Analysts’ Viewpoint on Market Scenario

Shortwave infrared lamps are widely used in industries such as plastics, automotive, printing, food, electronics, and textiles. Expansion of these industries is estimated to drive the demand for shortwave infrared lamps. These lamps are also used for radiant heating purposes in several industrial operations.

Growth in popularity of different types of shortwave infrared lamps such as white, gold, and non-glare lamps in varied power and lighted length showcases the positive shortwave infrared lamps market size. Key suppliers are offering advanced infrared solutions with highest quality standards to increase their market share.

Shortwave infrared lamp, also known as shortwave infrared light bulb or shortwave infrared heat lamp, is used in radiant heating for industrial applications. Rise in advancements in infrared technology and its usage in different industrial sectors is boosting the shortwave infrared lamps market.

Shortwave infrared-based cameras play a vital role in night vision, surveillance, and security. End-users consider infrared technologies to be a more convenient and energy-saving option. This is expected to drive market expansion during the forecast period.

Short-wave is an ideal technology for comfort heating, especially in warehouses, factories, and other industrial applications. It has a longer wavelength than visible light. Therefore, it is less affected by fine particles in the atmosphere. It also possesses good permeability.

Short-wave technology is transparent. It is not affected by diffused reflection caused by fine particles such as haze and smoke. Innovative shortwave infrared LED light technology is employed in InGaAs (Indium, Gallium, and Arsenide) sensors, as it has better sensitivity and can provide superior results than silicon-based sensors. Demand for shortwave infrared lamps is anticipated to rise in InGaAs sensors in the next few years.

Surge in adoption of infrared solutions in inspection of tamper-proof security codes, gauging relative water content of plants, inspection of fill levels of nontransparent containers, finding hidden moisture in packaging, verifying coating or dryness uniformity in bulk materials, anti-counterfeiting inspection, and wafer & solar cell production is influencing shortwave infrared lamps market development.

Rapid growth in the industrial sector and increase in investment in R&D to develop innovative infrared-based solutions are augmenting shortwave infrared lamps market share. Shortwave infrared lamp is used in industrial operations in heating, bottle blowing, paint drying, food catering & processing, pre-heating of Pet perform, and fusing printing ink applications.

It is also employed in drying process in paper mills, welding and deburring of plastic parts, vacuum laminating, coating of plastics, and plastic preformation. Thus, these lamps are widely used in industries to perform several industrial operations.

Following the lifting of the COVID-19 pandemic lockdowns, industrial sectors such as plastic, paper & printing, automotive, food, textile, and semiconductor are expected to expand at a significant pace during the forecast period. This is likely to contribute significantly to shortwave infrared lamps market growth.

Companies are investing significantly in R&D activities to launch innovative shortwave infrared-based products to meet the needs of a diverse range of users. Key suppliers are targeting their users through their own websites or different online channels to promote the sale of products and expand their reach. Increase in adoption of shortwave infrared technologies in astronomy, life sciences, Si wafer inspection, medical equipment, agriculture, pharma, defense, EV batteries, and mineral inspection is projected to drive market progress during the forecast period.

Manufacturers are anticipated to offer customized solutions to their clients in order to gain lucrative business opportunities. They are also likely to offer value-added services and advanced improvements in shortwave infrared lamps.

Regional governing bodies are enacting stringent laws to ensure the safety of workers in the manufacturing sector. These workers who are exposed to shortwave infrared lamps are likely to face risks associated with eye and skin damage.

The human eye is sensitive to all forms of radiation in the electromagnetic spectrum, especially if the intensity of radiation is high. Shortwave infrared lamps have high temperature and consequently produce a lot of heat. This is estimated to hamper shortwave infrared lamps market growth.

Key users are opting for alternatives for shortwave lamps, such as medium or long-wave infrared lamps, to perform similar industrial operations. Significant advantages associated with medium wave and long-wave infrared lamps and surge in demand for these lamps in a diverse range of industries are expected to adversely affect the shortwave infrared lamps market during the forecast period.

Suppliers with major market share need to offer value-added solutions to meet the technical aspects of user needs. This is likely to help them retain clients and maintain a healthy business relationship.

Asia Pacific is anticipated to hold significant share of the global shortwave infrared lamps market during the forecast period. Strong growth of the industrial sector and ongoing research & development activities are estimated to boost market statistics in the region.

Asia Pacific has been witnessing rapid growth in plastic, semiconductor, packaging, automotive, and food processing sectors since the last few years. This is accelerating the demand for innovative infrared technologies in the region.

Detailed profiles of providers of shortwave infrared lamps have been covered in the report to evaluate their financials, recent developments, key product offerings, and strategies. Most of the firms are investing significantly in research and development activities, primarily to introduce innovative products.

Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by prominent players to enhance their shortwave infrared lamps market revenue growth. Ushio Inc., Dr. Hönle Group, Heraeus Holding, Toshiba Corporation, DR. Fischer Group, and Fannon Products, LLC are the top players in the shortwave infrared lamps market.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 293.0 Mn |

|

Market Forecast Value in 2031 |

US$ 402.7 Mn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Regional qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Region Covered |

|

|

Shortwave Infrared Lamps Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

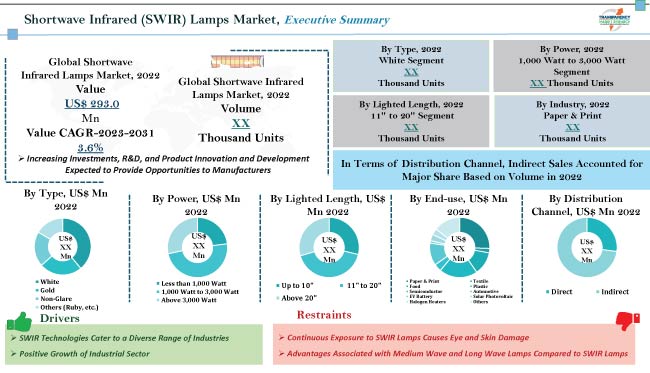

It was valued at US$ 293.0 Mn in 2022.

It is projected to reach US$ 402.7 Mn by the end of 2031.

The CAGR is anticipated to be 3.6% from 2023 to 2031.

Usage of shortwave infrared technologies in a diverse range of industries and growth of the industrial sector.

In terms of type, the white segment accounted for 39.0% share in 2022.

Asia Pacific is a highy attractive region for vendors.

Ushio Inc., Dr. Hönle Group, Heraeus Holding, Toshiba Corporation, DR. Fischer Group, and Fannon Products, LLC.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Standards and Regulations

5.9. Technology Overview

5.10. Global Shortwave Infrared Lamps Market Analysis, 2017- 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Value Projections (Thousand Units)

6. Global Shortwave Infrared Lamps Market Analysis and Forecast, by Type

6.1. Global Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Type, 2017- 2031

6.1.1. White

6.1.2. Gold

6.1.3. Non-glare

6.1.4. Others (Ruby, etc.)

6.2. Incremental Opportunity, by Type

7. Global Shortwave Infrared Lamps Market Analysis and Forecast, by Power

7.1. Global Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Power, 2017- 2031

7.1.1. Less than 1,000 Watt

7.1.2. 1,000 Watt to 3,000 Watt

7.1.3. Above 3,000 Watt

7.2. Incremental Opportunity, by Power

8. Global Shortwave Infrared Lamps Market Analysis and Forecast, by Lighted Length

8.1. Global Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Lighted Length, 2017- 2031

8.1.1. Up to 10"

8.1.2. 11" to 20"

8.1.3. Above 20"

8.2. Incremental Opportunity, by Lighted Length

9. Global Shortwave Infrared Lamps Market Analysis and Forecast, by End-use

9.1. Global Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by End-use, 2017- 2031

9.1.1. Paper & Print

9.1.2. Textile

9.1.3. Food

9.1.4. Plastic

9.1.5. Semiconductor

9.1.6. Automotive

9.1.7. EV Battery

9.1.8. Solar Photovoltaic

9.1.9. Halogen Heaters

9.1.10. Others (Glass Forming, etc.)

9.2. Incremental Opportunity, by End-use

10. Global Shortwave Infrared Lamps Market Analysis and Forecast, by Distribution Channel

10.1. Global Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Distribution Channel, 2017- 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Shortwave Infrared Lamps Market Analysis and Forecast, by Region

11.1. Global Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Region, 2017- 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. Latin America

11.2. Incremental Opportunity, by Region

12. North America Shortwave Infrared Lamps Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Price (US$)

12.5. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Type, 2017- 2031

12.5.1. White

12.5.2. Gold

12.5.3. Non-glare

12.5.4. Others (Ruby, etc.)

12.6. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Power, 2017- 2031

12.6.1. Less than 1,000 Watt

12.6.2. 1,000 Watt to 3,000 Watt

12.6.3. Above 3,000 Watt

12.7. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Lighted Length, 2017- 2031

12.7.1. Up to 10"

12.7.2. 11" to 20"

12.7.3. Above 20"

12.8. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by End-use, 2017- 2031

12.8.1. Paper & Print

12.8.2. Textile

12.8.3. Food

12.8.4. Plastic

12.8.5. Semiconductor

12.8.6. Automotive

12.8.7. EV Battery

12.8.8. Solar Photovoltaic

12.8.9. Halogen Heaters

12.8.10. Others (Glass Forming, etc.)

12.9. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Distribution Channel, 2017- 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Country & Sub-region, 2017- 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Shortwave Infrared Lamps Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Price (US$)

13.5. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Type, 2017- 2031

13.5.1. White

13.5.2. Gold

13.5.3. Non-glare

13.5.4. Others (Ruby, etc.)

13.6. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Power, 2017- 2031

13.6.1. Less than 1,000 Watt

13.6.2. 1,000 Watt to 3,000 Watt

13.6.3. Above 3,000 Watt

13.7. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Lighted Length, 2017- 2031

13.7.1. Up to 10"

13.7.2. 11" to 20"

13.7.3. Above 20"

13.8. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by End-use, 2017- 2031

13.8.1. Paper & Print

13.8.2. Textile

13.8.3. Food

13.8.4. Plastic

13.8.5. Semiconductor

13.8.6. Automotive

13.8.7. EV Battery

13.8.8. Solar Photovoltaic

13.8.9. Halogen Heaters

13.8.10. Others (Glass Forming, etc.)

13.9. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Distribution Channel, 2017- 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Country & Sub-region, 2017- 2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Shortwave Infrared Lamps Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Price (US$)

14.5. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Type, 2017- 2031

14.5.1. White

14.5.2. Gold

14.5.3. Non-glare

14.5.4. Others (Ruby, etc.)

14.6. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Power, 2017- 2031

14.6.1. Less than 1,000 Watt

14.6.2. 1,000 Watt to 3,000 Watt

14.6.3. Above 3,000 Watt

14.7. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Lighted Length, 2017- 2031

14.7.1. Up to 10"

14.7.2. 11" to 20"

14.7.3. Above 20"

14.8. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by End-use, 2017- 2031

14.8.1. Paper & Print

14.8.2. Textile

14.8.3. Food

14.8.4. Plastic

14.8.5. Semiconductor

14.8.6. Automotive

14.8.7. EV Battery

14.8.8. Solar Photovoltaic

14.8.9. Halogen Heaters

14.8.10. Others (Glass Forming, etc.)

14.9. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Distribution Channel, 2017- 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Country & Sub-region, 2017- 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Shortwave Infrared Lamps Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Price (US$)

15.5. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Type, 2017- 2031

15.5.1. White

15.5.2. Gold

15.5.3. Non-glare

15.5.4. Others (Ruby, etc.)

15.6. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Power, 2017- 2031

15.6.1. Less than 1,000 Watt

15.6.2. 1,000 Watt to 3,000 Watt

15.6.3. Above 3,000 Watt

15.7. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Lighted Length, 2017- 2031

15.7.1. Up to 10"

15.7.2. 11" to 20"

15.7.3. Above 20"

15.8. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by End-use, 2017- 2031

15.8.1. Paper & Print

15.8.2. Textile

15.8.3. Food

15.8.4. Plastic

15.8.5. Semiconductor

15.8.6. Automotive

15.8.7. EV Battery

15.8.8. Solar Photovoltaic

15.8.9. Halogen Heaters

15.8.10. Others (Glass Forming, etc.)

15.9. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Distribution Channel, 2017- 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Country & Sub-region, 2017- 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. Latin America Shortwave Infrared Lamps Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Price (US$)

16.5. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Type, 2017- 2031

16.5.1. White

16.5.2. Gold

16.5.3. Non-glare

16.5.4. Others (Ruby, etc.)

16.6. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Power, 2017- 2031

16.6.1. Less than 1,000 Watt

16.6.2. 1,000 Watt to 3,000 Watt

16.6.3. Above 3,000 Watt

16.7. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Lighted Length, 2017- 2031

16.7.1. Up to 10"

16.7.2. 11" to 20"

16.7.3. Above 20"

16.8. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by End-use, 2017- 2031

16.8.1. Paper & Print

16.8.2. Textile

16.8.3. Food

16.8.4. Plastic

16.8.5. Semiconductor

16.8.6. Automotive

16.8.7. EV Battery

16.8.8. Solar Photovoltaic

16.8.9. Halogen Heaters

16.8.10. Others (Glass Forming, etc.)

16.9. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Distribution Channel, 2017- 2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Shortwave Infrared Lamps Market Size (US$ Mn & Thousand Units), by Country & Sub-region, 2017- 2031

16.10.1. Brazil

16.10.2. Rest of Latin America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2021)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, Revenue (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. ACE HEAT TECH

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information

17.3.1.4. Revenue (Subject to Data Availability)

17.3.1.5. Business Strategies / Recent Developments

17.3.2. Anderson Thermal Devices, Inc.

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information

17.3.2.4. Revenue (Subject to Data Availability)

17.3.2.5. Business Strategies / Recent Developments

17.3.3. DR. FISCHER Group

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information

17.3.3.4. Revenue (Subject to Data Availability)

17.3.3.5. Business Strategies / Recent Developments

17.3.4. Dr. Hönle AG

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information

17.3.4.4. Revenue (Subject to Data Availability)

17.3.4.5. Business Strategies / Recent Developments

17.3.5. Hefei Quickly

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information

17.3.5.4. Revenue (Subject to Data Availability)

17.3.5.5. Business Strategies / Recent Developments

17.3.6. Helios Quartz Group SA

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information

17.3.6.4. Revenue (Subject to Data Availability)

17.3.6.5. Business Strategies / Recent Developments

17.3.7. Heraeus Holding

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information

17.3.7.4. Revenue (Subject to Data Availability)

17.3.7.5. Business Strategies / Recent Developments

17.3.8. Jiangsu Liangdi Technology Co., Ltd.

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information

17.3.8.4. Revenue (Subject to Data Availability)

17.3.8.5. Business Strategies / Recent Developments

17.3.9. Tempco Electric Heater Corporation

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information

17.3.9.4. Revenue (Subject to Data Availability)

17.3.9.5. Business Strategies / Recent Developments

17.3.10. Ushio America, Inc.

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information

17.3.10.4. Revenue (Subject to Data Availability)

17.3.10.5. Business Strategies / Recent Developments

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Type

18.1.2. Power

18.1.3. Lighted Length

18.1.4. End-use

18.1.5. Distribution Channel

18.1.6. Region

18.2. Understanding the Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Shortwave Infrared (SWIR) Lamps Market - By Type (Thousand Units)

Table 2: Global Shortwave Infrared (SWIR) Lamps Market - By Type (US$ Mn)

Table 3: Global Shortwave Infrared (SWIR) Lamps Market - By Power (Thousand Units)

Table 4: Global Shortwave Infrared (SWIR) Lamps Market - By Power (US$ Mn)

Table 5: Global Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (Thousand Units)

Table 6: Global Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (US$ Mn)

Table 7: Global Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 8: Global Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 9: Global Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (Thousand Units)

Table 10: Global Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (US$ Mn)

Table 11: Global Shortwave Infrared (SWIR) Lamps Market - By Region (Thousand Units)

Table 12: Global Shortwave Infrared (SWIR) Lamps Market - By Region (US$ Mn)

Table 13: North America Shortwave Infrared (SWIR) Lamps Market - By Type (Thousand Units)

Table 14: North America Shortwave Infrared (SWIR) Lamps Market - By Type (US$ Mn)

Table 15: North America Shortwave Infrared (SWIR) Lamps Market - By Power (Thousand Units)

Table 16: North America Shortwave Infrared (SWIR) Lamps Market - By Power (US$ Mn)

Table 17: North America Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (Thousand Units)

Table 18: North America Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (US$ Mn)

Table 19: North America Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 20: North America Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 21: North America Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (Thousand Units)

Table 22: North America Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (US$ Mn)

Table 23: North America Shortwave Infrared (SWIR) Lamps Market - By Country (Thousand Units)

Table 24: North America Shortwave Infrared (SWIR) Lamps Market - By Country (US$ Mn)

Table 25: Europe Shortwave Infrared (SWIR) Lamps Market - By Type (Thousand Units)

Table 26: Europe Shortwave Infrared (SWIR) Lamps Market - By Type (US$ Mn)

Table 27: Europe Shortwave Infrared (SWIR) Lamps Market - By Power (Thousand Units)

Table 28: Europe Shortwave Infrared (SWIR) Lamps Market - By Power (US$ Mn)

Table 29: Europe Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (Thousand Units)

Table 30: Europe Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (US$ Mn)

Table 31: Europe Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 32: Europe Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 33: Europe Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (Thousand Units)

Table 34: Europe Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (US$ Mn)

Table 35: Europe Shortwave Infrared (SWIR) Lamps Market - By Country (Thousand Units)

Table 36: Europe Shortwave Infrared (SWIR) Lamps Market - By Country (US$ Mn)

Table 37: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Type (Thousand Units)

Table 38: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Type (US$ Mn)

Table 39: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Power (Thousand Units)

Table 40: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Power (US$ Mn)

Table 41: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (Thousand Units)

Table 42: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (US$ Mn)

Table 43: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 44: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 45: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (Thousand Units)

Table 46: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (US$ Mn)

Table 47: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Country (Thousand Units)

Table 48: Asia Pacific Shortwave Infrared (SWIR) Lamps Market - By Country (US$ Mn)

Table 49: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Type (Thousand Units)

Table 50: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Type (US$ Mn)

Table 51: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Power (Thousand Units)

Table 52: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Power (US$ Mn)

Table 53: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (Thousand Units)

Table 54: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (US$ Mn)

Table 55: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 56: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 57: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (Thousand Units)

Table 58: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (US$ Mn)

Table 59: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Country (Thousand Units)

Table 60: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market - By Country (US$ Mn)

Table 61: Latin America Shortwave Infrared (SWIR) Lamps Market - By Type (Thousand Units)

Table 62: Latin America Shortwave Infrared (SWIR) Lamps Market - By Type (US$ Mn)

Table 63: Latin America Shortwave Infrared (SWIR) Lamps Market - By Power (Thousand Units)

Table 64: Latin America Shortwave Infrared (SWIR) Lamps Market - By Power (US$ Mn)

Table 65: Latin America Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (Thousand Units)

Table 66: Latin America Shortwave Infrared (SWIR) Lamps Market - By Lighted Length (US$ Mn)

Table 67: Latin America Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 68: Latin America Shortwave Infrared (SWIR) Lamps Market - By End-use (Thousand Units)

Table 69: Latin America Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (Thousand Units)

Table 70: Latin America Shortwave Infrared (SWIR) Lamps Market - By Sales Channel (US$ Mn)

Table 71: Latin America Shortwave Infrared (SWIR) Lamps Market - By Country (Thousand Units)

Table 72: Latin America Shortwave Infrared (SWIR) Lamps Market - By Country (US$ Mn)

List of Figures

Figure 1: Global Shortwave Infrared (SWIR) Lamps Market Projections by Type, Thousand Units, 2017-2031

Figure 2: Global Shortwave Infrared (SWIR) Lamps Market Projections by Type, US$ Mn, 2017-2031

Figure 3: Global Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Type, US$ Mn

Figure 4: Global Shortwave Infrared (SWIR) Lamps Market Projections by Power, Thousand Units, 2017-2031

Figure 5: Global Shortwave Infrared (SWIR) Lamps Market Projections by Power, US$ Mn, 2017-2031

Figure 6: Global Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Power, US$ Mn

Figure 7: Global Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length, Thousand Units, 2017-2031

Figure 8: Global Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length US$ Mn, 2017-2031

Figure 9: Global Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Lighted Length, US$ Mn

Figure 10: Global Shortwave Infrared (SWIR) Lamps Market Projections by End Use, Thousand Units, 2017-2031

Figure 11: Global Shortwave Infrared (SWIR) Lamps Market Projections by End Use, US$ Mn, 2017-2031

Figure 12: Global Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by End-use, US$ Mn

Figure 13: Global Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, Thousand Units, 2017-2031

Figure 14: Global Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, US$ Mn, 2017-2031

Figure 15: Global Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Sales Channel, US$ Mn

Figure 16: Global Shortwave Infrared (SWIR) Lamps Market Projections by Region, Thousand Units, 2017-2031

Figure 17: Global Shortwave Infrared (SWIR) Lamps Market Projections by Region, US$ Mn, 2017-2031

Figure 18: Global Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Region, US$ Mn

Figure 19: North America Shortwave Infrared (SWIR) Lamps Market Projections by Type, Thousand Units, 2017-2031

Figure 20: North America Shortwave Infrared (SWIR) Lamps Market Projections by Type, US$ Mn, 2017-2031

Figure 21: North America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Type, US$ Mn

Figure 22: North America Shortwave Infrared (SWIR) Lamps Market Projections by Power, Thousand Units, 2017-2031

Figure 23: North America Shortwave Infrared (SWIR) Lamps Market Projections by Power, US$ Mn, 2017-2031

Figure 24: North America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Power, US$ Mn

Figure 25: North America Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length, Thousand Units, 2017-2031

Figure 26: North America Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length US$ Mn, 2017-2031

Figure 27: North America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Lighted Length, US$ Mn

Figure 28: North America Shortwave Infrared (SWIR) Lamps Market Projections by End-use, Thousand Units, 2017-2031

Figure 29: North America Shortwave Infrared (SWIR) Lamps Market Projections by End-use, US$ Mn, 2017-2031

Figure 30: North America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by End-use, US$ Mn

Figure 31: North America Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, Thousand Units, 2017-2031

Figure 32: North America Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, US$ Mn, 2017-2031

Figure 33: North America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Sales Channel, US$ Mn

Figure 34: North America Shortwave Infrared (SWIR) Lamps Market Projections by Country, Thousand Units, 2017-2031

Figure 35: North America Shortwave Infrared (SWIR) Lamps Market Projections by Country, US$ Mn, 2017-2031

Figure 36: North America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Country, US$ Mn

Figure 37: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Type, Thousand Units, 2017-2031

Figure 38: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Type, US$ Mn, 2017-2031

Figure 39: Europe Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Type, US$ Mn

Figure 40: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Power, Thousand Units, 2017-2031

Figure 41: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Power, US$ Mn, 2017-2031

Figure 42: Europe Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Power, US$ Mn

Figure 43: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length, Thousand Units, 2017-2031

Figure 44: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length US$ Mn, 2017-2031

Figure 45: Europe Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Lighted Length, US$ Mn

Figure 46: Europe Shortwave Infrared (SWIR) Lamps Market Projections by End-use, Thousand Units, 2017-2031

Figure 47: Europe Shortwave Infrared (SWIR) Lamps Market Projections by End-use, US$ Mn, 2017-2031

Figure 48: Europe Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by End-use, US$ Mn

Figure 49: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, Thousand Units, 2017-2031

Figure 50: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, US$ Mn, 2017-2031

Figure 51: Europe Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Sales Channel, US$ Mn

Figure 52: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Country, Thousand Units, 2017-2031

Figure 53: Europe Shortwave Infrared (SWIR) Lamps Market Projections by Country, US$ Mn, 2017-2031

Figure 54: Europe Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Country, US$ Mn

Figure 55: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Type, Thousand Units, 2017-2031

Figure 56: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Type, US$ Mn, 2017-2031

Figure 57: Asia Pacific Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Type, US$ Mn

Figure 58: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Power, Thousand Units, 2017-2031

Figure 59: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Power, US$ Mn, 2017-2031

Figure 60: Asia Pacific Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Power, US$ Mn

Figure 61: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length, Thousand Units, 2017-2031

Figure 62: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length US$ Mn, 2017-2031

Figure 63: Asia Pacific Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Lighted Length, US$ Mn

Figure 64: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by End-use, Thousand Units, 2017-2031

Figure 65: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by End-use, US$ Mn, 2017-2031

Figure 66: Asia Pacific Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by End-use, US$ Mn

Figure 67: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, Thousand Units, 2017-2031

Figure 68: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, US$ Mn, 2017-2031

Figure 69: Asia Pacific Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Sales Channel, US$ Mn

Figure 70: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Country, Thousand Units, 2017-2031

Figure 71: Asia Pacific Shortwave Infrared (SWIR) Lamps Market Projections by Country, US$ Mn, 2017-2031

Figure 72: Asia Pacific Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Country, US$ Mn

Figure 73: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Type, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Type, US$ Mn, 2017-2031

Figure 75: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Type, US$ Mn

Figure 76: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Power, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Power, US$ Mn, 2017-2031

Figure 78: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Power, US$ Mn

Figure 79: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length, Thousand Units, 2017-2031

Figure 80: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length US$ Mn, 2017-2031

Figure 81: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Lighted Length, US$ Mn

Figure 82: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by End-use, Thousand Units, 2017-2031

Figure 83: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by End-use, US$ Mn, 2017-2031

Figure 84: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by End-use, US$ Mn

Figure 85: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, Thousand Units, 2017-2031

Figure 86: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, US$ Mn, 2017-2031

Figure 87: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Sales Channel, US$ Mn

Figure 88: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Country, Thousand Units, 2017-2031

Figure 89: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market Projections by Country, US$ Mn, 2017-2031

Figure 90: Middle East & Africa Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Country, US$ Mn

Figure 91: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Type, Thousand Units, 2017-2031

Figure 92: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Type, US$ Mn, 2017-2031

Figure 93: Latin America Shortwave Infrared (SWIR) Lamp Market, Incremental Opportunity, by Type, US$ Mn

Figure 94: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Power, Thousand Units, 2017-2031

Figure 95: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Power, US$ Mn, 2017-2031

Figure 96: Latin America Shortwave Infrared (SWIR) Lamp Market, Incremental Opportunity, by Power, US$ Mn

Figure 97: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length, Thousand Units, 2017-2031

Figure 98: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Lighted Length US$ Mn, 2017-2031

Figure 99: Latin America Shortwave Infrared (SWIR) Lamp Market, Incremental Opportunity, by Lighted Length, US$ Mn

Figure 100: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by End-use, Thousand Units, 2017-2031

Figure 101: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by End-use, US$ Mn, 2017-2031

Figure 102: Latin America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by End-use, US$ Mn

Figure 103: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, Thousand Units, 2017-2031

Figure 104: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Sales Channel, US$ Mn, 2017-2031

Figure 105: Latin America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Sales Channel, US$ Mn

Figure 106: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Country, Thousand Units, 2017-2031

Figure 107: Latin America Shortwave Infrared (SWIR) Lamps Market Projections by Country, US$ Mn, 2017-2031

Figure 108: Latin America Shortwave Infrared (SWIR) Lamps Market, Incremental Opportunity, by Country, US$ Mn