Staplers and sutures are conventional techniques used to close wounds and incisions during emergency treatments. However, these conventional techniques do not provide the desired results in complicated medical surgeries and are not capable of making a liquid-tight or an airtight seal on the artery or a lung wound. The uptake of surgical glue has, thus witnessed significant growth in the past few years and the trend is set to continue during the forecast period (2019-2027). Advancements in the surgical glue market were primarily aimed at addressing the limitations of traditional wound sealing techniques. Furthermore, due to favorable biological and physical properties of surgical glue, more number of surgeons are using this technique to seal wounds. Surgical glue is derived from several natural biopolymers including gelatin, collagen, chitosan, albumin, and fibrin.

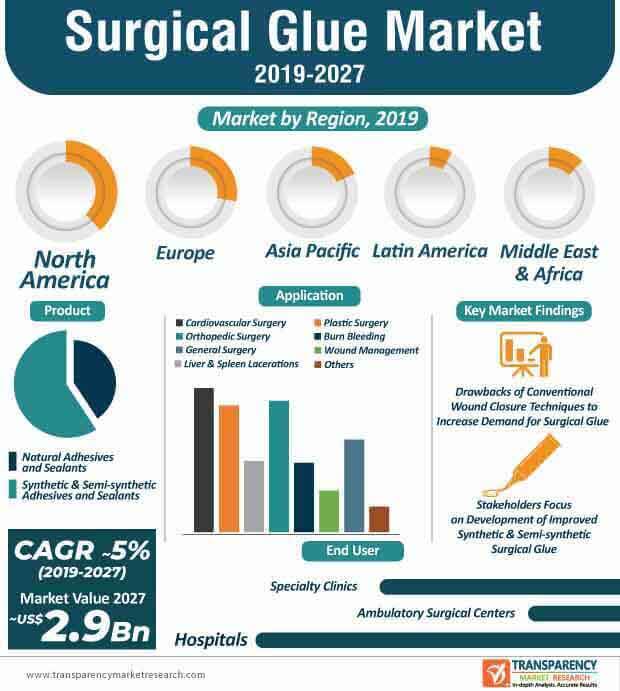

The adoption of surgical glue to perform orthopedic, cardiovascular, ophthalmic, gastrointestinal, periodontal, and reconstructive surgeries, among others, has witnessed significant growth. With consistent research and progress, innovations in the surgical glue market are expected to focus on improving the biocompatibility of these products. Increasing awareness regarding the advantages offered by surgical glue, a significant rise in the number of surgical procedures worldwide, and focus on improving the efficacy of new surgical glue are some of the leading factors that are expected to propel the growth of the market for surgical glue. The surgical glue market is expected to reach a value of ~US$ 2.9 Bn by 2027 from ~US$ 2 Bn in 2020.

The popularity of surgical glue continues to rise, as conventional wound closure techniques are time-consuming and involve multiple practical difficulties. Furthermore, traditional techniques are associated with causing pain to the surrounding tissues and in some cases, lead to infections. Mechanical procedures, including staplers and surgical sutures could leave unwanted gaps when used to treat specific body parts. In recent times, the demand for natural as well as synthetic biomedical adhesives has experienced a significant boost. The demand for these is on the rise, as they are safe and remain unaffected upon contact with internal organs, tissues, body fluids, blood, etc. One of the primary factors that are positively influencing the demand for surgical glue is the exceptional capability of the product to prevent fluid leakage.

Despite the strong competition between natural adhesives & sealants and synthetic & semi-synthetic adhesives & sealants, the latter is expected to hold a higher share of the surgical glue market during the forecast period. The synthetic & semi-synthetic adhesives and sealants product segment of the surgical glue market is likely to attain a market value of ~US$ 1.6 Bn and account for a market share of ~ 57% in 2027. Synthetic surgical glue is derived from cyanoacrylates, polyethylene glycol, polyurethanes, epoxies, etc. Of these, significant research is being carried out to explore the potential of cyanoacrylates and polyethylene glycol, as they are easy to use, have the desired biocompatibility, and offer competitive biological profiles. Despite following the trails of synthetic surgical glue in terms of market value, the natural adhesives & sealants product segment of the surgical glue market is expected to expand at a faster CAGR (~6%) during the forecast period. In the current scenario, research and development activities have paved the way for the new generation of adhesives, including blended adhesives – a combination of synthetic and natural substances. While blended surgical glue is likely to enter the surgical glue market in the near future, synthetic surgical glue will remain the most prominent product.

Stakeholders operating in the surgical glue market are expected to increase their efforts toward the development of new surgical glue with improved physical and functional properties. For instance, in June 2019, the research team at Technion – Israel Institute of Technology, announced that they have developed a new surgical glue that is non-toxic, biodegradable, and flexible. The new product is compatible with both internal as well as external surgeries. Despite emerging as a reliable alternative for surgical staplers and sutures, surgical glue is typically used for external applications only. However, the newly developed glue addresses this challenge.

Analysts’ Viewpoint

The surgical glue market is expected to grow at a CAGR of ~5% during the forecast period. Limitations of the traditional wound closure techniques and advent of surgical glue with enhanced capabilities and mechanical properties will provide an impetus for the adoption of surgical glue during the forecast period. Stakeholders should continue their pursuit of the development of new surgical glue and explore the potential of blended adhesives as well. North America and Europe are expected to be at the forefront, in terms of market share and value, owing to advancements in technology, significant investments in R&D, and high concentration of established market players in these regions.

Lack of Reimbursements

Surgical Glue Market: Competition Landscape

The report on the global surgical glue market discusses individual strategies, followed by company profiles of manufacturers of surgical glue products. The ‘Competition Landscape’ section has been included in the report to provide readers with a dashboard view and a company market share analysis of key players operating in the global surgical glue market.

Surgical glue market was valued at ~US$ 1.8 Bn in 2018

Surgical glue market is expected to reach a value of ~US$ 2.9 Bn by 2027

Surgical glue market is expected to expand at a CAGR of ~5% from 2019 to 2027

Surgical glue market is driven by rise in prevention of blood loss during surgeries

Key players in the global surgical glue market include Baxter, Braun Melsungen, Cardinal Health, CR. Bard, Johnson and Johnson

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Surgical Glue Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Surgical Glue Market Analysis and Forecasts, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Market Outlook

5.1. Key Mergers & Acquisitions

5.2. Pricing Analysis

6. Global Surgical Glue Market Analysis and Forecasts, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Forecast, by Product, 2017–2027

6.3.1. Natural Adhesives and Sealants

6.3.1.1. Fibrin Sealants

6.3.1.2. Collagen-based Adhesives

6.3.1.3. Gelatin-based Adhesives

6.3.2. Synthetic & Semi-synthetic Adhesives and Sealants

6.3.2.1. Cyanoacrylates

6.3.2.2. Hydrogels

6.3.2.3. Polyurethane-based Adhesives

6.4. Market Attractiveness, by Product

7. Global Surgical Glue Market Analysis and Forecasts, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Forecast, by Indication, 2017–2027

7.3.1. Hemostasis

7.3.2. Tissue Sealing

7.4. Market Attractiveness, by Indication

8. Global Surgical Glue Market Analysis and Forecasts, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Forecast, by Application, 2017–2027

8.3.1. Cardiovascular Surgery

8.3.2. Plastic Surgery

8.3.3. Liver & Spleen Laceration

8.3.4. Orthopedic Surgery

8.3.5. Burn Bleeding

8.3.6. Wound management

8.3.7. General Surgery

8.3.8. Others

8.4. Market Attractiveness, by Application

9. Global Surgical Glue Market Analysis and Forecasts, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Forecast, by End-user, 2017–2027

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Specialty Clinics

9.4. Market Attractiveness, by End-user

10. Global Surgical Glue Market Analysis and Forecasts, by Region

10.1. Key Findings

10.2. Market Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Surgical Glue Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Forecast, by Product, 2017–2027

11.2.1. Natural Adhesive and Sealants

11.2.1.1. Fibrin Sealants

11.2.1.2. Collagen-based Adhesives

11.2.1.3. Gelatin-based Adhesives

11.2.2. Synthetic & Semi-Synthetic Adhesives and Sealants

11.2.2.1. Cyanoacrylates

11.2.2.2. Hydrogels

11.2.2.3. Polyurethane-based Adhesives

11.3. Market Forecast, by Indication, 2017–2027

11.3.1. Hemostasis

11.3.2. Tissue Sealing

11.4. Market Forecast, by Application, 2017–2027

11.4.1. Cardiovascular Surgery

11.4.2. Plastic Surgery

11.4.3. Liver & Spleen Laceration

11.4.4. Orthopedic Surgery

11.4.5. Burn Bleeding

11.4.6. Wound Management

11.4.7. General Surgery

11.4.8. Others

11.5. Market Forecast, by End-user, 2017–2027

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Specialty Clinics

11.6. Market Forecast, by Country, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Indication

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Surgical Glue Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Forecast, by Product, 2017–2027

12.2.1. Natural Adhesive and Sealants

12.2.1.1. Fibrin Sealants

12.2.1.2. Collagen-based Adhesives

12.2.1.3. Gelatin-based Adhesives

12.2.2. Synthetic & Semi-synthetic Adhesives and Sealants

12.2.2.1. Cyanoacrylates

12.2.2.2. Hydrogels

12.2.2.3. Polyurethane-based Adhesives

12.3. Market Forecast, by Indication, 2017–2027

12.3.1. Hemostasis

12.3.2. Tissue Sealing

12.4. Market Forecast, by Application, 2017–2027

12.4.1. Cardiovascular Surgery

12.4.2. Plastic Surgery

12.4.3. Liver & Spleen Laceration

12.4.4. Orthopedic Surgery

12.4.5. Burn Bleeding

12.4.6. Wound Management

12.4.7. General Surgery

12.4.8. Others

12.5. Market Forecast, by End-user, 2017–2027

12.5.1. Hospitals

12.5.2. Ambulatory Surgical Centers

12.5.3. Specialty Clinics

12.6. Market Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Indication

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Surgical Glue Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Forecast, by Product, 2017–2027

13.2.1. Natural Adhesive and Sealants

13.2.1.1. Fibrin Sealants

13.2.1.2. Collagen-based Adhesives

13.2.1.3. Gelatin-based Adhesives

13.2.2. Synthetic & Semi-synthetic Adhesives and Sealants

13.2.2.1. Cyanoacrylates

13.2.2.2. Hydrogels

13.2.2.3. Polyurethane-based Adhesives

13.3. Market Forecast, by Indication, 2017–2027

13.3.1. Hemostasis

13.3.2. Tissue Sealing

13.4. Market Forecast, by Application, 2017–2027

13.4.1. Cardiovascular Surgery

13.4.2. Plastic Surgery

13.4.3. Liver & Spleen Laceration

13.4.4. Orthopedic Surgery

13.4.5. Burn Bleeding

13.4.6. Wound Management

13.4.7. General Surgery

13.4.8. Others

13.5. Market Forecast, by End-user, 2017–2027

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Specialty Clinics

13.6. Market Forecast, by Country/Sub-region, 2017–2027

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Indication

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Surgical Glue Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Forecast, by Product, 2017–2027

14.2.1. Natural Adhesive and Sealants

14.2.1.1. Fibrin Sealants

14.2.1.2. Collagen-based Adhesives

14.2.1.3. Gelatin-based Adhesives

14.2.2. Synthetic & Semi-synthetic Adhesives and Sealants

14.2.2.1. Cyanoacrylates

14.2.2.2. Hydrogels

14.2.2.3. Polyurethane-based Adhesives

14.3. Market Forecast, by Indication, 2017–2027

14.3.1. Hemostasis

14.3.2. Tissue Sealing

14.4. Market Forecast, by Application, 2017–2027

14.4.1. Cardiovascular Surgery

14.4.2. Plastic Surgery

14.4.3. Liver & Spleen Laceration

14.4.4. Orthopedic Surgery

14.4.5. Burn Bleeding

14.4.6. Wound Management

14.4.7. General Surgery

14.4.8. Others

14.5. Market Forecast, by End-user, 2017–2027

14.5.1. Hospitals

14.5.2. Ambulatory Surgical Centers

14.5.3. Specialty Clinics

14.6. Market Forecast, by Country/Sub-region, 2017–2027

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Indication

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Surgical Glue Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Forecast, by Product, 2017–2027

15.2.1. Natural Adhesive and Sealants

15.2.1.1. Fibrin Sealants

15.2.1.2. Collagen-based Adhesives

15.2.1.3. Gelatin-based Adhesives

15.2.2. Synthetic & Semi-synthetic Adhesives and Sealants

15.2.2.1. Cyanoacrylates

15.2.2.2. Hydrogels

15.2.2.3. Polyurethane-based Adhesives

15.3. Market Forecast, by Indication, 2017–2027

15.3.1. Hemostasis

15.3.2. Tissue Sealing

15.4. Market Forecast, by Application, 2017–2027

15.4.1. Cardiovascular Surgery

15.4.2. Plastic Surgery

15.4.3. Liver & Spleen Laceration

15.4.4. Orthopedic Surgery

15.4.5. Burn Bleeding

15.4.6. Wound Management

15.4.7. General Surgery

15.4.8. Others

15.5. Market Forecast, by End-user, 2017–2027

15.5.1. Hospitals

15.5.2. Ambulatory Surgical Centers

15.5.3. Specialty Clinics

15.6. Market Forecast, by Country/Sub-region, 2017–2027

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Israel

15.6.4. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Indication

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2018)

16.3. Company Profiles

16.3.1. Baxter

16.3.1.1. Company Overview

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. B. Braun Melsungen AG

16.3.2.1. Company Overview

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. Cardinal Health

16.3.3.1. Company Overview

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. CR. Bard

16.3.4.1. Company Overview

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Johnson and Johnson

16.3.5.1. Company Overview

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. OptMed, Inc.

16.3.6.1. Company Overview

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Applied Medical Resources Corporation

16.3.7.1. Company Overview

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. CryoLife

16.3.8.1. Company Overview

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. Integra LifeSciences

16.3.9.1. Company Overview

16.3.9.2. Company Financials

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. Medtronic

16.3.10.1. Company Overview

16.3.10.2. Company Financials

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

16.3.11. Other Prominent Key Players

List of Tables

Table 1: Global Surgical Glue Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 2: Global Surgical Glue Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 3: Global Surgical Glue Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 4: Global Surgical Glue Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 5: Global Surgical Glue Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 6: North America Surgical Glue Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 7: North America Surgical Glue Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 8: North America Surgical Glue Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 9: North America Surgical Glue Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 10: North America Surgical Glue Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 11: Europe Surgical Glue Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 12: Europe Surgical Glue Market Revenue (US$ Mn) Forecast, by Indication, 2017–2027

Table 13: Europe Surgical Glue Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 14: Europe Surgical Glue Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 15: Europe Surgical Glue Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Asia Pacific Surgical Glue Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 17: Asia Pacific Surgical Glue Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 18: Asia Pacific Surgical Glue Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 19: Asia Pacific Surgical Glue Market Value (US$ Mn) Forecast, by End-user, 2017–202

Table 20: Asia Pacific Surgical Glue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 21: Latin America Surgical Glue Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 22: Latin America Surgical Glue Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 23: Latin America Surgical Glue Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 24: Latin America Surgical Glue Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 25: Latin America Surgical Glue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 26: Middle East & Africa Surgical Glue Market Value (US$ Mn) Forecast, by Product, 2017–2027

Table 27: Middle East & Africa Surgical Glue Market Value (US$ Mn) Forecast, by Indication, 2017–2027

Table 28: Middle East & Africa Surgical Glue Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 29: Middle East & Africa Surgical Glue Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 30: Middle East & Africa Surgical Glue Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 1: Global Surgical Glue Market Value, by Product (US$ Mn), 2018

Figure 2: Global Surgical Glue Market Share, Top Trends by Product (2018)

Figure 3: Global Surgical Glue Market Share by Region, 2018

Figure 4: Global Surgical Glue Market Share Analysis, by Region

Figure 5: Porter’s Five Forces Analysis

Figure 6: Global Surgical Glue Market Value (US$ Mn) and Forecast, 2019–2027

Figure 7: Global Surgical Glue Market Value Share, by Product (2018)

Figure 8: Global Surgical Glue Market Value Share, by Indication (2018)

Figure 9: Global Surgical Glue Market Value Share, by Application (2018)

Figure 10: Global Surgical Glue Market Value Share, by End-user (2018)

Figure 11: Global Surgical Glue Market Value Share Analysis, by Product, 2018 and 2027

Figure 12: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Natural Adhesive and Sealants, 2017–2027

Figure 13: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Synthetic & Semi-synthetic Adhesives and Sealants, 2017–2027

Figure 14: Global Surgical Glue Market Attractiveness Analysis, by Product, 2019–2027

Figure 15: Global Surgical Glue Market Value Share Analysis, by Indication, 2018 and 2027

Figure 16: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hemostasis, 2017–2027

Figure 17: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Tissue Sealing, 2017–2027

Figure 18: Global Surgical Glue Market Attractiveness Analysis, by Indication, 2019–2027

Figure 19: Global Surgical Glue Market Value Share Analysis, by Application, 2018 and 2027

Figure 20: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cardiovascular Surgery, 2017–2027

Figure 21: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Plastic Surgery, 2017–2027

Figure 22: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Liver & Spleen Lacerations, 2017–2027

Figure 23: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Orthopedic Surgery, 2017–2027

Figure 24: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Burn Bleeding, 2017–2027

Figure 25: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Wound Management, 2017–2027

Figure 26: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by General Surgery, 2017–2027

Figure 27: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2027

Figure 28: Global Surgical Glue Market Attractiveness Analysis, by Application, 2019–2027

Figure 29: Global Surgical Glue Market Value Share Analysis, by End-user, 2018 and 2027

Figure 30: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), Hospitals, 2017–2027

Figure 31: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ambulatory Surgical Centers, 2017–2027

Figure 32: Global Surgical Glue Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Specialty Clinics, 2017–2027

Figure 33: Global Surgical Glue Market Attractiveness Analysis, by End-user, 2019–2027

Figure 34: Global Surgical Glue Market Value Share Analysis, by Region, 2018 and 2027

Figure 35: Global Surgical Glue Market Attractiveness Analysis, by Region, 2019–2027

Figure 36: North America Surgical Glue Market Value (US$ Mn) Forecast, 2017–2027

Figure 37: North America Surgical Glue Market Attractiveness Analysis, by Country, 2019–2027

Figure 38: North America Surgical Glue Market Value Share Analysis, by Product, 2018 and 2027

Figure 39: North America Surgical Glue Market Value Share Analysis, by Indication, 2018 and 2027

Figure 40: North America Surgical Glue Market Value Share Analysis, by Application, 2018 and 2027

Figure 41: North America Surgical Glue Market Value Share Analysis, by End-user, 2018 and 2027

Figure 42: North America Surgical Glue Market Value Share Analysis, by Country, 2018 and 2027

Figure 43: North America Surgical Glue Market Attractiveness Analysis, by Product, 2019-2027

Figure 44: North America Surgical Glue Market Attractiveness Analysis, by Indication, 2019-2027

Figure 45: North America Surgical Glue Market Attractiveness Analysis, by Application, 2019-2027

Figure 46: North America Surgical Glue Market Attractiveness Analysis, by End-user, 2018-2027

Figure 47: Europe Surgical Glue Market Value (US$ Mn) Forecast, 2017–2027

Figure 48: Europe Surgical Glue Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 49: Europe Surgical Glue Market Value Share Analysis, by Product, 2018 and 2027

Figure 50: Europe Surgical Glue Market Value Share Analysis, by Indication, 2018 and 2027

Figure 51: Europe Surgical Glue Market Value Share Analysis, by Application, 2018 and 2027

Figure 52: Europe Surgical Glue Market Value Share Analysis, by End-user, 2018 and 2027

Figure 53: Europe Surgical Glue Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 54: Europe Surgical Glue Market Attractiveness Analysis, by Product, 2019-2027

Figure 55: Europe Surgical Glue Market Attractiveness Analysis, by Indication, 2019-2027

Figure 56: Europe Surgical Glue Market Attractiveness Analysis, by Application, 2019-2027

Figure 57: Europe Surgical Glue Market Attractiveness Analysis, by End-user, 2018-2027

Figure 58: Asia Pacific Surgical Glue Market Value (US$ Mn) Forecast, 2017–2027

Figure 59: Asia Pacific Surgical Glue Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 60: Asia Pacific Surgical Glue Market Value Share Analysis, by Product, 2018 and 2027

Figure 61: Asia Pacific Surgical Glue Market Value Share Analysis, by Indication, 2018 and 2027

Figure 62: Asia Pacific Surgical Glue Market Value Share Analysis, by Application, 2018 and 2027

Figure 63: Asia Pacific Surgical Glue Market Value Share Analysis, by End-user, 2018 and 2027

Figure 64: Asia Pacific Surgical Glue Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 65: Asia Pacific Surgical Glue Market Attractiveness Analysis, by Product, 2019-2027

Figure 66: Asia Pacific Surgical Glue Market Attractiveness Analysis, by Indication, 2019-2027

Figure 67: Asia Pacific Surgical Glue Market Attractiveness Analysis, by Application, 2019-2027

Figure 68: Asia Pacific Surgical Glue Market Attractiveness Analysis, by End-user, 2018-2027

Figure 69: Latin America Surgical Glue Market Value (US$ Mn) Forecast, 2017–2027

Figure 70: Latin America Surgical Glue Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 71: Latin America Surgical Glue Market Value Share Analysis, by Product, 2018 and 2027

Figure 72: Latin America Surgical Glue Market Value Share Analysis, by Indication, 2018 and 2027

Figure 73: Latin America Surgical Glue Market Value Share Analysis, by Application, 2018 and 2027

Figure 74: Latin America Surgical Glue Market Value Share Analysis, by End-user, 2018 and 2027

Figure 75: Latin America Surgical Glue Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 76: Latin America Surgical Glue Market Attractiveness Analysis, by Product, 2019-2027

Figure 77: Latin America Surgical Glue Market Attractiveness Analysis, by Indication, 2019-2027

Figure 78: Latin America Surgical Glue Market Attractiveness Analysis, by Application, 2019-2027

Figure 79: Latin America Surgical Glue Market Attractiveness Analysis, by End-user, 2018-2027

Figure 80: Middle East & Africa Surgical Glue Market Value (US$ Mn) Forecast, 2017–2027

Figure 81: Middle East & Africa Surgical Glue Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 82: Middle East & Africa Surgical Glue Market Value Share Analysis, by Product, 2018 and 2027

Figure 83: Middle East & Africa Surgical Glue Market Value Share Analysis, by Indication, 2018 and 2027

Figure 84: Middle East & Africa Surgical Glue Market Value Share Analysis, by Application, 2018 and 2027

Figure 85: Middle East & Africa Surgical Glue Market Value Share Analysis, by End-user, 2018 and 2027

Figure 86: Middle East & Africa Surgical Glue Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 87: Middle East & Africa Surgical Glue Market Attractiveness Analysis, by Product, 2019-2027

Figure 88: Middle East & Africa Surgical Glue Market Attractiveness Analysis, by Indication, 2019-2027

Figure 89: Middle East & Africa Surgical Glue Market Attractiveness Analysis, by Application, 2019-2027

Figure 90: Middle East & Africa Surgical Glue Market Attractiveness Analysis, by End-user, 2018-2027