Analysts’ Viewpoint

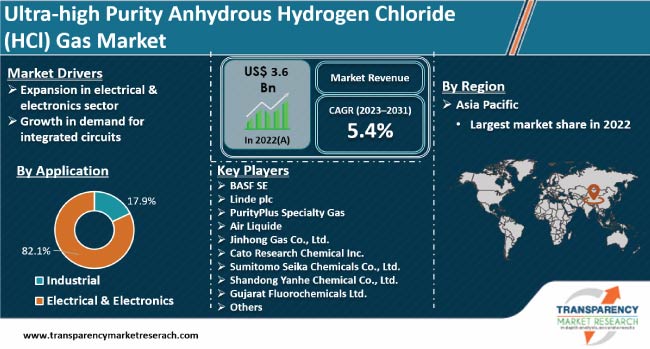

The future of the ultra-high purity anhydrous hydrogen chloride (HCl) gas market appears promising owing to expansion in the electrical & electronics sector. Growth in demand for integrated circuits is also projected to boost the demand for ultra-high purity anhydrous HCl gas in the near future.

Ultra-high purity HCl gas is widely employed in various operations in electrical & electronics and chemicals sectors. R&D in gas purification and handling is anticipated to offer lucrative opportunities to players in the global ultra-high purity anhydrous hydrogen chloride (HCl) gas industry. Vendors are providing customized solutions to expand their customer base and increase their ultra-high purity anhydrous hydrogen chloride (HCl) gas market share.

Ultra-high purity anhydrous hydrogen chloride gas is widely employed in a variety of industrial processes, such as semiconductor production and chemical synthesis, due to its remarkable purity levels and low moisture content.

Rise in demand for high-quality chemicals in several industries is projected to spur the ultra-high purity anhydrous hydrogen chloride (HCl) gas market growth during the forecast period. Ultra-high purity anhydrous HCl gas is used in various industries, including semiconductors, electrical & electronics, medicines, and laboratories. It is critical in assuring the integrity and quality of finished products in these sectors.

Communications equipment, computer hardware and software, consumer electronics, household appliances, and photography equipment are gaining traction worldwide, especially in China, Japan, and South Korea. Rise in adoption of electronic gadgets is expected to augment the ultra-high purity anhydrous hydrogen chloride (HCl) gas market value in the near future.

Ultra-high purity anhydrous HCL gas is widely utilized in the electrical & electronics sector. It is used in scouring furnaces (quartz chambers) and selective etching of windows in electronic microcircuits. It is also employed as a gaseous chloride carrier for non-volatile components. Ultra-high purity anhydrous HCL gas may also be dissolved in water and employed as an aqueous cleaning agent before electroplating metal surfaces.

Governments of several countries across the globe are investing significantly in the semiconductor sector. China is seeking to reduce its reliance on foreign chip manufacturers and increase its integrated circuit self-sufficiency to 70% by 2025. The Government of China plans to invest US$ 150.0 Bn in the semiconductor sector over the next few years.

South Korea plans to invest around US$ 1.3 Bn in next-generation semiconductor technologies by 2024. The country’s Ministry of Trade, Industry, and Energy recently announced plans to invest US$ 1.3 Bn in the development of cutting-edge semiconductor materials and technology to position South Korea as a worldwide semiconductor powerhouse. Such government initiatives and surge in demand for high-quality semiconductor devices are fueling the ultra-high purity anhydrous hydrogen chloride (HCl) gas market progress. Growth in demand for ultra-high purity anhydrous HCl gas has led to a rise in the cost of high-purity polysilicon.

Ultra-high purity anhydrous HCl gas manufacturers are likely to benefit significantly from economic development in Asia Pacific, notably in India and ASEAN nations. Significant FDIs and efforts, such as India's digitalization drive, are expected to boost the consumer electronics industry, thereby driving the ultra-high purity anhydrous hydrogen chloride (HCl) gas market size.

In the fabrication of integrated circuits, ultra-high purity anhydrous HCl gas is used for silicon etching, passivation, and epitaxy. It is also employed in metal smelting, optical communication, and scientific research.

Hydrogen chloride must have a minimal quantity of organic impurities to be suitable for usage in the electrical & electronics sector. Several strategies, with varying degrees of efficiency, have been used in the past to reduce the concentration of organic molecules, such as chlorinated compounds in hydrogen chloride. This highlights the rise in demand for ultra-high-purity anhydrous hydrogen chloride gas.

Recent advances in conventional technologies have led to a surge in purity standards of electronics specialized gases. A unique cylinder technique, with built-in purification, can be used to obtain higher purity and consistency in these gases. Additionally, the purity of hydrogen chloride has become increasingly important with the advent of large-scale integrated circuits. Progressively stringent limitations forced on the content of hydrocarbons and carbon oxides in wafer processing are also propelling the ultra-high purity anhydrous hydrogen chloride (HCl) gas market statistics.

The semiconductor sector is highly competitive. Rapid increase in IC and PCB fabrication is driving the demand for ultra-pure gases such as ultra-high purity anhydrous HCl gas. Surge in adoption of display flat panels is boosting the need for ultra-high purity anhydrous HCl gas for chamber cleaning. Ultra-pure anhydrous HCl gas can be employed to shorten cleaning cycles and reduce the carbon footprint of production processes.

LED solid-state lighting is gaining traction owing to its uses in LCD TV backlighting and low-power general illumination. LED producers rely extensively on nitrogen, high-purity ammonia, ultra-high purity anhydrous HCl gas, and hydrides to improve efficiency and flexibility in manufacturing. This indicates promising ultra-high purity anhydrous hydrogen chloride (HCl) gas market opportunity for vendors.

According to the latest ultra-high purity anhydrous hydrogen chloride (HCL) gas market forecast, Asia Pacific is expected to hold the largest share from 2023 to 2031. The region accounted for 45.3% share in 2022. Expansion in the electrical & electronics sector is driving the market dynamics of the region.

China, Japan, South Korea, and Taiwan are major manufacturing hubs of electronic devices. Significant FDI investments and rapid digitalization are propelling India's economy. Growth in automotive and telecommunications industries is fueling market expansion in Asia Pacific.

The business in North America is projected to grow at a steady pace in the near future. Presence of a well-established electrical & electronics sector is augmenting the market trajectory in the region. The U.S. is a prominent market for ultra-high purity HCI gas in North America, led by the presence of several semiconductor manufacturers, electronic component suppliers, and technology firms in the country.

Expansion in electrical & electronics and automotive industries in Germany, France, and the U.K. is driving the ultra-high purity anhydrous hydrogen chloride (HCl) gas market revenue in Europe. The industry in Latin America and Middle East & Africa is anticipated to grow at a steady pace during the forecast period.

The global landscape is characterized by intense rivalry, with the presence of multiple competitors. Most companies are investing significantly in the R&D of new products to stay competitive in the market.

BASF SE, Linde plc, PurityPlus Specialty Gas, Air Liquide, Jinhong Gas Co., Ltd., Cato Research Chemical Inc., Sumitomo Seika Chemicals Co., Ltd., Shandong Yanhe Chemical Co., Ltd., Gujarat Fluorochemicals Ltd., Shandong Weitai Fine Chemical Co., Ltd., Zibo Dijia Special Gas Co., Ltd., and ChemGas Korea are key entities operating in this industry.

Each of these companies has been profiled in the ultra-high purity anhydrous hydrogen chloride (HCl) gas market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 3.6 Bn |

| Forecast Value in 2031 | US$ 5.7 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2018-2022 |

| Quantitative Tons | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 3.6 Bn in 2022

It is projected to grow at a CAGR of 5.4% from 2023 to 2031

Expansion in electrical & electronics sector and growth in demand for integrated circuits

Electrical & electronics was the largest application segment in 2022

Asia Pacific recorded the highest demand in 2022

BASF SE, Linde plc, PurityPlus Specialty Gas, Air Liquide, Jinhong Gas Co., Ltd., Cato Research Chemical Inc., Sumitomo Seika Chemicals Co., Ltd., Shandong Yanhe Chemical Co., Ltd., Gujarat Fluorochemicals Ltd., Shandong Weitai Fine Chemical Co., Ltd., Zibo Dijia Special Gas Co., Ltd., and ChemGas Korea

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, 2023-2031

2.6.1. Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons)

2.6.2. Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Component Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas

3.2. Impact on Demand for Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas - Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Region

7. Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, by Application, 2023-2031

7.1. Introduction and Definitions

7.2. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

7.2.1. Industrial

7.2.2. Electrical & Electronics

7.3. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

8. Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, by Region, 2023-2031

8.1. Key Findings

8.2. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Region

9. North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, 2023-2031

9.1. Key Findings

9.2. North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

9.3. North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

9.3.1. U.S. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

9.3.2. Canada Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

9.4. North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness Analysis

10. Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.3. Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

10.3.1. Germany Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.3.2. France Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.3.3. U.K. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.3.4. Italy Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.3.5. Russia & CIS Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.3.6. Rest of Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.4. Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness Analysis

11. Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application

11.3. Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

11.3.1. China Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.3.2. Japan Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.3.3. India Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.3.4. ASEAN Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.3.5. Rest of Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4. Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness Analysis

12. Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.3. Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

12.3.1. Brazil Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.3.2. Mexico Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.3.3. Rest of Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4. Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness Analysis

13. Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.3. Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.3.1. GCC Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.3.2. South Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.3.3. Rest of Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.4. Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness Analysis

14. Competition Landscape

14.1. Market Players - Competition Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, 2022

14.3. Market Footprint Analysis

14.3.1. By Application

14.4. Company Profiles

14.4.1. BASF SE

14.4.1.1. Company Revenue

14.4.1.2. Business Overview

14.4.1.3. Product Segments

14.4.1.4. Geographic Footprint

14.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.2. Linde plc

14.4.2.1. Company Revenue

14.4.2.2. Business Overview

14.4.2.3. Product Segments

14.4.2.4. Geographic Footprint

14.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.3. PurityPlus Specialty Gas

14.4.3.1. Company Revenue

14.4.3.2. Business Overview

14.4.3.3. Product Segments

14.4.3.4. Geographic Footprint

14.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.4. Air Liquide

14.4.4.1. Company Revenue

14.4.4.2. Business Overview

14.4.4.3. Product Segments

14.4.4.4. Geographic Footprint

14.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.5. Jinhong Gas Co., Ltd.

14.4.5.1. Company Revenue

14.4.5.2. Business Overview

14.4.5.3. Product Segments

14.4.5.4. Geographic Footprint

14.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.6. Cato Research Chemicals Inc.

14.4.6.1. Company Revenue

14.4.6.2. Business Overview

14.4.6.3. Product Segments

14.4.6.4. Geographic Footprint

14.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.7. Sumitomo Seika Chemicals Co., Ltd.

14.4.7.1. Company Revenue

14.4.7.2. Business Overview

14.4.7.3. Product Segments

14.4.7.4. Geographic Footprint

14.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.8. Shandong Yanhe Chemical Co., Ltd.

14.4.8.1. Company Revenue

14.4.8.2. Business Overview

14.4.8.3. Product Segments

14.4.8.4. Geographic Footprint

14.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.9. Gujarat Fluorochemcals Ltd.

14.4.9.1. Company Revenue

14.4.9.2. Business Overview

14.4.9.3. Product Segments

14.4.9.4. Geographic Footprint

14.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.10. Shandong Weitai Fine Chemical Co., Ltd.

14.4.10.1. Company Revenue

14.4.10.2. Business Overview

14.4.10.3. Product Segments

14.4.10.4. Geographic Footprint

14.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.11. Zibo Dijia Special Gas Co., Ltd.

14.4.11.1. Company Revenue

14.4.11.2. Business Overview

14.4.11.3. Product Segments

14.4.11.4. Geographic Footprint

14.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.4.12. ChemGas Korea

14.4.12.1. Company Revenue

14.4.12.2. Business Overview

14.4.12.3. Product Segments

14.4.12.4. Geographic Footprint

14.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 2: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 3: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Region, 2023-2031

Table 4: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 5: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 6: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 7: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Country, 2023-2031

Table 8: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 9: U.S. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 10: U.S. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 11: Canada Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 12: Canada Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 13: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 14: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 15: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 16: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 17: Germany Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 18: Germany Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 19: France Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 20: France Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 21: U.K. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 22: U.K. Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 23: Italy Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 24: Italy Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 25: Spain Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 26: Spain Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 27: Russia & CIS Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 28: Russia & CIS Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 29: Rest of Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 30: Rest of Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 31: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 32: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 33: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 34: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 35: China Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 36: China Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 37: Japan Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 38: Japan Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 39: India Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 40: India Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 41: ASEAN Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 42: ASEAN Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 43: Rest of Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 44: Rest of Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 45: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 46: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 47: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 48: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 49: Brazil Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 50: Brazil Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 51: Mexico Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 52: Mexico Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 53: Rest of Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 55: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 56: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 57: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 58: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 59: GCC Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 60: GCC Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 61: South Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 62: South Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 63: Rest of Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume (Tons) Forecast, by Application, 2023-2031

Table 64: Rest of Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Value (US$ Bn) Forecast, by Application, 2023-2031

List of Figures

Figure 1: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 2: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

Figure 3: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Global Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Region

Figure 5: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

Figure 7: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 8: North America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Country and Sub-region

Figure 9: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

Figure 11: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 14: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

Figure 15: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 18: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

Figure 19: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Application

Figure 23: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Ultra-high Purity Anhydrous Hydrogen Chloride (HCl) Gas Market Attractiveness, by Country and Sub-region