Analysts’ Viewpoint on Global Online Gambling & Betting Market Scenario

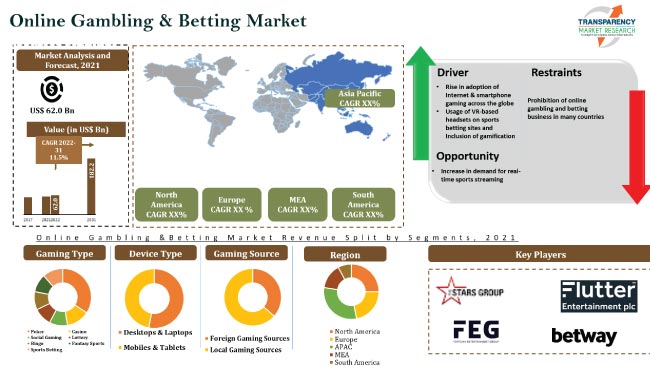

Increase in adoption of smartphones and rise in penetration of the internet are driving the global online gambling & betting market. The market grew at a rapid pace during the peak of the COVID-19 pandemic due to extended lockdowns across the globe and rise in online gaming activities over outdoor games and activities. Increase in internet-based gambling has also led to significant growth in the online casino market. This trend is expected to continue in the next few years. Rise in launch of VR-based headsets is also anticipated to boost the market during the forecast period. VR online gaming offers a real-time experience to gamers. Relaxation in laws regarding online gambling and betting is likely to provide lucrative opportunities to market players during the forecast period.

Online gambling and betting consist of games such as poker, casino, sports betting, lottery, online football betting, and online cricket betting. These games are played on smartphones, tablets, PCs, and other digital platforms. Users witness gambling and betting activities in real-time through their internet-based devices or other electronic devices. People around the world are spending increasing amount of time and money on online gambling sites. This can be ascribed to the rise in disposable income and growth in confidence of the people in online sports betting. The online gambling & betting market is expected to witness a paradigm shift during the forecast period depending upon the regulatory environment.

Smartphones and tablets have become the convenient mode for gambling and betting with high-speed internet, as users are engaged in gambling websites with a minimum impact on their daily activities. Thus, internet and smartphones are expected to play a key role in driving the demand for online gambling apps in the next few years. According to the Cisco Visual Networking Index, 2015 – 2021, the global smartphone connection speed was expected to reach 12.5 Mbps in 2021 from 7.5 Mbps in 2015. Furthermore, the tablet connection speed was estimated to reach 16.2 Mbps in 2021 from 11.6 Mbps in 2015. This would indirectly influence the adoption of video streaming and instant messaging services in the next years, triggering the growth of the sports betting market through mobile devices. Enhanced user experience through the development of better mobile applications and implementation of 4G and 5G networks is likely to augment the smartphone-based gaming industry market during the forecast period.

Users are increasingly seeking new and technologically advanced sources of entertainment due to the rise in disposable income. Virtual Reality (VR) in gambling provides an attractive source of entertainment, as users can experience the real environment during a game. It also enables users to be virtually present in the real-time online casino sections and better socialize with other players. NetEnt AB and Microgaming Software Systems Ltd. provide VR online poker, casinos, and sports betting games. Thus, according to the demand analysis of the online gambling & betting market, the integration of VR is expected to contribute significantly to the growth of the online gaming & betting market during the forecast period.

Gamification is expected to play a crucial role in disrupting the market in the near future owing to the rise in adoption of mobile devices in online gambling and betting. Market players are focusing on ways to generate customer loyalty in the online gambling industry. Gamification is expected to provide an edge to market players, as it offers strategies such as real-time performance analytics, competition with player friends, virtual rewards, and loyalty bonuses. This is projected to generate brand loyalty in gamers and distinguish a company’s games from those of its competitors.

In terms of gaming type, the global online gambling & betting market has been segregated into poker, casino, social gaming, lottery, bingo, sports betting, and fantasy sports. The sports betting segment is expected to dominate the global market during the forecast period owing to increase in popularity of sports such as football and cricket.

Other segments such as casino, poker, lottery, social gaming, bingo, and fantasy sports are also expected to grow significantly during the forecast period, as many online betting games offer real money. The top 10 online casinos are Red Dog, Slots.lv, Super Slots, Cafe Casino, Slots Empire, Ignition, Wild Casino, Las Atlantis, El Royale, and Intertops.

Europe dominated the global online gambling & betting market in 2021, owing to the rise in popularity of sports betting in the region. The market value of online gambling & betting in Asia Pacific is anticipated to grow at a lucrative CAGR during the forecast period. The primary drivers of the online gambling & betting market in the region are relaxation of laws regarding online gambling and betting, rise in internet penetration, and increase in presence of gambling & betting sites with attractive offers. The market in North America is also expected to grow significantly during the forecast period.

The global online gambling & betting market is consolidated, with a few large-scale vendors controlling majority of the share. Most firms are investing significantly in marketing and sponsorship activities to enhance their share in the global market. Expansion of product portfolios and mergers & acquisitions are the major strategies adopted by key players. 888 Holdings plc., The Stars Group, Paddy Power Betfair plc, Fortuna Entertainment Group, GVC Holdings Plc, Bet365 Group Ltd, Betfred Ltd., The Betway Group, Kindred Group, William Hill plc, Betsson AB, Mybet Holding, and Rank Group are prominent entities operating in this market.

Each of these players has been profiled in the online gambling & betting market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 62.0 Bn |

|

Market Forecast Value in 2031 |

US$ 182.2 Bn |

|

Growth Rate (CAGR) |

11.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global online gambling & betting market was valued at US$ 62.0 Bn in 2021

The market is estimated to advance at a CAGR of 11.5% during 2022-2031

Usage of VR-based headsets on sports betting sites; gamification; and rise in adoption of internet & smartphone gaming across the globe

The sports betting segment accounted for around 36% share of the market in 2021

Asia Pacific is likely to be the most lucrative region of the global online gambling & betting market during the forecast period

888 Holdings plc., The Stars Group, Paddy Power Betfair plc, Fortuna Entertainment Group, GVC Holdings Plc, Bet365 Group Ltd, Betfred Ltd, The Betway Group, Kindred Group, William Hill plc, BETSSON AB, and mybet Holding

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Sports Betting Market

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Technology Overview

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Global Online Gambling & Betting Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projections (US$ Bn)

6. Global Online Gambling & Betting Market Analysis and Forecast, by Gaming Type

6.1. Global Online Gambling & Betting Market Size (US$ Bn), by Gaming Type, 2017- 2031

6.1.1. Poker

6.1.2. Casino

6.1.3. Social Gaming

6.1.4. Lottery

6.1.5. Bingo

6.1.6. Fantasy Sports

6.1.7. Sports Betting

6.1.7.1. Football

6.1.7.2. Rugby

6.1.7.3. Basketball

6.1.7.4. Hockey

6.1.7.5. Cricket

6.1.7.6. Others (Baseball, Cycling, etc.)

6.2. Incremental Opportunity, by Gaming Type

7. Global Online Gambling & Betting Market Analysis and Forecast, by Device Type

7.1. Global Online Gambling & Betting Market Size (US$ Bn), by Device Type, 2017- 2031

7.1.1. Desktops & Laptops

7.1.2. Mobiles & Tablets

7.2. Incremental Opportunity, by Device Type

8. Global Online Gambling & Betting Market Analysis and Forecast, by Gaming Source

8.1. Global Online Gambling & Betting Market Size (US$ Bn), by Gaming Source, 2017- 2031

8.1.1. Foreign Gaming Sources

8.1.2. Local Gaming Sources

8.2. Incremental Opportunity, by Gaming Source

9. Global Online Gambling & Betting Market Analysis and Forecast, by Region

9.1. Global Online Gambling & Betting Market Size (US$ Bn), by Region, 2017- 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Online Gambling & Betting Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Brand Analysis

10.3. Number of Licensed Operators

10.4. Annual Wagering of User on Betting

10.5. Key Trends Analysis

10.5.1. Supply side

10.5.2. Demand Side

10.6. Price Trend Analysis

10.6.1. Weighted Average Selling Price (US$)

10.7. Online Gambling & Betting Market Size (US$ Bn), by Gaming Type, 2017- 2031

10.7.1. Poker

10.7.2. Casino

10.7.3. Social Gaming

10.7.4. Lottery

10.7.5. Bingo

10.7.6. Fantasy Sports

10.7.7. Sports Betting

10.7.7.1. Football

10.7.7.2. Rugby

10.7.7.3. Basketball

10.7.7.4. Hockey

10.7.7.5. Cricket

10.7.7.6. Others (Baseball, Cycling, etc.)

10.8. Online Gambling & Betting Market Size (US$ Bn), by Device Type, 2017- 2031

10.8.1. Desktops & Laptops

10.8.2. Mobiles & Tablets

10.9. Online Gambling & Betting Market Size (US$ Bn), by Gaming Source, 2017- 2031

10.9.1. Foreign Gaming Sources

10.9.2. Local Gaming Sources

10.10. Online Gambling & Betting Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

10.10.1. U.S.

10.10.2. Canada

10.10.3. Rest of North America

10.11. Incremental Opportunity Analysis

11. Europe Online Gambling & Betting Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Number of Licensed Operators

11.4. Annual Wagering of User on Betting

11.5. Key Trends Analysis

11.5.1. Supply side

11.5.2. Demand Side

11.6. Price Trend Analysis

11.6.1. Weighted Average Selling Price (US$)

11.7. Online Gambling & Betting Market Size (US$ Bn), by Gaming Type, 2017- 2031

11.7.1. Poker

11.7.2. Casino

11.7.3. Social Gaming

11.7.4. Lottery

11.7.5. Bingo

11.7.6. Fantasy Sports

11.7.7. Sports Betting

11.7.7.1. Football

11.7.7.2. Rugby

11.7.7.3. Basketball

11.7.7.4. Hockey

11.7.7.5. Cricket

11.7.7.6. Others (Baseball, Cycling, etc.)

11.8. Online Gambling & Betting Market Size (US$ Bn), by Device Type, 2017- 2031

11.8.1. Desktops & Laptops

11.8.2. Mobiles & Tablets

11.9. Online Gambling & Betting Market Size (US$ Bn), by Gaming Source, 2017- 2031

11.9.1. Foreign Gaming Sources

11.9.2. Local Gaming Sources

11.10. Online Gambling & Betting Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

11.10.1. U.K.

11.10.2. Germany

11.10.3. France

11.10.4. Rest of Europe

11.11. Incremental Opportunity Analysis

12. Asia Pacific Online Gambling & Betting Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Number of Licensed Operators

12.4. Annual Wagering of User on Betting

12.5. Key Trends Analysis

12.5.1. Supply side

12.5.2. Demand Side

12.6. Price Trend Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Online Gambling & Betting Market Size (US$ Bn), by Gaming Type, 2017- 2031

12.7.1. Poker

12.7.2. Casino

12.7.3. Social Gaming

12.7.4. Lottery

12.7.5. Bingo

12.7.6. Fantasy Sports

12.7.7. Sports Betting

12.7.7.1. Football

12.7.7.2. Rugby

12.7.7.3. Basketball

12.7.7.4. Hockey

12.7.7.5. Cricket

12.7.7.6. Others (Baseball, Cycling, etc.)

12.8. Online Gambling & Betting Market Size (US$ Bn), by Device Type, 2017- 2031

12.8.1. Desktops & Laptops

12.8.2. Mobiles & Tablets

12.9. Online Gambling & Betting Market Size (US$ Bn), by Gaming Source, 2017- 2031

12.9.1. Foreign Gaming Sources

12.9.2. Local Gaming Sources

12.10. Online Gambling & Betting Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

12.10.1. China

12.10.2. India

12.10.3. Japan

12.10.4. Rest of Asia Pacific

12.11. Incremental Opportunity Analysis

13. Middle East & Africa Online Gambling & Betting Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Number of Licensed Operators

13.4. Annual Wagering of User on Betting

13.5. Key Trends Analysis

13.5.1. Supply side

13.5.2. Demand Side

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Online Gambling & Betting Market Size (US$ Bn), by Gaming Type, 2017- 2031

13.7.1. Poker

13.7.2. Casino

13.7.3. Social Gaming

13.7.4. Lottery

13.7.5. Bingo

13.7.6. Fantasy Sports

13.7.7. Sports Betting

13.7.7.1. Football

13.7.7.2. Rugby

13.7.7.3. Basketball

13.7.7.4. Hockey

13.7.7.5. Cricket

13.7.7.6. Others (Baseball, Cycling, etc.)

13.8. Online Gambling & Betting Market Size (US$ Bn), by Device Type, 2017- 2031

13.8.1. Desktops & Laptops

13.8.2. Mobiles & Tablets

13.9. Online Gambling & Betting Market Size (US$ Bn), by Gaming Source, 2017- 2031

13.9.1. Foreign Gaming Sources

13.9.2. Local Gaming Sources

13.10. Online Gambling & Betting Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

13.10.1. GCC

13.10.2. South Africa

13.10.3. Rest of Middle East & Africa

13.11. Incremental Opportunity Analysis

14. South America Online Gambling & Betting Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. Number of Licensed Operators

14.4. Annual Wagering of User on Betting

14.5. Key Trends Analysis

14.5.1. Supply side

14.5.2. Demand Side

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Online Gambling & Betting Market Size (US$ Bn), by Gaming Type, 2017- 2031

14.7.1. Poker

14.7.2. Casino

14.7.3. Social Gaming

14.7.4. Lottery

14.7.5. Bingo

14.7.6. Fantasy Sports

14.7.7. Sports Betting

14.7.7.1. Football

14.7.7.2. Rugby

14.7.7.3. Basketball

14.7.7.4. Hockey

14.7.7.5. Cricket

14.7.7.6. Others (Baseball, Cycling, etc.)

14.8. Online Gambling & Betting Market Size (US$ Bn), by Device Type, 2017- 2031

14.8.1. Desktops & Laptops

14.8.2. Mobiles & Tablets

14.9. Online Gambling & Betting Market Size (US$ Bn), by Gaming Source, 2017- 2031

14.9.1. Foreign Gaming Sources

14.9.2. Local Gaming Sources

14.10. Online Gambling & Betting Market Size (US$ Bn), by Country & Sub-region, 2017- 2031

14.10.1. Brazil

14.10.2. Rest of South America

14.11. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2021)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. 888 Holdings plc.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information, (Subject to Data Availability)

15.3.1.4. Business Strategies / Recent Developments

15.3.2. The Stars Group

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information, (Subject to Data Availability)

15.3.2.4. Business Strategies / Recent Developments

15.3.3. Paddy Power Betfair plc

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information, (Subject to Data Availability)

15.3.3.4. Business Strategies / Recent Developments

15.3.4. Fortuna Entertainment Group

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information, (Subject to Data Availability)

15.3.4.4. Business Strategies / Recent Developments

15.3.5. GVC Holdings Plc

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information, (Subject to Data Availability)

15.3.5.4. Business Strategies / Recent Developments

15.3.6. Bet365 Group Ltd

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information, (Subject to Data Availability)

15.3.6.4. Business Strategies / Recent Developments

15.3.7. Betfred Ltd

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information, (Subject to Data Availability)

15.3.7.4. Business Strategies / Recent Developments

15.3.8. The Betway Group

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information, (Subject to Data Availability)

15.3.8.4. Business Strategies / Recent Developments

15.3.9. Kindred Group

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information, (Subject to Data Availability)

15.3.9.4. Business Strategies / Recent Developments

15.3.10. William Hill plc

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information, (Subject to Data Availability)

15.3.10.4. Business Strategies / Recent Developments

15.3.11. BETSSON AB

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financial Information, (Subject to Data Availability)

15.3.11.4. Business Strategies / Recent Developments

15.3.12. mybet Holding

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. Financial Information, (Subject to Data Availability)

15.3.12.4. Business Strategies / Recent Developments

15.3.13. Rank Group

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. Financial Information, (Subject to Data Availability)

15.3.13.4. Business Strategies / Recent Developments

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. Gaming Type

16.1.2. Gaming Source

16.1.3. Device

16.1.4. Geography

16.2. Understanding the Buying Process of Customers

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Table 2: Global Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Table 3: Global Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Table 4: Global Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Table 5: North America Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Table 6: North America Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Table 7: North America Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Table 8: North America Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Table 9: Europe Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Table 10: Europe Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Table 11: Europe Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Table 12: Europe Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Table 13: Asia Pacific Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Table 14: Asia Pacific Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Table 15: Asia Pacific Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Table 16: Asia Pacific Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Table 17: Middle East & Africa Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Table 18: Middle East & Africa Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Table 19: Middle East & Africa Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Table 20: Middle East & Africa Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Table 21: South America Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Table 22: South America Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Table 23: South America Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Table 24: South America Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Figure 2: Global Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Type, US$ Bn, 2017-2031

Figure 3: Global Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Figure 4: Global Online Gambling & Betting Market, by Incremental Opportunity, by Device Type, US$ Bn, 2017-2031

Figure 5: Global Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Figure 6: Global Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Source, US$ Bn, 2017-2031

Figure 7: Global Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Figure 8: Global Online Gambling & Betting Market, by Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 9: North America Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Figure 10: North America Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Type, US$ Bn, 2017-2031

Figure 11: North America Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Figure 12: North America Online Gambling & Betting Market, by Incremental Opportunity, by Device Type, US$ Bn, 2017-2031

Figure 13: North America Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Figure 14: North America Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Source, US$ Bn, 2017-2031

Figure 15: North America Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Figure 16: North America Online Gambling & Betting Market, by Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 17: Europe Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Figure 18: Europe Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Type, US$ Bn, 2017-2031

Figure 19: Europe Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Figure 20: Europe Online Gambling & Betting Market, by Incremental Opportunity, by Device Type, US$ Bn, 2017-2031

Figure 21: Europe Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Figure 22: Europe Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Source, US$ Bn, 2017-2031

Figure 23: Europe Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Figure 24: Europe Online Gambling & Betting Market, by Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 25: Asia Pacific Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Figure 26: Asia Pacific Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Type, US$ Bn, 2017-2031

Figure 27: Asia Pacific Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Figure 28: Asia Pacific Online Gambling & Betting Market, by Incremental Opportunity, by Device Type, US$ Bn, 2017-2031

Figure 29: Asia Pacific Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Figure 30: Asia Pacific Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Source, US$ Bn, 2017-2031

Figure 31: Asia Pacific Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Figure 32: Asia Pacific Online Gambling & Betting Market, by Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 33: Middle East & Africa Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Figure 34: Middle East & Africa Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Type, US$ Bn, 2017-2031

Figure 35: Middle East & Africa Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Figure 36: Middle East & Africa Online Gambling & Betting Market, by Incremental Opportunity, by Device Type, US$ Bn, 2017-2031

Figure 37: Middle East & Africa Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Figure 38: Middle East & Africa Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Source, US$ Bn, 2017-2031

Figure 39: Middle East & Africa Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Figure 40: Middle East & Africa Online Gambling & Betting Market, by Incremental Opportunity, by Region, US$ Bn, 2017-2031

Figure 41: South America Online Gambling & Betting Market, by Gaming Type, US$ Bn, 2017-2031

Figure 42: South America Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Type, US$ Bn, 2017-2031

Figure 43: South America Online Gambling & Betting Market, by Device Type, US$ Bn, 2017-2031

Figure 44: South America Online Gambling & Betting Market, by Incremental Opportunity, by Device Type, US$ Bn, 2017-2031

Figure 45: South America Online Gambling & Betting Market, by Gaming Source, US$ Bn, 2017-2031

Figure 46: South America Online Gambling & Betting Market, by Incremental Opportunity, by Gaming Source, US$ Bn, 2017-2031

Figure 47: South America Online Gambling & Betting Market, by Region, US$ Bn, 2017-2031

Figure 48: South America Online Gambling & Betting Market, by Incremental Opportunity, by Region, US$ Bn, 2017-2031