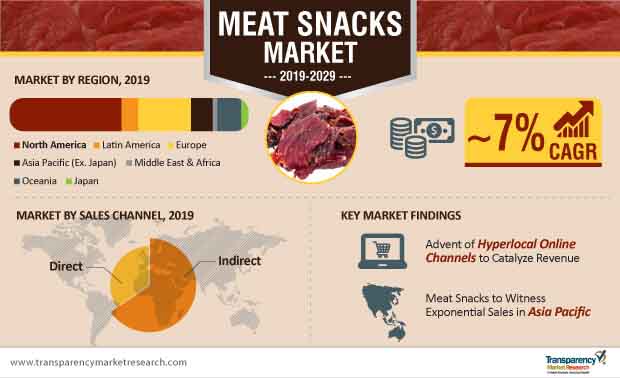

The global meat snacks market will reach a value tantamount to ~US$ 14.5 Bn by 2029, recording 2X growth from 2019. Meat snacks, acting as twofers to complete consumers’ quest for protein-rich and on-the-go dietary options, will continue to witness an increase in demand during the period of 2019-2029. The recent trend of Paleo diets will catalyze the demand for high-protein nutrition, highly contributed by North America.

Another exciting feature of the meat snacks market, to look out for, will be the improved penetration and exposure of products with newly-devised strategies, targeted at improving distribution networks in untapped markets. While the merger- and acquisition-oriented global reach approach has been a norm in the landscape, the advent of e-Commerce will complement the sales opportunities for market players. On top of that, meat snacks, seen as a meal replacement option among consumers leading a demanding lifestyle, are projected to offer a stout tailwind to the market during the forecast period.

However, market players also need to focus on the undercurrents of regulatory norms and fickle consumer choices. Stringent food control norms overruling the meat snacks market are likely to upkeep strong scrutiny on product claims, and any failure to justify these claims could lead to product recalls. What is more of a concern for market players is the surging popularity of plant-based snacks with the growing adoption of veganism and vegetarianism among the Western populace, which could shrink the size of the consumer base.

On the whole, considering the changing dynamics, seasoned analysts maintain a propitious outlook on the growth of the meat snacks market at a CAGR of ~7% during 2019-2029.

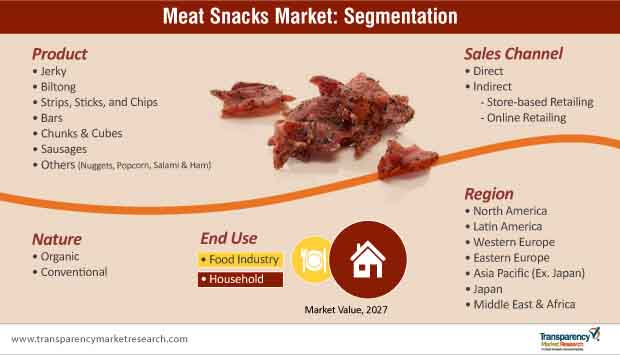

The recent revolution apropos of flavors and products brought in by market players sits at the nexus of evolving consumer preferences. While bars, chunks, and cubes need to find strong inroads in the consumer space, the popularity of jerky meat snacks is already high. This is owing to the marketability of jerky snacks as affordable, healthful, and delicious, and their easily availability at convenience stores and gas stations. According to TMR’s research, the sales of jerky meat snacks are projected to grow to ~US$ 6.3 million by 2029, while the demand for chunks and cubes is likely to strengthen at a CAGR of ~8% during 2019-2029.

Considering the high sales of jerky meat snacks, a leading company, Krave, capitalized on the popularity of quality-focused and high-protein snacks to target affluent consumers. Since affluent consumers evince a marked sensitivity towards the quality and taste of meat snacks, market players are focusing on increasing the exclusiveness of their premium product-based portfolios.

As per TMR’s estimates, global sales through indirect distribution channels, including store-based retailing and online retailing, are projected to reach a value of ~US$ 9.3 billion by 2029. While a majority of the sales closed through store-based retailing can be ascribed to the high concentration of hypermarkets, supermarkets, convenience stores, and specialty stores, consumers’ proclivity for convenience will open up new dimensions of revenue through online sales channels. On similar lines, the sales of meat snacks through online sales channels are estimated to register a CAGR of 9.5% during the forecast period.

With the success of e-Commerce channels, market players began looking at targeting niche demands, and are moving towards novel trends of hyperlocal marketing. Hyperlocal is likely to extend the frontiers of e-Commerce channels by targeting niche demand and catering to it. A rise in the number of on-demand startups such as Grofers, Instacart, Amazon Fresh, and Amazon Pantry point towards the underway shift from brick-and-mortar stores to online stores. The success rate and popularity of hyperlocal is likely to surpass that of e-Commerce channels, owing to the substantially shorter wait window for consumers, in terms of delivery.

Traditionally, North America has been a leading meat snacks market in terms of consumption and production, with a market share of ~46% in 2018, and much of this has to do with clean label and organic product claims. Efforts towards fostering a product-level innovation have instigated a notable spurt in the adoption of meat snacks in the region.

Meat snacks, once available at gas stations, have graduated to sophisticated sales channels, and their production process has an integral part to play. With a spurt in the innovative approach taken by market players, low-fat and sugar ingredients, small-sized packaging, and introduction of flavors such as smoke, honey bourbon, herbs and spice, pepper, BBQ, and teriyaki, are developed in order to penetrate into the affluent markets of North America and Europe.

With unequal distribution of meat snacks producers at a global level, meaning, a high concentration of market players in North America and Europe, and their low presence in Asia Pacific, Middle East and Africa, and Latin America, market majors are strategizing a shift to developing countries by entering into production and distribution partnerships & collaborations with regional players operating in these regions.

In the APEJ region, where the food and beverage industry is thriving, meat snacks are projected to perform well in terms of sales, to cater to the protein requirements of consumers. During the forecast period, the APEJ meat snacks market will register an exponential growth at a CAGR of ~9%.

How Should Players Approach the Meat Snacks Market?

Traditionally, in the consolidated meat snacks landscape, with Conagra Brands and Tyson Inc. operating globally, expansion of production facilities in high-growth countries - China and India - remains a key highlight. Besides, these players leverage new sales channels and emphasize on strategic alliances with regional suppliers and distributors. For instance, Conagra Brands Inc. provides meat snacks such as pepperoni meat sticks, jalapeno meat sticks, cranberry turkey jerky, and honey-glazed beef jerky, among others.

The meat snacks market operates amidst stringent regulations and food control authorities that need products to pass through numerous tests, including organic, halal, kosher, and non-GMO. This means that, market players should conform to these protocols in order to prevent product-recall instances. Since both, the household and food industry segments are key consumers of meat snacks, market players can look at strengthening partnerships with restaurants, fast-food chains, and similar eateries, with the intent to achieve a consolidated market position.

Meat Snacks Market: Overview

Free-From Trend in Meat Snacks Market to Attract Millennials

Meat Snacks Market: Trends

Meat Snacks Market: Strategy

Target Regions for Meat Snacks Market

Meat Snacks Market: Players

1. Global Meat Snacks Market - Executive Summary

1.1. Global Meat Snacks Market Country Analysis

1.2. Application – Product Mapping

1.3. Competition Blueprint

1.4. Technology Time Line Mapping

1.5. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Food Items across Globe

3.1.2. Global and Regional Per Capita Food Consumption (kcal per capita per day)

3.1.3. Change in Consumer Price Indexes (Percentage Change) 2018 (Forecast)

3.1.4. Population of Key Countries

3.1.5. Food and Beverage Industry Overview

3.1.6. Global Retail Dynamics

3.1.7. Per Capita Disposable Income

3.1.8. Organized Retail Penetration

3.1.9. Middle Income Population Group

3.1.10. Global GDP Growth Outlook

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.4. Forecast Factors – Relevance and Impact

3.5. Key Regulations and Claims

3.5.1. Food Packaging Claims

3.5.2. Labeling and Claims

3.5.3. Import/Export Regulations

4. Key Market Trends

4.1. Key Trends Impacting the Market

4.1.1. Marketers Reach Out to Millennial

4.1.2. Desirable Health Claims by Manufacturers and Brand Owners

4.1.3. Shortened M&A Activity

4.1.4. Heightened Product Launch Frequency

4.2. Product Innovation / Development Trends

4.2.1. Cultural Customization to Target Specific Population and Ethnic Group

4.2.2. Creating New Delivery Mechanisms

4.2.3. Indication Specific Products

4.2.4. Shift Toward Natural Ingredients

4.2.5. Preferential Inclination towards Non-Modified Convenience Ingredients

4.2.6. Packaging to Suit Customer Orientation

4.2.7. Brand Differentiation through Packaging

4.3. Deciphering Consumer Buying Pattern

4.3.1. Key Decision Centers

4.3.2. Buyer Decision Process

4.3.3. What are suppliers criterion’s

4.3.4. Frequency of purchase and volume at one go

5. Sentiment Analysis

5.1. Consumer Sentiment Analysis

5.1.1. Consumer Buying Pattern

5.1.2. Development of the Specification

5.1.3. Social & Economic Influencers – Factors

5.1.4. Consumer preferences: Historical Scenario and Futuristic Approach

5.1.5. Factors Affecting Consumer Preferences

5.1.6. Impact of labelling, claims, and certifications

5.1.7. Others

5.2. Social Media Sentiment Analysis

5.2.1. Consumer perception for products on social media platforms- Positive and Negative Mentions

5.2.2. Trending Brands

5.2.3. Social Media Platform Mentions (% of total mentions)

5.2.4. Trending Subject Titles

5.2.5. Others

6. Supply Chain Analysis

6.1. Profitability and Gross Margin Analysis By Competition

6.2. List of Active Participants- By Region

6.2.1. Raw Material Suppliers

6.2.2. Key Manufacturers

6.2.3. Key Distributor/Retailers

6.2.4. Operating Margins

7. Global Meat Snacks Market Pricing Analysis

7.1. Price Point Assessment by Region

7.1.1. Manufacturer Level Pricing

7.1.2. Distributor Level Pricing

7.1.3. Retailer Level Pricing

7.2. Price Point Assessment By Product

7.3. Price Forecast till 2029

8. Demand Assessment- Target Market

8.1. % of Demand by Meat Type (2019 & 2029)

8.1.1. Beef

8.1.2. Chicken

8.1.3. Turkey

8.1.4. Pork

8.1.5. Bison

8.1.6. Venison

8.1.7. Salmon

8.1.8. Lamb

8.1.9. Boar

8.1.10. Other Fish

8.2. % of Demand by Flavor (2019 & 2029)

8.2.1. Smoke

8.2.2. Teriyaki

8.2.3. BBQ

8.2.4. Pepper

8.2.5. Original

8.2.6. Herbs & Spice

8.2.7. Honey Bourbon

8.3. % of Demand by Special Diet Needs (2019 & 2029)

8.3.1. Low/No/Reduced Allergen

8.3.2. No Additives/Preservatives

8.3.3. High/Added Protein

8.3.4. Organic

8.3.5. Gluten-Free

8.3.6. Halal

8.3.7. Cholesterol-Free

8.3.8. Fat-Free

8.3.9. All Natural Product

9. Global Meat Snacks Market Analysis and Forecast

9.1. Market Size Analysis (2014-2018) and Forecast (2019-2029)

9.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

9.1.2. Absolute $ Opportunity

9.2. Global Meat Snacks Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

9.2.1. Forecast Factors and Relevance of Impact

9.2.2. Regional Meat Snacks Market Business Performance Summary

10. Global Meat Snacks Market Analysis By Product

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By Product

10.1.2. Basis Point Share (BPS) Analysis By Product

10.2. Meat Snacks Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Product

10.2.1. Jerky

10.2.2. Biltong

10.2.3. Strip, Sticks & Chips

10.2.4. Bars

10.2.5. Chunks & Cubes

10.2.6. Sausages

10.2.7. Others

10.3. Market Attractiveness Analysis By Product

11. Global Meat Snacks Market Analysis By Nature

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By Nature

11.1.2. Basis Point Share (BPS) Analysis By Nature

11.2. Meat Snacks Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Nature

11.2.1. Organic

11.2.2. Conventional

11.3. Market Attractiveness Analysis By Nature

12. Global Meat Snacks Market Analysis By End Use

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison By End Use

12.1.2. Basis Point Share (BPS) Analysis By End Use

12.2. Meat Snacks Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By End Use

12.2.1. Food Industry

12.2.2. Households

12.3. Market Attractiveness Analysis By End Use

13. Global Meat Snacks Market Analysis By Sales Channel

13.1. Introduction

13.1.1. Y-o-Y Growth Comparison By Sales Channel

13.1.2. Basis Point Share (BPS) Analysis By Sales Channel

13.2. Meat Snacks Market Size (US$ Mn) and Volume (MT) Analysis (2014-2018) & Forecast (2019-2029) By Sales Channel

13.2.1. Direct Sales

13.2.2. Indirect Sales

13.2.2.1. Store Based Retailers

13.2.2.1.1. Hypermarkets/Supermarkets

13.2.2.1.2. Convenience Stores

13.2.2.1.3. Specialty Stores

13.2.2.1.4. Independent Small Groceries

13.2.2.2. Online Retail

13.3. Market Attractiveness Analysis By Sales Channel

14. Global Meat Snacks Market Analysis and Forecast, By Region

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Region

14.1.2. Y-o-Y Growth Projections By Region

14.2. Meat Snacks Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2029) Analysis By Region

14.2.1. North America

14.2.2. Latin America

14.2.3. Europe

14.2.4. Asia Pacific (Excl. Japan)

14.2.5. Middle East & Africa (MEA)

14.2.6. Oceania

14.2.7. Japan

14.3. Market Attractiveness Analysis By Region

15. North America Meat Snacks Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

15.2.1. Market Attractiveness By Country

15.2.1.1. U.S.

15.2.1.2. Canada

15.2.2. By Product

15.2.3. By Nature

15.2.4. By End Use

15.2.5. By Sales Channel

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Product

15.3.3. By Nature

15.3.4. By End Use

15.3.5. By Sales Channel

15.4. Drivers and Restraints: Impact Analysis

16. Latin America Meat Snacks Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

16.2.1. By Country

16.2.1.1. Brazil

16.2.1.2. Mexico

16.2.1.3. Argentina

16.2.1.4. Rest of Latin America

16.2.2. By Product

16.2.3. By Nature

16.2.4. By End Use

16.2.5. By Sales Channel

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Product

16.3.3. By Nature

16.3.4. By End Use

16.3.5. By Sales Channel

16.4. Drivers and Restraints: Impact Analysis

17. Europe Meat Snacks Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

17.2.1. By Country

17.2.1.1. EU-4 (Germany, France, Italy, Spain)

17.2.1.2. U.K.

17.2.1.3. BENELUX

17.2.1.4. Nordic

17.2.1.5. Russia

17.2.1.6. Poland

17.2.1.7. Rest of Europe

17.2.2. By Product

17.2.3. By Nature

17.2.4. By End Use

17.2.5. By Sales Channel

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Product

17.3.3. By Nature

17.3.4. By End Use

17.3.5. By Sales Channel

17.4. Drivers and Restraints: Impact Analysis

18. APEJ Meat Snacks Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

18.2.1. By Country

18.2.1.1. China

18.2.1.2. India

18.2.1.3. ASEAN Countries

18.2.1.4. South Korea

18.2.1.5. Rest of APEJ

18.2.2. By Product

18.2.3. By Nature

18.2.4. By End Use

18.2.5. By Sales Channel

18.3. Market Attractiveness Analysis

18.3.1. By Country

18.3.2. By Product

18.3.3. By Nature

18.3.4. By End Use

18.3.5. By Sales Channel

18.4. Drivers and Restraints: Impact Analysis

19. Japan Meat Snacks Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

19.2.1. By Nature

19.2.2. By Product

19.2.3. By Nature

19.2.4. By End Use

19.2.5. By Sales Channel

19.3. Market Attractiveness Analysis

19.3.1. By Product

19.3.2. By Nature

19.3.3. By End Use

19.3.4. By Sales Channel

19.4. Drivers and Restraints: Impact Analysis

20. Oceania Meat Snacks Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.1.3. Key Regulations

20.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

20.2.1. By Country

20.2.1.1. Australia

20.2.1.2. New Zealand

20.2.2. By Product

20.2.3. By Nature

20.2.4. By End Use

20.2.5. By Sales Channel

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Product

20.3.3. By Nature

20.3.4. By End Use

20.3.5. By Sales Channel

20.4. Drivers and Restraints: Impact Analysis

21. Middle East and Africa (MEA) Meat Snacks Market Analysis and Forecast

21.1. Introduction

21.1.1. Basis Point Share (BPS) Analysis By Country

21.1.2. Y-o-Y Growth Projections By Country

21.1.3. Key Regulations

21.2. Meat Snacks Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

21.2.1. By Country

21.2.1.1. GCC Countries

21.2.1.2. South Africa

21.2.1.3. Turkey

21.2.1.4. Rest of MEA

21.2.2. By Product

21.2.3. By Nature

21.2.4. By End Use

21.2.5. By Sales Channel

21.3. Market Attractiveness Analysis

21.3.1. By Country

21.3.2. By Product

21.3.3. By Nature

21.3.4. By End Use

21.3.5. By Sales Channel

21.4. Drivers and Restraints: Impact Analysis

22. Competition Assessment

22.1. Global Meat Snacks Market Competition - a Dashboard View

22.2. Global Meat Snacks Market Structure Analysis

22.3. Global Meat Snacks Market Company Share Analysis

22.3.1. For Tier 1 Market Players, 2018

22.3.2. Company Market Share Analysis of Top 5 Players, By Region

22.4. Key Participants Market Presence (Intensity Mapping) by Region

23. Brand Assessment

23.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

23.2. Meat Snacks Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

23.3. Brand Strategy

24. Competition Deep-dive (Manufacturers/Suppliers)

24.1. Tillamook Country Smoker, Inc.

24.1.1. Overview

24.1.2. Product Portfolio

24.1.3. Sales Footprint

24.1.4. Channel Footprint

24.1.4.1. Distributors List

24.1.4.2. Sales Channel (Clients)

24.1.5. Strategy Overview

24.1.5.1. Marketing Strategy

24.1.5.2. Culture Strategy

24.1.5.3. Channel Strategy

24.1.6. SWOT Analysis

24.1.7. Financial Analysis

24.1.8. Revenue Share

24.1.9. Key Clients

24.1.10. Analyst Comments

24.2. ConAgra Brands

24.2.1. Overview

24.2.2. Product Portfolio

24.2.3. Sales Footprint

24.2.4. Channel Footprint

24.2.4.1. Distributors List

24.2.4.2. Sales Channel (Clients)

24.2.5. Strategy Overview

24.2.5.1. Marketing Strategy

24.2.5.2. Culture Strategy

24.2.5.3. Channel Strategy

24.2.6. SWOT Analysis

24.2.7. Financial Analysis

24.2.8. Revenue Share

24.2.9. Key Clients

24.2.10. Analyst Comments

24.3. Mighty Organic

24.3.1. Overview

24.3.2. Product Portfolio

24.3.3. Sales Footprint

24.3.4. Channel Footprint

24.3.4.1. Distributors List

24.3.4.2. Sales Channel (Clients)

24.3.5. Strategy Overview

24.3.5.1. Marketing Strategy

24.3.5.2. Culture Strategy

24.3.5.3. Channel Strategy

24.3.6. SWOT Analysis

24.3.7. Financial Analysis

24.3.8. Revenue Share

24.3.9. Key Clients

24.3.10. Analyst Comments

24.4. Wild Bill's Foods Inc.

24.4.1. Overview

24.4.2. Product Portfolio

24.4.3. Sales Footprint

24.4.4. Channel Footprint

24.4.4.1. Distributors List

24.4.4.2. Sales Channel (Clients)

24.4.5. Strategy Overview

24.4.5.1. Marketing Strategy

24.4.5.2. Culture Strategy

24.4.5.3. Channel Strategy

24.4.6. SWOT Analysis

24.4.7. Financial Analysis

24.4.8. Revenue Share

24.4.9. Key Clients

24.4.10. Analyst Comments

24.5. Tyson Foods, Inc.

24.5.1. Overview

24.5.2. Product Portfolio

24.5.3. Sales Footprint

24.5.4. Channel Footprint

24.5.4.1. Distributors List

24.5.4.2. Sales Channel (Clients)

24.5.5. Strategy Overview

24.5.5.1. Marketing Strategy

24.5.5.2. Culture Strategy

24.5.5.3. Channel Strategy

24.5.6. SWOT Analysis

24.5.7. Financial Analysis

24.5.8. Revenue Share

24.5.9. Key Clients

24.5.10. Analyst Comments

24.6. Oberto Sausage Co.

24.6.1. Overview

24.6.2. Product Portfolio

24.6.3. Sales Footprint

24.6.4. Channel Footprint

24.6.4.1. Distributors List

24.6.4.2. Sales Channel (Clients)

24.6.5. Strategy Overview

24.6.5.1. Marketing Strategy

24.6.5.2. Culture Strategy

24.6.5.3. Channel Strategy

24.6.6. SWOT Analysis

24.6.7. Financial Analysis

24.6.8. Revenue Share

24.6.9. Key Clients

24.6.10. Analyst Comments

24.7. Choo Choo R Snacks, Inc.

24.7.1. Overview

24.7.2. Product Portfolio

24.7.3. Sales Footprint

24.7.4. Channel Footprint

24.7.4.1. Distributors List

24.7.4.2. Sales Channel (Clients)

24.7.5. Strategy Overview

24.7.5.1. Marketing Strategy

24.7.5.2. Culture Strategy

24.7.5.3. Channel Strategy

24.7.6. SWOT Analysis

24.7.7. Financial Analysis

24.7.8. Revenue Share

24.7.9. Key Clients

24.7.10. Analyst Comments

24.8. Bumble Bee Seafoods, LLC.

24.8.1. Overview

24.8.2. Product Portfolio

24.8.3. Sales Footprint

24.8.4. Channel Footprint

24.8.4.1. Distributors List

24.8.4.2. Sales Channel (Clients)

24.8.5. Strategy Overview

24.8.5.1. Marketing Strategy

24.8.5.2. Culture Strategy

24.8.5.3. Channel Strategy

24.8.6. SWOT Analysis

24.8.7. Financial Analysis

24.8.8. Revenue Share

24.8.9. Key Clients

24.8.10. Analyst Comments

24.9. GoPicnic, Inc.

24.9.1. Overview

24.9.2. Product Portfolio

24.9.3. Sales Footprint

24.9.4. Channel Footprint

24.9.4.1. Distributors List

24.9.4.2. Sales Channel (Clients)

24.9.5. Strategy Overview

24.9.5.1. Marketing Strategy

24.9.5.2. Culture Strategy

24.9.5.3. Channel Strategy

24.9.6. SWOT Analysis

24.9.7. Financial Analysis

24.9.8. Revenue Share

24.9.9. Key Clients

24.9.10. Analyst Comments

24.10. Tarczynski SA

24.10.1. Overview

24.10.2. Product Portfolio

24.10.3. Sales Footprint

24.10.4. Channel Footprint

24.10.4.1. Distributors List

24.10.4.2. Sales Channel (Clients)

24.10.5. Strategy Overview

24.10.5.1. Marketing Strategy

24.10.5.2. Culture Strategy

24.10.5.3. Channel Strategy

24.10.6. SWOT Analysis

24.10.7. Financial Analysis

24.10.8. Revenue Share

24.10.9. Key Clients

24.10.10. Analyst Comments

24.11. Others (On Request)

24.11.1. Overview

24.11.2. Product Portfolio

24.11.3. Sales Footprint

24.11.4. Channel Footprint

24.11.4.1. Distributors List

24.11.4.2. Sales Channel (Clients)

24.11.5. Strategy Overview

24.11.5.1. Marketing Strategy

24.11.5.2. Culture Strategy

24.11.5.3. Channel Strategy

24.11.6. SWOT Analysis

24.11.7. Financial Analysis

24.11.8. Revenue Share

24.11.9. Key Clients

24.11.10. Analyst Comments

25. Recommendation- Critical Success Factors

26. Research Methodology

27. Assumptions & Acronyms Used

List of Tables

Table 1 : Global Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 2: Global Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 3: Global Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature , 2014-2018

Table 4: Global Meat Snacks Market Forecasted Value (US$ Mn) Analysis by Nature , 2019-2029

Table 5 : Global Meat Snacks Market Historical Value (US$ Mn) Analysis by End use, 2014-2018

Table 6 : Global Meat Snacks Market Forecasted Value (US$ Mn) Analysis by End use, 2019-2029

Table 7: Global Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel , 2014-2018

Table 8 : Global Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel , 2019-2029

Table 9: Global Meat Snacks Market Historical Value (US$ Mn) Analysis by Region , 2014-2018

Table 10 : Global Meat Snacks Market Forecast Value (US$ Mn) Analysis by Country, 2019-2029

Table 11: North America Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 12: North America Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 13: North America Meat Snacks Market Forecast Value (US$ Mn) Analysis by Nature, 2014-2018

Table 14: North America Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature, 2019- 2029

Table 15: North America Meat Snacks Market Forecast Value (US$ Mn) Analysis by End Use, 2014-2018

Table 16 : North America Meat Snacks Market Historical Value (US$ Mn) Analysis by End Use, 2019-2029

Table 17: North America Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel, 2014-2018

Table 18: North America Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel, 2019-2029

Table 19: North America Meat Snacks Market Forecast Value (US$ Mn) Analysis by Countries, 2014-2018

Table 20: North America Meat Snacks Market Historical Value (US$ Mn) Analysis by Countries, 2019-2029

Table 21: Latin America Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 22 Latin America Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 23: Latin America Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature , 2014-2018

Table 24: Latin America Meat Snacks Market Forecasted Value (US$ Mn) Analysis by Nature , 2019-2029

Table 25: Latin America Meat Snacks Market Historical Value (US$ Mn) Analysis by End use, 2014-2018

Table 26: Latin America Meat Snacks Market Forecasted Value (US$ Mn) Analysis by End use, 2019-2029

Table 27: Latin America Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel , 2014-2018

Table 28: Latin America Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel , 2019-2029

Table 29: Latin America Meat Snacks Market Historical Value (US$ Mn) Analysis by Country , 2014-2018

Table 30: Latin America Meat Snacks Market Forecast Value (US$ Mn) Analysis by Country, 2019-2029

Table 31: Europe Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 32: Europe Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 33: Europe Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature , 2014-2018

Table 34: Europe Meat Snacks Market Forecasted Value (US$ Mn) Analysis by Nature , 2019-2029

Table 35: Europe Meat Snacks Market Historical Value (US$ Mn) Analysis by End use, 2014-2018

Table 36: Europe Meat Snacks Market Forecasted Value (US$ Mn) Analysis by End use, 2019-2029

Table 37: Europe Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel , 2014-2018

Table 38 : Europe Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel , 2019-2029

Table 39: Europe Meat Snacks Market Historical Value (US$ Mn) Analysis by Country , 2014-2018

Table 40: Europe Meat Snacks Market Forecast Value (US$ Mn) Analysis by Country, 2019-2029

Table 41: APEJ Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 42: APEJ Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 43: APEJ Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature , 2014-2018

Table 44: APEJ Meat Snacks Market Forecasted Value (US$ Mn) Analysis by Nature , 2019-2019

Table 45: APEJ Meat Snacks Market Historical Value (US$ Mn) Analysis by End use, 2014-2018

Table 46: APEJ Meat Snacks Market Forecasted Value (US$ Mn) Analysis by End use, 2019-2029

Table 47: APEJ Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel , 2014-2018

Table 48: APEJ Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel , 2019-2029

Table 49: APEJ Meat Snacks Market Historical Value (US$ Mn) Analysis by Country , 2014-2018

Table 50: APEJ Meat Snacks Market Forecast Value (US$ Mn) Analysis by Country, 2019-2029

Table 51: Middle East & Africa Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 52 : Middle East & Africa Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 53: Middle East & Africa Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature , 2014-2018

Table 54 : Middle East & Africa Meat Snacks Market Forecasted Value (US$ Mn) Analysis by Nature , 2019-2029

Table 55: Middle East & Africa Meat Snacks Market Historical Value (US$ Mn) Analysis by End use, 2014-2018

Table 56: Middle East & Africa Meat Snacks Market Forecasted Value (US$ Mn) Analysis by End use, 2019-2029

Table 57: Middle East & Africa Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel , 2014-2018

Table 58: Middle East & Africa Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel , 2019-2029

Table 59: Middle East & Africa Meat Snacks Market Historical Value (US$ Mn) Analysis by Country , 2014-2018

Table 60: Middle East & Africa Meat Snacks Market Forecast Value (US$ Mn) Analysis by Country, 2019-2029

Table 61: Oceania Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 62: Oceania Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2019-2029

Table 63: Oceania Meat Snacks Market Forecast Value (US$ Mn) Analysis by Nature, 2014-2018

Table 64: Oceania Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature, 2019-2029

Table 65: Oceania Meat Snacks Market Forecast Value (US$ Mn) Analysis by End Use, 2014-2018

Table 66: Oceania Meat Snacks Market Historical Value (US$ Mn) Analysis by End Use, 2019-2029

Table 67: Oceania Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel, 2014-2018

Table 68: Oceania Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel, 2019-2029

Table 69: Oceania Meat Snacks Market Forecast Value (US$ Mn) Analysis by Country, 2014-2018

Table 70: Oceania Meat Snacks Market Historical Value (US$ Mn) Analysis by Country, 2019-2029

Table 71: Japan Meat Snacks Market Historical Value (US$ Mn) Analysis By Product, 2014-2018

Table 72: Japan Meat Snacks Market Forecast Value (US$ Mn) Analysis By Product, 2019-2029

Table 73: Japan Meat Snacks Market Historical Value (US$ Mn) Analysis by Nature , 2014-2018

Table 74: Japan Meat Snacks Market Forecasted Value (US$ Mn) Analysis by Nature , 2019-2029

Table 75: Japan Meat Snacks Market Historical Value (US$ Mn) Analysis by End use, 2014-2018

Table 76: Japan Meat Snacks Market Forecasted Value (US$ Mn) Analysis by End use, 2019-2029

Table 77: Japan Meat Snacks Market Historical Value (US$ Mn) Analysis by Sales Channel , 2014-2018

Table 78: Japan Meat Snacks Market Forecast Value (US$ Mn) Analysis by Sales Channel , 2019-2029

List of Figures:

Figure 01: Global Meat Snacks Market Size and Incremental $ Opportunity (US$ Mn), 2014-2029

Figure 02: Global Meat Snacks Market Value Share (%) and BPS Analysis By Product, 2014, 2019 & 2029

Figure 03: Global Meat Snacks Market Value (US$ Mn) Analysis By Product, 2019 & 2029

Figure 04: Global Meat Snacks Market Incremental Value (US$ Mn), By Product, 2014 to 2029

Figure 05: Global Meat Snacks Market Attractiveness, By Product, 2019 to 2029

Figure 06: Global Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 07: Global Meat Snacks Market Value (US$ Mn) Analysis by Nature, 2019 & 2029

Figure 08: Global Meat Snacks Market Incremental Value (US$ Mn), by Nature, 2014 to 2029

Figure 09: Global Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 10: Global Meat Snacks Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 11: Global Meat Snacks Market Value (US$ Mn) Analysis by End Use, 2019 & 2029

Figure 12: Global Meat Snacks Market Incremental Value (US$ Mn), by End Use, 2014 to 2029

Figure 13: Global Meat Snacks Market Attractiveness, by End Use, 2019 to 2029

Figure 14: Global Meat Snacks Market Value Share (%) and BPS Analysis by Sales Channel, 2014, 2019 & 2029

Figure 15: Global Meat Snacks Market Value (US$ Mn) Analysis by Sales Channel, 2019 & 2029

Figure 16: Global Meat Snacks Market Incremental Value (US$ Mn), by Sales Channel, 2014 to 2029

Figure 17: Global Meat Snacks Market Attractiveness, by Sales Channel, 2019 to 2029

Figure 18: Global Meat Snacks Market Value Share (%) and BPS Analysis by Region, 2014, 2019 & 2029

Figure 19: Global Meat Snacks Market Y-o-Y Growth (%) Projections by Region, 2019-2029

Figure 20: North America Meat Snacks Market Value BPS Analysis, by Country, 2019 & 2029

Figure 21: North America Meat Snacks Market Value Share (%) and BPS Analysis By Product, 2014, 2019 & 2029

Figure 22: North America Meat Snacks Market Value (US$) Analysis By Product, 2019 & 2029

Figure 23: North America Meat Snacks Market Incremental Value (US$ Mn), By Product, 2014 to 2029

Figure 24: North America Meat Snacks Market Attractiveness, By Product, 2019 to 2029

Figure 25: North America Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 26: North America Meat Snacks Market Value (US$ Mn) Analysis by Nature, 2019 & 2029

Figure 27: North America Meat Snacks Market Incremental Value (US$ Mn), by Nature, 2014 to 2029

Figure 28: North America Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 29: North America Meat Snacks Market Value Share (%) and BPS Analysis by End-Use, 2014, 2019 & 2029

Figure 30 : North America Meat Snacks Market Value (US$ Mn) Analysis by End-Use, 2019 & 2029

Figure 31 : North America Meat Snacks Market Incremental Value (US$ Mn), by End-Use, 2014 to 2029

Figure 32: North America Meat Snacks Market Attractiveness, by End-Use, 2019 to 2029

Figure 33: North America Meat Snacks Market Value Share (%) and BPS Analysis by Sales Channel, 2014, 2019 & 2029

Figure 34: North America Meat Snacks Market Value (US$ Mn) Analysis by Sales Channel, 2019 & 2029

Figure 35: North America Meat Snacks Market Incremental Value (US$ Mn), by Sales Channel, 2014 to 2029

Figure 36: North America Meat Snacks Market Attractiveness, by Sales Channel, 2019 to 2029

Figure 37: Latin America Meat Snacks Market Value BPS Analysis, by Country, 2019 & 2029

Figure 38: Latin America Meat Snacks Market Value Share (%) and BPS Analysis By Product 2014, 2019 & 2029

Figure 39: Latin America Meat Snacks Market Value (US$ Mn) Analysis By Product 2019 & 2029

Figure 40: Latin America Meat Snacks Market Incremental Value (US$ Mn), By Product 2014 to 2029

Figure 41: Latin America Meat Snacks Market Attractiveness, By Product 2019 to 2029

Figure 42: Latin America Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 43: Latin America Meat Snacks Market Value (US$ Mn) Analysis by Nature, 2019 & 2029

Figure 44: Latin America Meat Snacks Market Incremental Value (US$ Mn), by Nature, 2014 to 2029

Figure 45: Latin America Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 46: Latin America Meat Snacks Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 47: Latin America Meat Snacks Market Value (US$ Mn) Analysis by End Use, 2019 & 2029

Figure 48: Latin America Meat Snacks Market Incremental Value (US$ Mn), by End Use, 2014 to 2029

Figure49: Latin America Meat Snacks Market Attractiveness, by End Use, 2019 to 2029

Figure 50: Latin America Meat Snacks Market Value Share (%) and BPS Analysis by Sales Channel, 2014, 2019 & 2029

Figure 51: Latin America Meat Snacks Market Value (US$ Mn) Analysis by Sales Channel , 2019 & 2029

Figure 52: Latin America Meat Snacks Market Incremental Value (US$ Mn), by Sales Channel, 2014 to 2029

Figure 53: Latin America Meat Snacks Market Attractiveness, by Sales Channel, 2019 to 2029

Figure 54: Europe Meat Snacks Market Value BPS Analysis, by Country, 2019 & 2029

Figure 55: Europe Meat Snacks Market Value Share (%) and BPS Analysis By Product, 2014, 2019 & 2029

Figure 56: Europe Meat Snacks Market Value (US$ Bn) Analysis By Product, 2019 & 2029

Figure 57: Europe Meat Snacks Market Incremental Value (US$ Bn), By Product, 2014 to 2029

Figure 58: Europe Meat Snacks Market Attractiveness, By Product, 2019 to 2029

Figure 59: Europe Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 60: Europe Meat Snacks Market Value (US$ Bn) Analysis by Nature, 2019 & 2029

Figure 61: Europe Meat Snacks Market Incremental Value (US$ Bn), by Nature, 2014 to 2029

Figure 62: Europe Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 63: Europe Meat Snacks Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 64: Europe Meat Snacks Market Value (US$ Mn) Analysis by End Use, 2019 & 2029

Figure 65: Europe Meat Snacks Market Incremental Value (US$ Mn), by End Use, 2014 to 2029

Figure 66: Europe Meat Snacks Market Attractiveness, by End Use, 2019 to 2029

Figure 67: Europe Meat Snacks Market Value Share (%) and BPS Analysis by Sales channel , 2014, 2019 & 2029

Figure 68: Europe Meat Snacks Market Value (US$ Mn) Analysis by Sales channel , 2019 & 2029

Figure 69: Europe Meat Snacks Market Incremental Value (US$ Mn), by Sales channel , 2014 to 2029

Figure 70: Europe Meat Snacks Market Attractiveness, by Sales channel , 2019 to 2029

Figure 71: APEJ Meat Snacks Market Value BPS Analysis, by Country, 2019 & 2029

Figure 72: APEJ Meat Snacks Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 73: APEJ Meat Snacks Market Value (US$ Mn) Analysis by Product Type, 2019 & 2029

Figure 74: APEJ Meat Snacks Market Incremental Value (US$ Mn), By Product 2014 to 2029

Figure 75: APEJ Meat Snacks Market Attractiveness, By Product 2019 to 2029

Figure 76: APEJ Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 77: APEJ Meat Snacks Market Value (US$ Mn) Analysis by Nature, 2019 & 2029

Figure 78: APEJ Meat Snacks Market Incremental Value (US$ Mn), by Nature, 2014 to 2029

Figure 79: APEJ Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 80: APEJ Meat Snacks Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 81: APEJ Meat Snacks Market Value (US$ Mn) Analysis by End Use, 2019 & 2029

Figure 82: APEJ Meat Snacks Market Incremental Value (US$ Mn), by End Use, 2014 to 2029

Figure 83: APEJ Meat Snacks Market Attractiveness, by End Use, 2019 to 2029

Figure 84: APEJ Meat Snacks Market Value Share (%) and BPS Analysis by Sales channel , 2014, 2019 & 2029

Figure 85: APEJ Meat Snacks Market Value (US$ Mn) Analysis by Sales channel , 2019 & 2029

Figure 86: APEJ Meat Snacks Market Incremental Value (US$ Mn), by Sales channel , 2014 to 2029

Figure 87: APEJ Meat Snacks Market Attractiveness, by Sales channel , 2019 to 2029

Figure 88: Middle East and Africa Meat Snacks Market Value BPS Analysis, by Country, 2019 & 2029

Figure 89: Middle East and Africa Meat Snacks Market Value Share (%) and BPS Analysis By Product 2014, 2019 & 2029

Figure 90: Middle East and Africa Meat Snacks Market Value (US$ Mn) Analysis By Product 2019 & 2029

Figure 91: Middle East and Africa Meat Snacks Market Incremental Value (US$ Mn), By Product 2014 to 2029

Figure 92: Middle East and Africa Meat Snacks Market Attractiveness, By Product 2019 to 2029

Figure 93: Middle East and Africa Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 94: Middle East and Africa Meat Snacks Market Value (US$ Mn) Analysis by Nature, 2019 & 2029

Figure 95: Middle East and Africa Meat Snacks Market Incremental Value (US$ Mn), by Nature, 2014 to 2029

Figure 96: Middle East and Africa Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 97: Middle East and Africa Meat Snacks Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 98: Middle East and Africa Meat Snacks Market Value (US$ Mn) Analysis by End Use, 2019 & 2029

Figure 99: Middle East and Africa Meat Snacks Market Incremental Value (US$ Mn), by End Use, 2014 to 2029

Figure 100: Middle East and Africa Meat Snacks Market Attractiveness, by End Use, 2019 to 2029

Figure 101: Middle East and Africa Meat Snacks Market Value Share (%) and BPS Analysis by Sales Channel , 2014, 2019 & 2029

Figure 102: Middle East and Africa Meat Snacks Market Value (US$ Mn) Analysis by Sales Channel , 2019 & 2029

Figure 103:Middle East and Africa Meat Snacks Market Incremental Value (US$ Mn), by Sales Channel , 2014 to 2029

Figure 104: Middle East and Africa Meat Snacks Market Attractiveness, by Sales Channel , 2019 to 2029

Figure 105: Oceania Meat Snacks Market Value BPS Analysis, by Country, 2019 & 2029

Figure 106: Oceania Meat Snacks Market Value Share (%) and BPS Analysis By Product, 2014, 2019 & 2029

Figure 107: Oceania Meat Snacks Market Volume (MT) Analysis By Product, 2019 & 2029

Figure 108: Oceania Meat Snacks Market Incremental Value (US$ Mn), By Product, 2014 to 2029

Figure 109: Oceania Meat Snacks Market Attractiveness, By Product, 2019 to 2029

Figure110 : Oceania Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 111: Oceania Meat Snacks Market Value (US$ Mn) Analysis by Nature, 2019 & 2029

Figure 112 : Oceania Meat Snacks Market Incremental Value (US$ Mn), by Nature, 2014 to 2029

Figure 113: Oceania Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 114: Oceania Meat Snacks Market Value Share (%) and BPS Analysis by End-Use, 2014, 2019 & 2029

Figure 115: Oceania Meat Snacks Market Value (US$ Mn) Analysis by End-Use, 2019 & 2029

Figure 116: Oceania Meat Snacks Market Incremental Value (US$ Mn), by End-Use, 2014 to 2029

Figure 117: Oceania Meat Snacks Market Attractiveness, by End-Use, 2019 to 2029

Figure 118: Oceania Meat Snacks Market Value Share (%) and BPS Analysis by Sales Channel, 2014, 2019 & 2029

Figure 119: Oceania Meat Snacks Market Value (US$ Mn) Analysis by Sales Channel, 2019 & 2029

Figure 120: Japan Meat Snacks Market Value Share (%) and BPS Analysis by Product Type, 2014, 2019 & 2029

Figure 121: Japan Meat Snacks Market Value (US$ Bn) Analysis by Product Type, 2019 & 2029

Figure 122: Japan Meat Snacks Market Incremental Value (US$ Bn), By Product, 2014 to 2029

Figure 123: Japan Meat Snacks Market Attractiveness, By Product, 2019 to 2029

Figure 124: Japan Meat Snacks Market Value Share (%) and BPS Analysis by Nature, 2014, 2019 & 2029

Figure 125: Japan Meat Snacks Market Value (US$ Bn) Analysis by Nature, 2019 & 2029

Figure 126: Japan Meat Snacks Market Incremental Value (US$ Bn), by Nature, 2014 to 2029

Figure 127: Japan Meat Snacks Market Attractiveness, by Nature, 2019 to 2029

Figure 128: Japan Meat Snacks Market Value Share (%) and BPS Analysis by End Use, 2014, 2019 & 2029

Figure 129: Japan Meat Snacks Market Value (US$ Mn) Analysis by End Use, 2019 & 2029

Figure 130: Japan Meat Snacks Market Incremental Value (US$ Mn), by End Use, 2014 to 2029

Figure 131: Japan Meat Snacks Market Attractiveness, by End Use, 2019 to 2029

Figure 132: Japan Meat Snacks Market Value Share (%) and BPS Analysis by Sales channel , 2014, 2019 & 2029

Figure 133: Japan Meat Snacks Market Value (US$ Mn) Analysis by Sales channel , 2019 & 2029

Figure 134: Japan Meat Snacks Market Incremental Value (US$ Mn), by Sales channel , 2014 to 2029

Figure 135: Japan Meat Snacks Market Attractiveness, by Sales channel , 2019 to 2029