The overall slowdown of the global economy has affected business activities in the tagging machines market during the COVID-19 pandemic. As such, the burgeoning growth in eCommerce and online sales is helping stakeholders to keep economies running during the pandemic. Tagging machine manufacturers are increasing their focus on essential industries such as healthcare, pharmaceuticals, food & beverage (F&B), and agriculture in order to establish stable revenue streams.

Companies in the tagging machines market have entered the plug and play mode to adjust to the fluctuating demand and supply sentiments. They are adopting contingency planning to predict business activities as per future market trends. Stakeholders are carefully managing their financial and debt planning before investing in new technologies or launching new products.

The precision of labelling machines using suction method is being demanded by end users. However, this method of labelling can be slow and the labelling quality is not as good as other methods. Although this method is ideal for labelling difficult packaging products, the use of this method is dependent on the type of product that needs to be labelled.

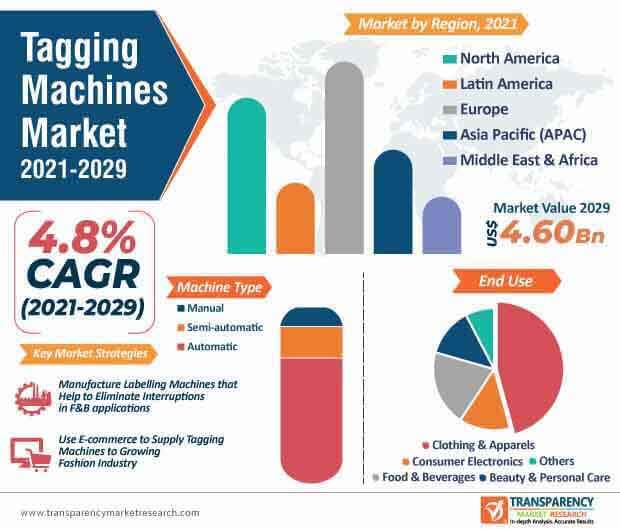

The tagging machines market is slated to clock a CAGR of 4.8% during the forecast period. Labelling machines using blow method and rubbing method are gaining popularity. It is highly recommended to check the settings in the rubbing method, since the labelling accuracy will depend on the speed of the labelling machine and the label distribution.

Clothing and apparels are anticipated to dominate the highest revenue share among all end uses in the tagging machines market. Manufacturers are boosting their production of clothing garment price label tagging machines made from hard plastic. These machines are a great tool for attaching cardboards, brand labels, and price labels to luggage, socks, and garments.

The tagging machines market is projected to surpass US$ 4.60 Bn by 2029. Clothing garment price label tagging guns are being publicized for use with regular clothing fabrics, including wool, linen, polyester, and the likes. These machines are being sold via eCommerce since growing startup culture in the fashion industry is fueling the demand for tagging machines.

The tagging machines market is anticipated to grow from a volume of 435,874 units in 2021 and cross 609,194 units by 2029. HERMA - a European specialist in the self-adhesive technology, is gaining recognition for its labelling machines that help to eliminate interruptions in food and beverage applications. Automated production operations in the F&B industry are triggering the demand for tagging machines.

The tailored servicing concept is growing prominent in the tagging machines market for use in F&B applications. This concept guarantees highest level of flexibility, reliability, and operability in a series production of large quantities of F&B products.

Analysts’ Viewpoint

Since essential industries such as pharmaceuticals, healthcare, F&B, and agriculture are working at breakneck speeds during the coronavirus pandemic, there is a demand for automated tagging machines that prevent operation interruptions. Even though labelling machines with rubbing method has shown to increase the working speed in operations, this method is associated with inaccuracies if the speed of the labelling machine and the label distribution varies. Hence, manufacturers in the tagging machines market should increase awareness about the settings of the rubbing method to ensure accuracy in product labelling. Machine manufacturers should establish stable income sources from F&B applications, owing to the demand for dispensing precision in challenging four-sided labelling.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Tagging Machines Market Overview

3.1. Introduction

3.2. Global Packaging Market Overview

3.3. Global Packaging Machinery Overview

3.4. Global GDP Growth Outlook

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

3.7. COVID-19 Impact Analysis

3.8. Tagging Machines Market Value Chain Analysis

3.8.1. Exhaustive List of Active Participants

3.8.1.1. Raw Material Suppliers

3.8.1.2. Manufacturers

3.8.1.3. Distributors/Retailers

3.8.1.4. End User

3.8.2. Profitability Margins

4. Tagging Machines Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Application

4.2. Market Value (US$ Mn) and Volume (Units) Analysis & Forecast

4.3. Y-o-Y Growth Projections

4.4. Absolute $ Opportunity Analysis

5. Tagging Machines Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunity Analysis

5.4. Trends

6. Global Tagging Machines Market Analysis 2015–2020 and Forecast 2021–2029, By Machine Type

6.1. Introduction

6.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Machine Type, 2015–2020

6.3. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Machine Type, 2021–2029

6.3.1. Automatic

6.3.2. Semi-Automatic

6.3.3. Manual

6.4. Market Attractiveness Analysis, By Machine Type

7. Global Tagging Machines Market Analysis 2015–2020 and Forecast 2021–2029, By Capacity

7.1. Introduction

7.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Capacity, 2015–2020

7.3. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Capacity, 2021–2029

7.3.1. Less than 50 TPM

7.3.2. 51-100 TPM

7.3.3. 101-250 TPM

7.3.4. Above 250 TPM

7.4. Market Attractiveness Analysis, By Capacity

8. Global Tagging Machines Market Analysis 2015–2020 and Forecast 2021–2029, By End Use

8.1. Introduction

8.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis, By End Use, 2015–2020

8.3. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By End Use, 2021–2029

8.3.1. Clothing & Apparel

8.3.2. Consumer Electronics

8.3.3. Food & Beverages

8.3.4. Beauty & Personal Care

8.3.5. Others

8.4. Market Attractiveness Analysis, By End Use

9. Global Tagging Machines Market Analysis 2015–2020 and Forecast 2021–2029, By Region

9.1. Introduction

9.2. Historical Market Size (US$ Mn) and Volume (Units) Analysis, By Region, 2015–2020

9.3. Current and Future Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, By Region, 2021–2029

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East and Africa (MEA)

9.4. Market Attractiveness Analysis, By Region

10. North America Tagging Machines Market Analysis and Forecast

10.1. Introduction

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

10.3.1. U.S.

10.3.2. Canada

10.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Machine Type

10.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Machine Type

10.5.1. Automatic

10.5.2. Semi-automatic

10.5.3. Manual

10.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

10.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

10.7.1. Less than 50 TPM

10.7.2. 51-100 TPM

10.7.3. 101-250 TPM

10.7.4. Above 250 TPM

10.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

10.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

10.9.1. Clothing & Apparel

10.9.2. Consumer Electronics

10.9.3. Food & Beverages

10.9.4. Beauty & Personal Care

10.9.5. Others

10.10. Market Attractiveness Analysis

10.10.1. By Country

10.10.2. By Machine Type

10.10.3. By Capacity

10.10.4. By End Use

10.11. Prominent Trends

11. Latin America Tagging Machines Market Analysis and Forecast

11.1. Introduction

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Machine Type

11.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Machine Type

11.5.1. Automatic

11.5.2. Semi-automatic

11.5.3. Manual

11.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

11.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

11.7.1. Less than 50 TPM

11.7.2. 51-100 TPM

11.7.3. 101-250 TPM

11.7.4. Above 250 TPM

11.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

11.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

11.9.1. Clothing & Apparel

11.9.2. Consumer Electronics

11.9.3. Food & Beverages

11.9.4. Beauty & Personal Care

11.9.5. Others

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Machine Type

11.10.3. By Capacity

11.10.4. By End Use

11.11. Prominent Trends

12. Europe Tagging Machines Market Analysis and Forecast

12.1. Introduction

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

12.3.1. Germany

12.3.2. Spain

12.3.3. Italy

12.3.4. France

12.3.5. U.K.

12.3.6. BENELUX

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Machine Type

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Machine Type

12.5.1. Automatic

12.5.2. Semi-automatic

12.5.3. Manual

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

12.7.1. Less than 50 TPM

12.7.2. 51-100 TPM

12.7.3. 101-250 TPM

12.7.4. Above 250 TPM

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

12.9.1. Clothing & Apparel

12.9.2. Consumer Electronics

12.9.3. Food & Beverages

12.9.4. Beauty & Personal Care

12.9.5. Others

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Machine Type

12.10.3. By Capacity

12.10.4. By End Use

12.11. Prominent Trends

13. Asia Pacific Tagging Machines Market Analysis and Forecast

13.1. Introduction

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Australia and New Zealand

13.3.6. Rest of APAC

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Machine Type

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Machine Type

13.5.1. Automatic

13.5.2. Semi-automatic

13.5.3. Manual

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

13.7.1. Less than 50 TPM

13.7.2. 51-100 TPM

13.7.3. 101-250 TPM

13.7.4. Above 250 TPM

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

13.9.1. Clothing & Apparel

13.9.2. Consumer Electronics

13.9.3. Food & Beverages

13.9.4. Beauty & Personal Care

13.9.5. Others

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Machine Type

13.10.3. By Capacity

13.10.4. By End Use

13.11. Prominent Trends

14. Middle East and Africa Tagging Machines Market Analysis and Forecast

14.1. Introduction

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Country

14.3.1. North Africa

14.3.2. GCC countries

14.3.3. South Africa

14.3.4. Turkey

14.3.5. Rest of MEA

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Machine Type

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Machine Type

14.5.1. Automatic

14.5.2. Semi-automatic

14.5.3. Manual

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By Capacity

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By Capacity

14.7.1. Less than 50 TPM

14.7.2. 51-100 TPM

14.7.3. 101-250 TPM

14.7.4. Above 250 TPM

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2020, By End Use

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2021-2029, By End Use

14.9.1. Clothing & Apparel

14.9.2. Consumer Electronics

14.9.3. Food & Beverages

14.9.4. Beauty & Personal Care

14.9.5. Others

14.10. Market Attractiveness Analysis

14.10.1. By Country

14.10.2. By Machine Type

14.10.3. By Capacity

14.10.4. By End Use

14.11. Prominent Trends

15. Competitive Landscape

15.1. Market Structure

15.2. Company Market Share Analysis

15.3. Competition Dashboard

15.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

15.5. Competition Deep Dive

15.5.1. Tagging Machines Market Manufacturers

15.5.2. Checkpoint Systems, Inc

15.5.2.1. Overview

15.5.2.2. Financials

15.5.2.3. Strategy

15.5.2.4. Recent Developments

15.5.2.5. SWOT Analysis

15.5.3. Pannier Corporation

15.5.3.1. Overview

15.5.3.2. Financials

15.5.3.3. Strategy

15.5.3.4. Recent Developments

15.5.3.5. SWOT Analysis

15.5.4. Markem-Imaje, a Dover Company

15.5.4.1. Overview

15.5.4.2. Financials

15.5.4.3. Strategy

15.5.4.4. Recent Developments

15.5.4.5. SWOT Analysis

15.5.5. Domino UK Ltd.

15.5.5.1. Overview

15.5.5.2. Financials

15.5.5.3. Strategy

15.5.5.4. Recent Developments

15.5.5.5. SWOT Analysis

15.5.6. The M&R Companies

15.5.6.1. Overview

15.5.6.2. Financials

15.5.6.3. Strategy

15.5.6.4. Recent Developments

15.5.6.5. SWOT Analysis

15.5.7. ProMach, Inc

15.5.7.1. Overview

15.5.7.2. Financials

15.5.7.3. Strategy

15.5.7.4. Recent Developments

15.5.7.5. SWOT Analysis

15.5.8. Label-Aire, Inc.

15.5.8.1. Overview

15.5.8.2. Financials

15.5.8.3. Strategy

15.5.8.4. Recent Developments

15.5.8.5. SWOT Analysis

15.5.9. Quadrel Labeling Systems

15.5.9.1. Overview

15.5.9.2. Financials

15.5.9.3. Strategy

15.5.9.4. Recent Developments

15.5.9.5. SWOT Analysis

15.5.10. ALTECH SRL

15.5.10.1. Overview

15.5.10.2. Financials

15.5.10.3. Strategy

15.5.10.4. Recent Developments

15.5.10.5. SWOT Analysis

15.5.11. Weber Packaging Solutions

15.5.11.1. Overview

15.5.11.2. Financials

15.5.11.3. Strategy

15.5.11.4. Recent Developments

15.5.11.5. SWOT Analysis

15.5.12. Benson Machining LLC

15.5.12.1. Overview

15.5.12.2. Financials

15.5.12.3. Strategy

15.5.12.4. Recent Developments

15.5.12.5. SWOT Analysis

15.5.13. Hangzhou Youngsun Intelligent Equipment Co., Ltd.

15.5.13.1. Overview

15.5.13.2. Financials

15.5.13.3. Strategy

15.5.13.4. Recent Developments

15.5.13.5. SWOT Analysis

15.5.14. Iwata Label Co., Ltd.

15.5.14.1. Overview

15.5.14.2. Financials

15.5.14.3. Strategy

15.5.14.4. Recent Developments

15.5.14.5. SWOT Analysis

15.5.15. Guangzhou Shallpack Equipment Co., Ltd.

15.5.15.1. Overview

15.5.15.2. Financials

15.5.15.3. Strategy

15.5.15.4. Recent Developments

15.5.15.5. SWOT Analysis

15.5.16. Zhangjiagang Sky Machine Co. Ltd

15.5.16.1. Overview

15.5.16.2. Financials

15.5.16.3. Strategy

15.5.16.4. Recent Developments

15.5.16.5. SWOT Analysis

15.5.17. Brothers Pharmamach (India) Pvt. Ltd.

15.5.17.1. Overview

15.5.17.2. Financials

15.5.17.3. Strategy

15.5.17.4. Recent Developments

15.5.17.5. SWOT Analysis

15.5.18. Ambica Pharma Machines Pvt. Ltd.

15.5.18.1. Overview

15.5.18.2. Financials

15.5.18.3. Strategy

15.5.18.4. Recent Developments

15.5.18.5. SWOT Analysis

15.5.19. Zhangjiagang U Tech Machine Co., Ltd.

15.5.19.1. Overview

15.5.19.2. Financials

15.5.19.3. Strategy

15.5.19.4. Recent Developments

15.5.19.5. SWOT Analysis

15.5.20. Denmark Machine Tools

15.5.20.1. Overview

15.5.20.2. Financials

15.5.20.3. Strategy

15.5.20.4. Recent Developments

15.5.20.5. SWOT Analysis

15.5.21. Wenzhou Daba Machinery Co., Ltd.

15.5.21.1. Overview

15.5.21.2. Financials

15.5.21.3. Strategy

15.5.21.4. Recent Developments

15.5.21.5. SWOT Analysis

15.5.22. Chin Yen Machinery Co., Ltd.

15.5.22.1. Overview

15.5.22.2. Financials

15.5.22.3. Strategy

15.5.22.4. Recent Developments

15.5.22.5. SWOT Analysis

15.5.23. Shanghai Xinhu Machinery Co., Ltd.

15.5.23.1. Overview

15.5.23.2. Financials

15.5.23.3. Strategy

15.5.23.4. Recent Developments

15.5.23.5. SWOT Analysis

*The above list is indicative in nature and is subject to change during the course of research

16. Assumptions and Acronyms

17. Research Methodology

List of Tables

Table 01: Global Tagging Machines Market Volume (Units) Analysis by Machine Type, 2015H-2029F

Table 02: Global Tagging Machines Market Value (US$ Mn) Analysis by Machine Type, 2015H-2029F

Table 03: Global Tagging Machines Market Volume (Units) Analysis by Capacity, 2015H-2029F

Table 04: Global Tagging Machines Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 05: Global Tagging Machines Market Volume (Units) Analysis by End Use, 2015H-2029F

Table 06: Global Tagging Machines Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 07: Global Tagging Machines Market Volume (Units) Analysis by Region, 2015H-2029F

Table 08: Global Tagging Machines Market Value (US$ Mn) Analysis by Region, 2015H-2029F

Table 09: North America Tagging Machines Market Volume (Units) Analysis by Machine Type, 2015H-2029F

Table 10: North America Tagging Machines Market Value (US$ Mn) Analysis by Machine Type, 2015H-2029F

Table 11: North America Tagging Machines Market Volume (Units) Analysis by Capacity, 2015H-2029F

Table 12: North America Tagging Machines Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 13: North America Tagging Machines Market Volume (Units) Analysis by End Use, 2015H-2029F

Table 14: North America Tagging Machines Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 15: North America Tagging Machines Market Volume (Units) Analysis by Country, 2015H-2029F

Table 16: North America Tagging Machines Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 17: Latin America Tagging Machines Market Volume (Units) Analysis by Machine Type, 2015H-2029F

Table 18: Latin America Tagging Machines Market Value (US$ Mn) Analysis by Machine Type, 2015H-2029F

Table 19: Latin America Tagging Machines Market Volume (Units) Analysis by Capacity, 2015H-2029F

Table 20: Latin America Tagging Machines Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 21: Latin America Tagging Machines Market Volume (Units) Analysis by End Use, 2015H-2029F

Table 22: Latin America Tagging Machines Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 23: Latin America Tagging Machines Market Volume (Units) Analysis by Country, 2015H-2029F

Table 24: Latin America Tagging Machines Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 25: Europe Tagging Machines Market Volume (Units) Analysis by Machine Type, 2015H-2029F

Table 26: Europe Tagging Machines Market Value (US$ Mn) Analysis by Machine Type, 2015H-2029F

Table 27: Europe Tagging Machines Market Volume (Units) Analysis by Capacity, 2015H-2029F

Table 28: Europe Tagging Machines Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 29: Europe Tagging Machines Market Volume (Units) Analysis by End Use, 2015H-2029F

Table 30: Europe Tagging Machines Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 31: Europe Tagging Machines Market Volume (Units) Analysis by Country, 2015H-2029F

Table 32: Europe Tagging Machines Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 33: Asia Pacific Tagging Machines Market Volume (Units) Analysis by Machine Type, 2015H-2029F

Table 34: Asia Pacific Tagging Machines Market Value (US$ Mn) Analysis by Machine Type, 2015H-2029F

Table 35: Asia Pacific Tagging Machines Market Volume (Units) Analysis by Capacity, 2015H-2029F

Table 36: Asia Pacific Tagging Machines Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 37: Asia Pacific Tagging Machines Market Volume (Units) Analysis by End Use, 2015H-2029F

Table 38: Asia Pacific Tagging Machines Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 39: Asia Pacific Tagging Machines Market Volume (Units) Analysis by Country, 2015H-2029F

Table 40: Asia Pacific Tagging Machines Market Value (US$ Mn) Analysis by Country, 2015H-2029F

Table 41: Middle East and Africa Tagging Machines Market Volume (Units) Analysis by Machine Type, 2015H-2029F

Table 42: Middle East and Africa Tagging Machines Market Value (US$ Mn) Analysis by Machine Type, 2015H-2029F

Table 43: Middle East and Africa Tagging Machines Market Volume (Units) Analysis by Capacity, 2015H-2029F

Table 44: Middle East and Africa Tagging Machines Market Value (US$ Mn) Analysis by Capacity, 2015H-2029F

Table 45: Middle East and Africa Tagging Machines Market Volume (Units) Analysis by End Use, 2015H-2029F

Table 46: Middle East and Africa Tagging Machines Market Value (US$ Mn) Analysis by End Use, 2015H-2029F

Table 47: Middle East and Africa Tagging Machines Market Volume (Units) Analysis by Country, 2015H-2029F

Table 48: Middle East and Africa Tagging Machines Market Value (US$ Mn) Analysis by Country, 2015H-2029Fy, 2015H-2029F

List of Figures

Figure 01: Global Tagging Machines Market Attractiveness Analysis by Machine Type, 2021E-2029F

Figure 02: Global Tagging Machines Market Y-o-Y Analysis by Machine Type, 2019H-2029F

Figure 03: Global Tagging Machines Market Value Share Analysis by Machine Type, 2021(E)

Figure 04: Global Tagging Machines Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 05: Global Tagging Machines Market Y-o-Y Analysis by Capacity, 2019H-2029F

Figure 06: Global Tagging Machines Market Value Share Analysis by Capacity, 2021(E)

Figure 07: Global Tagging Machines Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 08: Global Tagging Machines Market Y-o-Y Analysis by End Use, 2019H-2029F

Figure 09: Global Tagging Machines Market Value Share Analysis by End Use, 2021(E)

Figure 10: Global Tagging Machines Market Attractiveness Analysis by Region, 2021E-2029F

Figure 11: Global Tagging Machines Market Y-o-Y Analysis by Region, 2019H-2029F

Figure 12: Global Tagging Machines Market Value Share Analysis by Region, 2021(E)

Figure 13: North America Tagging Machines Market Y-o-Y Analysis by Machine Type, 2019H-2029F

Figure 14: North America Tagging Machines Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 15: North America Tagging Machines Market Share Analysis by Country, 2021E & 2029F

Figure 16: North America Tagging Machines Market Value Share Analysis by End Use, 2021(E)

Figure 17: Latin America Tagging Machines Market Y-o-Y Analysis by Machine Type, 2019H-2029F

Figure 18: Latin America Tagging Machines Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 19: Latin America Tagging Machines Market Share Analysis by Country, 2021E

Figure 20: Latin America Tagging Machines Market Value Share Analysis by End Use, 2021(E)

Figure 21: Europe Tagging Machines Market Y-o-Y Analysis by Machine Type, 2019H-2029F

Figure 22: Europe Tagging Machines Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 23: Europe Tagging Machines Market Share Analysis by Country, 2021E & 2029F

Figure 24: Europe Tagging Machines Market Value Share Analysis by End Use, 2021(E)

Figure 25: Asia Pacific Tagging Machines Market Y-o-Y Analysis by Machine Type, 2019H-2029F

Figure 26: Asia Pacific Tagging Machines Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 27: Asia Pacific Tagging Machines Market Share Analysis by Country, 2021E

Figure 28: Asia Pacific Tagging Machines Market Value Share Analysis by End Use, 2021(E)

Figure 29: Middle East and Africa Tagging Machines Market Y-o-Y Analysis by Machine Type, 2019H-2029F

Figure 30: Middle East and Africa Tagging Machines Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 31: Middle East and Africa Tagging Machines Market Share Analysis by Country, 2021E & 2029F

Figure 32: Middle East and Africa Tagging Machines Market Value Share Analysis by End Use, 2021(E)