Analysts’ Viewpoint

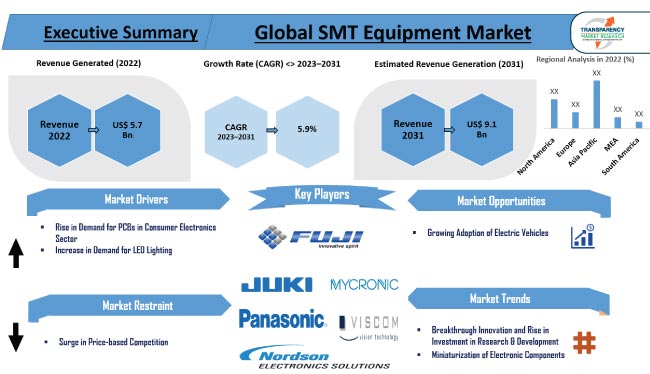

Rise in demand for PCBs in the consumer electronics sector is driving the global SMT equipment market. Demand for electronic products such as smartphones, laptops, IoT devices, consumer electronics, and industrial equipment has increased in the past few years. Technological advancements, consumer preference, industrial automation, and growth of the emerging markets are the other major factors propelling market expansion. Furthermore, high-speed and high-precision assembly of electronic components onto PCBs are likely to bolster the global SMT equipment market size during the forecast period.

Development of SMT machines that are capable of handling large volumes of small, intricate components efficiently and could enable rapid prototyping & quick product development cycles offers lucrative opportunities to market players. Manufacturers are focusing on introducing advanced SMT equipment machine that are fast and accurate in order to increase market share.

Surface mount technology (SMT) equipment is an integral part of the electronics manufacturing industry. This equipment is used for the assembly and production of electronic components onto printed circuit boards (PCBs).

Surface mount technology equipment includes various types of machines and tools such as pick-and-place machines, solder paste printers, reflow ovens, and inspection systems.

The printed circuit board (PCB) industry experienced rapid growth in the past few years, primarily owing to continuous development of consumer electronic devices and increase in demand for PCBs in all electronics and electrical equipment.

These electronic devices come in various shapes, forms, and sizes, and are developed according to the application requirement. Thus, the processing life cycle of an electronic device travels through the entire surface mount technology (SMT) equipment from being a printed circuit board to a finished electronic device.

The Internet of Things (IoT) is providing new opportunities to the manufacturers of consumer electronics, wearable devices, such as smart watches that incorporate chips, and flexible sensors. Breakthrough in designing these devices and manufacturing technology could have a significant impact on the PCB market. Moreover, the number of systems connected over the internet has increased across the globe in the past decade.

SMT manufacturing equipment enables PCB manufacturers to place more features on smaller boards without having to secure components with through-hole wire leads. SMT manufacturing equipment uses soldering and adhesive equipment to secure components directly to the surface of a printed circuit board.

According to India Brand Equity Foundation, the appliances and consumer electronics industry in India stood at US$ 9.84 Bn in 2021, and is expected to reach US$ 21.18 Bn by 2025.

These factors are projected to drive the SMT equipment market demand in the near future.

Longer operating life & higher brightness and growing awareness about green technology have propelled demand for LEDs in the past few years.

Traditional manufacturing methods cannot meet this sudden surge in demand for LED products. Therefore, LED manufacturers have shifted toward high quality SMT equipment that effectively increase the production output while cutting down manufacturing costs substantially.

Elimination of rework, improvement in manufacturing processes, reduction of associated costs, higher yield, and increased margins are the key benefits of adoption of SMT inspection equipment.

Prior to SMT line production, the process of placing LEDs into their packages was done by hand. Since most of the high-precision work was done manually, variations in output and inconsistencies caused by human error were some of the major issues faced.

By adopting SMT manufacturing lines, LED manufacturers and designers have witnessed a significant spike in yield, performance, and durability. Hence, benefits offered by SMT equipment to the semiconductor industry have increased their widespread adoption.

In terms of equipment type, the placement equipment segment accounted for the largest global SMT equipment market share of 31.0% in 2022. The segment is likely to expand at a CAGR of 6.6% during the forecast period.

SMT placement equipment, such as pick and place machines, can rapidly and accurately position surface mount components onto printed circuit boards (PCBs). This high-speed placement capability is essential to meet demand for large-scale electronic product manufacturing.

SMT placement equipment has the ability to handle miniature components and placing them with micron-level precision, enabling the miniaturization trend in the electronics industry. Hence, these factors are projected to bolster the SMT placement equipment segment in the near future.

Based on application, the consumer electronics segment dominated the global SMT equipment market in 2022. The segment is anticipated to expand at a CAGR of 6.3% during the forecast period. The consumer electronics segment’s dominance is ascribed to surge in demand for smartphones, tablets, televisions, and gaming consoles. Moreover, demand for SMT equipment has increased in high volume automated production of consumer electronics.

As per global SMT equipment market trends, Asia Pacific held the largest share of 42.8% in 2022. The region is at the forefront of the trend toward miniaturization and high component density in electronic devices. SMT equipment is tailored to handle tiny, densely packed components, supporting the development of smaller and lighter electronic products. Hence, demand for SMT equipment has increased in the region.

North America accounted for 26.2% share of the global market in 2022. The region is expected to dominate the SMT equipment market during the forecast period. This is ascribed to surge in demand for highly reliable electronic components for critical applications in aerospace and defense sectors. SMT equipment plays a vital role in producing these components, meeting the demand for advanced avionics, communication systems, and military electronics.

The global SMT equipment market is fragmented, with the presence of large number of players. Majority of companies are investing significantly on providing SMT equipment. Expansion of product portfolio and merger & acquisition are the key strategies adopted by the leading players.

ASM Assembly Systems GmbH & Co. Kg, Cyberoptics Corporation, Electro Scientific Industries, Inc., Fuji Corporation, Hitachi High-Technologies Corporation, Juki Corporation, Mycronic AB, Nordson (asymtek) Corporation, Orbotech Ltd., Viscom AG, Panasonic Corporation, Yamaha Motor Co., Ltd., and Hanwha Group are the prominent players in the market.

Each of these players has been profiled in the SMT equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 5.7 Bn |

| Forecast (Value) in 2031 | US$ 9.1 Bn |

| Growth Rate (CAGR) | 5.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value & Million Units for Volume |

| Market Analysis | It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.7 Mn in 2022.

It is expected to expand at a CAGR of 5.9% from 2023 to 2031.

Rise in demand for PCBs in consumer electronics sector and increase in demand for LED lighting.

The consumer electronics application segment accounted for major share of 27.9% in 2022.

Asia Pacific is a highly lucrative region for vendors.

The industry in China was valued at US$ 1.0 Bn in 2022.

ASM Assembly Systems GmbH & Co. Kg, Cyberoptics Corporation, Electro Scientific Industries, Inc., Fuji Corporation, Hitachi High-Technologies Corporation, Juki Corporation, Mycronic AB, Nordson (asymtek) Corporation, Orbotech Ltd., Viscom AG, Panasonic Corporation, Yamaha Motor Co., Ltd., and Hanwha Group.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global SMT Equipment Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Automation Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Component Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global SMT Equipment Market Analysis, By Equipment Type

5.1. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Equipment Type, 2017-2031

5.1.1. Inspection Equipment

5.1.2. Placement Equipment

5.1.3. Soldering Equipment

5.1.4. Screen Printing Equipment

5.1.5. Cleaning Equipment

5.1.6. Others

5.2. Market Attractiveness Analysis, By Equipment Type

6. Global SMT Equipment Market Analysis, By Component

6.1. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Component, 2017-2031

6.1.1. Passive Surface-mount Devices

6.1.2. Transistor & Diodes

6.1.3. Integrated Circuits

6.2. Market Attractiveness Analysis, By Component

7. Global SMT Equipment Market Analysis, By Application

7.1. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

7.1.1. Consumer Electronics

7.1.2. Telecommunication

7.1.3. Aerospace & Defense

7.1.4. Automotive

7.1.5. Medical

7.1.6. Industrial

7.1.7. Energy and Power Systems

7.2. Market Attractiveness Analysis, By Application

8. Global SMT Equipment Market Analysis and Forecast, By Region

8.1. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America SMT Equipment Market Analysis and Forecast

9.1. Market Snapshot

9.2. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Equipment Type, 2017-2031

9.2.1. Inspection Equipment

9.2.2. Placement Equipment

9.2.3. Soldering Equipment

9.2.4. Screen Printing Equipment

9.2.5. Cleaning Equipment

9.2.6. Others

9.3. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Component, 2017-2031

9.3.1. Passive Surface-mount Devices

9.3.2. Transistor & Diodes

9.3.3. Integrated Circuits

9.4. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Consumer Electronics

9.4.2. Telecommunication

9.4.3. Aerospace & Defense

9.4.4. Automotive

9.4.5. Medical

9.4.6. Industrial

9.4.7. Energy and Power Systems

9.5. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Equipment Type

9.6.2. By Component

9.6.3. By Application

9.6.4. By Country and Sub-region

10. Europe SMT Equipment Market Analysis and Forecast

10.1. Market Snapshot

10.2. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Equipment Type, 2017-2031

10.2.1. Inspection Equipment

10.2.2. Placement Equipment

10.2.3. Soldering Equipment

10.2.4. Screen Printing Equipment

10.2.5. Cleaning Equipment

10.2.6. Others

10.3. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Component, 2017-2031

10.3.1. Passive Surface-mount Devices

10.3.2. Transistor & Diodes

10.3.3. Integrated Circuits

10.4. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Consumer Electronics

10.4.2. Telecommunication

10.4.3. Aerospace & Defense

10.4.4. Automotive

10.4.5. Medical

10.4.6. Industrial

10.4.7. Energy and Power Systems

10.5. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Equipment Type

10.6.2. By Component

10.6.3. By Application

10.6.4. By Country and Sub-region

11. Asia Pacific SMT Equipment Market Analysis and Forecast

11.1. Market Snapshot

11.2. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Equipment Type, 2017-2031

11.2.1. Inspection Equipment

11.2.2. Placement Equipment

11.2.3. Soldering Equipment

11.2.4. Screen Printing Equipment

11.2.5. Cleaning Equipment

11.2.6. Others

11.3. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Component, 2017-2031

11.3.1. Passive Surface-mount Devices

11.3.2. Transistor & Diodes

11.3.3. Integrated Circuits

11.4. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Consumer Electronics

11.4.2. Telecommunication

11.4.3. Aerospace & Defense

11.4.4. Automotive

11.4.5. Medical

11.4.6. Industrial

11.4.7. Energy and Power Systems

11.5. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Equipment Type

11.6.2. By Component

11.6.3. By Application

11.6.4. By Country and Sub-region

12. Middle East & Africa SMT Equipment Market Analysis and Forecast

12.1. Market Snapshot

12.2. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Equipment Type, 2017-2031

12.2.1. Inspection Equipment

12.2.2. Placement Equipment

12.2.3. Soldering Equipment

12.2.4. Screen Printing Equipment

12.2.5. Cleaning Equipment

12.2.6. Others

12.3. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Component, 2017-2031

12.3.1. Passive Surface-mount Devices

12.3.2. Transistor & Diodes

12.3.3. Integrated Circuits

12.4. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Consumer Electronics

12.4.2. Telecommunication

12.4.3. Aerospace & Defense

12.4.4. Automotive

12.4.5. Medical

12.4.6. Industrial

12.4.7. Energy and Power Systems

12.5. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Equipment Type

12.6.2. By Component

12.6.3. By Application

12.6.4. By Country and Sub-region

13. South America SMT Equipment Market Analysis and Forecast

13.1. Market Snapshot

13.2. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Equipment Type, 2017-2031

13.2.1. Inspection Equipment

13.2.2. Placement Equipment

13.2.3. Soldering Equipment

13.2.4. Screen Printing Equipment

13.2.5. Cleaning Equipment

13.2.6. Others

13.3. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Component, 2017-2031

13.3.1. Passive Surface-mount Devices

13.3.2. Transistor & Diodes

13.3.3. Integrated Circuits

13.4. SMT Equipment Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Consumer Electronics

13.4.2. Telecommunication

13.4.3. Aerospace & Defense

13.4.4. Automotive

13.4.5. Medical

13.4.6. Industrial

13.4.7. Energy and Power Systems

13.5. SMT Equipment Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Equipment Type

13.6.2. By Component

13.6.3. By Application

13.6.4. By Country and Sub-region

14. Competition Assessment

14.1. Global SMT Equipment Market Competition Matrix - a Dashboard View

14.1.1. Global SMT Equipment Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ASM Assembly Systems GmbH & Co. Kg

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Cyberoptics Corporation

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Electro Scientific Industries, Inc.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Fuji corporation

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Hanwha Group

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Hitachi High-Technologies Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Juki Corporation

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Mycronic AB

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Nordson (asymtek) Corporation

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Orbotech Ltd.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Panasonic Corporation

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Viscom AG

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. Yamaha Motor Co., Ltd

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global SMT Equipment Market Value (US$ Mn) & Forecast, by Equipment Type, 2017‒2031

Table 2: Global SMT Equipment Market Volume (Million Units) & Forecast, by Equipment Type, 2017‒2031

Table 3: Global SMT Equipment Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 4: Global SMT Equipment Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 5: Global SMT Equipment Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: Global SMT Equipment Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 7: North America SMT Equipment Market Value (US$ Mn) & Forecast, by Equipment Type, 2017‒2031

Table 8: North America SMT Equipment Market Volume (Million Units) & Forecast, by Equipment Type, 2017‒2031

Table 9: North America SMT Equipment Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 10: North America SMT Equipment Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 11: North America SMT Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 12: North America SMT Equipment Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Europe SMT Equipment Market Value (US$ Mn) & Forecast, by Equipment Type, 2017‒2031

Table 14: Europe SMT Equipment Market Volume (Million Units) & Forecast, by Equipment Type, 2017‒2031

Table 15: Europe SMT Equipment Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 16: Europe SMT Equipment Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 17: Europe SMT Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 18: Europe SMT Equipment Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 19: Asia Pacific SMT Equipment Market Value (US$ Mn) & Forecast, by Equipment Type, 2017‒2031

Table 20: Asia Pacific SMT Equipment Market Volume (Million Units) & Forecast, by Equipment Type, 2017‒2031

Table 21: Asia Pacific SMT Equipment Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 22: Asia Pacific SMT Equipment Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 23: Asia Pacific SMT Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 24: Asia Pacific SMT Equipment Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 25: Middle East & Africa SMT Equipment Market Value (US$ Mn) & Forecast, by Equipment Type, 2017‒2031

Table 26: Middle East & Africa SMT Equipment Market Volume (Million Units) & Forecast, by Equipment Type, 2017‒2031

Table 27: Middle East & Africa SMT Equipment Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 28: Middle East & Africa SMT Equipment Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 29: Middle East & Africa SMT Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: Middle East & Africa SMT Equipment Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 31: South America SMT Equipment Market Value (US$ Mn) & Forecast, by Equipment Type, 2017‒2031

Table 32: South America SMT Equipment Market Volume (Million Units) & Forecast, by Equipment Type, 2017‒2031

Table 33: South America SMT Equipment Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 34: South America SMT Equipment Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 35: South America SMT Equipment Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 36: South America SMT Equipment Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global SMT Equipment

Figure 02: Porter Five Forces Analysis - Global SMT Equipment

Figure 03: Technology Road Map - Global SMT Equipment

Figure 04: Global SMT Equipment Market, Value (US$ Mn), 2017-2031

Figure 05: Global SMT Equipment Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global SMT Equipment Market Projections by Equipment Type, Value (US$ Mn), 2017‒2031

Figure 07: Global SMT Equipment Market, Incremental Opportunity, by Equipment Type, 2023‒2031

Figure 08: Global SMT Equipment Market Share Analysis, by Equipment Type, 2023 and 2031

Figure 09: Global SMT Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 10: Global SMT Equipment Market, Incremental Opportunity, by Component, 2023‒2031

Figure 11: Global SMT Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 12: Global SMT Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 13: Global SMT Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 14: Global SMT Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 15: Global SMT Equipment Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global SMT Equipment Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global SMT Equipment Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America SMT Equipment Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America SMT Equipment Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America SMT Equipment Market Projections by Equipment Type Value (US$ Mn), 2017‒2031

Figure 21: North America SMT Equipment Market, Incremental Opportunity, by Equipment Type, 2023‒2031

Figure 22: North America SMT Equipment Market Share Analysis, by Equipment Type, 2023 and 2031

Figure 23: North America SMT Equipment Market Projections by Component (US$ Mn), 2017‒2031

Figure 24: North America SMT Equipment Market, Incremental Opportunity, by Component, 2023‒2031

Figure 25: North America SMT Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 26: North America SMT Equipment Market Projections by Application Value (US$ Mn), 2017‒2031

Figure 27: North America SMT Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 28: North America SMT Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 29: North America SMT Equipment Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 30: North America SMT Equipment Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 31: North America SMT Equipment Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 32: Europe SMT Equipment Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe SMT Equipment Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe SMT Equipment Market Projections by Equipment Type Value (US$ Mn), 2017‒2031

Figure 35: Europe SMT Equipment Market, Incremental Opportunity, by Equipment Type, 2023‒2031

Figure 36: Europe SMT Equipment Market Share Analysis, by Equipment Type, 2023 and 2031

Figure 37: Europe SMT Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 38: Europe SMT Equipment Market, Incremental Opportunity, by Component, 2023‒2031

Figure 39: Europe SMT Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 40: Europe SMT Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 41: Europe SMT Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 42: Europe SMT Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 43: Europe SMT Equipment Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe SMT Equipment Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 45: Europe SMT Equipment Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 46: Asia Pacific SMT Equipment Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific SMT Equipment Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific SMT Equipment Market Projections by Equipment Type Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific SMT Equipment Market, Incremental Opportunity, by Equipment Type, 2023‒2031

Figure 50: Asia Pacific SMT Equipment Market Share Analysis, by Equipment Type, 2023 and 2031

Figure 51: Asia Pacific SMT Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific SMT Equipment Market, Incremental Opportunity, by Component, 2023‒2031

Figure 53: Asia Pacific SMT Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 54: Asia Pacific SMT Equipment Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific SMT Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 56: Asia Pacific SMT Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 57: Asia Pacific SMT Equipment Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific SMT Equipment Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 59: Asia Pacific SMT Equipment Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 60: Middle East & Africa SMT Equipment Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa SMT Equipment Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 62: Middle East & Africa SMT Equipment Market Projections by Equipment Type Value (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa SMT Equipment Market, Incremental Opportunity, by Equipment Type, 2023‒2031

Figure 64: Middle East & Africa SMT Equipment Market Share Analysis, by Equipment Type, 2023 and 2031

Figure 65: Middle East & Africa SMT Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa SMT Equipment Market, Incremental Opportunity, by Component, 2023‒2031

Figure 67: Middle East & Africa SMT Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 68: Middle East & Africa SMT Equipment Market Projections by Application Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa SMT Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 70: Middle East & Africa SMT Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 71: Middle East & Africa SMT Equipment Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa SMT Equipment Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 73: Middle East & Africa SMT Equipment Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 74: South America SMT Equipment Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: South America SMT Equipment Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 76: South America SMT Equipment Market Projections by Equipment Type Value (US$ Mn), 2017‒2031

Figure 77: South America SMT Equipment Market, Incremental Opportunity, by Equipment Type, 2023‒2031

Figure 78: South America SMT Equipment Market Share Analysis, by Equipment Type, 2023 and 2031

Figure 79: South America SMT Equipment Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 80: South America SMT Equipment Market, Incremental Opportunity, by Component, 2023‒2031

Figure 81: South America SMT Equipment Market Share Analysis, by Component, 2023 and 2031

Figure 82: South America SMT Equipment Market Projections by Application Value (US$ Mn), 2017‒2031

Figure 83: South America SMT Equipment Market, Incremental Opportunity, by Application, 2023‒2031

Figure 84: South America SMT Equipment Market Share Analysis, by Application, 2023 and 2031

Figure 85: South America SMT Equipment Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 86: South America SMT Equipment Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 87: South America SMT Equipment Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 88: Global SMT Equipment Market Competition

Figure 89: Global SMT Equipment Market Company Share Analysis