Global OTT Services Market – Snapshot

OTT services are delivered over the internet, however, they don’t have any involvement in the planning or provisioning of service. As these services are directly offered to consumers ‘over the top’ of internet service provider’s network, they have derived the name - over the top services. In response to the proliferation of smartphones and their compatibility with OTT applications, the demand for OTT services is poised to rise exponentially in the coming years. Likewise, affordable rates of high speed mobile internet has bolstered the adoption of OTT market at large.

Th global over the top (OTT) services market has grown by leaps and bounds in recent years, mainly due to the availability of smart technologies amongst the masses. There has been little contention about the utility of OTT services amongst consumers of varying age groups. The consumption of knowledge has been made easier through the use of OTT services and offerings. Moreover, people have become more inclined towards high-end technologies and utility-driven means of consuming informative and entertainment content. The emergence of new OTT platforms has widened the scope of offerings available at the disposal of the masses. Henceforth, the global over the top (OTT) services market is foreseen to grow at a sturdy pace in the years to follow.

Several key entities such as Netflix and Amazon Prime have made a niche for themselves in the global over the top (OTT) services market.

The OTT service providers have emerged as tough competitors for telecom service providers and cable operators. The mobile network operator messaging revenue has already declined to a great extent in the last five years and the impact has started to show up in their voice revenues as well. Also, the number of cord-cutters and cord trimmers has gone up due to on-demand media content available and reasonable rates as compared to traditional cable operators.

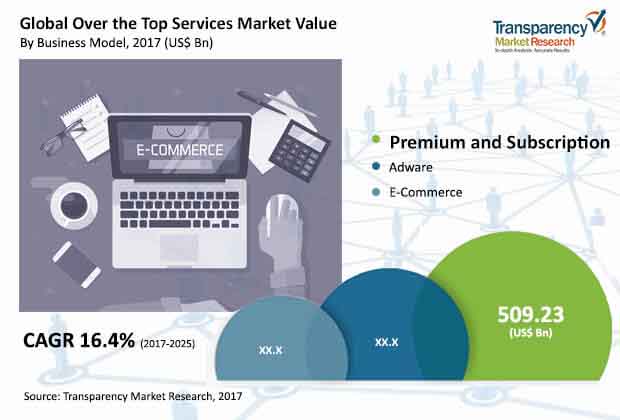

The global over the top services market was valued at US$1,049.21 billion in 2017 and the demand for OTT is estimated to expand at a CAGR of 16.4% from 2017 to 2025, reaching a value of US$3,538.04 billion by 2025.

Premium and Subscription Emerge as Leading Segment based on Business Model

On the basis of business model, the market is segmented into premium and subscriptions, adware, and ecommerce. The premium and subscription business model segment emerged dominant with a share of nearly 48.5% in the overall market in 2017. The segment earns revenue from fixed fee that the customer pays to download and access their application. The memberships or freemium turned premium service applications are also part of premium and subscriptions’ business model. Revenue generated by the premium and subscription segment is expected to increase owing to the increase in revenue of OTT media content and cloud service applications. The adware business model that earns revenue from advertisements on OTT applications is also expected to contribute for the OTT market. The ecommerce business model earns revenue from sales of its own products and services.

E-services that comprise of e-learning, e-health, e-business and e-commerce was the largest application segment in terms of revenue in the OTT services market in 2017, generating a revenue of 447.60 billion. The e-services segment is also anticipated to hold its foremost place throughout the forecast period. Media content and cloud services are also expected to produce higher revenues in the forthcoming period owing to quick content and service on demand made available through high speed internet at a reasonable price.

Asia Pacific to Showcase Higher CAGR than Other Regional Segments

North America led the OTT services market in 2017 and is expected to remain dominant throughout the forecast period 2017 to 2025. The primary drivers for the growth of OTT services market in North America region are the highest mobile internet penetration levels as compared to other regions with internet speed from 13.1 Mbps to 14 Mbps in the U.S.A and Canada. Apart from North America, Europe and Asia Pacific are expected to experience significant growth in the OTT services market during the forecast period. TMR forecasts the Asia Pacific OTT services market to exhibit the highest CAGR of 16.1% between 2017 and 2025.

Based on end use, the global OTT services market can be bifurcated into personal and commercial segments. Among end-use verticals, the commercial segment emerged dominant in the OTT services market. Within the commercial segment, the ecommerce sector held the largest share of 32.1% in 2017. Apart from ecommerce, the media and entertainment, IT, education, and healthcare held considerable share within the commercial segment. This trend is expected to continue prevailing in the coming years owing to the increasing application of OTT in media and entertainment, and ecommerce.

Major OTT services market players profiled in the report are Amazon Inc., Twitter Inc., Netflix, Inc., Facebook, Inc., Dropbox, Inc., Google, Inc., LinkedIn Corporation, Skype (Microsoft Corporation), Apple, Inc., Evernote Corporation, Hulu, LLC., and Rakuten, Inc.

Segmentations of the OTT Services market:

|

Business Model |

|

|

Application |

|

|

End Use |

|

|

Geography |

|

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Over The Top (OTT) Services Market

4. Market Overview

4.1. Introduction

4.1.1. Definitions

4.1.2. Industry Evolution / Developments

4.2. Global OTT Services Market Overview

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Global OTT Services Market Analysis and Forecasts, 2015 – 2025

4.5.1. Market Revenue Projections (US$ Bn)

4.6. Porter’s Five Force Analysis

4.7. Ecosystem Analysis

4.8. Market Outlook

5. Global OTT Services Market Analysis and Forecasts, By Business Model

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Size (US$ Bn) Forecast By Business Model 2015 – 2025 (US$ Bn)

5.4.1. Premium and Subscriptions

5.4.2. Adware

5.4.3. E-commerce

5.5. Business Model Comparison Matrix

5.6. Market Attractiveness By Business Model

6. Global OTT Services Market Analysis and Forecasts, By Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Size (US$ Bn) Forecast By Application 2015 – 2025 (US$ Bn)

6.4.1. Communication

6.4.2. E-Services

6.4.3. Media Content

6.4.3.1. Audio/Video

6.4.3.2. Gaming

6.4.3.3. Web Content

6.4.4. Cloud Services

6.5. Application Comparison Matrix

6.6. Market Attractiveness By Application

7. Global OTT Services Market Analysis and Forecasts, By End-use Vertical

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Size (US$ Bn) Forecast By End-use Vertical, 2015 – 2025 (US$ Bn)

7.4.1. Personal

7.4.2. Commercial

7.4.2.1. Healthcare

7.4.2.2. Media and Entertainment

7.4.2.3. Ecommerce

7.4.2.4. IT

7.4.2.5. Education

7.4.2.6. Others (Manufacturing, Energy and Transportation)

7.5. End-use Vertical Comparison Matrix

7.6. Market Attractiveness By End-use Vertical

8. Global OTT Services Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Size (US$ Bn) Forecast By Region, 2015 – 2025 (US$ Bn)

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East and Africa

8.2.5. South America

8.3. Market Attractiveness By Country/Region

9. North America OTT Services Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Market Size (US$ Bn) Forecast By Business Model, 2015 – 2025 (US$ Bn)

9.3.1. Premium and Subscriptions

9.3.2. Adware

9.3.3. E-commerce

9.4. Market Size (US$ Bn) Forecast By Application 2015 – 2025 (US$ Bn)

9.4.1. Communication

9.4.2. E-Services

9.4.3. Media Content

9.4.3.1. Audio/Video

9.4.3.2. Gaming

9.4.3.3. Web Content

9.4.4. Cloud Services

9.5. Market Size (US$ Bn) Forecast By End-use Vertical, 2015 – 2025 (US$ Bn)

9.5.1. Personal

9.5.2. Commercial

9.5.2.1. Healthcare

9.5.2.2. Media and Entertainment

9.5.2.3. Ecommerce

9.5.2.4. IT

9.5.2.5. Education

9.5.2.6. Others (Manufacturing, Energy and Transportation)

9.6. Market Size (US$ Bn) Forecast By Country, 2015 – 2025 (US$ Bn)

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Country

9.7.2. By Business Model

9.7.3. By Application

9.7.4. By End-use Vertical

10. Europe OTT Services Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Market Size (US$ Bn) Forecast By Business Model, 2015 – 2025 (US$ Bn)

10.3.1. Premium and Subscriptions

10.3.2. Adware

10.3.3. E-commerce

10.4. Market Size (US$ Bn) Forecast By Application 2015 – 2025 (US$ Bn)

10.4.1. Communication

10.4.2. E-Services

10.4.3. Media Content

10.4.3.1. Audio/Video

10.4.3.2. Gaming

10.4.3.3. Web Content

10.4.4. Cloud Services

10.5. Market Size (US$ Bn) Forecast By End-use Vertical, 2015 – 2025 (US$ Bn)

10.5.1. Personal

10.5.2. Commercial

10.5.2.1. Healthcare

10.5.2.2. Media and Entertainment

10.5.2.3. IT

10.5.2.4. Education

10.5.2.5. Others (Manufacturing, Energy and Transportation)

10.6. Market Size (US$ Bn) Forecast By Country, 2015 – 2025 (US$ Bn)

10.6.1. Germany

10.6.2. France

10.6.3. The U.K.

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Country

10.7.2. By Business Model

10.7.3. By Application

10.7.4. By End-use Vertical

11. Asia Pacific OTT Services Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Market Size (US$ Bn) Forecast By Business Model, 2015 – 2025 (US$ Bn)

11.3.1. Premium and Subscriptions

11.3.2. Adware

11.3.3. E-commerce

11.4. Market Size (US$ Bn) Forecast By Application 2015 – 2025 (US$ Bn)

11.4.1. Communication

11.4.2. E-Services

11.4.3. Media Content

11.4.3.1. Audio/Video

11.4.3.2. Gaming

11.4.3.3. Web Content

11.4.4. Cloud Services

11.5. Market Size (US$ Bn) Forecast By End-use Vertical, 2015 – 2025 (US$ Bn)

11.5.1. Personal

11.5.2. Commercial

11.5.2.1. Healthcare

11.5.2.2. Media and Entertainment

11.5.2.3. Ecommerce

11.5.2.4. IT

11.5.2.5. Education

11.5.2.6. Others (Manufacturing, Energy and Transportation)

11.6. Market Size (US$ Bn) Forecast By Country, 2015 – 2025 (US$ Bn)

11.6.1. China

11.6.2. Japan

11.6.3. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Country

11.7.2. By Business Model

11.7.3. By Application

11.7.4. By End-use Vertical

12. Middle East and Africa OTT Services Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Market Size (US$ Bn) Forecast By Business Model, 2015 – 2025 (US$ Bn)

12.3.1. Premium and Subscriptions

12.3.2. Adware

12.3.3. E-commerce

12.4. Market Size (US$ Bn) Forecast By Application 2015 – 2025 (US$ Bn)

12.4.1. Communication

12.4.2. E-Services

12.4.3. Media Content

12.4.3.1. Audio/Video

12.4.3.2. Gaming

12.4.3.3. Web Content

12.4.4. Cloud Services

12.5. Market Size (US$ Bn) Forecast By End-use Vertical, 2015 – 2025 (US$ Bn)

12.5.1. Personal

12.5.2. Commercial

12.5.2.1. Healthcare

12.5.2.2. Media and Entertainment

12.5.2.3. Ecommerce

12.5.2.4. IT

12.5.2.5. Education

12.5.2.6. Others (Manufacturing, Energy and Transportation)

12.6. Market Size (US$ Bn) Forecast By Country, 2015 – 2025 (US$ Bn)

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of MEA

12.7. Market Attractiveness Analysis

12.7.1. By Country

12.7.2. By Business Model

12.7.3. By Application

12.7.4. By End-use Vertical

13. South America OTT Services Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Market Size (US$ Bn) Forecast By Business Model, 2015 – 2025 (US$ Bn)

13.3.1. Premium and Subscriptions

13.3.2. Adware

13.3.3. E-commerce

13.4. Market Size (US$ Bn) Forecast By Application 2015 – 2025 (US$ Bn)

13.4.1. Communication

13.4.2. E-Services

13.4.3. Media Content

13.4.3.1. Audio/Video

13.4.3.2. Gaming

13.4.3.3. Web Content

13.4.4. Cloud Services

13.5. Market Size (US$ Bn) Forecast By End-use Vertical, 2015 – 2025 (US$ Bn)

13.5.1. Personal

13.5.2. Commercial

13.5.2.1. Healthcare

13.5.2.2. Media and Entertainment

13.5.2.3. Ecommerce

13.5.2.4. IT

13.5.2.5. Education

13.5.2.6. Others (Manufacturing, Energy and Transportation)

13.6. Market Size (US$ Bn) Forecast By Country, 2015 – 2025 (US$ Bn)

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Country

13.7.2. By Business Model

13.7.3. By Application

13.7.4. By End-use Vertical

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis By Company (2016)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Players

14.3.1.1. Facebook, Inc.

14.3.1.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.1.2. Company Description

14.3.1.1.3. SWOT Analysis

14.3.1.1.4. Strategic Overview

14.3.1.2. Twitter Inc.

14.3.1.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.2.2. Company Description

14.3.1.2.3. SWOT Analysis

14.3.1.2.4. Strategic Overview

14.3.1.3. LinkedIn Corp.

14.3.1.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.3.2. Company Description

14.3.1.3.3. SWOT Analysis

14.3.1.3.4. Strategic Overview

14.3.1.4. Netflix, Inc.

14.3.1.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.4.2. Company Description

14.3.1.4.3. SWOT Analysis

14.3.1.4.4. Strategic Overview

14.3.1.5. Google, Inc.

14.3.1.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.5.2. Company Description

14.3.1.5.3. SWOT Analysis

14.3.1.5.4. Strategic Overview

14.3.1.6. Skype (Microsoft Corporation)

14.3.1.6.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.6.2. Company Description

14.3.1.6.3. SWOT Analysis

14.3.1.6.4. Strategic Overview

14.3.1.7. Amazon Inc.

14.3.1.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.7.2. Company Description

14.3.1.7.3. SWOT Analysis

14.3.1.7.4. Strategic Overview

14.3.1.8. Apple, Inc.

14.3.1.8.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.8.2. Company Description

14.3.1.8.3. SWOT Analysis

14.3.1.8.4. Strategic Overview

14.3.1.9. Rakuten, Inc.

14.3.1.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.9.2. Company Description

14.3.1.9.3. SWOT Analysis

14.3.1.9.4. Strategic Overview

14.3.1.10. Evernote Corporation

14.3.1.10.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.10.2. Company Description

14.3.1.10.3. SWOT Analysis

14.3.1.10.4. Strategic Overview

14.3.1.11. Dropbox, Inc.

14.3.1.11.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.11.2. Company Description

14.3.1.11.3. SWOT Analysis

14.3.1.11.4. Strategic Overview

14.3.1.12. Hulu, LLC

14.3.1.12.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.12.2. Company Description

14.3.1.12.3. SWOT Analysis

14.3.1.12.4. Strategic Overview

15. Key Takeaways

List of Tables

Table 1: Global OTT Market Forecast, By Business Model, 2015–2025 (US$ Bn)

Table 2: Global OTT Market Forecast, By Application, 2015–2025 (US$ Bn)

Table 3: Global OTT Market Forecast, By Media Content, 2015–2025 (US$ Bn)

Table 4: Global OTT Market Forecast, By End-use Vertical, 2015–2025 (US$ Bn)

Table 5: Global OTT Market Forecast, By Commercial, 2015–2025 (US$ Bn)

Table 6: Global OTT Market Forecast, By Region, 2015–2025 (US$ Bn)

Table 7: North America OTT Market Forecast, By Business Model, 2015–2025 (US$ Bn)

Table 8: North America OTT Market Forecast, By Application, 2015–2025 (US$ Bn)

Table 9: North America VR Market Forecast, By Media Content, 2015–2025 (US$ Bn)

Table 10: North America OTT Market Forecast, By End-use Vertical, 2015–2025 (US$ Bn)

Table 11: North America OTT Market Forecast, By Commercial, 2015–2025 (US$ Bn)

Table 12: North America OTT Market Forecast, By Country, 2015–2025 (US$ Bn)

Table 13: Europe OTT Market Forecast, By Business Model, 2015–2025 (US$ Bn)

Table 14: Europe OTT Market Forecast, By Application, 2015–2025 (US$ Bn)

Table 15: Europe VR Market Forecast, By Media Content, 2015–2025 (US$ Bn)

Table 16: Europe OTT Market Forecast, By End-use Vertical, 2015–2025 (US$ Bn)

Table 17: Europe OTT Market Forecast, By Commercial, 2015–2025 (US$ Bn)

Table 18: Europe OTT Market Forecast, By Country, 2015–2025 (US$ Bn)

Table 19: APAC OTT Market Forecast, By Business Model, 2015–2025 (US$ Bn)

Table 20: APAC OTT Market Forecast, By Application, 2015–2025 (US$ Bn)

Table 21: APAC VR Market Forecast, By Media Content, 2015–2025 (US$ Bn)

Table 22: APAC OTT Market Forecast, By End-use Vertical, 2015–2025 (US$ Bn)

Table 23: APAC OTT Market Forecast, By Commercial, 2015–2025 (US$ Bn)

Table 24: APAC OTT Market Forecast, By Country, 2015–2025 (US$ Bn)

Table 25: MEA OTT Market Forecast, By Business Model, 2015–2025 (US$ Bn)

Table 26: MEA OTT Market Forecast, By Application, 2015–2025 (US$ Bn)

Table 27: MEA VR Market Forecast, By Media Content, 2015–2025 (US$ Bn)

Table 28: MEA OTT Market Forecast, By End-use Vertical, 2015–2025 (US$ Bn)

Table 29: MEA OTT Market Forecast, By Commercial, 2015–2025 (US$ Bn)

Table 30: MEA OTT Market Forecast, By Country, 2015–2025 (US$ Bn)

Table 31: South America OTT Market Forecast, By Business Model, 2015–2025 (US$ Bn)

Table 32: South America OTT Market Forecast, By Application, 2015–2025 (US$ Bn)

Table 33: South America VR Market Forecast, By Media Content, 2015–2025 (US$ Bn)

Table 34: South America OTT Market Forecast, By End-use Vertical, 2015–2025 (US$ Bn)

Table 35: South America OTT Market Forecast, By Commercial, 2015–2025 (US$ Bn)

Table 36: South America OTT Market Forecast, By Country, 2015–2025 (US$ Bn)

List of Figures

Figure 1: Market Revenue Projections, 2015 – 2025 (US$ Bn)

Figure 2: Market Value Share By Business Model (2017)

Figure 4: Market Value Share By End-use Vertical (2017)

Figure 3: Market Value Share By Application (2017)

Figure 5: Market Value Share By Geography (2017)

Figure 6: Global OTT Market Value Share Analysis, By Business Model, 2017 and 2025

Figure 7: Premium & Subscription Graph

Figure 8: Adware Graph

Figure 9: E-commerce Graph

Figure 10: Business Model Comparison Matrix

Figure 11: OTT Market Attractiveness Analysis, By Business Model

Figure 12: Global OTT Market Value Share Analysis, By Application, 2017 and 2025

Figure 13: Communication Graph

Figure 14: E-services Graph

Figure 15: Media Content Graph

Figure 16: Cloud Service Graph

Figure 17: Global OTT Market Value Share Analysis, By Media Content, 2017 and 2025

Figure 18: Application Comparison Matrix

Figure 19: Global OTT Market Forecast, By Application

Figure 20: Global OTT Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 21: Personal Graph

Figure 22: Commercial Graph

Figure 23: Global OTT Market Value Share Analysis, By Commercial, 2017 and 2025

Figure 24: End-use Vertical Comparison Matrix

Figure 25: Global OTT Market Forecast, By End-use Vertical

Figure 26: OTT Market CAGR (2017 – 2025) Analysis, By Country

Figure 27: OTT Market Attractiveness Analysis, By Region

Figure 28: North America OTT Market Revenue (US$ Bn) and Y-o-Y Forecast, 2017 – 2025

Figure 29: North America OTT Market Value Share Analysis, By Business Model, 2017 and 2025

Figure 30: North America OTT Market Value Share Analysis, By Application, 2017 and 2025

Figure 31: North America OTT Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 32: North America OTT Market Value Share Analysis, By Country, 2017 and 2025

Figure 33: North America OTT Market Attractiveness Analysis, By Business Model

Figure 34: North America OTT Market Attractiveness Analysis, By Application

Figure 35: North America OTT Market Attractiveness Analysis, By End-use Vertical

Figure 36: North America OTT Market Attractiveness Analysis, By Country

Figure 37: Europe OTT Market Revenue (US$ Bn) and Y-o-Y Forecast, 2017 – 2025

Figure 38: Europe OTT Market Value Share Analysis, By Business Model, 2017 and 2025

Figure 39: Europe OTT Market Value Share Analysis, By Application, 2017 and 2025

Figure 40: Europe OTT Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 41: Europe OTT Market Value Share Analysis, By Country, 2017 and 2025

Figure 42: Europe OTT Market Attractiveness Analysis, By Business Model

Figure 43: Europe OTT Market Attractiveness Analysis, By Application

Figure 44: Europe OTT Market Attractiveness Analysis, By End-use Vertical

Figure 45: Europe OTT Market Attractiveness Analysis, By Country

Figure 46: APAC OTT Market Revenue (US$ Bn) and Y-o-Y Forecast, 2017 – 2025

Figure 47: APAC OTT Market Value Share Analysis, By Business Model, 2017 and 2025

Figure 48: APAC OTT Market Value Share Analysis, By Application, 2017 and 2025

Figure 49: APAC OTT Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 50: APAC OTT Market Value Share Analysis, By Country, 2017 and 2025

Figure 51: APAC OTT Market Attractiveness Analysis, By Business Model

Figure 52: APAC OTT Market Attractiveness Analysis, By Application

Figure 53: APAC OTT Market Attractiveness Analysis, By End-use Vertical

Figure 54: APAC OTT Market Attractiveness Analysis, By Country

Figure 55: MEA OTT Market Revenue (US$ Bn) and Y-o-Y Forecast, 2017 – 2025

Figure 56: MEA OTT Market Value Share Analysis, By Business Model, 2017 and 2025

Figure 57: MEA OTT Market Value Share Analysis, By Application, 2017 and 2025

Figure 58: MEA OTT Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 59: MEA OTT Market Value Share Analysis, By Country, 2017 and 2025

Figure 60: MEA OTT Market Attractiveness Analysis, By Business Model

Figure 61: MEA OTT Market Attractiveness Analysis, By Application

Figure 62: MEA OTT Market Attractiveness Analysis, By End-use Vertical

Figure 63: MEA OTT Market Attractiveness Analysis, By Country

Figure 64: South America OTT Market Revenue (US$ Bn) and Y-o-Y Forecast, 2017 – 2025

Figure 65: South America OTT Market Value Share Analysis, By Business Model, 2017 and 2025

Figure 66: South America OTT Market Value Share Analysis, By Application, 2017 and 2025

Figure 67: South America OTT Market Value Share Analysis, By End-use Vertical, 2017 and 2025

Figure 68: South America OTT Market Value Share Analysis, By Country, 2017 and 2025

Figure 69: South America OTT Market Attractiveness Analysis, By Business Model

Figure 70: South America OTT Market Attractiveness Analysis, By Application

Figure 71: South America OTT Market Attractiveness Analysis, By End-use Vertical

Figure 72: South America OTT Market Attractiveness Analysis, By Country

Figure 73: Global OTT Market Share Analysis (2017)