Global Polyimide Films Market: Snapshot

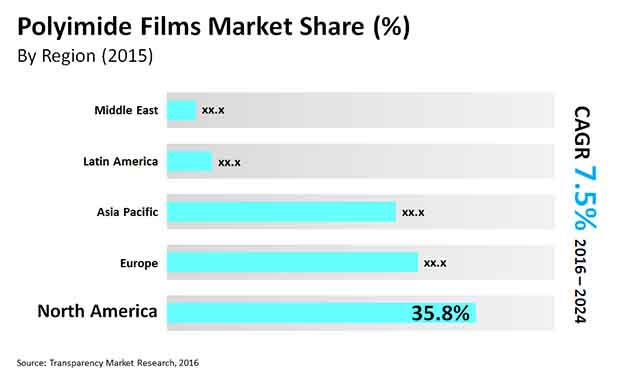

Polyimide films used widely in electronics, aerospace, and aircraft industry as they are capable of withstanding high temperatures they are widely used to make flexible printed circuit boards and pressure sensitive tapes. Polyimide films enable implementation of compact and complex assemblies which minimizes size and weight. Polyimide films can withstand temperatures above 3000 C and are widely used for insulating wires and cables of motors and generators. Due to their lightweight they are also used in insulating the wires of aircrafts as it provides significant weight savings. According to the research report, the global polyimide films market is expected to be worth US$ 1770.1 mn by 2024 from US$927.7 mn in 2015. During the forecast period of 2016 and 2024, the overall global market is likely to register a CAGR of 7.5%.

The increasing trend of miniaturization of electronic products and increasing demand for heat and fire resistant insulation films are expected to drive the market during the forecast period. However, the high cost of processing of polyimide films and its tendency to get hydrolyzed and shrink are anticipated to hamper the market during the forecast period. The application of polyimide films in flexible and thin photovoltaic materials and colorless polyimide films are expected to be the area of opportunity for polyimide films. Polyimide films are an ideal choice for usage as substrates in photovoltaic materials due to their high performance in the electronics industry, flexibility, and resistance to high temperature.

Flexible Printed Circuit Boards to Dominate Global Polyimide Films Market Over Forecast Period

Key applications of polyimide films include flexible printed circuit boards which accounts for more than 70% share of the global polyimide films market and is likely to be a highly lucrative segment during the forecast period. Wires and Cable insulation is expected to expand significantly during the forecast period. However the threat of substitutes from polyethylene terephthalate (PET) film and polyethylene naphthalate (PEN) film is expected to remain low during the forecast period due to the fact that, polyimide film has the advantageous characteristics of retaining its properties at high processing temperatures and provide a high range of operating temperature which is in contrast to PET and PEN films.

Asia Pacific to Offer Tremendous Scope for Growth to the Global Market

The global polyimide films market is anticipated to expand during the forecast period. In terms of volume, Asia Pacific above 40% share of the global polyimide films market in 2015 owing the huge electronics industry in China, Japan, and Taiwan. North America is likely to follow Asia Pacific in terms of consumption. It is likely to expand due to huge aerospace industry in the region. Europe is also forecasted to expand during the forecast period.

The key players of polyimide films market include Kaneka Corporation, DuPont, SKCKOLONPI Co. Ltd, Anabond Limited, Taimide Tech Inc., I.S.T. Corporation, Saint-Gobain Performance Plastics, UBE Industries Ltd, Toyobo Co. Ltd. DuPont and SKCKOLON PI are anticipated to be the leading manufacturers of polyimide films. Manufacturers are augmenting their production capacity to meet increasing demand from end user industries. Also, manufacturers of polyimide films are investing huge amounts in R&D for developing polyimide films which is shrinkage free. The manufacturers of polyimide film in China have eaten up the share of major manufacturers as Chinese polyimide films are available in low cost.

Converters Lean on Improving Functionalities in Polyimide Films Market to Meet Emerging Demands

Polyamide films are known for their remarkable resistance to heat and chemicals. Their characteristic to retain their mechanical and chemical properties in various harshest environments is what propels demand in the polyamide films market. Converter companies use cutting-edge engineering methods to further modify the functional characteristics to meet the specialized conditions in end-use applications. Leading chemical companies operating the polyamide films market are leaning on unlocking the versatility of their products to stay ahead of the curve. For instance, some behemoths in the chemical industry are developing films that withstand high heat and temperature and vibration prevalent in outer space and popular aerospace applications. Chemical companies aim at imparting a combination of mechanical properties to improve performance and reliability at high temperature. Such properties are utilized in range of material application, thereby expanding the revenue potential of the polyamide films market. A case in point is the demand for these films in making high-end insulation materials. Due to advanced functional characteristics, polyamide films also hold promise for specialized packaging applications. An example is in packaging of chips. Growing use of these in printed circuit boards is one of the key application areas that have boosted the sales in the market.

The COVID-19 pandemic has massive brought disruptions to the strategic frameworks companies had been adhering over the past few years. The mortality and morbidity of the novel coronavirus outbreaks forced governments to enter into massive, prolonged lockdowns, which severely hindered various economic activities. On the other hand, companies that were quick to shift their business models to align with new normals were the first to move past the competitive curve. For instance, market players see a new avenue in making films that can fight off the infections of the virus and its variants. This is likely to help players target new consumer propositions in the post-pandemic world.

The report segments the global Polyimide Films market as:

|

Application Analysis |

|

|

Regional Analysis |

|

Chapter 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Objectives

Chapter 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms Used

2.2 Research Methodology

Chapter 3 Executive Summary

3.1 Market Size, Indicative (US$ Mn)

3.2 Top 3 Trends

3.3 Top 3 Drivers

3.4 Top Market Restraint

3.5 Total Market Value in US$ Mn

Chapter 4 Market Overview

4.1 Product Overview

4.2 Drivers and Restraints Analysis

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Value Chain Analysis

4.4 Porter's Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Threat of Substitutes

4.4.3 Threat of New Entrants

4.4.4 Bargaining Power of Suppliers

4.4.5 Degree of Competition

Chapter 5 Global Polyimide Films Market: Price Trend Analysis (US$/Tons)

5.1 Market price, by Application

Chapter 6 Global Polyimide Films Market, by Application

6.1 Application Overview

6.2 Global Polyimide Films Market Value Share Analysis by Application

6.3 Global Polyimide Films Market Volume (Tons) Forecast, by Application

6.4 Global Polyimide Films Market Size (US$ Mn) Forecast, by Application

6.5 Global Polyimide Films Market Attractiveness Analysis, by Application

6.6 Global Polyimide Films Market Value Share Analysis, by Region,

6.7 Global Polyimide Films Market Volume (Kilo Tons) Forecast, by Region

6.8 Global Polyimide Films Market Size (US$ Mn) Forecast, by Region

6.9 Global Polyimide Films Market Attractiveness Analysis, by Region

Chapter 7 North America Polyimide Films Market

7.1 North America Polyimide Films Market Value Share Analysis, by Application

7.2 North America Polyimide Films Market Volume (Tons) Forecast, by Application

7.3 North America Polyimide Films Market Size (US$ Mn) Forecast, by Application

7.4 North America Polyimide Films Market Value Share Analysis, by Country

7.5 North America Polyimide Films Market Volume (Kilo Tons) Forecast, by country

7.6 North America Polyimide Films Market Size (US$ Mn) Forecast, by country

7.7 North America Polyimide Films Market Attractiveness Analysis, by Application

Chapter 8 Europe Polyimide Films Market

8.1 Europe Polyimide Films Market Value Share Analysis, by Application

8.2 Europe Polyimide Films Market Volume (Tons) Forecast, by Application

8.3 Europe Polyimide Films Market Size (US$ Mn) Forecast, by Application

8.4 Europe Polyimide Films Market Value Share Analysis, by Country

8.5 Europe Polyimide Films Market Volume (Kilo Tons) Forecast, by country

8.6 Europe Polyimide Films Market Size (US$ Mn) Forecast, by country

8.7 Europe Polyimide Films Market Attractiveness Analysis, by Application

Chapter 9 Asia Pacific Polyimide Films Market

9.1 Asia Pacific Polyimide Films Market Value Share Analysis, by Application

9.2 Asia Pacific Polyimide Films Market Volume (Tons) Forecast, by Application

9.3 Asia Pacific Polyimide Films Market Size (US$ Mn) Forecast, by Application

9.4 Asia Pacific Polyimide Films Market Value Share Analysis, by Country

9.5 Asia Pacific Polyimide Films Market Volume (Kilo Tons) Forecast, by country

9.6 Asia Pacific Polyimide Films Market Size (US$ Mn) Forecast, by country

9.7 Asia Pacific Polyimide Films Market Attractiveness Analysis, by Application

Chapter 10 Latin America Polyimide Films Market

10.1 Latin America Polyimide Films Market Value Share Analysis, by Application

10.2 Latin America Polyimide Films Market Volume (Tons) Forecast, by Application

10.3 Latin America Polyimide Films Market Size (US$ Mn) Forecast, by Application

10.4 Latin America Polyimide Films Market Value Share Analysis, by Country

10.5 Latin America Polyimide Films Market Volume (Kilo Tons) Forecast, by country

10.6 Latin America Polyimide Films Market Size (US$ Mn) Forecast, by country

10.7 Latin America Polyimide Films Market Attractiveness Analysis, by Application

Chapter 11 Middle East & Africa Polyimide Films Market

11.1 Middle East & Africa Polyimide Films Market Value Share Analysis, by Application

11.2 Middle East & Africa Polyimide Films Market Volume (Tons) Forecast, by Application

11.3 Middle East & Africa Polyimide Films Market Size (US$ Mn) Forecast, by Application

11.4 Middle East & Africa Polyimide Films Market Value Share Analysis, by Country

11.5 Middle East & Africa Polyimide Films Market Volume (Kilo Tons) Forecast, by country

11.6 Middle East & Africa Polyimide Films Market Size (US$ Mn) Forecast, by country

11.7 Middle East & Africa Polyimide Films Market Attractiveness Analysis, by Application

Chapter 12 Competition Landscape

12.1 Global Polyimide Films Market Share Analysis by Company

12.2 Competition Matrix

12.3 Company Profiles

12.3.1 Kaneka Corporation

12.3.1.1 Company Details

12.3.1.2 Company Description

12.3.1.3 Business Overview

12.3.1.4 SWOT Analysis

12.3.1.5 Breakdown of Net sales, by Business Segment

12.3.1.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.2 DuPont

12.3.2.1 Company Details

12.3.2.2 Company Description

12.3.2.3 Business Overview

12.3.2.4 SWOT Analysis

12.3.2.5 Breakdown of Net sales, by region

12.3.2.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.3 SKCKOLON PI Co. Ltd

12.3.3.1 Company Details

12.3.3.2 Company Description

12.3.3.3 Business Overview

12.3.3.4 SWOT Analysis

12.3.3.5 Breakdown of Net sales, by Industry

12.3.3.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.4 UBE Industries Ltd

12.3.3.1 Company Details

12.3.3.2 Company Description

12.3.3.3 Business Overview

12.3.3.4 SWOT Analysis

12.3.3.5 Breakdown of Net sales, by Industry

12.3.3.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

12.3.5 Anabond Limited

12.3.5.1 Company Details

12.3.5.2 Company Description

12.3.5.3 Business Overview

12.3.6 Taimide Tech. Inc

12.3.6.1 Company Details

12.3.6.2 Company Description

12.3.6.3 Business Overview

12.3.7 I.S.T. Corporation

12.3.7.1 Company Details

12.3.7.2 Company Description

12.3.7.3 Business Overview

12.3.8 Saint-Gobain Performance Plastics

12.3.8.1 Company Details

12.3.8.2 Company Description

12.3.8.3 Business Overview

12.3.9 Toyobo Co. Ltd

12.3.3.1 Company Details

12.3.3.2 Company Description

12.3.3.3 Business Overview

12.3.3.4 SWOT Analysis

12.3.3.5 Breakdown of Net sales, by region

12.3.3.6 Revenue (US$ Bn ) and Y-o-Y Growth (%), 2012-2015

Chapter 13 Key Takeaways

13.1 Primary Research-Key Findings

List of Tables

Table 1: Global Polyimide films Market Volume (Tons) Forecast, by Application, 2015–2024

Table 2: Global Polyimide films Market Revenue (US$ Mn) Forecast, by Application, 2015–2024

Table 3: Global Polyimide films Market Volume (Tons) Forecast, by Region, 2015–2024

Table 4: Global Polyimide films Market Size (US$ Mn) Forecast, by Region, 2015–2024

Table 5: North America Polyimide films Market Volume (Tons) Forecast, by Application, 2015–2024

Table 6: North America Polyimide films Market Revenue (US$ Mn) Forecast, by Application, 2015–2024

Table 7: North America Polyimide films Market Size Volume (Tons) Forecast, by Country, 2015–2024

Table 8: North America Polyimide films Market Size (US$ Mn) Forecast, by Country, 2015–2024

Table 9: Europe Polyimide films Market Volume (Tons) Forecast, by Application, 2015–2024

Table 10: Europe Polyimide films Market Revenue (US$ Mn) Forecast, by Application, 2015–2024

Table 11: Europe Polyimide films Market Size Volume (Tons) Forecast, by Country, 2015–2024

Table 12: Europe Polyimide films Market Size (US$ Mn) Forecast, by Country, 2015–2024

Table 13: Asia Pacific Polyimide films Market Volume (Tons) Forecast, by Application, 2015–2024

Table 14: Asia Pacific Polyimide films Market Revenue (US$ Mn) Forecast, by Application, 2015–2024

Table 15: Asia Pacific Polyimide films Market Volume (Tons) Forecast, by Country, 2015–2024

Table 16: Asia Pacific Polyimide films Market Size (US$ Mn) Forecast, by Country, 2015–2024

Table 17: Latin America Polyimide films Market Volume (Tons) Forecast, by Application, 2015–2024

Table 18: Latin America Polyimide films Market Revenue (US$ Mn) Forecast, by Application, 2015–2024

Table 19: Latin America Polyimide films Market Volume (Tons) Forecast, by Country, 2015–2024

Table 20: Latin America Polyimide films Market Size (US$ Mn) Forecast, by Country, 2015–2024

Table 21: Middle East & Africa Polyimide films Market Volume (Tons) Forecast, by Application, 2015–2024

Table 22: Middle East & Africa Polyimide films Market Revenue (US$ Mn) Forecast, by Application, 2015–2024

Table 23: Middle East & Africa Polyimide films Market Volume (Tons) Forecast, by Country, 2015–2024

Table 24: Middle East & Africa Polyimide films Market Size (US$ Mn) Forecast, by Country, 2015–2024

List of Figures

Figure 1: Prices of polyethylene terephthalate, by Application, US$/Ton, 2015–2024

Figure 2: Global Polyimide films Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 3: Global Polyimide films Market Average Price (US$/ Ton) 2015–2024

Figure 4: Global Polyimide films Market Value Share Analysis, By Application, 2015 and 2024

Figure 5: Wires & Cables Insulation, 2015 – 2024 (US$ Mn)

Figure 6: Flexible PCB, 2015 – 2024 (US$ Mn)

Figure 7: Others, 2015 – 2024 (US$ Mn)

Figure 8: Global Polyimide films Market Attractiveness Analysis, by Region

Figure 9: Global Polyimide films Market Attractiveness Analysis , by Application

Figure 10: North America Polyimide films Market Value Share Analysis, By Application, 2015 and 2024

Figure 11: North America Polyimide films Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 12: North America Polyimide films Market Attractiveness Analysis, by Country

Figure 13: U.S. Polyimide films Market Analysis, 2015–2024

Figure 14: Canada Polyimide films Market Analysis, 2015–2024

Figure 15: North America Polyimide films Market Attractiveness Analysis ,by Application

Figure 16: Europe Polyimide films Market Value Share Analysis, By Application, 2015 and 2024

Figure 17: Europe Polyimide films Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 18: Europe Polyimide films Market Attractiveness Analysis, by Country

Figure 19: U.K. Polyimide films Market Analysis, 2015–2024

Figure 20: Italy Polyimide films Market Analysis, 2015–2024

Figure 21: Germany Polyimide films Market Analysis, 2015–2024

Figure 22: France Polyimide films Market Analysis, 2015–2024

Figure 23: Spain Polyimide films Market Analysis, 2015–2024

Figure 24: RoE Polyimide films Market Analysis, 2015–2024

Figure 25: Europe Polyimide films Market Attractiveness Analysis , by Application

Figure 26: Asia Pacific Polyimide films Market Value Share Analysis, by Application, 2015 and 2024

Figure 27: Asia Pacific Polyimide films Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 28: Asia Pacific Polyimide films Market Attractiveness Analysis, by Country

Figure 29: China Polyimide films Market Analysis, 2015–2024

Figure 30: Japan Polyimide films Market Analysis, 2015–2024

Figure 31: India Polyimide films Market Analysis, 2015–2024

Figure 32: ASEAN Polyimide films Market Analysis, 2015–2024

Figure 33: Rest of APAC Polyimide films Market Analysis, 2015–2024

Figure 34: Asia Pacific Polyimide films Market Attractiveness Analysis, by Application

Figure 35: Latin America Polyimide films Market Value Share Analysis, by Application, 2015 and 2024

Figure 36: Latin America Polyimide films Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 37: Latin America Polyimide films Market Attractiveness Analysis, by Country

Figure 38: Brazil Polyimide films Market Analysis, 2015–2024

Figure 39: Mexico Polyimide films Market Analysis, 2015–2024

Figure 40: Rest of LATAM Polyimide films Market Analysis, 2015–2024

Figure 41: Latin America Polyimide films Market Attractiveness Analysis, by Application

Figure 42: Middle East & Africa Polyimide films Market Value Share Analysis, by Application, 2015 and 2024

Figure 43: Middle East & Africa Polyimide films Market Size (US$ Mn) and Volume (Tons) Forecast, 2015–2024

Figure 44: Middle East & Africa Polyimide films Market Attractiveness Analysis, by Country

Figure 45: GCC Polyimide films Market Analysis, 2015–2024

Figure 46: South Africa Polyimide films Market Analysis, 2015–2024

Figure 47: Rest of MEA Polyimide films Market Analysis, 2015–2024

Figure 48: Middle East & Africa Polyimide films Market Attractiveness Analysis, by Application