Companies in the plastic compounding market are increasing efforts to meet the demand for high-quality polymers and compounds used in critical devices during the ongoing coronavirus pandemic. Compounding Solutions - a global manufacturer company of custom medical polymer compounds and color concentrates, among others, is working at break-neck speeds to increase the availability of TPUs (Thermoplastic Polyurethanes) and TPEs (Thermoplastic Elastomers).

Manufacturers in the plastic compounding market are proactively communicating with customers and suppliers to understand demand and supply chain risks. They are adopting additional safety measures during manufacturing processes to prevent transmission of the COVID-19 infection through plastic compounds used in critical medical devices such as ventilator components, personal protective equipment (PPE), and other consumables. As such, stakeholders need to tide over shipping complications and cancellation of orders. Corporate travel bans and social-distancing requirements have given rise to virtual events and meetings.

The plastic compounding market is expected to expand at a favorable CAGR of ~6% during the forecast period. However, there is a need to boost the availability of more lightweight, durable, and low-emission materials since current trends are indicating an oversupply of raw materials. Thus, stakeholders are cutting on their R&D budgets and rather leaning on testing activities, along with distribution partners to expand business streams. Companies are increasing their focus on technical assistance due to increasing demand for innovative designs and materials in the plastic industry.

Manufacturers are seen investing in laboratory infrastructure to upgrade and experiment with the value of polymers or polymer systems through melt blending and mixing of additives to a polymer matrix.

Vehicle fuel efficiency is being linked with plastic compounding. The ever-evolving automotive industry is creating stable revenue streams for stakeholders in the global plastic compounding market. Houston-based Ascend Performance Materials has declared an acquisition pact with Tehe Engineering Plastic and NCM Co. Ltd. to expand their compounding assets in China. Companies are taking efforts to invest in R&D centers with immense focus on existing applications in the automotive, electronics, and consumer goods sectors.

Stakeholders are gaining proficiency in sustainable compounding to strengthen their position in the automotive industry. The craze of lightweight vehicles among Gen-Z population to achieve fuel efficiency is driving plastic manufacturers in the plastic compounding market to innovate in sustainable compounding. Reduced vehicle weight is the key to combat the risk of carbon emissions from an automobile. Such trends are fueling plastic compounding activities in the automotive industry.

Thermoplastic compounding is gaining prominence in consumer goods, medical, and 3D (3 Dimensional) modeling applications. Companies in the plastic compounding market are increasing their production capabilities in long-fiber reinforced thermoplastics. Oak Tree Engineering - a specialist in thermoplastics compounding is incorporating a wide range of additives, polymers, fillers, and colorants in thermoplastics to meet demanding needs of clients in the automotive, consumer goods, and 3D modeling applications.

Plastic is the material choice for most consumer goods. Manufacturers in the plastic compounding market are using twin-screw compounding and additives to enhance the flexibility, impact strength, and flame retardance of thermoplastics. These thermoplastics compliment consumer goods approved for food contact and pet use. Manufacturers are making use of chemical and mechanical knowledge to ensure that thermoplastics are free from raw materials that may concern consumers.

Specialty compounding is being used to enhance UV protection and electrical conductivity in plastics. Epsilon Carbon Pvt. Ltd. - a leading manufacturer of coal tar derivatives, is acquiring recognition for specialty compounding and is using a blend of pigments, carrier resins, and masterbatches to strengthen the properties of plastic.

On the other hand, custom polymer compounding is gaining popularity in the plastic compounding market. Companies are increasing their R&D capabilities for feedstock testing, in-process testing, and final quality control testing to gain a competitive edge over other market players. Pre-work testing and post-blending testing help to qualify the base raw materials to ensure high performance characteristics in products. In-process testing helps to ensure client requirements are being met at every step.

Asia Pacific is predicted to dictate the plastic compounding market during the assessment period in terms of volume in 2020. This is evident since companies in India are incorporating fully automated plants to make sure of material quality and safe working environment for its employees. APPL Industries Limited - a polymer compounding pioneer in India is being highly publicized for its world-class compounding products made with robust R&D support and quality standards.

Extensive involvement in research and development is helping manufacturers in expansion of multiple locations and along with multiple clients. Companies in the India plastic compounding market are entering into joint ventures with companies based in Shanghai, Germany, and the U.S. to introduce niche products in the market. Such strategies are helping to broaden their revenue streams and carve a new level of trust in existing and prospective partners.

Apart from automotive, electronics and construction, manufacturers in the plastic compounding market are extending their supply arms in defense, irrigation, and furniture applications. Underground cables and appliances are catalyzing the demand for plastic compounding. With the help of advanced materials, plastics are being transformed to exhibit high tensile strength as compared to most metals. Injection molding companies are capitalizing on these trends, since low manufacturing cost of plastic and design flexibility is being preferred in various end-use cases.

Switching to plastic is found to deliver cost savings, as multiple metal parts can be combined into one plastic part. Companies in the plastic compounding market are able to save on manufacturing time and eliminate the need for fasteners & assembly. Moreover, color can be added to plastic components, which also eliminates the need for paints.

Analysts’ Viewpoint

Virtual knowledge-sharing and networking events are gaining prominence in the plastic compounding market during the coronavirus pandemic. The market is estimated to reach the value of US$ 107.6 Bn by 2031. Plastics made from advanced materials help to deploy better dimensional stability and design flexibility than metals. However, the growing plastic waste is affecting the environment. Hence, companies should engage in sustainable compounding such as in the case of the automotive industry where stakeholders are increasing efforts to develop lightweight vehicles to decrease the risks of emissions from automobiles and deliver fuel efficiency. Companies should increase focus on thermoplastics to advance in medical, 3D modeling, and consumer goods applications.

Plastic Compounding Market: Overview

Increase in Demand for Plastic Compounding in End-use Industries: Key Driver of Plastic Compounding Market

Growth in Consumer Demand for Green Plastics to Drive Bio-based Plastic Compounding Market

Plastic Compounding Market: Prominent Types

Automotive to be Major Application Area

Asia Pacific to be Highly Lucrative Regional Market

Plastic Compounding Market: Competition Landscape

Plastic Compounding Market: Key Developments

Plastic Compounding Market is expected to reach USD 107.6 Bn between 2021 and 2031

Plastic Compounding Market is estimated to rise at a CAGR of 6% during forecast period

Increase in demand for plastics in construction, automotive, and electrical & electronics sectors is likely to be a major factor driving the global plastic compounding market

Asia Pacific is more attractive for vendors in the Plastic Compounding Market

Key players of Plastic Compounding Market are BASF SE, DuPont, Covestro AG, Celanese Corporation, Sojitz Corporation, Clariant International, Citadel Plastics, DSM N.V., Arkema Group, AMI LLC, RTP Company, Kingfa Science & Technology Co., Ltd.

1. Executive Summary

1.1. Plastic Compounding Market Snapshot

1.2. Current Market & Future Potential

2. Market Overview

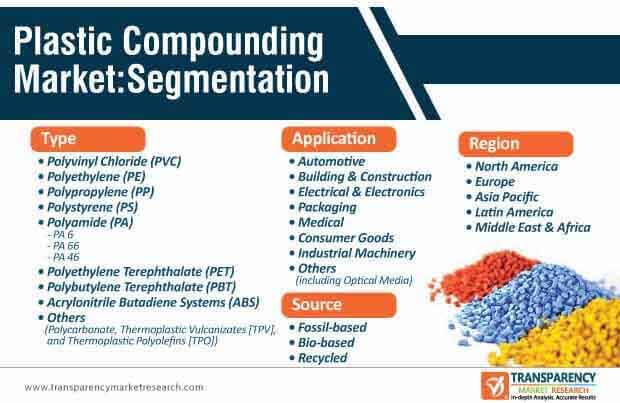

2.1. Market Segmentation

2.2. Product Overview

2.3. Market Developments

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Compounders

2.6.2. List of Potential Customers

3. Covid-19 Impact Analysis

4. Global Production Output Analysis, 2020

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Global Plastic Compounding Market Price Trend Analysis, 2017–2031

5.1. By Type

5.2. By Region

6. Global Plastic Compounding Market Analysis and Forecast, by Type

6.1. Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

6.1.1. Polyvinyl Chloride (PVC)

6.1.2. Polyethylene (PE)

6.1.3. Polypropylene (PP)

6.1.4. Polystyrene (PS)

6.1.5. Polyamide (PA)

6.1.5.1. PA 6

6.1.5.2. PA 66

6.1.5.3. PA 46

6.1.6. Polyethylene Terephthalate (PET)

6.1.7. Polybutylene Terephthalate (PBT)

6.1.8. Acrylonitrile Butadiene Systems (ABS)

6.1.9. Others

6.2. Global Plastic Compounding Market Attractiveness Analysis, by Type

7. Global Plastic Compounding Market Analysis and Forecast, by Source

7.1. Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

7.1.1. Fossil-based

7.1.2. Bio-based

7.1.3. Recycled

7.2. Global Plastic Compounding Market Attractiveness Analysis, by Source

8. Global Plastic Compounding Market Analysis and Forecast, by Application

8.1. Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

8.1.1. Automotive

8.1.2. Building & Construction

8.1.3. Electrical & Electronics

8.1.4. Packaging

8.1.5. Medical

8.1.6. Consumer Goods

8.1.7. Industrial Machinery

8.1.8. Others

8.2. Global Plastic Compounding Market Attractiveness Analysis, by Application

9. Global Plastic Compounding Market Analysis and Forecast, by Region

9.1. Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn), by Region, 2017–2031

9.1.1. North America

9.1.2. Latin America

9.1.3. Europe

9.1.4. Asia Pacific

9.1.5. Middle East & Africa

10. North America Plastic Compounding Market Analysis and Forecast, by Type

10.1. Key Findings, by Type

10.2. North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

10.2.1. Polyvinyl Chloride (PVC)

10.2.2. Polyethylene (PE)

10.2.3. Polypropylene (PP)

10.2.4. Polystyrene (PS)

10.2.5. Polyamide (PA)

10.2.5.1. PA 6

10.2.5.2. PA 66

10.2.5.3. PA 46

10.2.6. Polyethylene Terephthalate (PET)

10.2.7. Polybutylene Terephthalate (PBT)

10.2.8. Acrylonitrile Butadiene Systems (ABS)

10.2.9. Others

10.3. North America Plastic Compounding Market Attractiveness Analysis, by Type

11. North America Plastic Compounding Market Analysis and Forecast, by Source

11.1. Key Findings, by Source

11.2. North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

11.2.1. Fossil-based

11.2.2. Bio-based

11.2.3. Recycled

11.3. North America Plastic Compounding Market Attractiveness Analysis, by Source

12. North America Plastic Compounding Market Analysis and Forecast, by Application

12.1. Key Findings, by Application

12.2. North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

12.2.1. Automotive

12.2.2. Building & Construction

12.2.3. Electrical & Electronics

12.2.4. Packaging

12.2.5. Medical

12.2.6. Consumer Goods

12.2.7. Industrial Machinery

12.2.8. Others

12.3. North America Plastic Compounding Market Attractiveness Analysis, by Application

12.4. North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country, 2017–2031

12.5. U.S. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

12.5.1. Polyvinyl Chloride (PVC)

12.5.2. Polyethylene (PE)

12.5.3. Polypropylene (PP)

12.5.4. Polystyrene (PS)

12.5.5. Polyamide (PA)

12.5.5.1. PA 6

12.5.5.2. PA 66

12.5.5.3. PA 46

12.5.6. Polyethylene Terephthalate (PET)

12.5.7. Polybutylene Terephthalate (PBT)

12.5.8. Acrylonitrile Butadiene Systems (ABS)

12.5.9. Others

12.6. U.S. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

12.6.1. Fossil-based

12.6.2. Bio-based

12.6.3. Recycled

12.7. U.S. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

12.7.1. Automotive

12.7.2. Building & Construction

12.7.3. Electrical & Electronics

12.7.4. Packaging

12.7.5. Medical

12.7.6. Consumer Goods

12.7.7. Industrial Machinery

12.7.8. Others

12.8. Canada Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

12.8.1. Polyvinyl Chloride (PVC)

12.8.2. Polyethylene (PE)

12.8.3. Polypropylene (PP)

12.8.4. Polystyrene (PS)

12.8.5. Polyamide (PA)

12.8.5.1. PA 6

12.8.5.2. PA 66

12.8.5.3. PA 46

12.8.6. Polyethylene Terephthalate (PET)

12.8.7. Polybutylene Terephthalate (PBT)

12.8.8. Acrylonitrile Butadiene Systems (ABS)

12.8.9. Others

12.9. Canada Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

12.9.1. Fossil-based

12.9.2. Bio-based

12.9.3. Recycled

12.10. Canada Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

12.10.1. Automotive

12.10.2. Building & Construction

12.10.3. Electrical & Electronics

12.10.4. Packaging

12.10.5. Medical

12.10.6. Consumer Goods

12.10.7. Industrial Machinery

12.10.8. Others

13. Europe Plastic Compounding Market Analysis and Forecast, by Type

13.1. Key Findings, by Type

13.2. Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

13.2.1. Polyvinyl Chloride (PVC)

13.2.2. Polyethylene (PE)

13.2.3. Polypropylene (PP)

13.2.4. Polystyrene (PS)

13.2.5. Polyamide (PA)

13.2.5.1. PA 6

13.2.5.2. PA 66

13.2.5.3. PA 46

13.2.6. Polyethylene Terephthalate (PET)

13.2.7. Polybutylene Terephthalate (PBT)

13.2.8. Acrylonitrile Butadiene Systems (ABS)

13.2.9. Others

13.3. Europe Plastic Compounding Market Attractiveness Analysis, by Type

14. Europe Plastic Compounding Market Analysis and Forecast, by Source

14.1. Key Findings, by Source

14.2. Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

14.2.1. Fossil-based

14.2.2. Bio-based

14.2.3. Recycled

14.3. Europe Plastic Compounding Market Attractiveness Analysis, by Source

15. Europe Plastic Compounding Market Analysis and Forecast, by Application

15.1. Key Findings, by Application

15.2. Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.2.1. Automotive

15.2.2. Building & Construction

15.2.3. Electrical & Electronics

15.2.4. Packaging

15.2.5. Medical

15.2.6. Consumer Goods

15.2.7. Industrial Machinery

15.2.8. Others

15.3. Europe Plastic Compounding Market Attractiveness Analysis, by Application

15.4. Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

15.5. Germany Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.5.1. Polyvinyl Chloride (PVC)

15.5.2. Polyethylene (PE)

15.5.3. Polypropylene (PP)

15.5.4. Polystyrene (PS)

15.5.5. Polyamide (PA)

15.5.5.1. PA 6

15.5.5.2. PA 66

15.5.5.3. PA 46

15.5.6. Polyethylene Terephthalate (PET)

15.5.7. Polybutylene Terephthalate (PBT)

15.5.8. Acrylonitrile Butadiene Systems (ABS)

15.5.9. Others

15.6. Germany Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.6.1. Fossil-based

15.6.2. Bio-based

15.6.3. Recycled

15.7. Germany Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.7.1. Automotive

15.7.2. Building & Construction

15.7.3. Electrical & Electronics

15.7.4. Packaging

15.7.5. Medical

15.7.6. Consumer Goods

15.7.7. Industrial Machinery

15.7.8. Others

15.8. France Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.8.1. Polyvinyl Chloride (PVC)

15.8.2. Polyethylene (PE)

15.8.3. Polypropylene (PP)

15.8.4. Polystyrene (PS)

15.8.5. Polyamide (PA)

15.8.5.1. PA 6

15.8.5.2. PA 66

15.8.5.3. PA 46

15.8.6. Polyethylene Terephthalate (PET)

15.8.7. Polybutylene Terephthalate (PBT)

15.8.8. Acrylonitrile Butadiene Systems (ABS)

15.8.9. Others

15.9. France Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.9.1. Fossil-based

15.9.2. Bio-based

15.9.3. Recycled

15.10. France Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.10.1. Automotive

15.10.2. Building & Construction

15.10.3. Electrical & Electronics

15.10.4. Packaging

15.10.5. Medical

15.10.6. Consumer Goods

15.10.7. Industrial Machinery

15.10.8. Others

15.11. U.K. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.11.1. Polyvinyl Chloride (PVC)

15.11.2. Polyethylene (PE)

15.11.3. Polypropylene (PP)

15.11.4. Polystyrene (PS)

15.11.5. Polyamide (PA)

15.11.5.1. PA 6

15.11.5.2. PA 66

15.11.5.3. PA 46

15.11.6. Polyethylene Terephthalate (PET)

15.11.7. Polybutylene Terephthalate (PBT)

15.11.8. Acrylonitrile Butadiene Systems (ABS)

15.11.9. Others

15.12. U.K. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.12.1. Fossil-based

15.12.2. Bio-based

15.12.3. Recycled

15.13. U.K. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.13.1. Automotive

15.13.2. Building & Construction

15.13.3. Electrical & Electronics

15.13.4. Packaging

15.13.5. Medical

15.13.6. Consumer Goods

15.13.7. Industrial Machinery

15.13.8. Others

15.14. Italy Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.14.1. Polyvinyl Chloride (PVC)

15.14.2. Polyethylene (PE)

15.14.3. Polypropylene (PP)

15.14.4. Polystyrene (PS)

15.14.5. Polyamide (PA)

15.14.5.1. PA 6

15.14.5.2. PA 66

15.14.5.3. PA 46

15.14.6. Polyethylene Terephthalate (PET)

15.14.7. Polybutylene Terephthalate (PBT)

15.14.8. Acrylonitrile Butadiene Systems (ABS)

15.14.9. Others

15.15. Italy Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.15.1. Fossil-based

15.15.2. Bio-based

15.15.3. Recycled

15.16. Italy Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.16.1. Automotive

15.16.2. Building & Construction

15.16.3. Electrical & Electronics

15.16.4. Packaging

15.16.5. Medical

15.16.6. Consumer Goods

15.16.7. Industrial Machinery

15.16.8. Others

15.17. Spain Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.17.1. Polyvinyl Chloride (PVC)

15.17.2. Polyethylene (PE)

15.17.3. Polypropylene (PP)

15.17.4. Polystyrene (PS)

15.17.5. Polyamide (PA)

15.17.5.1. PA 6

15.17.5.2. PA 66

15.17.5.3. PA 46

15.17.6. Polyethylene Terephthalate (PET)

15.17.7. Polybutylene Terephthalate (PBT)

15.17.8. Acrylonitrile Butadiene Systems (ABS)

15.17.9. Others

15.18. Spain Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.18.1. Fossil-based

15.18.2. Bio-based

15.18.3. Recycled

15.19. Spain Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.19.1. Automotive

15.19.2. Building & Construction

15.19.3. Electrical & Electronics

15.19.4. Packaging

15.19.5. Medical

15.19.6. Consumer Goods

15.19.7. Industrial Machinery

15.19.8. Others

15.20. Russia & CIS Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.20.1. Polyvinyl Chloride (PVC)

15.20.2. Polyethylene (PE)

15.20.3. Polypropylene (PP)

15.20.4. Polystyrene (PS)

15.20.5. Polyamide (PA)

15.20.5.1. PA 6

15.20.5.2. PA 66

15.20.5.3. PA 46

15.20.6. Polyethylene Terephthalate (PET)

15.20.7. Polybutylene Terephthalate (PBT)

15.20.8. Acrylonitrile Butadiene Systems (ABS)

15.20.9. Others

15.21. Russia & CIS Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.21.1. Fossil-based

15.21.2. Bio-based

15.21.3. Recycled

15.22. Russia & CIS Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.22.1. Automotive

15.22.2. Building & Construction

15.22.3. Electrical & Electronics

15.22.4. Packaging

15.22.5. Medical

15.22.6. Consumer Goods

15.22.7. Industrial Machinery

15.22.8. Others

15.23. Rest of Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

15.23.1. Polyvinyl Chloride (PVC)

15.23.2. Polyethylene (PE)

15.23.3. Polypropylene (PP)

15.23.4. Polystyrene (PS)

15.23.5. Polyamide (PA)

15.23.5.1. PA 6

15.23.5.2. PA 66

15.23.5.3. PA 46

15.23.6. Polyethylene Terephthalate (PET)

15.23.7. Polybutylene Terephthalate (PBT)

15.23.8. Acrylonitrile Butadiene Systems (ABS)

15.23.9. Others

15.24. Rest of Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

15.24.1. Fossil-based

15.24.2. Bio-based

15.24.3. Recycled

15.25. Rest of Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

15.25.1. Automotive

15.25.2. Building & Construction

15.25.3. Electrical & Electronics

15.25.4. Packaging

15.25.5. Medical

15.25.6. Consumer Goods

15.25.7. Industrial Machinery

15.25.8. Others

16. Asia Pacific Plastic Compounding Market Analysis and Forecast, by Type

16.1. Key Findings, by Type

16.2. Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

16.2.1. Polyvinyl Chloride (PVC)

16.2.2. Polyethylene (PE)

16.2.3. Polypropylene (PP)

16.2.4. Polystyrene (PS)

16.2.5. Polyamide (PA)

16.2.5.1. PA 6

16.2.5.2. PA 66

16.2.5.3. PA 46

16.2.6. Polyethylene Terephthalate (PET)

16.2.7. Polybutylene Terephthalate (PBT)

16.2.8. Acrylonitrile Butadiene Systems (ABS)

16.2.9. Others

16.3. Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Type

17. Asia Pacific Plastic Compounding Market Analysis and Forecast, by Source

17.1. Key Findings, by Source

17.2. Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

17.2.1. Fossil-based

17.2.2. Bio-based

17.2.3. Recycled

17.3. Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Source

18. Asia Pacific Plastic Compounding Market Analysis and Forecast, by Application

18.1. Key Findings, by Application

18.2. Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

18.2.1. Automotive

18.2.2. Building & Construction

18.2.3. Electrical & Electronics

18.2.4. Packaging

18.2.5. Medical

18.2.6. Consumer Goods

18.2.7. Industrial Machinery

18.2.8. Others

18.3. Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Application

18.4. Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

18.5. China Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

18.5.1. Polyvinyl Chloride (PVC)

18.5.2. Polyethylene (PE)

18.5.3. Polypropylene (PP)

18.5.4. Polystyrene (PS)

18.5.5. Polyamide (PA)

18.5.5.1. PA 6

18.5.5.2. PA 66

18.5.5.3. PA 46

18.5.6. Polyethylene Terephthalate (PET)

18.5.7. Polybutylene Terephthalate (PBT)

18.5.8. Acrylonitrile Butadiene Systems (ABS)

18.5.9. Others

18.6. China Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

18.6.1. Fossil-based

18.6.2. Bio-based

18.6.3. Recycled

18.7. China Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

18.7.1. Automotive

18.7.2. Building & Construction

18.7.3. Electrical & Electronics

18.7.4. Packaging

18.7.5. Medical

18.7.6. Consumer Goods

18.7.7. Industrial Machinery

18.7.8. Others

18.8. Japan Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

18.8.1. Polyvinyl Chloride (PVC)

18.8.2. Polyethylene (PE)

18.8.3. Polypropylene (PP)

18.8.4. Polystyrene (PS)

18.8.5. Polyamide (PA)

18.8.5.1. PA 6

18.8.5.2. PA 66

18.8.5.3. PA 46

18.8.6. Polyethylene Terephthalate (PET)

18.8.7. Polybutylene Terephthalate (PBT)

18.8.8. Acrylonitrile Butadiene Systems (ABS)

18.8.9. Others

18.9. Japan Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

18.9.1. Fossil-based

18.9.2. Bio-based

18.9.3. Recycled

18.10. Japan Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

18.10.1. Automotive

18.10.2. Building & Construction

18.10.3. Electrical & Electronics

18.10.4. Packaging

18.10.5. Medical

18.10.6. Consumer Goods

18.10.7. Industrial Machinery

18.10.8. Others

18.11. India Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

18.11.1. Polyvinyl Chloride (PVC)

18.11.2. Polyethylene (PE)

18.11.3. Polypropylene (PP)

18.11.4. Polystyrene (PS)

18.11.5. Polyamide (PA)

18.11.5.1. PA 6

18.11.5.2. PA 66

18.11.5.3. PA 46

18.11.6. Polyethylene Terephthalate (PET)

18.11.7. Polybutylene Terephthalate (PBT)

18.11.8. Acrylonitrile Butadiene Systems (ABS)

18.11.9. Others

18.12. India Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

18.12.1. Fossil-based

18.12.2. Bio-based

18.12.3. Recycled

18.13. India Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

18.13.1. Automotive

18.13.2. Building & Construction

18.13.3. Electrical & Electronics

18.13.4. Packaging

18.13.5. Medical

18.13.6. Consumer Goods

18.13.7. Industrial Machinery

18.13.8. Others

18.14. ASEAN Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

18.14.1. Polyvinyl Chloride (PVC)

18.14.2. Polyethylene (PE)

18.14.3. Polypropylene (PP)

18.14.4. Polystyrene (PS)

18.14.5. Polyamide (PA)

18.14.5.1. PA 6

18.14.5.2. PA 66

18.14.5.3. PA 46

18.14.6. Polyethylene Terephthalate (PET)

18.14.7. Polybutylene Terephthalate (PBT)

18.14.8. Acrylonitrile Butadiene Systems (ABS)

18.14.9. Others

18.15. ASEAN Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

18.15.1. Fossil-based

18.15.2. Bio-based

18.15.3. Recycled

18.16. ASEAN Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

18.16.1. Automotive

18.16.2. Building & Construction

18.16.3. Electrical & Electronics

18.16.4. Packaging

18.16.5. Medical

18.16.6. Consumer Goods

18.16.7. Industrial Machinery

18.16.8. Others

18.17. Rest of Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

18.17.1. Polyvinyl Chloride (PVC)

18.17.2. Polyethylene (PE)

18.17.3. Polypropylene (PP)

18.17.4. Polystyrene (PS)

18.17.5. Polyamide (PA)

18.17.5.1. PA 6

18.17.5.2. PA 66

18.17.5.3. PA 46

18.17.6. Polyethylene Terephthalate (PET)

18.17.7. Polybutylene Terephthalate (PBT)

18.17.8. Acrylonitrile Butadiene Systems (ABS)

18.17.9. Others

18.18. Rest of Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

18.18.1. Fossil-based

18.18.2. Bio-based

18.18.3. Recycled

18.19. Rest of Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

18.19.1. Automotive

18.19.2. Building & Construction

18.19.3. Electrical & Electronics

18.19.4. Packaging

18.19.5. Medical

18.19.6. Consumer Goods

18.19.7. Industrial Machinery

18.19.8. Others

19. Latin America Plastic Compounding Market Analysis and Forecast, by Type

19.1. Key Findings, by Type

19.2. Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

19.2.1. Polyvinyl Chloride (PVC)

19.2.2. Polyethylene (PE)

19.2.3. Polypropylene (PP)

19.2.4. Polystyrene (PS)

19.2.5. Polyamide (PA)

19.2.5.1. PA 6

19.2.5.2. PA 66

19.2.5.3. PA 46

19.2.6. Polyethylene Terephthalate (PET)

19.2.7. Polybutylene Terephthalate (PBT)

19.2.8. Acrylonitrile Butadiene Systems (ABS)

19.2.9. Others

19.3. Latin America Plastic Compounding Market Attractiveness Analysis, by Type

20. Latin America Plastic Compounding Market Analysis and Forecast, by Source

20.1. Key Findings, by Source

20.2. Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

20.2.1. Fossil-based

20.2.2. Bio-based

20.2.3. Recycled

20.3. Latin America Plastic Compounding Market Attractiveness Analysis, by Source

21. Latin America Plastic Compounding Market Analysis and Forecast, by Application

21.1. Key Findings, by Application

21.2. Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

21.2.1. Automotive

21.2.2. Building & Construction

21.2.3. Electrical & Electronics

21.2.4. Packaging

21.2.5. Medical

21.2.6. Consumer Goods

21.2.7. Industrial Machinery

21.2.8. Others

21.3. Latin America Plastic Compounding Market Attractiveness Analysis, by Application

21.4. Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

21.5. Brazil Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

21.5.1. Polyvinyl Chloride (PVC)

21.5.2. Polyethylene (PE)

21.5.3. Polypropylene (PP)

21.5.4. Polystyrene (PS)

21.5.5. Polyamide (PA)

21.5.5.1. PA 6

21.5.5.2. PA 66

21.5.5.3. PA 46

21.5.6. Polyethylene Terephthalate (PET)

21.5.7. Polybutylene Terephthalate (PBT)

21.5.8. Acrylonitrile Butadiene Systems (ABS)

21.5.9. Others

21.6. Brazil Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

21.6.1. Fossil-based

21.6.2. Bio-based

21.6.3. Recycled

21.7. Brazil Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

21.7.1. Automotive

21.7.2. Building & Construction

21.7.3. Electrical & Electronics

21.7.4. Packaging

21.7.5. Medical

21.7.6. Consumer Goods

21.7.7. Industrial Machinery

21.7.8. Others

21.8. Mexico Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

21.8.1. Polyvinyl Chloride (PVC)

21.8.2. Polyethylene (PE)

21.8.3. Polypropylene (PP)

21.8.4. Polystyrene (PS)

21.8.5. Polyamide (PA)

21.8.5.1. PA 6

21.8.5.2. PA 66

21.8.5.3. PA 46

21.8.6. Polyethylene Terephthalate (PET)

21.8.7. Polybutylene Terephthalate (PBT)

21.8.8. Acrylonitrile Butadiene Systems (ABS)

21.8.9. Others

21.9. Mexico Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

21.9.1. Fossil-based

21.9.2. Bio-based

21.9.3. Recycled

21.10. Mexico Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

21.10.1. Automotive

21.10.2. Building & Construction

21.10.3. Electrical & Electronics

21.10.4. Packaging

21.10.5. Medical

21.10.6. Consumer Goods

21.10.7. Industrial Machinery

21.10.8. Others

21.11. Rest of Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

21.11.1. Polyvinyl Chloride (PVC)

21.11.2. Polyethylene (PE)

21.11.3. Polypropylene (PP)

21.11.4. Polystyrene (PS)

21.11.5. Polyamide (PA)

21.11.5.1. PA 6

21.11.5.2. PA 66

21.11.5.3. PA 46

21.11.6. Polyethylene Terephthalate (PET)

21.11.7. Polybutylene Terephthalate (PBT)

21.11.8. Acrylonitrile Butadiene Systems (ABS)

21.11.9. Others

21.12. Rest of Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

21.12.1. Fossil-based

21.12.2. Bio-based

21.12.3. Recycled

21.13. Rest of Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

21.13.1. Automotive

21.13.2. Building & Construction

21.13.3. Electrical & Electronics

21.13.4. Packaging

21.13.5. Medical

21.13.6. Consumer Goods

21.13.7. Industrial Machinery

21.13.8. Others

22. Middle East & Africa Plastic Compounding Market Analysis and Forecast, by Type

22.1. Key Findings, by Type

22.2. Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

22.2.1. Polyvinyl Chloride (PVC)

22.2.2. Polyethylene (PE)

22.2.3. Polypropylene (PP)

22.2.4. Polystyrene (PS)

22.2.5. Polyamide (PA)

22.2.5.1. PA 6

22.2.5.2. PA 66

22.2.5.3. PA 46

22.2.6. Polyethylene Terephthalate (PET)

22.2.7. Polybutylene Terephthalate (PBT)

22.2.8. Acrylonitrile Butadiene Systems (ABS)

22.2.9. Others

22.3. Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Type

23. Middle East & Africa Plastic Compounding Market Analysis and Forecast, by Source

23.1. Key Findings, by Source

23.2. Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

23.2.1. Fossil-based

23.2.2. Bio-based

23.2.3. Recycled

23.3. Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Source

24. Middle East & Africa Plastic Compounding Market Analysis and Forecast, by Application

24.1. Key Findings, by Application

24.2. Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

24.2.1. Automotive

24.2.2. Building & Construction

24.2.3. Electrical & Electronics

24.2.4. Packaging

24.2.5. Medical

24.2.6. Consumer Goods

24.2.7. Industrial Machinery

24.2.8. Others

24.3. Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Application

24.4. Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

24.5. GCC Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

24.5.1. Polyvinyl Chloride (PVC)

24.5.2. Polyethylene (PE)

24.5.3. Polypropylene (PP)

24.5.4. Polystyrene (PS)

24.5.5. Polyamide (PA)

24.5.5.1. PA 6

24.5.5.2. PA 66

24.5.5.3. PA 46

24.5.6. Polyethylene Terephthalate (PET)

24.5.7. Polybutylene Terephthalate (PBT)

24.5.8. Acrylonitrile Butadiene Systems (ABS)

24.5.9. Others

24.6. GCC Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

24.6.1. Fossil-based

24.6.2. Bio-based

24.6.3. Recycled

24.7. GCC Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

24.7.1. Automotive

24.7.2. Building & Construction

24.7.3. Electrical & Electronics

24.7.4. Packaging

24.7.5. Medical

24.7.6. Consumer Goods

24.7.7. Industrial Machinery

24.7.8. Others

24.8. South Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

24.8.1. Polyvinyl Chloride (PVC)

24.8.2. Polyethylene (PE)

24.8.3. Polypropylene (PP)

24.8.4. Polystyrene (PS)

24.8.5. Polyamide (PA)

24.8.5.1. PA 6

24.8.5.2. PA 66

24.8.5.3. PA 46

24.8.6. Polyethylene Terephthalate (PET)

24.8.7. Polybutylene Terephthalate (PBT)

24.8.8. Acrylonitrile Butadiene Systems (ABS)

24.8.9. Others

24.9. South Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

24.9.1. Fossil-based

24.9.2. Bio-based

24.9.3. Recycled

24.10. South Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

24.10.1. Automotive

24.10.2. Building & Construction

24.10.3. Electrical & Electronics

24.10.4. Packaging

24.10.5. Medical

24.10.6. Consumer Goods

24.10.7. Industrial Machinery

24.10.8. Others

24.11. Rest of Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

24.11.1. Polyvinyl Chloride (PVC)

24.11.2. Polyethylene (PE)

24.11.3. Polypropylene (PP)

24.11.4. Polystyrene (PS)

24.11.5. Polyamide (PA)

24.11.5.1. PA 6

24.11.5.2. PA 66

24.11.5.3. PA 46

24.11.6. Polyethylene Terephthalate (PET)

24.11.7. Polybutylene Terephthalate (PBT)

24.11.8. Acrylonitrile Butadiene Systems (ABS)

24.11.9. Others

24.12. Rest of Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

24.12.1. Fossil-based

24.12.2. Bio-based

24.12.3. Recycled

24.13. Rest of Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

24.13.1. Automotive

24.13.2. Building & Construction

24.13.3. Electrical & Electronics

24.13.4. Packaging

24.13.5. Medical

24.13.6. Consumer Goods

24.13.7. Industrial Machinery

24.13.8. Others

25. Competition Landscape

25.1. Global Plastic Compounding Market Share Analysis, by Company (2019)

25.2. Market Footprint Analysis

25.2.1. By Application

25.3. Company Profiles

25.3.1. BASF SE

25.3.1.1. Company Description

25.3.1.2. Business Overview

25.3.1.3. Product Portfolio

25.3.1.4. Revenue Analysis

25.3.1.5. Strategic Outlook

25.3.2. DuPont de Nemours, Inc.

25.3.2.1. Company Description

25.3.2.2. Business Overview

25.3.2.3. Product Portfolio

25.3.2.4. Revenue Analysis

25.3.3. Coperion K-Tron

25.3.3.1. Company Description

25.3.3.2. Business Overview

25.3.3.3. Product Portfolio

25.3.3.4. Revenue Analysis

25.3.4. Adell Plastics

25.3.4.1. Company Description

25.3.4.2. Business Overview

25.3.4.3. Product Portfolio

25.3.4.4. Revenue Analysis

25.3.5. RTP Company

25.3.5.1. Company Description

25.3.5.2. Business Overview

25.3.5.3. Product Portfolio

25.3.5.4. Strategic Outlook

25.3.5.5. Revenue Analysis

25.3.6. Sojitz Corporation

25.3.6.1. Company Description

25.3.6.2. Business Overview

25.3.6.3. Product Portfolio

25.3.6.4. Revenue Analysis

25.3.7. Ravago Group

25.3.7.1. Company Description

25.3.7.2. Business Overview

25.3.7.3. Product Portfolio

25.3.7.4. Revenue Analysis

25.3.7.5. Strategic Outlook

25.3.8. Asahi Kasei Corporation

25.3.8.1. Company Description

25.3.8.2. Business Overview

25.3.8.3. Product Portfolio

25.3.9. Celanese Corporation

25.3.9.1. Company Description

25.3.9.2. Business Overview

25.3.9.3. Product Portfolio

25.3.10. Covestro AG

25.3.10.1. Company Description

25.3.10.2. Business Overview

25.3.10.3. Product Portfolio

25.3.10.4. Strategic Outlook

25.3.10.5. Revenue Analysis

25.3.11. Aurora Plastics LLC

25.3.11.1. Company Description

25.3.11.2. Business Overview

25.3.11.3. Product Portfolio

25.3.12. Agiplast Italia SRL

25.3.12.1. Company Description

25.3.12.2. Business Overview

25.3.12.3. Product Portfolio

25.3.12.4. Revenue Analysis

25.3.13. Kingfa Science & Technology Co. Ltd.

25.3.13.1. Company Description

25.3.13.2. Business Overview

25.3.13.3. Product Portfolio

25.3.13.4. Revenue Analysis

25.3.14. Plastiblends India, Ltd.

25.3.14.1. Company Description

25.3.14.2. Business Overview

25.3.14.3. Product Portfolio

25.3.14.4. Revenue Analysis

25.3.15. Celanese SO.F.TER

25.3.15.1. Company Description

25.3.15.2. Business Overview

25.3.15.3. Product Portfolio

25.3.15.4. Revenue Analysis

25.3.16. Citadel Plastics Holdings, Inc.

25.3.16.1. Company Description

25.3.16.2. Business Overview

25.3.16.3. Product Portfolio

25.3.16.4. Revenue Analysis

25.3.17. Resinex Group

25.3.17.1. Company Description

25.3.17.2. Business Overview

25.3.17.3. Product Portfolio

25.3.17.4. Revenue Analysis

25.3.18. Arkema Group

25.3.18.1. Company Description

25.3.18.2. Business Overview

25.3.18.3. Product Portfolio

25.3.18.4. Revenue Analysis

25.3.19. DSM NV

25.3.19.1. Company Description

25.3.19.2. Business Overview

25.3.19.3. Product Portfolio

25.3.19.4. Revenue Analysis

25.3.20. AKRO-Plastic GmbH

25.3.20.1. Company Description

25.3.20.2. Business Overview

25.3.20.3. Product Portfolio

25.3.20.4. Revenue Analysis

26. Key Primary Insights

List of Tables

Table 1: Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 2: Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 3: Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 4: Global Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Region, 2017–2031

Table 5: North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 6: North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 7: North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 8: North America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country, 2017–2031

Table 9: U.S. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 10: U.S. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 11: U.S. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Canada Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 13: Canada Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 14: Canada Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 16: Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 17: Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

Table 19: Germany Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 20: Germany Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 21: Germany Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 22: Italy Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 23: Italy Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 24: Italy Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 25: France Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 26: France Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 27: France Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 28: U.K. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 29: U.K. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 30: U.K. Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 31: Spain Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 32: Spain Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 33: Spain Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 34: Russia & CIS Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 35: Russia & CIS Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 36: Russia & CIS Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 37: Rest of Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 38: Rest of Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 39: Rest of Europe Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 40: Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 41: Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 42: Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 43: Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

Table 44: China Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 45: China Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 46: China Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 47: India Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 48: India Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 49: India Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 50: Japan Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 51: Japan Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 52: Japan Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 53: ASEAN Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 54: ASEAN Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 55: ASEAN Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 56: Rest of Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 57: Rest of Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 58: Rest of Asia Pacific Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 59: Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 60: Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 61: Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 62: Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

Table 63: Brazil Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 64: Brazil Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 65: Brazil Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 66: Mexico Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 67: Mexico Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 68: Mexico Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 69: Rest of Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 70: Rest of Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 71: Rest of Latin America Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 72: Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 73: Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 74: Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 75: Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2017–2031

Table 76: GCC Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 77: GCC Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 78: GCC Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 79: South Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 80: South Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 81: South Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

Table 82: Rest of Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Type, 2017–2031

Table 83: Rest of Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Source, 2017–2031

Table 84: Rest of Middle East & Africa Plastic Compounding Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2017–2031

List of Figures

Figure 1: Global Plastic Compounding Market Share Analysis, by Type

Figure 2: Global Plastic Compounding Market Attractiveness Analysis, by Type

Figure 3: Global Plastic Compounding Market Share Analysis, by Source

Figure 4: Global Plastic Compounding Market Attractiveness Analysis, by Source

Figure 5: Global Plastic Compounding Market Share Analysis, by Application

Figure 6: Global Plastic Compounding Market Attractiveness Analysis, by Application

Figure 7: Global Plastic Compounding Market Share Analysis, by Region

Figure 8: Global Plastic Compounding Market Attractiveness Analysis, by Region

Figure 9: North America Plastic Compounding Market Share Analysis, by Type

Figure 10: North America Plastic Compounding Market Attractiveness Analysis, by Type

Figure 11: North America Plastic Compounding Market Share Analysis, by Source

Figure 12: North America Plastic Compounding Market Attractiveness Analysis, by Source

Figure 13: North America Plastic Compounding Market Share Analysis, by Application

Figure 14: North America Plastic Compounding Market Attractiveness Analysis, by Application

Figure 15: North America Plastic Compounding Market Share Analysis, by Country

Figure 16: Europe Plastic Compounding Market Attractiveness Analysis, by Country and Sub-region

Figure 17: Europe Plastic Compounding Market Share Analysis, by Type

Figure 18: Europe Plastic Compounding Market Attractiveness Analysis, by Type

Figure 19: Europe Plastic Compounding Market Share Analysis, by Source

Figure 20: Europe Plastic Compounding Market Attractiveness Analysis, by Source

Figure 21: Europe Plastic Compounding Market Share Analysis, by Application

Figure 22: Europe Plastic Compounding Market Attractiveness Analysis, by Application

Figure 23: Europe Plastic Compounding Market Share Analysis, by Country and Sub-region

Figure 24: Europe Plastic Compounding Market Attractiveness Analysis, by Country and Sub-region

Figure 25: Asia Pacific Plastic Compounding Market Share Analysis, by Type

Figure 26: Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Type

Figure 27: Asia Pacific Plastic Compounding Market Share Analysis, by Source

Figure 28: Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Source

Figure 29: Asia Pacific Plastic Compounding Market Share Analysis, by Application

Figure 30: Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Application

Figure 31: Asia Pacific Plastic Compounding Market Share Analysis, by Country and Sub-region

Figure 32: Asia Pacific Plastic Compounding Market Attractiveness Analysis, by Country and Sub-region

Figure 33: Latin America Plastic Compounding Market Share Analysis, by Type

Figure 34: Latin America Plastic Compounding Market Attractiveness Analysis, by Type

Figure 35: Latin America Plastic Compounding Market Share Analysis, by Source

Figure 36: Latin America Plastic Compounding Market Attractiveness Analysis, by Source

Figure 37: Latin America Plastic Compounding Market Share Analysis, by Application

Figure 38: Latin America Plastic Compounding Market Attractiveness Analysis, by Application

Figure 39: Latin America Plastic Compounding Market Share Analysis, by Country and Sub-region

Figure 40: Latin America Plastic Compounding Market Attractiveness Analysis, by Country and Sub-region

Figure 41: Middle East & Africa Plastic Compounding Market Share Analysis, by Type

Figure 42: Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Type

Figure 43: Middle East & Africa Plastic Compounding Market Share Analysis, by Source

Figure 44: Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Source

Figure 45: Middle East & Africa Plastic Compounding Market Share Analysis, by Application

Figure 46: Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Application

Figure 47: Middle East & Africa Plastic Compounding Market Share Analysis, by Country and Sub-region

Figure 48: Middle East & Africa Plastic Compounding Market Attractiveness Analysis, by Country and Sub-region