Analysts’ Viewpoint on Unified Communication-as-a-Service (UCaaS) Market Scenario

Availability of low-priced smartphones, increase in internet penetration, and rise in adoption of digital platforms that enable remote work are propelling the global Unified Communication-as-a-Service (UCaaS) market. IP-PBX manufacturing companies provide unified communication and collaboration capabilities to smartphones through mobile client software. Mobile unified communications offer flexibility to connect from anywhere around the globe. This helps increase productivity and improve employee collaboration. Increase in significance of API-driven programmable communication features is also driving the global Unified Communication-as-a-Service (UCaaS) market. Public sector companies are deploying unified communications technology to enhance their services. UCaaS solutions reduce the total cost of ownership of companies, owing to the pricing model adopted by providers that suits end-user requirements within the existing IT infrastructure.

Unified Communication-as-a-Service (UCaaS) is a cloud-based software that charges a monthly subscription for the web-based interface, communication on the go, and customization & integration. It is ideal for contact center operations, continuous support, and reporting & analytics. Various organizations implement cloud-based unified communications platforms due to their lower cost compared to traditional Private Branch Exchange (PBX) systems. UCaaS provides all unified communications and collaboration tools on a single platform.

UCaaS solutions include unified messaging, team collaboration, presence technology (instant messaging), telephony, online meetings, and conferencing. UCaaS works as a subscription service with minimal or no initial charges. Various SMEs as well as large enterprises adopt UCaaS solutions due to their low cost and cloud-based nature.

There are several benefits of unified communications technology. UCaaS solutions support mobility, provide flexibility, and increase productivity across businesses. Organizations can hold online meetings using video conferencing and audio conferencing with the support of UCaaS solutions. Business applications are equipped with audio, programmable video, messaging, and other services that help industrialize the engagement process. These built-in features enable developers to showcase the application's most important and prominent features.

Enterprises can implement unified communications at minimal cost compared to on-premises PBX systems due to development of cloud-based unified communications, which provide employees the flexibility to connect at any location and any time. UCaaS solutions use software from externally hosted infrastructure and charge for a monthly subscription, thereby reducing TCO. These features improve collaboration, productivity, and job satisfaction of employees while reducing their travel expenses. UCaaS solutions require VoIP-ready telephone handsets and dedicated routing equipment on premise instead of expensive telecommunication equipment. Thus, reduced total cost of ownership is augmenting the global Unified Communication-as-a-Service market size.

Law enforcement agencies and government organizations need to adopt advanced technologies to enhance various public services. These public sector institutions are investing in unified communications consulting to accelerate information sharing, boost coordination among departments, and increase productivity. UCaaS companies enable government organizations to more flexibly adapt to unexpected industry changes such as the COVID-19 pandemic. They also provide a consolidated environment for all the tools that public sector employees need to adopt advanced technologies such as chatbots, automation tools, and AI analytics. UCaaS solutions provide an open and flexible environment to help public sector organizations adopt advanced technologies, evolve quickly, stay updated, and consequently offer public service more effectively.

Companies in the hospitality sector are increasing their investment in UCaaS solutions. Adoption of Unified Communication-as-a-Service offers a streamlined and effective travel experience to customers. It also improves productivity, efficiency, and teamwork of employees. An UCaaS environment allows multiple employees to access softphones through their mobile devices from any place to manage customer queries.

UCaaS solutions provide tools that enable collaboration between team members, as hospitality companies rely on teamwork and coordination among managers, customer service experts, and front-end receptionists. UCaaS providers also enable contact center agents to share information about customer experience and preferences from CRM tools and service tickets with employees present in the hospitality environment.

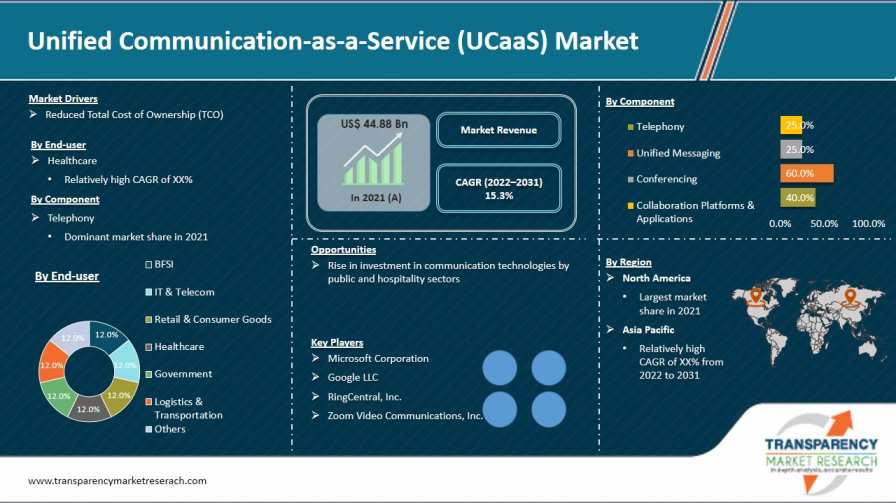

Based on component, the global Unified Communication-as-a-Service (UCaaS) market has been divided into telephony, unified messaging, conferencing, and collaboration platforms & applications. The unified messaging segment dominates the market due to advancements in enterprise software for communication and various benefits associated with it. Unified messaging offers features such as instant messaging, group-based real-time chat, file sharing, and multiple communication mediums such as voicemail, email, and mobile.

North America is expected to account for the largest share of the Unified Communication-as-a-Service (UCaaS) market by the end of 2022. Growth of the market can be ascribed to the increase in adoption of telepresence systems, advanced business solutions, and Bring Your Own Device (BYOD) in the region. Organizations across the region are adopting advanced unified communication services such as conferencing, unified messaging, enterprise telephony, and instant messaging. The usage of contact center capabilities such as auto-attendant, call routing, interactive voice response, and CRM integrations is also rising in North America.

Asia Pacific is anticipated to record the highest CAGR in the Unified Communication-as-a-Service (UCaaS) market during the forecast period due to the rise in demand for internet-based communication services among SMEs in the region. UCaaS industry trends in Asia Pacific include adoption of unified communication services and cloud technologies such as VoIP unified communications and voice & video conferencing.

The competition landscape section has been included in the report to provide readers with a dashboard view and company market share analysis of key players operating in the global Unified Communication-as-a-Service (UCaaS) market. Unified communications vendors are focusing on product launches, partnerships & collaborations, and M&A strategies to enhance their UCaaS market share. Key players operating in the market are Microsoft Corporation, Google LLC, RingCentral, Inc., Zoom Video Communications, Inc., Cisco Systems, Inc., 8x8, Inc., Verizon Communications Inc., GoTo, Dialpad, Inc., Nextiva, Sangoma Technologies Corporation, and Wildix.

Each of these players has been profiled in the Unified Communication-as-a-Service (UCaaS) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 44.88 Bn |

|

Market Forecast Value in 2031 |

US$ 161.67 Bn |

|

Growth Rate (CAGR) |

15.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Example: Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global Unified Communication-as-a-Service (UCaaS) market stood at US$ 44.88 Bn in 2021

The global Unified Communication-as-a-Service (UCaaS) market is estimated to grow at a CAGR of 15.3% during the forecast period and reach US$ 161.67 Bn by 2031

Reduced Total Cost of Ownership (TCO) and rise in investment in Unified Communication-as-a-Service by public and hospitality sectors

The telephony segment contributes the largest share in the global Unified Communication-as-a-service (UCaaS) market

Asia Pacific is a more attractive region for vendors in the Unified Communication-as-a-Service (UCaaS) market

Microsoft Corporation, Google LLC, RingCentral, Inc., Zoom Video Communications, Inc., Cisco Systems, Inc., 8x8, Inc., Verizon Communications Inc., GoTo, DIALPAD, INC., Nextiva, Sangoma Technologies Corporation, and Wildix

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Unified Communication-as-a-Service (UCaaS) Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Unified Communication-as-a-Service (UCaaS) Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Enterprise Size

4.5.3. By End-user

5. Global Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Unified Communication-as-a-Service (UCaaS) Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Telephony

6.3.2. Unified Messaging

6.3.3. Conferencing

6.3.4. Collaboration Platforms & Applications

7. Global Unified Communication-as-a-Service (UCaaS) Market Analysis, by Enterprise Size

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

7.3.1. SMEs

7.3.2. Large Enterprises

8. Global Unified Communication-as-a-Service (UCaaS) Market Analysis, by End-user

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.3.1. BFSI

8.3.2. IT & Telecom

8.3.3. Retail & Consumer Goods

8.3.4. Healthcare

8.3.5. Government

8.3.6. Logistics & Transportation

8.3.7. Others

9. Global Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecast

10.1. Regional Outlook

10.2. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Enterprise Size

10.2.3. By End-user

10.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecast

11.1. Regional Outlook

11.2. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Enterprise Size

11.2.3. By End-user

11.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecast

12.1. Regional Outlook

12.2. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Enterprise Size

12.2.3. By End-user

12.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecast

13.1. Regional Outlook

13.2. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Enterprise Size

13.2.3. By End-user

13.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. The United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Unified Communication-as-a-Service (UCaaS) Market Analysis and Forecast

14.1. Regional Outlook

14.2. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Enterprise Size

14.2.3. By End-user

14.3. Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. Microsoft Corporation

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.2. Google LLC

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.3. RingCentral, Inc.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.4. Zoom Video Communications, Inc.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.5. Cisco Systems, Inc.

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.6. 8x8, Inc.

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.7. Verizon Communications Inc.

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.8. GoTo

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.9. DIALPAD, INC.

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.10. Nextiva

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.11. Sangoma Technologies Corporation

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.12. Wildix

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.13. Others

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in Unified Communication-as-a-Service (UCaaS) Market

Table 2: North America Unified Communication-as-a-Service (UCaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 3: Europe Unified Communication-as-a-Service (UCaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 4: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 5: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 6: South America Unified Communication-as-a-Service (UCaaS) Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact

Table 8: Global Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 9: Global Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 10: Global Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 11: North America Unified Communication-as-a-Service (UCaaS) Market Volume (US$ Bn) Forecast, by Region, 2018 – 2031

Table 12: North America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 13: North America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 14: North America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 15: North America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 16: U.S. Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 17: Canada Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 18: Mexico Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Europe Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 20: Europe Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 21: Europe Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 22: Europe Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 23: Germany Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: U.K. Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: France Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Spain Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Italy Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 29: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 30: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 31: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 32: China Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: India Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Japan Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: ASEAN Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 37: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 38: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 39: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 40: Saudi Arabia Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: United Arab Emirates Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: South Africa Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: South America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 44: South America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 45: South America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 46: South America Unified Communication-as-a-Service (UCaaS) Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 47: Brazil Emirates Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 48: Argentina Unified Communication-as-a-Service (UCaaS) Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: Mergers & Acquisitions, Expansions, Product Launch, etc. (1/2)

Table 50: Mergers & Acquisitions, Expansions, Product Launch, etc. (2/2)

List of Figures

Figure 1: Global Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Unified Communication-as-a-Service (UCaaS) Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Unified Communication-as-a-Service (UCaaS) Market

Figure 4: Global Unified Communication-as-a-Service (UCaaS) Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Unified Communication-as-a-Service (UCaaS) Market Attractiveness Assessment, by Component

Figure 6: Global Unified Communication-as-a-Service (UCaaS) Market Attractiveness Assessment, by Enterprise Size

Figure 7: Global Unified Communication-as-a-Service (UCaaS) Market Attractiveness Assessment, by End-user

Figure 8: Global Unified Communication-as-a-Service (UCaaS) Market Attractiveness Assessment, by Region

Figure 9: Global Unified Communication-as-a-Service (UCaaS) Market Revenue (US$ Bn) Historic Trends, 2016 - 2021

Figure 10: Global Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2021

Figure 11: Absolute Dollar Opportunity

Figure 12: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2022

Figure 13: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2031

Figure 14: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Telephony, 2022 – 2031

Figure 15: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Unified Messaging, 2022 – 2031

Figure 16: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Conferencing, 2022 – 2031

Figure 17: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Collaboration Platforms & Applications, 2022 – 2031

Figure 18: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 19: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 20: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by SMEs, 2022 – 2031

Figure 21: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 22: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2022

Figure 23: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2031

Figure 24: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 25: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 26: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Retail & Consumer Goods, 2022 – 2031

Figure 27: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 28: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 29: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2022 – 2031

Figure 30: Global Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 31: Global Unified Communication-as-a-Service (UCaaS) Market Opportunity (US$ Bn), by Region

Figure 32: Global Unified Communication-as-a-Service (UCaaS) Market Opportunity Share (%), by Region, 2022–2031

Figure 33: Global Unified Communication-as-a-Service (UCaaS) Market Size (US$ Bn), by Region, 2022 & 2031

Figure 34: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Region, 2022

Figure 35: Global Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Region, 2031

Figure 36: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 37: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 38: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 39: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 40: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 41: North America Absolute Dollar Opportunity

Figure 42: North America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Component

Figure 43: North America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 44: North America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by End-user

Figure 45: North America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Country

Figure 46: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2022

Figure 47: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2031

Figure 48: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Telephony, 2022 – 2031

Figure 49: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Unified Messaging, 2022 – 2031

Figure 50: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Conferencing, 2022 – 2031

Figure 51: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Collaboration Platforms & Applications, 2022 – 2031

Figure 52: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 53: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 54: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by SMEs, 2022 – 2031

Figure 55: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 56: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2022

Figure 57: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2031

Figure 58: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 59: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 60: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Retail & Consumer Goods, 2022 – 2031

Figure 61: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 62: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 63: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2022 – 2031

Figure 64: North America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 65: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2022

Figure 66: North America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2031

Figure 67: U.S. Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 68: Canada Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 69: Mexico Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 70: Europe Absolute Dollar Opportunity

Figure 71: Europe Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Component

Figure 72: Europe Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 73: Europe Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by End-user

Figure 74: Europe Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Country

Figure 75: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Telephony, 2022 – 2031

Figure 76: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Unified Messaging, 2022 – 2031

Figure 77: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Conferencing, 2022 – 2031

Figure 78: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Collaboration Platforms & Applications, 2022 – 2031

Figure 79: Europe Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 80: Europe Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 81: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by SMEs, 2022 – 2031

Figure 82: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 83: Europe Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2022

Figure 84: Europe Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2031

Figure 85: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 86: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 87: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Retail & Consumer Goods, 2022 – 2031

Figure 88: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 89: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2022 – 2031

Figure 90: Europe Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 91: Europe Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2022

Figure 92: Europe Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2031

Figure 93: Germany Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 94: U.K. Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 95: France Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 96: Spain Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 97: Italy Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 98: Asia Pacific Absolute Dollar Opportunity

Figure 99: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Component

Figure 100: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 101: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by End-user

Figure 102: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Country

Figure 103: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2022

Figure 104: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2031

Figure 105: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Telephony, 2022 – 2031

Figure 106: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Unified Messaging, 2022 – 2031

Figure 107: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Conferencing, 2022 – 2031

Figure 108: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Collaboration Platforms & Applications, 2022 – 2031

Figure 109: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 110: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 111: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by SMEs, 2022 – 2031

Figure 112: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 113: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2022

Figure 114: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2031

Figure 115: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 116: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 117: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Retail & Consumer Goods, 2022 – 2031

Figure 118: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 119: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 120: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2022 – 2031

Figure 121: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 122: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2022

Figure 123: Asia Pacific Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2031

Figure 124: China Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 125: India Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 126: Japan Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 127: ASEAN Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 128: Middle East & Africa Absolute Dollar Opportunity

Figure 129: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Component

Figure 130: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 131: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by End-user

Figure 132: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Country

Figure 133: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2022

Figure 134: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2031

Figure 135: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Telephony, 2022 – 2031

Figure 136: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Unified Messaging, 2022 – 2031

Figure 137: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Conferencing, 2022 – 2031

Figure 138: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Collaboration Platforms & Applications, 2022 – 2031

Figure 139: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 140: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 141: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by SMEs, 2022 – 2031

Figure 142: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 143: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2022

Figure 144: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2031

Figure 145: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 146: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 147: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Retail & Consumer Goods, 2022 – 2031

Figure 148: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 149: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 150: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 151: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2022

Figure 152: Middle East & Africa Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2031

Figure 153: Saudi Arabia Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 154: United Arab Emirates Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 155: South Africa Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 156: South America Absolute Dollar Opportunity

Figure 157: South America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Component

Figure 158: South America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Enterprise Size

Figure 159: South America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by End-user

Figure 160: South America Unified Communication-as-a-Service (UCaaS) Market Revenue Opportunity Share, by Country

Figure 161: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2022

Figure 162: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Component, 2031

Figure 163: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Telephony, 2022 – 2031

Figure 164: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Unified Messaging, 2022 – 2031

Figure 165: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Conferencing, 2022 – 2031

Figure 166: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Collaboration Platforms & Applications, 2022 – 2031

Figure 167: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2022

Figure 168: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Enterprise Size, 2031

Figure 169: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by SMEs, 2022 – 2031

Figure 170: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 171: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2022

Figure 172: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by End-user, 2031

Figure 173: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by BFSI, 2022 – 2031

Figure 174: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2022 – 2031

Figure 175: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Retail & Consumer Goods, 2022 – 2031

Figure 176: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 177: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 178: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2022 – 2031

Figure 179: South America Unified Communication-as-a-Service (UCaaS) Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 180: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2022

Figure 181: South America Unified Communication-as-a-Service (UCaaS) Market Value Share Analysis, by Country, 2031

Figure 182: Brazil Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 183: Argentina Unified Communication-as-a-Service (UCaaS) Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031