (CES) 2021. These displays are highly scrollable and portable, and can easily fit anywhere, akin to scroll painting.

Manufacturers have also developed printed electrochromic displays on flexible conductive polymers, thus offering ultra-thinness, flexibility, robustness, and low power consumption. These displays can be integrated into smart products. Rise in trend of touchscreen and three-dimensional displays is further augmenting the demand for printed electronics.

The screen printing technology segment held significant market share in 2022. The segment is likely to maintain its leading position in the near future.

Screen printing can be performed on a wide range of substrates, including flexible materials such as plastics, paper, and textiles. This versatility enables the creation of flexible and conformable electronic devices suitable for diverse applications.

Screen printing is easily scalable, making it suitable for mass production of printed electronic devices. This scalability ensures consistent quality and cost-efficiency as production volume increases. Thus, screen printing technology is widely used in the manufacture of flexible displays, RFID tags, sensors, and even solar cells.

In terms of material, the global market has been classified into substrates and inks. As per the printed electronics market analysis, the inks segment accounted for major share in 2022. The segment is estimated to dominate during the forecast period.

The inks material segment can be further segmented into conductive inks, dielectric inks, and semiconductive inks. Conductive ink is used to print conductive traces, interconnects, and electrodes, thus enabling the flow of electrical current within electronic devices. This is essential for components such as antennas, heaters, and sensors.

Prominent types of conductive inks include flake-based silver, nanoparticle-based silver, gold, and copper, while applications include photovoltaics, flexible hybrid electronics (FHE), multiple types of printed sensors, in-mold electronics (IME), and RFID/smart packaging.

Asia Pacific dominated the global landscape with 44.6% share in 2022. According to the printed electronics market research analysis, the region is anticipated to lead the industry in the next few years.

Rise in demand for flexible and lightweight electronic devices is one of the key factors fueling market statistics in Asia Pacific. Several Asian countries, especially China, have established themselves as manufacturing hubs for printed electronic components due to lower production costs and well-developed electronics manufacturing ecosystem.

Japan and South Korea are known for their significant investments in research and development activities related to printed electronics. These investments are leading to innovation and development of new printed electronic technologies.

Increase in adoption of smart devices and rise in application of Internet of Things (IoT) in sectors such as healthcare, education, retail, entertainment, gaming, and security are further propelling the demand for printed electronics in Asia Pacific.

The printed electronics market size in North America is projected to increase during the forecast period, owing to the development of innovative consumer electronic products, especially in the U.S. Rise in trend of using advanced smartphones, virtual reality (VR) and augmented reality (AR) devices, and smart home technologies is also augmenting market expansion in the region.

Consumer wearables such as smartwatches, fitness trackers, and electronic textiles often incorporate printed electronics. Surge in usage of these devices in North America is fueling the printed electronics market growth in the region.

The global landscape is fragmented, with the presence of large numbers of vendors controlling the majority of the printed electronics market share. As per the latest printed electronics market forecast, several companies are likely to spend significantly on research activities and new product launches. Partnerships, new product development, and mergers are the key strategies implemented by leading players across the globe.

Brückner Maschinenbau GmbH & Co. KG, Cicor Management AG, DuraTech Industries, Heidelberger Druckmaschinen AG, Henkel AG & Co. KGaA, InkTec Co., Ltd., Jabil Inc., KOMURA-TECH CO., LTD., Molex LLC, Nissha Co., Ltd., Optomec, Inc., TRITEK CO., LTD., Witte Technology GmbH, and Ynvisible Interactive Inc. are some of the prominent players operating in the global market. These companies are following the latest printed electronics market trends to avail lucrative revenue opportunities.

Leading players have been profiled in the printed electronics market report based on parameters such as business strategies, latest developments, company overview, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 13.6 Bn |

| Market Forecast Value in 2031 | US$ 45.5 Bn |

| Growth Rate (CAGR) | 14.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 13.6 Bn in 2022

It is anticipated to advance at a CAGR of 14.7% by 2031

It would be worth US$ 45.5 Bn in 2031

The screen printing technology segment held major share in 2022

Growth in the healthcare industry and surge in demand for flexible displays

Asia Pacific is a more lucrative region for vendors

Brückner Maschinenbau GmbH & Co. KG, Cicor Management AG, DuraTech Industries, Heidelberger Druckmaschinen AG, Henkel AG & Co. KGaA, InkTec Co., Ltd., Jabil Inc., KOMURA-TECH CO., LTD., Molex LLC, Nissha Co., Ltd., Optomec, Inc., TRITEK CO., LTD., Witte Technology GmbH, and Ynvisible Interactive Inc.

1. Preface

1.1. Market and Segment Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Printed Electronics Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Electronics Manufacturing Industry Overview

4.2. Value Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

5. Global Printed Electronics Market Analysis By Technology

5.1. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

5.1.1. Flexography

5.1.2. Inkjet Printing

5.1.3. Screen Printing

5.1.4. Offset Printing

5.1.5. Others

5.2. Market Attractiveness Analysis, By Technology

6. Global Printed Electronics Market Analysis By Material

6.1. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Material, 2017-2031

6.1.1. Substrates

6.1.1.1. Organic Materials

6.1.1.1.1. Polymers

6.1.1.1.2. Papers

6.1.1.1.3. Fabrics

6.1.1.2. Inorganic Materials

6.1.1.2.1. Silicon

6.1.1.2.2. Glass

6.1.1.2.3. Metals

6.1.2. Inks

6.1.2.1. Conductive Inks

6.1.2.2. Dielectric Inks

6.1.2.3. Semiconductive Inks

6.2. Market Attractiveness Analysis, By Material

7. Global Printed Electronics Market Analysis By Application

7.1. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

7.1.1. Sensors & Switches

7.1.2. Displays

7.1.3. Medical Wearables

7.1.4. Photovoltaic Cells

7.1.5. Antennas

7.1.6. Heaters

7.1.7. In-Mold Electronics

7.1.8. Lighting

7.1.9. Others

7.2. Market Attractiveness Analysis, By Application

8. Global Printed Electronics Market Analysis By Industry Vertical

8.1. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Industry Vertical, 2017-2031

8.1.1. Automotive & Transportation

8.1.2. Consumer Electronics

8.1.3. Healthcare

8.1.4. Aerospace & Defense

8.1.5. Industrial

8.1.6. Others

8.2. Market Attractiveness Analysis, By Industry Vertical

9. Global Printed Electronics Market Analysis and Forecast, By Region

9.1. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Printed Electronics Market Analysis and Forecast

10.1. Market Snapshot

10.2. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

10.2.1. Flexography

10.2.2. Inkjet Printing

10.2.3. Screen Printing

10.2.4. Offset Printing

10.2.5. Others

10.3. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Material, 2017-2031

10.3.1. Substrates

10.3.1.1. Organic Materials

10.3.1.1.1. Polymers

10.3.1.1.2. Papers

10.3.1.1.3. Fabrics

10.3.1.2. Inorganic Materials

10.3.1.2.1. Silicon

10.3.1.2.2. Glass

10.3.1.2.3. Metals

10.3.2. Inks

10.3.2.1. Conductive Inks

10.3.2.2. Dielectric Inks

10.3.2.3. Semiconductive Inks

10.4. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Sensors & Switches

10.4.2. Displays

10.4.3. Medical Wearables

10.4.4. Photovoltaic Cells

10.4.5. Antennas

10.4.6. Heaters

10.4.7. In-Mold Electronics

10.4.8. Lighting

10.4.9. Others

10.5. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Industry Vertical, 2017-2031

10.5.1. Automotive & Transportation

10.5.2. Consumer Electronics

10.5.3. Healthcare

10.5.4. Aerospace & Defense

10.5.5. Industrial

10.5.6. Others

10.6. Printed Electronics Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Technology

10.7.2. By Material

10.7.3. By Application

10.7.4. By Industry Vertical

10.7.5. By Country/Sub-region

11. Europe Printed Electronics Market Analysis and Forecast

11.1. Market Snapshot

11.2. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

11.2.1. Flexography

11.2.2. Inkjet Printing

11.2.3. Screen Printing

11.2.4. Offset Printing

11.2.5. Others

11.3. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Material, 2017-2031

11.3.1. Substrates

11.3.1.1. Organic Materials

11.3.1.1.1. Polymers

11.3.1.1.2. Papers

11.3.1.1.3. Fabrics

11.3.1.2. Inorganic Materials

11.3.1.2.1. Silicon

11.3.1.2.2. Glass

11.3.1.2.3. Metals

11.3.2. Inks

11.3.2.1. Conductive Inks

11.3.2.2. Dielectric Inks

11.3.2.3. Semiconductive Inks

11.4. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Sensors & Switches

11.4.2. Displays

11.4.3. Medical Wearables

11.4.4. Photovoltaic Cells

11.4.5. Antennas

11.4.6. Heaters

11.4.7. In-Mold Electronics

11.4.8. Lighting

11.4.9. Others

11.5. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Industry Vertical, 2017-2031

11.5.1. Automotive & Transportation

11.5.2. Consumer Electronics

11.5.3. Healthcare

11.5.4. Aerospace & Defense

11.5.5. Industrial

11.5.6. Others

11.6. Printed Electronics Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. The U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Technology

11.7.2. By Material

11.7.3. By Application

11.7.4. By Industry Vertical

11.7.5. By Country/Sub-region

12. Asia Pacific Printed Electronics Market Analysis and Forecast

12.1. Market Snapshot

12.2. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

12.2.1. Flexography

12.2.2. Inkjet Printing

12.2.3. Screen Printing

12.2.4. Offset Printing

12.2.5. Others

12.3. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Material, 2017-2031

12.3.1. Substrates

12.3.1.1. Organic Materials

12.3.1.1.1. Polymers

12.3.1.1.2. Papers

12.3.1.1.3. Fabrics

12.3.1.2. Inorganic Materials

12.3.1.2.1. Silicon

12.3.1.2.2. Glass

12.3.1.2.3. Metals

12.3.2. Inks

12.3.2.1. Conductive Inks

12.3.2.2. Dielectric Inks

12.3.2.3. Semiconductive Inks

12.4. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Sensors & Switches

12.4.2. Displays

12.4.3. Medical Wearables

12.4.4. Photovoltaic Cells

12.4.5. Antennas

12.4.6. Heaters

12.4.7. In-Mold Electronics

12.4.8. Lighting

12.4.9. Others

12.5. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Industry Vertical, 2017-2031

12.5.1. Automotive & Transportation

12.5.2. Consumer Electronics

12.5.3. Healthcare

12.5.4. Aerospace & Defense

12.5.5. Industrial

12.5.6. Others

12.6. Printed Electronics Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Technology

12.7.2. By Material

12.7.3. By Application

12.7.4. By Industry Vertical

12.7.5. By Country/Sub-region

13. Middle East & Africa Printed Electronics Market Analysis and Forecast

13.1. Market Snapshot

13.2. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

13.2.1. Flexography

13.2.2. Inkjet Printing

13.2.3. Screen Printing

13.2.4. Offset Printing

13.2.5. Others

13.3. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Material, 2017-2031

13.3.1. Substrates

13.3.1.1. Organic Materials

13.3.1.1.1. Polymers

13.3.1.1.2. Papers

13.3.1.1.3. Fabrics

13.3.1.2. Inorganic Materials

13.3.1.2.1. Silicon

13.3.1.2.2. Glass

13.3.1.2.3. Metals

13.3.2. Inks

13.3.2.1. Conductive Inks

13.3.2.2. Dielectric Inks

13.3.2.3. Semiconductive Inks

13.4. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Sensors & Switches

13.4.2. Displays

13.4.3. Medical Wearables

13.4.4. Photovoltaic Cells

13.4.5. Antennas

13.4.6. Heaters

13.4.7. In-Mold Electronics

13.4.8. Lighting

13.4.9. Others

13.5. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Industry Vertical, 2017-2031

13.5.1. Automotive & Transportation

13.5.2. Consumer Electronics

13.5.3. Healthcare

13.5.4. Aerospace & Defense

13.5.5. Industrial

13.5.6. Others

13.6. Printed Electronics Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of the Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Technology

13.7.2. By Material

13.7.3. By Application

13.7.4. By Industry Vertical

13.7.5. By Country/Sub-region

14. South America Printed Electronics Market Analysis and Forecast

14.1. Market Snapshot

14.2. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Technology, 2017-2031

14.2.1. Flexography

14.2.2. Inkjet Printing

14.2.3. Screen Printing

14.2.4. Offset Printing

14.2.5. Others

14.3. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Material, 2017-2031

14.3.1. Substrates

14.3.1.1. Organic Materials

14.3.1.1.1. Polymers

14.3.1.1.2. Papers

14.3.1.1.3. Fabrics

14.3.1.2. Inorganic Materials

14.3.1.2.1. Silicon

14.3.1.2.2. Glass

14.3.1.2.3. Metals

14.3.2. Inks

14.3.2.1. Conductive Inks

14.3.2.2. Dielectric Inks

14.3.2.3. Semiconductive Inks

14.4. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

14.4.1. Sensors & Switches

14.4.2. Displays

14.4.3. Medical Wearables

14.4.4. Photovoltaic Cells

14.4.5. Antennas

14.4.6. Heaters

14.4.7. In-Mold Electronics

14.4.8. Lighting

14.4.9. Others

14.5. Printed Electronics Market Value (US$ Bn) Analysis & Forecast, By Industry Vertical, 2017-2031

14.5.1. Automotive & Transportation

14.5.2. Consumer Electronics

14.5.3. Healthcare

14.5.4. Aerospace & Defense

14.5.5. Industrial

14.5.6. Others

14.6. Printed Electronics Value (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Technology

14.7.2. By Material

14.7.3. By Application

14.7.4. By Industry Vertical

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Printed Electronics Market Competition Matrix - a Dashboard View

15.1.1. Global Printed Electronics Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Brückner Maschinenbau GmbH & Co. KG

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Cicor Management AG

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. DuraTech Industries

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Heidelberger Druckmaschinen AG

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Henkel AG & Co. KGaA

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. InkTec Co., Ltd.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Jabil Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. KOMURA-TECH CO., LTD.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Molex LLC

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Nissha Co., Ltd.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Optomec, Inc.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. TRITEK CO., LTD.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Witte Technology GmbH

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Ynvisible Interactive Inc.

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Printed Electronics Market Size & Forecast, By Technology, Value (US$ Bn), 2017-2031

Table 2: Global Printed Electronics Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 3: Global Printed Electronics Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 4: Global Printed Electronics Market Size & Forecast, By Industry Vertical, Value (US$ Bn), 2017-2031

Table 5: Global Printed Electronics Market Size & Forecast, By Region, Value (US$ Bn), 2017-2031

Table 6: North America Printed Electronics Market Size & Forecast, By Technology, Value (US$ Bn), 2017-2031

Table 7: North America Printed Electronics Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 8: North America Printed Electronics Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 9: North America Printed Electronics Market Size & Forecast, By Industry Vertical, Value (US$ Bn), 2017-2031

Table 10: North America Printed Electronics Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 11: Europe Printed Electronics Market Size & Forecast, By Technology, Value (US$ Bn), 2017-2031

Table 12: Europe Printed Electronics Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 13: Europe Printed Electronics Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 14: Europe Printed Electronics Market Size & Forecast, By Industry Vertical, Value (US$ Bn), 2017-2031

Table 15: Europe Printed Electronics Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 16: Asia Pacific Printed Electronics Market Size & Forecast, By Technology, Value (US$ Bn), 2017-2031

Table 17: Asia Pacific Printed Electronics Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 18: Asia Pacific Printed Electronics Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 19: Asia Pacific Printed Electronics Market Size & Forecast, By Industry Vertical, Value (US$ Bn), 2017-2031

Table 20: Asia Pacific Printed Electronics Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 21: Middle East & Africa Printed Electronics Market Size & Forecast, By Technology, Value (US$ Bn), 2017-2031

Table 22: Middle East & Africa Printed Electronics Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 23: Middle East & Africa Printed Electronics Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 24: Middle East & Africa Printed Electronics Market Size & Forecast, By Industry Vertical, Value (US$ Bn), 2017-2031

Table 25: Middle East & Africa Printed Electronics Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

Table 26: South America Printed Electronics Market Size & Forecast, By Technology, Value (US$ Bn), 2017-2031

Table 27: South America Printed Electronics Market Size & Forecast, By Material, Value (US$ Bn), 2017-2031

Table 28: South America Printed Electronics Market Size & Forecast, By Application, Value (US$ Bn), 2017-2031

Table 29: South America Printed Electronics Market Size & Forecast, By Industry Vertical, Value (US$ Bn), 2017-2031

Table 30: South America Printed Electronics Market Size & Forecast, By Country, Value (US$ Bn), 2017-2031

List of Figures

Figure 1: Global Printed Electronics Market Share Analysis, by Region

Figure 2: Global Printed Electronics Price Trend Analysis (Average Price, US$)

Figure 3: Global Printed Electronics Market, Value (US$ Bn), 2017-2031

Figure 4: Global Printed Electronics Market Size & Forecast, By Technology, Revenue (US$ Bn), 2017-2031

Figure 5: Global Printed Electronics Market Share Analysis, by Technology, 2023 and 2031

Figure 6: Global Printed Electronics Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 7: Global Printed Electronics Market Size & Forecast, By Material, Revenue (US$ Bn), 2017-2031

Figure 8: Global Printed Electronics Market Share Analysis, by Material, 2023 and 2031

Figure 9: Global Printed Electronics Market Attractiveness, By Material, Value (US$ Bn), 2023-2031

Figure 10: Global Printed Electronics Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 11: Global Printed Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Printed Electronics Market Attractiveness, By Application, Value (US$ Bn), 2023-2031

Figure 13: Global Printed Electronics Market Size & Forecast, By Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 14: Global Printed Electronics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 15: Global Printed Electronics Market Attractiveness, By Industry Vertical, Value (US$ Bn), 2023-2031

Figure 16: Global Printed Electronics Market Size & Forecast, By Region, Revenue (US$ Bn), 2017-2031

Figure 17: Global Printed Electronics Market Share Analysis, by Region, 2023 and 2031

Figure 18: Global Printed Electronics Market Attractiveness, By Region, Value (US$ Bn), 2023-2031

Figure 19: North America Printed Electronics Market Size & Forecast, By Technology, Revenue (US$ Bn), 2017-2031

Figure 20: North America Printed Electronics Market Share Analysis, by Technology, 2023 and 2031

Figure 21: North America Printed Electronics Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 22: North America Printed Electronics Market Size & Forecast, By Material, Revenue (US$ Bn), 2017-2031

Figure 23: North America Printed Electronics Market Share Analysis, by Material, 2023 and 2031

Figure 24: North America Printed Electronics Market Attractiveness, By Material, Value (US$ Bn), 2023-2031

Figure 25: North America Printed Electronics Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 26: North America Printed Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 27: North America Printed Electronics Market Attractiveness, By Application, Value (US$ Bn), 2023-2031

Figure 28: North America Printed Electronics Market Size & Forecast, By Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 29: North America Printed Electronics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 30: North America Printed Electronics Market Attractiveness, By Industry Vertical, Value (US$ Bn), 2023-2031

Figure 31: North America Printed Electronics Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 32: North America Printed Electronics Market Share Analysis, by Country 2023 and 2031

Figure 33: North America Printed Electronics Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 34: Europe Printed Electronics Market Size & Forecast, By Technology, Revenue (US$ Bn), 2017-2031

Figure 35: Europe Printed Electronics Market Share Analysis, by Technology, 2023 and 2031

Figure 36: Europe Printed Electronics Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 37: Europe Printed Electronics Market Size & Forecast, By Material, Revenue (US$ Bn), 2017-2031

Figure 38: Europe Printed Electronics Market Share Analysis, by Material, 2023 and 2031

Figure 39: Europe Printed Electronics Market Attractiveness, By Material, Value (US$ Bn), 2023-2031

Figure 40: Europe Printed Electronics Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 41: Europe Printed Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 42: Europe Printed Electronics Market Attractiveness, By Application, Value (US$ Bn), 2023-2031

Figure 43: Europe Printed Electronics Market Size & Forecast, By Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 44: Europe Printed Electronics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 45: Europe Printed Electronics Market Attractiveness, By Industry Vertical, Value (US$ Bn), 2023-2031

Figure 46: Europe Printed Electronics Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 47: Europe Printed Electronics Market Share Analysis, by Country 2023 and 2031

Figure 48: Europe Printed Electronics Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Printed Electronics Market Size & Forecast, By Technology, Revenue (US$ Bn), 2017-2031

Figure 50: Asia Pacific Printed Electronics Market Share Analysis, by Technology, 2023 and 2031

Figure 51: Asia Pacific Printed Electronics Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Printed Electronics Market Size & Forecast, By Material, Revenue (US$ Bn), 2017-2031

Figure 53: Asia Pacific Printed Electronics Market Share Analysis, by Material, 2023 and 2031

Figure 54: Asia Pacific Printed Electronics Market Attractiveness, By Material, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Printed Electronics Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 56: Asia Pacific Printed Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 57: Asia Pacific Printed Electronics Market Attractiveness, By Application, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Printed Electronics Market Size & Forecast, By Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 59: Asia Pacific Printed Electronics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 60: Asia Pacific Printed Electronics Market Attractiveness, By Industry Vertical, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Printed Electronics Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 62: Asia Pacific Printed Electronics Market Share Analysis, by Country 2023 and 2031

Figure 63: Asia Pacific Printed Electronics Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Printed Electronics Market Size & Forecast, By Technology, Revenue (US$ Bn), 2017-2031

Figure 65: Middle East & Africa Printed Electronics Market Share Analysis, by Technology, 2023 and 2031

Figure 66: Middle East & Africa Printed Electronics Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Printed Electronics Market Size & Forecast, By Material, Revenue (US$ Bn), 2017-2031

Figure 68: Middle East & Africa Printed Electronics Market Share Analysis, by Material, 2023 and 2031

Figure 69: Middle East & Africa Printed Electronics Market Attractiveness, By Material, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Printed Electronics Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 71: Middle East & Africa Printed Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 72: Middle East & Africa Printed Electronics Market Attractiveness, By Application, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Printed Electronics Market Size & Forecast, By Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 74: Middle East & Africa Printed Electronics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 75: Middle East & Africa Printed Electronics Market Attractiveness, By Industry Vertical, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Printed Electronics Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 77: Middle East & Africa Printed Electronics Market Share Analysis, by Country 2023 and 2031

Figure 78: Middle East & Africa Printed Electronics Market Attractiveness, By Country Value (US$ Bn), 2023-2031

Figure 79: South America Printed Electronics Market Size & Forecast, By Technology, Revenue (US$ Bn), 2017-2031

Figure 80: South America Printed Electronics Market Share Analysis, by Technology, 2023 and 2031

Figure 81: South America Printed Electronics Market Attractiveness, By Technology, Value (US$ Bn), 2023-2031

Figure 82: South America Printed Electronics Market Size & Forecast, By Material, Revenue (US$ Bn), 2017-2031

Figure 83: South America Printed Electronics Market Share Analysis, by Material, 2023 and 2031

Figure 84: South America Printed Electronics Market Attractiveness, By Material, Value (US$ Bn), 2023-2031

Figure 85: South America Printed Electronics Market Size & Forecast, By Application, Revenue (US$ Bn), 2017-2031

Figure 86: South America Printed Electronics Market Share Analysis, by Application, 2023 and 2031

Figure 87: South America Printed Electronics Market Attractiveness, By Application, Value (US$ Bn), 2023-2031

Figure 88: South America Printed Electronics Market Size & Forecast, By Industry Vertical, Revenue (US$ Bn), 2017-2031

Figure 89: South America Printed Electronics Market Share Analysis, by Industry Vertical, 2023 and 2031

Figure 90: South America Printed Electronics Market Attractiveness, By Industry Vertical, Value (US$ Bn), 2023-2031

Figure 91: South America Printed Electronics Market Size & Forecast, By Country Revenue (US$ Bn), 2017-2031

Figure 92: South America Printed Electronics Market Share Analysis, by Country 2023 and 2031

Figure 93: South America Printed Electronics Market Attractiveness, By Country Value (US$ Bn), 2023-2031