Analysts at Transparency Market Research opine that 2020 was supposed to be the semiconductor industry’s year of recovery after a series of merger & acquisition (M&A) deal made in 2019. However, the COVID-19 crisis has greatly influenced business decisions, thus affecting many M&A deals. Nevertheless, companies in the traction transformer market are taking data-driven decisions before entering into mergers and acquisitions.

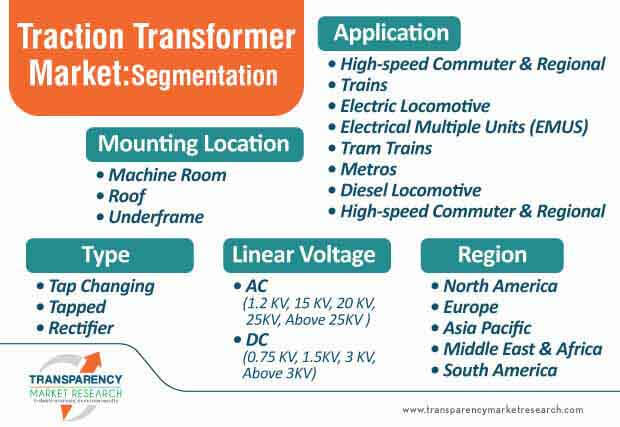

Companies in the traction transformer market are focusing on positive or limited negative sectors such as high-speed commuter & regional applications, trains, and electric locomotives to keep the economies running. Mission-critical projects related to engineering and infrastructure are creating income sources for market stakeholders. Companies are rethinking supply networks and diversifying their supply chains to avoid putting all eggs in one geographical basket.

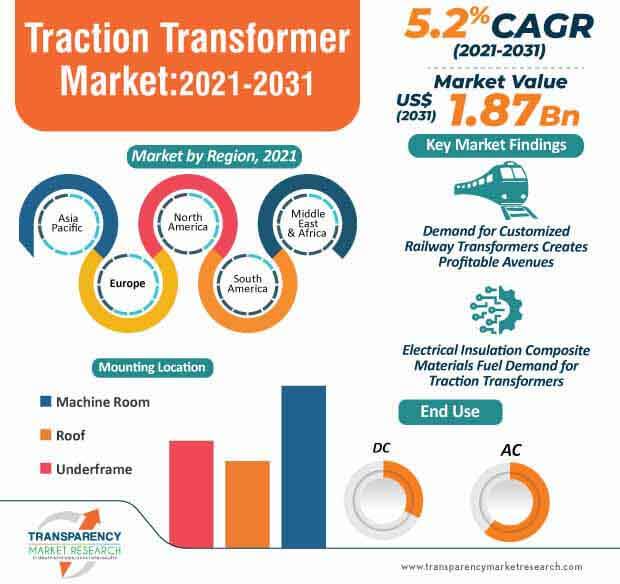

The traction transformer market is projected to advance at a CAGR of 5.2% during the forecast period. This is evident since there is a need of special components for traction transformers. Elektro-Isola - a materials company in Vejle, Denmark, is capitalizing on this opportunity to provide electromechanical composite materials for traction transformers in the range of Etronit, Etronax, and G-Etronax, respectively.

There is a demand for electrical insulation composite materials in the traction transformer market based on paper and glass materials. Excellent electrotechnical properties of these materials play a crucial role in the production of traction transformer components.

Traction transformers are critical components in the traction chain, affecting both train performance and operator services. Hitachi ABB Power Grids - a global pioneer in power technologies, is being recognized for its comprehensive portfolio of traction transformers that are being extensively used in tram trains, AC metros and high speed, commuter & regional trains.

Engineers are looking for companies with decades of experience in the field of traction transformers. In order to boost credibility, companies in the traction transformer market are offering custom-made solutions to withstand physical and operating constraints. The burgeoning growth of the high-speed rail sector is creating revenue opportunities for semiconductor companies. The total weight of transformers is a crucial factor in the development of high-speed trains.

The traction transformer market is predicted to mature from a revenue of US$ 1.08 Bn in 2020 and reach US$ 1.87 Bn by 2031. There is a demand for customized and state-of-the-art railway transformers. Siemens Energy— a multinational energy technology company, is increasing efforts to meet this demand to offer maximum reliability, economic efficiency, and safety in railway transformers.

Manufacturers in the traction transformer market are designing single-phase and multi-phase units for rail operators and train manufacturers. Companies are maintaining a stellar track record by establishing a refined system for global logistics and by adhering to internationally binding quality standards.

Compact, lightweight, and exceptionally reliable traction transformers are being preferred for locomotives. Manufacturers in the traction transformer market are increasing their R&D capabilities to engineer units that help to withstand harsh and demanding environments. Traction transformers for locomotives are being designed to power heavy freight loads over long distances and on tracks with many challenges such as excessive wear, steep profiles, and short curve radii, among others.

Stakeholders in the traction transformer market are providing high level technical experience that facilitates the delivery of traction transformer technology regardless of the constraints faced by commuter train suppliers.

On the other hand, natural and sustainable cooling systems are gaining popularity in traction transformers that optimize cost and improves reliability. Constant innovation and technological enhancement is necessary in the field of traction transformers. Next-gen traction transformers are increasingly replacing traditional fan-based cooling systems by offering a natural and sustainable airflow of the trains’ motion.

Analysts’ Viewpoint

Companies in the traction transformers are pursuing M&A deals that will help to build a more sustainable and forward-thinking company, owing to the disruptions caused by the COVID-19 outbreak. Conventional traction transformers are subject to substantial energy losses, which heat-up the internal windings. Hence, companies in the traction transformer market should innovate in natural and sustainable cooling systems for traction transformers that reduce cost associated with the maintenance of traditional units. On the other hand, there is a growing demand for electrical insulation composite materials that play a pivotal role in the production of traction transformers. Customer-specific materials are being developed to provide exceptional electrical insulation and mechanical properties in traction transformers.

|

Attribute |

Detail |

|

Market Size Value in 2020 (base year) |

US$ 1.08 Bn |

|

Market Forecast Value in 2031 |

US$ 1.87 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Units for Volume |

|

Market analysis |

It includes cross segment analysis at global as well as regional level. Further, qualitative analysis includes drivers, restraints, opportunities, key trends, porters five forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) or word + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Traction Transformer Market is projected to reach US $1.87 Bn by 2031

Traction Transformer Market is expected to grow at a CAGR of 5.2% during 2021-2031

Traction Transformer Market is studied from 2021-2031

Key vendors in the Traction Transformer Market are Hitachi ABB Power Grids Ltd, Siemens AG, Toshiba Corporation, Mitsubishi Electric Corporation, SPX Transformer Solutions Inc., MGM Transformer, Neeltran , Altrafo Srl, Alstom SA, and JST Transformateurs.

Asia Pacific region Takes Lead in the Traction Transformer Market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Traction Transformer Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.3.1. Economic Drivers

3.3.2. Supply Side Drivers

3.3.3. Demand Side Drivers

3.4. Market Restraints and Opportunities

3.5. Market Trends

3.5.1. Demand Side

3.5.2. Supply Side

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Impact of Covid-19 Pandemic

4.3. Supply Chain Analysis

4.4. Type Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Traction Transformer Market Analysis, by Type

5.1. Global Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Type, 2017‒2031

5.1.1. Tap Changing

5.1.2. Tapped

5.1.3. Rectifier

5.2. Market Attractiveness Analysis, by Type

6. Global Traction Transformer Market Analysis, by Line Voltage

6.1. Global Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Line Voltage, 2017‒2031

6.1.1. AC

6.1.1.1. 1.2 KV

6.1.1.2. 15 KV

6.1.1.3. 20 KV

6.1.1.4. 25KV

6.1.1.5. Above 25KV

6.1.2. DC

6.1.2.1. 0.75 KV

6.1.2.2. 1.5KV

6.1.2.3. 3 KV

6.1.2.4. Above 3KV

6.2. Global Traction Transformer Market Attractiveness Analysis, by Line Voltage

7. Global Traction Transformer Market Analysis, by Application

7.1. Global Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Type, 2017‒2031

7.1.1. High-speed commuter & Regional

7.1.2. Trains

7.1.3. Electric Locomotive

7.1.4. Electrical Multiple Units (EMUS)

7.1.5. Tram Trains

7.1.6. Metros

7.1.7. Diesel Locomotive

7.2. Global Traction Transformer Market Attractiveness Analysis, by Application

8. Global Traction Transformer Market Analysis, by Mounting Location

8.1. Global Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Mounting Location, 2017‒2031

8.1.1. Machine Room

8.1.2. Roof

8.1.3. Underframe

8.2. Global Traction Transformer Market Attractiveness Analysis, by Mounting Location

9. Global Traction Transformer Market Analysis and Forecast, by Region

9.1. Global Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Region, 2017 – 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global Traction Transformer Market Attractiveness Analysis, by Region

10. North America Traction Transformer Market Analysis and Forecast

10.1. Market Snapshot

10.2. Key Trends Analysis

10.3. Drivers and Restraints: Impact Analysis

10.4. Pricing Analysis

10.5. Key Regulations

10.6. North America Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Type, 2017‒2031

10.6.1. Tap Changing

10.6.2. Tapped

10.6.3. Rectifier

10.7. North America Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Line Voltage, 2017‒2031

10.7.1. AC

10.7.1.1. 1.2 KV

10.7.1.2. 15 KV

10.7.1.3. 20 KV

10.7.1.4. 25KV

10.7.1.5. Above 25KV

10.7.2. DC

10.7.2.1. 0.75 KV

10.7.2.2. 1.5KV

10.7.2.3. 3 KV

10.7.2.4. Above 3KV

10.8. North America Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

10.8.1. High-speed commuter & Regional

10.8.2. Trains

10.8.3. Electric Locomotive

10.8.4. Electrical Multiple Units (EMUS)

10.8.5. Tram Trains

10.8.6. Metros

10.8.7. Diesel Locomotive

10.9. North America Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Mounting Location, 2017‒2031

10.9.1. Machine Room

10.9.2. Roof

10.9.3. Underframe

10.10. North America Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

10.10.1. U.S.

10.10.2. Canada

10.10.3. Rest of North America

10.11. North America Traction Transformer Market Attractiveness Analysis

10.11.1. By Type

10.11.2. By Line Voltage

10.11.3. By Application

10.11.4. By Mounting Location

10.11.5. By Country & Sub-region

11. Europe Traction Transformer Market Analysis and Forecast

11.1. Market Snapshot

11.2. Key Trends Analysis

11.3. Drivers and Restraints: Impact Analysis

11.4. Pricing Analysis

11.5. Key Regulations

11.6. Europe Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Type, 2017‒2031

11.6.1. Tap Changing

11.6.2. Tapped

11.6.3. Rectifier

11.7. Europe Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Line Voltage, 2017‒2031

11.7.1. AC

11.7.1.1. 1.2 KV

11.7.1.2. 15 KV

11.7.1.3. 20 KV

11.7.1.4. 25KV

11.7.1.5. Above 25KV

11.7.2. DC

11.7.2.1. 0.75 KV

11.7.2.2. 1.5KV

11.7.2.3. 3 KV

11.7.2.4. Above 3KV

11.8. Europe Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

11.8.1. High-speed commuter & Regional

11.8.2. Trains

11.8.3. Electric Locomotive

11.8.4. Electrical Multiple Units (EMUS)

11.8.5. Tram Trains

11.8.6. Metros

11.8.7. Diesel Locomotive

11.9. Europe Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Mounting Location, 2017‒2031

11.9.1. Machine Room

11.9.2. Roof

11.9.3. Underframe

11.10. Europe Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

11.10.1. U.K.

11.10.2. Germany

11.10.3. France

11.10.4. Italy

11.10.5. Russia

11.10.6. Rest of Europe

11.11. Europe Traction Transformer Market Attractiveness Analysis

11.11.1. By Type

11.11.2. By Line Voltage

11.11.3. By Application

11.11.4. By Mounting Location

11.11.5. By Country & Sub-region

12. Asia Pacific Traction Transformer Market Analysis and Forecast

12.1. Market Snapshot

12.2. Key Trends Analysis

12.3. Drivers and Restraints: Impact Analysis

12.4. Pricing Analysis

12.5. Key Regulations

12.6. Asia Pacific Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Type, 2017‒2031

12.6.1. Tap Changing

12.6.2. Tapped

12.6.3. Rectifier

12.7. Asia Pacific Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Line Voltage, 2017‒2031

12.7.1. AC

12.7.1.1. 1.2 KV

12.7.1.2. 15 KV

12.7.1.3. 20 KV

12.7.1.4. 25KV

12.7.1.5. Above 25KV

12.7.2. DC

12.7.2.1. 0.75 KV

12.7.2.2. 1.5KV

12.7.2.3. 3 KV

12.7.2.4. Above 3KV

12.8. Asia Pacific Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

12.8.1. High-speed commuter & Regional

12.8.2. Trains

12.8.3. Electric Locomotive

12.8.4. Electrical Multiple Units (EMUS)

12.8.5. Tram Trains

12.8.6. Metros

12.8.7. Diesel Locomotive

12.9. Asia Pacific Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Mounting Location, 2017‒2031

12.9.1. Machine Room

12.9.2. Roof

12.9.3. Underframe

12.10. Asia Pacific Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

12.10.1. China Asia Pacific Traction Transformer

12.10.2. India

12.10.3. Japan

12.10.4. South Korea

12.10.5. ASEAN

12.10.6. Rest of Asia Pacific

12.11. Asia Pacific Traction Transformer Market Attractiveness Analysis

12.11.1. By Type

12.11.2. By Line Voltage

12.11.3. By Application

12.11.4. By Mounting Location

12.11.5. By Country & Sub-region

13. Middle East & Africa (MEA) Traction Transformer Market Analysis and Forecast

13.1. Market Snapshot

13.2. Key Trends Analysis

13.3. Drivers and Restraints: Impact Analysis

13.4. Pricing Analysis

13.5. Key Regulations

13.6. Middle East & Africa Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Type, 2017‒2031

13.6.1. Tap Changing

13.6.2. Tapped

13.6.3. Rectifier

13.7. Middle East & Africa Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Line Voltage, 2017‒2031

13.7.1. AC

13.7.1.1. 1.2 KV

13.7.1.2. 15 KV

13.7.1.3. 20 KV

13.7.1.4. 25KV

13.7.1.5. Above 25KV

13.7.2. DC

13.7.2.1. 0.75 KV

13.7.2.2. 1.5KV

13.7.2.3. 3 KV

13.7.2.4. Above 3KV

13.8. Middle East & Africa Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

13.8.1. High-speed commuter & Regional

13.8.2. Trains

13.8.3. Electric Locomotive

13.8.4. Electrical Multiple Units (EMUS)

13.8.5. Tram Trains

13.8.6. Metros

13.8.7. Diesel Locomotive

13.9. Middle East & Africa Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Mounting Location, 2017‒2031

13.9.1. Machine Room

13.9.2. Roof

13.9.3. Underframe

13.10. Middle East & Africa Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

13.10.1. GCC

13.10.2. South Africa

13.10.3. North Africa

13.10.4. Rest of Middle East & Africa

13.11. Middle East & Africa Traction Transformer Market Attractiveness Analysis

13.11.1. By Type

13.11.2. By Line Voltage

13.11.3. By Application

13.11.4. By Mounting Location

13.11.5. By Country & Sub-region

14. South America Traction Transformer Market Analysis and Forecast

14.1. Market Snapshot

14.2. Key Trends Analysis

14.3. Drivers and Restraints: Impact Analysis

14.4. Pricing Analysis

14.5. Key Regulations

14.6. South America Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Type, 2017‒2031

14.6.1. Tap Changing

14.6.2. Tapped

14.6.3. Rectifier

14.7. South America Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Line Voltage, 2017‒2031

14.7.1. AC

14.7.1.1. 1.2 KV

14.7.1.2. 15 KV

14.7.1.3. 20 KV

14.7.1.4. 25KV

14.7.1.5. Above 25KV

14.7.2. DC

14.7.2.1. 0.75 KV

14.7.2.2. 1.5KV

14.7.2.3. 3 KV

14.7.2.4. Above 3KV

14.8. South America Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

14.8.1. High-speed commuter & Regional

14.8.2. Trains

14.8.3. Electric Locomotive

14.8.4. Electrical Multiple Units (EMUS)

14.8.5. Tram Trains

14.8.6. Metros

14.8.7. Diesel Locomotive

14.9. South America Traction Transformer Market Size (US$ Mn) Analysis & Forecast, by Mounting Location, 2017‒2031

14.9.1. Machine Room

14.9.2. Roof

14.9.3. Underframe

14.10. South America Traction Transformer Market Size (US$ Mn and Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

14.10.1. Brazil

14.10.2. Argentina

14.10.3. Rest of South America

14.11. South America Traction Transformer Market Attractiveness Analysis

14.11.1. By Type

14.11.2. By Line Voltage

14.11.3. By Application

14.11.4. By Mounting Location

14.11.5. By Country & Sub-region

15. Competition Assessment

15.1. Global Traction Transformer Market Competition Matrix - a Dashboard View

15.1.1. Global Traction Transformer Market Company Share Analysis, by Value (2020) and Volume

15.1.2. Technological Differentiator

16. Company Profiles (Manufacturers/Suppliers)

16.1. Hitachi ABB Power Grids Ltd

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Financial Analysis

16.2. Siemens AG

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Financial Analysis

16.3. Toshiba Corporation

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Financial Analysis

16.4. Mitsubishi Electric Corporation

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Financial Analysis

16.5. SPX Transformer Solutions Inc.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Financial Analysis

16.6. MGM Transformer

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Financial Analysis

16.7. Neeltran

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Financial Analysis

16.8. Altrafo Srl

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Financial Analysis

16.9. Alstom SA

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Financial Analysis

16.10. JST Transformateurs

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Financial Analysis

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Type

17.1.2. By Line Voltage

17.1.3. By Application

17.1.4. By Mounting Location

17.1.5. By Region

List of Tables

Table 01: Global Traction Transformer Market Value (US$ Mn), by Type, 2017–2031

Table 02: Global Traction Transformer Market Volume (Units), by Type, 2017–2031

Table 03: Global Traction Transformer Market Value (US$ Mn), by Line Voltage, 2017–2031

Table 04: Global Traction Transformer Market Volume (Units), by Line Voltage, 2017–2031

Table 05: Global Traction Transformer Market Value (US$ Mn), by Application, 2017–2031

Table 06: Global Traction Transformer Market Value (US$ Mn), by Mounting Location, 2017–2031

Table 07: Global Traction Transformer Market Value (US$ Mn), by Region, 2017–2031

Table 08: Global Traction Transformer Market Volume (Units), by Region, 2017–2031

Table 09: North America Traction Transformer Market Value (US$ Mn), by Type, 2017–2031

Table 10: North America Traction Transformer Market Volume (Units), by Type, 2017–2031

Table 11: North America Traction Transformer Market Value (US$ Mn), by Line Voltage, 2017–2031

Table 12: North America Traction Transformer Market Volume (Units), by Line Voltage, 2017–2031

Table 13: North America Traction Transformer Market Value (US$ Mn), by Application, 2017–2031

Table 14: North America Traction Transformer Market Value (US$ Mn), by Mounting Location, 2017–2031

Table 15: North America Traction Transformer Market Value (US$ Mn), by Country & Sub-region, 2017–2031

Table 16: North America Traction Transformer Market Volume (Units), by Country & Sub-region, 2017–2031

Table 17: Europe Traction Transformer Market Value (US$ Mn), by Type, 2017–2031

Table 18: Europe Traction Transformer Market Volume (Units), by Type, 2017–2031

Table 19: Europe Traction Transformer Market Value (US$ Mn), by Line Voltage, 2017–2031

Table 20: Europe Traction Transformer Market Volume (Units), by Line Voltage, 2017–2031

Table 21: Europe Traction Transformer Market Value (US$ Mn), by Application, 2017–2031

Table 22: Europe Traction Transformer Market Value (US$ Mn), by Mounting Location, 2017–2031

Table 23: Europe Traction Transformer Market Value (US$ Mn), by Country & Sub-region, 2017–2031

Table 24: Europe Traction Transformer Market Volume (Units), by Country & Sub-region, 2017–2031

Table 25: Asia Pacific Traction Transformer Market Value (US$ Mn), by Type, 2017–2031

Table 26: Asia Pacific Traction Transformer Market Volume (Units), by Type, 2017–2031

Table 27: Asia Pacific Traction Transformer Market Value (US$ Mn), by Line Voltage, 2017–2031

Table 28: Asia Pacific Traction Transformer Market Volume (Units), by Line Voltage, 2017–2031

Table 29: Asia Pacific Traction Transformer Market Value (US$ Mn), by Application, 2017–2031

Table 30: Asia Pacific Traction Transformer Market Value (US$ Mn), by Mounting Location, 2017–2031

Table 31: Asia Pacific Traction Transformer Market Value (US$ Mn), by Country & Sub-region, 2017–2031

Table 32: Asia Pacific Traction Transformer Market Volume (Units), by Country & Sub-region, 2017–2031

Table 33: Middle East & Africa Traction Transformer Market Value (US$ Mn), by Type, 2017–2031

Table 34: Middle East & Africa Traction Transformer Market Volume (Units), by Type, 2017–2031

Table 35: Middle East & Africa Traction Transformer Market Value (US$ Mn), by Line Voltage, 2017–2031

Table 36: Middle East & Africa Traction Transformer Market Volume (Units), by Line Voltage, 2017–2031

Table 37: Middle East & Africa Traction Transformer Market Value (US$ Mn), by Application, 2017–2031

Table 38: Middle East & Africa Traction Transformer Market Value (US$ Mn), by Mounting Location, 2017–2031

Table 39: Middle East & Africa Traction Transformer Market Value (US$ Mn), by Country & Sub-region, 2017–2031

Table 40: Middle East & Africa Traction Transformer Market Volume (Units), by Country & Sub-region, 2017–2031

Table 41: South America Traction Transformer Market Value (US$ Mn), by Type, 2017–2031

Table 42: South America Traction Transformer Market Volume (Units), by Type, 2017–2031

Table 43: South America Traction Transformer Market Value (US$ Mn), by Line Voltage, 2017–2031

Table 44: South America Traction Transformer Market Volume (Units), by Line Voltage, 2017–2031

Table 45: South America Traction Transformer Market Value (US$ Mn), by Application, 2017–2031

Table 46: South America Traction Transformer Market Value (US$ Mn), by Mounting Location, 2017–2031

Table 47: South America Traction Transformer Market Value (US$ Mn), by Country & Sub-region, 2017–2031

Table 48: South America Traction Transformer Market Volume (Units), by Country & Sub-region, 2017–2031

List of Figures

Figure 01: Global Traction Transformer Market Value (US$ Mn) Forecast, 2021–2031

Figure 02: Global Traction Transformer Market, by Tap Changing

Figure 03: Global Traction Transformer Market, by Tapped

Figure 04: Global Traction Transformer Market, by Rectifier

Figure 05: Global Traction Transformer Market Attractiveness Analysis, by Type

Figure 06: Global Traction Transformer Market, by AC

Figure 07: Global Traction Transformer Market, by DC

Figure 08: Global Traction Transformer Market Attractiveness Analysis, by Line Voltage

Figure 09: Global Traction Transformer Market, by High-speed commuter & Regional Trains

Figure 10: Global Traction Transformer Market, by Electric Locomotive

Figure 11: Global Traction Transformer Market, by Electrical Multiple Units (EMUS)

Figure 12: Global Traction Transformer Market, by Tram Trains

Figure 13: Global Traction Transformer Market, by Metros

Figure 14: Global Traction Transformer Market, by Diesel Locomotive

Figure 15: Global Traction Transformer Market Attractiveness Analysis, by Application

Figure 16: Global Traction Transformer Market, by Machine Room

Figure 17: Global Traction Transformer Market, by Roof

Figure 18: Global Traction Transformer Market, by Underframe

Figure 19: Global Traction Transformer Market Attractiveness Analysis, by Mounting Location

Figure 20: Global Traction Transformer Market Value Share Analysis, by Region (2021E)

Figure 21: Global Traction Transformer Market Value Share Analysis, by Region (2031F)

Figure 22: Global Traction Transformer Market Volume Share Analysis, by Region (2021E)

Figure 23: Global Traction Transformer Market Volume Share Analysis, by Region (2031F)

Figure 24: Global Traction Transformer Market Attractiveness Analysis, by Region

Figure 25: North America Traction Transformer Market Size Analysis (2017-2020) and Forecast (2021‒2031)

Figure 26: North America Traction Transformer Market Value (US$ Mn) Forecast, 2017–2031

Figure 27: North America Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 28: North America Traction Transformer Market Volume (Units) Forecast, 2017–2031

Figure 29: North America Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 30: North America Traction Transformer Market Value Share Analysis, by Type (2021)

Figure 31: North America Traction Transformer Market Value Share Analysis, by Type (2031)

Figure 32: North America Traction Transformer Market Volume Share Analysis, by Type (2021)

Figure 33: North America Traction Transformer Market Volume Share Analysis, by Type (2031)

Figure 34: North America Traction Transformer Market Value Share Analysis, by Line Voltage (2021)

Figure 35: North America Traction Transformer Market Value Share Analysis, by Line Voltage (2031)

Figure 36: North America Traction Transformer Market Volume Share Analysis, by Line Voltage (2021)

Figure 37: North America Traction Transformer Market Volume Share Analysis, by Line Voltage (2031)

Figure 38: North America Traction Transformer Market Value Share Analysis, by Application (2021)

Figure 39: North America Traction Transformer Market Value Share Analysis, by Application (2031)

Figure 40: North America Traction Transformer Market Value Share Analysis, by Mounting Location (2021)

Figure 41: North America Traction Transformer Market Value Share Analysis, by Mounting Location (2031)

Figure 42: North America Traction Transformer Market Value Share Analysis, by Country & Sub-region (2021)

Figure 43: North America Traction Transformer Market Value Share Analysis, by Country & Sub-region (2031)

Figure 44: North America Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2021)

Figure 45: North America Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2031)

Figure 46: North America Traction Transformer Market Attractiveness Analysis, by Type

Figure 47: North America Traction Transformer Market Attractiveness Analysis, by Line Voltage

Figure 48: North America Traction Transformer Market Attractiveness Analysis, by Application

Figure 49: North America Traction Transformer Market Attractiveness Analysis, by Mounting Location

Figure 50: North America Traction Transformer Market Attractiveness Analysis, by Country & Sub-region

Figure 51: North America Traction Transformer Market Size Analysis (2017-2020) and Forecast (2021-2031)

Figure 52: Europe Traction Transformer Market Value (US$ Mn) Forecast, 2017–2031

Figure 53: Europe Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 54: Europe Traction Transformer Market Volume (Units) Forecast, 2017–2031

Figure 55: Europe Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 56: Europe Traction Transformer Market Value Share Analysis, by Type (2021)

Figure 57: Europe Traction Transformer Market Value Share Analysis, by Type (2031)

Figure 58: Europe Traction Transformer Market Volume Share Analysis, by Type (2021)

Figure 59: Europe Traction Transformer Market Volume Share Analysis, by Type (2031)

Figure 60: Europe Traction Transformer Market Value Share Analysis, by Line Voltage (2021)

Figure 61: Europe Traction Transformer Market Value Share Analysis, by Line Voltage (2031)

Figure 62: Europe Traction Transformer Market Volume Share Analysis, by Line Voltage (2021)

Figure 63: Europe Traction Transformer Market Volume Share Analysis, by Line Voltage (2031)

Figure 64: Europe Traction Transformer Market Value Share Analysis, by Application (2021)

Figure 65: Europe Traction Transformer Market Value Share Analysis, by Application (2031)

Figure 66: Europe Traction Transformer Market Value Share Analysis, by Mounting Location (2021)

Figure 67: Europe Traction Transformer Market Value Share Analysis, by Mounting Location (2031)

Figure 68: Europe Traction Transformer Market Value Share Analysis, by Country & Sub-region (2021)

Figure 69: Europe Traction Transformer Market Value Share Analysis, by Country & Sub-region (2031)

Figure 70: Europe Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2021)

Figure 71: Europe Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2031)

Figure 72: Europe Traction Transformer Market Attractiveness Analysis, by Type

Figure 73: Europe Traction Transformer Market Attractiveness Analysis, by Line Voltage

Figure 74: Europe Traction Transformer Market Attractiveness Analysis, by Application

Figure 75: Europe Traction Transformer Market Attractiveness Analysis, by Mounting Location

Figure 76: Europe Traction Transformer Market Attractiveness Analysis, by Country & Sub-region

Figure 77: Asia Pacific Traction Transformer Market Size Analysis (2017-2020) and Forecast (2021-2031)

Figure 78: Asia Pacific Traction Transformer Market Value (US$ Mn) Forecast, 2017–2031

Figure 79: Asia Pacific Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 80: Asia Pacific Traction Transformer Market Volume (Units) Forecast, 2017–2031

Figure 81: Asia Pacific Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 82: Asia Pacific Traction Transformer Market Value Share Analysis, by Type (2021)

Figure 83: Asia Pacific Traction Transformer Market Value Share Analysis, by Type (2031)

Figure 84: Asia Pacific Traction Transformer Market Volume Share Analysis, by Type (2021)

Figure 85: Asia Pacific Traction Transformer Market Volume Share Analysis, by Type (2031)

Figure 86: Asia Pacific Traction Transformer Market Value Share Analysis, by Line Voltage (2021)

Figure 87: Asia Pacific Traction Transformer Market Value Share Analysis, by Line Voltage (2031)

Figure 88: Asia Pacific Traction Transformer Market Volume Share Analysis, by Line Voltage (2021)

Figure 89: Asia Pacific Traction Transformer Market Volume Share Analysis, by Line Voltage (2031)

Figure 90: Asia Pacific Traction Transformer Market Value Share Analysis, by Application (2021)

Figure 91: Asia Pacific Traction Transformer Market Value Share Analysis, by Application (2031)

Figure 92: Asia Pacific Traction Transformer Market Value Share Analysis, by Mounting Location (2021)

Figure 93: Asia Pacific Traction Transformer Market Value Share Analysis, by Mounting Location (2031)

Figure 94: Asia Pacific Traction Transformer Market Value Share Analysis, by Country & Sub-region (2021)

Figure 95: Asia Pacific Traction Transformer Market Value Share Analysis, by Country & Sub-region (2031)

Figure 96: Asia Pacific Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2021)

Figure 97: Asia Pacific Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2031)

Figure 98: Asia Pacific Traction Transformer Market Attractiveness Analysis, by Type

Figure 99: Asia Pacific Traction Transformer Market Attractiveness Analysis, by Line Voltage

Figure 100: Asia Pacific Traction Transformer Market Attractiveness Analysis, by Application

Figure 101: Asia Pacific Traction Transformer Market Attractiveness Analysis, by Mounting Location

Figure 102: Asia Pacific Traction Transformer Market Attractiveness Analysis, by Country & Sub-region

Figure 103: Middle East & Africa Traction Transformer Market Size Analysis (2017-2020) and Forecast (2021-2031)

Figure 104: Middle East & Africa Traction Transformer Market Value (US$ Mn) Forecast, 2017–2031

Figure 105: Middle East & Africa Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 106: Middle East & Africa Traction Transformer Market Volume (Units) Forecast, 2017–2031

Figure 107: Middle East & Africa Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 108: Middle East & Africa Traction Transformer Market Value Share Analysis, by Type (2021)

Figure 109: Middle East & Africa Traction Transformer Market Value Share Analysis, by Type (2031)

Figure 110: Middle East & Africa Traction Transformer Market Volume Share Analysis, by Type (2021)

Figure 111: Middle East & Africa Traction Transformer Market Volume Share Analysis, by Type (2031)

Figure 112: Middle East & Africa Traction Transformer Market Value Share Analysis, by Line Voltage (2021)

Figure 113: Middle East & Africa Traction Transformer Market Value Share Analysis, by Line Voltage (2031)

Figure 114: Middle East & Africa Traction Transformer Market Volume Share Analysis, by Line Voltage (2021)

Figure 115: Middle East & Africa Traction Transformer Market Volume Share Analysis, by Line Voltage (2031)

Figure 116: Middle East & Africa Traction Transformer Market Value Share Analysis, by Application (2021)

Figure 117: Middle East & Africa Traction Transformer Market Value Share Analysis, by Application (2031)

Figure 118: Middle East & Africa Traction Transformer Market Value Share Analysis, by Mounting Location (2021)

Figure 119: Middle East & Africa Traction Transformer Market Value Share Analysis, by Mounting Location (2031)

Figure 120: Middle East & Africa Traction Transformer Market Value Share Analysis, by Country & Sub-region (2021)

Figure 121: Middle East & Africa Traction Transformer Market Value Share Analysis, by Country & Sub-region (2031)

Figure 122: Middle East & Africa Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2021)

Figure 123: Middle East & Africa Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2031)

Figure 124: Middle East & Africa Traction Transformer Market Attractiveness Analysis, by Type

Figure 125: Middle East & Africa Traction Transformer Market Attractiveness Analysis, by Line Voltage

Figure 126: Middle East & Africa Traction Transformer Market Attractiveness Analysis, by Application

Figure 127: Middle East & Africa Traction Transformer Market Attractiveness Analysis, by Mounting Location

Figure 128: Middle East & Africa Traction Transformer Market Attractiveness Analysis, by Country & Sub-region

Figure 129: South America Traction Transformer Market Size Analysis (2017-2020) and Forecast (2021-2031)

Figure 130: South America Traction Transformer Market Value (US$ Mn) Forecast, 2017–2031

Figure 131: South America Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 132: South America Traction Transformer Market Volume (Units) Forecast, 2017–2031

Figure 133: South America Traction Transformer Market Y-o-Y Growth Projection, 2021–2031

Figure 134: South America Traction Transformer Market Value Share Analysis, by Type (2021)

Figure 135: South America Traction Transformer Market Value Share Analysis, by Type (2031)

Figure 136: South America Traction Transformer Market Volume Share Analysis, by Type (2021)

Figure 137: South America Traction Transformer Market Volume Share Analysis, by Type (2031)

Figure 138: South America Traction Transformer Market Value Share Analysis, by Line Voltage (2021)

Figure 139: South America Traction Transformer Market Value Share Analysis, by Line Voltage (2031)

Figure 140: South America Traction Transformer Market Volume Share Analysis, by Line Voltage (2021)

Figure 141: South America Traction Transformer Market Volume Share Analysis, by Line Voltage (2031)

Figure 142: South America Traction Transformer Market Value Share Analysis, by Application (2021)

Figure 143: South America Traction Transformer Market Value Share Analysis, by Application (2031)

Figure 144: South America Traction Transformer Market Value Share Analysis, by Mounting Location (2021)

Figure 145: South America Traction Transformer Market Value Share Analysis, by Mounting Location (2031)

Figure 146: South America Traction Transformer Market Value Share Analysis, by Country & Sub-region (2021)

Figure 147: South America Traction Transformer Market Value Share Analysis, by Country & Sub-region (2031)

Figure 148: South America Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2021)

Figure 149: South America Traction Transformer Market Volume Share Analysis, by Country & Sub-region (2031)

Figure 150: South America Traction Transformer Market Attractiveness Analysis, by Type

Figure 151: South America Traction Transformer Market Attractiveness Analysis, by Line Voltage

Figure 152: South America Traction Transformer Market Attractiveness Analysis, by Application

Figure 153: South America Traction Transformer Market Attractiveness Analysis, by Mounting Location

Figure 154: South America Traction Transformer Market Attractiveness Analysis, by Country & Sub-region

Figure 155: Global Traction Transformer Market Share Analysis, by Company